Travel and tourism are very vast categories. It includes a huge list of well-known brands and companies.

The Travel & Tourism market in the world is projected to grow by 8.46 % (2022-2026) resulting in a market volume of $ 992.10 billion in 2026. Revenue in the Travel & Tourism market is projected to reach $ 716.80 billion in 2022. By using the stock signals, you can avoid hours of technical analysis to understand the market.

Top 10 Travel and Tourism Stocks

Here are the top 10 Travel and Tourism stocks to buy in 2024:

- Booking Holdings (NASDAQ: BKNG)

- Southwest Airlines (NYSE: LUV)

- Airbnb (NASDAQ: ABNB)

- Marriott International (NASDAQ: MAR)

- TRIPADVISOR (NASDAQ: TRIP)

- The Boeing Company (NYSE: BA)

- Royal Caribbean Group (RCL)

- The Walt Disney Company (NYSE: DIS)

- Expedia Group (EXPE)

- EasyJet (LSE: EZJ)

Booking Holdings (NASDAQ: BKNG)

Booking Holdings (NASDAQ: BKNG)

Booking Holdings, Inc. engages in the provision of online travel and related solutions. It is the world’s leading provider of online travel and related services and provides to consumers and local partners in more than 220 countries and territories.

The company offers services through the following brands: Booking.com, KAYAK, Priceline, Agoda, Rentalcars.com, and OpenTable. It provides accommodation reservations including hotels, hostels, apartments, vacation rentals, and other properties.

Check out: List of Most Volatile Stocks

The below chart shows the recent quarterly reports of Booking Holdings for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Revenue | $ 6.1 billion | $ 4.3 billion | $ 2.7 billion |

| Operating Income | $ 2.6 billion | $ 1 billion | $ 174 million |

| Net Income / Loss | $ 1.7 billion | $ 857 million | ($ 700) million |

Booking Holdings has a market cap of $ 75.5 billion. Its shares are trading at $ 1,946.

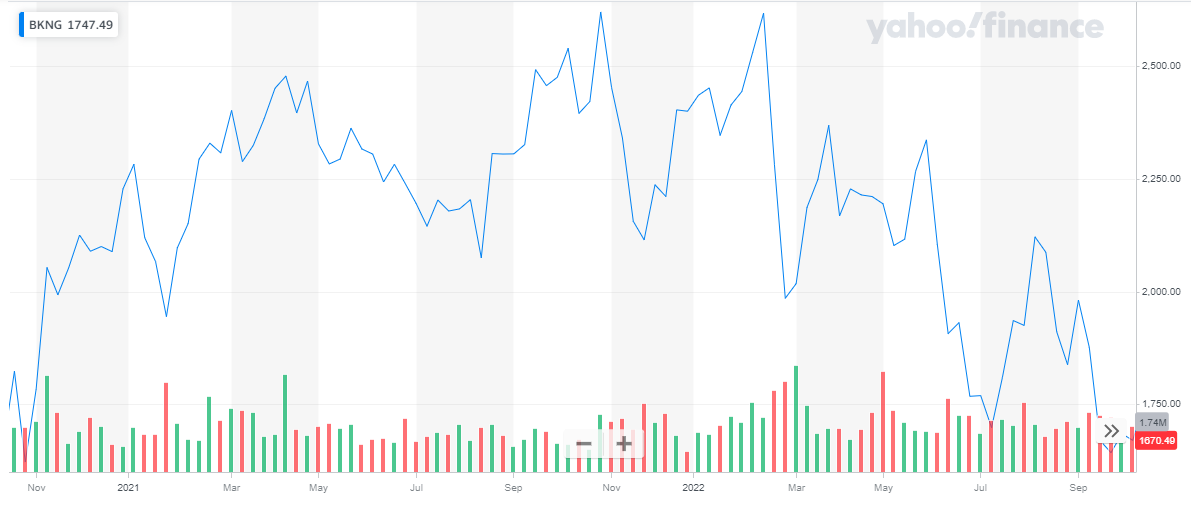

In 2021, they started at $ 2,227. Throughout the year the stock remained volatile while maintaining an upward trend. The stock closed the year at $ 2,399 representing a 7.7 % appreciation during the year.

Get to know about Best Trading and Forex Signal Providers

In 2022, the stock continued with its volatile behavior but it also started declining. The stock last closed at $ 1,946 representing a 19 % decline to date.

Check out our updates for Nasdaq Forecast.

Also read:

Southwest Airlines (NYSE: LUV)

Southwest Airlines Co. operates as a passenger airline company that provide scheduled air transportation services in the United States and near-international markets. It offers ancillary services such as early bird check-in, upgraded boarding, and transportation of pets and unaccompanied minors. It operates in U.S. states, the District of Columbia, the Commonwealth of Puerto Rico, Mexico, Jamaica, The Bahamas, Aruba, the Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands, and Turks and Caicos.

Solar energy stocks are also one of the best investment options.

The below chart shows the recent quarterly reports of Southwest Airlines for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Revenue | $ 6.2 billion | $ 6.7 billion | $ 4.7 billion |

| Operating Income | $ 395 million | $ 1.16 billion | ($ 151) million |

| Net Income / Loss | $ 277 million | $ 760 million | ($ 278) million |

| Earnings per share | $ 0.47 | $ 1.29 | ($ 0.47) |

Get to know about Hydrogen stocks, which are companies focusing on the production of hydrogen fuel cells.

Southwest Airlines has a market cap of $ 23.05 billion. Its shares are trading at $ 38.82.

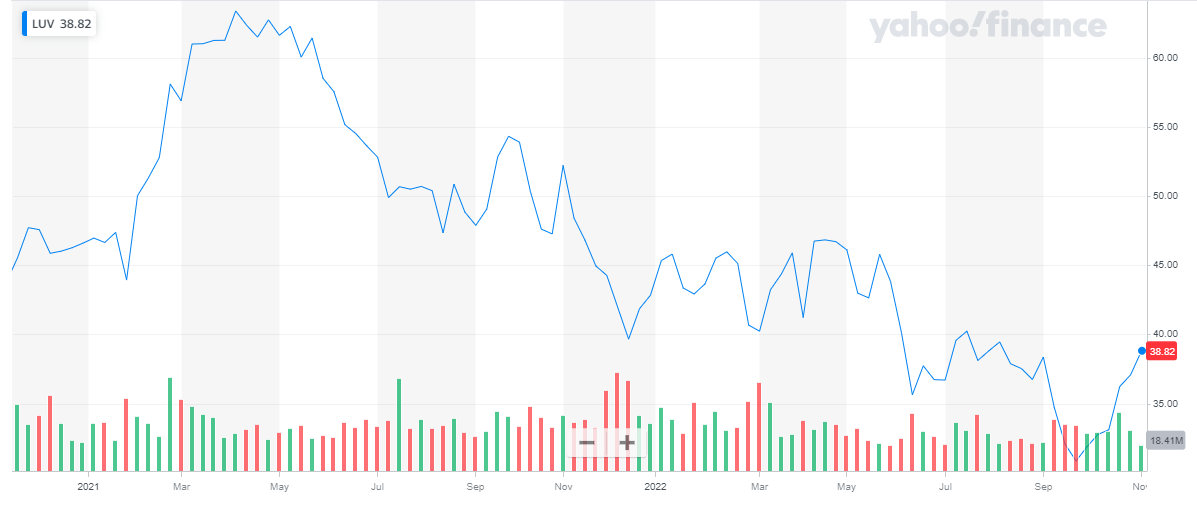

The stock of the company started trading at $ 46.61 at the start of the year 2021. After an initial rise in price, the stock picked up a declining trend. The stock closed the year at $ 42.84 representing an 8 % decline throughout the year.

In the year 2022, the stock continued its declining trend. From $ 42.84, the stock went to the low of $ 30.84 and last closed at $ 38.82. To date, the stock has declined by 9.4 %.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Airbnb (NASDAQ: ABNB)

Airbnb is a community marketplace for people to list, discover and book unique spaces around the world through mobile phones or the internet. Airbnb connects travelers seeking authentic experiences with hosts offering unique, inspiring spaces around the world. Airbnb is a trusted online marketplace for people to list, discover, and book unique accommodations and experiences around the world.

By facilitating bookings and financial transactions, Airbnb makes the process of listing or booking a space effortless and efficient. With 4,500,000 listings in over 65,000 cities in 191 countries, Airbnb offers the widest variety of unique spaces for everyone, at any price point around the globe. Airbnb has grown to over 4 million Hosts who have welcomed more than 1 billion guest arrivals in almost every country across the globe. Stocks are profitable. But it’s always wise to limit your exposure to risky investments like best altcoins.

The below chart shows the recent quarterly reports of Airbnb for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Revenue | $ 2.89 billion | $ 2.1 billion | $ 1.51 billion |

| Net Income / Loss | $ 1.2 billion | $ 379 million | ($ 18.8) million |

| Earnings per share | $ 1.9 | $ 0.59 | $ 0.03 |

Airbnb has a market cap of $ 64.8 billion. Its shares are trading at $ 102.4.

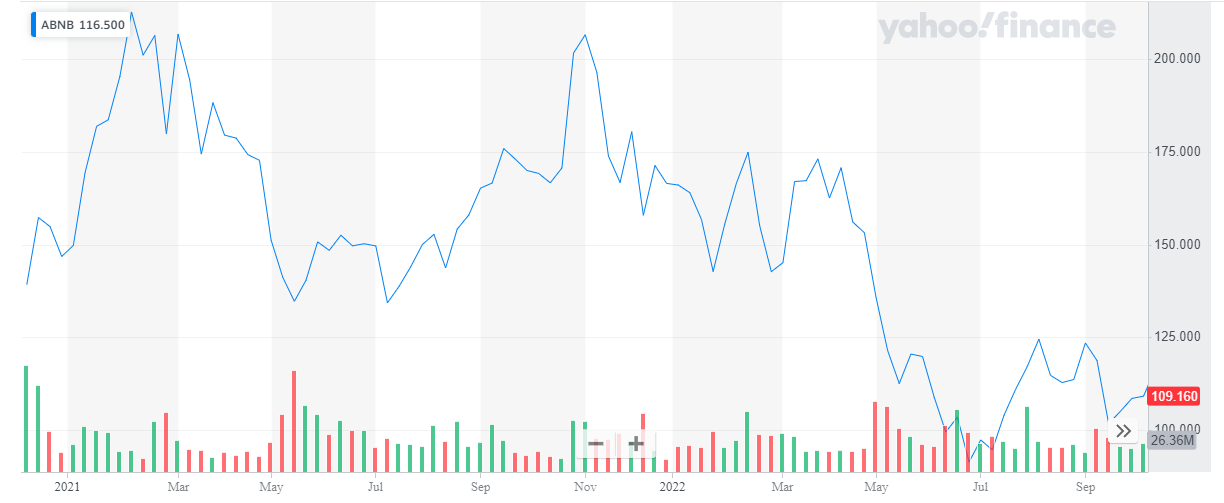

The stock of the company has been quite volatile in the past two years. It started the year 2021 at $ 146.8 and after multiple dips and peaks throughout the year closed off the year at $ 166.49. Overall, the stock appreciated by 13.4 %.

In 2021, the stock picked up a downward trend. From $ 166.49, the stock last closed at $ 102.4 representing a 38.5 % decline to date.

Oil stocks are one of the riskier yet most profit-generating sectors. No doubt oil is the largest energy market but natural gas stocks also play an important role.

Marriott International (NASDAQ: MAR)

Marriott International Inc. engages in the operation and franchise of hotel, residential, and timeshare properties.

It operates through the following business segments:

- North American Full-Service- The North American Full-Service segment includes luxury and premium brands located in the U.S. and Canada

- North American Limited-Service – The North American Limited-Service segment comprises select properties located in the U.S. and Canada.

- Asia Pacific – The Asia Pacific segment focuses on all brand tiers in the Asia Pacific region.

- Other International – The Other International segment represents its Caribbean and Latin America, Europe, and Middle East and Africa properties.

Get to know the best commodities to invest in now.

The company owns 30 brands and 8,000 plus properties across 139 countries.

The below chart shows the recent quarterly reports of Marriott International for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Revenue | $ 5.3 billion | $ 5.3 billion | $ 4.2 billion |

| Earning/ Loss from Operations | $ 958 million | $ 950 million | $ 558 million |

| Net Income / Loss | $ 630 million | $ 678 million | $ 337 million |

| Earnings per share | $1.94 | $ 2.06 | $ 1.15 |

Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022.

Marriott International has a market cap of $ 50 billion. Its shares are trading at $ 157.98.

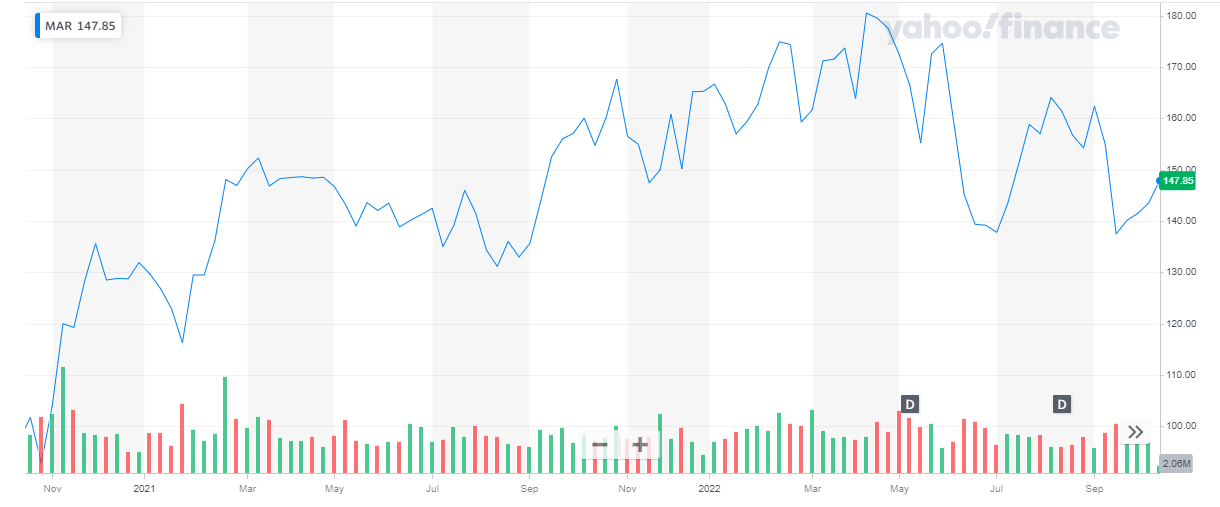

The stock of the company has been on a bullish run for the major part of the last two years. In 2021 the stock started trading at $ 131.92. Throughout the year the stock started rising slowly and steadily and closed the year at $ 165.24 representing a 25 % appreciation during the year.

In 2022, the stock continued with an upward rising trend till it peaked at $ 180.51. After this, the stock reversed its course and started declining. The stock last closed at $ 157.98 representing a 12.8 decline to date.

If you have entered the crypto investment market, you should explore crypto staking platforms.

TRIPADVISOR (NASDAQ: TRIP)

TripAdvisor is an American online travel company customers can compare prices on flights, hotels, and cruises. Airlines, hotels, and restaurants will be eager to entice consumers back, which means the demand for advertising on TripAdvisor should see a significant increase. The bulk of TripAdvisor’s revenue comes from click-based advertising and subscription-based advertising so any uptick in the travel sector will be good for the price of the TRIP stock.

Also, learn about top shipping stocks in 2024.

The below chart shows the recent quarterly reports of Trip Advisor for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Revenue | $ 459 million | $ 417 million | $ 262 million |

| Net Income / Loss | $ 25 million | $ 31 million | ($ 34) million |

| Earnings per share | $ 0.17 | $ 0.21 | ($ 0.24) |

There are many stock advisory services that recommend a few of the best stocks to their members and subscribers.

Trip advisor has a market cap of $ 2.93 billion. Its shares are trading at $ 20.86.

The stock started trading at $ 28.78. After an initial spike in price, the stock peaked at $ 59.99. After that, the stock reversed its course and started to decline. The stock closed the year at $ 27.26. Overall, the stock declined by 5 % during the year.

In 2022, the stock continued its declining trend and last closed at $ 20.89 representing a 23.4 % decline to date.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

The Boeing Company (NYSE: BA)

The Boeing Company designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

Also learn about Head and Shoulders Pattern – Trading Guide with Rules & Examples

The company operates through four segments:

- Commercial Airplanes – The Commercial Airplanes segment provides commercial jet aircraft for passenger and cargo requirements, as well as fleet support services.

- Defense, Space & Security – The Defense, Space & Security segment engages in the research, development, production, and modification of manned and unmanned military aircraft and weapons systems; strategic defense and intelligence systems, which include strategic missile and defense systems, command, control, communications, computers, intelligence, surveillance and reconnaissance, cyber and information solutions, and intelligence systems; and satellite systems, such as government and commercial satellites, and space exploration.

- Global Services – The Global Services segment offers products and services, including supply chain and logistics management, engineering, maintenance and modifications, upgrades and conversions, spare parts, pilot and maintenance training systems and services, technical and maintenance documents, and data analytics and digital services to commercial and defense customers

- Boeing Capital – The Boeing Capital segment offers financing services and manages financing exposure for a portfolio of equipment under operating leases, sales-type/finance leases, notes, and other receivables, assets held for sale or re-lease, and investments.

The below chart shows the recent quarterly reports of The Boeing Company for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Revenue | $ 15.96 billion | $ 16.7 billion | $ 13.99 billion |

| Earning/ Loss from Operations | ($ 2.8 billion) | $ 774 million | ($ 1.2 billion) |

| Net Income / Loss | ($ 3.3 billion) | $ 160 million | ($ 1.24 billion) |

| Earnings per share | ($ 5.49) | ($ 0.32) | ($ 2.06) |

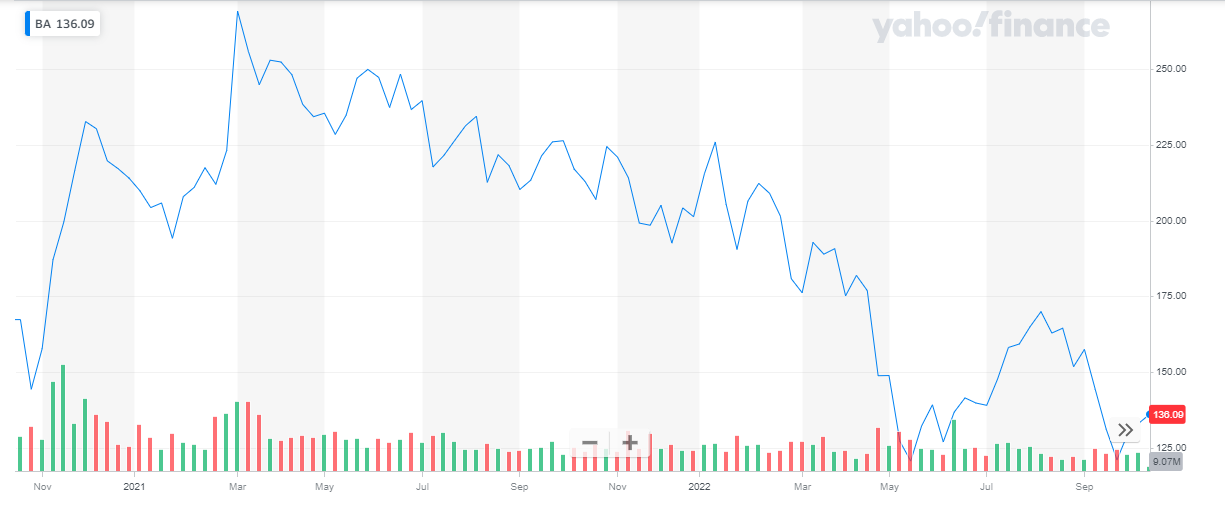

The Boeing Company has a market cap of $ 100.57 billion. Its shares are trading at $ 168.74.

The stock started in the year 2021 at $ 214.06. After an initial spike in price, the stock reversed course and continued to climb for the remaining of the year. The stock closed the year at $ 201.32. Overall, the stock declined by 6 % during the year. Learn about Best Day Trading Stocks

In 2022, the stock continued its bearish run. The stock last closed at $ 168.78 representing a 16.2 % decline to date.

Royal Caribbean Group (RCL)

Royal Caribbean Group (RCL)

Royal Caribbean Group is one of the leading cruise companies in the world with a global fleet of 64 ships traveling to approximately 1,000 destinations around the world. Royal Caribbean Group is the owner and operator of three award-winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, the brands have an additional 10 ships on order as of September 30, 2022. ETFs offer a low-cost option to get exposure to oil and gas ETFs.

The below chart shows the recent quarterly reports of Royal Caribbean Group for the year 2022:

| Q3 2022 | Q3 2021 | |

| Total Revenue | $ 3 billion | $ 457 million |

| Net Income / Loss | $ 33 million | $ 1.4 billion |

| Earnings per share | $ 0.13 | -$ 5.59 |

Royal Caribbean has a market cap of $ 13.4 billion. Its shares are trading at $ 52.53.

The stock of the company remained volatile in 2021 but it managed to remain steady. From a price of $ 74.69, the stock closed the year at $ 76.9 representing a 3 % appreciation during the year.

In 2022, the stock picked up a bearish pattern. During the year the stock dropped as low as $ 32.76. The stock last closed at $ 45.11 representing a 41 % decline to date.

If you are seeking a steady stream of income, you should invest in REIT stocks.

The Walt Disney Company (NYSE: DIS)

Walt Disney Travel and Tourism Stocks have grown tremendously because of the rising popularity of Walt Disney. The Walt Disney Travel Company is the company name for the services The Walt Disney Company employs to help guests book tickets and reservations for the Walt Disney Parks and Resorts around the world. Travel agencies currently book their vacation packages through the Walt Disney Travel Company. Semiconductor stocks are also one of the best investment opportunities.

The below chart shows the quarterly reports of the Walt Disney Company for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Revenue | $ 21 billion | $ 17 billion | $ 21.8 billion |

| Net Income / Loss | $ 1.4 billion | $ 923 million | $ 1.15 billion |

| Earnings per share | $ 0.77 | $ 0.5 | $ 0.63 |

The past three years were rough for Disney. In 2020, the pandemic forced it to temporarily close its theme parks and resorts and disrupted its production and theatrical releases of new movies. Disney’s post-pandemic recovery gained more momentum this year as its core businesses stabilized. It also locked in 221 million streaming subscribers across all its services at the end of the third quarter.

Walt Disney has a market cap of $ 158 billion. Its shares are trading at $ 86.75.

The share started in the year 2021 at $ 181.18. After a steady performance, the stock picked up a bearish run. The stock started to decline slowly and steadily and closed the year at $ 154.89. Overall, the stock declined by 14.5 %.

In 2022, the stock continued with its bearish pattern. It last closed at $ 86.75 representing a 44 % decline to date.

Also read: Best long term ETFs to invest in 2024.

Expedia Group (EXPE)

Expedia Group (EXPE)

Expedia is a popular website for booking travel accommodations. It aims to provide the lowest prices for any booking, which is backed up with the “Best Price Guarantee.” You can search for hotels, cars, flights, or packages based on your travel requirements, and sort through accommodations that meet your needs. What makes Expedia a preferred choice amongst airlines is its convenience, it is low cost, easy cancellation, and refund policy and travel insurance for every passenger.

Like all other airline companies, Expedia suffered a massive decline in income due to the pandemic. However, its latest results confirm that the company is en route toward recovery and growth.

Get to know Bull vs Bear market.

The below table shows the financial highlights for the airline from 31st Dec 2021 onwards till the recent financial report. The performance of the travel company has been steadily improving every quarter as shown in the figures below. And as per the recent third-quarter report, the company has reported net income after the reported loss for two consecutive quarters.

| Q3 2022 | Q2 2022 | Q1 2022 | Q3 2021 | |

| Total Revenue | $ 3,619 million | $ 3,181 million | $ 2,249 million | $ 2,962 million |

| Operating Income | $ 747 million | $ 345 million | ($ 135) million | $ 524 million |

| Net Income / Loss | $ 482 million | ($ 185) million | ($ 122) million | $ 362 million |

| Earnings per share | $ 2.98 | ($ 1.17) | ($ 0.78) | $ 2.26 |

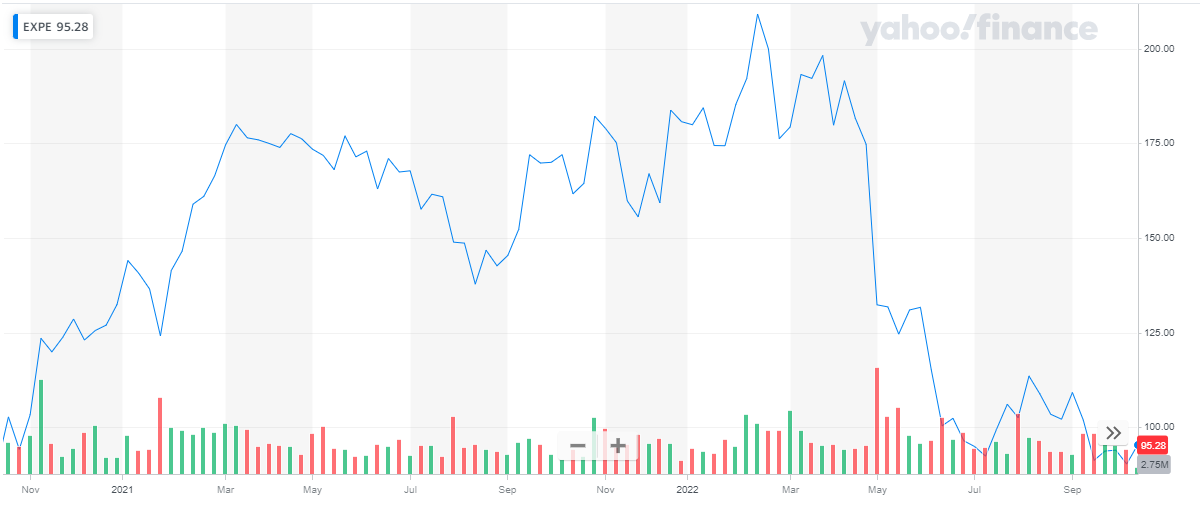

Expedia has a market cap of $ 14 billion. Its shares are trading at a price of $ 89.7.

The company’s stock enjoyed the stellar year 2021. It started at $ 132.4 and closed the year at $ 180.72 representing a 36.5 % appreciation during the year.

In 2022, the stock continued with its bullish performance. The stock peaked at $ 209.17 during the year. However, the tables turned for the travel company stock. The stock suffered a huge blow and dropped to a low of below $ 90. To date, the stock has declined by more than 50 %.

EasyJet (LSE: EZJ)

EasyJet (LSE: EZJ)

EasyJet Airlines is a leading international low-cost airline offering air travel to more than 120 destinations in over 90 countries. The company’s main markets are Asia, Europe, and North America. The airline flight routes also include a few selected Caribbean destinations. Learn about best auto stocks in 2024.

The EasyJet Airline has an online presence through which travelers can book their tickets. Travelers can also use EasyJet’s mobile services.

The airline’s financial highlights are as below:

| First Half 2022 | First Half 2021 | |

| Capacity (Millions of seats) | 30.3 | 6.4 |

| Passengers (Millions) | 22.3 | 4.1 |

| Total Revenue (£ million) | 1,498 | 240 |

| Reported loss before tax (£ million) | (557) | (645) |

EasyJet holidays continues its rapid growth to become a major player within the sector, having seen over 500 % increase in Summer 2022 bookings versus the previous 2019 model. As a result of these stats, easyJet holidays is the UK’s fastest-growing holiday company. The company’s holidays business is well on track to deliver over 1.1m passengers in 2022 and has already sold over 70% of that planned volume

The company has a market cap of $ 2.89 billion. Its shares are trading at $ 381.7.

Read: Best Index Funds in 2024.

The stock of the company enjoyed good performance during the first half of 2021. After that, the stock started declining. The stock started at $ 830, went as high as $ 1,095, and finally closed off at $ 556. Overall, the stock declined by 33 %.

In 2022, the stock continued its downward journey. From $ 556, the stock last closed at $ 381.7. To date, the stock has declined by 31 %.

Conclusion

Conclusion

Investing in travel stocks has its benefits and challenges. While the industry has pretty much recovered after the pandemic, the industry still has a few challenges which need to be addressed before planning to invest in the travel industry:

- The boom of digitalization

- High Taxes

- The fall of business travel

Also, some of the key financial metrics to asses the travel stocks are:

- Return on Assets

- Quick ratio

- Operating Leverage

The travel industry is a very wide sector with a lot of subcategories. The above list of selected companies has been performing extremely well and has shown great improvement in the post-pandemic era.

You may also like reading: