What are Cyclical Stocks?

Cyclical stocks are securities that are heavily affected by the economic cycles of the overall economy. These securities rise and fall in line with the general economic cycle and are affected by macroeconomic changes in the overall economy.

These stocks usually belong to companies producing discretionary products like luxury clothing, furniture, cars, or non-essential services like vacations, travel, and eating out in restaurants. When the economy is down, consumer spending on discretionary items like luxury clothing, vacations, cars, new technology, or higher-priced items like furniture also declines. As a result, the stock prices decline.

On the other hand, consumer spending on discretionary items increases when the economy is booming, so cyclical stocks are also prospering and growing.

Some of the cyclical industries include:

- Automotive industry

The automotive industry faces seasonal changes in demand. The demand for this sector keeps on changing as it is highly dependent on consumer purchasing power. When consumer spending falls, revenues for the car manufacturing industry drop.

- Real estate industry

The overall health of the economy plays a crucial role in the investment trend in this sector. Real estate is primarily affected by consumer spending power and economic conditions. Investors tend to invest in the REIT sector when they see prices going down, and buyers feel encouraged to buy when the economy is doing well.

- Travel and airline industry

The travel industry is also cyclical as it relies heavily on consumer spending on vacations and travel. When the health of the economy is good, earnings are good, people are more likely to take holidays and travel. Whereas, when the economy is down, the travels sector also falls,

- Hospitality

The hospitality industry is also cyclical and moves in line with the economy. Hotels, restaurants, bars, and other leisure activity providers also suffer during an economic downturn. People have less money to spend on these services when the economy is down.

- Retail: luxury fashion and clothing, furniture

The demand for high-end luxury items such as watches, jewelry, branded apparel, luxury handbags, or furniture, also falls when consumer spending falls.

- Financial services

Bank stocks are cyclical as interest rates tend to fall during recessions, and as banks make money from lending, lower interest rates result in lower profits.

List of 10 Best Cyclical Stocks

List of 10 Best Cyclical Stocks

Here is a list of the 10 best cyclical stocks:

| Sr. | Company Name | Symbol | Price (As of 8th April 2023) | Market Cap |

| 1 | American Airlines Group Inc. | AAL | $ 14.01 | $ 19 billion |

| 2 | Halliburton Co. | HAL | $ 32.71 | $ 29.6 billion |

| 3 | Lowe’s Cos. Inc. | LOW | $ 198.57 | $ 118.4 billion |

| 4 | Nike Inc. | NKE | $ 120.22 | $ 186.4 billion |

| 5 | Hormel Foods Corporation | HRL | $ 40.31 | $ 22 billion |

| 6 | Caterpillar Inc. | CAT | $ 209.17 | $ 108 billion |

| 7 | Ford Motor Company | F | $ 12.33 | $ 49.32 billion |

| 8 | Expedia | EXPE | $ 91.7 | $ 14.1 billion |

| 9 | EPR Properties | EPR | $ 38.25 | $ 2.88 billion |

| 10 | The Walt Disney Company | DIS | $ 99.97 | $ 182.6 billion |

American Airlines Group Inc.

American Airlines Group Inc (AAL) is a provider of passenger airline services. It provides scheduled air transportation for passengers and cargo. The company operates hubs in Chicago, Charlotte, Dallas, Miami, Los Angeles, New York, Philadelphia, Phoenix, and Washington, D.C. in the US. It also collaborates with third-party regional carriers to provide regional jet and turboprop services. AAG also offers non-stop flights to transcontinental locations across Central and South America, Asia, Oceania, and Europe. It provides freight and mail services globally.

The company also offers frequent flyer programs under the brand, AAdvantage to improve passenger loyalty by providing awards to travelers for continued patronage. It also provides marketing services related to the sale of mileage credits in the AAdvantage program, membership fees and Admirals Club operations, and other miscellaneous services. AAG is headquartered in Fort Worth, Texas, the US.

American Airlines Group recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 48,971 | $ 29,882 | 63.9 % |

| Operating Income | $ 1,607 million | ($ 1,059) million | – |

| Net Income | $ 127 million | ($ 1,993) million | – |

| Earnings per share | $ 0.2 | ($ 3.09) | – |

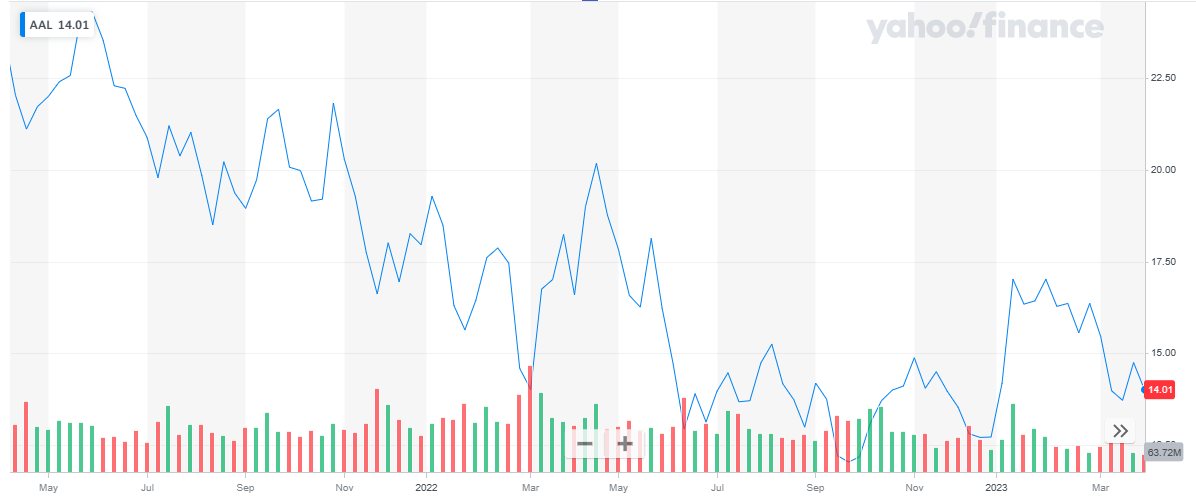

American Airlines Group Inc has a market cap of $ 19 billion. Its shares are trading at $ 14.01.

The stock of the company has been on a bearish run for the past two years. It started the year 2022 at $ 17.96. The stock remained bearish throughout the year and closed the year at $ 12.72 representing a 29 % decline during the year.

In 2023, initially, the stock recovered a bit and reached $ 17.02. After that, the stock started to decline and last closed at $ 14.01, representing a 10 % appreciation to date.

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Halliburton Co.

Halliburton Co (Halliburton) is an oilfield service company. The company serves the upstream oil and gas industry throughout the lifecycle of the reservoir, from identifying hydrocarbons and managing geological data to drilling and formation evaluation, well construction and completion, and optimizing production. Halliburton offers cementing, stimulation, intervention, artificial lift, well-bore placement solutions, and completion services for oil and gas upstream companies. The company has manufacturing facilities in the US, Malaysia, Singapore, and the UK. Geographically, the company has a presence in North America, Europe, Africa, Latin America, Asia, and the Middle East. Halliburton is headquartered in Houston, Texas, the US.

Halliburton Co recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 11,582 million | $ 8,410 million | 38 % |

| Operating Income | $ 2,707 million | $ 1,800 million | 50 % |

| Net Income | $ 1,595 million | $ 1,468 million | 8.65 % |

| Earnings per share | $ 1.74 | $ 1.63 | 7 % |

Halliburton Co has a market cap of $ 29.6 billion. Its shares are trading at $ 32.71.

The stock started the year 2022 at $ 22.87. The stock picked up a bullish trend and spiked high till it peaked at $ 41.95. After that, the stock pulled back and dropped to $ 24.58. Eventually, the stock closed the year at $ 39.35. Overall, the stock appreciated by 20 % during the year.

In 2023, initially, the stock continued with an upward rising trend. After hitting the peak of $ 42.66, the stock reversed its course and started to decline. The stock last closed at $ 32.71, representing a 16.69 % decline to date.

Lowe’s Cos. Inc.

Lowe’s Cos. Inc.

Lowe’s Companies is a Fortune 50 company and the world’s second-largest home improvement retailer. With over two million additional items available through the company’s online selling channels, its stores offer approximately 40,000 products for repair and improvement projects (such as lumber, paint, plumbing and electrical supplies, and tools), gardening and outdoor living, and home furnishing and decorating. It targets homeowners, renters, and professional customers with national brand-name merchandise as well as its private labels including Kobalt (tools), Harbor Breeze (ceiling fans), Sta-Green (lawn and garden products), Moxie (cleaning products), and Style Selection (home décor products), among other. The company only operates in North America, with the vast majority of sales generated in the US.

Lowe’s Co recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 97,059 million | $ 96,250 million | 0.8 % |

| Operating Income | $ 10,159 million | $ 12,093 million | 19 % |

| Net Income | $ 6,437 million | $ 8,442 million | -24 % |

| Earnings per share | $ 10.2 | $ 12.07 | 15.5 % |

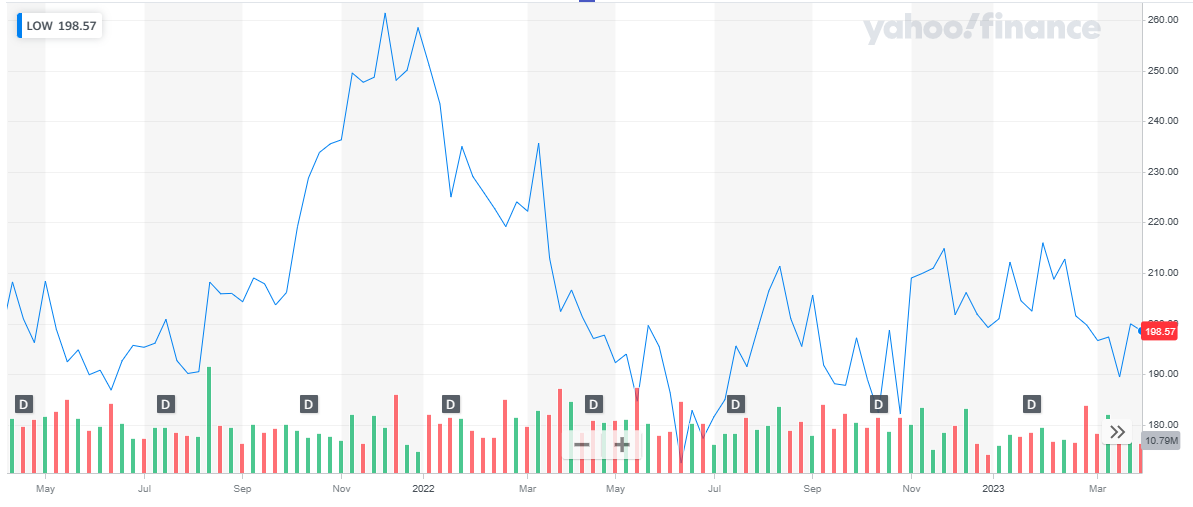

Lowe’s Co has a market cap of $ 118.4 billion. Its shares are trading at $ 198.57.

The stock started the year 2022 at $ 258.43. during the year, the stock picked up a bearish run. After dropping to the low of 4 172.47, the stock closed the year at $ 199.24. Overall, the stock declined by 22.9 % during the year.

In 2023, initially, the stock inched up but then started to decline. The stock last closed at $ 198.57, maintaining its price level at the start of the year.

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Nike Inc.

NIKE Inc (NIKE) designs, markets, and distributes athletic footwear, apparel, equipment, and accessories to men, women, and children. It markets and distributes various products for kids and other recreational and athletic activities such as football, baseball, cricket, lacrosse, skateboarding, tennis, volleyball, wrestling, walking, and outdoor activities, and various apparel with licensed college and professional team and league logos. The company markets these products under various brands, including Nike, Jordan, and Converse. Nike sells these products through company-owned retail stores, e-commerce portals, independent distributors, licensees, and sales representatives located worldwide. It also merchandises these products through its e-commerce portal nike.com. It has a presence in the Americas, Asia-Pacific, the Middle East, Africa, and Europe. Nike is headquartered in Beaverton, Oregon, the US.

Nike Inc. recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 46,710 million | $ 44,538 million | 5 % |

| Net Income | $ 6,046 million | $ 5,727 million | 5.6 % |

| Earnings per share | $ 3.83 | $ 3.64 | 5.2 % |

Nike has a market cap of $ 186.4 billion. Its shares are trading at $ 120.22.

The stock started the year 2022 at $ 166.67. Throughout the year the stock remained bearish and dropped to the low of $ 83.12. Eventually, the stock closed at $ 117.01. Overall, the stock declined by 30 %.

In 2023, the stock has appreciated slightly, to date by 2.74 %.

Hormel Foods Corporation

Hormel Foods Corporation

Hormel Foods Corp (Hormel Foods) is a meat and food processing company. The company primarily offers fresh meats, frozen items, refrigerated meal solutions, sausages, hams, guacamole, and bacon. It also provides canned luncheon meats, shelf-stable microwaveable meals, stews, chilies, hash, flour and corn tortillas, salsas, peanut butter, nutritional food products and supplements, dessert, and drink mixes, and industrial gelatin products. The company sells these products under Always Tender, Hormel, Applegate, Austin Blues, Bacon 1, Black Label, Bread Ready, Cafe H, Chi-Chi’s, and Valley Fresh brand names among others. The company has a business presence in the Americas, Asia-Pacific, and Europe. Hormel Foods is headquartered in Austin, Minnesota, the US.

Hormel Foods Corp recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 12,458 million | $ 11,386 million | 9.4 % |

| Operating Income | $ 1,312 million | $ 1,122 million | 17 % |

| Net Income | $ 1,000 million | $ 909 million | 10 % |

| Earnings per share | $ 1.84 | $ 1.68 | 9.5 % |

Hormel Foods has a market cap of $ 22 billion. Its shares are trading at $ 40.31.

The stock started the year 2022 at $ 48.81. initially, the stock started to rise and reached $ 53.58. After that, the stock pulled back and eventually closed the year at $ 45.55. Overall, the stock declined by 7 %.

In 2023, the stock continued with a bearish trend and last closed at $ 40.31, representing an 11.5 % decline to date.

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

Caterpillar Inc.

Caterpillar Inc (Caterpillar) is a manufacturer of construction, transportation, and energy equipment. It designs, manufactures, markets, and sells construction and mining equipment, industrial gas turbines, forestry equipment, diesel-electric locomotives, and diesel and natural gas engines. The company’s product portfolio includes asphalt pavers, backhoe loaders, compactors, draglines, integrated systems, reciprocating engines, and many others. Caterpillar also offers retail and wholesale financing solutions for Caterpillar products to customers and dealers. The company, through its subsidiaries and dealers, markets and sells its products in several countries across North and South America, Asia-Pacific, Africa, the Middle East, and Europe. Caterpillar is headquartered in Deerfield, Illinois, the US.

Caterpillar Inc recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 59,427 million | $ 50,971 million | 16.6 % |

| Operating Income | $ 7,904 million | $ 6,878 million | 15 % |

| Net Income | $ 6,705 million | $ 6,489 million | 3.3 % |

| Earnings per share | $ 12.72 | $ 11.93 | 6.7 % |

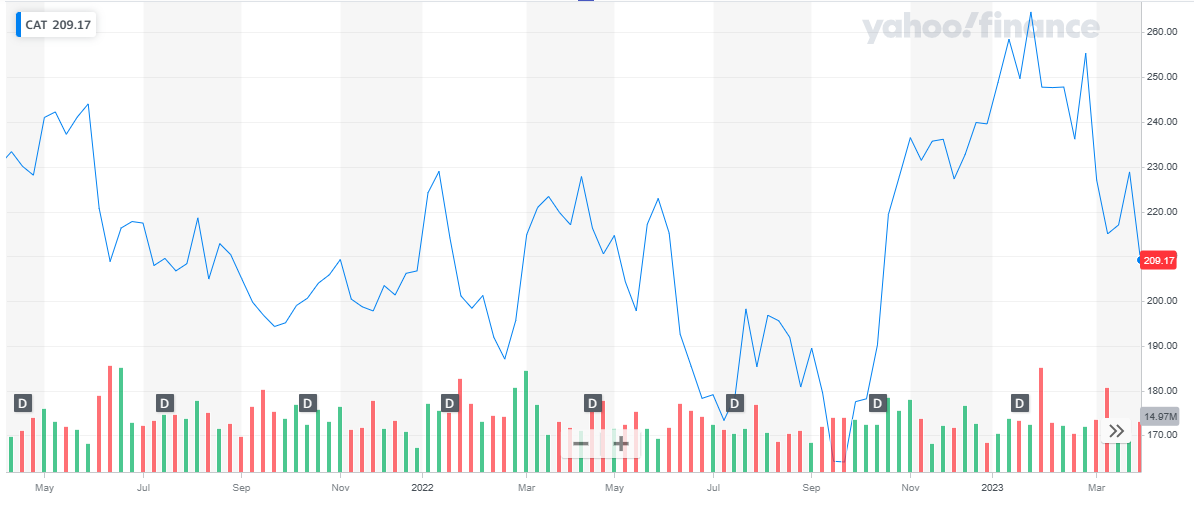

Caterpillar has a market cap of $ 108 billion. Its shares are trading at $ 209.17.

The stock started the year 2022 at $ 206.74. The stock remained volatile through the major art of the year. during the last quarter, the stock spiked high and closed the year at $ 239.56. Overall, the stock appreciated by 16 % during the year.

In 2023, the stock pulled back and last closed at $ 209.17 representing a 12.7 % decline to date.

Ford Motor Company

Ford Motor Company

Ford Motor Co (Ford) is an automotive company, which designs, manufactures, markets, and services a full line of cars, trucks, sport utility vehicles, and electrified vehicles. The company provides vehicle-related financing and leasing services. Ford markets its products under Ford and Lincoln brand names. It serves customers across South America, the Middle East, Europe, North America, Africa, and Asia Pacific. The company operates transmission plants, assembly plants, casting plants, metal stamping plants, engine plants, and other component plants across the world. It also operates assembly facilities, manufacturing plants, parts distribution centers, and engineering centers worldwide.

Ford recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 158,057 million | $ 136,341 million | 16 % |

| Operating Income | $ 6,276 million | $ 4,523 million | 39 % |

| Net Income/ Loss | ($ 1,981) million | $ 17,937 | – |

| Earnings per share | ($ 0.49) | $ 4.49 | – |

Ford has a market cap of $ 49.32 billion. Its shares are trading at $ 12.33.

In the last quarter of 2021, the stock of the company spiked high. The stock continued with this bullish pattern entering 2022 and immediately peaked at $ 25.19. After that, the stock reversed its course and started to decline. The stock dropped as low as $ 11.2 and eventually closed the year at $ 11.63. Overall, the stock declined by 44 %.

In 2023, the stock maintained its price level with a few ups and downs. To date, the stock has appreciated by 6 %.

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Expedia

Expedia Group Inc (Expedia Group) is an online travel company. It provides a wide range of services which includes booking of hotel rooms, airline seats, car rentals, and destination services through its travel suppliers. These services are offered under various brands including Expedia.com, Hotels.com, Vrbo, Orbitz, ebookers, CheapTickets, Hotwire, CarRentals .com, Travelocity, Expedia Partner Solutions, and Wotif Group. Expedia Group serves customers through mobile bookings, alternative distribution channels, private label businesses, and call centers. The company also carries out advertising and media business and travel management businesses. Expedia Group is headquartered in Seattle, Washington, the US.

Expedia operates several travel websites. The company is highly dependent on economic growth. When the economy slows fewer people book trips using Expedia’s websites. As a result, profits decline.

Expedia recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 11,667 million | $ 8,598 million | 36 % |

| Operating Income | $ 1,085 million | $ 186 million | 483 % |

| Net Income | $ 352 million | ($ 269) million | – |

| Earnings per share | $ 2.24 | ($ 1.8) | – |

Expedia has a market cap of $ 14.1 billion. Its shares are trading at $ 91.7.

The stock started in the year 2022 at $ 180.72. Following an initial rise in price, the stock hit $ 209.17. After that, the stock reversed its course and dropped sharply. The stock went as low as $ 86.43 and eventually closed off at $ 87.6. Overall, the stock declined by 51 %.

In 2023, initially, the stock took a hike up. After reaching $ 118.7, the stock pulled back and last closed at $ 91.7. To date, the stock has appreciated by 3.5 %.

EPR Properties

EPR Properties

EPR Properties (EPR) is a real estate investment company. It owns, acquires, develops, leases, and finances specialty assets such as entertainment, education, and recreational properties. The company provides dining, shopping, live entertainment, fitness facilities, gaming, lodging, cultural properties, ice skating, and other entertainment experiences. It also offers rides and attractions for tourists by investing in amusement parks and water parks. Its portfolio of properties also includes private schools and childhood education centers. In addition, EPR also specializes in investment funds, asset management, financing, dispositions, and other development activities. The company operates in Canada and the US. EPR is headquartered in Kansas City, Missouri, the US.

EPR Properties (EPR)recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 658 million | $ 532 million | 24 % |

| Operating Income | $ 311 million | $ 279 million | 11.5 % |

| Net Income | $ 152 million | $ 74.5 million | 104 % |

| Earnings per share | $ 2.03 | $ 1 | 103 % |

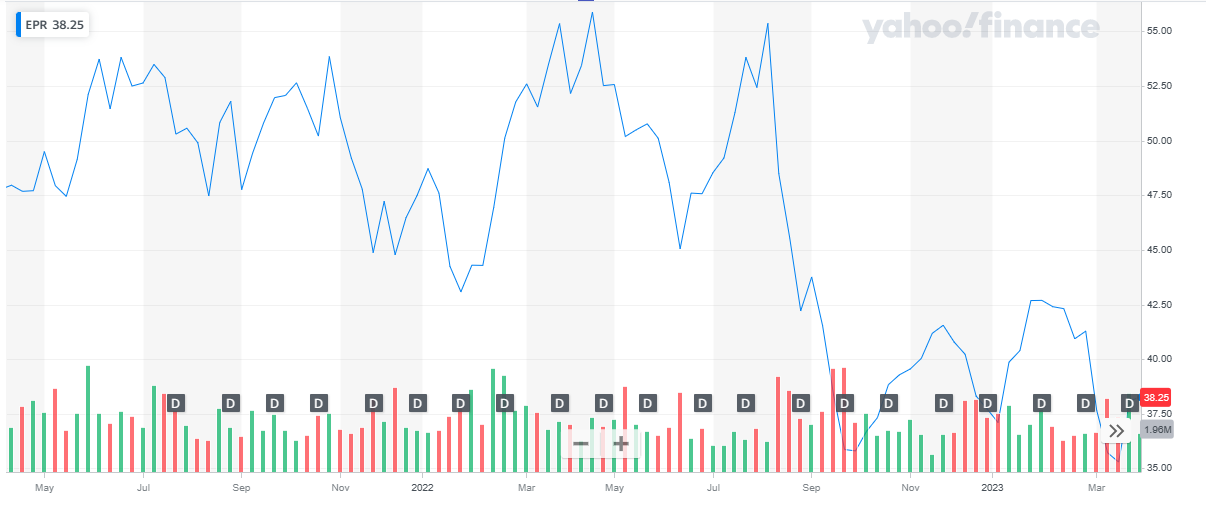

EPR Properties has a market cap of $ 2.88 billion. Its shares are trading at $ 38.25.

The stock started the year 2022 at $ 47.49. Throughout the year, the stock remained volatile. After hitting $ 55.36 in July, the stock dropped sharply and went as low as $ 35.86. Eventually, the stock closed the year at $ 37.72. Overall, the stock declined by 20.5 %.

In 2023, after an initial rise, the stock again dropped and went as low as $ 35.29. The stock last closed at $38.25 representing a 1.5 % appreciation to date.

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

The Walt Disney Company

The Walt Disney Co (Disney) is an entertainment and media company. It produces and acquires television programs, live-action films, and animated motion pictures. The company owns and operates theme parks and resorts, and television networks and channels; develops and publishes books, comic books, and magazines; sells products related to Disney themes, and delivers an English language learning curriculum for Chinese children. Disney operates cable channels under the Disney, ESPN, FX, Freeform, and National Geographic brands and television networks under the ABC brand. It owns and operates stores in North America, Europe, and Asia. Disney is headquartered in Burbank, California, the US.

Entertainment giant Disney is highly cyclical. Consumers reduce their spending on entertainment such as vacations during a recession. Since Disney is an entertainment company, the number of visitors in its parks declines and so do the other consumer businesses.

Walt Disney recently reported its full-year results for FY 2022:

| 2022 | 2021 | Percentage Change | |

| Revenues | $ 82,722 million | $ 67,418 million | 22.7 % |

| Net Income | $ 3,145 million | $ 1,995 million | 57.6 % |

| Earnings per share | $ 1.73 | $ 1.1 | 57.3 % |

Walt Disney has a market cap of $ 182.6 billion. Its shares are trading at $ 99.97.

The stock has been on a bearish run for the past two years. It started the year 2022 at $ 154.89. Throughout the year the stock remained bearish and closed the year at $ 86.88. Overall, the stock declined by 44 % during the year.

In 2023, the stock recovered and has appreciated by 15 % to date.

Also read:

- Best uranium stocks

- Best commodity stocks

- Best AI stocks

- Best wheat stocks

- Best travel stocks

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals