The best tech companies are those that are contributing towards building a better future. They can be a part of improving mobile phones or contributing towards a better digital world. In today fast growing world, technology is becoming an important part of everyone’s life. In fact, technology is not only contributing towards a better future but is also an integral part of economic growth.

The Best Information Technology Stocks 2024

Here we have listed the 10 best Information Technology stocks that are worth investing in 2024:

| Sr. | Company Name | Symbol | Price (As on March 2023) | Market Cap |

| 1 | Microsoft Corp. | MSFT | $ 279.43 | $ 2.08 trillion |

| 2 | Nvidia Corp | NVDA | $ 257.25 | $ 641.1 billion |

| 3 | Mastercard Inc. | MA | $ 349.66 | $ 331.7 billion |

| 4 | Cisco Systems Inc. | CSCO | $ 50.19 | $ 205.6 billion |

| 5 | Accenture PLC | CAN | $ 250 | $ 159.4 billion |

| 6 | Salesforce Inc | CRM | $ 184.85 | $ 184.5 billion |

| 7 | Apple Inc. | APPL | $ 155 | $ 2.47 trillion |

| 8 | Taiwan Semiconductor Manufacturing Company | TSM | $ 89.47 | $ 464 billion |

| 9 | Meta Platforms Inc. | META | $ 195.61 | $ 531.3 billion |

| 10 | Intel Corporation | INTC | $ 29.81 | $ 124.8 billion |

Microsoft Corp.

Microsoft Corp.

Microsoft is the world’s largest software maker. The company develops, licenses, and supports software products, services, and devices. It offers a comprehensive range of operating systems, cross-device productivity applications, server applications, software development tools, business solution applications, desktop and server management tools, video games, and training and certification services. It also designs, manufactures, and sells hardware products including PCs, tablets, gaming and entertainment consoles, and other intelligent devices.

The company provides a broad spectrum of services including cloud-based solutions, solution support, and consulting services. Microsoft markets distribute, and sells offerings through original equipment manufacturers, distributors, resellers, online marketplaces, Microsoft stores, and other partner channels. The company has a business presence across the Americas, Europe, Asia-Pacific, the Middle East, and Africa. Microsoft is headquartered in Redmond, Washington, the US.

The company recently reported its annual report for 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 198,270 million | $ 168,088 million | 18 % |

| Gross margin | $ 135,620 million | $ 115,856 million | 17 % |

| Operating income | $ 83,383 million | $ 916 million | 19 % |

| Net income | $ 72,738 million | $ 61,271 million | 19 % |

| Diluted earnings per share | $ 9.65 | $ 8.05 | 20 % |

- Revenue reported an 18 % annual increase

- Operating Income reported a 17 % annual increase

- Net Income reported a 19 % annual increase

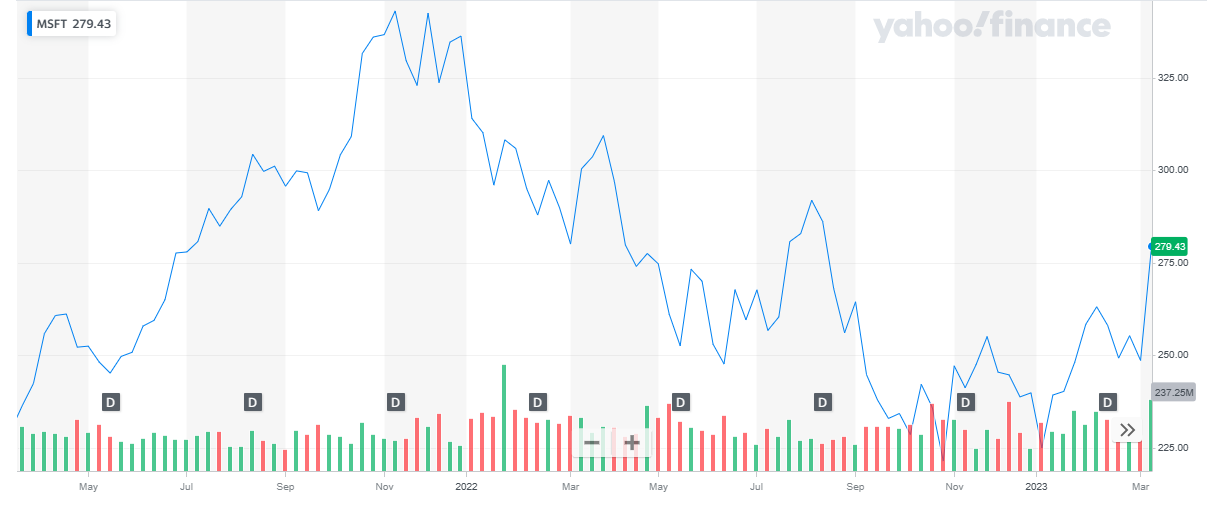

Microsoft has a market cap of $ 2.08 trillion. Its shares are trading at $ 279.43.

The stock started the year 2022 at $ 336.32. Throughout the year the stock stayed bearish and dropped to the low of $ 221.39. Eventually, the stock closed at $ 239.32, representing a 29 % decline in 2022.

In 2023, the stock started off with a rise in price. The stock continued to rise to date and last closed at $ 279.43.

Also, learn:

Also, learn:

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Nvidia Corp

NVIDIA Corp (NVIDIA) designs and develops graphics processing units, central processing units, and system-on-a-chip units for gaming, professional visualization, data center, and automotive markets. It also offers solutions for Artificial Intelligence and data science, data center and cloud computing, design and visualization, edge computing, high-performance computing, and self-driving vehicles. NVIDIA offers products for gamers, professional graphic designers, researchers, and developers through GeForce NOW, Quadro, GeForce, SHIELD, vGPU, DOCA, JESTON, and Bluefield brand names. the company serves various sectors, including architecture, engineering, construction, internet, cybersecurity, energy, financial services, healthcare and life sciences, education, gaming, manufacturing, media and entertainment, retail, robotics, telecommunication, and transportation. It has a business presence across the Americas, Asia-Pacific, and Europe. NVIDIA is headquartered in Santa Clara, California, the US.

NVIDIA recently reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 26,914 million | $ 16,675 million | 61 % |

| Gross margin | 64.9 % | 62.3 % | |

| Operating income | $ 7,434 million | $ 5,864 million | 27 % |

| Net income | $ 9,752 million | $ 4,332 million | 125 % |

| Diluted earnings per share | $ 3.85 | $ 1.73 | 123 % |

- Revenue reported a 61 % annual increase

- Operating Income reported a 27 % annual increase

- Net Income reported a 125 % annual increase

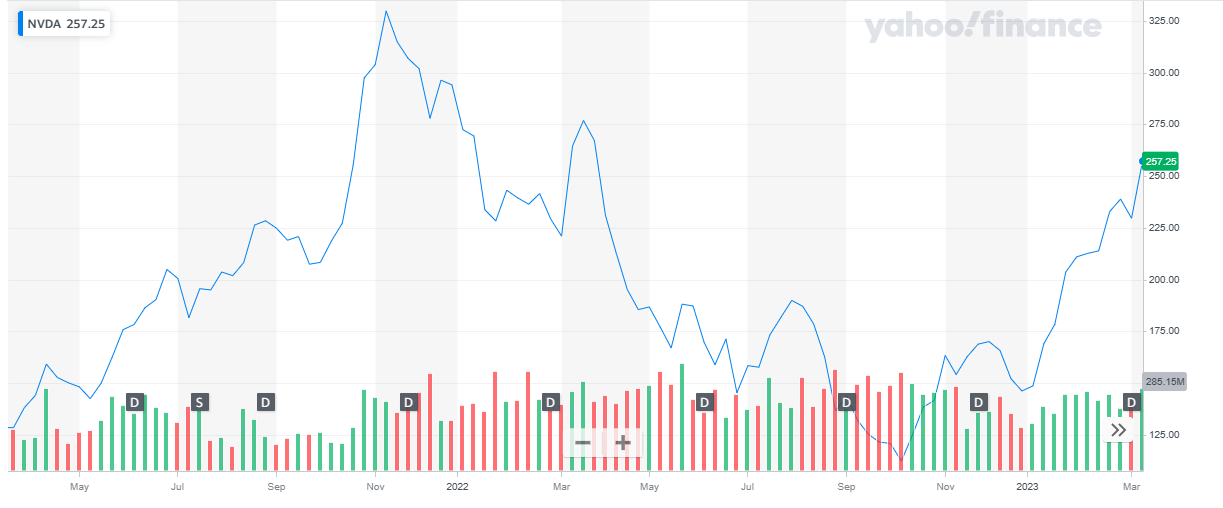

NVIDIA has a market cap of $ 641.1 billion. Its shares are trading at $ 257.25.

The stock started in the year 2022 at $ 294.11. The stock went bearish and dropped to the low of $ 112.28 and eventually closed the year at $ 146.14. Overall, the stock declined by 50.3 % in 2022.

In 2023, the stock picked up a bullish trend. It last closed at $ 257.25 representing a 76 % appreciation to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Mastercard Inc.

Mastercard Inc (Mastercard) is a payment and technology company, which deals with the clearing, authorization, and settlement of payment transactions. It offers a wide range of payment solutions for credit, debit, prepaid, and commercial cards; digital payments, real-time account-based payments, and payment system security; transaction services such as cross-border and domestic transactions.

Mastercard also offers value-added services such as loyalty and rewards and advisory services such as consulting, analytics, and implementation services. Mastercard serves individuals, financial institutions, digital partners, businesses, merchants, governments, and other organizations. It has operations in the Americas, the Middle East, Africa, Europe, and Asia-Pacific. Mastercard is headquartered in Purchase, New York, the US.

Mastercard reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 22,237 million | $ 18,884 million | 17.7 % |

| Operating income | $ 12,264 million | $ 10,082 million | 21.6 % |

| Net income | $ 9,930 million | $ 8,687 million | 14.3 % |

| Diluted earnings per share | $ 10.22 | $ 8.76 | 17 % |

- Revenue reported a 17.7 % annual increase

- Operating Income reported a 21.6 % annual increase

- Net Income reported a 14.3 % annual increase

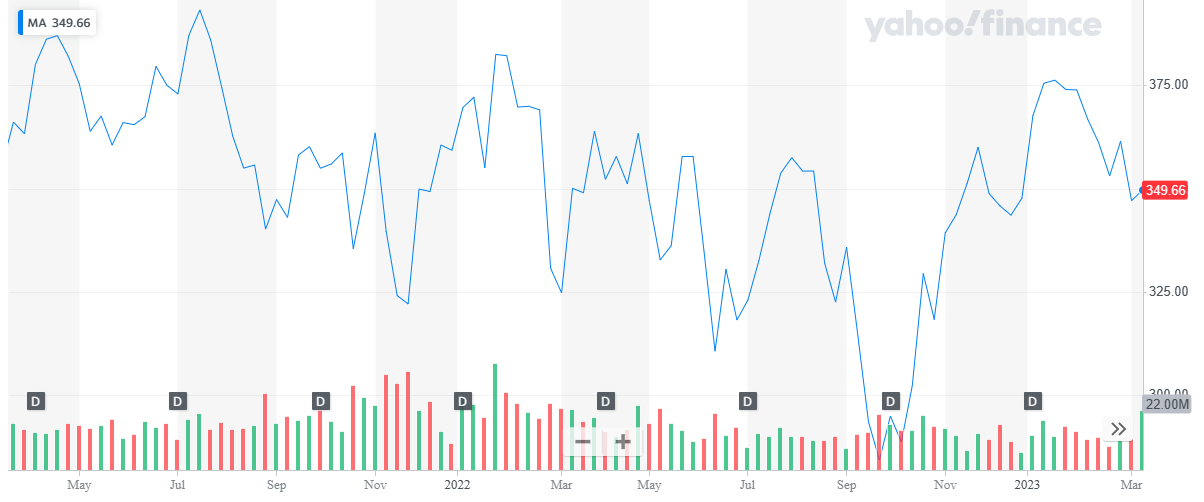

Mastercard has a market cap of $ 331.7 billion. Its shares are trading at $ 349.66. The stock has been volatile in the past two years. It started off in the year 2022 at $ 359.32. Throughout the year the stock went through multiple dips and peaks and eventually closed off the year at $ 347.73. Overall, the stock declined by 3.22 %.

In 2023, the stock reversed its course of action and started to rise. The stock rose to $ 376.28 and last closed at $ 349.66.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Cisco Systems Inc.

Cisco Systems Inc (Cisco) is an integrator of intent-based technologies across networking, security, collaboration, applications, and the cloud. The company’s products and technologies assist clients in managing more users, devices, and things connecting to their networks. Cisco serves a wide range of industries, including enterprises, commercial units, service providers, and the public sector. It markets solutions through a direct sales force and channel partners, including service providers, system integrators, distributors, and resellers. The company has a business and operational presence across the Americas, Europe, the Middle East, Africa, Asia-Pacific, Japan, and China. Cisco is headquartered in San Jose, California, US.

Cisco reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 51,557 million | $ 49,818 million | 3.5 % |

| Gross margin | $ 32,248 million | $ 31,894 million | 1.1 % |

| Operating income | $ 13,969 million | $ 12,833 million | 8.85 % |

| Net income | $ 11,812 million | $ 10,591 million | 11.5 % |

| Diluted earnings per share | $ 2.82 | $ 2.5 | 12.8 % |

- Revenue reported a 3.5 % annual increase

- Operating Income reported an 8.85 % annual increase

- Net Income reported an 11.5 % annual increase

Cisco has a market cap of $ 205.6 billion. Its shares are trading at $ 50.19.

The stock started the year 2022 at $ 63.37. Throughout the year the stock remained bearish till it dropped to the low of $ 40 and eventually closed off at $ 47.64. Overall, the stock declined by 25 %.

In 2023, the stock went on to rise steadily. From $ 47.64 the stock last closed at $ 50.19 representing a 5 % appreciation to date.

Accenture Plc.

Accenture Plc.

Accenture Plc (Accenture) is a provider of a wide range of services and solutions in strategy, consulting, digital, technology, and operations areas. The company offers consulting, technology, and outsourcing services to several industries including agribusiness, automotive, banking, capital markets, chemicals, media and technology, and communications. Accenture operates business processes for enterprise functions such as sourcing and procurement, finance and accounting, supply chain, marketing, and sales. It also offers industry-specific services including banking, platform trust and safety, insurance, and health services. The company has a business presence in the Americas, Europe, Africa, the Middle East, and Asia-Pacific. Accenture is headquartered in Dublin, Ireland.

Accenture reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 61,594 million | $ 50,533 million | 22 % |

| Operating income | $ 9,367 million | $ 7,621 million | 22.9 % |

| Net income | $ 6,877 million | $ 5,906 million | 16.4 % |

| Diluted earnings per share | $ 10.71 | $ 9.31 | 15 % |

- Revenue reported a 22 % annual increase

- Operating Income reported a 22.9 % annual increase

- Net Income reported a 16.4 % annual increase

Accenture has a market cap of $ 159.4 billion. Its shares are trading at $ 250.

The stock started the year 2022 at $ 414.55. Throughout the year the stock remained bearish and closed the year at $ 266.84 representing a 35.6 % decline during the year.

In 2023, the stock remained stable initially before dropping to $ 250. To date, the stock has declined by 6.31 %.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

Salesforce Inc

Salesforce Inc (Salesforce), formerly known as Salesforce.com Inc, is a provider of enterprise cloud computing solutions. The company’s cloud computing services enable businesses to connect, engage, sell, service, and collaborate with customers. Salesforce provides its solutions as a service through all major internet browsers and on leading mobile devices to all sizes of businesses on a subscription basis, primarily through its direct sales force and partners. The company also enables third parties to develop additional functionality and new apps that run on its platform. The company has a business presence across the Americas, Asia Pacific, Europe, the Middle East, and Africa. Salesforce is headquartered in San Francisco, California, US.

Salesforce reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 26,492 million | $ 21,252 million | 25 % |

| Gross Profit | $ 19,466 million | $ 15,814 million | 23 % |

| Operating income | $ 548 million | $ 455 million | 20.4 % |

| Net income | $ 1,444 million | $ 4,072 million | -64 % |

| Diluted earnings per share | $ 1.48 | $ 4.38 | -66.2 % |

- Revenue reported a 25 % annual increase

- Operating Income reported a 20.4 % annual increase

- Net Income reported a -64 % annual increase

Salesforce has a market cap of $ 184.5 billion. Its shares are trading at $ 184.85.

The stock started the year 2022 at $ 254.13. Throughout the year the stock remained bearish and closed the year at $ 132.59. Overall, the stock declined by 48 %.

In 2023, the stock reversed its course of action and started to rise. To date, the stock has appreciated by 39.4 %.

Read: ETFs vs Index funds, where should you invest?

Read: ETFs vs Index funds, where should you invest?

Apple Inc.

Apple Inc (Apple) designs, manufactures, and markets smartphones, tablets, personal computers (PCs), and portable and wearable devices. The company also offers software and related services, accessories, and third-party digital content and applications. Apple’s product portfolio includes iPhone, iPad, Mac, iPod, Apple Watch, and Apple TV. It offers various consumer and professional software applications such as iOS, macOS, iPadOS, watchOS, iCloud, AppleCare, Apple Pay, and accessories. Apple sells and delivers digital content and applications through Apple Store, App Store, Apple Arcade, Apple News+, Apple Fitness+, Apple Card, Apple Pay, and Apple Music. The company has a business presence across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Apple is headquartered in Cupertino, California, the US.

Apple reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 394,328 million | $ 365,817 million | 8 % |

| Gross Profit | $ 170,782 million | $ 152,836 million | 11.8 % |

| Operating income | $ 119,437 million | $ 108,949 million | 9.62 % |

| Net income | $ 99,803 million | $ 94,680 million | 5.4 % |

| Diluted earnings per share | $ 6.11 | $ 5.61 | 8.3 % |

- Revenue reported an 8 % annual increase

- Operating Income reported a 9.62 % annual increase

- Net Income reported a 5.4 % annual increase

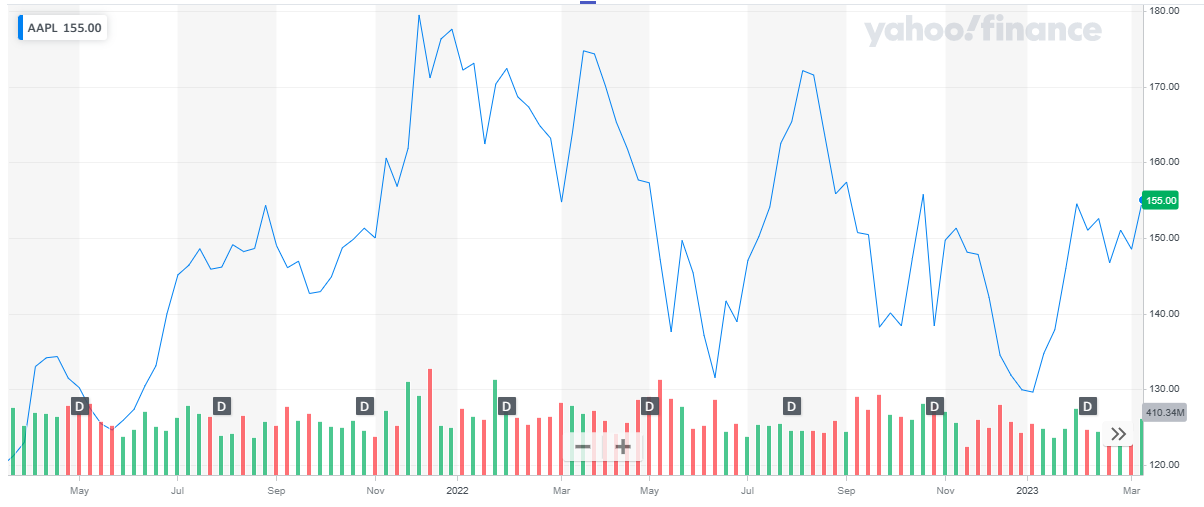

Apple has a market cap of $ 2.5 trillion. Its shares are trading at $ 155.

The stock started the year 2022 at $ 177.57. The stock picked up a bearish trend and dropped to the low of $ 131.56. From here the stock reversed its course and started to rise. The stock remained volatile and eventually closed off the year at $ 129.93. Overall, the stock declined by 27 %.

In 2023, the stock started to rise and last closed at $ 155. To date, the stock has appreciated by 19.4 %.

Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Co Ltd (TSMC) is a provider of semiconductor foundry services. The company manufactures customized logic semiconductors, mixed-signal and radio frequency (RF) semiconductors, memory semiconductors, and CMOS image sensor semiconductors based on the clients’ or third parties’ proprietary integrated circuit designs.

It also offers design, advanced packing services, mask-making, testing, and assembly services. TSMC caters its products under the Open Innovation Platform, CyberShuttle, CoWoS, TSMC-SoIC, 3DFabric, TSMC 3DFabric, N12e, and TSCM brands. The company offers services through its offices located in Hsinchu and wholly owned subsidiaries in the US, Canada, Japan, China, the Netherlands, and South Korea. TSMC is headquartered in Hsinchu, Taiwan.

Taiwan Semiconductor Manufacturing Co reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | NT $ 2,263,891 million | NT $ 1,587,415 million | 42.6 % |

| Gross Profit | NT $ 1,348,354 million | NT $ 819,537 million | 64.5 % |

| Operating income | NT $ 1,121,278 million | NT $ 649,980 million | 72.5 % |

| Net income | NT $ 1,016,900 million | NT $ 597,073 million | 70 % |

| Diluted earnings per share | NT $ 39.2 | NT $ 23.01 | 70.4 % |

- Revenue reported a 42.6 % annual increase

- Operating Income reported a 72.5 % annual increase

- Net Income reported a 70 % annual increase

Taiwan Semiconductor Manufacturing has a market cap of $ 463 billion. Its shares are trading at $ 89.47.

The stock started the year 2022 at $ 120.3. after an initial spike in price, the stock started to decline. The stock dropped to the low of $ 62.01 before recovering and closing the year at $ 74.49. Overall, the stock declined by 38 %.

In 2023, the stock started to rise and last closed at $ 89.47 representing a 20 % appreciation to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Meta Platforms Inc.

Meta Platforms Inc (Meta), formerly Facebook Inc, is a provider of social networking, advertising, and business insight solutions. The company, through its virtual-reality vision, the metaverse, focuses on developing a virtual environment that allows people to interact and connect with technology. Through its major products Facebook, Instagram, Oculus, Messenger, and WhatsApp, the company connects people with their friends, families, and co-workers across the world, and helps them discover new products and services from local and global businesses. It enables people to share their opinions, ideas, photos and videos, and other activities through mobile devices and personal computers with audiences ranging from their closest friends to the public. Meta sells advertising placements for marketers to reach people based on various factors including age, gender, location, interests, and behavior. The company has a business presence across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Meta is headquartered in Menlo Park, California, the US.

Meta Platform reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 116,609 million | $ 117,929 million | -1 % |

| Operating income | $ 28,944 million | $ 46,753 million | -38 % |

| Net income | $ 23,200 million | $ 39,370 million | -41 % |

| Diluted earnings per share | $ 8.59 | $ 13.77 | -38 % |

- Revenue reported an -1 % annual increase

- Operating Income reported an -38 % annual increase

- Net Income reported a -41 % annual increase

Meta has a market cap of $ 531 billion. Its shares are trading at $ 195.61.

The stock started the year 2022 at $ 336.35. throughout the year the stock remained bearish and closed off the year at $ 120.34. Overall, the stock declined by 64 %.

In 2023, the stock started to recover and last closed at $ 195.61 representing a 62.5 % appreciation to date.

Intel Corporation

Intel Corporation

Intel Corp (Intel) designs and develops technology products and components. The company’s product portfolio comprises microprocessors, chipsets, embedded processors and microcontrollers, flash memory, graphic, network and communication, and conferencing. It also offers processors, chipsets, motherboards, solid-state drives, server products, wireless connectivity products, and software and applications. Intel sells its products and solutions to original equipment manufacturers, industrial and communications equipment manufacturers, and original design manufacturers. The company’s products find applications in notebooks, tablets, servers, and desktops. Intel markets processors under Core, Quark, Atom, Celeron, Pentium, Xeon, and Itanium brand names. The company has business operations in China, Singapore, the US, and Taiwan. Intel is headquartered in Santa Clara, California, the US.

Intel corp. reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Change | |

| Revenue | $ 63,054 million | $ 79,024 million | -20 % |

| Gross Profit | $ 26,866 million | $ 43,815 million | -38.7 % |

| Operating income | $ 2,334 million | $ 19,456 million | -88 % |

| Net income | $ 8,014 million | $ 19,868 million | -60 % |

| Diluted earnings per share | $ 1.95 | $ 4.89 | -60 % |

- Revenue reported an -20 % annual increase

- Operating Income reported an -88 % annual increase

- Net Income reported a -60 % annual increase

Intel has a market cap of $ 124.8 billion. Its shares are trading at $ 29.81.

The stock started the year 2022 at $ 51.5 and closed off at $ 26.43 representing a 49 % decline during the year.

In 2023, the stock has been volatile and last closed at $ 29.81. To date, the stock has appreciated by 13 %.

Also read:

- Best uranium stocks

- Best commodity stocks

- Best AI stocks

- Best wheat stocks

- Best travel stocks

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks