Volatility should be the favorite play for those who choose to trade in Penny Stocks. Penny stocks, which are stocks traded under $5, are usually of small companies which have a low trading frequency. As an investor, you will see fewer buyers of penny stocks in the market which makes it low on liquidity. As a result, you might face difficulty selling penny stocks at a price that aligns with the market price. Therefore, penny stocks can make you large amounts of profits but there is an equal amount of risk involved of you losing a huge amount of your investment in a short period.

Pros and Cons of Penny Stocks:

| Pros | Cons |

| Many excellent companies are trading for very low and have a very solid future. | The majority of Penny Stocks have low performing companies on the back |

| Penny stocks with strong prospects have big price changes within days. | The market of Penny Stocks has very low requirements and regulations which allows entry of poor performing companies very easy. |

| Investors can purchase thousands of Penny stocks in a very small amount. | Very low trading frequency. |

| Rapid and Huge price movements in a short span of time. |

Also read: Best Stock Forecasts & Prediction Services

List of Best Penny Stocks to Invest

We have compiled a list of Penny stocks for 2024, which are worth investing:

| Sr | Company Name | Symbol | Price (as on 26th July, 2021) | 52-week change | Average Volume (3-month) | Market Capitalization |

|---|---|---|---|---|---|---|

| 1. | Boxlight Corp | BOXL | 1.96 | -14.78% | 3.36 Million | 109 Million |

| 2. | CloudCommerce Inc | CLWD | 0.016 | 66.05% | 6.59 Million | 16.7 Million |

| 3. | Zomedica Corp | ZOM | 0.61 | 269% | 31.5 Million | 587 Million |

| 4. | First Majestic Silver Corp. | AG | 13.12 | -4.65% | 4.52 Million | 3.3 Billion |

| 5. | Cielo Waste Solutions Corp | CWSFF | 1.105 | 3,058% | 704,250 | 396.6 Million |

| 6. | Clickstream Corp | CLIS | 0.142 | 89.2% | 1.03 Million | 11.54 Million |

| 7. | Gold Resource Corporation | GORO | 2.05 | -55.34% | 1.11 Million | 154.1 Million |

| 8. | VerifyMe, Inc. | VRME | 3.91 | 14% | 97,000 | 28.9 Million |

| 9. | RF Industries, Ltd | RFIL | $9.33 | 103% | 72,000 | $93.31 Million |

| 10. | Solitario Zinc Corp. | XPL | $0.577 | 34.15% | 572,640 | $33.7 Million |

| 11. | Exela Technologies Inc | XELA | $2.46 | 20.9% | 61 Million | $146 Million |

| 12. | Conduent Inc. | CNDT | $6.81 | 250% | 1.27 Million | $1.45 Billion |

| 13. | 9F Inc. | JFU | $1.9 | -10% | 1.87 Million | $387 Million |

| 14. | Resonant Inc. | RESN | $2.72 | 15.6% | 1.37 Million | $164 Million |

| 15. | Ideanomics Inc. | IDEX | $2.51 | 88% | 18 Million | $1.15 Billion |

| 16. | Peak Fintech Group Inc. | BOXL | 1.96 | -14.78% | 3.36 Million | 109 Million |

| 17. | ToughBuilt Industries Inc. | TBLT | 0.5031 | -32.86% | 3.87 Million | 65.28 Million |

| 18. | Solid Biosciences | SLDB | 2.21 | -29.75% | 1.14 Million | 239.9 Million |

| 19. | Phunware Inc. | PHUN | 3.9 | 508.9% | 26.7 Million | 328.7 Million |

| 20. | Global Entertainment Holdings Inc. | GBHL | 0.0029 | 287.5% | 51.22 Million | 663,283 |

| 21. | Voyager Therapeutics | VYGR | 3.51 | -58.17% | 5.51 Million | 133.22 Million |

| 22. | Sundial Growers Inc | SNDL | 0.6775 | 153.52% | 85.39 Million | 1.396 Billion |

| 23. | United States Antimony Corporation | UAMY | 0.8598 | 160% | 2.6 Million | 91.14 Million |

| 24. | BIOLASE Inc. | BIOL | 0.6 | 96.77% | 4.18 Million | 91.81 Million |

1. Boxlight Corp

Boxlight Corporation is amongst the leading provider of technology solutions for the global learning market. The company develops, sells, and services its integrated, interactive solution suite including software, classroom technologies, professional development, and support services. The vision of Boxlight Corp is to improve the learning experience for students and create engagement in classrooms to enhance student output.

Boxlight Corp reported a $9.5 Million revenue for the previous quarter and earnings per share of $0.09. Since last year when COVID became a pandemic, the stock of Boxlight has shown a tremendous improvement. It has increased by more than 250% since then making it one of the best penny stock to buy now. Get to know about fibonacci retracement, extension & trading strategies.

Find below the stock performance chart over the last 2 years:

Read more:

2. CloudCommerce Inc

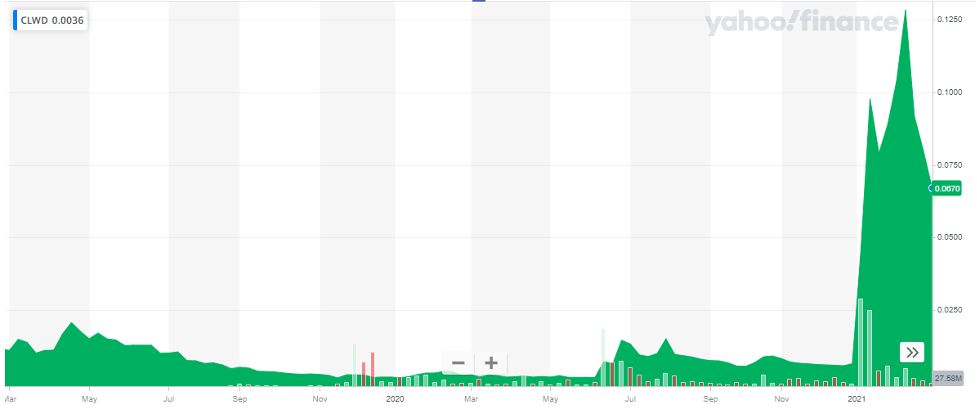

CloudCommerce is leading the new age of data-driven marketing technology with the integration of software and services. With SWARM, a proprietary audience-driven business intelligence solution, the company can analyze a robust mix of audience data to help businesses find who to talk to, what to say to them, and how to market to them.

CloudCommerce has recently announced that it has officially launched aiAdvertising, Inc. AiAdvertising is owned by CloudCommerce which makes use of Artificial Intelligence. It helps the company with an improved SWARM solution and also aims towards cutting advertising costs by half. CloudCommerce Inc. is paving way for a bright future by making use of AI in today’s data-driven digital marketing campaigns and is on the road to become one of the best performing penny stock. Get to know about best drone stocks to invest in.

Find below the stock performance chart over the last 2 years:

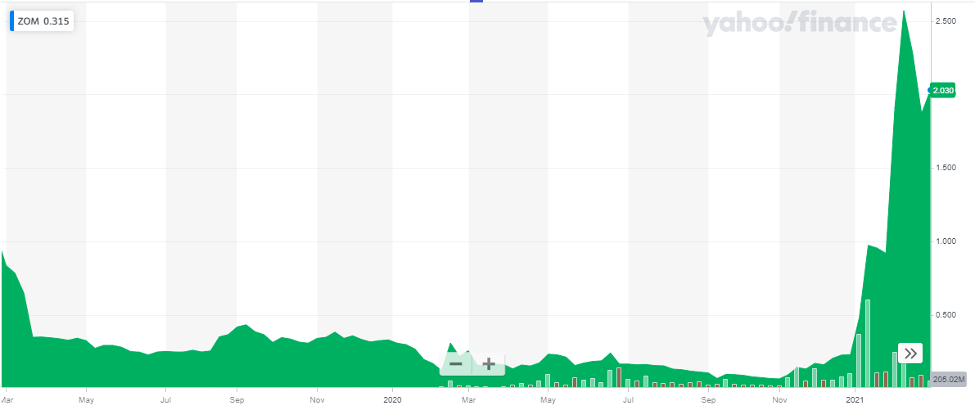

3. Zomedica Corp

Zomedica is a veterinary health company creating products for dogs and cats. The company’s USP is that it focuses on the unmet needs of clinical veterinarians. Zomedica’s product portfolio includes innovative diagnostics and medical devices. Zomedica Corp. aims to enable veterinarians to achieve higher productivity and higher revenues while providing better service to the animals in their care.

Adoption of pets has increased during COVID which has increased the demand for veterinary services. The pet care market associated with diagnostic services is expected to reach $2.8 billion annually by 2024. Zomedica Corp plans to become a leading operator in this line of business and plans to launch a new tool this year, Truforma, which will help veterinarians detect adrenal and thyroid issues in dogs and cats. The stock has already doubled in 2021, and a successful launch of its new tool might push it up even higher. The current industry demand and the Zomedica’s future plans makes it one of the best penny stock to buy now.

Zomedica recently raised $173.5 Million through a public offering of common shares. They plan to use the money in making Zomedica operations better and to provide better services to customers. Get to know about relative strength index – basics and RSI trading strategies

Find below the stock performance chart over the last 2 years:

Read more:

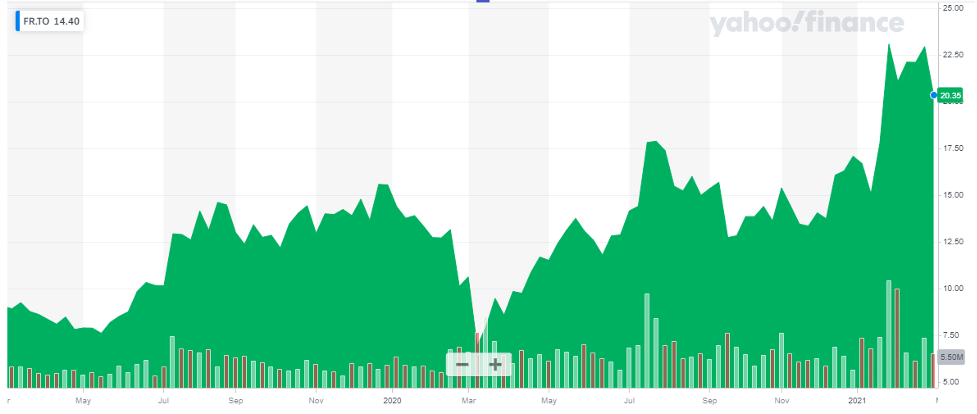

4. First Majestic Silver Corp

First Majestic is a publicly-traded mining company focused on silver production in Mexico and is aggressively pursuing the development of its existing mineral property assets. The Company owns and operates multiple mines and the total production from all these mines are estimated to be around 12.5 to 13.9 million silver ounces or 20.6 to 22.9 million silver equivalent ounces as in 2021.

In the first four weeks of January 2021, shares of First Majestic Silver Corp started to rise and attracted the attention of many investors. WallStreetBets and Reddit started recommending this stock to investors to buy. The reason for this soaring price was the company reported the 2nd highest silver production in Q4 2020. In February investors lost interest in this stock and the momentum of the trading decreased.

Learn about head and shoulders patterns trading guide.

Find below the stock performance chart over the last 2 years:

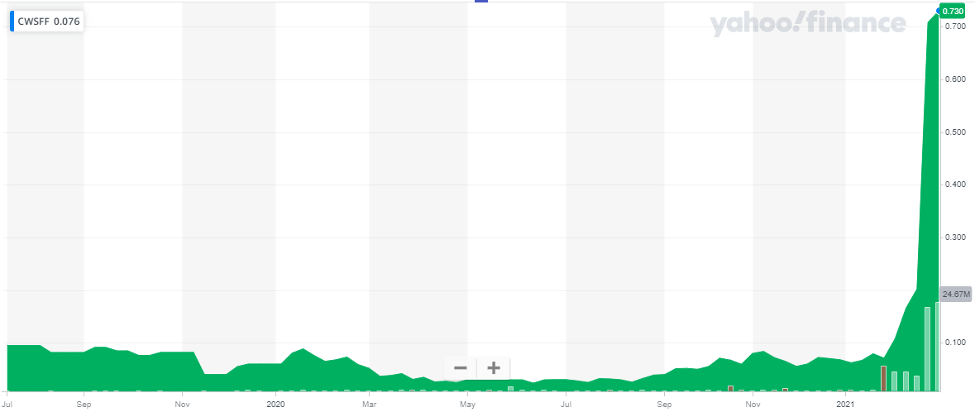

5. Cielo Waste Solutions Corp

Cielo Waste Solutions Corp. engages in refining landfill and municipal and commercial waste into a renewable diesel in Canada. It uses landfill waste, tires, plastics, wood shavings, and paper products to produce renewable Kerosene, highway diesel, and naphtha.

Cielo Waste Solutions Corp recently announced its first major sale of renewable fuels with a purchase commitment for 900,000 liters of renewable diesel. The aggregate price of this sale is CAD 1,500,000. The company has begun expanding its operations by contracting with multiple parties. The feedstock that Cielo plans to use is the world’s most available and inexpensive feedstock which will minimize the cost of production. Read: Best Gold Trading Signal Providers.

The company’s EPS is moving in a positive direction and the Reddit analysts claim this stock to be currently undervalued. With slow progress in the short term, it’s expected to grow in long term. Get to know about list of best forex brokers for trading

Find below the stock performance chart over the last 2 years:

6. Clickstream Corp

ClickStream is a technology company that is in the business of developing apps and digital platforms that disrupt conventional industries. The company’s initial offering WinQuik is a free-to-play synchronized mobile app and digital gaming platform. The platform is designed to enable WinQuik users to have fun, interact and compete to win real money and prizes. ClickStream’s other app HeyPal is a language learning app that focuses on “language exchanging” between users around the world. The USP of this app is that they enable user learning by matching them together with native speakers of their target language.

The company’s IOS app HeyPal is currently live in 10 countries and they plan to launch it in 5 more countries by March 15th, 2021. WinQuik users have also increased by 33% in the past two weeks, as reported by the company. Clickstream Corp has recently launched its website and they plan on putting a solid foot down in their line of business. This makes Clickstream Corp one of the best penny stock for 2024.

Find below the stock performance chart over the last 2 years:

Read more:

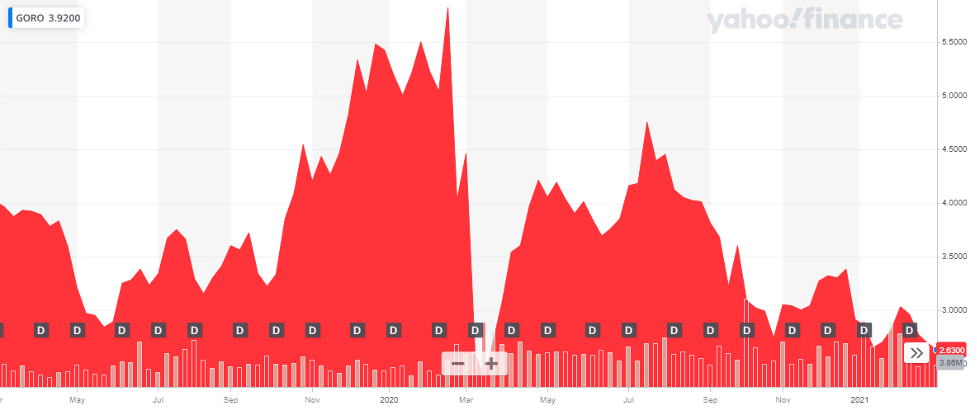

7. Gold Resource Corporation

Gold Resource Corporation is a gold and silver producer, developer, and explorer with operations in Oaxaca, Mexico, and Nevada, USA. The Company targets low capital expenditure projects with the potential for generating high returns on capital.

Gold Resource Corp completed 10 years of operations and takes pride in generating over $1 billion in revenues. It has been giving back to its shareholders in form of dividends. The company declared a dividend of 1/3 of a cent per common share as a monthly dividend for February 2021. Up till today, a total of $115 million has been issued as dividends. The company reported a net income of $4.4 million with revenue of $90.7 million and gross profit of $12.5 million from continuing operations for the year ended December 31, 2020.

The stock has remained pretty volatile since its huge drop after achieving a peak price in March 2020. With Covid shutting down operations and the company transitioning to a single mine operation, the company’s performance has slowed down. The current Don David Gold mine has great growth potential that should not be overlooked. The stock is highly correlated to the gold price, and it is crucial to trade GORO based on the gold price. From investors Gold Resource Corporation is one of the best penny stocks to invest in. Get to know about bonds vs stocks – where to invest in

Find below the stock performance chart over the last 2 years:

8. VerifyMe, Inc

VerifyMe, Inc. is a global technology solutions company delivering brand protection offerings to mitigate counterfeiting, product diversion, and illicit trade.

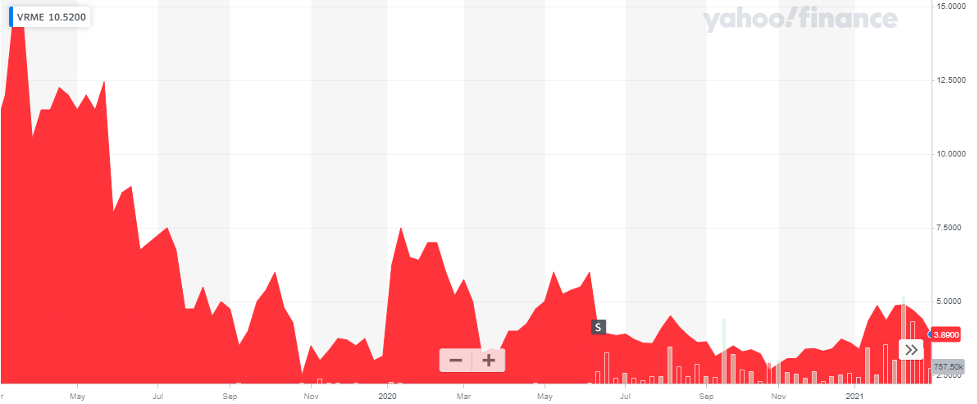

The major concern for an investor is that VerifyMe is reporting net losses and is unable to achieve breakeven. According to industry analysts, the company is expected to achieve breakeven in 2022. Despite its net loss situation, the company has managed a stellar debt-equity position with debt being a mere 0.8% of the equity. This reduces the risk of investing in the loss-making company. According to the earnings, EPS is expected to rise next year; EPS has been growing continuously at almost 60% per year over the last five years. VerifyMe Inc is one of the best penny stocks to invest in and is expected a to grow positively in future. get to know about elliott wave theory.

Find below the stock performance chart over the last 2 years:

9. RF Industries, Ltd.

RF Industries designs and manufactures a broad range of interconnect products across diversified, growing markets including wireless/wireline telecom, data communications and industrial. The Company’s products include RF connectors, coaxial cables, data cables, wire harnesses, fiber optic cables, custom cabling, energy-efficient cooling systems and integrated small cell enclosures.

The company announced its second quarter results just recently. Net Sales were reported to be $11.1 million and net income was $4.8 million. The company is optimistic about future growth and has received a sizeable order for its Optiflex hybrid fiber solution. Also, the company foresees sales growth in their industrial OEM customers and distribution partners.

The stock of RF Industries has been doing really well on the stock market. Currently trading at $9.16, the stock has recovered itself from the low levels of $3.79 during COVID-19.

With a market capitalization of just over $92 Million, RF industries is a promising penny stock to invest today. With an approximate 85% increase year-to-date, RF industries has great potential to provide high returns to investors making it one of the best penny stocks to invest in.

With a market capitalization of just over $92 Million, RF industries is a promising penny stock to invest today. With an approximate 85% increase year-to-date, RF industries has great potential to provide high returns to investors making it one of the best penny stocks to invest in.

Get to know the best covered call stocks to buy now.

10. Solitario Zinc Corp.

Solitario Zinc Corp. is a zinc focused exploration company engaging in the acquisition, exploration, and development of zinc properties in safe jurisdictions in North and South America. The company has significant interests in two large, high-grade zinc development projects which are: Florida Canyon Zinc Project and Lik Zinc Project. With the demand of Zinc increasing and the prices elevating, these recent joint ventures will propel the growth rate of the company.

The company has no source of revenue. It is currently raising money through equity finance. and has a small amount of debt. On 31st March 2021, the company had USD$1,404 million in cash. The cash burn of the exploration company is US$1.0m over the past 12 months. Therefore, at this rate, the cash runaway is at comforting levels. Cash runway is the approximate time the company will exhaust its cash reserves if spending continues at the current rate.

The stock of Solitario Zinc Corp. is trading at $0.553. The stock crossed $1 mark in February this year. The stock has shown outstanding performance since it went public last year.

The future prospects of Solitario Zinc Corp. are positive. Exploration Work Has Commenced on the Lik Zinc Project. The Lik project has the potential to open-pitable Indicated Resource of 17.3 million tonnes and an additional 2.9 million tonnes of Inferred Resource. This penny stock is a great investment today.

The future prospects of Solitario Zinc Corp. are positive. Exploration Work Has Commenced on the Lik Zinc Project. The Lik project has the potential to open-pitable Indicated Resource of 17.3 million tonnes and an additional 2.9 million tonnes of Inferred Resource. This penny stock is a great investment today.

11. Exela Technologies Inc.

Exela is a business process automation (BPA) leader, leveraging a global footprint and proprietary technology to provide digital transformation solutions enhancing quality, productivity, and end-user experience. It currently provides to over 4000 customers spread across 50 countries. More than 60 companies of the Fortune 100 companies are Exela’s clients.

The debt holdings of the company are comparatively low. As on March 31, 2021, debt was nearly $1.5 billion. The BPA company has raised $100 million in an at-the-market equity program in May and has plans to raise a further $150 million. A portion of this $150 million has been raised. In its recent quarterly earnings, the company reported $300 million in revenues, a 18% year-on-year decline. The recent Digital Mailroom Platform (DMR) for Small and Mid-sized Businesses (SMBs) is showing robust growth. DMR customers grew 117% as reported in the quarterly report.

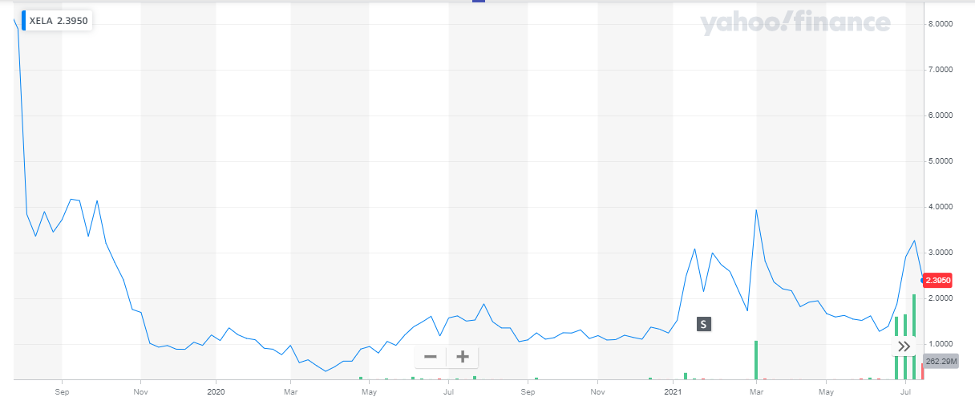

With a market capitalization of over $140 million, Exela Technologies is off to a promising year. The stock is currently trading at $2.39. The stock has been pretty volatile the since the start of the year but it has maintained its bullish trend. The below chart shows the stock performance over the past 2 years:

12. Conduent Inc

12. Conduent Inc

Conduent Inc is a business process services company which specializes in transaction-intensive processing, analytics, and automation. Conduent is a globally recognized BPO leader and it holds the leading position in:

- Healthcare

- Business Services

- HR Services

The company recently posted its quarterly earnings report and posted $1 billion in revenue, a 2.2% decline. Conduent Inc. continued its growth momentum achieving significant operational, industry and associate-focused milestones. The company improved its service delivery and earned its name amongst the Top 500 Best Employers for Diversity in the U.S. by Forbes Magazine. Additional highlights from quarterly report include strong sales performance with $356M in new business TCV signings, reporting a10% increase from last year’s quarter.

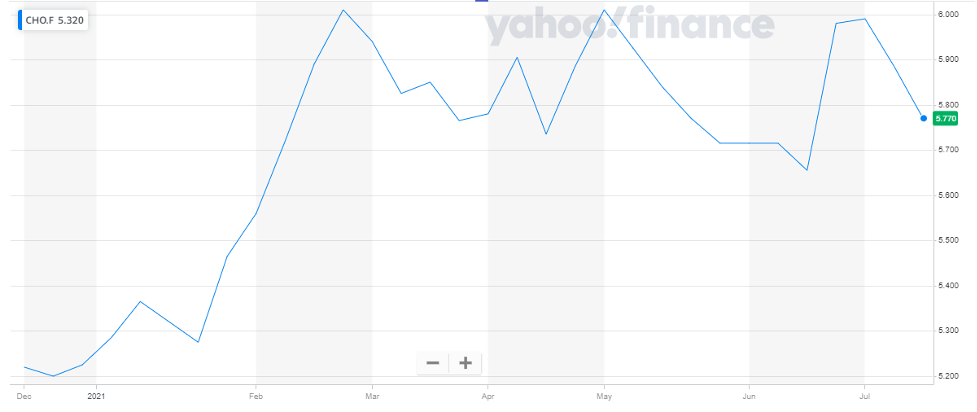

With a market capitalization of around Eur 997 million, the stock of the company is currently trading at Eur 5.77. The below chart shows the stock performance of the company:

Conduit Inc. has strong operations backing the financials. Moreover, the continuous improvement of the company towards leading position in its service offerings makes the company stock a great attraction for investors. This penny stock is a great investment today and is expected to explode in near future.

Conduit Inc. has strong operations backing the financials. Moreover, the continuous improvement of the company towards leading position in its service offerings makes the company stock a great attraction for investors. This penny stock is a great investment today and is expected to explode in near future.

13. 9F Inc.

9F Inc is internet technology company that focuses on providing technology services to financing and consumption industries in China and overseas, including fintech technology services to financial institution partners, online wealth management technology services, e-commerce services as well as overseas expansion of our consumer financing technology services in Southeast Asian countries.

In the recent half year earnings, the company reported:

- Total net revenues of US$120.1 million, representing a decrease of 61.0%

- Net loss of US$105.4 million, down by 73.9%

The company has been greatly affected by the pandemic since its operations are based in China. The company’s growth has been suspended as a result. But with the economy on the road to recovery, the future holds great prospects for the company.

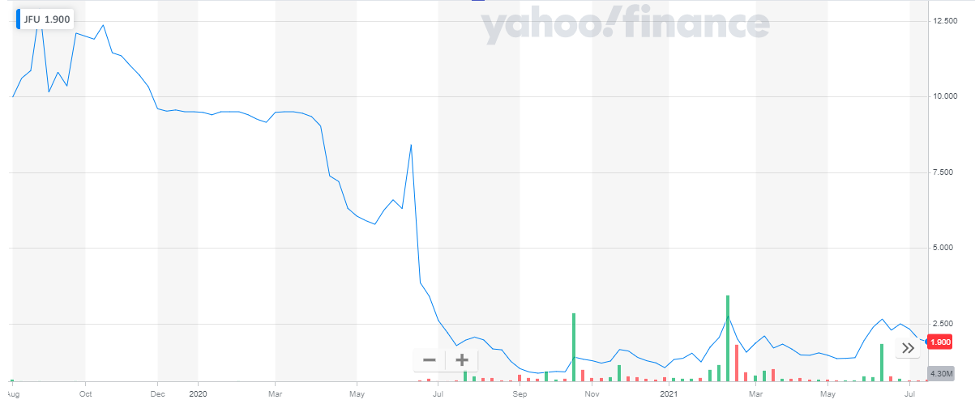

With a market capitalization of over $420 million the stock of 9F is currently trading at $1.9. As the below chart shows, the stock was largely affected by Covid-19 and there was a huge drop in price. Since the company is on the path to recovery, very soon this penny stock will be back to the pre-pandemic levels. Hence this is one of the best penny stocks to invest in today.

14. Resonant Inc.

Resonant is transforming the market for RF front-ends (RFFE) and disrupting the RFFE supply chain by enabling customers and partners to deliver 5G filters designed using its WaveX software tools platform. They are developing the world’s most advanced surface acoustic wave filters and have a design platform that allows technologists to create what was once thought impossible.

The Elliotwave view of this penny stock can be viewed here.

In the quarterly earnings report, Revenues were $0.6 million compared to $0.5 million in the same quarter a year-ago. Net loss was $8.8 million, compared to a net loss of $8.0 million in the same quarter a year-ago.

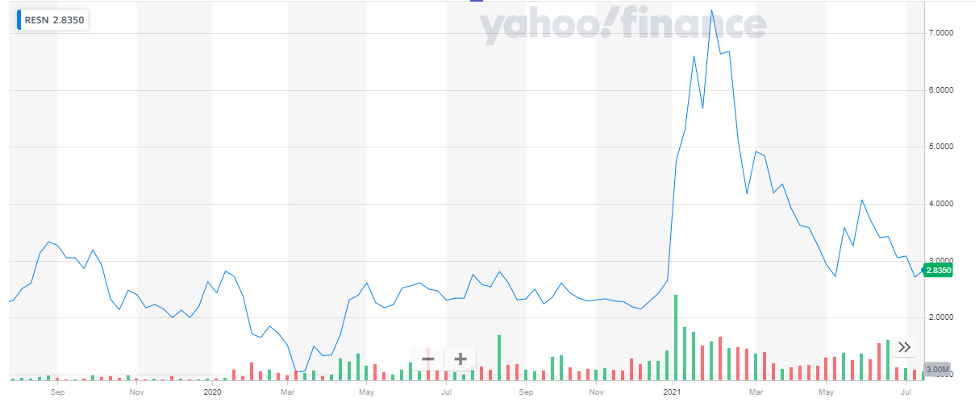

Resonant Inc has a market capitalization of over 176 million. Its stock is currently trading at $2.835. The stock of the company has been performing really well since the start of the year. It peaked at $7.4 in January end and is now trading at lower levels. As per the Elliotwave forecast, the stock is expected to move higher, making it one of the best penny stocks to invest in today.

15. Ideanomics Inc.

Ideanomics is a global company that is driving the sustainability transformation. It operates as a financial technology company that focuses on facilitating the adoption of commercial electric vehicles and developing next-generation financial services and Fintech products.

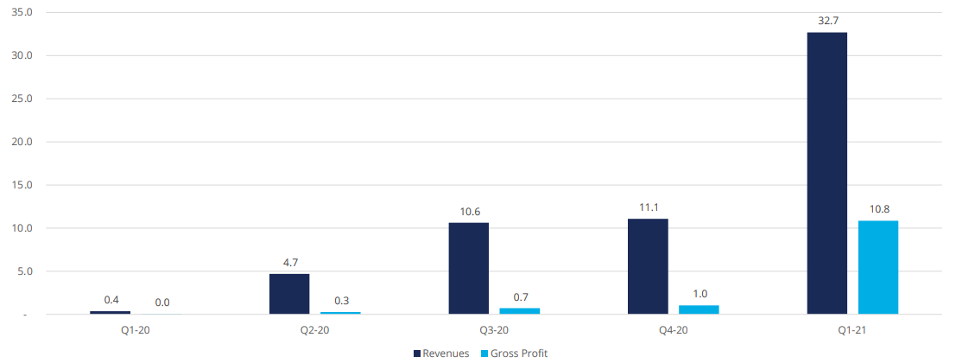

The fintech company reported very strong quarterly results:

- Revenue of $32.7M

- Cash of $356 million

The company’s earnings are on a continuous growth streak, as shown in the below chart:

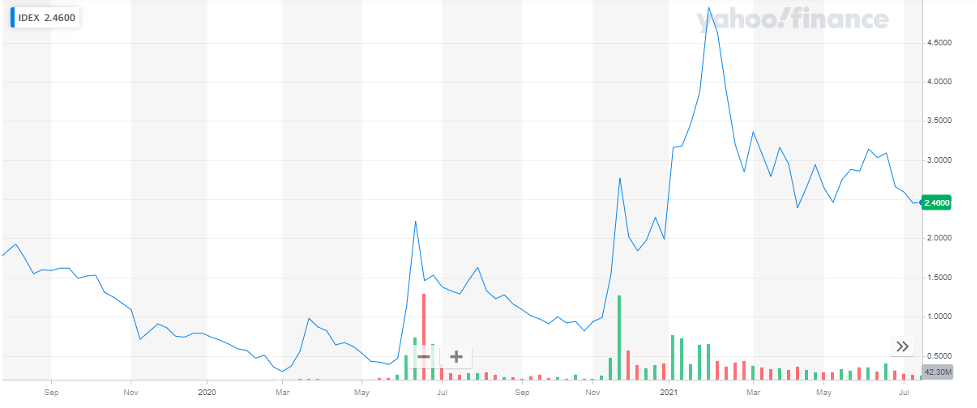

The Ideanomics stock is currently trading at $2.46. It has a market capitalization of around $1.132 billion. The stock performance for the past two years can be viewed in the below chart:

The Ideanomics stock is currently trading at $2.46. It has a market capitalization of around $1.132 billion. The stock performance for the past two years can be viewed in the below chart:

The stock performance is backed by strong financial growth. With the company’s earnings on a sequential growth pattern, this penny stock can explode in near future and generate multifold returns for investors. This is one of the best penny stocks to buy today.

The stock performance is backed by strong financial growth. With the company’s earnings on a sequential growth pattern, this penny stock can explode in near future and generate multifold returns for investors. This is one of the best penny stocks to buy today.

16. Peak Fintech Group Inc.

Peak Fintech Group Inc. provides software solutions by offering lending hub ecosystem solutions which automates the process for lenders to find borrowers across several market verticals that allow banks and lenders to safely increase loan volumes.

With a market capitalization of around 290 million, the stock of Peak Fintech is currently trading at $2.27. the company’s stock has exploded in the past months as shown in the below chart. The company’s stock kicked off the year 2021 at around $1.4 and has now increased by more than 50% year-to-date.

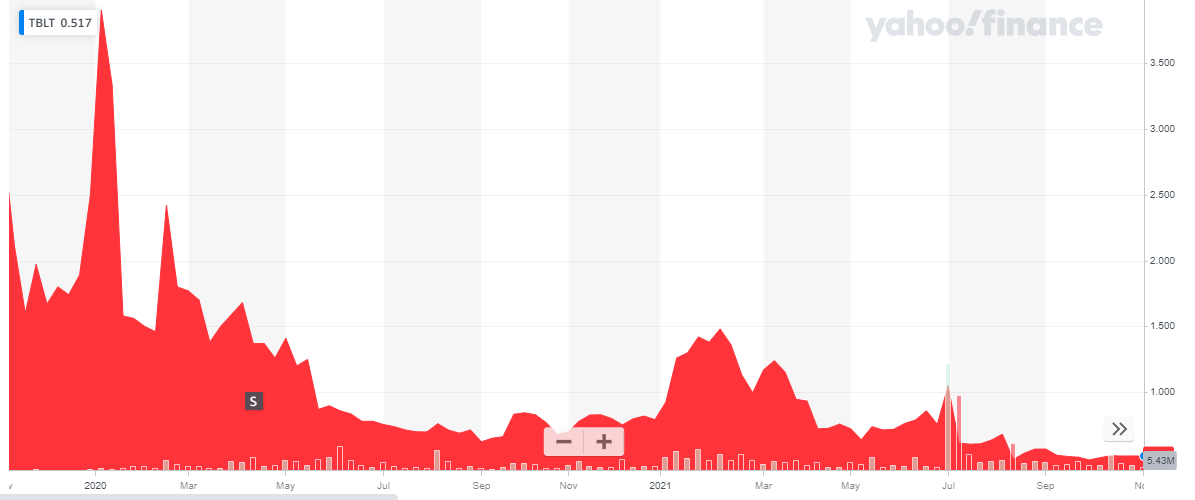

17. ToughBuilt Industries Inc. (NASDAQ: TBLT)

ToughBuilt is an advanced product design, manufacturer, and distributor of innovative tools and accessories. It is currently focused on tools and other accessories for the professional and do-it-yourself construction industries. A few examples of its products include bags and totes, knee pads, sawhorses, miter saw stands, pouches, and clip tech tool belts. The company’s product line includes two major categories: Soft Goods & Kneepads and Sawhorses & Work Products.

In the last quarterly report published, the company reported:

- A 132% increase of revenue to $15.9 million, compared to $6.8 million in the second quarter of 2020. The increase was due to strong demand from leading retailers in the US and abroad across all product lines.

- A 41% increase in Gross Profit to $3.4 million, compared to $2.4 million in the second quarter of 2020.

The market valuation of ToughBuilt Industries currently stands at $66.8 million. The share of the company is currently trading at $0.5169. The below chart shows the stock performance of the stock over the last 2 years:

The impressive revenue growth of the company indicates the company’s stock is highly undervalued right now. Therefore, ToughBuilt Industries is an excellent penny stock to invest in which has great potential in near future.

The impressive revenue growth of the company indicates the company’s stock is highly undervalued right now. Therefore, ToughBuilt Industries is an excellent penny stock to invest in which has great potential in near future.

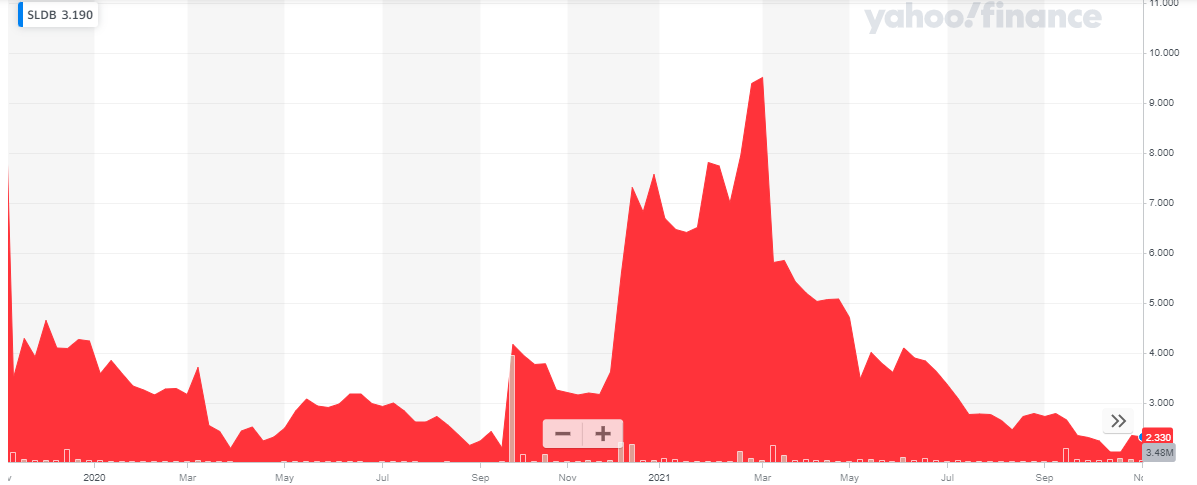

18. Solid Biosciences (NASDAQ: SLDB)

Solid Biosciences is a life science company focused on developing transformative treatments to improve the lives of patients living with Duchenne muscular dystrophy (Duchenne). The company is progressing and focusing on the two major drugs: SGT-001 and SGT-003. SGT-003 is currently a pipeline project while SGT-001 is in the process of clinical trials

In its third-quarter report, the company reported:

- Collaboration revenue for the third quarter of 2021 was $3.5 million, compared to no collaboration revenue for the third quarter of 2020

- Cash and investments of $229.8 million and cash runway till Q2 2023

The market valuation of the company is $255 million. The stock of Solid Biosciences is currently trading at $2.32. The below chart shows the stock performance of the stock over the last 2 years:

Despite showing high volatility in the past year, this penny stock is an excellent long-term investment. Not only its performance is improving, but the industry overall also has potential for explosive growth

Despite showing high volatility in the past year, this penny stock is an excellent long-term investment. Not only its performance is improving, but the industry overall also has potential for explosive growth

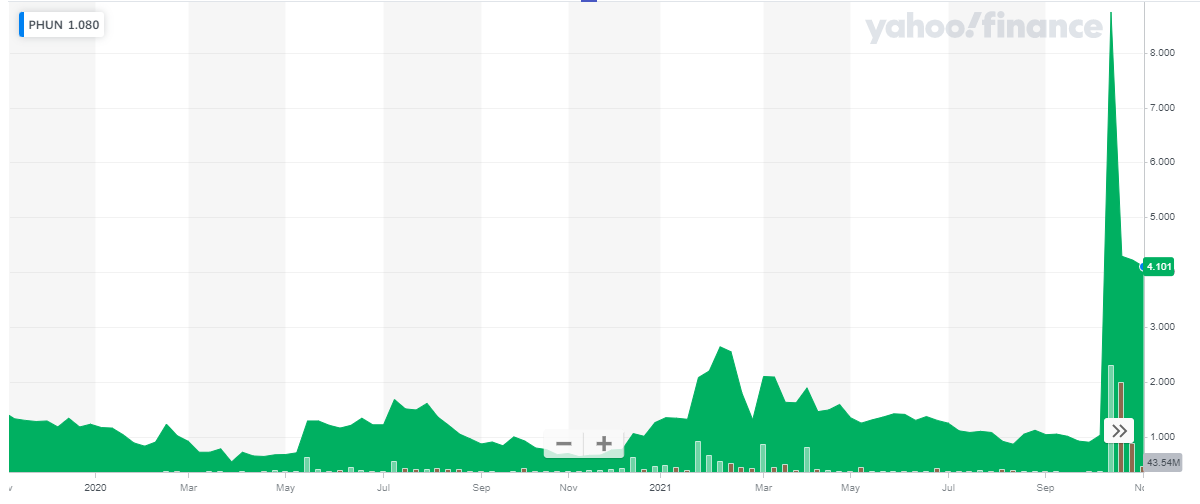

19. Phunware Inc. (NASDAQ: PHUN)

Phunware, Inc. is an American mobile software and blockchain company. It produces mobile applications for advertising and marketing purposes such as personalized ad targeting, location tracking, and cryptocurrency brand loyalty programs. The company offers a wide range of platforms such as mobile interaction, geolocation services, content management, analytics, and business intelligence.

The company has finally rolled out a blockchain-enabled Mobile Loyalty Ecosystem specific to PhunToken, PhunCoin, and PhunWallet on a direct-to-consumer basis. In addition to it, the company has bagged a global multi-year agreement with a Fortune 500 company as a distribution partner for its indirect channels.

