Best Penny Stocks to Buy Now

| Sr | Company Name | Symbol | Price (as of 7th Dec 2023) | 52-week change | Average Volume (3-month) | Market Capitalization |

| 1. | Boxlight Corp | BOXL | $ 1.1 | -58.08% | 41,060 | $ 10.572 Million |

| 2. | Zomedica Corp | ZOM | $ 0.6193 | -9.63 % | 3.22 Million | $ 165.9 Million |

| 3. | First Majestic Silver Corp. | AG | $ 5.91 | -35.27 % | 5.83 Million | $ 1.69 Billion |

| 4. | Cielo Waste Solutions Corp | CWSFF | $ 0.0201 | -34.63 % | 20,440 | $ 37.098 Million |

| 5. | Gold Resource Corporation | GORO | $ 0.3208 | -80.25 % | 436,820 | $ 28.453 Million |

| 6. | VerifyMe, Inc. | VRME | $ 1.02 | -11.03 % | 11,790 | $ 10.192 Million |

| 7. | RF Industries, Ltd | RFIL | $ 2.76 | -46.38 % | 15,870 | $ 28.4 Million |

| 8. | Solitario Zinc Corp. | XPL | $ 0.5407 | -12.9 % | 41,050 | $ 42.707 Million |

| 9. | Exela Technologies Inc | XELA | $ 3.515 | -87.54 % | 126,130 | 21.579 Million |

| 10. | Conduent Inc. | CNDT | $ 3.245 | -15.45 % | 998,470 | $ 705,096 Million |

| 11. | 9F Inc. | JFU | $ 4.14 | 0.49 % | 5,540 | $ 48.859 Million |

| 12. | Ideanomics Inc. | IDEX | $ 1.74 | -93.04 % | 309,490 | $ 20.832 Million |

| 13. | Entasis Therapeutics | ETTX | ||||

| 14. | ToughBuilt Industries Inc. | TBLT | $ 0.1880 | -91.67 % | 504,330 | $ 6.94 Million |

| 15. | Solid Biosciences | SLDB | $ 4.9 | -47.22 % | 274,340 | $ 98.87 Million |

| 16. | Phunware Inc. | PHUN | $ 0.0909 | 86.58 % | 2.6 Million | $ 12.265 Million |

| 17. | Global Entertainment Holdings Inc. | GBHL | $ 0.0004 | -66.67 % | 2.39 Million | 721,791 |

| 18. | Voyager Therapeutics | VYGR | $ 7.76 | -26.41 % | 226,110 | $ 341.404 Million |

| 19. | Sundial Growers Inc | SNDL | $ 1.47 | -44.06% | 3.72 Million | $ 384.111 Billion |

| 20. | United States Antimony Corporation | UAMY | $ 0.2502 | -36.59 % | 125,160 | $ 26.933 Million |

| 21. | BIOLASE Inc. | BIOL | $ 1.18 | -98.38 % | 384,600 | $ 2.71 Million |

Boxlight Corp

Boxlight Corporation is amongst the leading providers of technology solutions for the global learning market. The company develops, sells, and services its integrated, interactive solution suite including software, classroom technologies, professional development, and support services. The vision of Boxlight Corp is to improve the learning experience for students and create engagement in classrooms to enhance student output.

Boxlight Corp recently reported its third-quarter results for the year 2023:

- Revenue was reported at $ 49.7 million, as compared to $ 68.7 million in the previous year’s same quarter reporting a decrease of 28 %.

- Net loss was reported at $ 17.8 million compared to net income of $ 3.1 million in the previous year’s same period.

- Net loss per basic and diluted common share was $(1.90), compared to net income per basic and diluted common share of $0.31 and $0.28, in the previous year’s same period

Analyst of CNN Money offers a 12-month price forecast of $ 5 with a high estimate of $ 6 and a low estimate of $ 3 for Boxlight Corp. The analyst’s stance on Boxlight Corp stock is to “Buy”.

Find below the stock performance chart over the last 2 years:

Zomedica Corp

Zomedica Corp

Zomedica is a veterinary health company creating products for dogs and cats. The company’s USP is that it focuses on the unmet needs of clinical veterinarians. Zomedica’s product portfolio includes innovative diagnostics and medical devices. Zomedica Corp. aims to enable veterinarians to achieve higher productivity and higher revenues while providing better service to the animals in their care.

Adoption of pets has increased during COVID which has increased the demand for veterinary services. The pet care market associated with diagnostic services is expected to reach $2.8 billion annually by 2024. Zomedica Corp plans to become a leading operator in this line of business and plans to launch a new tool this year, Truforma, which will help veterinarians detect adrenal and thyroid issues in dogs and cats. The stock has already doubled in 2021, and a successful launch of its new tool might push it up even higher. The current industry demand and Zomedica’s plans make it one of the best penny stocks to buy now.

Zomedica recently reported its third quarter report for the year 2023:

- Revenue was reported at $ 6.3 million, as compared to $ 4.8 million in the previous year’s same quarter

- Loss from operations was reported at ($ 5.69 million) as compared to loss from operations in the previous year’s same quarter of ($ 6.6 million)

- Net loss was reported at ($ 491,000) as compared to a net loss of ($ 5) million in the previous year’s same period.

- Net loss per share was $ (0.001), compared to a net loss of ($0.005) in the previous year’s same period

Analyst of CNN Money offers a 12-month price forecast with a mean target of $ 0.44 for Zomedica Corp. The analyst’s stance on Zomedica Corp stock is to “hold”.

Find below the stock performance chart from the start of the year 2023:

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

- Reliable forex signals

First Majestic Silver Corp.

First Majestic is a publicly traded mining company focused on silver production in Mexico and is aggressively pursuing the development of its existing mineral property assets. The Company owns and operates multiple mines and the total production from all these mines is estimated to be around 12.5 to 13.9 million silver ounces or 20.6 to 22.9 million silver equivalent ounces as of 2021.

First Majestic recently reported its third quarter report for the year 2023:

- Revenue was reported at $ 133 million, as compared to $ 160 million in the previous year’s same quarter

- Loss from operations was reported at ($ 18 million) as compared to loss from operations in the previous year’s same quarter of ($ 15 million)

- Net loss was reported at ($ 27) million as compared to a net loss of ($ 20.1) million in the previous year’s same period.

- Net loss per share was $ (0.09), compared to net loss of $ (0.08) in the previous year

Analyst of CNN Money offers a 12-month price forecast with a mean estimate of $ 7.24, with a high estimate of $ 12 and a low estimate of $ 5.8 for First Majestic Silver Corp. The analyst’s stance on First Majestic Silver Corp stock is to “Hold”.

Find below the stock performance chart since the start of the year:

Cielo Waste Solutions Corp

Cielo Waste Solutions Corp

Cielo Waste Solutions Corp. engages in refining landfill and municipal and commercial waste into renewable diesel in Canada. It uses landfill waste, tires, plastics, wood shavings, and paper products to produce renewable Kerosene, highway diesel, and naphtha.

The Company’s strategic intent is to become a leading waste-to-fuel company using economically sustainable technology while minimizing the environmental impact. Cielo has a patented process that can convert waste feedstocks, including organic material and wood derivative waste, to fuel. Having demonstrated its ability to produce diesel and naphtha from waste, Cielo’s business model is to construct additional processing facilities. Cielo’s objective is to generate value by converting waste to fuel while fueling the sustainable energy transition.

The Company continued to focus during and subsequent to the year ended April 30, 2023, on progress toward the commercialization of its waste‐to‐fuel technology while strategically managing costs.

The net loss for the Company in the year ended April 30, 2023, was $36.2 million, an increase of $21.7 million from $14.4 million for the year ended April 30, 2022. The increase in net loss is primarily due to the recognition of impairment of $25.6 million, offset by a $5.3 million decrease in general and administrative expenditures, research and development expenditures, and share-based compensation.

Find below the stock performance chart since the start of the year:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Gold Resource Corporation

Gold Resource Corporation is a gold and silver producer with its operations centered on the Don David Gold Mine in Oaxaca, Mexico its Back Forty gold-copper development Project in Michigan, USA. Under the direction of an experienced board and senior leadership team, the Company’s focus is to unlock the significant exploration upside of its mine and surrounding large land package to the benefit of its existing infrastructure

Gold Resource Corporation recently reported its third quarter report for the year 2023:

- Revenue was reported at $ 20.55 million, as compared to $ 23.9 million in the previous year’s same quarter

- Net loss was reported at ($ 7.34) million as compared to net loss of ($ 9.7) million in the previous year’s same period.

- Net loss per share was $ (0.08), compared to net loss of $ (0.011) in the previous year

Analyst of CNN Money offers a 12-month price forecast of $ 1.5 for Gold Resource Corporation with a high estimate of $ 1.75 and a low estimate of $ 1.25. The analyst’s stance on Gold Resource Corporation stock is to “Buy”.

Find below the stock performance chart since the start of the year

VerifyMe, Inc.

VerifyMe, Inc.

VerifyMe, Inc., together with its subsidiaries, PeriShip Global and Trust Codes Global, provides traceability, and brand solutions. The company operates an Authentication Segment and a Precision Logistics Segment to provide item-level traceability, anti-diversion, anti-counterfeit protection, brand protection, and enhancement technology solutions, as well as specialized logistics for time and temperature-sensitive products. VerifyMe serves customers worldwide.

VerifyMe, Inc. recently reported its third-quarter earnings report for the year 2023:

- Revenue was reported at $ 5.6 million in Q3 2023, compared to $ 5.2 million in Q3 2022

- Net loss was reported at ($ 0.9) million in Q3 2023, compared to a net loss of ($ 0.6) million in Q3 2022

- Net loss per share was reported at ($ 0.06) as compared to a net loss of ($ 0.1) per share in Q3 2022

Analysts of Wallet Investors forecast a price of $ 0.897 for VerifyMe, Inc. for the next 12 months. This share is labeled as a bad investment by the Wallet Investors Analysts.

Find below the stock performance chart since the start of the year:

RF Industries, Ltd.

RF Industries, Ltd.

RF Industries designs and manufactures a broad range of interconnect products across diversified, growing markets including wireless/wireline telecom, data communications, and industrial. The Company’s products include RF connectors, coaxial cables, data cables, wire harnesses, fiber optic cables, custom cabling, energy-efficient cooling systems, and integrated small cell enclosures.

RF Industries announced results for its third fiscal quarter ended July 31, 2023:

- Net sales decreased 34% to $15.7 million compared to sales of $23.8 million in the third quarter of fiscal 2022, primarily the result of the decrease in sales of hybrid fiber cables to wireless carrier customers and sales related to carrier projects involving approved RF components.

- Operating loss was $(2.0) million compared to operating income of $1.1 million in the third quarter of fiscal 2022, due to lower net sales.

- Consolidated net loss was $(1.6) million, compared to net income of $771,000 in the third quarter of fiscal 2022

- Net loss per share was $(0.16) per diluted share as compared to $0.08 per diluted share in the third quarter of fiscal 2022.

Find below the stock performance chart since the start of the year:

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Solitario Zinc Corp.

Solitario Zinc Corp. is a zinc-focused exploration company engaging in the acquisition, exploration, and development of zinc properties in safe jurisdictions in North and South America. The company has significant interests in two large, high-grade zinc development projects which are: the Florida Canyon Zinc Project and the Lik Zinc Project. With the demand for Zinc increasing and the prices elevating, these recent joint ventures will propel the growth rate of the company.

The company has no source of revenue. It is currently raising money through equity finance. and has a small amount of debt. On 30th September 2023, the company reported its third-quarter report:

- Net loss was reported at $ (1.3) million as compared to net loss of $ (1.1) million in the previous year same quarter

- Net loss per share was reported at $ (0.02) as compared to $ (0.02) in the previous year’s same quarter

Find below the stock performance chart since the start of the year:

Exela Technologies Inc.

Exela Technologies Inc.

Exela Technologies is a business process automation (BPA) leader, leveraging a global footprint and proprietary technology to provide digital transformation solutions enhancing quality, productivity, and end-user experience. With decades of experience operating mission-critical processes, Exela serves a growing roster of more than 4,000 customers throughout 50 countries, including over 60% of the Fortune® 100. Utilizing foundational technologies spanning information management, workflow automation, and integrated communications, Exela’s software and services include multi-industry, departmental solution suites addressing finance and accounting, human capital management, and legal management, as well as industry-specific solutions for banking, healthcare, insurance, and the public sector. Through cloud-enabled platforms, built on a configurable stack of automation modules, and approximately 15,000 employees operating in 21 countries, Exela rapidly deploys integrated technology and operations as an end-to-end digital journey partner

Exela Technologies recently reported its first quarter results for the year 2023:

- Revenue was reported at $ 273.6 million, a decline of 2.1% compared to $279.4 million in Q1 2022

- Operating loss for Q1 2023 was $6.9 million, compared with operating loss of $7.3 million in Q1 2022.

- Net loss for Q1 2023 was $47.5 million, compared with a net loss of $57.9 million in Q1 2022

Exela Technologies has a market capitalization of over $ 21.2 million. The stock is currently trading at $ 3.11. The stock has been on a bearish trend since the start of the year. The below chart shows the stock performance since the start of the year 2023:

Conduent Inc.

Conduent Inc.

Conduent Inc. is a business process services company that specializes in transaction-intensive processing, analytics, and automation. Conduent is a globally recognized BPO leader and it holds the leading position in:

- Healthcare

- Business Services

- HR Services

For the second consecutive year, Conduent Inc. has been recognized as a Leader in the Everest Group Healthcare Payer Operations PEAK Matrix Assessment 2023 which evaluates service providers on multiple factors.

The company recently reported its third quarter report for the year 2023:

- Revenue was reported at $ 932 million, as compared to $ 977 million in the previous year’s same period

- Net Loss was reported at $ (289) million, as compared to net profit of $ 15 million in the previous year’s same period

- Loss per share was reported at $ (1.34) as compared to earnings per share of $ 0.06 in the previous year’s same period

With a market capitalization of around $ 701.8 million, the stock of the company is currently trading at $ 3.23. The below chart shows the stock performance of the company since the start of the year 2023:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

9F Inc.

9F Inc. is an internet technology company that focuses on providing technology services to financing and consumption industries in China and overseas, including fintech technology services to financial institution partners, online wealth management technology services, e-commerce services as well as overseas expansion of our consumer financing technology services in Southeast Asian countries.

In the recent half-year earnings, the company reported:

- Total net revenues of US$120.1 million, representing a decrease of 61.0%

- Net loss of US$105.4 million, down by 73.9%

The company has been greatly affected by the pandemic since its operations are based in China. The company’s growth has been suspended as a result. But with the economy on the road to recovery, the future holds great prospects for the company.

With a market capitalization of over $ 47.093 million, the stock of 9F is currently trading at $ 4. As the below chart shows, the stock has been highly volatile with multiple ups and downs throughout the year. during the year the stock went as low as $ 1.52 and as high as $ 5.27.

Ideanomics Inc.

Ideanomics Inc.

Ideanomics is a global company that is driving the sustainability transformation. It operates as a financial technology company that focuses on facilitating the adoption of commercial electric vehicles and developing next-generation financial services and Fintech products.

The fintech company reported its second-quarter results for the year 2023:

- Revenue was reported at $ 8.2 million, as compared to $ 9.4 million in the previous year’s same quarter

- Loss from operations was reported at $ (35) million, as compared to a loss of $ ( 37.1) million in the previous year’s same period.

- Net Loss was reported at $ (37.1) million, as compared to net loss of $ ( 37.1) million in the previous year’s same period.

- Net loss per share was reported at $ (3.19), as compared to a loss of $ (8.86) million in the previous year’s same period.

The Ideanomics stock is currently trading at $ 1.54. It has a market capitalization of around $ 18.44 million. The stock performance since the start of the year can be viewed in the below chart. The stock has been on a bearish trend since the start of the year and has been trading at the lowest lows of $ 2.5

ToughBuilt Industries Inc. (NASDAQ: TBLT)

ToughBuilt Industries Inc. (NASDAQ: TBLT)

ToughBuilt is an advanced product designer, manufacturer, and distributor of innovative tools and accessories. It is currently focused on tools and other accessories for the professional and do-it-yourself construction industries. A few examples of its products include bags and totes, knee pads, sawhorses, miter saw stands, pouches, and clip tech tool belts. The company’s product line includes two major categories: Soft Goods and kneepads and Sawhorses and work Products.

In the last quarterly report published, the company reported:

- A 132% increase in revenue to $15.9 million, compared to $6.8 million in the second quarter of 2020. The increase was due to strong demand from leading retailers in the US and abroad across all product lines.

- A 41% increase in Gross Profit to $3.4 million, compared to $2.4 million in the second quarter of 2020.

The market valuation of ToughBuilt Industries currently stands at $ 5.785 million. The share of the company is currently trading at $ 0.1567. The stock has been on a bearish trend since the start of the year. The stock went from $ 2.17 to $ $ 0.1567.

The below chart shows the stock performance of the stock since the start of the year:

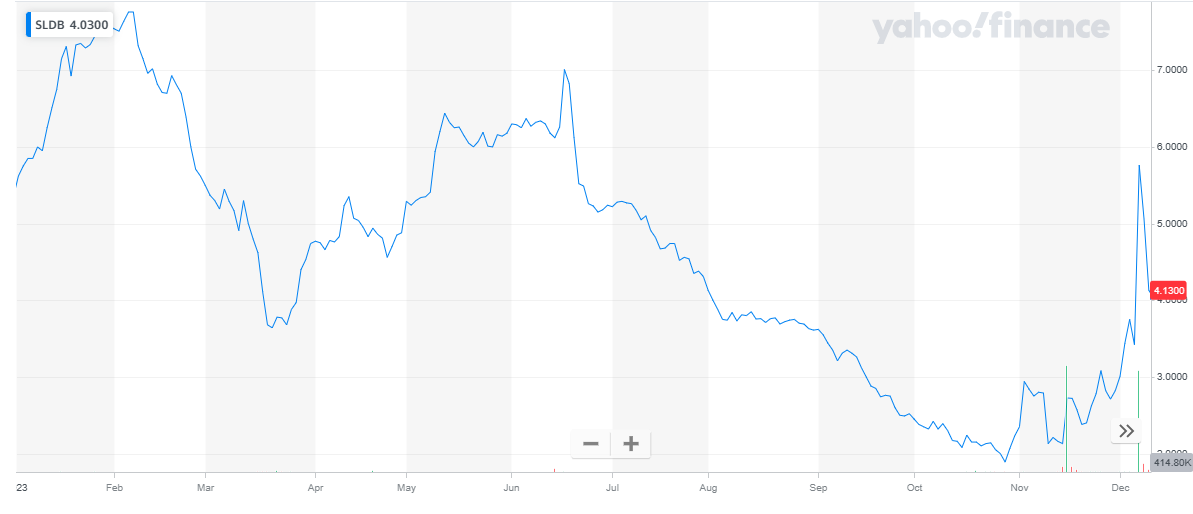

Solid Biosciences (NASDAQ: SLDB)

Solid Biosciences (NASDAQ: SLDB)

Solid Biosciences is a life science company focused on advancing a portfolio of neuromuscular and cardiac programs, including SGT-003, a differentiated gene transfer candidate for the treatment of Duchenne muscular dystrophy (Duchenne), AVB-202-TT, a gene therapy program for the treatment of Friedreich’s Ataxia, AVB-401 a gene therapy program for the treatment of BAG3 mediated dilated cardiomyopathy, and additional assets for the treatment of undisclosed cardiac diseases. Solid aims to be the center of excellence across a given disease spectrum bringing together those with expertise in science, technology, disease management, and care. Patient-focused and founded by those directly impacted, Solid’s mandate is to improve the daily lives of patients living with these devastating diseases.

Solid Biosciences reported its first quarter results for the year 2023 ending March 31, 2023

- No collaboration revenues for the first quarter of 2023, compared to $1.9 million, for the first quarter of 2022. Collaboration revenue in the 2022 period was related to research services and cost reimbursement from our Collaboration Agreement with Ultragenyx, which the Company entered into in the fourth quarter of 2020.

- Net loss for the first quarter of 2023 was $30.1 million, compared to $25.3 million for the first quarter of 2022. The increase in net loss was the result of a greater investment in research and development to progress DMD candidates.

Solid had $185.5 million in cash, cash equivalents, and available-for-sale securities as of March 31, 2023, compared to $213.7 million as of December 31, 2022. The Company expects that its cash, cash equivalents, and available-for-sale securities will enable it to fund key strategic priorities into 2025.

The market valuation of the company is $ 81.315 million. The stock of Solid Biosciences is currently trading at $ 4.03.

The below chart shows the stock performance of the stock since the start of the year. The stock has been mildly volatile during the year. It started the year at $ 5.63 and last closed at $ 4.03. During the year the stock went as high as $ 7.76 and as low as $ 1.89.

Also, read:

Phunware Inc. (NASDAQ: PHUN)

Phunware, Inc. offers a fully integrated software platform that equips companies with the products, solutions, and services necessary to engage, manage, and monetize their anytime, anywhere users worldwide. Their location-based software-as-a-service platform provides the entire mobile lifecycle of applications and media in one login through one procurement relationship. Their technology is available in Software Development Kit (“SDK”) form for organizations developing their own application, via customized development services and prepackaged solutions. Through their integrated mobile advertising platform of publishers and advertisers, they provide in-app application transactions for mobile audience building, user acquisition, application discovery, audience engagement, and audience monetization. Founded in 2009, Phunware is a Delaware corporation headquartered in Austin, Texas.

Phunware recently reported its third quarter report for the year 2023:

- Net revenues for the quarter totaled $2.8 million, as compared to $ 4.8 million in the previous year’s same quarter

- Platform revenues were $1.3 million for the quarter

- Hardware revenues were $1.5 million for the quarter

- Net loss was $(19.0) million, as compared to net loss $ (18) million in the previous year same quarter

- Net loss per share was $(0.16) as compared to net loss per share of $ (0.08) million in the previous year same quarter

Phunware has a market capitalization of $ 13.965 million. Its share is currently trading at $ 0.0781. The below chart shows the stock performance of the stock since the start of the year. After an initial rise in price, the stock continued on a downward journey. Throughout the year, the stock remained bearish and it last closed at $ 0.089.

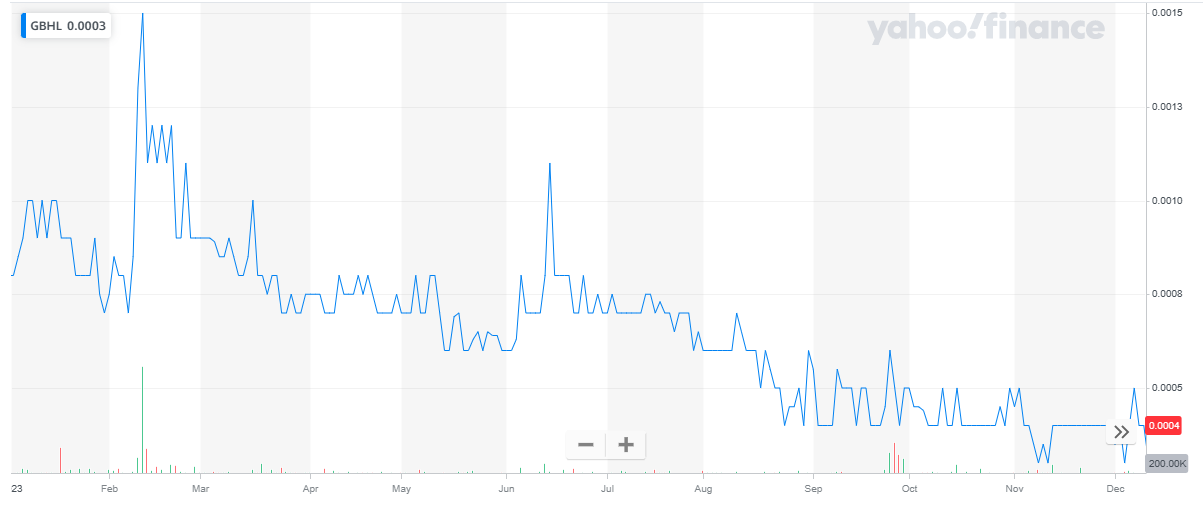

Global Entertainment Holdings Inc. (OTC: GBHL)

Global Entertainment Holdings Inc. (OTC: GBHL)

GBHL is a publicly-held, entertainment company with the goal of building a worldwide entertainment and media organization with domestic and foreign subsidiaries, affiliates, and/or joint venture partners. GBHL operates primarily through its wholly-owned subsidiaries of Global Universal Film Group (Film Production & sales), Global Entertainment Media (media content delivery; the “i-HUB”), and Global Entertainment Film Fund, LLC (Film Slate Financing). The Company is determined to stay on the cutting edge of social networking and media distribution through its wholly-owned subsidiary, You’ve Got the Part, Inc. Global Entertainment Media is focused on the development of digital distribution of media content with the i-HUB set-top convergence system. The Company also utilizes joint ventures to maximize revenue while reducing equity exposure.

Global Entertainment Holdings has a market capitalization of around $ 641,589. The stock of the company is currently trading at $0.0004. The below chart shows the stock performance of the stock since the start of the year. It has been volatile throughout the year. The company’s stock started the year at $ 0.0008 and last closed at $ 0.0003. During the year the stock went as high as $ 0.0015 and as low as $ 0.003.

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Voyager Therapeutics (NASDAQ: VYGR)

Voyager Therapeutics is a biotechnology company dedicated to breaking through barriers in gene therapy and neurology. The potential of both disciplines has been constrained by delivery challenges; Voyager is leveraging cutting-edge expertise in capsid discovery and deep neuropharmacology capabilities to address these constraints.

Voyager’s TRACER™ AAV capsid discovery platform has generated novel capsids with high target delivery and blood-brain barrier penetration at low doses, potentially addressing the narrow therapeutic window associated with conventional gene therapy delivery vectors. This platform is fueling alliances with Alexion, AstraZeneca Rare Disease; Novartis Pharma AG; Neurocrine Biosciences, Inc., and Sangamo Therapeutics, Inc., as well as multiple programs in Voyager’s own pipeline. Voyager’s pipeline includes wholly-owned and collaborative preclinical programs in Alzheimer’s disease, amyotrophic lateral sclerosis (ALS), Parkinson’s disease, and other diseases of the central nervous system, with a focus on validated targets and biomarkers to enable a path to rapid potential proof-of-biology.

Voyager Therapeutics reported its third-quarter results for the year 2023:

- Voyager had collaboration revenue of $4.6 million for the third quarter of 2023, compared to $41.1 million for the same period in 2022. The decrease was primarily due to $40.0 million in collaboration revenue recognized during the third quarter of 2022 in connection with Pfizer exercising its option to license a novel capsid generated from the TRACER capsid discovery platforms.

- Net loss was $25.9 million for the third quarter of 2023, compared to net income of $17.6 million for the same period in 2022. The difference is primarily due to the decrease in collaboration revenue discussed above.

The company’s market valuation is at $ 323.36 million. Its stock is currently trading at $ 7.35. The below chart shows the stock performance since the start of the year. The stock has been volatile during the year. During the year the stock price went as high as $ 13.99 and as low as $ 6.28

Sundial Growers Inc (NASDAQ: NSDL)

Sundial Growers Inc (NASDAQ: NSDL)

SNDL Inc. engages in the production, distribution, and sale of cannabis products in Canada. The company operates through four segments: Liquor Retail, Cannabis Retail, Cannabis Operations, and Investments. It engages in the cultivation, distribution, and sale of cannabis for the adult-use and medical markets; sells wines, beers, and spirits through wholly owned liquor stores; and private sale of recreational cannabis through wholly owned and franchised retail cannabis stores. The company also produces and distributes inhalable products, such as flowers, pre-rolls, and vapes. It offers its products under the Top Leaf, Sundial Cannabis, Palmetto, and Grasslands brands. The company was formerly known as Sundial Growers Inc. and changed its name to SNDL Inc. in July 2022.

SNDL recently reported its third quarter report for the year 2023:

- Net revenue for the third quarter of 2023 of $237.6 million, compared to $230.5 million in the third quarter of 2022, an increase of 3.1%

- Net loss of $21.8 million for the third quarter of 2023, compared to a loss of $98.8 million in the third quarter of 2022, an improvement of 77.9% mainly driven by asset impairments recorded in 2022

Sundial Growers has a market capitalization of $ 365.8 million. Its share is currently trading at $ 1.4. The below chart shows the stock performance of the stock since the start of the year. The stock has exhibited volatile behavior in this past year with multiple dips and peaks. During the year, the stock went as high as $ 2.39 and as low as $ 1.25

United States Antimony Corporation (AMEX: UAMY)

United States Antimony Corporation (AMEX: UAMY)

United States Antimony Corporation engages in the production and sale of antimony, silver, gold, and zeolite products in the United States. The company operates through two divisions, Antimony and Zeolite.

The company reported earnings results for the first quarter ended March 31, 2023:

- Sales were reported at $ 2.21 million compared to $ 3.58 million a year ago.

- Net loss was $ 0.806984 million compared to net income of $ 0.786252 million a year ago

- Basic loss per share from continuing operations was $ 0.01 compared to basic earnings per share from continuing operations of $ 0.01 a year ago

United States Antimony Corporation has a market capitalization of around $ 24.76 million. The share of the company is trading at $ 0.23. The below chart shows the stock performance since the start of the year. The stock has been mildly volatile during this year. From a price of $ 0.48, the stock dropped to $ 0.31. From here the stock picked up and went as high as $ 0.47 and eventually closed at $ 0.23.

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

BIOLASE Inc. (NASDAQ: BIOL)

BIOLASE, Inc. is a medical device company and a global market leader in the manufacturing and marketing of proprietary dental laser systems. Biolase changed the dentistry industry by making laser dentistry the standard of care. It is a thriving medical device manufacturing company.

In the second quarter of 2021, the company reported:

- Net revenue for the quarter ended September 30, 2023, was $10.9 million, a decrease of 9% compared to net revenue of $12.0 million for the quarter ended September 30, 2022.

- Net loss attributable to common stockholders for the quarter ended September 30, 2023, was $4.6 million, or $3.89 per share, compared to a net loss of $8.4 million, or $110.36 per share (as adjusted for the reverse stock split), for the quarter ended September 30, 2022.

The current market valuation of Biolase is at $ 4.235. The share of the company is currently trading at $ 1.24.