Crude oil is a naturally occurring liquid petroleum product. It is a nonrenewable resource, which means that it can’t be replaced naturally at the rate we consume it and is, therefore, a limited resource. Crude oil is a global commodity that trades in markets around the world, both as spot oil and via derivatives contracts.

Oil companies are an important building block of the global economy. They provide fuels for transportation and power. They also supply the core ingredients of petrochemicals used to make products such as plastics, rubber, and fertilizer.

On the other hand, this industry is highly volatile and very competitive. There are huge jumps in profits due to a slight change in the price and demand of oil. Supply and demand imbalances can cause huge fluctuations in oil prices. This happened in 2022. Russia’s invasion of Ukraine led to a huge spike in crude prices soaring which resulted in a multifold increase in price over many years.

There are many oil stocks available for investment nowadays. They are involved in pure-play E&Ps, midstream companies, service providers, and refiners to integrated oil majors. This provides a lot of options to investors for investment.

List of the 10 Best Crude Oil Stocks

Here is a list of the 10 Best Crude Oil Stocks to buy now:

| Sr. | Company Name | Symbol | Market Price (As of 24th Feb 2023) | Market Cap |

| 1 | Exxon Mobil Corp | XOM | $ 110.75 | $ 450.86 billion |

| 2 | Hess Corp | HES | $ 138.95 | $ 42.9 billion |

| 3 | Pioneer Natural Resources Co | PXD | $ 196.57 | $ 46.2 billion |

| 4 | Targa Resources Corp. | TRGP | $ 75.76 | $ 17.2 billion |

| 5 | Schlumberger Limited | SLB | $ 53.92 | $ 77 billion |

| 6 | Halliburton Co. | HAL | $ 36.99 | $ 33.4 billion |

| 7 | Marathon Petroleum Corp | MPC | $ 124.92 | $ 55.6 billion |

| 8 | Diamondback Energy | FANG | $ 142.38 | $ 26.14 billion |

| 9 | EOG Resources | EOG | $ 114.29 | $ 67.15 billion |

| 10 | Occidental Petroleum | OCM | $ 58.98 | $ 53.6 billion |

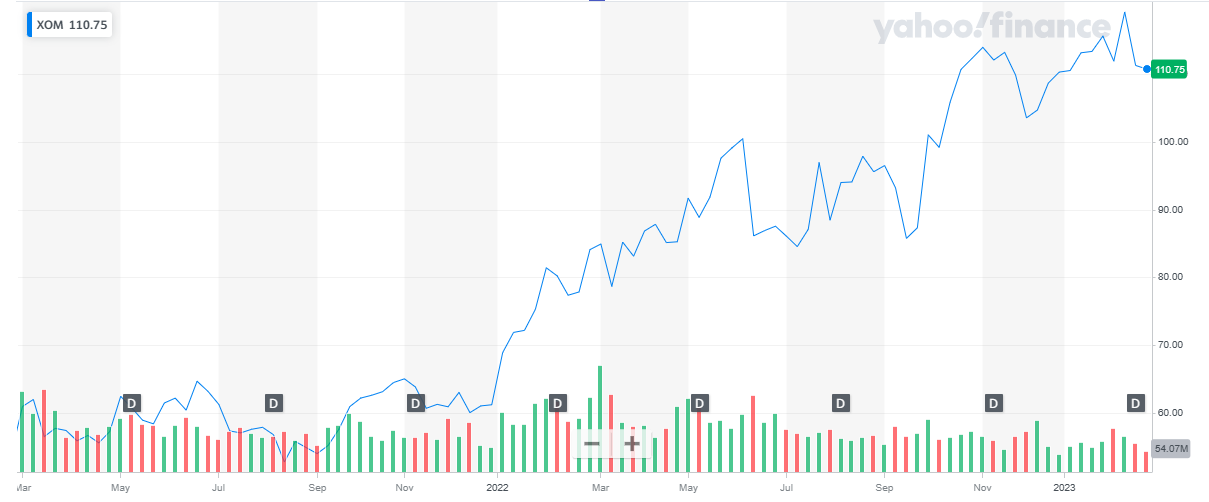

Exxon Mobil Corp.

Exxon Mobil Corp.

Exxon Mobil Corporation is committed to being the world’s premier petroleum and chemical manufacturing company. ExxonMobil is one of the biggest companies in the world. It is an American multinational oil and gas company, formed in 1999 by the merger of Exxon and Mobil. It is the largest refiner in the world. ExxonMobil is headquartered in Irving, Texas, United States. It is the parent company of Esso in the UK.

The main activities of the ExxonMobil Group are the exploration, production, transportation, and sale of crude oil and natural gas as well as the manufacture, transportation, and sale of petroleum products. The group also manufactures and markets petrochemicals and participates in coal and minerals mining, and electric power generation

Exxon Mobil recently published its full-year financials for 2022:

- Total Revenue was reported at $ 413.7 billion, as compared to $ 285.6 billion in the previous year

- Net income was reported at $ 55.7 billion, as compared to $ 23 billion in the previous year

- Earnings per share were reported at $ 13.26, as compared to $ 5.39 in the previous year

Exxon has a market cap of $ 450.86 billion. Its shares are trading at $ 110.75.

The stock has been on a bullish run since the start of the year 2022. It started at $ 61.19 and closed the year at $ 110.3. Overall, the stock appreciated by 80 %.

The stock continued its bullish run in the current year. It peaked at $ 119.07 and last closed at $ 110.75.

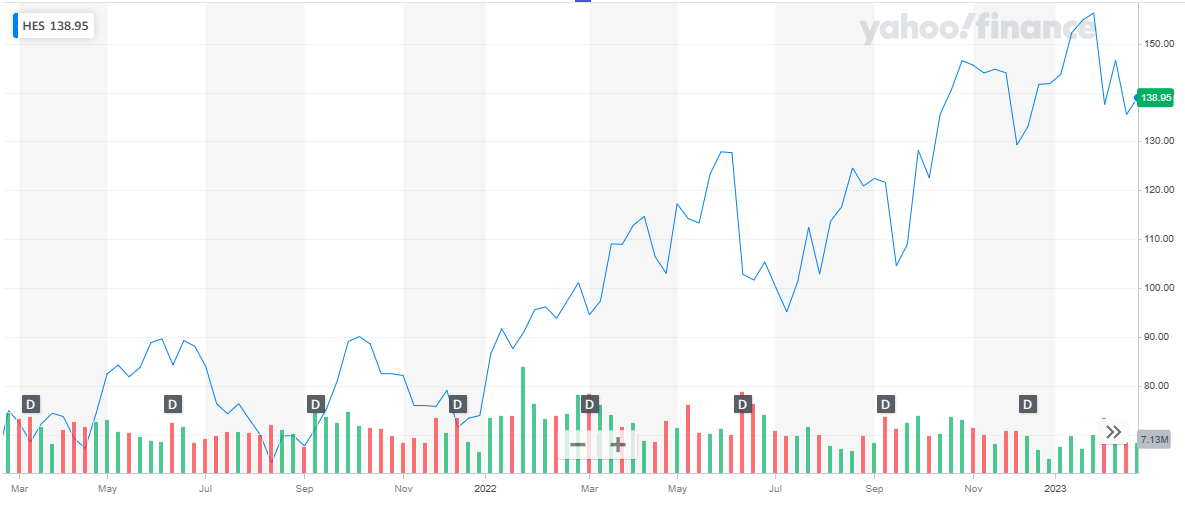

Hess Corp.

Hess Corp.

Hess Corp (Hess) is a global independent energy company, which carries out the exploration and production of crude oil and natural gas. It offers fee-based services including gathering, and processing of natural gas and the fractionation of natural gas liquids, transportation of crude oil by rail car, and terminaling and loading crude oil and natural gas liquids. Hess also carries out the storage and terminaling of propane, essentially in the Bakken shale play of North Dakota. Besides strategically positioned integrated assets in the core of the Bakken shale in the US, the company has operations in Denmark, the Malaysia/Thailand Joint Development Area (JDA), and Malaysia.

Hess Corp recently reported its financial results for the year 2022:

- Total revenue was reported at $ 11.6 billion, as compared to $ 7.6 billion in the year 2021

- Net income was reported at $ 2.2 billion, as compared to $ 559 million in the year 2021

- Earnings per share were reported at $ 7.18, as compared to $ 1.81 in the year 2021

Hess Corp has a market cap of $ 42.9 billion. Its shares are trading at $ 138.95.

The stock has been on a bullish run since the start of 2022. The stock started trading at $ 74.03 at the start of the year and closed off at $ 141.82. Overall, the stock appreciated by 90 % in 2022.

In 2023, the stock continued its bullish trend. The stock hit a peak of $ 156.25 and last closed at $ 138.95. To date, the stock has declined slightly by 1.5 %,

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Pioneer Natural Resources Co. (PXD)

Pioneer Natural Resources Co. is an Irving, Texas-based, large, independent oil and gas company. The company was created in 1997 by the merger of Parker & Parsley Petroleum Company and MESA Inc. The company has approximately 4,000 employees. It is listed on the S&P 500. Pioneer Natural Resources’ main business is the exploration and production of oil, natural gas liquids, and gas reserves.

Pioneer Natural Resources is historically a Texas-based oil company. It is one of the most active drillers in Texas’ Spraberry/Wolfcamp oil field in the Permian Basin and the Eagle Ford Shale play in South Texas. It is also one of the largest natural gas operators in southeastern Colorado’s coal bed methane-rich Raton Basin and in the gas fields around Hugoton, Kansas, and the western part of the Texas Panhandle. Its operations include ongoing drilling programs in Texas’ liquids-rich Barnett Shale and in Alaska’s Oooguruk oil field, where Pioneer became the first independent operator to produce oil on the North Slope in 2000.

Pioneer Natural Resources recently reported its full-year financial results:

- Total Revenue was reported at $ 24.3 billion, as compared to $ 14.6 billion in the year 2021.

- Net income was reported at $ 7.845 billion, as compared to $ 2.12 billion in the year 2021

- Earnings per share were reported at $ 32.61, as compared to $ 9.06 in the year 2021

Pioneer Natural resources have a market cap of $ 46.2 billion. Its shares are trading at $ 196.57.

The stock of Pioneer has been on a bullish streak since the last quarter of 2021. In 2021, the stock went from $ 181.88 to $ 228.39, representing a 25.6 % appreciation during the year. The bullish streak halted when the stock peaked at $ 280 in the mid of the year 2022. However, the stock maintained a good price level.

During 2023, the stock has been declining and last closed at $ 196.57 representing a 13.8 % decline to date.

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Targa Resources Corp. (TRGP)

Targa Resources Corp. provides midstream natural gas and natural gas liquids services. It also provides gathering, storing, and terminaling crude oil, and storing, terminaling, and selling refined petroleum products. It operates through the following business segments:

- Gathering and Processing – The Gathering and Processing segment includes assets used in the gathering of natural gas produced from oil and gas wells and processing this raw natural gas into merchantable natural gas by extracting NGLs and removing impurities and assets used for crude oil gathering and terminaling.

- Logistics and Transportation – The Logistics and Transportation segment includes all the activities necessary to convert mixed NGLs into NGL products and provides certain value-added services such as the storing, fractionating, terminaling, transporting, and marketing of NGLs and NGL products, including services to LPG exporters, and the storing and terminaling of refined petroleum products and crude oil and certain natural gas supply and marketing activities in support of its other businesses.

Targa Resources Corp reported record results for the full year 2022:

- Total revenues were reported at $ 21 billion, as compared to $ 17 billion for the full year 2021

- EBITDA was recorded at $ 2,901.1 million compared to $ 2,052.0 million for the full year 2021.

- Net income was reported at $ 1,195.5 million compared to $ 71.2 million for 2021.

Targa declared a quarterly dividend of $0.35 per share of its common stock for the fourth quarter of 2022 or $1.40 per share on an annualized basis.

Targa Resources has a $ 17.2 billion market cap. Its shares are trading at $ 75.76.

The stock picked up a bullish streak during COVID-19. This bullish trend continued throughout 2020, and the year 2021 and ended in 2022 when it peaked at $ 78.64 in April 2022.

In 2022, the stock went volatile with multiple ups and downs. Overall, the stock appreciated by 41 % in 2022. During the current year, the stock has been rising slowly and steadily. To date, the stock has appreciated by 3 %.

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Schlumberger Ltd. (SLB)

Schlumberger Limited is an oilfield services company. The Company, through its subsidiaries, provides a wide range of services, including technology, project management, and information solutions to the petroleum industry as well as advanced acquisition and data processing surveys. The company also supplies products and services to the industry, from exploration through production and integrated pipeline solutions for hydrocarbon recovery. Schlumberger’s products and services include open-hole and cased-hole wireline logging; drilling services; well completion services including well testing and artificial lift; well services such as cementing, coiled tubing, stimulations, and sand control; interpretation and consulting services; and integrated project management.

Schlumberger has a global presence in more than 100 countries.

Schlumberger Limited recently reported its full-year financial results for 2022:

- Revenue was reported at $ 28.1 billion representing an increase of 23 % from the previous year

- Net Income was reported at $ 3.4 billion, representing an increase of 83 % from the previous year

- Earnings per share were reported at $ 2.39, an increase of 81 % from the previous year

Schlumberger Ltd has a market cap of $ 77 billion. Its shares are trading at $ 53.92.

The share picked up a bullish trend at the start of 2022. The stock started at $ 29.95, went as high as $ 54.82, and closed at $ 53.46. Overall, the stock appreciated by 79 % during the year.

In 2023, the stock continued its bullish run. It went as high as $ 58.28 and last closed at $ 53.92.

Halliburton Co.

Halliburton Co.

Halliburton Co. is an oilfield service company. The company serves the upstream oil and gas industry throughout the lifecycle of the reservoir, from identifying hydrocarbons and managing geological data to drilling and formation evaluation, well construction and completion, and optimizing production. Halliburton offers cementing, stimulation, intervention, artificial lift, well-bore placement solutions, and completion services for oil and gas upstream companies. The company has manufacturing facilities in the US, Malaysia, Singapore, and the UK. Geographically, the company has a presence in North America, Europe, Africa, Latin America, Asia, and the Middle East.

Haliburton recently reported its full-year financials for the year 2022:

- Revenue was reported at $ 20.3 billion, as compared to $ 15.3 billion in the previous year

- Operating income was reported at $ 2.7 billion, as compared to $ 1.8 billion in the previous year

- Net income was reported at $ 1.6 billion, as compared to $ 1.5 billion in the previous year

- Earnings per share were reported at $ 1.75 as compared to $ 1.63 in the previous year

Halliburton has a market cap of $ 33.4 billion. Its shares are trading at $ 36.99.

The stock of Halliburton picked up a bullish trend in 2022. The stock started the year at $ 22.87. During the year it peaked at $ 41.95 and closed the year at $ 39.35. Overall, the stock appreciated by 72 % in 2022.

In 2021, the stock went as high as $ 42.66 and recently closed at $ 36.99.

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

Marathon Petroleum Corp

Marathon Petroleum Corp (MPC) is a downstream energy company that refines, markets, and transports petroleum products. The company owns and operates refineries in the Gulf Coast and Midwest regions in the US. It also owns common carrier pipeline systems that transport crude oil and refined products to the company’s refineries, terminals, and other pipeline systems. MPC sells gasoline and a range of merchandise through several convenience stores. An integrated system provides crude oil, feedstock, and petroleum-related products through a distribution network in the Midwest, East Coast, Southeast, and Gulf Coast regions in the US.

Marathon Petroleum recently reported its full-year financial results for 2022:

- Total revenue was reported at $ 180 billion, as compared to $ 121 billion in the previous year

- Net income was reported at $ 14.5 billion, as compared to $ 9.7 billion in the previous year

- Earnings per share were reported at $ 28.31 as compared to $ 15.34 in the previous year

Marathon Petroleum has a market cap of $ 55.6 billion. Its shares are trading at $ 124.92

The stock has been on a bullish run since the year 2021. However, the stock picked up pace in 2022 and went from $ 63.99, at the start of the year, to $ 116.39 at the end of the year. Overall, the stock appreciated by 82 % in 2022.

In 2023, the stock continued rising. It went as high as $ 132.85 and last closed at $ 124.92. To date, the stock has appreciated by 7.3 %.

Diamondback Energy

Diamondback Energy

Diamondback Energy is an independent oil and gas producer in the United States. The company operates exclusively in the Permian Basin. The company is focused on the acquisition, development, exploration, and exploitation of unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas. Diamondback’s activities are primarily focused on the horizontal exploitation of multiple intervals within the Wolfcamp, Spraberry, and Bone Spring formations.

At the end of 2022, the company reported net proven reserves of 2 billion barrels of oil equivalent.

Diamondback Energy has recently reported its full-year financial results for 2022:

- Total revenue was reported at $ 9.4 billion, as compared to $ 6.8 billion in the previous year

- Income from operations was reported at $ 6.5, as compared to $ 4 billion in the previous year

- Net income was reported at $ 4.4 billion, as compared to $ 2.2 billion in the previous year

- Earnings per share were reported at $ 24.61 as compared to $ 12.24 in the previous year

Diamondback Energy has a market cap of $ 26.14 billion. Its shares are trading at $ 142.38.

The stock has been appreciating since the last quarter of 2021. The stock started the year 2021 at $ 107.85, went as high as $ 164.35, and closed off the year at $ 136.78. Overall, the stock appreciated by 27 % in 2022.

The stock continued its bullish trend in 2023. The stock has appreciated by 4 % to date.

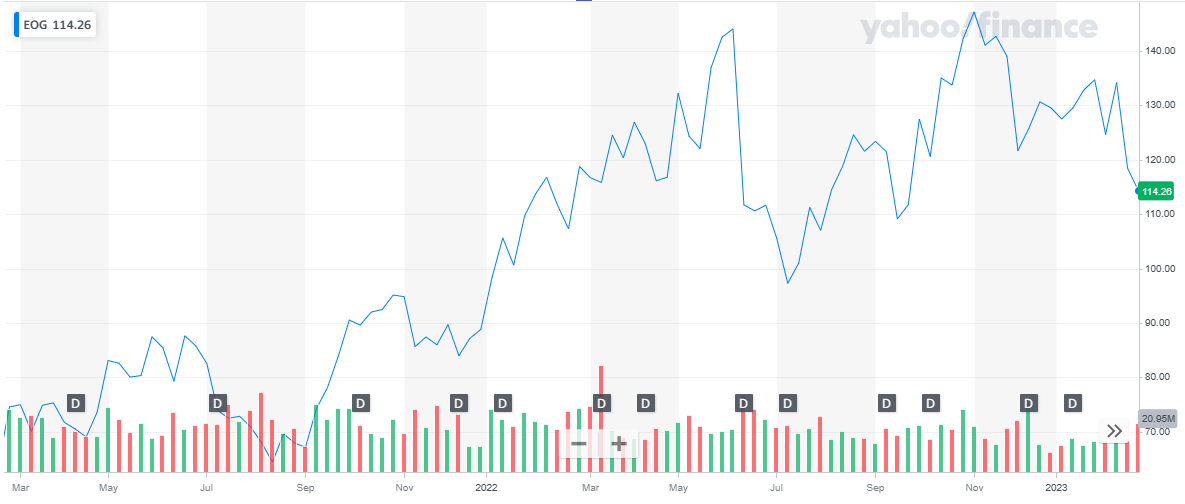

EOG Resources

EOG Resources

EOG Resources is a company that explores, develops, produces, and markets crude oil, natural gas liquids, and natural gas. It uses 3D seismic, core analysis, and microseismic technology to develop proprietary petro-physical models.

EOG Resources, Inc. recently reported full-year financial results for 2022:

- Total revenues were reported at $ 25.7 billion, as compared to $ 18.6 billion in the previous year

- Total operating income was reported at $ 9.96 billion, as compared to $ 6.1 billion in the previous year

- Net Income was reported at $ 7.75 billion, as compared to $ 4.66 billion in the previous year

- Earnings per share were reported at $ 13.31, as compared to $ 8.03 in the previous year

EOG Resources has a market cap of $ 67.15 billion. Its shares are trading at $ 114.26.

The stock of EOG Resources has been on a bullish run since the last quarter of 2021. In 2022, the stock started the year at $ 88.83, went as high as $ 147.11, and eventually closed off at $ 129.52. Overall, the stock appreciated by 45 %.

In 2023, the stock declined slightly. The stock started the year at $ 129.52 and last closed at $ 114.26.

Also, learn:

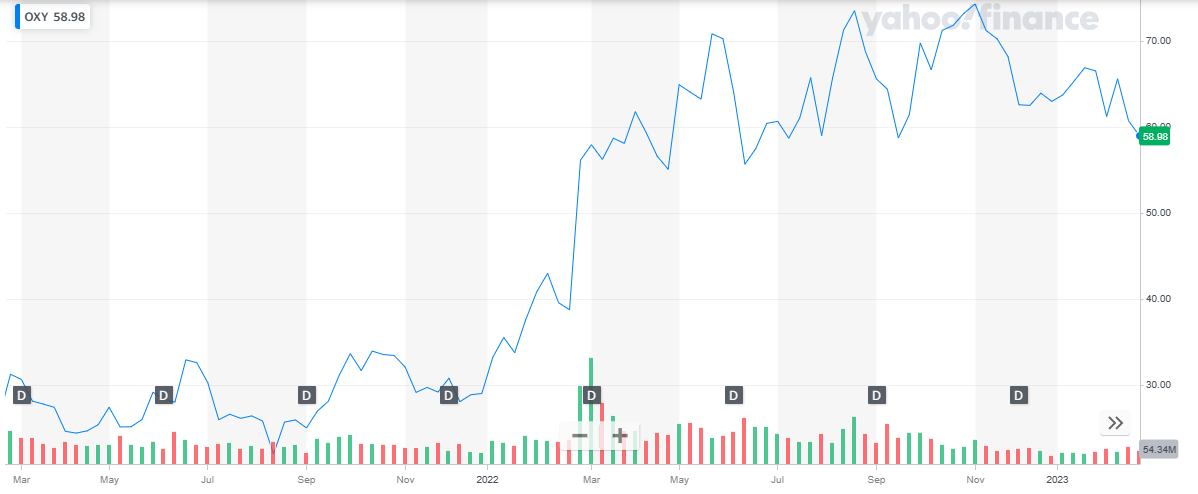

Occidental Petroleum

Occidental Petroleum Corp is an oil and gas exploration and production company with integrated assets. It explores for, develops, and produces oil, natural gas liquids (NGLs), natural gas, and condensate. The company gathers, processes, transports, stores, purchases, and markets oil, condensate, NGLs, natural gas, carbon dioxide (CO2), and power. Occidental also manufactures and markets basic chemicals and vinyl. The company operates through its major subsidiaries, Oxychem and Occidental Low Carbon Ventures, which are involved in the chemicals business and Midstream business, respectively

In the last financial report, the company reported third-quarter results for the year:

- Net sales were reported at $ 9.5 billion, as compared to $ 6.8 billion in the previous year’s same period

- Total Income was reported at $ 2.5 billion, as compared to $ 628 million in the previous year’s same period

- Earnings per share were reported at $ 2.74, as compared to $ 0.67 in the previous year’s same period

Occidental Petroleum has a market cap of $ 53.6 billion. Its shares are trading at $ 58.98.

The stock picked up a bullish run in the last quarter of 2021. In the year 2022, the stock started trading at $ 28.99, went as high as $ 74.33, and closed the year at $ 62.99. Overall, the stock appreciated by 117 % in 2022.

In 2023, the stock pulled back by 6.8 % and last closed at $ 58.98.

Wrap Up

Wrap Up

Many economists view crude oil as the single most important commodity in the world. However, with so many options available for investment, the smart investment will lead to taking the maximum advantage of this profitable yet highly volatile industry.

Also read: