The stock market has always been volatile. Economic ups and downs, political activities, and changes in government rules and regulations always give a jolt to the stock market. In addition to the market’s volatility, there are always a set of stocks that have greater price movements and make them amongst the most volatile stocks to trade. A volatile stock is one whose price fluctuates by a large percentage each day.

Volatility is a measure of the price change and/or return over a period of time for a specific stock or any financial instrument. The risk of volatile stocks is mitigated through different investment strategies and diversifications.

How to Trade Volatility

Trading Volatile Stocks is usually done in short bursts which fall under the category of Day Trading. In day trading, a trader is on the hunt to generate maximum profits on a daily basis. This means the frequency of buying and selling is higher in one day.

Check out our list of top day trading stocks.

Volume is one of the key indicators of a volatile stock. A stock with high trading volume makes buying and selling easy. If the trading volume is not high, you will be stuck with the purchase no matter how cheap it was.

Another key point to consider while trading volatile stocks is timing. As an investor, you need to act quickly to take maximum advantage of an opportunity. Trading volatile stocks are not easy and every second matter during its trade.

Also read: Best Stock Forecasts & Prediction Services

List of the Most Volatile Stocks For 2023

| Sr. | Company Name | Symbol | Beta (5Y Monthly) |

|---|---|---|---|

| 1. | Prospect Capital | PSEC | 0.93 |

| 2. | Realty Income | O | 0.72 |

| 3. | STAG Industrial | STAG | 0.92 |

| 4. | Shaw Communications | SJR | 0.44 |

| 5. | LTC Properties | LTC | 0.95 |

| 6. | Gladstone Investment Corporation | GLAD | 1.45 |

| 7. | Urban One | UONE | 1.02 |

| 8. | Alterity Therapeutics | ATHE | 0.89 |

| 9. | Simon Property Group | SPG | 1.56 |

| 10. | Carver Bancorp, Inc. | CARV | 1.41 |

| 11. | Advanced Micro Devices, Inc. | AMD | 2.01 |

| 12. | Affirm Holdings Inc | AFRM | NA |

| 13. | Connect Biopharma Holdings Limited | CNTB | NA |

| 14. | Reto Eco Solutions Inc. | RETO | 1.68 |

| 15. | Greenland Technologies Holdings Corporation | GTEC | 2.77 |

1. Prospect Capital (PSEC)

Prospect Capital Corporation is a leading publicly-traded Business Development Company that focuses on delivering steady, attractive returns to our shareholders. Prospect’s investment objective is to generate both current income and long-term capital appreciation through debt and equity investments.

Prospect Capital has a market capitalization of approximately $3 Billion. The average traded volume for the last 10 days is 2.15 Million shares. The 5Y Monthly Beta of PSEC is 0.93 which makes this stock moderately volatile. Its last closing price was $7.79 on 17th March 2021.

Read: Best Gold Trading Signal Providers.

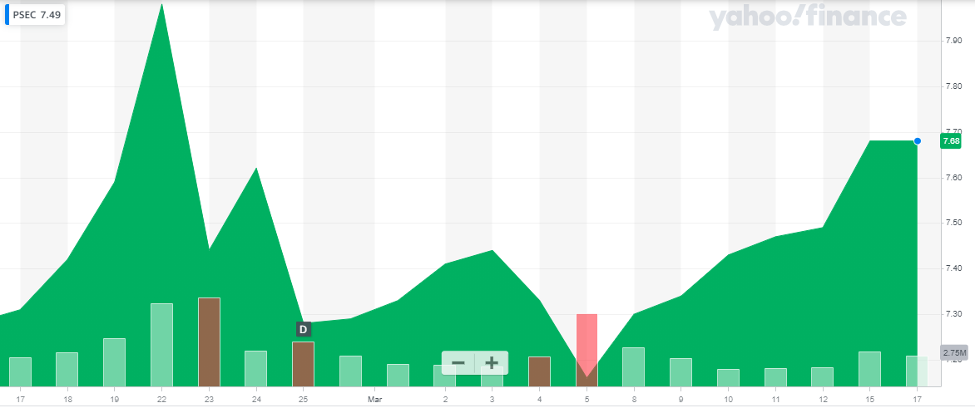

The company’s stock performance for the last 30 days is as below:

The stock price has been moving up and down during the course of the last 30 days. It rose to $7.98 and dropped to $7.17 with 12 days. After which it has been rising and has reached $7.68 as of 17th March 2021.

The stock price has been moving up and down during the course of the last 30 days. It rose to $7.98 and dropped to $7.17 with 12 days. After which it has been rising and has reached $7.68 as of 17th March 2021.

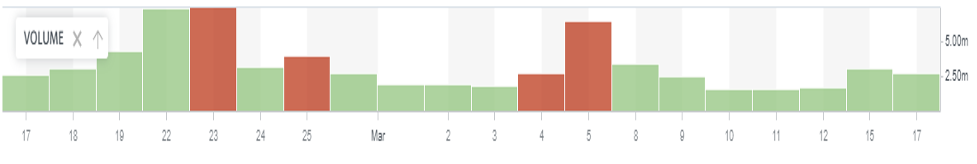

The volume chart for the last 30 days is as below:

The trading volume of Prospect Capital is very high reaching up to 7.9 million on 23rd March 2021. The stock has maintained its high trading volume during the duration of the last 30 days.

The trading volume of Prospect Capital is very high reaching up to 7.9 million on 23rd March 2021. The stock has maintained its high trading volume during the duration of the last 30 days.

Read more:

2.Realty Income (O)

Realty Income, The Monthly Dividend Company is committed to providing a steady stream of monthly income to shareholders. It has been providing a steady dividend to its investors and also gives an additional bonus every year according to the company’s performance.

Realty Income has a market capitalization of approximately $24 Billion. Its Average traded Volume for the past 10 days is 3.1 Million shares. The 5Y Monthly Beta for Realty Income is 0.72 which makes this stock moderate volatile. Its last closing price was $63.88 on 17th March 2021.

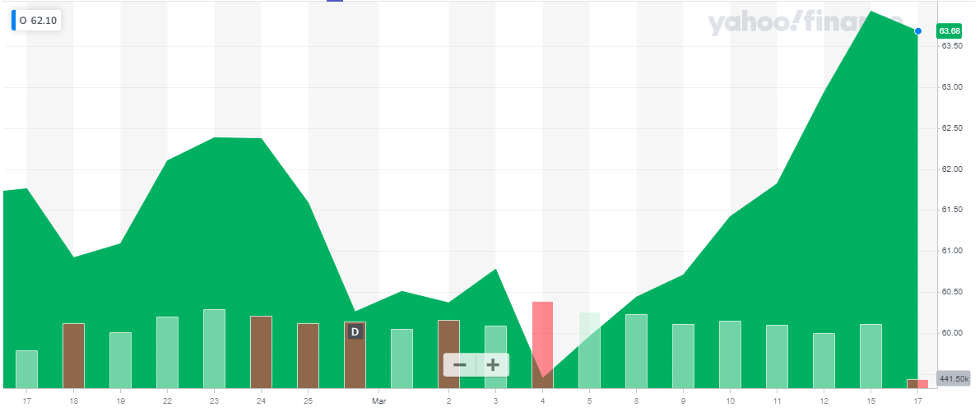

The company’s stock performance for the last 30 days is as below:

The stock of Realty Income has been pretty volatile in the last 30 days. The above chart shows multiple upward and downward movements during the last 30 days. It dropped to $59.45 on 4th March 2021 and rose to $63.92 on 15th March 2021.

The stock of Realty Income has been pretty volatile in the last 30 days. The above chart shows multiple upward and downward movements during the last 30 days. It dropped to $59.45 on 4th March 2021 and rose to $63.92 on 15th March 2021.

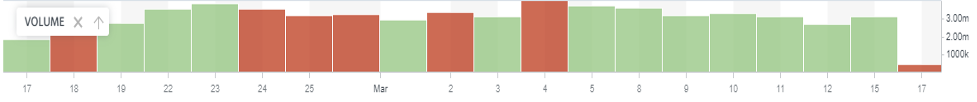

The volume chart for the last 30 days is as below:

The trading volume of Realty Income has been consistently high in the last 30 days. The highest it has reached is 4.3 million shares on 4th March 2021.

The trading volume of Realty Income has been consistently high in the last 30 days. The highest it has reached is 4.3 million shares on 4th March 2021.

Get to know the best covered call stocks to buy now.

3. STAG Industrial (STAG)

STAG Industrial Inc. is a real estate investment trust which operates by acquiring single-tenant industrial properties in the United States. Through this approach towards business, STAG Industrial can maintain company growth and provide its investors with a balanced return.

STAG Industrial has a market capitalization of approximately $5.4 billion. The Average Traded Volume for the last 10 days is 1.21 Million shares. The 5Y Monthly Beta is 0.92 making it a moderately high volatile stock. Its last closing price was $34.33 on 17th March 2021.

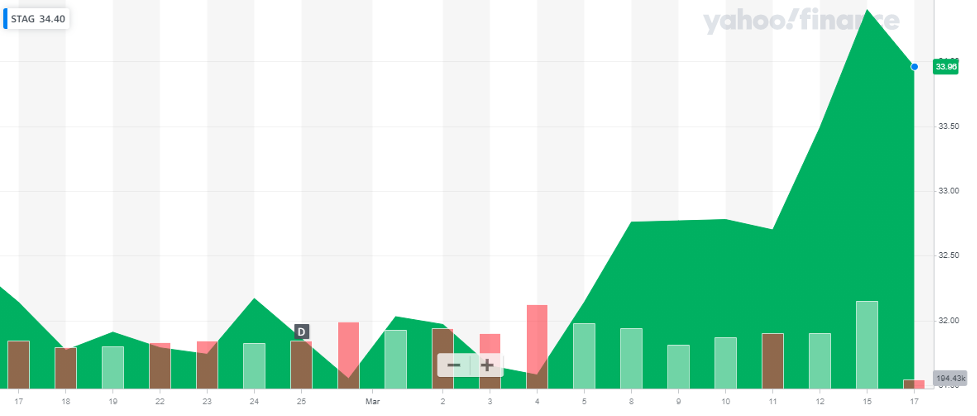

The company’s stock performance for the last 30 days is as below:

The company’s stock price has undergone various ups and downs during the course of the last 30 days. As shown in the above chart, there are multiple trenches and peaks within the period. STAG Industrial stock price dropped down to $31.55 on 26th Feb 2021 and rose up to $34.40 on 15th March 2021.

The company’s stock price has undergone various ups and downs during the course of the last 30 days. As shown in the above chart, there are multiple trenches and peaks within the period. STAG Industrial stock price dropped down to $31.55 on 26th Feb 2021 and rose up to $34.40 on 15th March 2021.

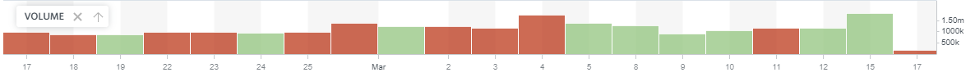

The volume chart for the last 30 days is as below:

The trading volume of STAG has been high and consistent during the past 30 days. It reached 1.74 million shares on 4th March 2021.

The trading volume of STAG has been high and consistent during the past 30 days. It reached 1.74 million shares on 4th March 2021.

As an investor, you need to stay put and wait a while before you can benefit from your investment. Investing in value stocks is a long-term investment.

Read more:

4. Shaw Communications (SJR)

Shaw Communications Inc. is a leading Canadian connectivity company. It serves consumers and businesses with broadband Internet, data, WiFi, digital phone, and video services

Shaw Communications has a market capitalization of $9.7 Billion. The Average Traded Volume for the last 10 days is 3 Million shares. The 5Y Monthly Beta is 0.44. The stock closed at $28.03 on 17th March 2021.

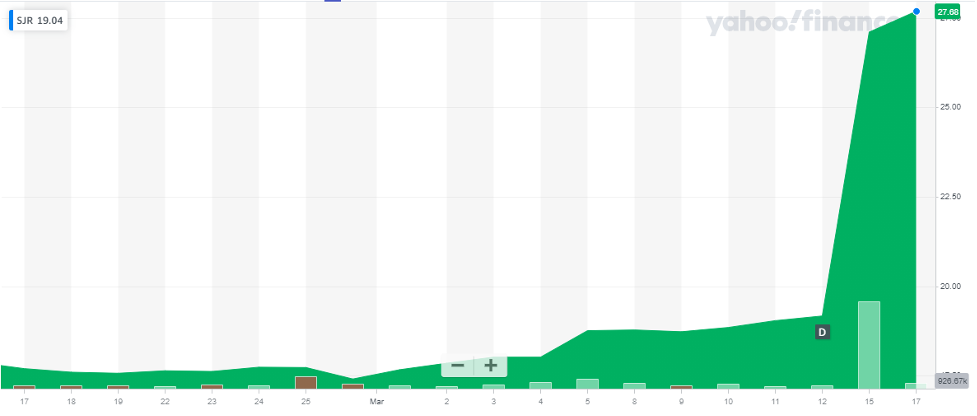

The company’s stock performance for the last 30 days is as below:

The stock of Shaw Communications has been on an upward trend during this week. It reached $27.68 on 17th March 2021. There has been a sharp rise in the price of Shaw Communications stock in the previous week. There has been a 44% increase in price in the last 7 days. During the course of the last 30 days, the minimum the stock price has dropped to is $17.41

The stock of Shaw Communications has been on an upward trend during this week. It reached $27.68 on 17th March 2021. There has been a sharp rise in the price of Shaw Communications stock in the previous week. There has been a 44% increase in price in the last 7 days. During the course of the last 30 days, the minimum the stock price has dropped to is $17.41

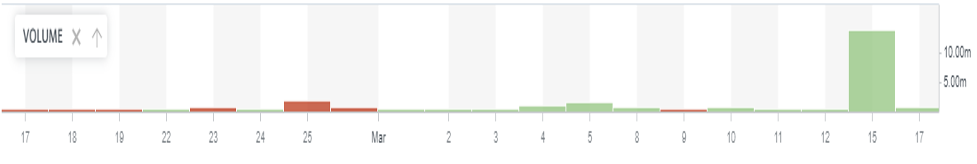

The volume chart for the last 30 days is as below:

The trading frequency has also been high and moved with the price volatility. There was an astonishing amount of trade of Shaw Communications stock on 15th March 2021. Approximately 14 million shares were traded on that day.

The trading frequency has also been high and moved with the price volatility. There was an astonishing amount of trade of Shaw Communications stock on 15th March 2021. Approximately 14 million shares were traded on that day.

5. LTC Properties (LTC)

LTC Properties Inc. is a real estate investment trust which has a diversified portfolio of well-structured leases and mortgages.

The market capitalization of LTC Properties is approximately $1.73 Billion. The Average Traded Volume for the last 10 days is 240,000 shares. The 5Y Monthly Beta is 0.95 making LTC Properties a moderately high volatile stock. The stock closed at $43.98 on 17th March 2021.

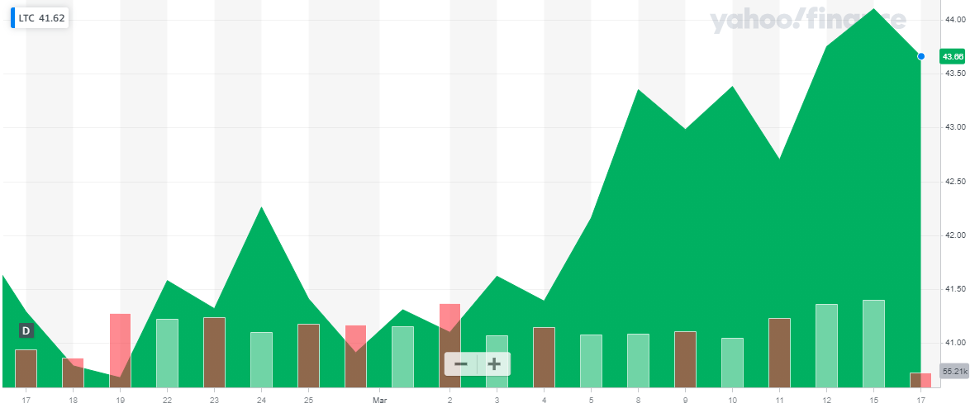

The company’s stock performance for the last 30 days is as below:

The stock of LTC has been pretty volatile in the last 30 days. As per the chart above, there are multiple downward and upward trends. The stock dropped down to $40.68 on 19th Feb 2021 and rose to $44.1 on 15th March 2021.

The volume chart for the last 30 days is as below:

The volume of trade has been consistent in the last 30 days. The highest traded volume traded in the last 30 days was 326,000 on 15th March 2021.

The volume of trade has been consistent in the last 30 days. The highest traded volume traded in the last 30 days was 326,000 on 15th March 2021.

Read more:

6. Gladstone Investment Corporation (GLAD)

Gladstone Investment Corporation is a real estate investment trust focused on acquiring, owning, and operating net leased industrial and office properties across the United States.

The market capitalization of Gladstone Investment Corporation is approximately $327 Million. The Average Traded Volume for the last 10 days is 228,666 shares. The 5Y Monthly Beta is 1.45 making Gladstone an extremely high volatile stock. The stock closed at $10.08 on 17th March 2021.

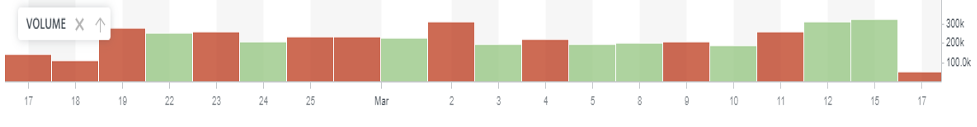

The company’s stock performance for the last 30 days is as below:

The stock of Gladstone has been highly volatile on the market. As per the chart, you can observe a sharp drop and sharp increase in prices. There has been no consistent price trend. The price has been moving upward and downward in the last 30 days. The stock dropped down to $9.66 on 25th Feb 2021 and rose to $10.35 on 15th March 2021

The stock of Gladstone has been highly volatile on the market. As per the chart, you can observe a sharp drop and sharp increase in prices. There has been no consistent price trend. The price has been moving upward and downward in the last 30 days. The stock dropped down to $9.66 on 25th Feb 2021 and rose to $10.35 on 15th March 2021

The volume chart for the last 30 days is as below:

The trading frequency of Gladstone has been consistent in the last 30 days. The highest traded volume in the past 30 days was 334,200 shares on 15th March 2021.

The trading frequency of Gladstone has been consistent in the last 30 days. The highest traded volume in the past 30 days was 334,200 shares on 15th March 2021.

7. Urban One (UONE)

Urban One Inc., together with its subsidiaries, operates as an urban-oriented multi-media company in the United States. The company operates through four segments: Radio Broadcasting, Cable Television, Reach Media, and Digital. The company majorly targets African-American and urban through its media channels.

The market capitalization of Urban One is approximately $127 Million. The Average Traded Volume for the last 10 days is 457,580 shares. The 5Y Monthly Beta is 1.02 making Gladstone a moderately high volatile stock. The stock closed at $5.95 on 17th March 2021.

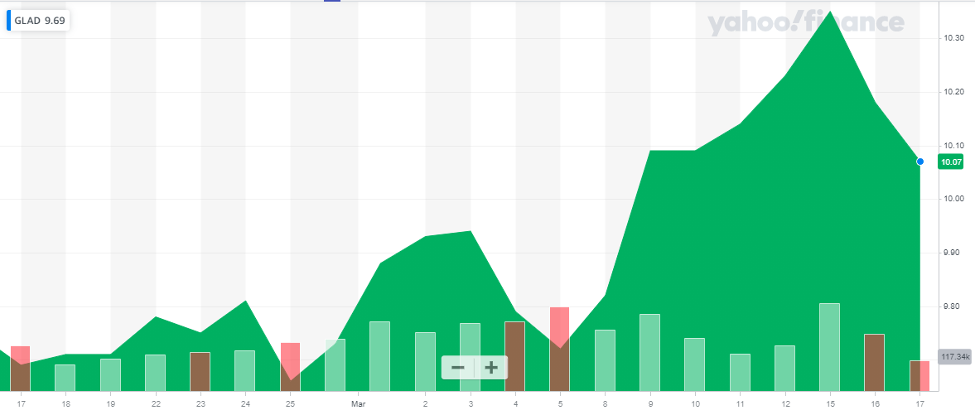

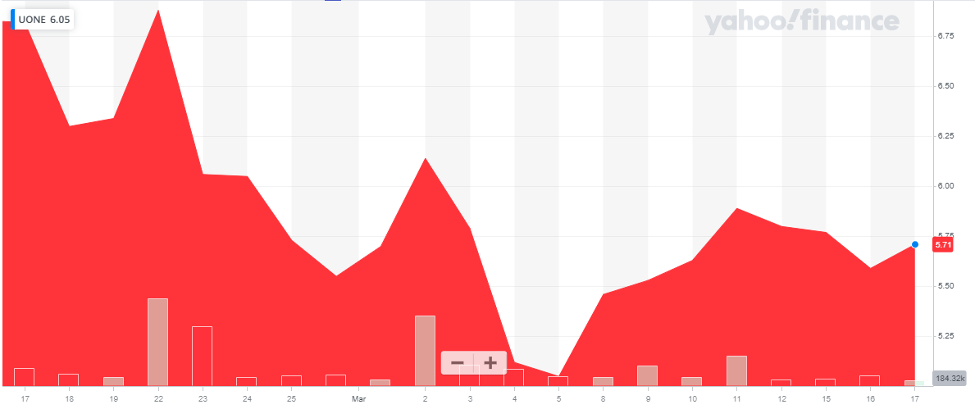

The company’s stock performance for the last 30 days is as below:

The stock of Urban One has been very volatile on the market. As per the chart, you can observe multiple upward and downward movements in the price of the stock. There has been no consistent price trend in the last 30 days.

The stock of Urban One has been very volatile on the market. As per the chart, you can observe multiple upward and downward movements in the price of the stock. There has been no consistent price trend in the last 30 days.

The volume chart for the last 30 days is as below:

The traded volume of Urban One stock has been high. The traded volume rose to 3.13 million on 22nd Feb 2021, a record 900% increase in trading frequency from the previous day. Get to know about buying the dips at the blue box area

The traded volume of Urban One stock has been high. The traded volume rose to 3.13 million on 22nd Feb 2021, a record 900% increase in trading frequency from the previous day. Get to know about buying the dips at the blue box area

8. Alterity Therapeutics (ATHE)

Alterity Therapeutics Limited is a biotech company that researches and develops therapeutic drugs for the treatment of Parkinsonian’s disease and other neurodegenerative diseases in Australia. The company’s lead drug candidate is ATH434 is used for the treatment of Parkinson’s disease. The company is in the process of developing PBT2 which will be used as an antimicrobial agent.

The market capitalization of Alterity Therapeutics is approximately $57 Million. The Average Traded Volume for the last 10 days is 550,000 shares. The 5Y Monthly Beta is 0.89 making Alterity Therapeutics a moderately high volatile stock. The stock closed at $ 1.63 on 17th March 2021.

