Gold has always been a valuable commodity and a good investment. By investing in gold investors can hedge against inflation and deflation, both. Also, gold is an excellent way to diversify your portfolio. Gold has maintained its value in every decade. Hence, it’s considered a safe form of investment as compared to currency and other assets. The value of other assets has fluctuated over time but gold has maintained its value.

Gold is trading at around $1,800 an ounce in the international market. The below graph shows the performance of gold over the past year.

Purchasing physical gold is not the only way investors can invest in gold. They can invest in gold through exchange-traded funds (ETFs), buying stock in gold miners and other associated companies. Using Gold Trading Signal Providers is a smart approach for traders.

Purchasing physical gold is not the only way investors can invest in gold. They can invest in gold through exchange-traded funds (ETFs), buying stock in gold miners and other associated companies. Using Gold Trading Signal Providers is a smart approach for traders.

Gold stocks are the publicly traded stocks of companies and funds focused on gold. These companies are involved in the business of mining gold and selling gold. Also, these gold stocks are companies which are gold streaming and royalty companies. These companies are the middlemen in the exchange of gold.

Investing in gold stocks has proved to be more profitable rather than purchasing physical gold. Gold companies are more likely to generate higher returns because they not only benefit from rising gold prices only. These gold companies can expand operations which ultimately lead to higher profits. This way, gold stocks outperform the price of gold.

List of Best Gold Stocks to Invest in 2024

Below is a list of gold stocks that have been performing well and are a must-buy nowadays.

| Sr. | Name | Symbol | Price (as on 20th October 2021) | Market Cap |

| 1 | Royal Gold Inc | RGLD | $99.2 | $6.47 billion |

| 2 | Franco-Nevada | FNV | $140.69 | $27.22 billion |

| 3 | Barrick Gold Corporation | GOLD | $19.42 | $34.3 billion |

| 4 | Sibanye-Stillwater Ltd | SBSW | $15.09 | $10.32 billion |

| 5 | Torex Gold Resources Inc. | TXG.TO | $14.46 | $1.23 billion |

| 6 | Agnico Eagle Mines Limited | AEM | $57.34 | $13.95 billion |

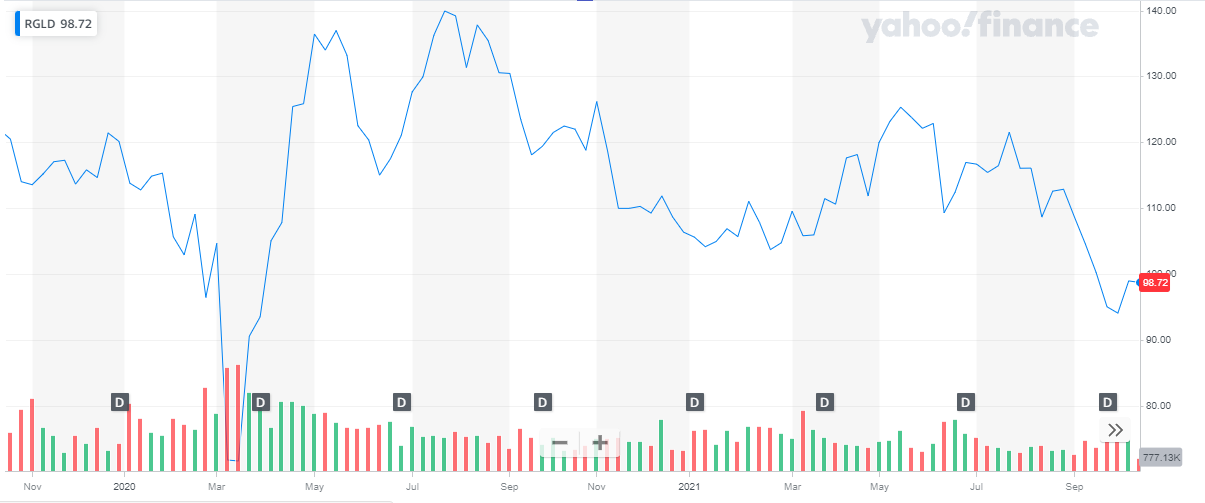

Royal Gold Inc. (NASDAQ: RGLD)

Royal Gold, Inc. is a precious metals stream and royalty company engaged in the acquisition and management of precious metal streams, royalties, and other similar production-based interests. The company focuses on the production, development, evaluation, and exploration stage streams and royalties located in prolific gold regions. Royal Gold provides investors exposure to precious metals without many of the risks of investing in traditional precious metal producers. There are dozens of technical indicators, and using effective indicators ensures that consistent signs may be detected as part of a plan.

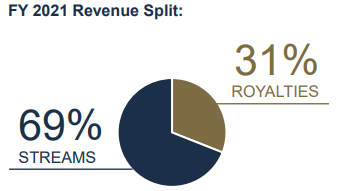

Royal Gold has two business segments that generate revenue:

- Royalty Interest – An interest in real property (generally) that provides a right to a percentage of revenue or metals produced from a mining project

- Stream Interest – A contractual arrangement to purchase metal production from a mining project at a predetermined price

The revenue breakdown for the year 2021, is shown in the below chart

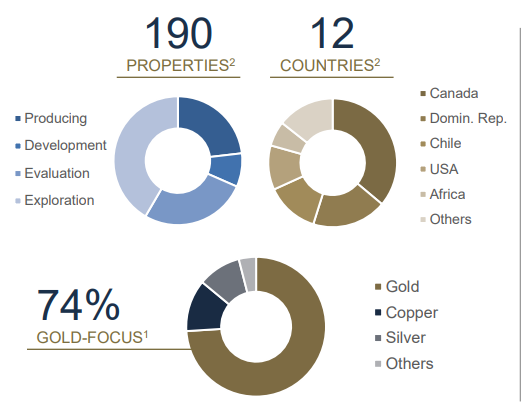

The company’s diversified portfolio is as below:

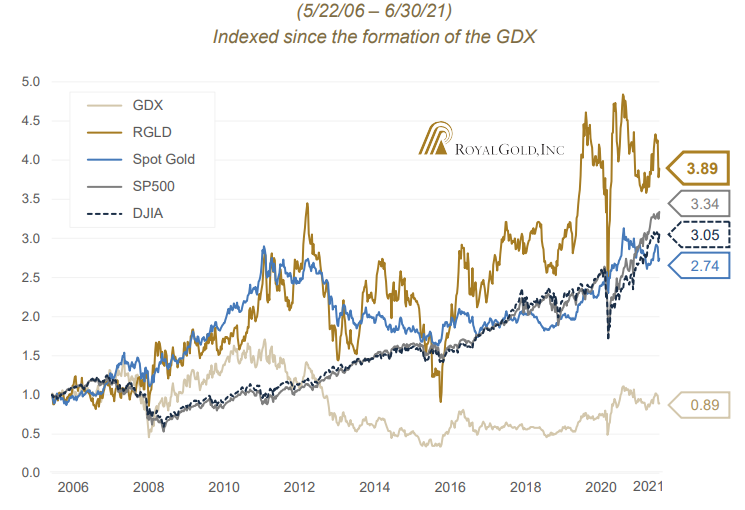

Until September 2021, the company reported a 74% revenue contribution from Gold. Revenue Gold provides its shareholders a stable sustainable investment with market-beating returns. The below chart shows the return offered by Revenue Gold in comparison with Spot Gold price, S&P 500 index, DJIA Index and GDX:

Royal Gold’s revenue is sourced from a geographically and operationally diverse portfolio, underpinned by primarily precious metals mines. Globally-diverse portfolio minimizes the influence of geopolitical volatility on revenue. Principal property revenues supported by a broad number of underlying assets

The company has a market capitalization of around $6.45 billion. The stock of Royal Gold is trading at $99.

Royal Gold has limited exposure to cost inflation. Changes in operating and capital costs are absorbed by the mine operator. In commodity boom cycles, operator costs tend to increase while Royal Gold’s costs remain stable. These positives are highly attractive for investors and provide a cushion of safety to them. Hence it is one of the best gold stocks in the market to invest in now.

Royal Gold has limited exposure to cost inflation. Changes in operating and capital costs are absorbed by the mine operator. In commodity boom cycles, operator costs tend to increase while Royal Gold’s costs remain stable. These positives are highly attractive for investors and provide a cushion of safety to them. Hence it is one of the best gold stocks in the market to invest in now.

Franco-Nevada (NYSE: FNV)

Franco-Nevada Corporation is the leading gold-focused royalty and streaming company with the largest and most diversified portfolio of cash-flow producing assets. Its business model provides investors with gold price and exploration optionality while limiting exposure to cost inflation. Franco-Nevada is debt-free and uses its free cash flow to expand its portfolio and pay dividends. It also has the most diverse portfolio by asset, operator, and country.

You may also like reading: Best Monthly Dividend Stocks to Buy

The company’s portfolio is diversified across the globe with 325 miming-based assets and 82 energy-based assets. The company has recently invested more than 800 million dollars in Vale Iron Ore Royalty Debentures, Condestable Precious Metal Stream, and Haynesville Natural Gas Royalties.

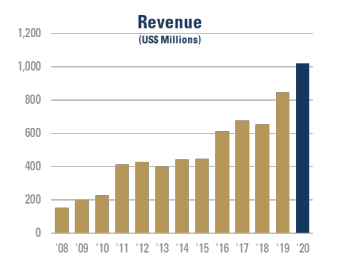

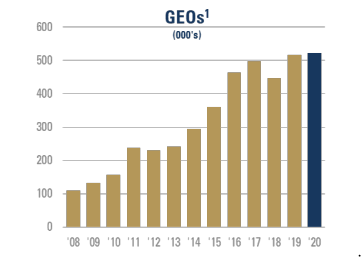

The revenue of Franco- Nevada has an excellent growth history.

The Gold Equivalent Ounces sold also have been steadily increasing over the years:

The company has a future outlook of approx. 630,000 – 660,000 GEOs by 2025. This is expected to be achieved via new mines in Salares Norte, Hardrock, Valentine Lake, by acquiring Vale Royalty.

Owing to organic growth and strategic acquisitions in the first half of 2021, Franco Nevada has shown record results. Franco-Nevada generated adjusted EBITDA of $290.0 million in the quarter, has no debt, and has $197.7 million in cash and cash equivalents.

The royalty company has a market capitalization of over $27 billion. Its share is currently trading at $143.

The revenue-based business model is particularly attractive during periods of industry cost inflation, as reflected in earnings. Also, the high P/E ratio indicates growth potential in coming years which makes it an excellent gold stock to invest in.

The revenue-based business model is particularly attractive during periods of industry cost inflation, as reflected in earnings. Also, the high P/E ratio indicates growth potential in coming years which makes it an excellent gold stock to invest in.

Read more:

Barrick Gold (NYSE: GOLD)

Barrick is a mining company that has gold and copper mining operations and projects in 13 countries in North and South America, Africa, Papua New Guinea, and Saudi Arabia. Its diversified portfolio spans many of the world’s prolific gold districts and is focused on high-margin, long-life assets.

There is a vast array of trading courses available online which you can join, each with its own merits and every course suitable for different types of traders. In its recent quarter, the company reported steady gold production despite a few operational glitches. Also, a significant contribution from copper assets continues to differentiate Barrick from its peers. The ongoing projects of the company are day by day progressing and bringing positive news:

- Updated Goldrush feasibility study delivers a robust project that meets our investment criteria

- Ongoing evaluation of Goldrush has the potential to further enhance project

- Successful commissioning of Phase 6 at Veladero, in line with guidance

- The third shaft at Turquoise Ridge reaches the final depth

- Dominican Republic Minister of Mines announces Government-led independent, strategic environmental assessment of Pueblo Viejo’s Mine Life Extension Project

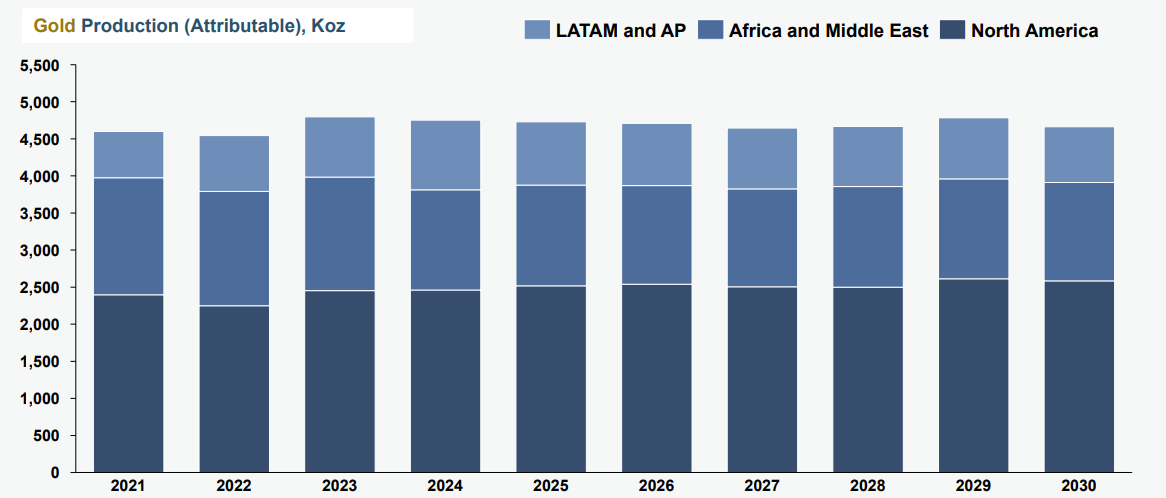

A total of 1,041 Koz of gold was produced in Q2 2021. Total net earnings were $411 million and net earnings per share were recorded at 23 cents. Gold and copper production is on track to achieve the target for 2021 guidance. The production in the second half of 2021 is expected to be higher than the first half. Also, the company owns a strong balance sheet with a cash balance of over $5 billion, as reported in the second-quarter report. A dividend of $0.09/share was also announced.

The company has a very progressive future outlook. The below chart shows the 10-year gold production outlook.

Barrick Gold has a market capitalization of $33.4 billion. Its share is currently trading at $19.3.

Barrick Gold has a market capitalization of $33.4 billion. Its share is currently trading at $19.3.

The company offers industry-leading cash return to shareholders all the while continuing to invest in the future growth and development of its assets, underpinned by strong operational and financial performance. It is running its business for the long term instead of focusing on short-term gains and working to extend its resource-based 10-year plans to 15 and even 20 years. These all are excellent attraction points for investors making it an investment-worthy gold stock to invest in now. Learn about head and shoulders patterns trading guide.

The company offers industry-leading cash return to shareholders all the while continuing to invest in the future growth and development of its assets, underpinned by strong operational and financial performance. It is running its business for the long term instead of focusing on short-term gains and working to extend its resource-based 10-year plans to 15 and even 20 years. These all are excellent attraction points for investors making it an investment-worthy gold stock to invest in now. Learn about head and shoulders patterns trading guide.

Sibanye-Stillwater Ltd (NYSE: SBSW)

Sibanye-Stillwater is a leading international precious metal mining company, with a diverse portfolio of platinum group metal (PGM) operations in the United States and Southern Africa, gold operations and projects in South Africa, and copper, gold, and PGM exploration properties in North and South America.

The company was established in 2013. In less than 10 years the company has grown and expanded into one of the world’s primary producers of platinum, palladium, and rhodium. In addition to it, Sibanye-Stillwater Limited is also a top-tier gold producer, which is currently ranked third, globally, on a gold equivalent basis.

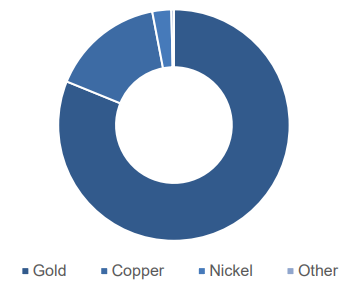

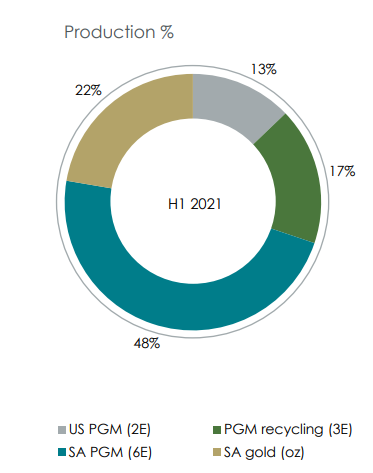

In the recent half-yearly, report published for the year 2021, the company’s production breakdown is displayed in the below chart. Gold comprises a total of 22% of the total production capacity of the company, as reported in the half-year report 2021.

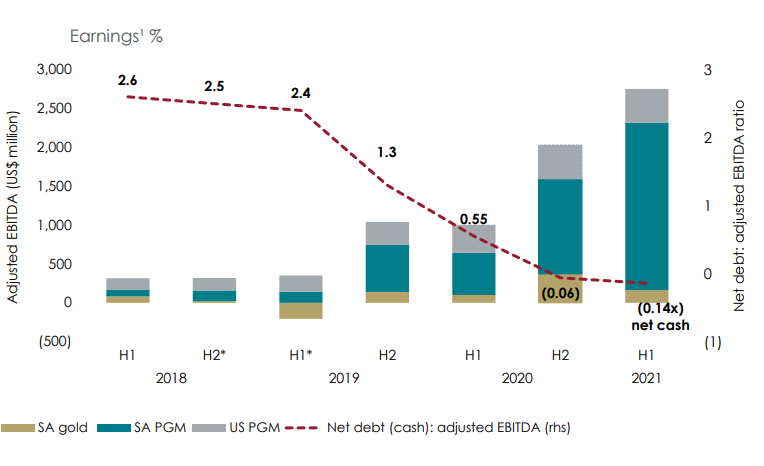

Earning contribution of the company, according to the item it produces is displayed in the below graph. Gold contributes the smallest percentage in the total earnings, the company is still one of the major gold producers globally.

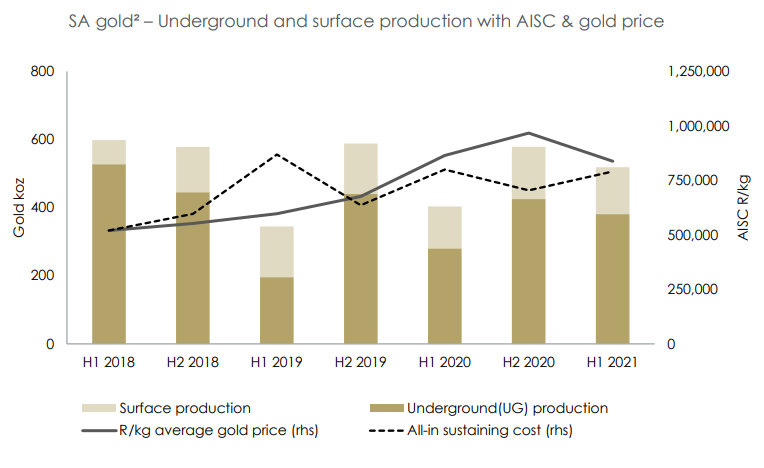

The below graph shows the production of gold in Koz, over the past years along with the value of the commodity produced by the company.

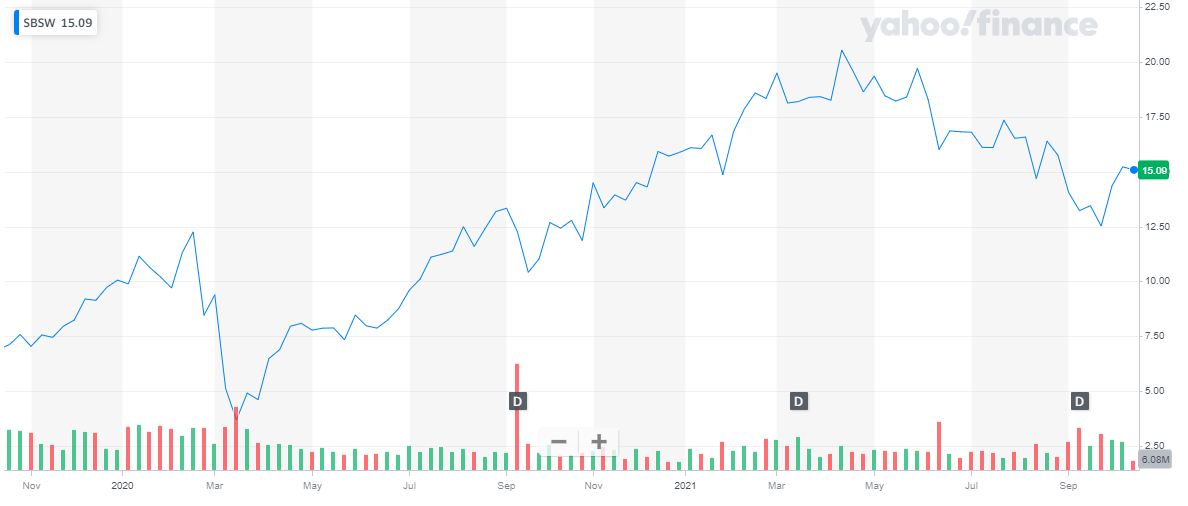

Sibanye- Stillwater Limited has a market valuation of around $11 billion. Its stock is currently trading at $15. Since the pandemic crisis, when the stock dropped to the lowest of $3.5, the stock has come a long way. It not only has recovered from the market crash but has shown tremendous improvement. Within the current year, the stock peaked at $20.

Sibanye- Stillwater Limited has a market valuation of around $11 billion. Its stock is currently trading at $15. Since the pandemic crisis, when the stock dropped to the lowest of $3.5, the stock has come a long way. It not only has recovered from the market crash but has shown tremendous improvement. Within the current year, the stock peaked at $20.

Sibanye-Stillwater is expanding and diversifying its business. It has recently invested in a lithium hydroxide project in Finland. With the acquisition of a 30% shareholding in Keliber Oy in February 2021 by acquiring a 30% stake in the company. With the current year showing a 63% increase in revenue as reported in its half-year report and interim dividend declared at $2.92/share, Sibanye-Stillwater is attracting a lot of investor attention and an excellent buy amongst gold stocks. Get to know about bonds vs stocks – where to invest.

Sibanye-Stillwater is expanding and diversifying its business. It has recently invested in a lithium hydroxide project in Finland. With the acquisition of a 30% shareholding in Keliber Oy in February 2021 by acquiring a 30% stake in the company. With the current year showing a 63% increase in revenue as reported in its half-year report and interim dividend declared at $2.92/share, Sibanye-Stillwater is attracting a lot of investor attention and an excellent buy amongst gold stocks. Get to know about bonds vs stocks – where to invest.

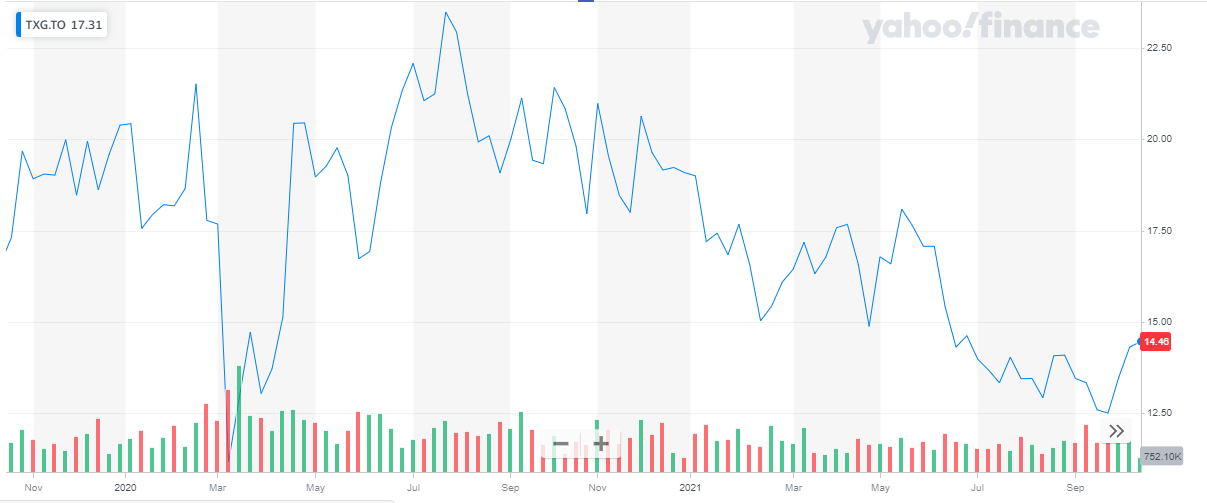

Torex Gold Resources Inc. (TORONTO: TXG.TO)

Torex Gold is a leading Canadian intermediate gold producer engaged in mining, developing and exploring our 29,000-hectare Morelos Gold Property in the highly prospective Guerrero Gold Belt in Mexico. Torex currently is Mexico’s second-largest gold producer.

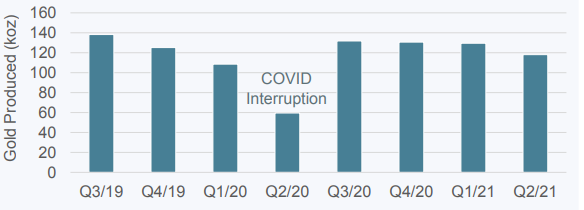

In its recent second-quarter report, the company reported $206 in revenues, an approx. 100% increase year-on-year. Total gold production has been 118,054 oz of gold during the quarter.

The gold production in Koz of Torex, over the past few years, is shown in the below graph:

Torex Gold Resources Inc is currently valued at CAD 1.2 billion. The stock of the company is currently trading at CAD 14.46.

Torex Resources has shown excellent earnings growth over the past few years. Also, its cash generation and holdings are strong. In the second quarter of 2021, the company reported cash flow from operations of $82M and free cash flow of $22M. for investors earnings growth and cash flows is a positive sign for expected future growth, making it an excellent gold stock for investment now.

Torex Resources has shown excellent earnings growth over the past few years. Also, its cash generation and holdings are strong. In the second quarter of 2021, the company reported cash flow from operations of $82M and free cash flow of $22M. for investors earnings growth and cash flows is a positive sign for expected future growth, making it an excellent gold stock for investment now.

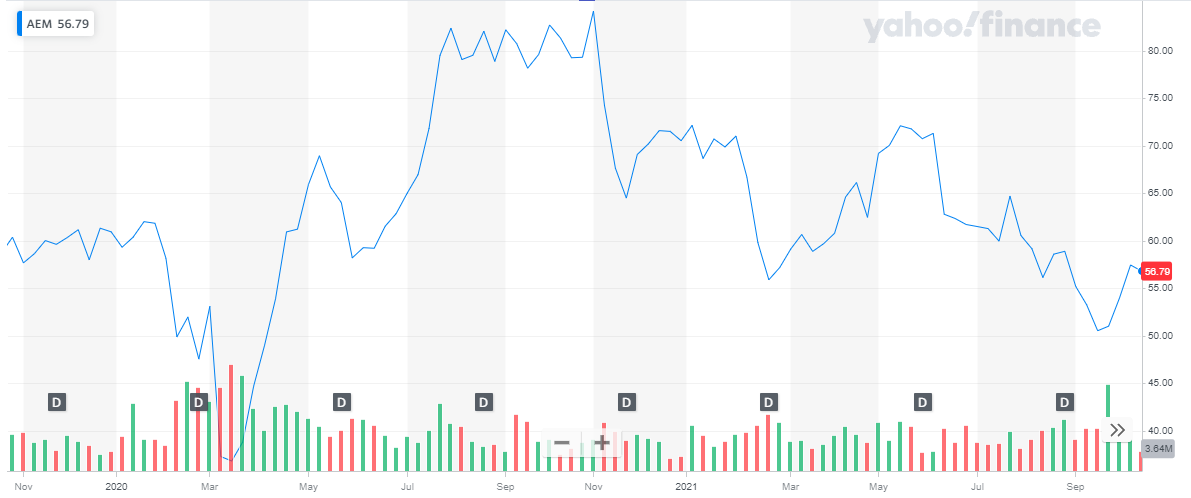

Agnico Eagle Mines Limited (NYSE: AEM)

Agnico Eagle Mines Limited (NYSE: AEM)

Agnico Eagle is a senior Canadian gold mining company that has produced precious metals since 1957. The company plans to spend more on exploration and take advantage of the opportunities of the existing mines. The company’s focus is on growth.

In its recent second-quarter report, the company reported a quarterly net income of $189.6 million, an 81% increase from last year’s second quarter. These high earnings were due to higher mine operating margins (from higher sales volumes and higher realized metal prices) and lower losses in non-cash items related to mark-to-market adjustments on financial instruments owned. Also, this quarter reported gold production of 500,698 ounces. The company’s total payable gold production was a record 1,005,243 ounces for the first half of 2021. This is primarily due to strong performance at the Company’s key mines, including higher than forecast tonnage and grade at the LaRonde Complex and higher than the expected grade at the Meliadine mine. A quarterly dividend of $0.35 per share has been declared

The market capitalization of Agnico Eagle Mines Limited currently stands at $13.9 billion. Its stock is trading at $57.

The sound operational platform and stable financial position of the company enable the company to increase its exploration spending in 2021 and advance its pipeline of development projects. This leads to excellent growth in the coming years, making it a perfect stock for investment now.

The sound operational platform and stable financial position of the company enable the company to increase its exploration spending in 2021 and advance its pipeline of development projects. This leads to excellent growth in the coming years, making it a perfect stock for investment now.

Conclusion

The best gold mining companies have a low-cost system, low debt levels, and have less involvement in risky projects related to mining precious metals. In addition to mining companies, gold streaming companies are also suitable as they benefit from rising gold prices without the risks associated with the mining process. With the above list of companies, investors can get a good idea of which gold company stock to invest in now.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading: