A commodity ETF is a type of exchange-traded fund (ETF) that is invested in physical goods such as agricultural commodities, precious metals, and natural resources. Usually, a commodity ETF focuses on investments related to futuristic contracts or a single commodity concerning physical storage.

There are four basic types of commodity ETFs:

- Physically backed funds– Physical commodity ETFs own the underlying commodity. Investors gain an ownership stake in the fund’s stockpile

- Equity funds – An equity-based commodity ETF offers “leverage-like” exposure to commodities through the stocks of companies involved in natural resources and other raw materials.

- Futures-based funds – Futures-backed commodity funds are designed to produce exposure to the targeted commodity through the use of futures contracts, forward contracts, and swaps.

- Exchange-traded notes (ETNs) – ETNs are senior, unsubordinated, unsecured debt issued by an institution. ETNs are linked to a variety of assets, including commodities and currencies

By investing in commodity funds, you are exposing your portfolio to the supply chain of the industry.

Stock trading advisory websites help investors make the right financial decisions.

List of Best Commodity ETFs

Here we have selected the 15 best commodity ETFs to invest in 2024:

| Sr. | ETF Name | Symbol | Net Expense Ratio | NAV ( as of 18th April 2022) | Total Net Assets |

| 1 | Aberdeen Bloomberg Industrial Metals Strategy K1 Free ETF | BCIM | 0.47 % | $ 31.75 | $ 40.9 million |

| 2 | United States Natural Gas Fund LP | UNG | 0.9 % | $ 24.59 | $ 41.8 million |

| 3 | SPDR Gold Shares | GLD | 0.4 % | $ 183.14 | $ 69.4 billion |

| 4 | United States Oil Fund LP | USO | 0.83 % | $ 80.6 | $ 3.15 billion |

| 5 | Invesco Dynamic Oil & Gas Services ETF | PXJ | 0.63 % | $ 5.03 | $ 76.3 million |

| 6 | iShares Silver Trust | SLV | $ 23.69 | $ 14.8 billion | |

| 7 | iPath Series B Bloomberg Nickel Subindex Total Return ETN | JJN | 0.45 % | $ 44.98 | $ 62.7 million |

| 8 | SPDR S&P Oil & Gas Exploration & Production ETF | XOP | 0.35 % | $ 142.96 | $ 5.9 billion |

| 9 | First Trust Natural Gas ETF | FCG | 0.60 % | $ 26.27 | $ 759 million |

| 10 | Aberdeen Standard Physical Palladium Shares ETF | PALL | 0.6 % | $ 218.66 | $ 461 .7 million |

| 11 | United States Brent Oil Fund LP | BNO | 1.13 % | $ 32.23 | $ 315.9 million |

| 12 | VanEck Oil Services ETF | OIH | 0.35 % | $ 308.48 | $ 4.3 billion |

| 13 | iShares U.S. Oil Equipment & Services ETF | IEZ | 0.41 % | $ 20.5 | $ 390 million |

| 14 | VanEck Gold Miners ETF | GDX | 0.53 % | $ 40.87 | $ 14.345 million |

| 15 | SPDR S&P Metals and Mining ETF | XME | $ 65.56 | $ 3.45 billion |

Aberdeen Bloomberg Industrial Metals Strategy K1 Free ETF

The Aberdeen Bloomberg Industrial Metals Strategy K-1 Free ETF seeks to provide investment results that closely correspond to the performance of the Bloomberg Industrial Metals Subindex. The Index consists of 4 commodities futures contracts for aluminum, copper, nickel, and zinc. Glencore is one of the world’s largest globally diversified copper stock companies.

The top index holding, as of 31st Dec 2021:

- Copper: 33.51%

- Aluminum: 29.9%

- Zinc: 20.55%

- Nickel: 16.04%

The total expense ratio of this fund is 0.47%.

The annual return for the Bloomberg Industrial Metals Subindex is reported to be 30.34%, for the period 31st Dec 2020 to 31st Dec 2021.

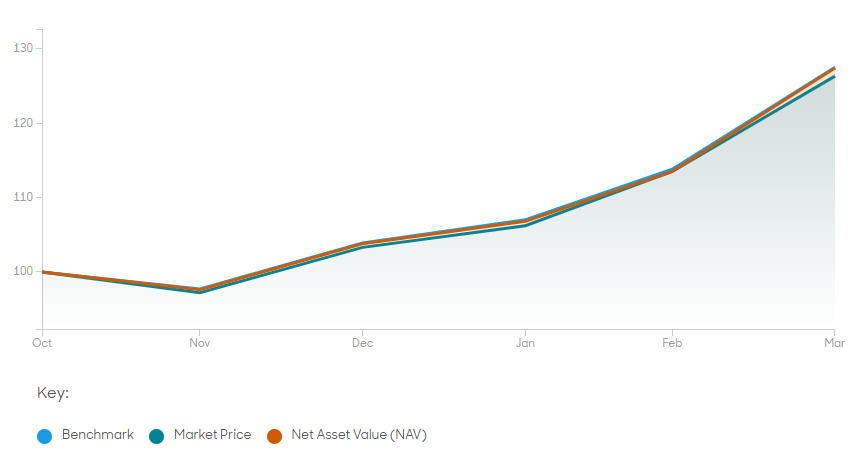

The below graph displays the performance chart of the ETF from October 2021 to March 2022.

Get to know the best tech stocks to invest in now.

United States Natural Gas Fund LP

This United States Natural Gas Fund LP offers exposure to one of America’s most important commodities, natural gas, and potentially has appeal as an inflation hedge. It is a very good investment for short-term traders. The investment objective of UNL is for the daily changes in percentage terms of its shares NAV to reflect the daily changes in percentage terms of the price of natural gas delivered at the Henry Hub Louisiana. Get to know about top Infrastructure stocks to invest.

UNL invests primarily in listed natural gas futures contracts and other natural gas-related futures contracts and may invest in forwards and swap contracts. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of two years or less.

The benefits of investing in UNG are:

- UNG offers commodity exposure without using a commodity futures account.

- The fund provides features including, intra-day pricing, and market, limit, and stop orders.

- UNG provides portfolio holdings, market price, NAV, and TNA on its website each day.

It has an expense ratio of 0.9%.

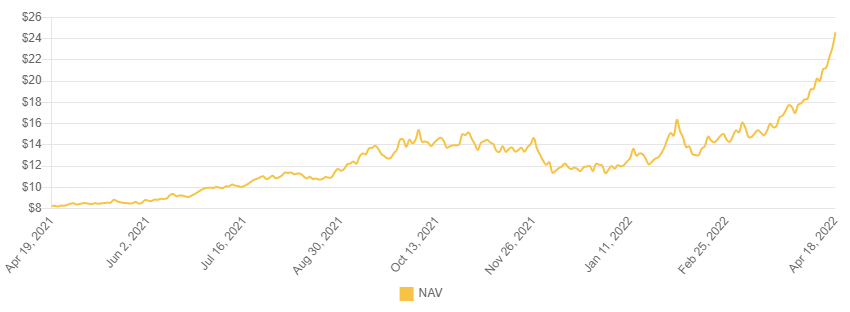

The below chart shows the historical Net Asset Value of the Fund over the past year.

Also read:

SPDR Gold Shares

SPDR Gold Shares offer an innovative, relatively cost-efficient, and secure way to access the gold market. SPDR Gold Shares is the largest physically-backed gold exchange-traded fund (ETF) in the world which is traded on the New York Stock Exchange. The first US-traded gold ETF and the first US-listed ETF backed by a physical asset. Gold stocks are the publicly traded stocks of companies and funds focused on gold. Investing in gold stocks has proved to be more profitable rather than purchasing physical gold.

Its gross expense ratio is 0.4%.

Benefits of investing in SPDR Gold Share Fund:

- Easily accessible

- Secure investment: The Gold Shares represent fractional, undivided interests in the Trust, the sole assets of which are physical gold bullion and, from time to time, cash

- Transparency: There exists a 24-hour global over-the-counter market for gold bullion, which provides readily available market data. The price, holdings, and net asset value of the Gold Shares, as well as market data for the overall gold bullion market, can be tracked daily at spdrgoldshares.com.

- Flexible investment: SPDR shares can be easily traded like ordinary stocks. Investors can also place market, limit, and stop-loss orders for Gold Shares

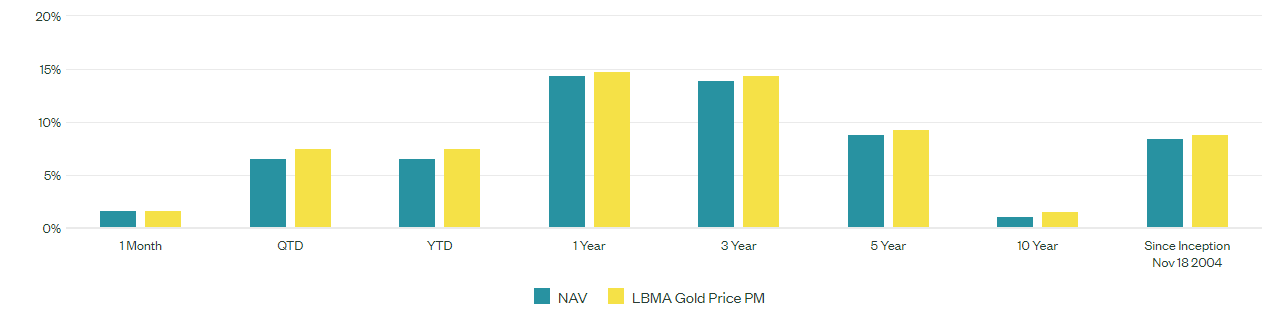

The below chart shows the fund performance over the past years.

Semi conductor stocks are one of the best investment opportunities.

Semi conductor stocks are one of the best investment opportunities.

United States Oil Fund LP

United States Oil Fund’s investment objective is for the daily changes, in percentage terms, of its shares’ net asset value (NAV) to reflect the daily changes, in percentage terms, of the spot price of light sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the Benchmark Oil Futures Contract. Oil stocks is one of the riskier yet most profit-generating sectors.

USO invests primarily in listed crude oil futures contracts and other oil-related contracts and may invest in forwards and swap contracts. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of 2 years or less.

The total expense ratio of the fund is $ 0.83%

Benefits of Investing in USO:

- USO provides features including, intra-day pricing, and market, limit, and stop orders.

- USO provides portfolio holdings, market price, NAV, and TNA on its website each day. It also provides USO’s target portfolio anticipated by the end of the roll or any rebalance, based on market conditions and regulatory requirements on the website each day.

The below chart shows the NAV performance of the fund over the past year:

Read more: Best Biotech Stocks to Buy in 2022.

Invesco Dynamic Oil & Gas Services ETF

The Invesco Dynamic Oil & Gas Services ETF is based on the Dynamic Oil Services Intellidex Index. The Index usually invests in common stocks and thoroughly evaluates those companies. The Index is composed of stocks of 30 U.S. companies that are involved in the production, processing, and distribution of oil and gas. Oil and gas ETFs are a great addition to the investment portfolio. We also have covered best ETFs to buy in all categories.

The top holdings of the ETF are:

- Helmerich & Payne- 6.24 %

- Baker Hughes – 6.17 %

- Halliburton – 5.79 %

- TechnipFMC – 5.79 %

- Patterson-UTI Energy – 5.73 %

- ChampionX – 5.66 %

- NOV- 5.43 %

- Schlumberger- 5.04 %

- Golar – 4.74 %

- Transocean – 4.06 %

It has an expense ratio of $ 0.63%.

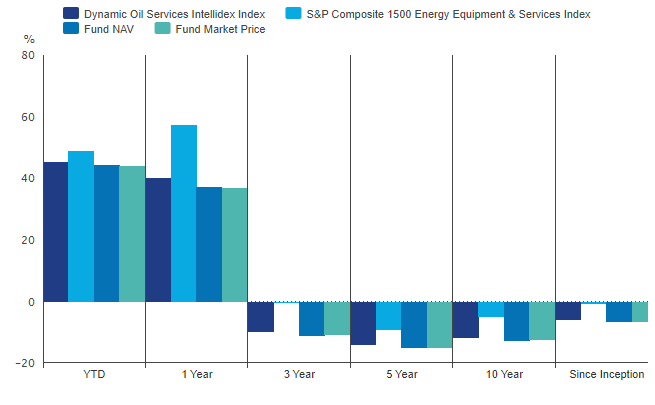

The below chart shows the performance of the fund over the past years:

If you are seeking a steady stream of income, you should invest in REIT stocks.

iShares Silver Trust

The iShares Silver Trust seeks to reflect generally the performance of the price of silver. Silver stock is a valuable investment.

Benefits of investing in SLV

- Exposure to the day-to-day movement of the price of silver bullion

- Convenient, cost-effective access to physical silver

- Use to diversify your portfolio and help protect against inflation

Get to know best vaccine stocks to invest in now.

iPath Series B Bloomberg Nickel Subindex Total Return ETN

iPath Series B Bloomberg Nickel Subindex Total Return ETN offers exposure to one of the world’s most important industrial metals, nickel. This gives makes it an excellent investment as an inflation hedge. For investors seeking exposure to nickel beyond physical exposure or through a mining firm, JJN is the only pure-play choice available. Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

It has an expense ratio of 0.45 %.

SPDR S&P Oil & Gas Exploration & Production ETF

The S&P Oil & Gas Exploration & Production ETF represents the oil and gas exploration and production segment of the S&P Total Market Index (“S&P TMI”). The S&P TMI is designed to track the broad U.S. equity market. The oil and gas exploration and production segment of the S&P TMI comprises the following sub-industries:

- Integrated Oil & Gas

- Oil & Gas Exploration & Production

- Oil & Gas Refining & Marketing

The Index is one of the twenty-one S&P Select Industry Indices, each designed to measure the performance of a narrow sub-industry or group of sub-industries determined based on the Global Industry Classification Standard (“GICS”). Get to know the list of crypto mining companies that are leading the industry.

The SPDR S&P Oil & Gas Exploration & Production ETF seeks to provide investment results that, correspond generally to the total return performance of the S&P Oil & Gas Exploration & Production Select Industry Index. The ETF seeks to track a modified equal-weighted index which provides the potential for un-concentrated industry exposure across large, mid, and small-cap stocks. Also, this fund offers targeted strategic or tactical positions, for investors. Learn about head and shoulders patterns trading guide.

It has an expense ratio of 0.35%.

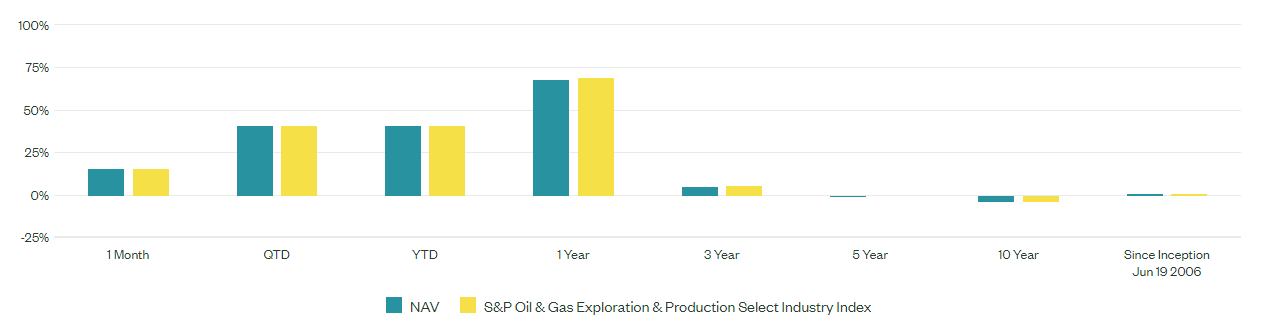

The below chart shows the performance of the ETF over the past years, as of 31st March 2022.

Always do research and consider few crucial parameters that you as an investor should look into before selecting a crypto signal provider.

Always do research and consider few crucial parameters that you as an investor should look into before selecting a crypto signal provider.

First Trust Natural Gas ETF

First Trust Natural Gas ETF seeks investment results that correspond generally to the price and yield of an equity index called the ISE-Revere Natural Gas Index. The ISE-Revere Natural GasTM Index is comprised of exchange-listed companies that derive a substantial portion of their revenues from the exploration and production of natural gas. The US companies that are involved in the exploration and production of natural gas are included in the index. Get to know top COVID-19 vaccine stocks to invest in now.

Benefits of investing in FCG:

- Companies that fulfill the requirements of the index are further ranked on liquidity and market capitalization within their segments.

- Weights within each segment are scaled so that the largest weight is a multiple of the smallest weight.

- The Index is optimized for liquidity and market capitalization at the component level.

- The Index is rebalanced on the application of the above model on a quarterly basis.

FCG has an expense ratio of 0.6%

Top Holdings of the Index include:

- EQT Corporation – 4.75%

- Occidental Petroleum Corporation – 4.43%

- DCP Midstream, LP – 4.11%

- Antero Resources Corporation – 3.73%

- Western Midstream Partners LP – 3.72%

- Southwestern Energy Company – 3.71%

- ConocoPhillips – 3.66%

- EOG Resources, Inc. – 3.58%

- Coterra Energy Inc. – 3.48%

- Marathon Oil Corporation -3.35%

Get to know the best tech stocks to invest in now.

Aberdeen Standard Physical Palladium Shares ETF

Aberdeen Standard Physical Palladium Shares ETF’s investment objective is to reflect the performance of the price of palladium. The Shares are designed for investors who want a cost-effective and convenient way to invest in physical palladium. Check our updated for NASDAQ Forecast.

Benefits of investing in PALL

- Physically backed to palladium

- Transparency: Transparency: The metal is held in allocated bars and a bar list is posted daily on brdn.com/usa/etf

- Price: The metal is priced off the LPPM’s specifications for Good Delivery

PALL has an expense ratio of 0.6 %.

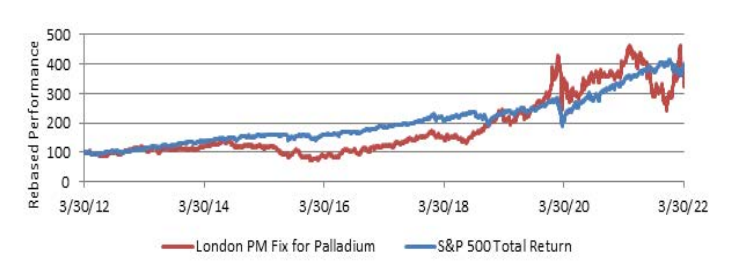

The below chart shows the performance of the fund, in correlation with the S&P index:

The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

United States Brent Oil Fund LP

The United States Brent Oil Fund LP is an exchange-traded security designed to track the daily price movements of Brent crude oil.

BNO invests primarily in listed crude oil futures contracts and other oil-related futures contracts and may invest in forwards and swap contracts. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of two years or less. Also read: Best EV Stocks

Benefits of investing in BNO

- BNO offers commodity exposure without using a commodity futures account.

- BNO provides features including, intra-day pricing, and market, limit, and stop orders.

- BNO provides portfolio holdings, market price, NAV, and TNA on its website each day.

BNO has an expense ratio of 1.13%.

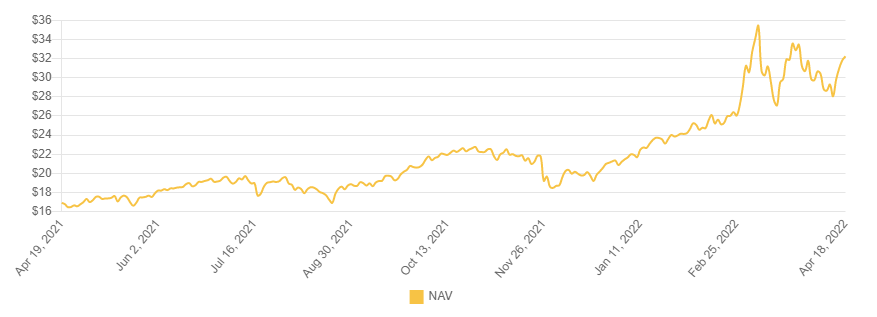

The below chart shows the NAV of the ETF over the past year

VanEck Oil Services ETF

VanEck Oil Services ETF seeks to replicate the price and yield performance of the MVIS US Listed Oil Services 25 Index (MVOIHTR). The (MVOIHTR) is intended to track the overall performance of U.S.-listed companies involved in oil services to the upstream oil sector, which include oil equipment, oil services, or oil drilling. Penny stocks are also one of the best investment opportunities.

Benefits of investing in OIH

- The index tracks some of the Highly Liquid Companies based on market capitalization and trading volume

- The largest companies in the industry are part of the index

- The index has global exposure as it includes both domestic and U.S. listed foreign companies

OIH has an expense ratio of 0.35%.

The top holdings of OIH are:

- Schlumberger NV – 19.13 %

- Halliburton Co. – 12.93 %

- Baker Hughes – 8.41 %

- Tenaris SA – 5.35 %

Also read: Best Stocks for Covered Calls in 2024.

iShares U.S. Oil Equipment & Services ETF

The iShares U.S. Oil Equipment & Services ETF seeks to track the investment results of an index composed of U.S. equities in the oil equipment and services sector.

Also check out Best Forex Brokers for Trading

Benefits of investing in IEZ:

- Targeted exposure to U.S. companies that are involved in the business of equipment and services for oil exploration and extraction

- Focus on domestic oil equipment and services stocks

- Use to express a sector view

IEZ has an expense ratio of 0.41%

The top holdings of the ETF are:

- Halliburton – 23.3 %

- Schlumberger NV – 21.41 %

- Baker Hughes Class A – 4.75%

- Helmerich and Payne Inc. – 4.55 %

- Champion X Corp – 4.38%

- NOV Inc. – 4.09 %

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

VanEck Gold Miners ETF

VanEck Gold Miners ETF is one of the most popular funds in the global gold-mining segment. This ETF offers investors exposure to some of the largest gold mining companies in the world. Since the profitability of gold miners depends on the prevailing market price for the goods that they sell, these stocks will generally exhibit a strong-correlations to movements in spot gold prices. Investing in value stocks is a long-term investment.

The VanEck Vectors Gold Miners (GDX) ETF is one of the most liquid vehicles on the market but it also comes with its set of risks. Not everyime a rise in gold prices will reflect a positive change in the GDX. On the contrary, a drop in price of gold will be reflected in the GDX.

GDX is considered a speculative investment. This is a good investment for investors who are willing to take the risks that comes along.

GDX has an expense ratio of 0.53%.

The top holdings of the ETF are:

- Goldcorp Inc – 9.88 %

- Barrick Gold Corporation – 8.21 %

- Newmont Mining Corporation – 6.18 %

- Randgold Resources Limited Sponsored ADR – 5.25 %

- Franco-Nevada Corporation – 5.03 %

- Newcrest Mining Limited – 5%

Also check out: List of Most Volatile Stocks

SPDR S&P Metals & Mining ETF

The SPDR S&P Metals & Mining ETF seeks to provide investment results that correspond generally to the total return performance of the S&P Metals and Mining Select Industry Index. Also, it provides exposure to the metals & mining segment of the S&P TMI, which comprises the following sub-industries: Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Precious Metals & Minerals, Silver, and Steel. Also learn about Best Day Trading Stocks

Benefits of investing in XME:

- It offers the potential for unconcentrated industry exposure across large, mid and small cap stocks

- Allows investors to take strategic or tactical positions at a more targeted level than traditional sector-based investing

XME has an expense ratio of 0.35%.

The top holdings of the ETF are:

- MP Materials Corp Class A – 5.56 %

- Cleveland-Cliffs Inc – 5.28 %

- Steel Dynamics Inc. – 4.90 %

- Alcoa Corporation – 4.83 %

- United States Steel Corporation – 4.80 %

- Nucor Corporation – 4.66 %

- Peabody Energy Corporation – 4.52%

- Freeport-McMoRan Inc. – 4.49 %

- Newmont Corporation – 4.38 %

- Royal Gold Inc. – 4.37 %

You may also like reading: