Commodities are the goods and raw materials that circulate on the global market, such as natural resources and agricultural products. They impact our everyday lives, whether we’re investors or not. Investors can also invest in commodities through the use of futures contracts or exchange-traded products (ETPs) that directly track the specific commodity index.

Commodities are the goods and raw materials that circulate on the global market, such as natural resources and agricultural products. They impact our everyday lives, whether we’re investors or not. Investors can also invest in commodities through the use of futures contracts or exchange-traded products (ETPs) that directly track the specific commodity index.

There are three types of commodities:

- Agriculture – Agriculture commodities include a variety of products

- Drink which includes sugar, cocoa, coffee, and orange juice

- Grains, such as wheat, soybeans, soybean oil, rice, oats, and corn

- Cattle and pork

- Cotton and lumber

- Metals – Metals include mined commodities, such as gold, copper, silver, and platinum. We have a list of gold stocks that have been performing well and are a must-buy nowadays.

- Energy – The energy category includes crude oil, RBOB gasoline, natural gas, and heating oil.

The price of these commodities is determined in the trading market of commodities. Therefore, the prices of these items, which you use every day, are often fluctuating. Just like every form of investment, commodity investment has its own set of advantages and disadvantages, which are listed below:

Advantages of Commodity Investing

A Diversified Portfolio– Commodities and Stocks have a negative correlation. A rise in the price of commodities leads to a decline in stocks. Therefore, the losses incurred due to the drop in stock prices are adjusted by the gains in the rising commodity prices. Thus, commodities provide diversification in your portfolio.

A hedge against Inflation – During inflation, the stock prices go down. Meanwhile, commodities benefit from inflation. This happens because the demand for commodities rises because of the growing demand for finished goods. As a result, the price of commodities increases.

Potential returns due to different growth opportunities – Different commodities experience price fluctuations due to multiple factors which are supply and demand, exchange rates, inflation, and the overall health of the economy. The price of commodities is highly affected by the demand and economic development in multiple countries around the globe. As a result, the investors earn high returns due to economic growth in a specific country.

Get to know about:

Disadvantages of Commodity Investing

Volatility – Commodities is amongst the most volatile asset class. The risk of volatile stocks is mitigated through different investment strategies and diversifications. Therefore, Mutual funds and/or exchange-traded products (ETPs) that track these commodities also show higher volatility. The supply and demand of commodities are price inelastic. This means there is no link of price with the supply of the commodity. Hence the cumulative inelastic demand and inelastic supply create huge fluctuations in prices whenever there is a small shift in the market.

Low Returns – Commodities don’t generate any income for the investor. Also, the return on commodities is very low.

Asset Concentration – In commodity funds, the portfolio is usually concentrated in 1 or 2 industries which represents a non-diversified commodity portfolio. As a result, a change in the price of a commodity can have a huge impact on the commodity fund.

List of Best Commodities to Invest in 2024

While there are several commodities to invest in for good profits, we have compiled some of the most profitable commodity’s options here:

Crude Oil

Crude oil tops the list in commodity investing. It is also considered the single most important commodity in the world because it is, currently, the primary source of energy production. Leading oil-producing countries include the United States, Saudi Arabia, and Russia. Like every commodity, supply and demand determine the price and hence the profitability of crude oil.

The is no stop to the increasing demand for crude oil. Crude Oil is used in the manufacturing of gasoline and other items such as cosmetics, fertilizers, plastics, and even medicines. Oil is one of those resources that will never go out of massive demand.

The tourism and hospitality sectors are back on the rise after the lift on lock-down. This has led given a huge boost to the price of Crude Oil. Global travel is expected to drive the demand for fuel even further by the end of the year. Get to know everything about high frequency trading.

The below graph shows the trading price of Light Sweet crude oil on the New York Mercantile Exchange.

As an investor, you can invest in Crude Oil by:

As an investor, you can invest in Crude Oil by:

- Invest in Exchange-traded funds (ETF). Get to know the best ESG ETFs to buy now,

- Buy Oil Futures,

- DPP – Oil, and Gas Direct Participation Program

- Exploration Drilling Program

Despite the massive returns and high demand, crude oil has its own set of cons that should be kept in mind while investing. Firstly, the probability of price fluctuations is huge. Also, the political level intervention can lead to massive changes in the price of crude oil which increases the risks of this investment.

India and China are some of the largest importers and consumers of crude in the world. Therefore, staying updated with their economic situation is the key to understanding how that influences the global energy markets. And can help investors when to exit and enter the crude oil trading.

Gold

Gold is one of the top commodities to trade-in due to its stability and worldwide acceptance. The high demand for gold among retail investors and traders makes it a popular asset class for fund managers. One of the key advantages of gold over other commodities is that it cannot get used up or consumed.

