Materials-sector companies are involved in activities such as mining, producing refined metals, and manufacturing chemicals. Their products are effective building blocks used in developing a variety of goods. Examples of such products are steel, which is used to create buildings, fertilizers are used to grow food, and coal which is used for energy production.

Materials-sector companies are involved in activities such as mining, producing refined metals, and manufacturing chemicals. Their products are effective building blocks used in developing a variety of goods. Examples of such products are steel, which is used to create buildings, fertilizers are used to grow food, and coal which is used for energy production.

List of Best Material Stocks to Invest In 2023

Below is the list of best material stocks to invest in now:

| Sr. | Company Name | Symbol | Price | Market Cap |

| 1 | Nucor | NUE | $ 171.21 | $ 43.65 billion |

| 2 | Freeport-McMoRan | FCX | $ 40.54 | $ 58 billion |

| 3 | The Mosaic Company | MOS | $ 54.34 | $ 18.5 billion |

| 4 | BHP Group Ltd | RIO | $ 61.46 | $ 220 billion |

| 5 | Rio Tinto Plc. | LIN | $ 69.33 | $ 112.54 billion. |

| 6 | Linde Plc. | VALE | $ 354.1 | $ 173.13 billion |

| 7 | Vale SA | CE | $ 16.72 | $ 73.9 billion |

| 8 | Celanese | CE | $ 117.4 | $ 12.74 billion |

| 9 | Commercial Metals | CMC | $ 52.35 | $ 6 billion |

| 10 | Air Products & Chemicals Inc | APD | $ 290.04 | $ 64.13 billion |

Nucor (NUE)

Nucor (NUE)

Nucor Corp. manufactures steel and steel products. The company also produces direct reduced iron for use in its steel mills. The operations include international trading and sales companies that buy and sell steel and steel products manufactured by the company and others. The operating business segments are:

- Steel mills

- Steel products

- Raw materials

The steel mills segment generates the maximum revenue. The steel mills segment includes carbon and alloy steel in sheet, bars, structural, and plate; steel trading businesses; rebar distribution businesses; and Nucor’s equity method investments in NuMit and NJSM.

NUCOR recently reported its financial results for the year 2022:

- Net Sales were reported at $ 41.5 billion, as compared to $ 36.5 billion in the previous year

- Net Earnings were reported at $ 8.1 billion, as compared to $ 7.12 billion in the previous year

- Earnings per share were reported at $ 28.88, as compared to $ 23.23 in the previous year

NUCOR has a market cap of $ 43.65 billion. Its shares are trading at $ 171.21.

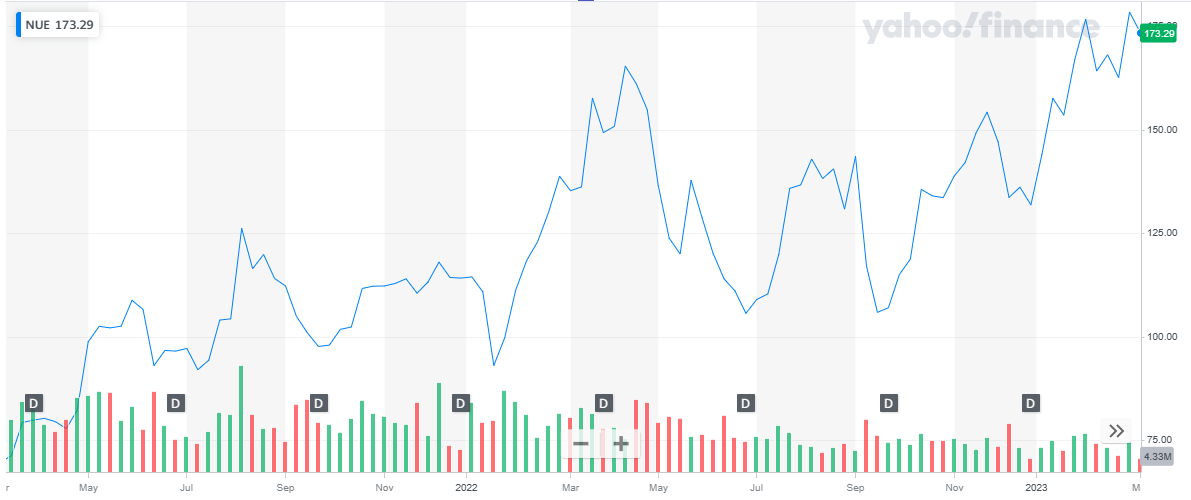

The stock started in the year 2022 at $ 114.15. During the year the stock went as high as $ 165.32 and eventually closed off the year at $ 131.81. Overall, the stock appreciated by 15.5 %.

In 2023, the stock continued to rise further. To date, it has appreciated by 31.5 %.

Also, learn:

Also, learn:

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Freeport-McMoRan (FCX)

Freeport-McMoran (formerly Freeport-McMoRan Copper & Gold) is an international mining company that operates geographically diverse assets with reserves of copper, gold, and molybdenum. It is a producer of copper concentrate, cathode, and continuous-cast copper rods. The company also provides gold sold as a component of its copper concentrate or in slimes, which are a product of the smelting and refining process. Besides, it offers molybdenum and molybdenum-based chemicals.

FCX is one of the world’s largest publicly traded copper producers. FCX’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits; and significant mining operations in North America and South America, including the large-scale Morenci minerals district in Arizona and the Cerro Verde operation in Peru.

Freeport McMoRan recently reported its year-end financials for 2022:

- Revenues were reported at $ 22.78 billion, as compared to $ 22.85 billion in the previous year

- Operating income was reported at $ 7.1 billion, as compared to $ 8.4 billion in the previous year

- Net Income was reported at $ 3.5 billion, as compared to $ 4.3 billion in the previous year

- Earnings per share were reported at $ 2.39 as compared to $ 2.8 in the previous year

Freeport-McMoran has a market cap of $ 58 billion. Its shares are trading at $ 40.54.

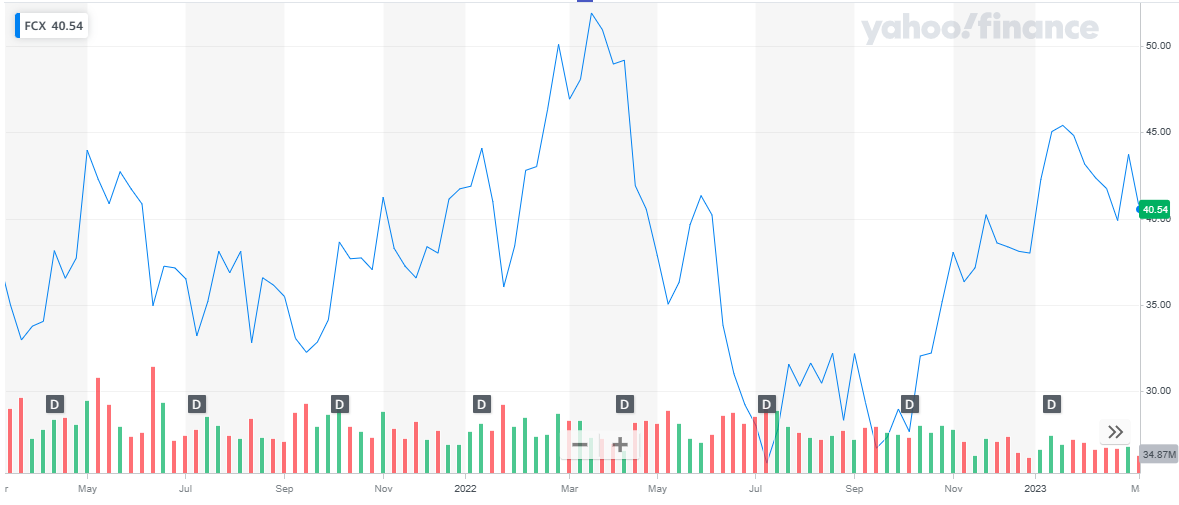

The stock started in the year 2022 at $ 41.73. During the year the stock rose as high as $ 51.93 and as low as $ 25.82. The stock eventually closed the year at $ 38. Overall, the stock declined by 9 %.

In 2023, the stock went from $ 38, at the start of the year, to $ 40.85, at its recent closing. To date, the stock has appreciated by 7.5 %.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

The Mosaic Company (MOS)

The Mosaic Co (Mosaic) is a crop nutrition company. It produces and distributes concentrated phosphate, potash, and animal feed ingredients for the global agricultural industry. Its products are used as fertilizers, water softener regenerates, and de-icing agents; and in the manufacture of mixed crop nutrients. The company has mines, production facilities, and blending or distribution facilities in the US, Canada, Brazil, China, India, and Paraguay. It has interests in a phosphate rock mine in Bayovar, Peru, and a joint venture to develop a phosphate rock mine and chemical complexes in Saudi Arabia. The company serves crop nutrient manufacturers and industrial clients in North America, South America, Asia Pacific, and the Middle East. Mosaic is headquartered in Tampa, Florida US.

The Mosaic Co recently reported its year-end financials for 2022:

- Net Sales were reported at $ 19.125 billion, as compared to $ 12.4 billion in the previous year

- Operating income was reported at $ 4.8 billion, as compared to $ 2.5 billion in the previous year

- Net income was reported at $ 3.6 billion, as compared to $ 1.63 billion in the previous year

- Earnings per share were reported at $ 10.06, as compared to $ 4.27 in the previous year

The Mosaic Company has a market cap of $ 18.5 billion. Its shares are trading at $ 54.34.

The stock started the year at $ 39.29. During the year the stock went as high as $ 76.05 and eventually closed the year at $ 43.87. Overall, the stock appreciated by 11.7 %.

In 2023, the stock last closed at $ 54.34 representing a 25.3 % appreciation to date.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

BHP Group Ltd (BHP)

BHP Group Ltd. engages in the exploration, development, production, and processing of iron ore, metallurgical coal, and copper. It operates through the following segments:

- Petroleum – The Petroleum segment explores, develops, and produces oil and gas.

- Copper – The Copper segment refers to the mining of copper, silver, lead, zinc, molybdenum, uranium, and gold

- Iron Ore – The Iron Ore segment consists of iron ore.

- Coal – The Coal segment focuses on metallurgical coal and energy coal.

BHP Group recently reported its half-year results for FY 2023:

- Revenues were reported at $ 25.7 billion, as compared to $ 30.5 billion in the previous year’s same period

- Profit from operations was reported at $ 10.8 billion, as compared to $ 14.8 billion in the previous year’s same period

- Net Profit was reported at $ 6.5 billion, as compared to $ 9.44 billion in the previous year’s same period

- Earnings per share were reported at $ 127.5, as compared to $ 186.6 in the previous year’s same period

BHP Group has a market cap of $ 220 billion. Its shares are trading at $ 61.46.