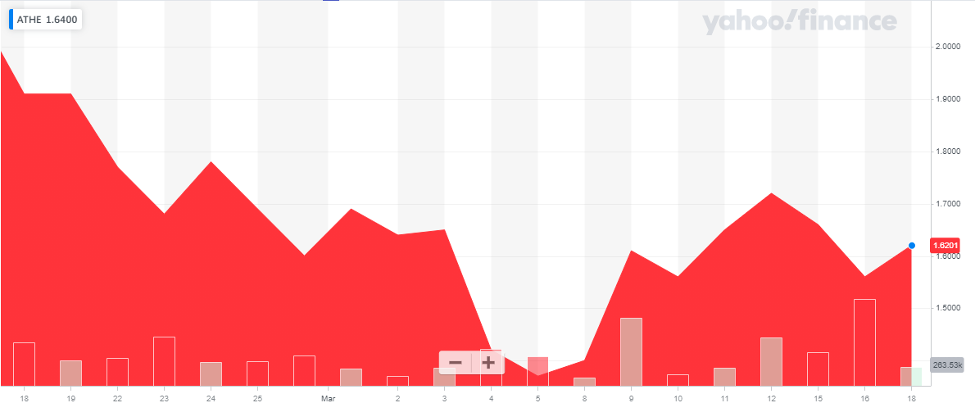

The company’s stock performance for the last 30 days is as below:

The stock of Alterity Therapeutics has been very volatile on the market. As per the chart, you can observe multiple trenches and peaks. There has been no consistent price trend in the last 30 days, the stock has been moving upward and downward. The stock price was at $1.91 on 19th Feb 2021 and dropped to $1.37 on 5th March 2021.

The stock of Alterity Therapeutics has been very volatile on the market. As per the chart, you can observe multiple trenches and peaks. There has been no consistent price trend in the last 30 days, the stock has been moving upward and downward. The stock price was at $1.91 on 19th Feb 2021 and dropped to $1.37 on 5th March 2021.

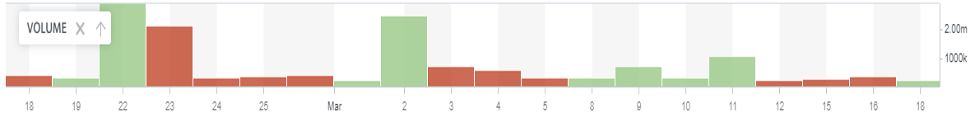

The volume chart for the last 30 days is as below:

The traded volume of Alterity Therapeutics stock has been high in the last 30 days. The traded volume rose to 1.2 million on 16th March 2021.

The traded volume of Alterity Therapeutics stock has been high in the last 30 days. The traded volume rose to 1.2 million on 16th March 2021.

Also check out our list of best penny stocks to invest in.

9. Simon Property Group (SPG)

Simon is a global leader in the ownership of premier shopping, dining, entertainment, and mixed-use destinations. It is also one of the largest real estate investment trusts.

The market capitalization of Simon Property Group is approximately $39 Billion. The Average Traded Volume for the last 10 days is 3.49 Million shares. The 5Y Monthly Beta is 1.56 making Simon Property Group an extremely high volatile stock. The stock closed at $118.24 on 17th March 2021.

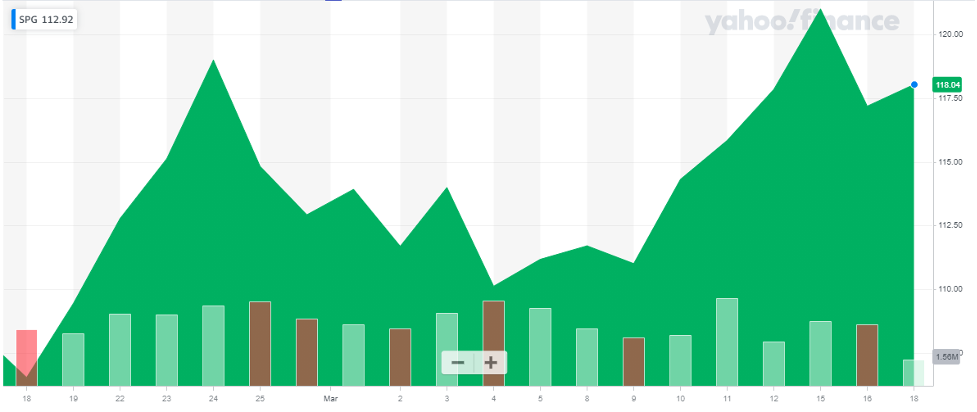

The company’s stock performance for the last 30 days is as below:

The stock of Simon Property Group has been pretty volatile on the market with price moving in multiple directions. As per the chart, you can observe the stock has been moving upward and downward both in the last 30 days. The stock price was at $110.11 on 4th March 2021 and dropped to $121 on 15th March 2021.

The stock of Simon Property Group has been pretty volatile on the market with price moving in multiple directions. As per the chart, you can observe the stock has been moving upward and downward both in the last 30 days. The stock price was at $110.11 on 4th March 2021 and dropped to $121 on 15th March 2021.

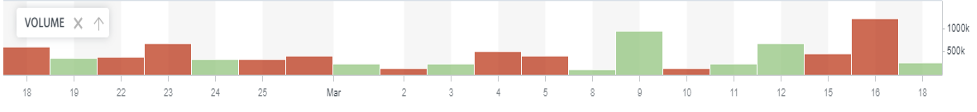

The volume chart for the last 30 days is as below:

The traded volume of Simon Property Group stock has been consistently high in the last 30 days. The traded volume rose to 5 million on 4th March 2021.

The traded volume of Simon Property Group stock has been consistently high in the last 30 days. The traded volume rose to 5 million on 4th March 2021.

10. Carver Bancorp Inc. (CARV)

Carver Bancorp Inc. is the holding company for Carver Federal Savings Bank, a federally chartered savings bank offering consumer and business banking products and services. Carver provides mortgage loans to families to purchase properties, loans; it also provides mortgage loans for construction or renovation of commercial property and residential housing development and provides a loan to the business and non-profit organizations.

The market capitalization of Carver Bancorp is approximately $37 Million. The Average Traded Volume for the last 10 days is 412,660 shares. The 5Y Monthly Beta is 1.41 making Alterity Therapeutics an extremely high volatile stock. The stock closed at $11.19 on 17th March 2021.

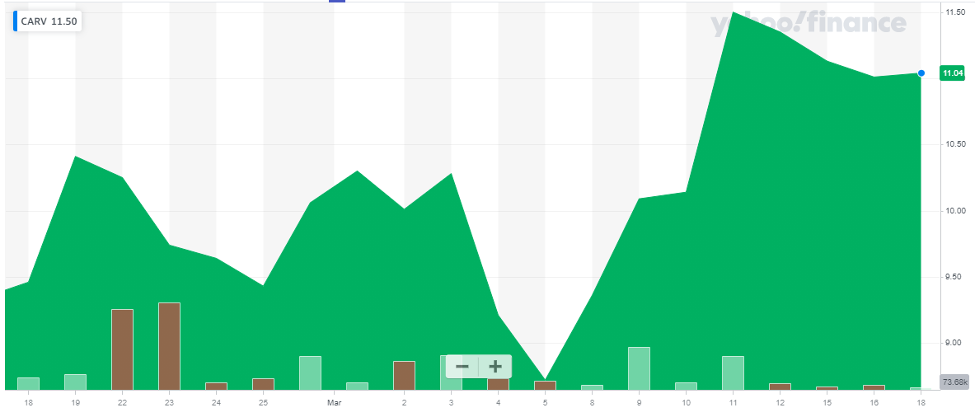

The company’s stock performance for the last 30 days is as below:

The stock of Carver Bancorp has been very volatile on the market. As per the chart, you can observe multiple sharp changes in price movements in the last 30 days. The stock price dropped to $8.72 on 5th March 2021 and rose to $11.5 on 11th March 2021.

The stock of Carver Bancorp has been very volatile on the market. As per the chart, you can observe multiple sharp changes in price movements in the last 30 days. The stock price dropped to $8.72 on 5th March 2021 and rose to $11.5 on 11th March 2021.

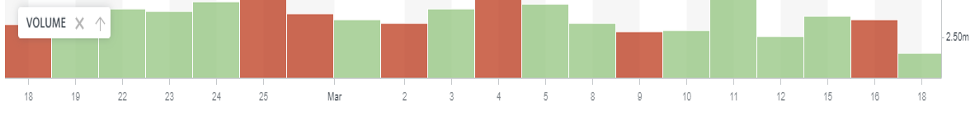

The volume chart for the last 30 days is as below:

The traded volume of Carver Bancorp Inc stock has been high in the last 30 days. The traded volume rose to 2.4 million on 23rd Feb 2021.

The traded volume of Carver Bancorp Inc stock has been high in the last 30 days. The traded volume rose to 2.4 million on 23rd Feb 2021.

11. Advanced Micro Devices, Inc.

Advanced Micro Devices develops high-performance computing and visualization products to solve some of the world’s toughest and most interesting challenges. It operates as a semiconductor company worldwide. The company operates in two segments, Computing and Graphics; and Enterprise, Embedded, and Semi-Custom.

In its third-quarter report for the year, the company reported a Net Income of $4.3 billion, representing a 54% year-on-year increase. Net Income was recorded at $923, reflecting a 137% year-on-year increase.

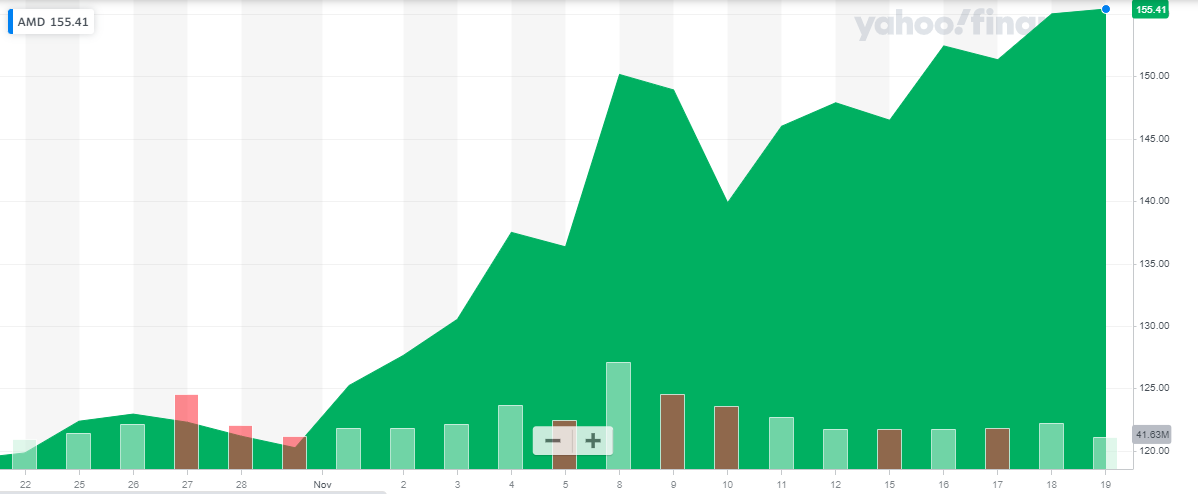

Advanced Micro Devices has a market capitalization of over $187 billion. The average traded volume for the past 10 days is $70.51 million. The 5Y monthly beta of AMD is 2.01. The share of AMD is currently trading at $155.41. The below graph shows the stock performance of AMD for the past 30 days.

In the past 30 days, the stock price of AMD has risen from $119 to $155, reflecting a 30% appreciation. Throughout the month the stock has experienced multiple hikes and drops in price.

In the past 30 days, the stock price of AMD has risen from $119 to $155, reflecting a 30% appreciation. Throughout the month the stock has experienced multiple hikes and drops in price.

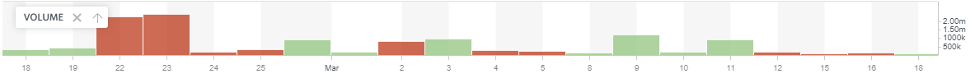

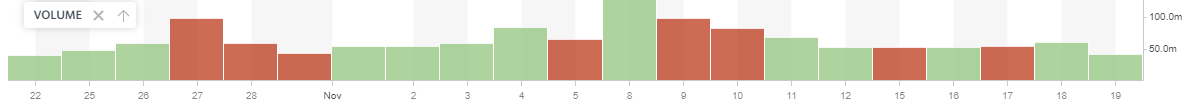

Trading volume also has experienced volatility. A few days traded volume peaked at 98 million while other days it has been below 50 million shares per day.

Trading volume also has experienced volatility. A few days traded volume peaked at 98 million while other days it has been below 50 million shares per day.

12. Affirm Holdings, Inc.

Affirm is a financial technology services company that offers installment loans to consumers at the point of sale. It aims to revolutionize the banking industry to be more accountable and accessible to consumers. Unlike payment options that have compounding interest and unexpected costs, Affirm Holdings shows customers upfront exactly what they’ll pay each month — with no hidden fees and no surprises.

In its recent quarterly report, the company reported an increase of 55% in revenue, totaling $269 million. Active consumers grew by a whopping 124%. Total consumers are around 8.7 billion by the end of the quarter

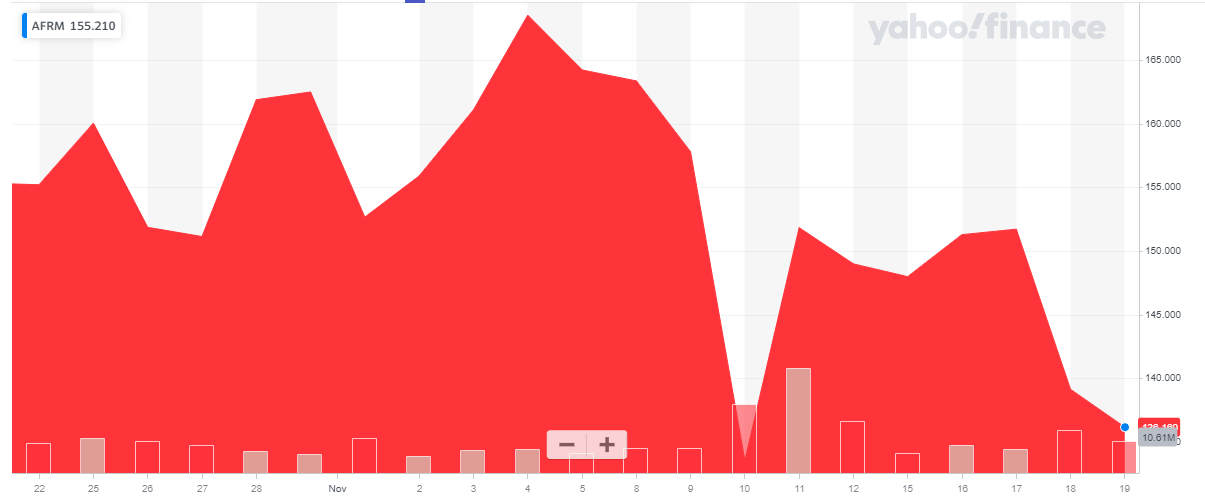

Affirm Holdings has a market capitalization of $38.3 billion. The average traded volume for the past 10 days is 13.93 million. The share of AFRM is currently trading at a price of $136.

In the past 30 days, the stock of AFRM has been very volatile. It saw a huge dip from $157 to $133 in a single day. At the start of the month, the stock of Affirm Holdings was trading at around $160. And with a reduction of approx. 15% in a month.

In the past 30 days, the stock of AFRM has been very volatile. It saw a huge dip from $157 to $133 in a single day. At the start of the month, the stock of Affirm Holdings was trading at around $160. And with a reduction of approx. 15% in a month.

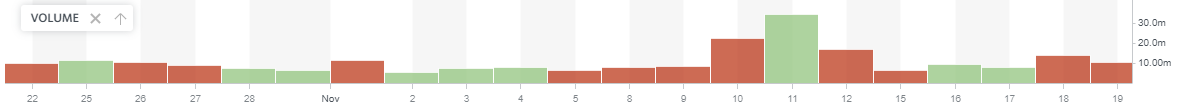

Traded Volume has been extremely volatile. On one day the traded volume peaked at around 30 million shares in a day, while on the remaining days, the traded volume remained under 10 million shares.

Traded Volume has been extremely volatile. On one day the traded volume peaked at around 30 million shares in a day, while on the remaining days, the traded volume remained under 10 million shares.

13. Connect Biopharma Holdings Limited

Connect Biopharma Holdings Limited is a global clinical-stage biopharmaceutical company dedicated to improving the lives of patients living with chronic inflammatory diseases through the development of therapies derived from our T cell-driven research. Their most popular drug CBP-201 is designed to treat several inflammatory diseases such as atopic dermatitis and asthma.

During its IPO the company raised a total of $204 million. The biopharma company has products in its trial stage therefore a lot of expense is going towards research and development and high-professional fees. Hence the company is unable to generate profits. The company’s high expenses have raised net loss for the recent quarter

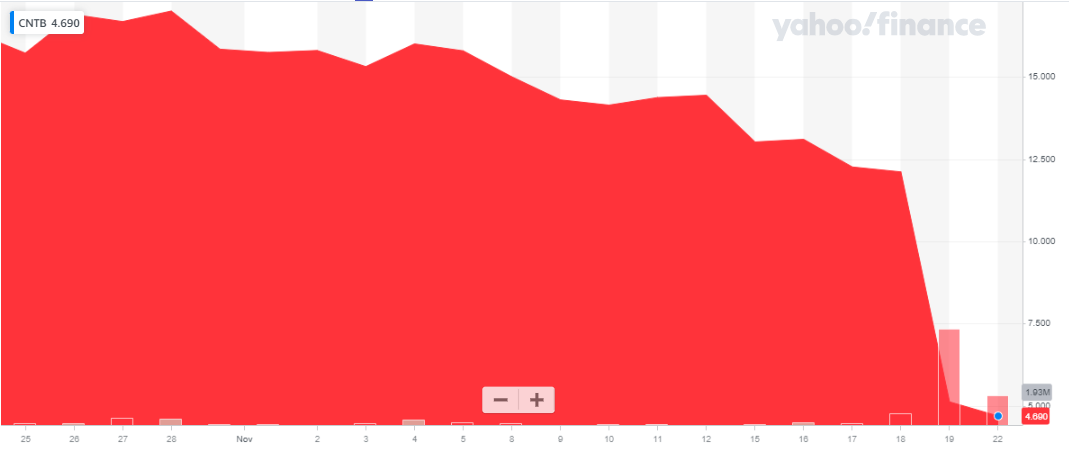

The company has recently gone public and its shares are currently trading at a price of $4.69. It has a market capitalization of $270 million. The average 10-Day traded volume is 754,500.

The share price has been extremely volatile and is on a downward trend since the start of the month. The share price started at a price of $15.72 and has decreased by almost 70% during 30 days.

The share price has been extremely volatile and is on a downward trend since the start of the month. The share price started at a price of $15.72 and has decreased by almost 70% during 30 days.

Since the company has recently gone public, the traded volume of Connect Biopharma shares has been low. During the last 3 trading days, the traded volume spiked up to 5 million shares within a day

Since the company has recently gone public, the traded volume of Connect Biopharma shares has been low. During the last 3 trading days, the traded volume spiked up to 5 million shares within a day

14. Reto Eco Solutions Inc.

ReTo Eco-Solutions is a manufacturer and distributor of eco-friendly construction materials, made from mining waste and fly-ash, as well as equipment used for the production of these eco-friendly construction materials.

ReTo Eco solutions have a market cap of $29 million and its share is currently trading at $1.07. The stock has a 5Y Monthly beta of 1.68 and the average 10 days traded volume is 6.43 million.

The stock of ReTo Eco Solutions has shown extreme volatility in the past month. During the last 30 days, the stock reached a peak of $3.05 and the lowest of $0.87. Within the last 30 days, the stock appreciated by more than 200% and then declined by 65%.

The stock of ReTo Eco Solutions has shown extreme volatility in the past month. During the last 30 days, the stock reached a peak of $3.05 and the lowest of $0.87. Within the last 30 days, the stock appreciated by more than 200% and then declined by 65%.

The traded volume over the past month has been pretty volatile. With some days the traded volume crossed 8 million shares within a day. And other days the traded volume was less than 1 million shares.

The traded volume over the past month has been pretty volatile. With some days the traded volume crossed 8 million shares within a day. And other days the traded volume was less than 1 million shares.

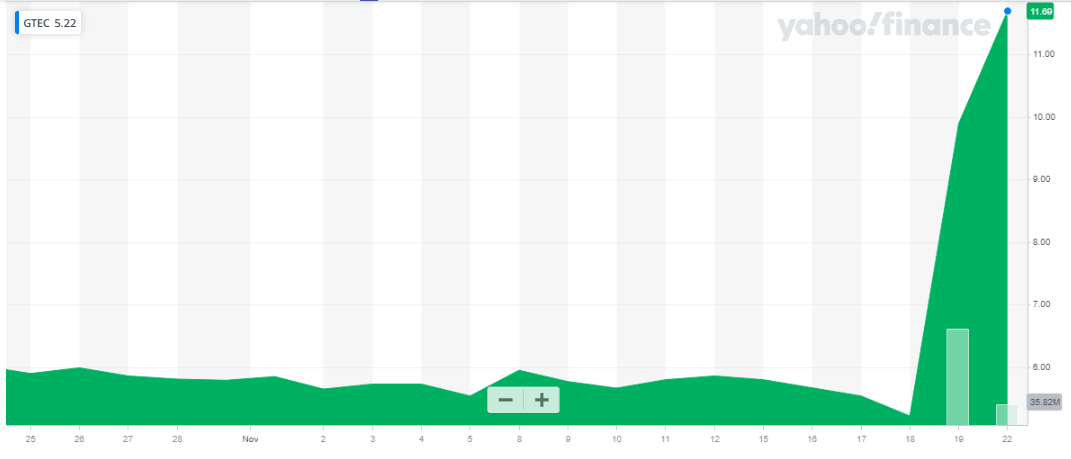

15. Greenland Technologies Holdings Corporation

Greenland Technologies Holdings Corporation is a leading developer and manufacturer of electric industrial vehicles and power systems for material handling equipment. Established in 2006, Greenland Technologies is a leading transmission and drivetrain systems provider for material handling equipment such as forklift trucks for industrial and logistic applications.

In its third-quarter report, the company reported revenue of $23.1 million, up by 39.7% year over year. Net income for the quarter was reported at $1.3 million, a 172.5% increase year on year.

Greenland Technologies Holdings has a market capitalization of $133 million. Its share is currently trading at $11.69. The stock has a 5Y monthly beta of 2.77. An average 10 days traded volume is 16.52 million.

The stock of Greenland has seen extreme jumps in price over the past 30 days. The stock price more than doubled in the last 2 trading days. At the start of the last 30 days, the stock was trading at $5.9 and is currently trading at $11.69.

The stock of Greenland has seen extreme jumps in price over the past 30 days. The stock price more than doubled in the last 2 trading days. At the start of the last 30 days, the stock was trading at $5.9 and is currently trading at $11.69.

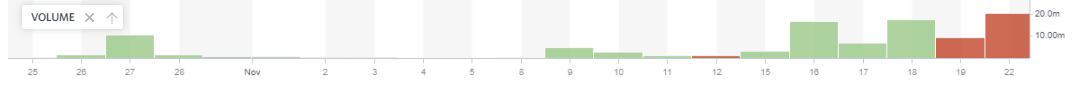

The traded volume has also seen extreme levels in the past 30 days. The traded volume rose beyond 100 million shares in one day. While other days the traded volume was less than 1 million shares.

The traded volume has also seen extreme levels in the past 30 days. The traded volume rose beyond 100 million shares in one day. While other days the traded volume was less than 1 million shares.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

Back