Investors buy shares of companies to earn from the profitability and value creation of the companies’ businesses. Companies that pay dividends are essentially distributing some of that business value back to their owners.

However, some companies do not pay dividends. This creates uncertainty amongst investors about the return they are earning on their investments. Companies that regularly pay dividends provide investors with greater certainty about how and when business profits will be returned to shareholders, which often makes their stock more attractive. Dividend-paying companies tend to be viewed as financially strong because of their ability to remove money from the corporation and pay it to investors.

But not all companies pay dividends. This is often a very calculated decision. Companies that do not pay dividends are by no means necessarily less appealing investment options. These companies if are operating in a high growth phase might give an excellent return to investors in terms of stock price appreciation while not paying dividends. Investors in these sorts of companies can earn investing profits by selling their shares for capital gains.

Top Companies That Don’t Pay Dividends

Some of the largest companies that currently don’t pay dividends include:

| Sr. | Company Name | Symbol | Market Cap | Price (As of 26th April 2023) |

| 1 | Amazon (AMZN) | AMZN | $ 1.077 Trillion | $ 104.98 |

| 2 | Alphabet (GOOGL) (GOOG) | GOOGL | $ 1.339 Trillion | $ 103.71 |

| 3 | Berkshire Hathaway (BRK.B) | BRK | $ 708.9 billion | $ 320.53 |

| 4 | Meta Platforms (META) | META | $ 614 billion | $ 209.4 |

| 5 | Teradata Corporation (TDC | TDC | $ 3.92 billion | $ 38.1 |

| 6 | Monster Beverage Corporation (MNST) | MNST | $ 57.2 billion | $ 54.26 |

| 7 | Advanced Micro Devices Inc. (AMD) | AMD | $ 138.9 billion | $ 85.94 |

| 8 | Netflix Inc. (NFLX) | NFLX | $ 144.45 billion | $ 321.15 |

Amazon (AMZN)

Amazon (AMZN)

Amazon.com is an American tech multinational whose business interests include e-commerce, cloud computing, digital streaming, and artificial intelligence. A Fortune 100 mainstay, Amazon.com is also one of the Big Five or the five largest and most dominant technology companies in the U.S.

During the coronavirus pandemic, Amazon’s business soared, as millions of Americans in lockdown became more reliant than ever on the company’s delivery services. In early April 2021, then-CEO Jeff Bezos said the company had amassed 200 million Prime subscribers, compared with 150 million at the start of 2020.

Amazon has always been one of those stocks which were highly-priced. As a result, many investors could not afford to buy it. However, in 2022, amazon decided to split its stock, making shares more affordable for investors.

While many big companies pay dividends Amazon doesn’t pay dividends to shareholders. But that’s not necessarily a bad thing. Amazon’s business model has long centered on innovating and branching out into different corners of the market, as evidenced by its foray into the grocery and pharmacy business in recent years. As such, it’s easy to see why Amazon doesn’t choose to pay dividends — it would rather use its money to grow as a company.

Here are the company’s financial highlights for the past few years:

| 2022 | 2021 | 2020 | |

| Net Sales | $ 386,064 million | $ 469,822 million | $ 513,983 million |

| Operating Income | $ 22,899 million | $ 24,879 million | $ 12,248 million |

| Net Income / Loss | $ 21,331 million | $ 33,364 million | $ (2,722) million |

| Earnings per share | $ 2.13 | $ 3.3 | $ (0.27) |

Amazon has a market cap of $ 1.077 trillion. Its shares are trading at $ 104.98.

The stock of Amazon started the year 2022 at $ 166.72. The stock started with a downward trend and continued to decline throughout the year. The stock closed the year at a low of $ 84. Overall, the stock declined by 49.6 %.

In 2023, the stock recovered a bit and has appreciated by 25 % to date.

Also, read:

Alphabet (GOOGL) (GOOG)

Alphabet, the multinational parent of Google and Google subsidiaries, was created through a restructuring at Google in 2015. Largely owing to Google’s success and YouTube’s rapid growth, Alphabet is the world’s leader in digital ad revenue and cracked the Fortune 500’s top 10 for the first time in 2020, with some $ 183 billion in revenue and more than $ 40 billion in profits. In recent years, Alphabet and other tech giants have come under regulatory scrutiny in the U.S. and abroad for possible breaches in user data privacy and security. As of 2021 Alphabet still faces federal and state antitrust lawsuits, pressure from a newly formed employee union, and scrutiny over problematic content disseminated on YouTube.

Alphabet has never paid a dividend despite being one of the most profitable companies in the world and having $ 125 billion in cash, cash equivalents, and marketable securities on its balance sheet. As the company’s free cash flow has ramped up, it’s spent much of that cash on buying back shares. Buying back stock helps inflate earnings per share, reducing the number of shares that company profits get divided by.

Like many technology stocks, Alphabet has never paid a dividend to shareholders. But as companies mature and grow their profits and cash flow, their ability to pay dividends also rises. Alphabet is easily able to pay a dividend; it simply has not made the decision to initiate a dividend yet.

Alphabet released first quarter results for the year 2023:

| Q1 2022 | Q1 2023 | % Change | |

| Revenues | $ 69,787 million | $ 68,011 million | 3 % |

| Operating Income | $ 17,415 million | $ 20,094 million | -13.3 % |

| Net Income | $ 15,051 million | $ 16,436 million | -8.4 % |

| Earnings per share | $ 1.17 | $ 1.23 | -4.87 % |

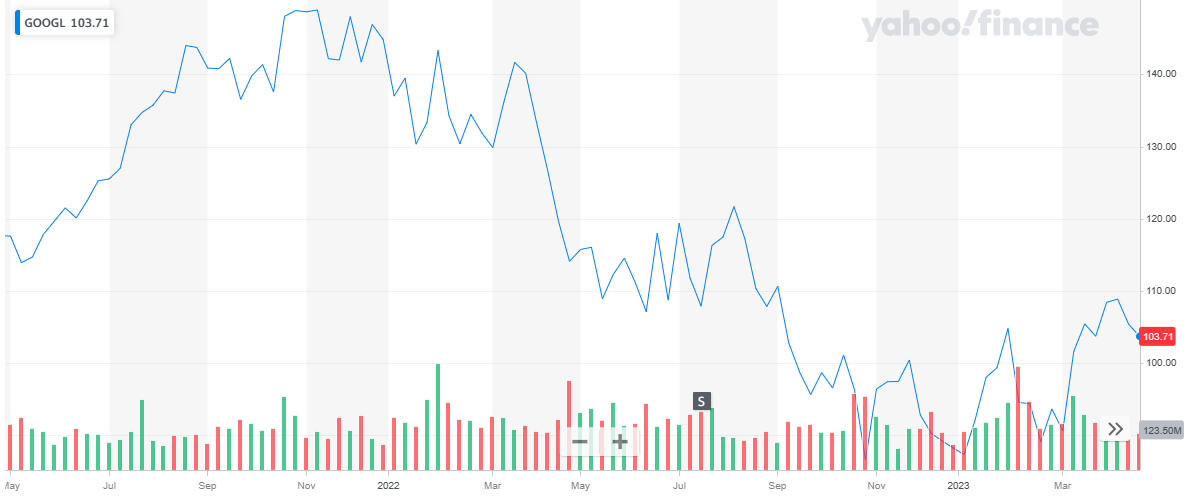

Alphabet has a market cap of $ 1.339 trillion. Its shares are trading at $ 103.7.

The stock started the year 2022 at $ 144.85. The stock picked up a bearish run during the year. After continuing to decline throughout the year, the stock closed the year at $ 88.23. Overall, the stock declined by 39 % during the year.

In 2023, the stock started to recover and has appreciated by 17.5 % to date.

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Berkshire Hathaway (BRK.B)

Berkshire Hathaway is a diversified multinational holding company with full ownership of such well-known brands as GEICO, Duracell, Fruit of the Loom, and Dairy Queen. Berkshire also has significant holdings in many other publicly traded companies. The company has seen consistent growth in revenue and value for decades. In May of 2021, Warren Buffett, Berkshire’s 90-year-old CEO, publicly announced the company’s likely successor: Greg Abel, the 58-year-old vice chairman of Berkshire’s noninsurance businesses.

Berkshire now enjoys major ownership in an unmatched collection of huge and diversified businesses. At year-end 2022, Berkshire was the largest owner of eight of these giant companies: American Express, Bank of America, Chevron, Coca-Cola, HP Inc., Moody’s, Occidental Petroleum, and Paramount Global. In addition to those eight investees, Berkshire owns 100% of BNSF and 92% of BH Energy, each with earnings that exceed the $3 billion mark noted above ($5.9 billion at BNSF and $4.3 billion at BHE).

Warren Buffett listed his three priorities for using cash that is ahead of any dividend:

- Reinvesting in the businesses

- Making new acquisitions

- Buying back stock

Warren Buffett prefers to reinvest profits in the companies he controls to improve their efficiency, expand their reach, create new products and services, and improve existing ones. Buffett feels that investing back into the business provides more long-term value to shareholders than paying them directly because the company’s financial success rewards shareholders with higher stock values. Despite the company having a record amount of cash on hand, the prospect of a Berkshire Hathaway dividend is dim as long as Buffett is in charge.

Here are the company’s financial highlights for the past few years:

| 2022 | 2021 | 2020 | |

| Revenues | $ 302,089 million | $ 276,203 million | $ 245,579 million |

| Net Income / Loss | ($ 22,819) million | $ 89,795 million | $ 42,521 million |

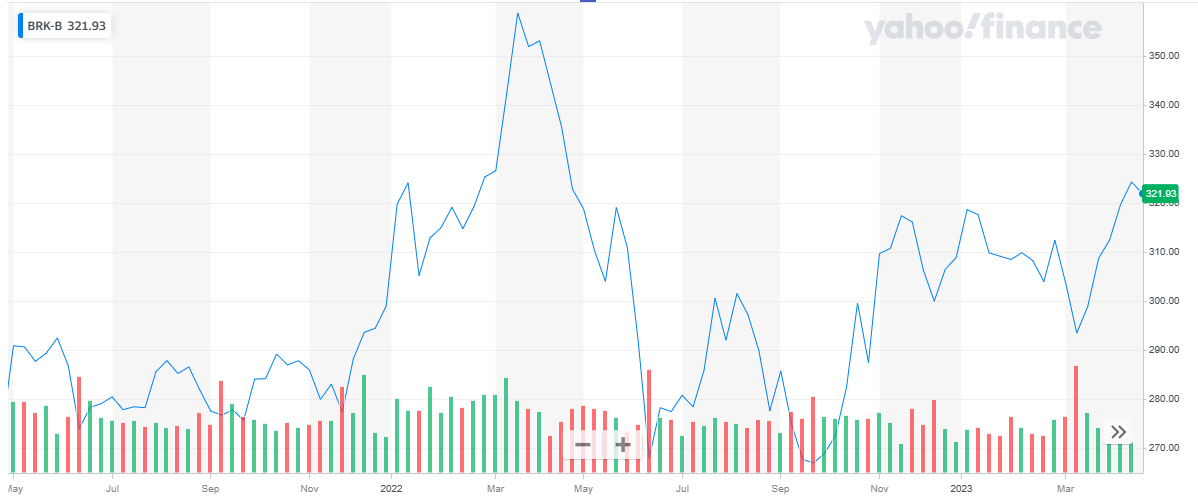

Berkshire Hathaway has a market cap of $ 708.9 billion. Its shares are trading at $ 320.53.

The stock started the year 2022 at $ 299. Initially, the stock spiked high and hit $ 358.7. after that, the stock suffered a huge drop and went as low as $ 268. Eventually, the stock closed at $ 308.9, representing a 13.7 % decline during the year.

In 2023, the stock suffered small drops and eventually recovered. It last closed at $ 320.53 representing a 3.8 % appreciation to date.

Meta Platforms (META)

Meta Platforms (META)

Meta Platforms, Inc., engages in the development of social media applications. It builds technology that helps people connect, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented and virtual reality-related consumer hardware, software, and content.

Meta Platform’s fundamentals seem to support a dividend payment, as the company is highly profitable. However, the company has not yet announced any dividend. Introducing dividends will open up a new and large group of institutional investors who manage income-oriented funds. Also, income investors who previously would not have invested in a non-dividend paying stock, such as Meta Platforms, would likely be enticed by a dividend payout.

Here are the company’s financial highlights for the past few years:

| 2022 | 2021 | % Change | |

| Net Sales | $ 116,609 million | $ 117,929 million | (1) % |

| Operating Income | $ 28,944 million | $ 46,753 million | (38) % |

| Net Income / Loss | $ 23,200 million | $ 39,370 million | (41) % |

| Earnings per share | $ 8.59 | $ 13.77 | (38) % |

Meta has a market cap of $ 614 billion. Its shares are trading at $ 209.4.

The stock started the year 2022 at $ 336.35. the stock started off with a bearish run. It continued to decline throughout the year and went as low as $ 90.79. The stock eventually closed off at $ 120.34 representing a 64 % decline during the year.

In 2023, the stock took a recovery path and has appreciated by 98 % to date.

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Teradata Corporation (TDC)

Teradata Corp (Teradata) provides analytics applications for transforming corporate data into business intelligence. The company’s product offerings comprise software, cloud, hardware, and ecosystem management to deliver analytics for the business analytical ecosystem. It offers solutions, such as asset optimization, customer experience, finance transformation, production innovation, risk mitigation, artificial intelligence, big data, fraud prevention, financial visibility, and dynamics identity management. The company offers its solutions to diversified industries, such as financial services, communications, government, insurance, healthcare, manufacturing, retail, energy, utilities, natural resources, travel, automotive, and transportation. It has a business presence across the Americas, Europe, the Middle East and Africa, and Asia-Pacific. Teradata is headquartered in San Diego, California, the US.

Here are the company’s financial highlights for the past few years:

| 2022 | 2021 | % Change | |

| Net Sales | $ 1,795 million | $ 1,917 million | (6) % |

| Operating Income | $ 118 million | $ 231 million | (49) % |

| Net Income / Loss | $ 33 million | $ 147 million | (77) % |

| Earnings per share | $ 0.32 | $ 1.35 | (74) % |

Teradata Corporation has a market cap of $ 3.92 billion. Its shares are trading at $ 38.1.

The stock has been volatile in the past few years. In 2022, the stock started off at $ 42.47. After an initial rise in price, the stock started to decline and continued to do so throughout the year. The stock closed the year at $ 33.66 representing a 20.7 % decline during the year.

In 2023, the stock recovered a bit and last closed at $ 38.1 representing a 13.2 % recovery to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Monster Beverage Corporation (MNST)

Monster Beverage Corp (Monster Beverage) develops, markets, and distributes an assortment of energy drinks. Its product portfolio includes carbonated energy drinks, energy shakes, high-performance energy drinks, and pure energy seltzers. The company markets and sells products under various brand names such as Monster Energy, BPM, BU, Java Monster, Muscle Monster, Burn, Nalu, NOS, Play and Power Play, Samurai, and Ultra Energy. Its major clients include bottlers and full-service beverage distributors, retail grocery and specialty chains, wholesalers, club stores, mass merchandisers, convenience chains, drug stores, food service customers, and the military. The company’s operations are spread across the Americas, Asia-Pacific, Europe, the Middle East and Africa. Monster Beverage is headquartered in Corona, California, the US.

Here are the company’s financial highlights for the past few years:

| 2022 | 2021 | % Change | |

| Net Sales | $ 6,311 million | $ 5,541 million | 14 % |

| Operating Income | $ 1,585 million | $ 1,311 million | 21 % |

| Net Income / Loss | $ 1,192 million | $ 1,377 million | (13.4) % |

| Earnings per share | $ 2.26 | $ 2.61 | (13.4) % |

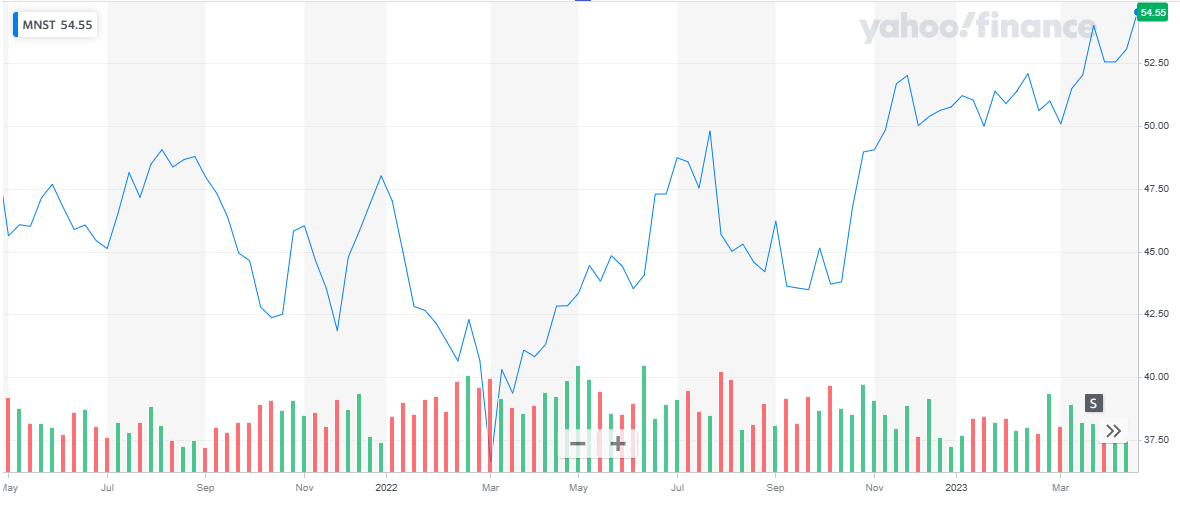

Monster Beverage has a market cap of $ 57.2 billion. Its shares are trading at $ 54.26.

The stock started the year 2022 at $ 48.02. Throughout the year the stock remained mildly volatile; it dropped as low as $ 36.61 and as high as $ 52.2. Eventually, the stock closed at $ 50.76 representing an 8.7 % appreciation throughout the year.

In 2023, the stock continued the climbing pattern which it picked up in the last quarter of 2022. To date, the stock has appreciated by 6.9 %.

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

Advanced Micro Devices Inc. (AMD)

Advanced Micro Devices Inc (AMD) is a manufacturer of semiconductor products. The company designs, manufactures, develops, and markets high-performance computing, graphics, and visualization technologies. Its product portfolio includes desktop graphics, desktop processors, laptop graphics, laptop processors, chipsets, memory products, professional graphics, and server processors. AMD markets its products under AMD, Athlon, EPYC, FreeSync, FirePro, Geode, Opteron, Ryzen, Radeon, and Threadripper brands. It serves original equipment manufacturers (OEMs), original design manufacturers, system builders, independent distributors, add-in-board manufacturers (AIBs), public cloud service providers, and other contract manufacturers. The company has a business presence across North America, Latin America, Europe, Asia-Pacific, and the Middle East. AMD is headquartered in Santa Clara, California, the US.

Here are the company’s financial highlights for the past few years:

| 2022 | 2021 | % Change | |

| Net Sales | $ 23,601 million | $ 16,434 million | 44 % |

| Operating Income | $ 1,264 million | $ 3,648 million | (65) % |

| Net Income / Loss | $ 1,320 million | $ 3,162 million | (58) % |

| Earnings per share | $ 0.84 | $ 2.57 | (67) % |

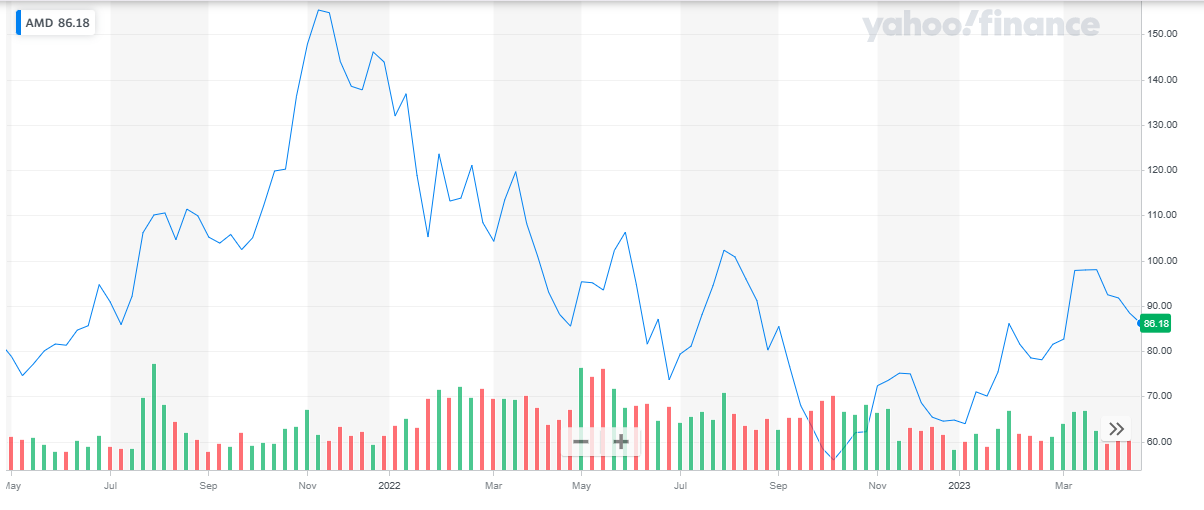

Advanced Micro Devices has a market cap of $ 138.9 billion. Its shares are trading at $ 85.94.

The stock started the year 2022 at $ 143.9 with a bearish trend. The stock continued to decline throughout the year and dropped as low as $ 55.94. Eventually, the stock closed at $ 64.77 representing a 55 % decline during the year.

In 2023, the stock picked up a recovery pattern and has appreciated by 33 %.

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Netflix, Inc. (NFLX)

Netflix Inc (Netflix) provides entertainment services. The company offers TV shows and movies such as original series, documentaries, and feature films through an internet subscription on TV, computer, and mobile devices. It also offers a wide range of leisure activities, video games, and other sources of entertainment. Netflix also operates a separate library of movies that can be watched instantly on subscribers’ TV through mobile applications, or computers. It licenses, acquires, and produces content, including original programming. The company markets and promotes its service through various marketing partners including multichannel video programming distributors, streaming entertainment providers, consumer electronics manufacturers, mobile operators, and internet service providers. It has a business presence across the Americas, EMEA, and APAC. Netflix is headquartered in Los Gatos, California, the US.

Netflix continues to use its cash flow on growth initiatives to increase its pool of subscribers. Because of this, Netflix has failed to generate positive free cash flow growth on a consistent basis. The company expects to generate positive cash flow this year and beyond, which is an improvement as it usually is typical for Netflix to post negative free cash flow.

Using large amounts of capital also means that Netflix has to access debt markets to keep spending. This has impacted the company’s balance sheet, offering another obstacle to a future dividend payment. This interest-bearing debt makes it much more difficult for Netflix to offer shareholders a dividend.

Netflix released first quarter results for the year 2023:

| Q1 2023 | Q1 2022 | % Change | |

| Revenues | $ 8,161 million | $ 7,868 million | 3.7 % |

| Operating Income | $ 1,714 million | $ 1,972 million | (13) % |

| Net Income | $ 1,305 million | $ 1,597 million | (18.3) % |

| Earnings per share | $ 2.93 | $ 3.6 | (18.6) % |

Netflix has a market cap of $ 144.45 billion. Its shares are trading at $ 321.15.

The stock started the year at a price of $ 602.44 with a bearish trend. During the year the stock continued to decline and dropped to the low of $ 175.51 in the month of June. Eventually, the stock closed at $ 294.88 representing a 51 % decline during the year.

In 2023, the stock continued on the recovery trend. To date, the stock has appreciated by 10.7 %.

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

CONCLUSION

Many companies pay dividends as they are an important part of their capital allocation programs. Some companies have been paying dividends for many decades and in fact, they increased their dividends for several consecutive decades also.

Dividends are a valuable source of income for people post-retirement. Life’s expenses continue even when people no longer receive a paycheck from their employer. For this reason, dividends can be a very important component of a retirement planning strategy.

However, many growth companies, listed above choose not to pay dividends. They chose to reinvest in the growth and expansion of business and give returns to investors in the form of capital appreciation of the stock.

Back