Large-cap stocks are typically mature companies with moderate to high growth prospects. Investors seeking high growth potential may prefer to invest in smaller companies at the lower end of the market cap range.

| CATEGORY | MARKET CAPITALIZATION |

| Micro-cap companies | Less than $300 million |

| Small-cap companies | $300 million to $2 billion |

| Mid-cap companies | $2 billion to $10 billion |

| Large-cap companies | $10 billion to $200 billion |

| Mega-cap companies | More than $200 billion |

List of Best Large Cap Stocks

Below is a list of the top 10 large-cap stocks worth investing in 2024:

| Sr. # | Company Name | Symbol | Price (As of 7th March 2023) | Market Cap |

| 1 | Starbucks | SBUX | $ 103.34 | $ 117 billion |

| 2 | MercadoLibre, Latin | MELI | $ 1,264.91 | $ 62.12 billion |

| 3 | Walmart | WMT | $ 139.25 | $ 371.9 billion |

| 4 | Altria Group Inc | MO | $ 46.8 | $ 83.56 billion |

| 5 | JPMorgan Chase & Co | JPM | $ 138.62 | $ 406 billion |

| 6 | Consolidated Edison, Inc | ED | $ 90.66 | $ 32.55 billion |

| 7 | AT&T Inc | T | $ 18.71 | $ 132.7 billion |

| 8 | Cardinal Health | CAH | $ 72.65 | $ 18.72 billion |

| 9 | Tesla Inc. | TSLA | $ 187.71 | $ 575.9 billion |

| 10 | Align Technology | ALGN | $ 332.26 | $ 25.455 billion |

Starbucks (SBUX)

Starbucks (SBUX)

Starbucks is a good example of a large-cap stock which excellent growth potential. The company has many growth opportunities in the growing economy of China. The company has considerable competitive advantages, including its well-known brand, popular rewards programs, and tech initiatives such as Mobile Order & Pay.

The company has gotten through difficult times before and came out strong. Today, Starbucks has more than 36,000 stores worldwide and is the premier roaster and retailer of specialty coffee in the world.

In the recent quarterly report, the company reported:

- Revenues were reported at $ 8.7 billion, as compared to $ 8.05 billion in the previous year’s same period

- Operating Income was reported at $ 1.253 billion, as compared to $ 1.18 billion in the previous year’s same period

- Net Income was reported at $ 855 million, as compared to $ 816 million in the previous year’s same period

- Earnings per share were reported at $ 0.74, as compared to $ 0.69 in the previous year’s same period

Starbucks has a market cap of $ 117 billion. Its shares are trading at $ 103.34.

The stock started the year 2022 at $ 116.97. During the year the stock dropped to the low of $ 71.87 before closing off at $ 99.2. Overall, the stock declined by 15 %.

In 2023, the stock continued to rise. To date, the stock has appreciated by 2.6 %.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

MercadoLibre (MELI)

MercadoLibre, Latin America’s largest e-commerce site business, is a great example of a large-cap company that is growing quickly. It serves as an integrated regional platform and as a provider of the necessary digital and technology-based tools that allow businesses and individuals to trade products and services in the region. The Company enables commerce through its marketplace platform which allows users to buy and sell in most of Latin America.

MercadoLibre has a number of similarities to Amazon with its leading e-commerce business and shipping network in MercadoEnvios, but it also has unique solutions for Latin America, including providing point-of-sales machines for brick-and-mortar merchants.

The company recently reported its financial results for the year:

- Total Revenues were reported at $ 10.5 billion, as compared to $ 7.1 billion in the previous year

- Income from operations was reported at $ 1.034 billion, as compared to $ 441 million in the previous year

- Net Income was reported at $ 482 million, as compared to $ 83 million in the previous year

- Earnings per share were reported at $ 9.57, as compared to $ 1.67 in the previous year

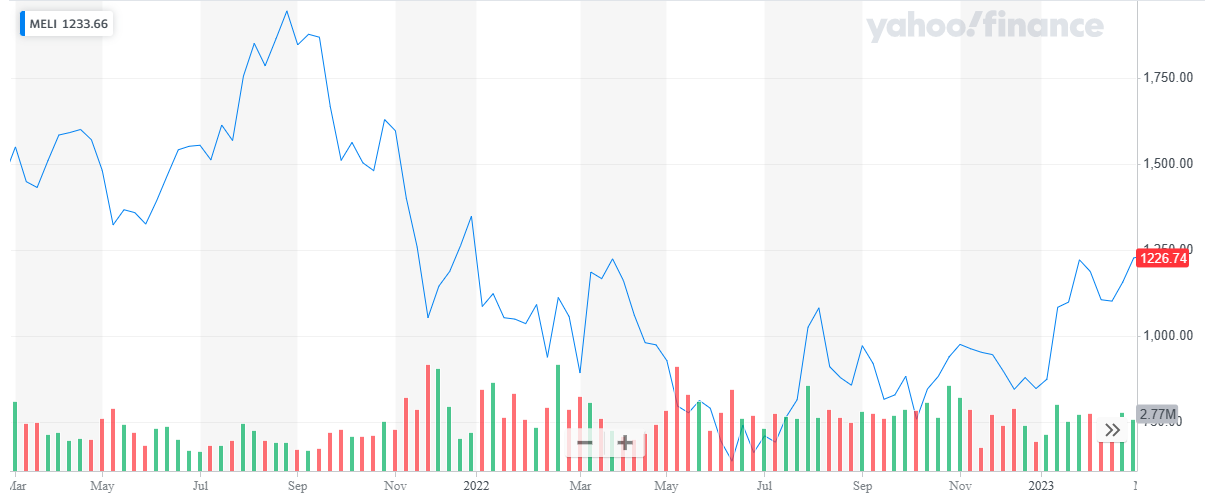

MercadoLibre has a market cap of $ 62.12 billion. Its shares are trading at $ 1,264.91.

The stock started the year 2022 at $ 1,384. During the year the stock dropped to the low of $ 635.22 and soon recovered. The stock closed the year at $ 846.22 representing a 39 % decline during the year.

In 2023, the stock continued to rise. To date, it has appreciated by 45 % till date.

Read: ETFs vs Index funds, where should you invest?

Read: ETFs vs Index funds, where should you invest?

Walmart (WMT)

Walmart is the world’s biggest retailer, as well as the world’s largest company by revenue. Walmart is becoming more than just a retailer. The company is leveraging its physical footprint to enter industries such as healthcare by adding health clinics. It also launched a fintech startup in early 2021. The company has built a formidable e-commerce business that ranks second in the U.S. behind Amazon, giving it a valuable stake in a rapidly growing market. With the company evolving, Walmart could be a much different organization in five or 10 years.

Each week, approximately 230 million customers and members visit more than 10,500 stores and numerous eCommerce websites under 46 banners in 24 countries. With the fiscal year 2022 revenue of $573 billion, Walmart employs approximately 2.3 million associates worldwide.

In the recent third-quarter report, the company reported:

- Revenue was reported at $ 152.8 billion, as compared to $ 140.2 billion in the previous year’s same period

- Operating income was reported at $ 2.7 billion, as compared to $ 5.8 billion in the previous year’s same period

- Net loss was reported at $ 1.8 billion, as compared to $ 3.1 billion in the previous year’s same period

- Loss per share was reported at $ 0.66 as compared to $ 1.11 per share in the previous year’s same period

Walmart has a market cap of $ 371.9 billion. Its shares are trading at $ 139.25. The share started the year 2022 at $ 144.69, went as high as $ 157.41, and closed the year at $ 141.79.

In 2023, the stock has depreciated by 3 % to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Altria Group Inc. (MO)

Altria Group has a leading portfolio of tobacco products for U.S. tobacco.

Their wholly owned subsidiaries include leading manufacturers of both combustible and smoke-free products. In combustibles, it owns Philip Morris USA Inc. (PM USA), the most profitable U.S. cigarette manufacturer, and John Middleton Co. (Middleton), a leading U.S. cigar manufacturer. The company’s smoke-free portfolio includes ownership of U.S. Smokeless Tobacco Company LLC (USSTC), the leading global moist smokeless tobacco (MST) manufacturer, and Helix Innovations LLC (Helix), a leading manufacturer of oral nicotine pouches.

The company’s brand portfolios of tobacco operating companies include Marlboro®, Black & Mild®, Copenhagen®, Skoal®, and on! ®.

The company recently reported its financial results for the year:

- Net revenues were reported at $ 25.1 billion, as compared to $ 26 billion in the previous year

- Operating income was reported at $ 11.9 billion, as compared to $ 11.56 billion in the previous year

- Net Income was reported at $ 5.8 billion, as compared to $ 2.5 billion in the previous year

- Earnings per share were reported at $ 3.19, as compared to $ 1.34 billion in the previous year

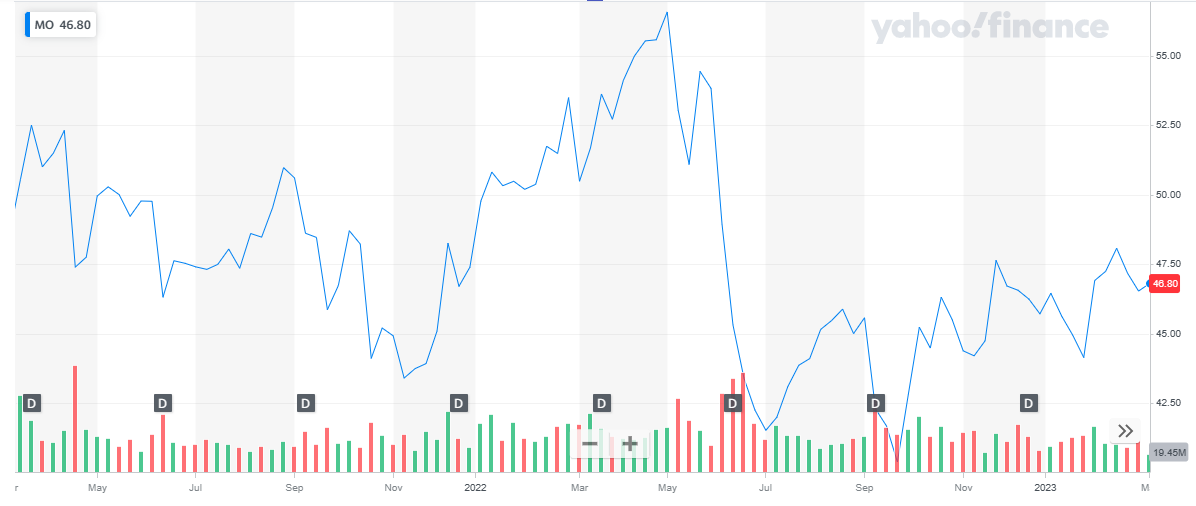

Altria Group has a market cap of $ 83.56 billion. Its shares are trading at $ 46.55.

The stock started the year 2022 at $ 47.39. It rose to $ 56.57 before closing the year at $ 45.71. Overall, the stock declined by 3.5 %.

In 2023, the stock appreciated by 2.4 %.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

JPMorgan Chase & Co. (JPM)

JPMorgan Chase & Co. is a leading financial services firm based in the United States of America, with operations worldwide. JPMorgan Chase had $3.7 trillion in assets and $292.3 billion in stockholders’ equity as of December 31, 2022. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers predominantly in the U.S., and many of the world’s most prominent corporate, institutional, and government clients globally.

In the recent fourth-quarter report, the company reported:

- Net Income of $ 11 billion, as compared to $ 10.4 billion in the previous year’s same period

- Earnings per share were reported at $ 3.57, as compared to $ 3.33 in the previous year’s same period

- ROCE was reported at $ 16 %, as compared to 16 % in the previous year’s same period. The financial company reported the same ROCE in both the above-mentioned periods

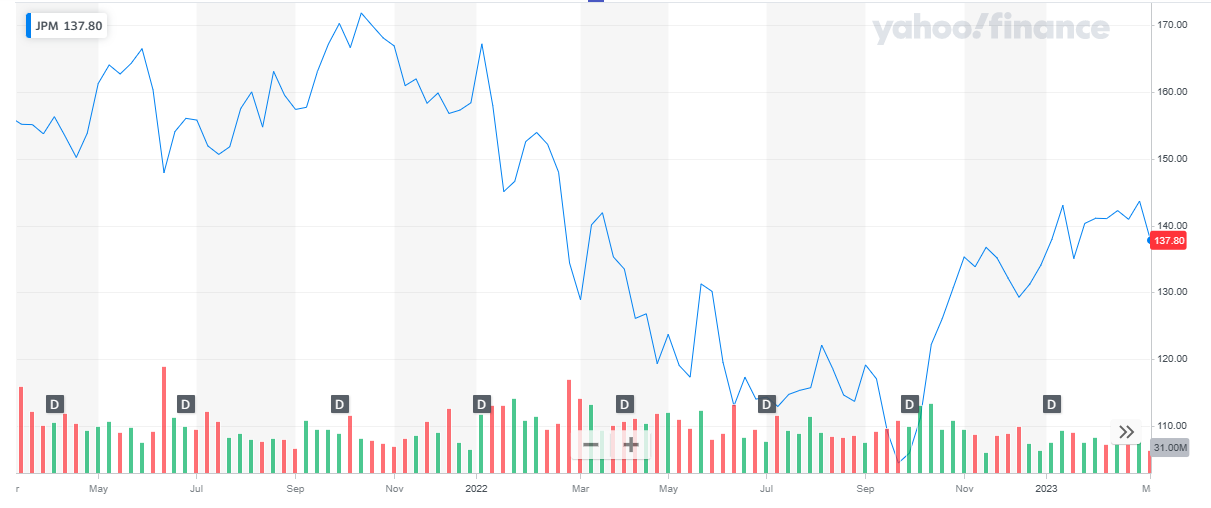

JPMorgan Chase and Co have a market cap of $ 406 billion. Its shares are trading at $ 138.62.

The stock started the year 2022 at $ 158.35. The stock continued to decline till it reached the low of $ 104.5. From here the stock reversed its course and closed the year at $ 134.1, representing a 15 % decline during the year.

In 2023, the stock continued to rise. It last closed at $ 138.62, representing a 3.4 % decline to date.

Consolidated Edison Inc. (ED)

Consolidated Edison Inc. (ED)

Consolidated Edison, Inc. is one of the nation’s largest investor-owned energy-delivery companies, with approximately $16 billion in annual revenues and $69 billion in assets.

The company provides a wide range of energy-related products and services to its customers through the following subsidiaries:

- Consolidated Edison Company of New York, Inc. (CECONY), a regulated utility providing electric service in New York City and New York’s Westchester County, gas service in Manhattan, the Bronx, parts of Queens, and parts of Westchester, and steam service in Manhattan;

- Orange and Rockland Utilities, Inc. (O&R), a regulated utility serving customers in a 1,300-square-mile area in southeastern New York State and northern New Jersey;

- Con Edison Clean Energy Businesses, Inc., which was classified as held for sale as of year-end 2022;

- Con Edison Transmission, Inc., which falls primarily under the oversight of the Federal Energy Regulatory Commission

Through its subsidiaries, it invests in electric transmission projects supporting its parent company’s effort to transition to clean, renewable energy.

Consolidated Edison Transmission manages, through joint ventures, both electric and gas assets while seeking to develop electric transmission projects that will bring clean, renewable electricity to customers, focusing on New York, New England, the Mid-Atlantic states, and the Midwest.

The company recently reported a full-year financial report:

- Total Revenues were reported at $ 15.67 billion, as compared to $ 13.67 billion in the previous year

- Operating income was reported at $ 2.6 billion, as compared to $ 2.8 billion in the previous year

- Net Income was reported at $ 1.6 billion, as compared to $ 1.346 billion in the previous year

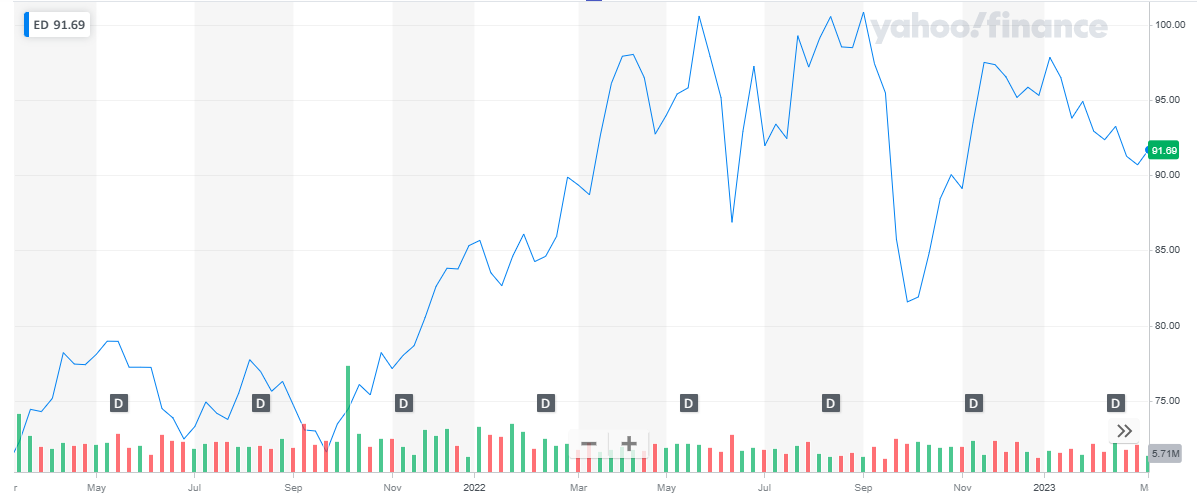

Consolidated Edison Inc has a market cap of $ 32.55 billion. Its shares are trading at $ 90.66.

The stock picked up a bullish trend in 2021 which continued till 2022. It started the year 2022 at $ 85.32 and went as high as $ 100.85. After hitting the peak, the stock suffered a huge blow and dropped to $ 81.58 and eventually closed off the year at $ 95.31. Overall, the stock appreciated by 11.7 % during the year.

In 2023, the stock has declined by 3.8 % to date.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

AT&T Inc. (T)

AT&T Inc (AT&T) is a provider of telecommunications, media, and technology services. The company offers wireless communications, data/broadband and internet services, local and long-distance telephone services, telecommunications equipment, managed networking, and wholesale services. AT&T also develops, produces, and distributes feature films, television, gaming, and content in physical and digital formats. It also provides advertisement and entertainment services to household customers. The company serves individual customers and business enterprises. It markets services under AT&T, Cricket, SKY, AT&T TV, AT&T PREPAID, AT&T Fiber, and Unefon brand names.

The company recently reported a full-year financial report:

- Total Revenues were reported at $ 120.7 billion, as compared to $ 134 billion in the previous year

- Operating loss was reported at $ 4.6 billion, as compared to operating income of $ 25.9 billion in the previous year

- Net Loss was reported at $ 8.7 billion, as compared to net income of $ 19.87 billion in the previous year

- Loss per share was reported at $ 1.13, as compared to earnings per share of $ 2.77 in the previous year

AT&T has a market cap of $ 132.7 billion. Its shares are trading at $ 18.71.

The stock started the year 2022 at $ 18.58. Throughout the year the stock remained a bit volatile till it dropped to the low of $ 14.99 in September 2022. From here the stock picked up the pace and closed the year at $ 18.41 representing a mere 1 % decline during the year.

In 2023, the stock has remained the same with a mere 1 % appreciation to date.

Cardinal Health Inc. (CAH)

Cardinal Health Inc. (CAH)

Cardinal Health is a healthcare services company specializing in the distribution of pharmaceuticals and medical products to more than 100,000 locations in the U.S. and abroad. Cardinal also specializes in the manufacture of medical and surgical products. During the coronavirus pandemic, the company collaborated with industry partners and the U.S. government to help provide essential workers with personal protective equipment such as gloves and masks. In recent years, the company has faced thousands of lawsuits over its alleged role in the nationwide opioid crisis. In 2019, Cardinal agreed to pay upwards of $5.63 billion in settlement claims in opioid-related lawsuits, as well as to provide free distribution of drugs used to treat overdoses.

In the recent quarterly report, the company reported:

- Revenue was reported at $ 51.5 billion, as compared to $ 45.5 billion in the previous year’s same period

- Operating loss was reported at $ 119 million, as compared to $ 950 million in the previous year’s same period

- Net Loss was reported at $ 130 million, as compared to net income of $ 49 million in the previous year’s same period

- Net loss per share was reported at $ 0.5, as compared to earnings per share of $ 0.17 in the previous year’s same period

Cardinal Health has a market cap of $ 18.72 billion. Its shares are trading at $ 72.65.

The stock started the year 2022 at $ 51.49. The stock picked up a bullish trend, went as high as $ 80.88, and closed the year at $ 72.65. Overall, the stock appreciated by 41 % in 2022.

In 2023, after remaining stable in the initial days, the stock dropped and last closed at $ 72.65 representing a 5.5 % decline to date.

Also, learn:

Also, learn:

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Tesla Inc. (TSLA)

Tesla Inc (Tesla) is an automotive and energy company. It designs, develops, manufactures, sells, and leases electric vehicles and energy generation and storage systems. The company produces and sells the Model Y, Model 3, Model X, Model S, Cybertruck, Tesla Semi, and Tesla Roadster vehicles. Tesla also installs and maintains energy systems and sells solar electricity; and offers end-to-end clean energy products, including generation, storage, and consumption. It markets and sells vehicles to consumers through a network of company-owned stores and galleries. The company has manufacturing facilities in the US, Germany, and China and has operations across the Asia Pacific and Europe.

The company recently reported its financials for the year 2022:

- Total Revenues were reported at $ 81.46 billion, as compared to $ 53.8 billion in the previous year, a 51 % year-on-year increase

- Net Income was reported at $ 12.6 billion, as compared to $ 5.5 billion, in the previous year, a 128 % year-on-year increase

- Earnings per share were reported at $ 3.62, as compared to $ 1.63 in the previous year, a 122 % year-on-year increase.

Tesla has a market cap of $ 575.9 billion. Its shares are trading at $ 187.71.

The stock of Tesla started a bearish trend in the last quarter of 2021. In 2022 it continued with the bearish streak. Starting from $ 352.26, at the start of the year, the stock closed at $ 123.18 representing a 65 % decline in 2022.

The stock kicked off in the year 2023 with a course change and started to rise. To date, the stock has appreciated by 47.8 %.

Align Technology (ALGN)

Align Technology (ALGN)

Align Technology is the leading manufacturer of clear aligners. Invisalign, its main product, was approved by the FDA in 1998 and it has since dominated the clear aligner space, controlling over 90 % of the market. Invisalign can treat roughly 90% of all malocclusion cases (misaligned teeth), and there are over 230,000 Invisalign-trained dentists and orthodontists. In 2022, Invisalign treated over 2 million cases or roughly 10 % of all orthodontic cases for the year, and it has treated over 14 million patients since its launch. Align also sells intraoral scanners under the brand iTero, which captures digital impressions of patients’ teeth and illustrates treatment plans. Over 85 % of Invisalign cases are submitted by digital scans and iTero scans makeup over half of these scans.

The company recently reported its financial results for the year 2022:

- Total revenues were reported at $ 3.73 billion, a 5.5 % decline from the previous year

- Earnings per share were reported at $ 4.61, as compared to a net loss per share of $ 5.08 in the previous year

Align Technology has a market cap of $ 25.455 billion. Its shares are trading at $ 332.26.

The stock started in the year 2022 at $ 657.18. The stock suffered a huge blow and continued to decline throughout the year. The stock closed the year at $ 210.9 representing a 68 % decline in stock price during the year.

In 2023, the stock reversed its course and started to rise. To date, it has appreciated by 58 %.

Also read:

Also read:

- Best uranium stocks

- Best commodity stocks

- Best AI stocks

- Best wheat stocks

- Best travel stocks

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks