-

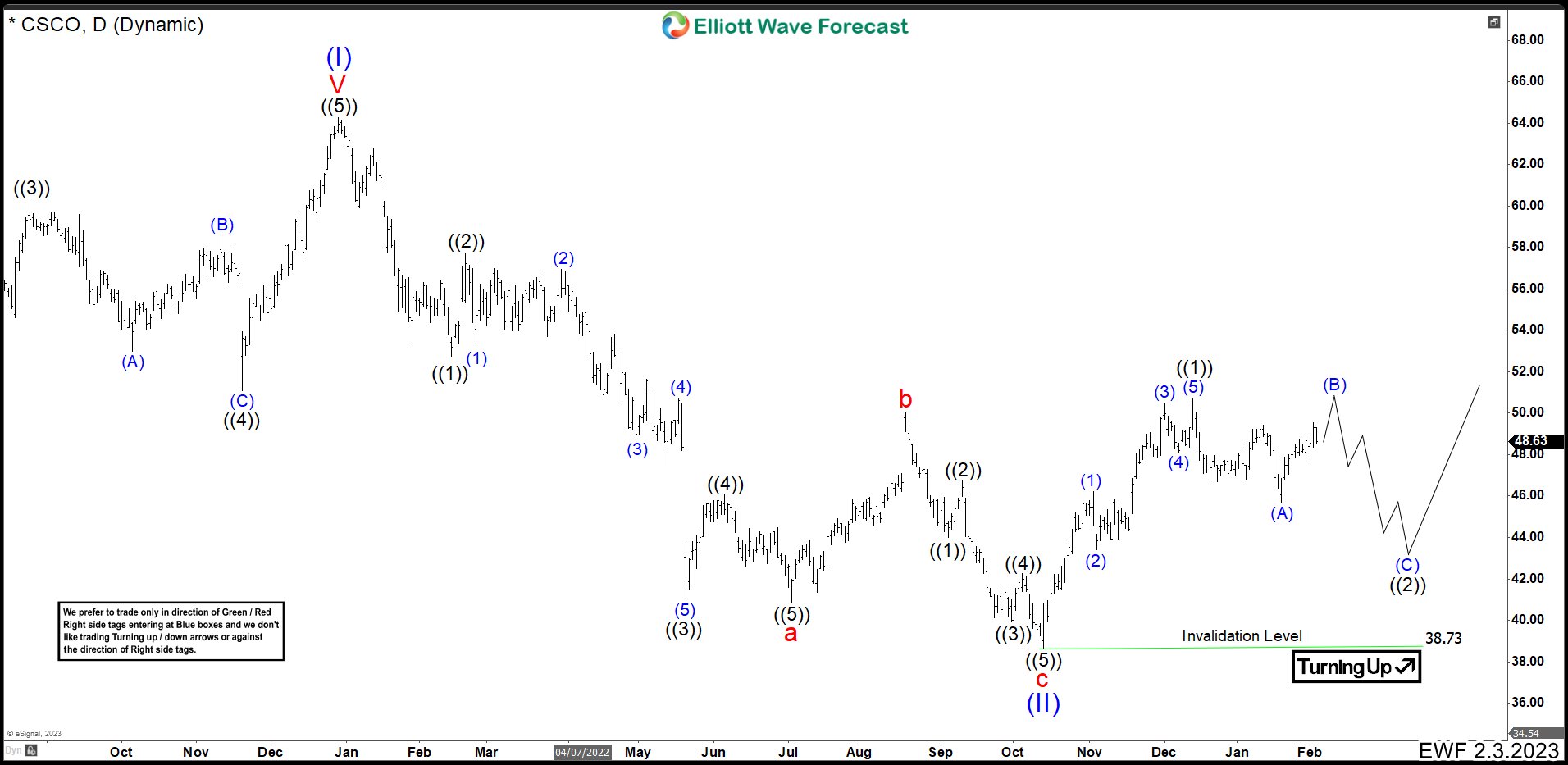

Cisco (CSCO) Ended a Bearish Cycle And It Should Continue With Rally.

Read MoreCisco Systems, Inc., commonly known as Cisco (CSCO), is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products. Cisco specializes in specific tech markets such as: the Internet of Things (IoT), domain security, videoconferencing, and energy management with leading products including Webex, OpenDNS, Jabber, Duo Security, and Jasper. CSCO Daily Chart February 2023 At the end of 2021, Cisco finished […]

-

JPMorgan (JPM) Missed The Blue Box And Rally As Expected

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]

-

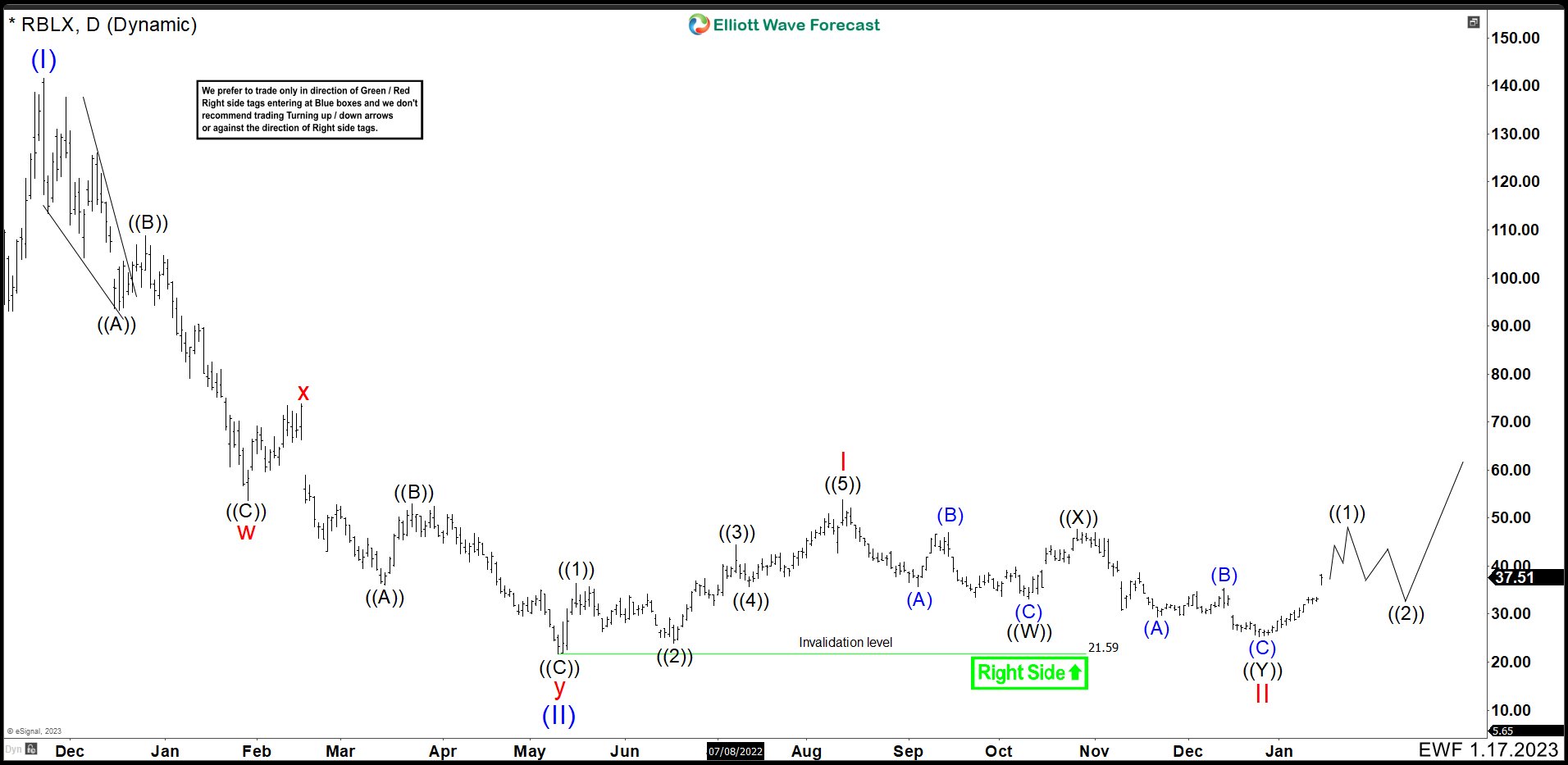

Roblox (RBLX) Has A Nice Opportunity For Long Term Trade

Read MoreRoblox (RBLX) is an online game platform and game creation system developed by Roblox Corporation that allows users to program games and play games created by other users. Created by David Baszucki and Erik Cassel in 2004 and released in 2006, the platform hosts user-created games of multiple genres coded in the programming language Lua. RBLX January 2023 Daily Chart Roblox (RBLX) finished a bullish movement in December 2021. […]

-

JNJ Could Have Started A Bearish Movement To End Wave II Correction.

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

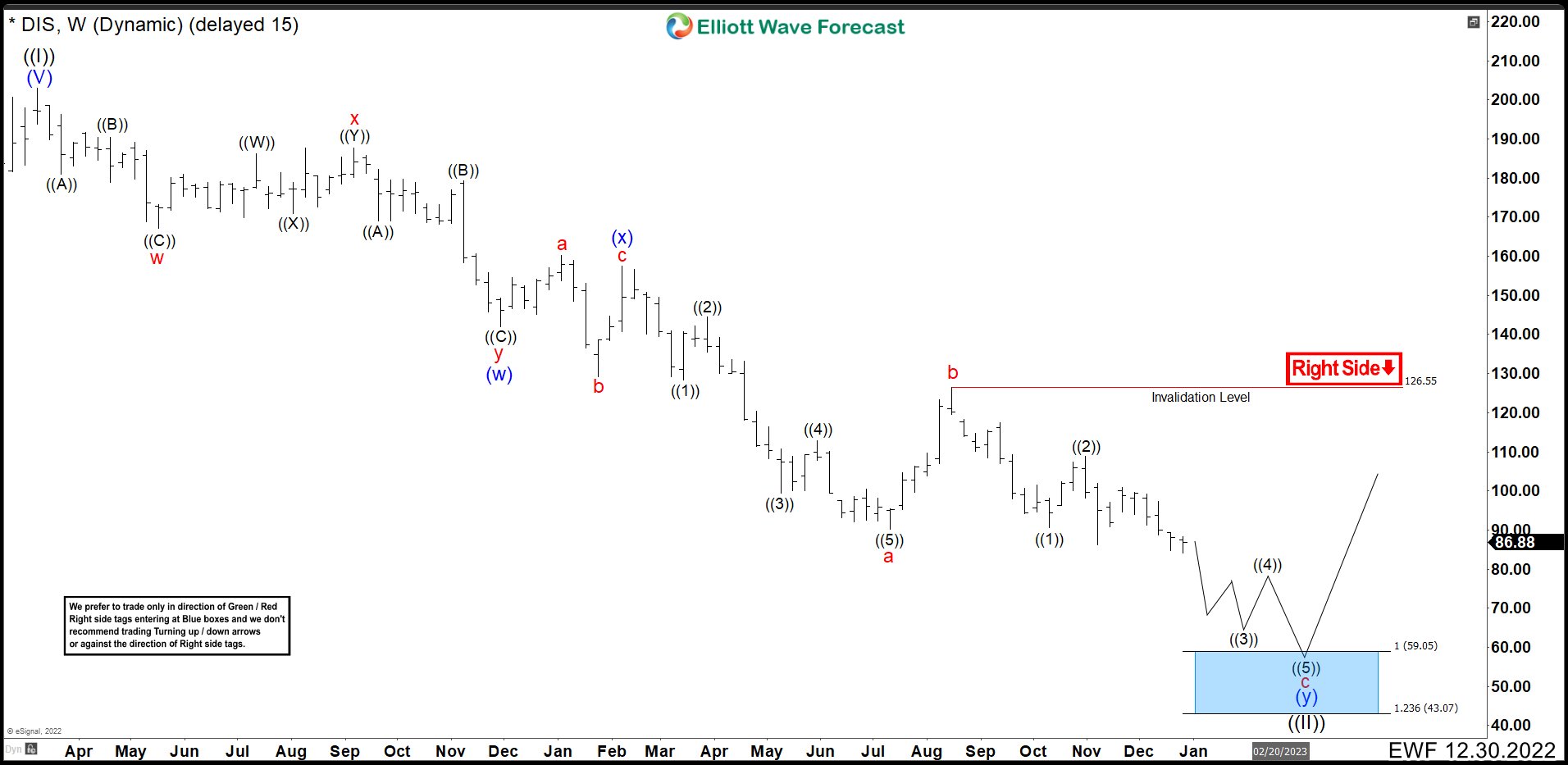

Disney (DIS) Is Giving Us A Great Opportunity For Long Term Buying

Read MoreThe Walt Disney Company, commonly known as Disney DIS, it is an American, multinational, mass media and entertainment conglomerate that is headquartered at the Walt Disney Studios complex in Burbank, California. Disney was founded on October 16, 1923, by brothers Walt and Roy O. Disney as Disney Brothers Studio. DIS Daily Chart December 2021 One year ago, we were looking to finish a double correction of a new cycle that started […]

-

HDFC BANK Is Looking Good To Continue The Rally From The Blue Box

Read MoreHDFC Bank Limited is an Indian banking and financial services company headquartered in Mumbai. It is India’s largest private sector bank by assets and world’s 10th largest bank by market capitalization as of April 2021, the third largest company by market capitalization of $122.50 billion on the Indian stock exchanges. It is also the fifteenth […]