In its second-quarter report, the company reported:

- Revenue of $1.4 million

- Net loss of $8.3 million

Phunware has a market capitalization of $345 million. Its share is currently trading at $4.11. The below chart shows the stock performance of the stock over the last 2 years:

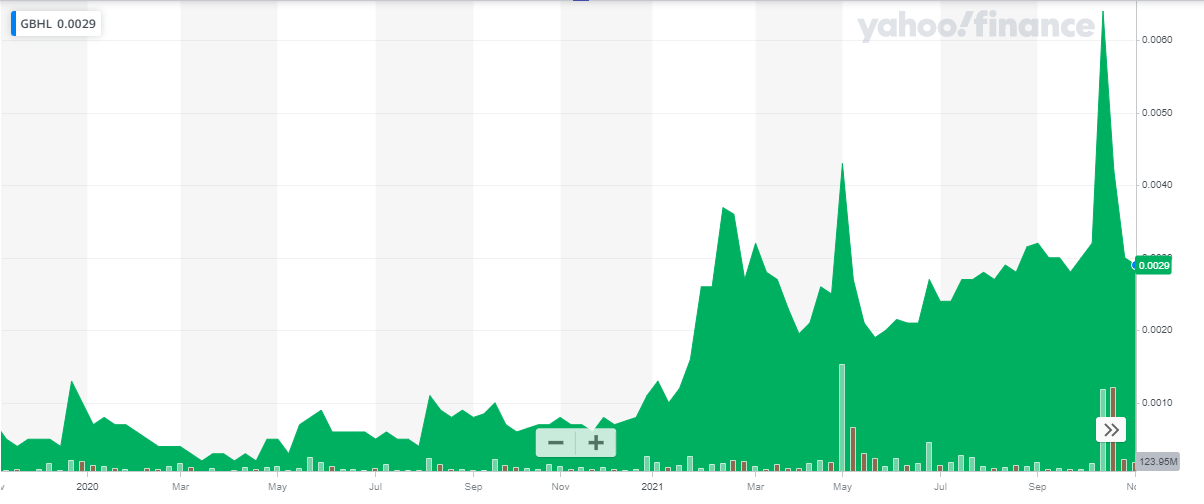

20. Global Entertainment Holdings Inc. (OTC: GBHL)

20. Global Entertainment Holdings Inc. (OTC: GBHL)

Global Entertainment Holdings Inc is engaged in the production of low-medium budgeted, high quality, genre pictures with recognizable name talent. It is also involved in the production, financing, and distribution of motion picture films, digital versatile discs packaged with original manuscripts, and music publishing and merchandising through its subsidiaries.

Global Entertainment Holdings currently has approximately 844 million shares of common stock issued. It has a market capitalization of around $675,000. The stock of the company is currently trading at $0.0029. The below chart shows the stock performance of the stock over the last 2 years:

Global Entertainment Holdings is a great penny stock to invest in. The stock is gradually growing and improving. At the current price, a small investment could lead to huge profits in the future.

Global Entertainment Holdings is a great penny stock to invest in. The stock is gradually growing and improving. At the current price, a small investment could lead to huge profits in the future.

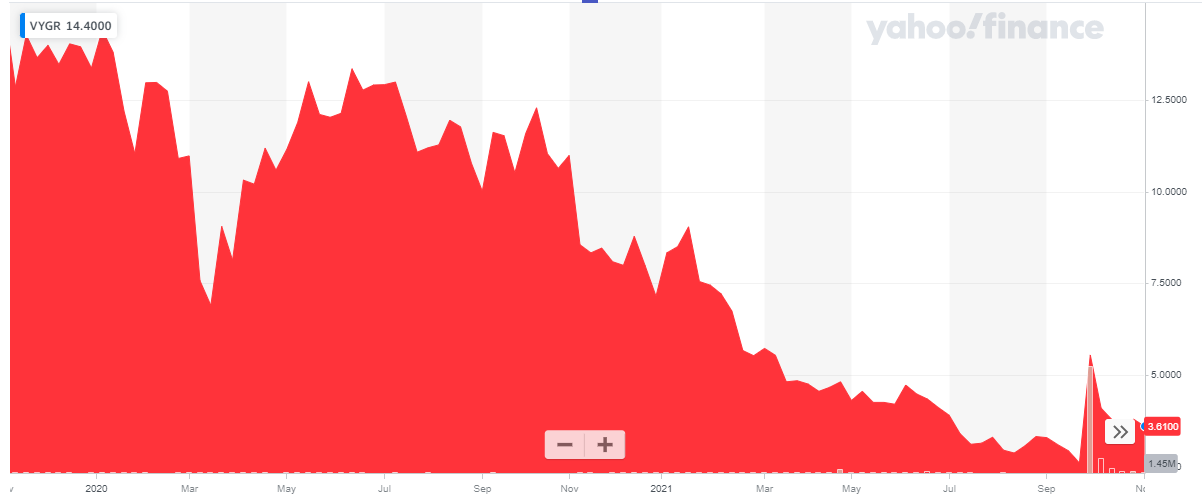

21. Voyager Therapeutics (NASDAQ: VYGR)

Voyager Therapeutics develops and delivers life-changing therapies for people with severe neurological diseases. It is a leader in developing next-generation AAV gene therapies to unlock the potential of the technology to treat devastating diseases. The pharma company is advancing towards an innovative gene therapy pipeline.

The current year has been comparatively slow in growth and financial performance, the company’s forecasted growth rate is high. The company’s market valuation is at $137 million. Its stock is currently trading at $3.61. The below chart shows the stock performance of the stock over the last 2 years:

The company’s revenue is growing at around 70% annually for the past 3 years. It has started generating profits in the last five years; hence the stock price is expected to rise more. Therefore, it is the best time to buy this penny stock.

The company’s revenue is growing at around 70% annually for the past 3 years. It has started generating profits in the last five years; hence the stock price is expected to rise more. Therefore, it is the best time to buy this penny stock.

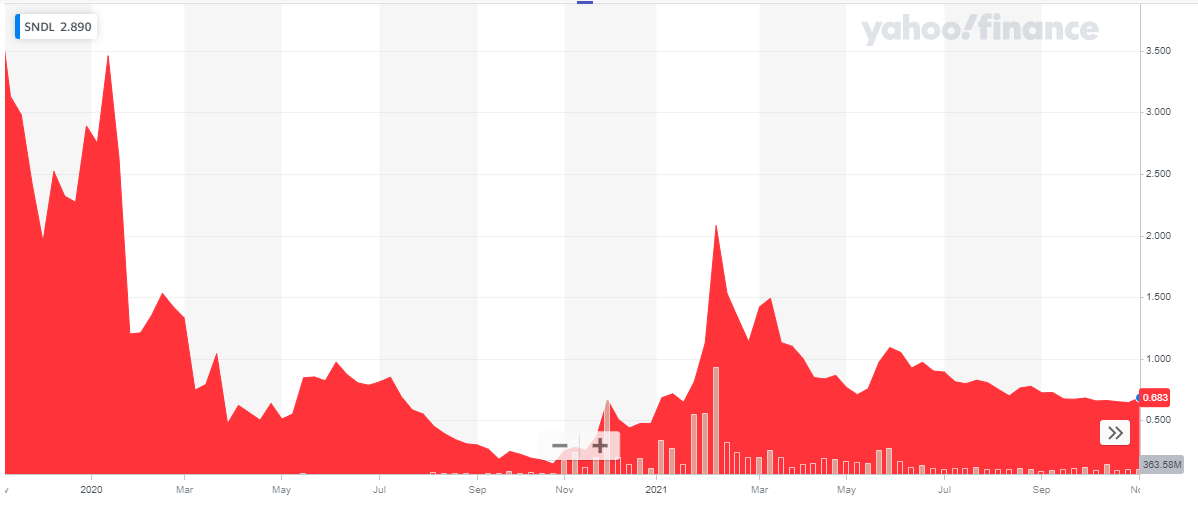

22. Sundial Growers Inc (NASDAQ: NSDL)

Sundial Growers Inc. operates as a pharmaceutical company. The Company produces and grows a range of cannabis strains, as well as, sells a variety of cannabis derivative products. The company carries its business through two operating segments: Cannabis and Investments.

In its second quarter of 2021, the company reported:

- Net revenue for the Company’s cannabis segment of $9.2 million. Investment and fee revenue of $5.7 million

- Net loss of $52.3 million for the second quarter of 2021 compared to $60.4 million in the second quarter of 2020

The company is diligently focused on its business model which it restructured in 2020. Moreover, Sundial completed its acquisition of Inner Spirit and the Spiritleaf, Canada’s largest cannabis retail store network, in July 2021. These acquisitions will enable the pharma company to reach consumers through an entirely new channel. In less than three years, Spiritleaf has achieved more than 100 stores, amongst which there are franchised and corporate-owned stores across Canada in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, and Newfoundland and Labrador.

Sundial Growers has a market capitalization of $1.4 billion. Its share is currently trading at $0.684. The below chart shows the stock performance of the stock over the last 2 years:

Sundial Growers is an excellent penny stock to invest in, in the long run.

Sundial Growers is an excellent penny stock to invest in, in the long run.

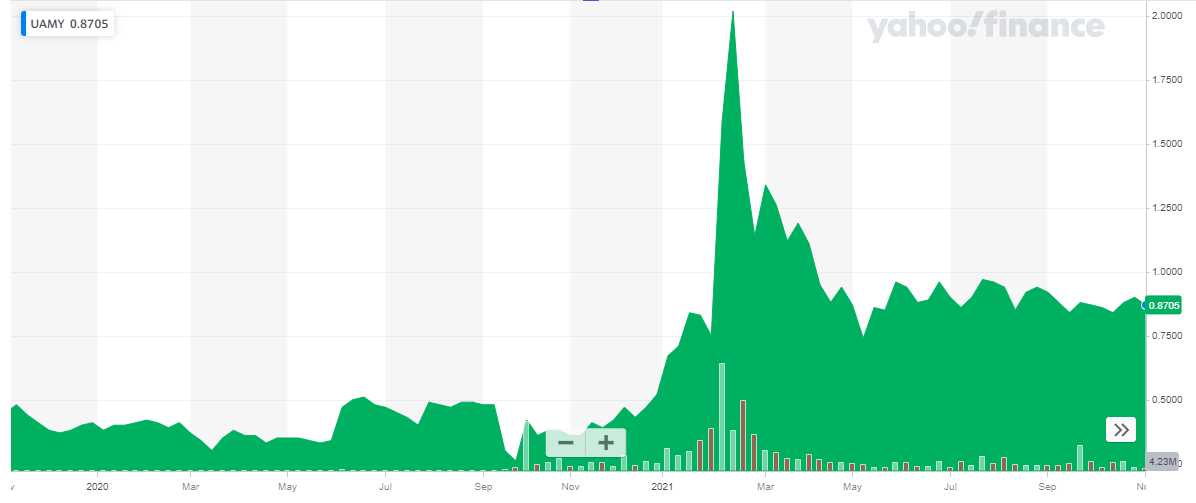

23. United States Antimony Corporation (AMEX: UAMY)

United States Antimony Corporation engages in the production and sale of antimony, silver, gold, and zeolite products in the United States. The company operates through two divisions, Antimony and Zeolite.

In the second quarter report of 2021, the company reported:

- Total revenue of $2.28M

- Net Income of $337

United States Antimony Corporation has a market capitalization of around $93 million. The share of the company is trading at $0.87. The below chart shows the stock performance of the stock over the last 2 years:

The price of this penny stock has been growing at a good pace, as shown in the graph.

The price of this penny stock has been growing at a good pace, as shown in the graph.

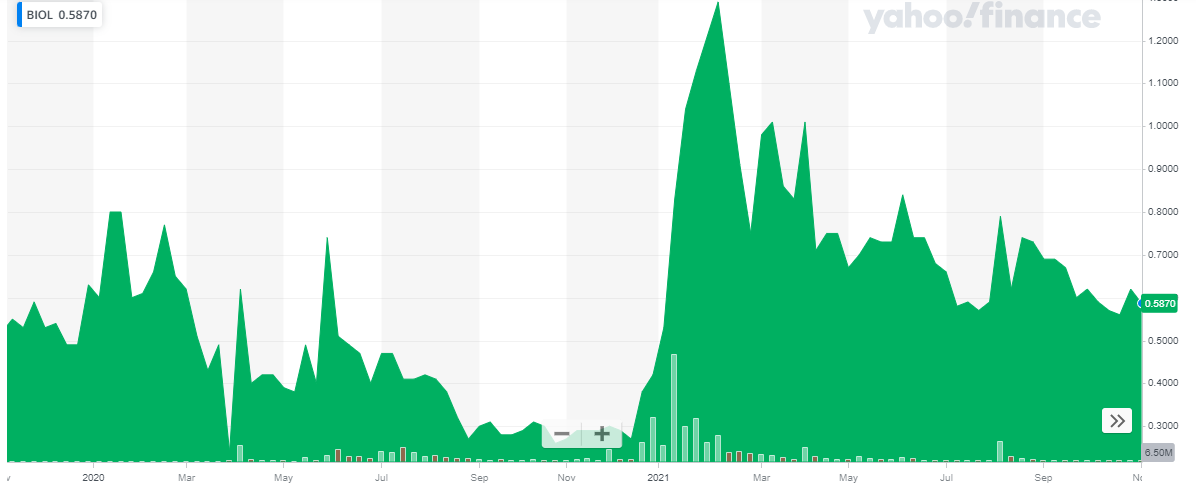

24. BIOLASE Inc. (NASDAQ: BIOL)

BIOLASE, Inc. is a medical device company and a global market leader in the manufacturing and marketing of proprietary dental laser systems. Biolase changed the dentistry industry by making laser dentistry the standard of care. It is a thriving medical device manufacturing company.

In the second quarter of 2021, the company reported:

- A 211% growth in net revenue to $9.1 million

- Net loss was $702,000

- Cash and cash equivalents totaled $37.1 million

Laser system sales increased by 424% in the second quarter of 2021. The huge growth in sales indicates the increased awareness and acceptance of the company products. As per the company officials, this growth is just the beginning and more is yet to come. Moreover, Biolase laser machines contribute towards a greener environment by reducing the spread of aerosolization.

The current market valuation of Biolase is at $89. The share of the company is currently trading at $0.587.

Other Notable Stocks to consider investing:

Other Notable Stocks to consider investing:

17. SunHydrogen Inc.

18. Loop Insights Inc.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Best Stock & Forex Trading Courses

- Best Day Trading Stocks to invest in

- Best Cryptocurrencies to Invest in

- Best trading and forex signal providers

- Best Renewable Energy Stocks to Invest

- Monthly Dividend Stocks to Buy