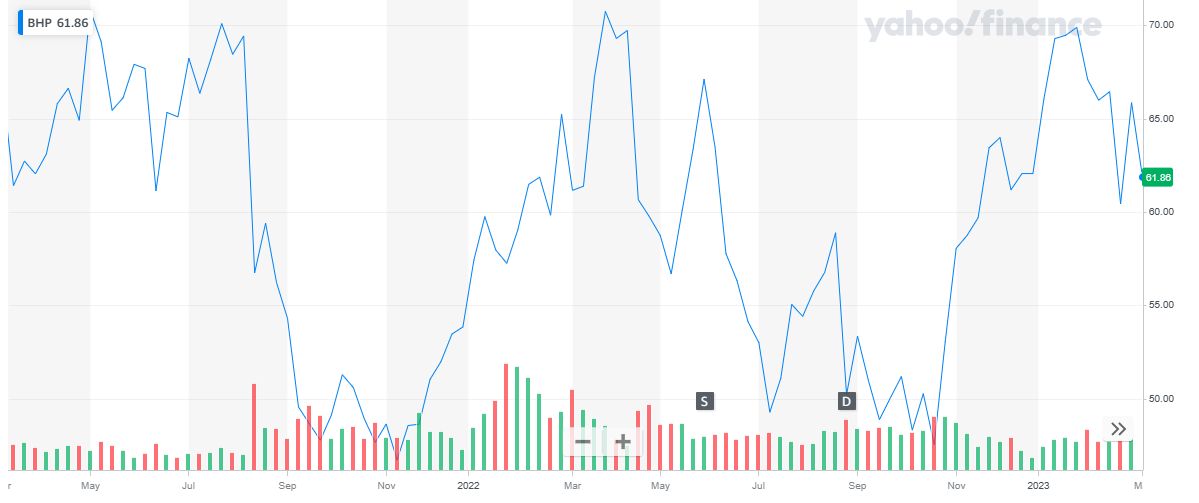

In 2022, the stock started trading at $ 53.84. During the year the stock went as high as $ 70.74 and as low as $ 47.53. Eventually, the stock closed at $ 62.05 representing a 15 % appreciation during the year.

In 2023, the stock started with a bullish run and last closed at $ 61.85 representing a slight decline to date.

Rio Tinto PLC (RIO)

Rio Tinto PLC (RIO)

Rio Tinto is an international metals and mining company that carries out the mining, exploration, and processing of various mineral resources. It supplies a range of minerals and metals, including aluminum, diamonds, uranium, copper, gold, and iron ore. Rio Tinto also supplies industrial minerals such as borax, titanium dioxide, and salt. The company operates port and rail facilities, smelters, refineries, processing plants, shipping, and commercial and research facilities. It also carries out the exploration, technology, and innovation business through research centers. The company has operations in Europe, Africa, Asia-Pacific, the Middle East, and the Americas. Rio Tinto is headquartered in London, Greater London, the UK

Rio Tinto recently reported its full-year results for FY 2022:

- Total revenues were reported at $ 55.55 billion, as compared to $ 63.5 billion in the previous year

- Operating Profit was reported at $ 19.9 billion, as compared to $ 29.8 billion in the previous year

- Net Profit was reported at $ 13.1 billion, as compared to $ 22.6 billion in the previous year

- Earnings per share were reported at 766 cents as compared to 1,303 cents in the previous year

Rio Tinto has a market cap of $ 112.54 billion. Its shares are trading at $ 69.33.

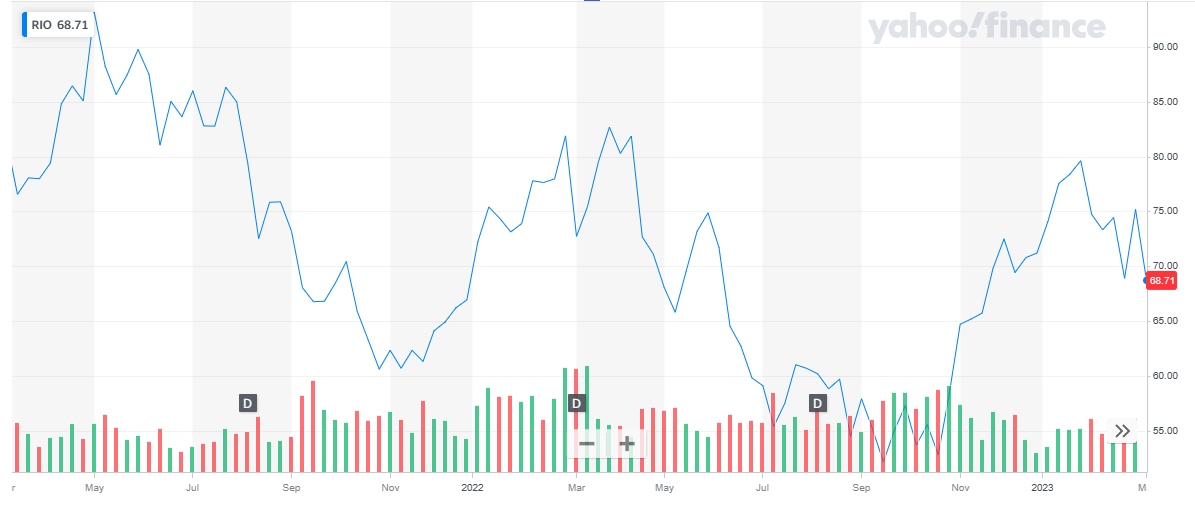

The stock started the year 2022 at $ 66.94. During the year, the stock went as high as $ 82.68 and as low as $ 52.16. Eventually, the stock closed at $ 71.2, representing a 6.4 % appreciation during the year.

In 2023, the stock rose up to $ 79.61 and last closed at $ 68.63. To date, the stock has declined by 3.6 %.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

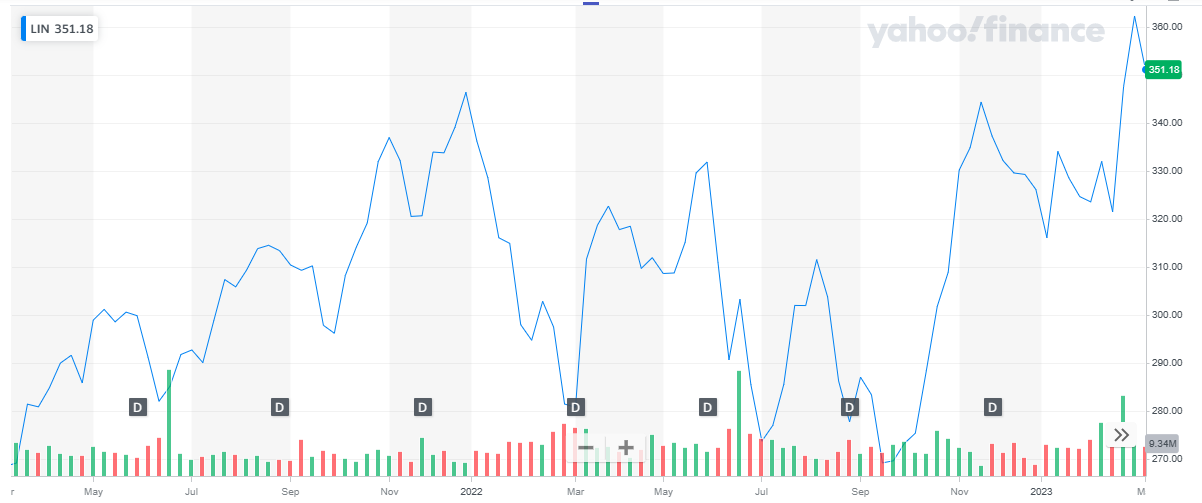

Linde PLC (LIN)

Linde plc (Linde) is an industrial gas and engineering company. It supplies industrial, process, and specialty gases. The company’s products include atmospheric gases such as oxygen, nitrogen, and argon; and process gases including carbon dioxide, helium, hydrogen, electronic gases, and acetylene. Linde also designs, engineers, and builds equipment that produce gases for internal use and offers a wide range of gas production and processing services. It serves numerous industries including healthcare, petroleum refining, manufacturing, food, beverage carbonation, fiber-optics, steel making, aerospace, chemicals, energy, electronics, and water treatment. It operates cryogenic air separation plants, hydrogen plants, and carbon dioxide plants across APAC, EMEA, and the Americas.

Linde recently reported its full-year results for FY 2022:

- Sales were reported at $ 33.4 billion, as compared to $ 30.8 billion in the previous year

- Operating Profit was reported at $ 5.4 billion, as compared to $ 5 billion in the previous year

- Net Income was reported at $ 4.15 billion, as compared to $ 3.8 billion in the previous year

- Earnings per share were reported at $ 8.3, as compared to $ 7.4 in the previous year

Linde Plc has a market cap of $ 173.13 billion. Its shares are trading at $ 354.9.

The stock has been volatile in the past few years. It started the year 2022 at $ 346.43. After multiple ups and downs throughout the year, the stock closed at $ 326.18. Overall, the stock depreciated by 5.9 %.

In 2023, the stock spiked up and reached $ 362.38 and last closed at $ 354.9. To date, the stock has appreciated by 8.8 %.

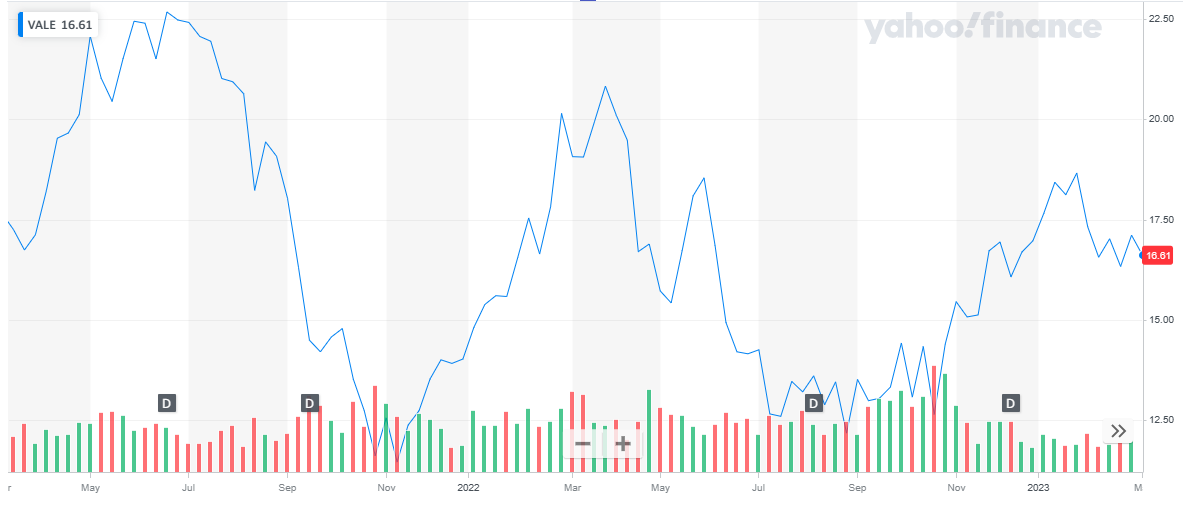

Vale SA (VALE)

Vale SA (VALE)

Vale is a large global miner and the world’s largest producer of iron ore and pellets. In recent years the company has sold noncore assets such as its fertilizer, coal, and steel operations to concentrate on iron ore, nickel, and copper. Earnings are dominated by the bulk materials division, primarily iron ore and iron ore pellets. The base metals division is much smaller, consisting of nickel mines and smelters along with copper mines producing copper in concentrate.

Vale SA recently reported its yearly financial report for FY 2022:

- Total Revenues were reported at $ 43.9 billion, as compared to $ 54.5 billion in the previous year

- Operating Income was reported at $ 17.2 billion, as compared to $ 27.7 billion in the previous year

- Net Income was reported at $ 18.8 billion, as compared to $ 22.5 billion in the previous year

- Earnings per share were reported at $ 4.05, as compared to $ 4.47 in the previous year

Vale SA has a market cap of $ 73.9 billion. Its shares are trading at $ 16.72.

The stock started in the year 2022 at $ 14.02. During the year the stock went as high as $ 20.83 and dropped to a low of $ 12.17. Eventually, the stock closed the year at $ 16.97 representing a 21 % appreciation during the year.

In 2023, the stock maintained its share price with a slight decline.

Read: ETFs vs Index funds, where should you invest?

Read: ETFs vs Index funds, where should you invest?

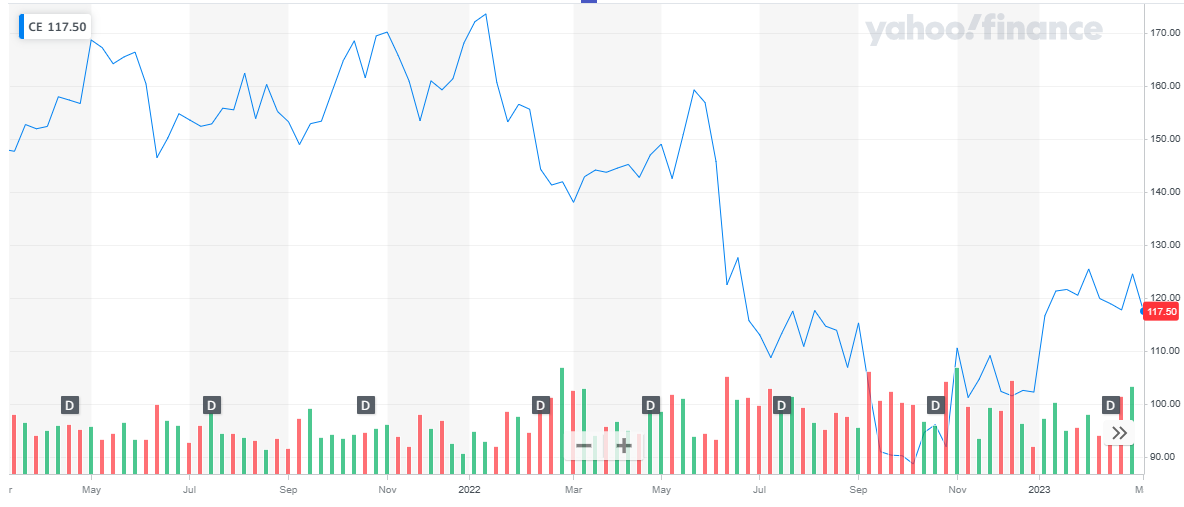

Celanese (CE)

Celanese is one of the world’s largest producers of acetic acid and its downstream derivative chemicals, which are used in various end markets, including coatings and adhesives. The company also produces specialty polymers used in the automotive, electronics, medical, and consumer end markets as well as cellulose derivatives used in cigarette filters.

Celanese recently reported its full-year financials for FY 2022:

- Net Sales were reported at $ 9.673 billion, as compared to $ 8.537 billion in the previous year

- Operating profit was reported at $ 1.4 billion, as compared to $ 1.95 billion in the previous year

- Net Earnings were reported at $ 2.2 billion, as compared to $ 2.5 billion in the previous year

- Earnings per share were reported at $ 17.34, as compared to $ 16.86 in the previous year

Celanese has a market cap of $ 12.74 billion. Its shares are trading at $ 117.5.

The stock started in the year 2022 at $ 168.06. The stock picked up a bearish run and eventually closed the year at $ 102.24 representing a 39 % decline during the year.

In 2023, the stock started to rise and has appreciated by 14.6 % to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Commercial Metals (CMC)

Commercial Metals Company (CMC) is a company that manufactures, recycles, and fabricates steel and metals products, and provides related materials and services. The company is divided into two segments: North America and Europe. The North American segment is a network of recycling facilities, steel mills, and fabrication operations that process ferrous and nonferrous scrap metals. The Europe segment includes a network of recycling facilities, an electric arc furnace (EAF) mini mill, and fabrication operations and provides steel products such as rebar, merchant bar, wire rod, and semi-finished billets. The company serves the agriculture, construction, energy, heavy equipment, infrastructure, and manufacturing industries.

Commercial Metals recently reported its first quarter results for the year 2023:

- Net Sales were reported at $ 2.23 billion, as compared to $ 1.98 billion in the previous year

- Net Earnings were reported at $ 261.8 million, as compared to $ 233 million in the previous year

- Earnings per share were reported at $ 2.23, as compared to $ 1.92 in the previous year

Commercial Metals has a market cap of $ 6 billion. Its shares are trading at $ 52.35.

The stock started the year 2022 at $ 36.29 and picked up a bullish trend. The stock closed the year at $ 48.3, representing a 33 % appreciation the year.

In 2023, the stock continued its bullish run and reached as high as $ 57.08. The stock last closed at $ 50.8 representing a 5 % appreciation to date.

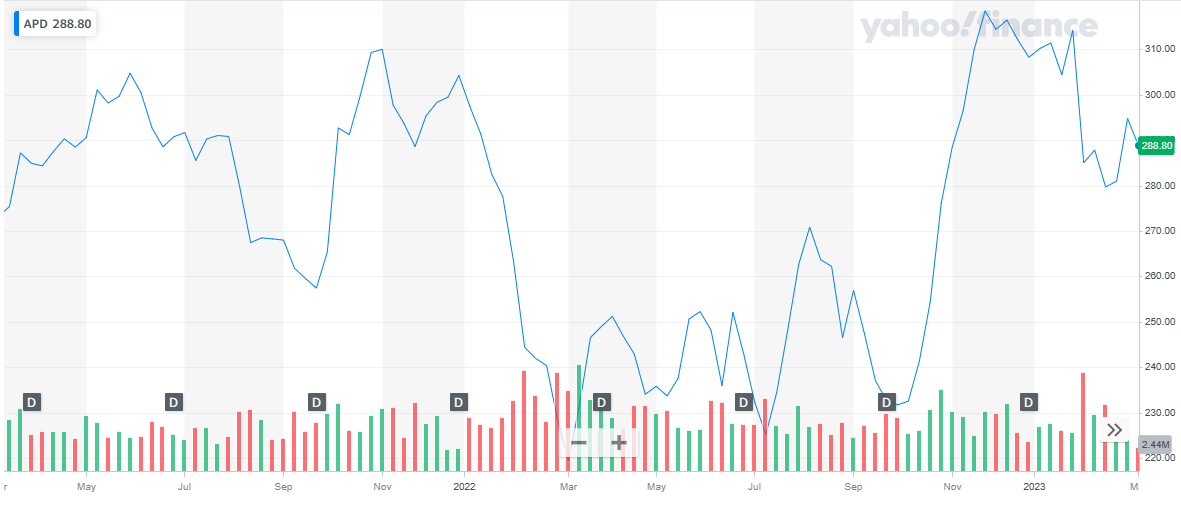

Air Products & Chemicals Inc (APD)

Air Products & Chemicals Inc (APD)

Since its founding in 1940, Air Products has become one of the leading industrial gas suppliers globally, with operations in 50 countries and 19,000 employees. The company is the largest supplier of hydrogen and helium in the world. It has a unique portfolio serving customers in a number of industries, including chemicals, energy, healthcare, metals, and electronics.

Air Products recently reported its first quarter results for the year 2023:

- Sales were reported at $ 3.2 billion, as compared to $ 3 billion in the previous year

- Operating Income was reported at $ 652 million, as compared to $ 523 million in the previous year

- Net Income was reported at $ 572 million, as compared to $ 560 million in the previous year

- Earnings per share were reported at $ 2.58, as compared to $ 2.53 in the previous year

Air Products has a market cap of $ 64.13 billion. Its shares are trading at $ 290.04.

The stock started the year at $ 304.26. During the year the stock suffered a huge blow and dropped as low as $ 219.38. During the last quarter, the stock spiked high and eventually, the stock closed the year at $ 308.26. Overall, the stock appreciated by 1.3 % during the year.

In 2023, the stock started to decline again. To date, the stock has declined by 6.4 %.

Also read:

Also read:

- Best uranium stocks

- Best commodity stocks

- Best AI stocks

- Best wheat stocks

- Best travel stocks

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks