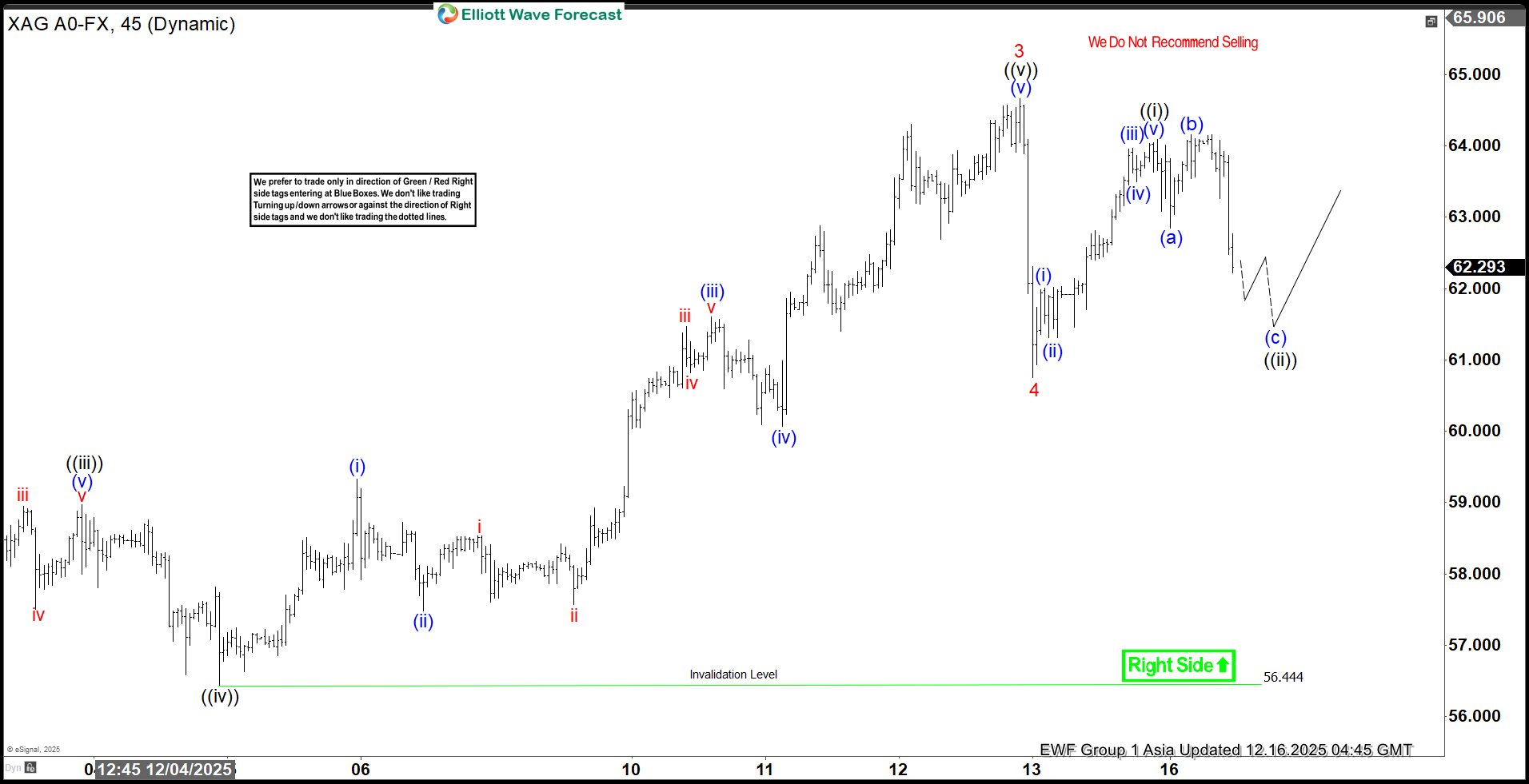

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Silver (XAGUSD) Elliott Wave: Strong Impulsive Rally Unfolding

Read MoreSilver (XAGUSD) continues to demonstrate a powerful impulsive rally, advancing steadily toward new all-time highs. The short-term cycle that began from the January 15, 2026 low is unfolding as a clear impulse five-wave rally. From that date, wave (i) concluded at $93.03, followed by a corrective pullback in wave (ii) that ended at $86.83. Momentum […]

-

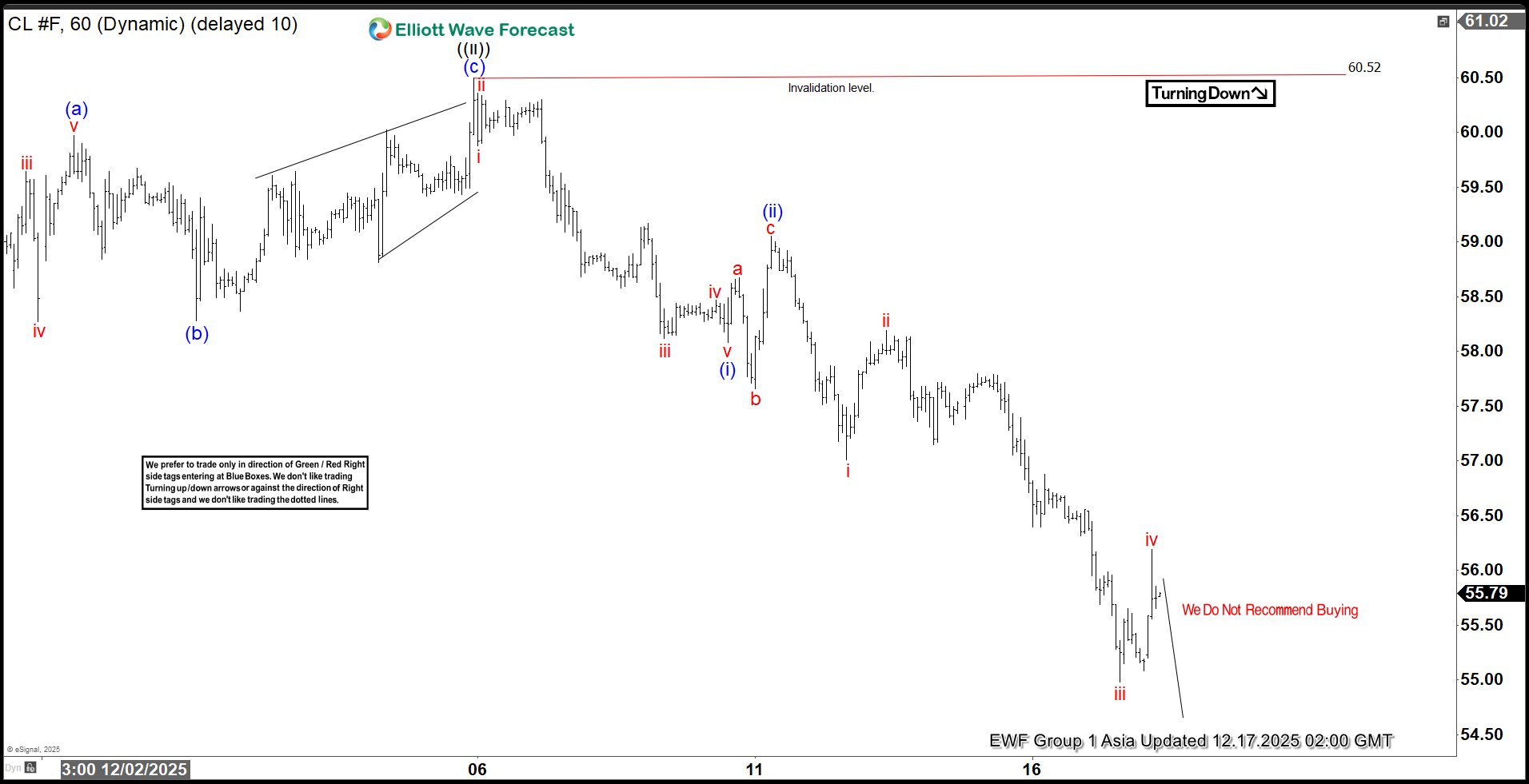

Elliott Wave View: Light Crude Oil (CL) Looking for Larger Degree Correction

Read MoreThe short-term Elliott Wave outlook for Oil (CL) shows the cycle from the June 23, 2025 peak ended at the December 16, 2025 low of $54.98. After this completion, Oil began correcting the prior cycle in a larger degree, expected to unfold in either three or seven swings. From the December 16 low, wave ((i)) […]

-

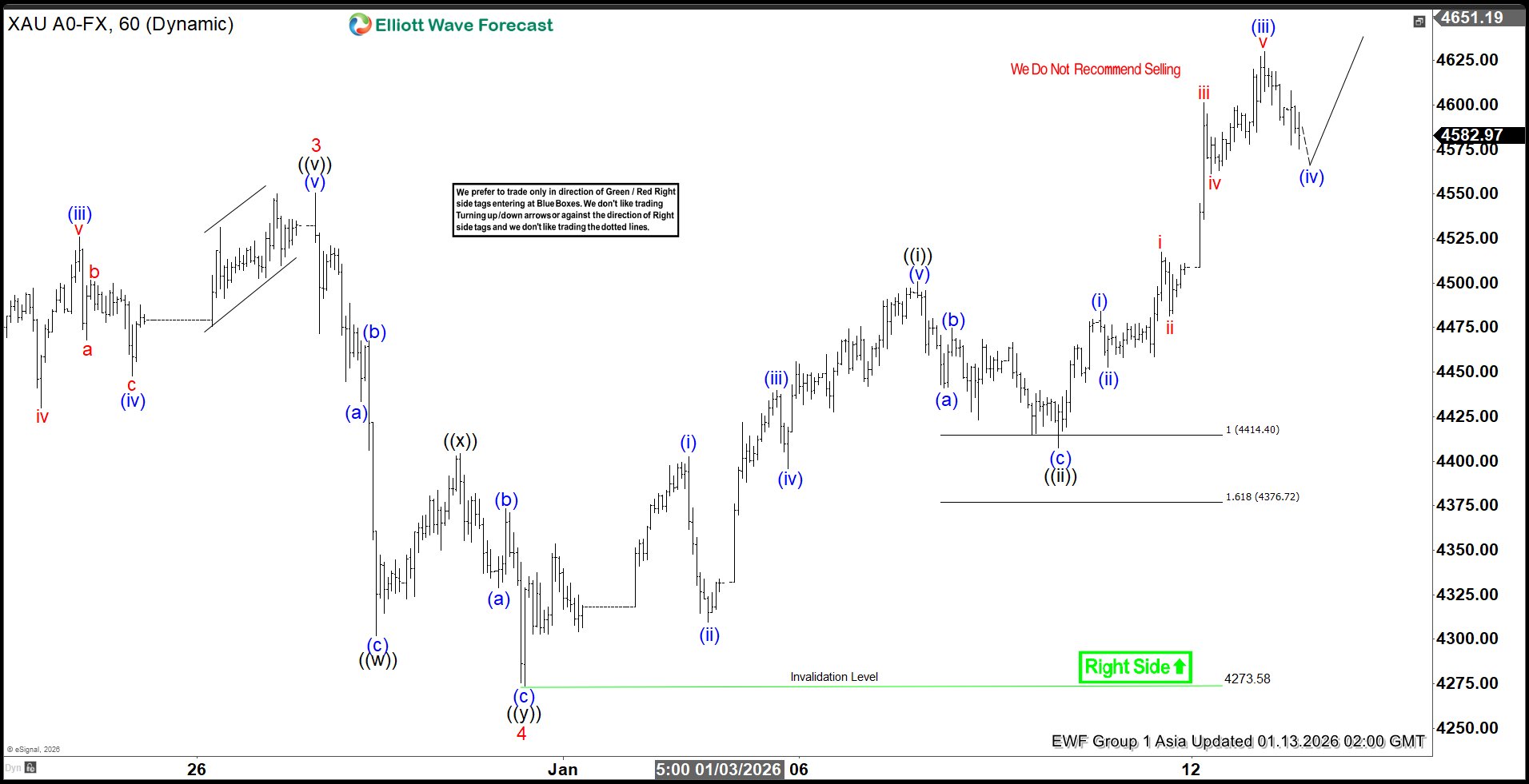

Elliott Wave Structure: Gold (XAUUSD) Targeting Final Leg of Wave 5

Read MoreGold (XAUUSD) surged to a new all‑time high, reinforcing the bullish trend. This article and video examine the Elliott Wave trajectory of the metal.

-

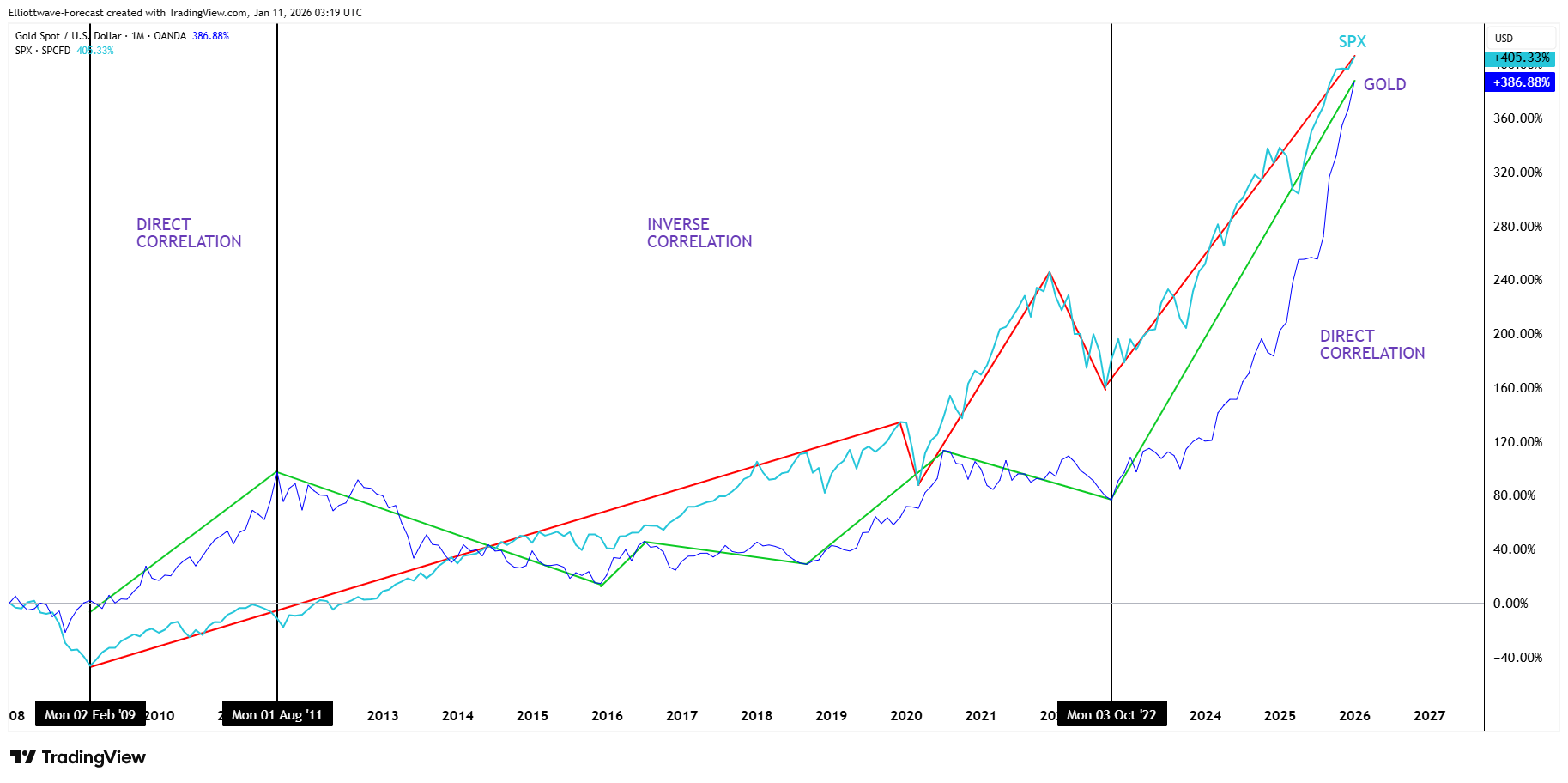

Gold, Silver, and the S&P 500: Navigating the New Correlation

Read MoreFor decades, investors viewed Gold and Silver as the ultimate insurance policy. Traditionally, precious metals and equities moved in opposite directions, providing a natural hedge for portfolios. However, the market dynamics of 2024 and 2025 completely rewrote the rulebook. As we navigate the first quarter of 2026, understanding this new “direct correlation” is vital for […]

-

Bearish Sequence Pressures Oil (CL) Lower

Read MoreLight Crude Oil (CL) breaks to the downside and creates bearish sequence from March 2022 peak. This article and video look at the Elliott Wave path.

-

Silver (XAGUSD) Pullback Seen as Buying Opportunity Amid Record Breaking Rally

Read MoreSilver (XAGUSD) Continues to make Record High and the metal should find support in any pullback in 3, 7, 11 swing for Further Upside.