-

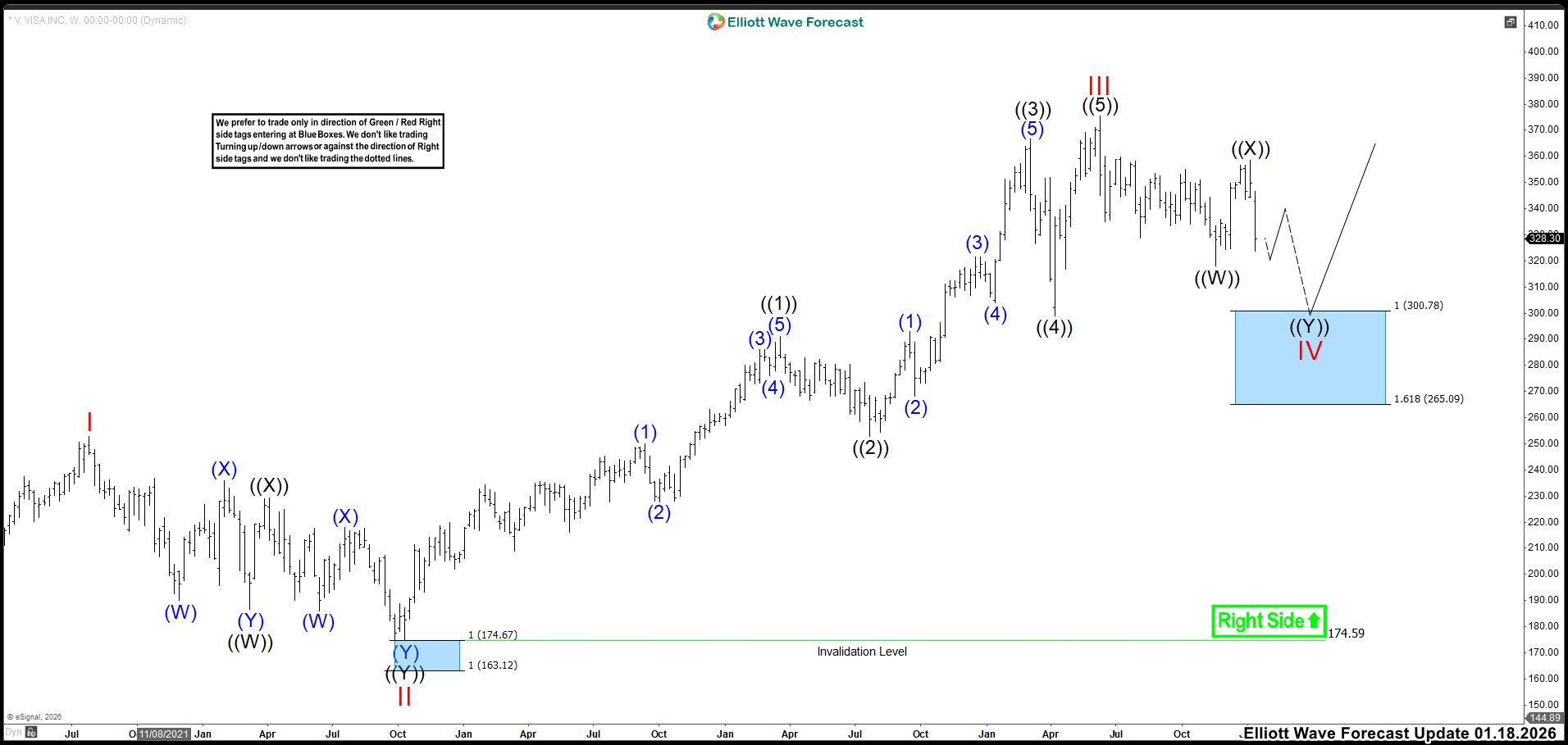

Visa (V): Can the 2026 Bullish Trend Overcome Recent Price Lag?

Read MoreMarket analysts expected Visa (V) to post strong results in early 2026. They pointed to rapid AI adoption and rising global travel. Visa planned to report earnings on January 29, 2026. Estimates projected an EPS near $3.14, showing a clear double‑digit gain from last year. Visa also used its value‑added services and new flow initiatives […]

-

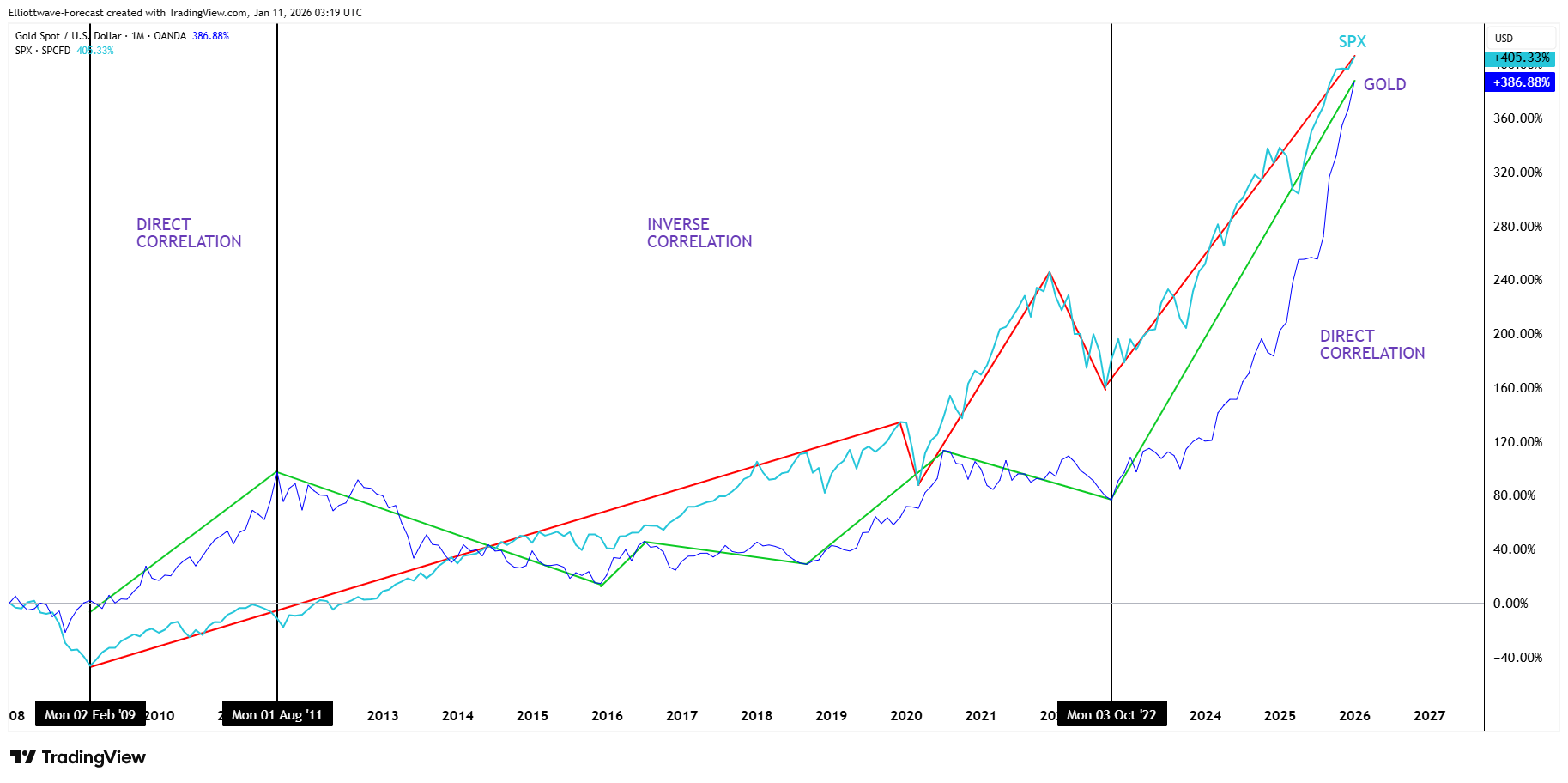

Gold, Silver, and the S&P 500: Navigating the New Correlation

Read MoreFor decades, investors viewed Gold and Silver as the ultimate insurance policy. Traditionally, precious metals and equities moved in opposite directions, providing a natural hedge for portfolios. However, the market dynamics of 2024 and 2025 completely rewrote the rulebook. As we navigate the first quarter of 2026, understanding this new “direct correlation” is vital for […]

-

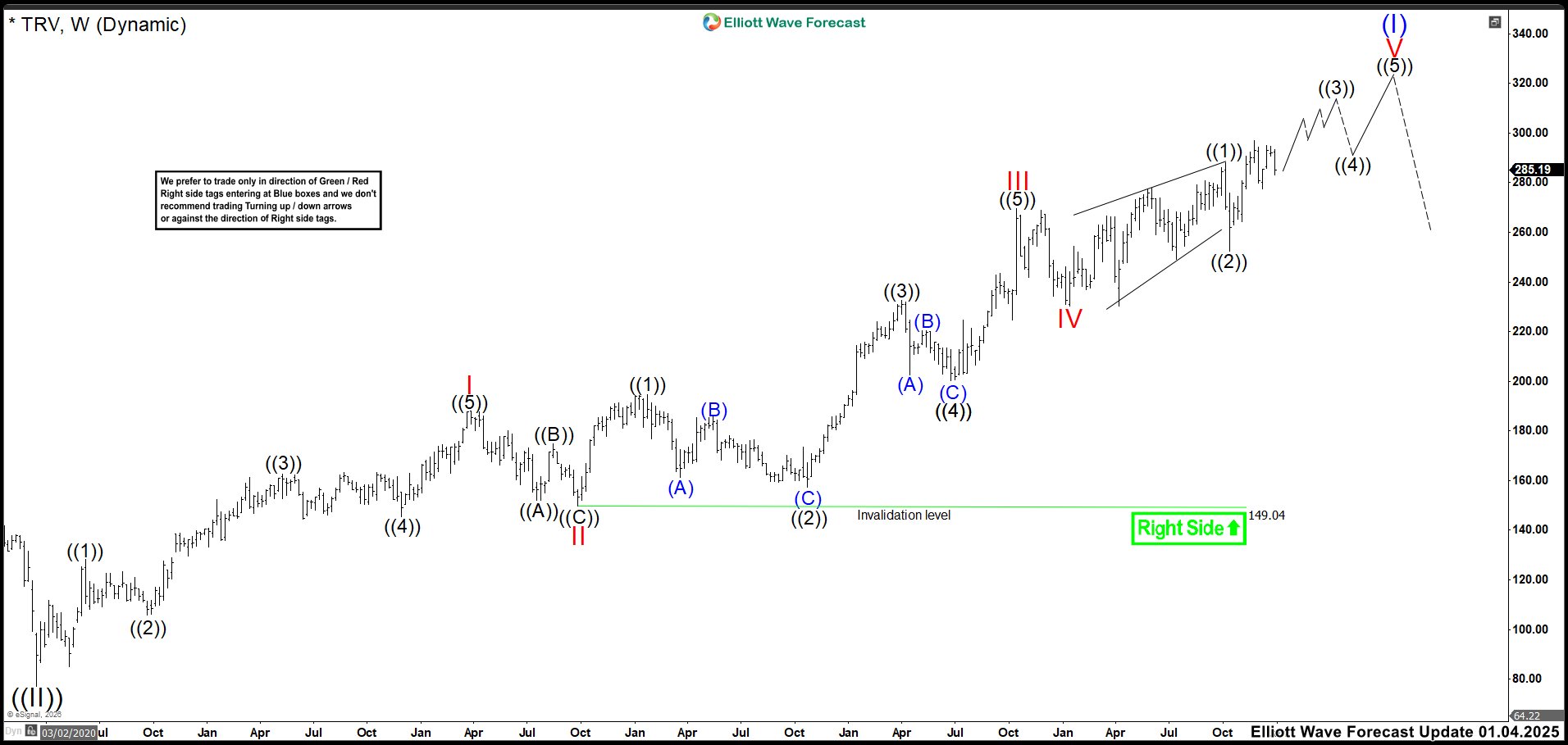

TRV Extends Its Rally: The Jan 2025 Impulse Drives Next Move

Read MoreAt the beginning of the year, TRV often moves into a price‑discovery phase shaped by analyst updates and early‑quarter earnings expectations. Most analysts rate the stock as a Hold, with an average 12‑month target near $294.25. That level suggests only a 3.13% upside from current prices, which signals that institutions expect steady underwriting results rather […]

-

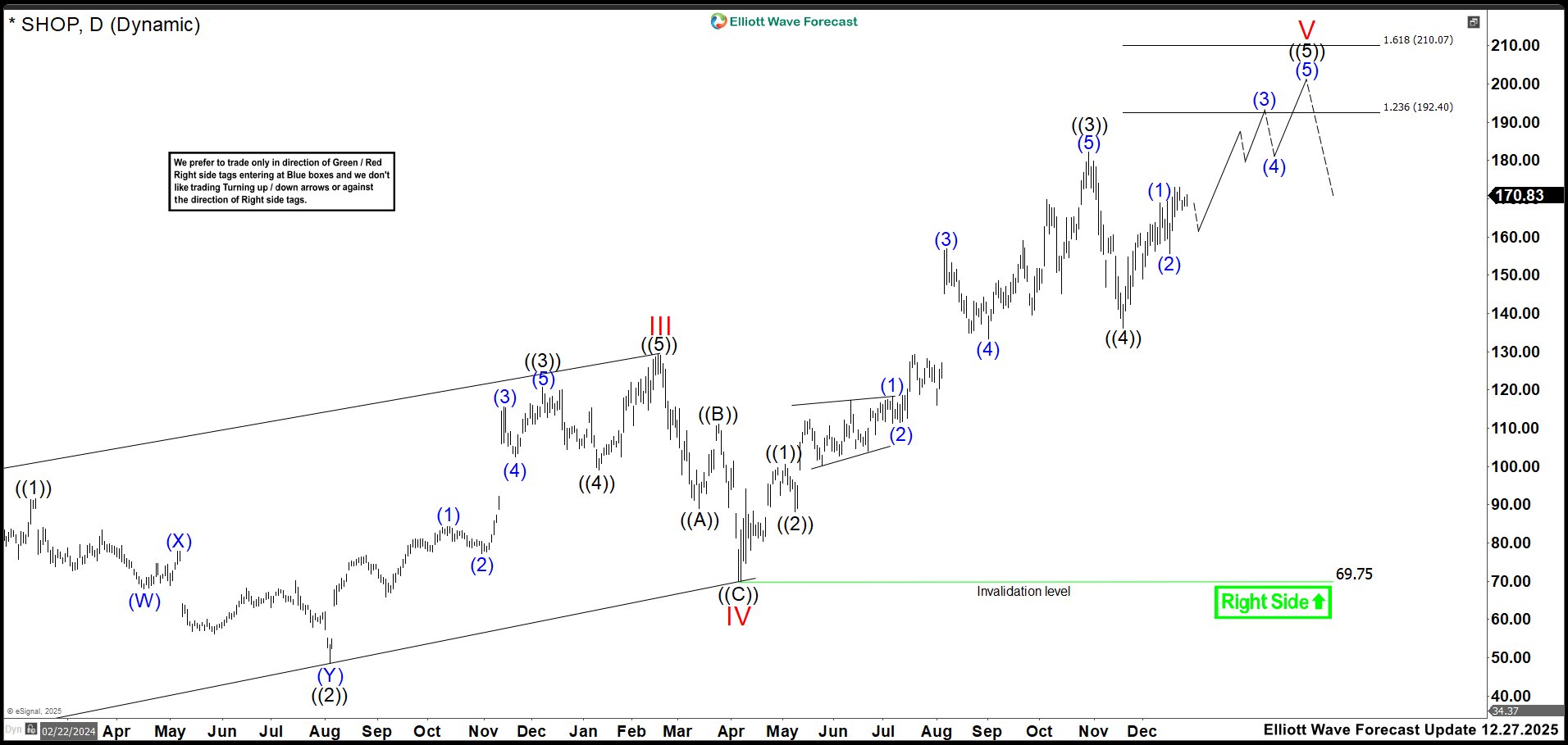

A 25% Drop Shook Traders… but SHOP Still Points Higher

Read MoreShopify (SHOP) enters the next quarters with solid momentum, and more importantly, its latest results suggest that this strength is not temporary. The company delivered 31% year‑over‑year revenue growth. Also, it saw GMV accelerate across North America, Europe, and Asia, with Europe alone growing 42% on a constant‑currency basis. As a result, management now expects […]

-

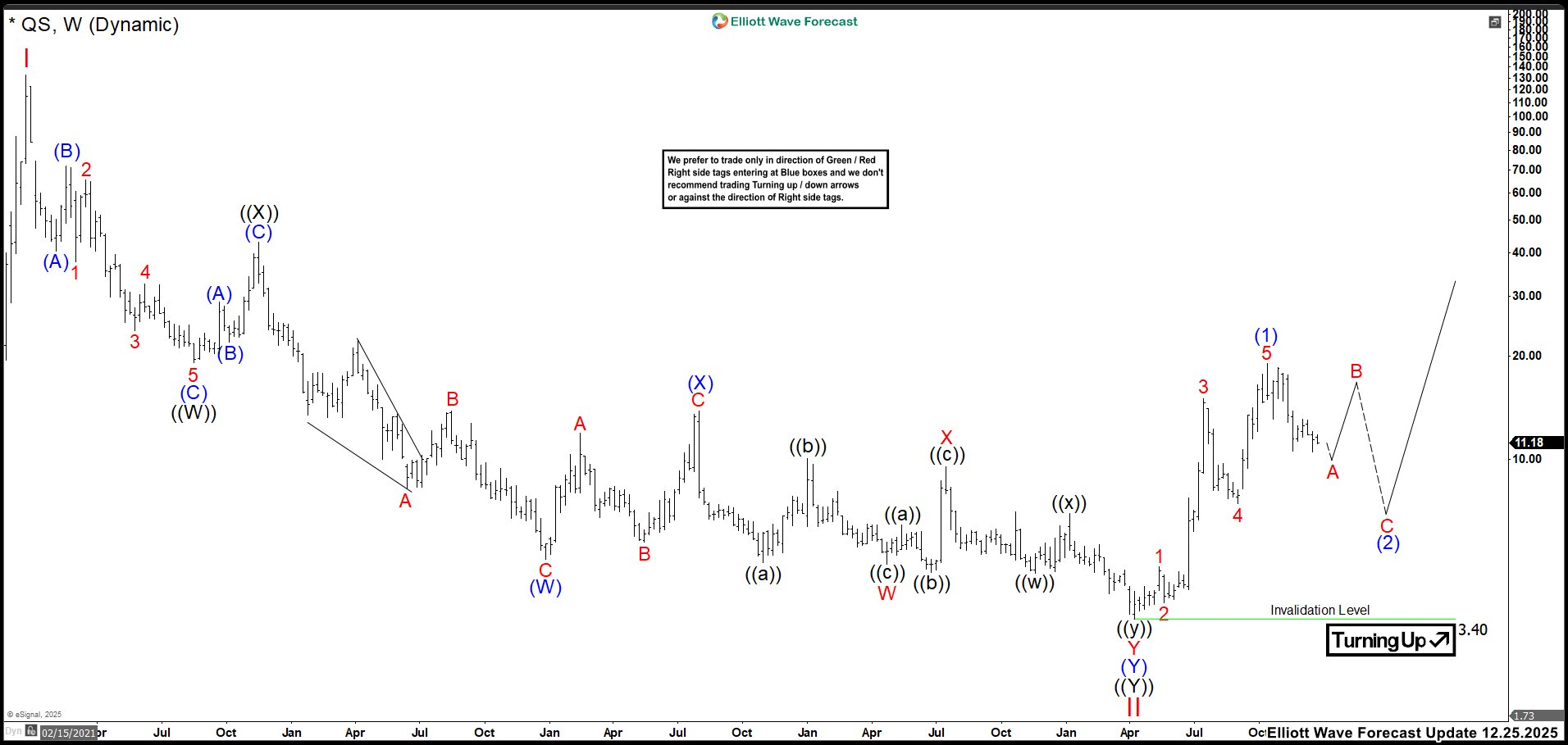

Why Traders Are Watching QS More Closely Than Ever?

Read MoreQuantumScape (QS) enters the next quarter at a pivotal moment. The company moves from lab‑scale development to real‑world validation after shipping its B1 sample cells, a key milestone noted in recent reports. This step strengthens its long‑term case for solid‑state battery leadership as it improves energy density, charging speed, and safety. Even so, QuantumScape remains […]

-

Surfing the Market Waves: How the Blue Box Shapes Hecla Mining (HL)

Read MoreHecla Mining (HL) has shown strong revenue growth in 2025, climbing to $1.33 billion, up 43% year-over-year, while earnings per share surged to $0.38 from $0.06. This performance highlights the company’s ability to capitalize on favorable silver and gold prices, as well as operational improvements across its mining assets. However, despite these gains, analysts remain […]