Gold stands apart from other commodities as it has many benefits. According to the report by Gold Hub, Gold has the below characteristics:

- Gold has delivered superior absolute and risk-adjusted returns to other commodities over multiple time horizons

- Gold is a more effective diversifier than other commodities

- Gold outperforms commodities in low inflation periods

- Gold has lower volatility

- Gold is a proven store of value

- Gold is highly liquid

Commodities are often used by investors as hedges during periods of high inflation. Gold has proven to be the best performing commodity during inflation. Also, Gold has a long and influential role as a monetary asset. The gold market is robust and highly liquid making it an even more attractive commodity for investing.

The below graph shows the price of gold over the past two years:

Despite being one of the most attractive commodities, this commodity has its downsides for investments. Gold does not generate any income for investors. Also, the price of gold is highly dependent on macroeconomic factors which have no relevance to demand. This makes it difficult to analyze the price fundamentals. Using Gold Trading Signal Providers is a smart approach for traders.

Despite being one of the most attractive commodities, this commodity has its downsides for investments. Gold does not generate any income for investors. Also, the price of gold is highly dependent on macroeconomic factors which have no relevance to demand. This makes it difficult to analyze the price fundamentals. Using Gold Trading Signal Providers is a smart approach for traders.

Gold is known as a crisis commodity as the price of this commodity rise during the economic and financial crisis. Hence, it is one of the best commodities to invest in and diversify your portfolio.

Read more:

Coffee

Coffee is the second-most-traded commodity in the world after crude oil. Since it is integrated into the daily life of every person, the global demand continues to rise.

Coffee benefits from strong global economic growth. Demand for coffee from emerging economies is expected to increase, which will give a huge boost to the demand and ultimately the price of coffee.

You can invest in coffee by:

- Purchasing coffee ETFs,

- Investing in stocks of coffee companies

- Purchasing coffee futures

Coffee is a good investment. But it is prone to risks. Coffee has risks similar to agriculture and crude oil markets, many of which are out of control.

- Weather risks significantly affect the coffee produced. Not only natural disasters and/or major weather events can reduce coffee produce, but a mere frost during harvest season can also damage the produce

- Coffee prices are highly affected by the foreign currency exchange rates

- Economic and political factors affecting coffee-producing countries directly affect coffee supply and ultimately the price

- Changes in trade regulations and restrictions also have a significant effect on the price

The below chart shows the rise in the price of coffee during the current year.

Despite the rise in prices, the demand for coffee continues to rise. People keep on buying lattes and cappuccinos and there is no stopping them. Looking at the upward price trend of coffee, it is the best time to invest in this commodity to earn profits in the future. Check out the best NFT stocks to buy now.

Despite the rise in prices, the demand for coffee continues to rise. People keep on buying lattes and cappuccinos and there is no stopping them. Looking at the upward price trend of coffee, it is the best time to invest in this commodity to earn profits in the future. Check out the best NFT stocks to buy now.

Copper

Copper is a unique precious metal that is often overlooked by investors, even though it’s one of the most useful and reliable minerals out there. Copper is a low-risk investment and offers excellent value to investors. Copper is used in nearly every major industry of the world: transportation, engineering, machinery and equipment, electrical, building, automotive, and computer. It is used in everyone’s homes as a part of both our plumbing and electrical systems. It is a key component of our cars. Also, this commodity is used in creating coins of currencies.

South America has the most copper mines. And the highest production of refined copper is done in China. Copper is mined in countries all over the world. With the global economy expanding, the demand for copper has grown. Moreover, developing countries increasing their focus on infrastructure have increased their purchase of copper.

The price and demand of copper are highly affected by:

- Emerging Markets – Emerging markets are a key driver of copper prices. When economies grow, the focus on infrastructure increases. This ultimately increases the demand for copper, and hence the price

- US Housing Market – The building construction industry comprises almost half of the copper used in the United States. Therefore, factors that affect US housing demand, play an important role in determining copper demand.

- Supply Disruptions – Political, environmental, and labor issues in copper-producing countries have a huge impact on copper supply and ultimately the price of the commodity.

- Substitution – Cheaper metals like aluminum are a great substitute for copper in power cables, electrical equipment, and refrigeration equipment. Rising copper prices can shift consumers to low price substitutes.

The below graph shows the price trend of copper over the past two years.

Diversifying your assets with a precious metal such as copper can help you to retain a valuable portfolio. But there have been no discoveries of copper mines in many decades. Due to which manufacturing companies are shifting towards aluminum. It is a great threat to the copper market in the commodity trading world.

Diversifying your assets with a precious metal such as copper can help you to retain a valuable portfolio. But there have been no discoveries of copper mines in many decades. Due to which manufacturing companies are shifting towards aluminum. It is a great threat to the copper market in the commodity trading world.

Check out our list of top day trading stocks.

Palladium

Palladium is a rare, platinum-group metal that is used extensively for industrial purposes. This metal does not rust or corrode and chemicals cannot damage it. The properties of this rare metal make it a very valuable commodity. Palladium attracted investor attention in the 21st century because it has often outperformed gold, silver, and platinum. It is now considered an excellent store of value for investors.

Production of palladium is very low in comparison to other precious metals. Whereas, the demand for the commodity is rising. This suggests a strong future outlook for the palladium price.

Palladium is widely used in:

- Catalytic convertors

- Electronics

- Dental Industry

- Miscellaneous Industrial Uses

The price of Palladium is highly affected by:

- Demand in Automotive Industry – The demand for palladium is highest in the automotive industry. As countries are shifting towards greener environments that promote low carbon emission automobiles, the demand for catalytic converters rises. This ultimately leads to higher demand for palladium. The demand for palladium is seen in countries with large markets, such as China and the US.

- The Strength of the US dollar – Another factor that drives the price of this commodity is its inverted relationship with US dollars. When the dollar is declining, palladium strengthens as a commodity as investors seek precious metals as a store of value.

- Geopolitical conditions – Russia and South Africa are the prime palladium suppliers. Since the global economy is all interconnected, any disruptions in the supply countries of palladium can have a huge influence on palladium price movements.

- Substitutes – Palladium is very scarce, hence it is priced high. But the high price of palladium will eventually make the manufacturers seek cheaper substitutes such as platinum.

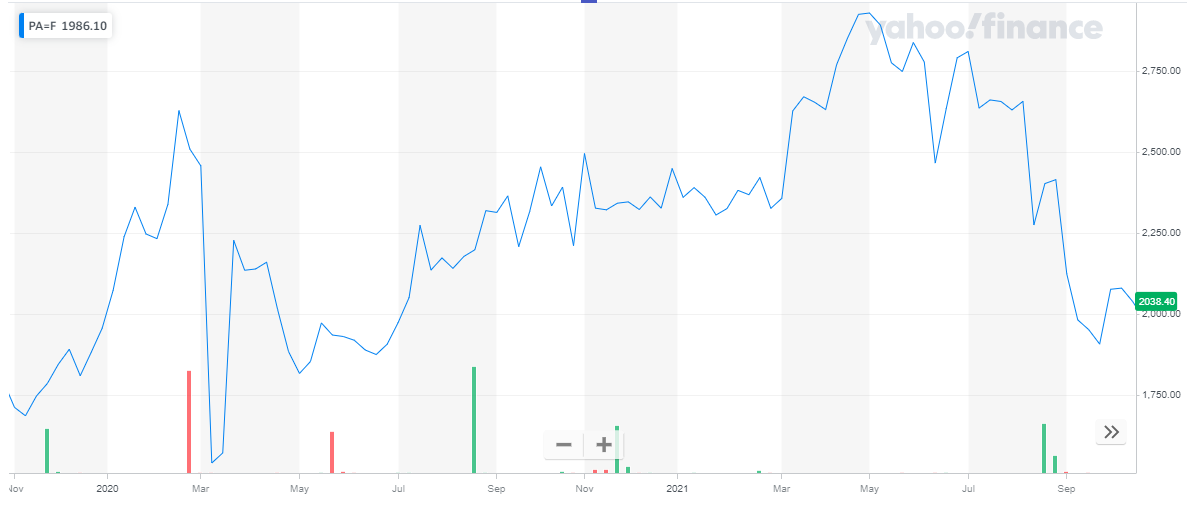

The below graph shows the price chart of Palladium over the past two years.

Palladium production often takes place as a by-product of producing other metals, hence it is a scarce metal. The scarcity causes it to trade at a premium price over gold and silver. Palladium is a great commodity to invest in today as the scarcity of metal will further boost the price in near future.

Palladium production often takes place as a by-product of producing other metals, hence it is a scarce metal. The scarcity causes it to trade at a premium price over gold and silver. Palladium is a great commodity to invest in today as the scarcity of metal will further boost the price in near future.

Conclusion

Investing in commodities is not for novice traders. It is better suited to experienced traders who can understand and analyze the markets of each commodity. Investing in commodities is encouraged because it is an excellent source to diversify portfolio risk. The above-mentioned commodities have their own sets of pros and cons which eventually make them the best options out there. Before investing in these commodities, always invest your time in understanding the commodity price movements and factors that match your investment objective.

We have compiled the best commodity to invest in in 2024. Keeping in mind your investment objectives and risk adherence, choose your investments wisely.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Fibonacci Retracement, Extension & Trading Strategies

- Best Trading and Forex Signal Providers

- Best Crypto Currencies To Invest

- Monthly Dividend Stocks to Buy

- Best Renewable Energy Stocks to Invest

- Best Drone Stocks to Buy

- Best Penny Stocks to Buy

- Best Stock Signal Providers

- Best Crypto Signal Providers

- Best Quantum Computing Stocks to Buy in 2021

- Best Swing Trading Stocks To Buy Now