The energy industry is an important part of the global economy. The sector of the economy is highly correlated with the global economy. However, the energy sector is experiencing huge changes. The sector which was dominated by the oil and gas companies is now being replaced by clean energy alternatives like solar, wind, and fuel cell technologies. Stock trading advisory websites help investors make the right financial decisions.

The emergence of clean energy sources has brought new investment opportunities to the horizon. Moreover, with the world’s dominant players shifting toward clean energy sources, this sector has just become more appealing to investors.

The market is expected to grow at a CAGR of 8.3% and is anticipated to reach around $ 1911 million by 2026.

Before diving into the best clean energy stocks, let’s discuss what are the pros and cons of investing in Clean Energy Stocks:

Pros of Investing in Clean Energy Stocks

- Clean Energy Sources are better for the environment. Unlike traditional energy sources, there is no harmful emission of greenhouse gases. Using clean energy sources reduces the effects of climate change

- Renewable Energy Sources are more reliable. Oil and Gas are available in limited supply on earth. Whereas, clean energy sources like solar, wind, and water, can never run out. Oil stocks are one of the riskier yet most profit-generating sectors.

- It contributes toward conserving natural resources. With the shift of energy generation towards renewable resources, natural resources will not be used. Therefore, clean energy sources help conserve natural resources for future generation.

- Multiple sources of clean energy. We are not limited to any specific source of clean energy source, as there are many:

- Solar Energy

- Wind Energy

- Geo-Thermal Energy

- Hydropower

- Biomass

- A huge reduction in energy bills. Not only that, the excess energy generated can be sold and earned money. If you are seeking a steady stream of income, you should invest in REIT stocks.

Cons of Investing in Clean Energy Stocks

- The very high initial cost of setup – To set up solar panels, wind turbines, and other renewable technology can get very expensive. Get to know the best tech stocks to invest in now.

- Limitations to every source of clean energy. Every source of clean energy has its set of limitations.

- Hydropower is dependent upon water. Hence in case of drought, there will be no water for energy generation

- Wind power is dependent upon the wind.

- Solar Energy requires the availability of the sun for a specific number of hours. Not every country has enough sunlight to use for power generation.

This limitation coupled with certain geographic limitations can limit the usefulness of clean energy sources.

- Renewable energy is difficult to store. Unlike energy generated from natural resources which are burned according to demand. Sun, water, or wind cannot be stored for later use.

Get to know about top Infrastructure stocks to invest.

Top Clean Energy Stocks to Invest in 2024

Despite all these limitations, the world is shifting towards cleaner energy sources. Here we have listed the top clean energy stocks to invest in 2024:

| Sr. | Company Name | Symbol | Price (As of 20th May 2022) | Market Capitalization |

| 1 | General Electric | GE | $ 75.25 | $ 82.8 billion |

| 2 | Emerson Electric | EMR | $ 83.64 | $ 49.67 billion |

| 3 | Enphase Energy | ENPH | $ 168.25 | $ 22.72 billion |

| 4 | SolarEdge Technologies | SEDG | $ 256.81 | $ 14.22 billion |

| 5 | Plug Power | PLUG | $ 16.45 | $ 9.51 billion |

| 6 | First Solar | FSLR | $ 65.77 | $ 7 billion |

| 7 | Clearway Energy | CWER | $ 32.71 | $ 6.44 billion |

| 8 | Renewable Energy Group | REGI | $ 61.44 | $ 3.1 billion |

| 9 | SunPower Corporation | SPWR | $ 16.6 | $ 2.88 billion |

| 10 | Canadian Solar | CSIQ | $ 29.39 | $ 1.88 billion |

General Electric

General Electric Company is a high-tech industrial company that operates worldwide through its four segments:

- Aviation

- Healthcare

- Renewable Energy

- Power

General Electric has a vast presence in the global clean-energy revolution. One-third of the world’s power is created by GE and 90% of power transmission utilities worldwide are equipped with our technology. The world’s largest installed base of nearly 38,000 commercial aircraft engines is powered by GE and our partners. Semiconductor stocks are one of the best investment opportunities.

For the first of 2022, GE reported:

- Revenues of $ 17 billion

- Aviation contributed $ 5.6 billion

- Healthcare contributed $ 4.4 billion

- Renewable Energy contributed $ 2.9 billion

- Power contributed $ 3.5 billion

- Net loss was reported to be $ 809 million

- Loss per share was reported at $ 0.74

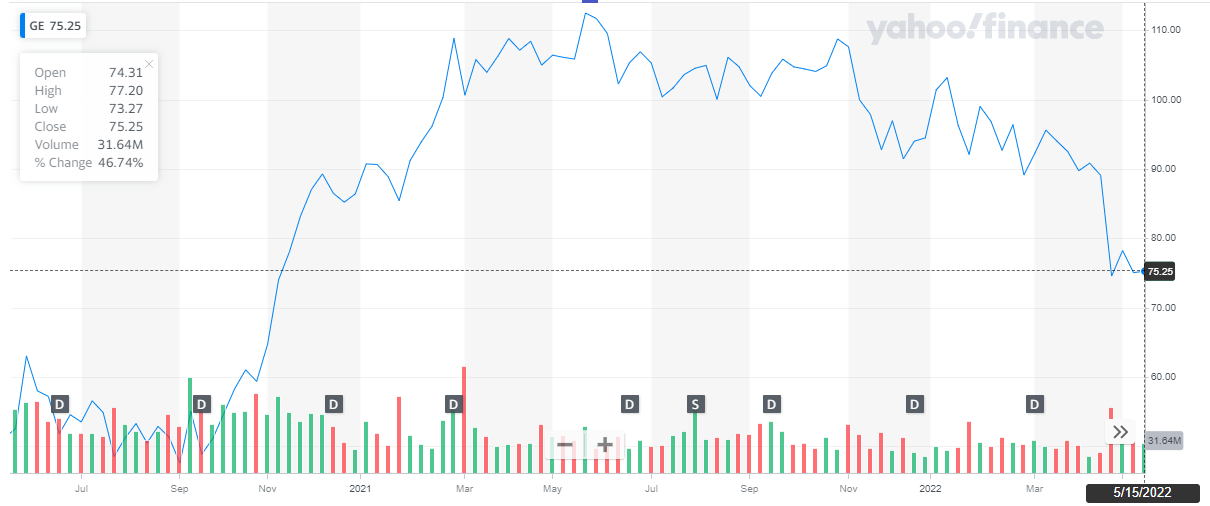

GE has a market capitalization of around $ 83 billion. The share of GE is trading a $ 75.25. The below chart shows the past two-year performance of GE stock. After suffering a huge blow in 2020, the GE stock sustained the low price, trading under $ 50, for the major part of 2020. The stock started accelerating in the last quarter of 2020 and peaked at $ 112. The stock stayed above $ 100 for the major part of 2021. During the current year, the stocks experienced a slight drop but the GE stock managed to stay above $ 90, to date.

We also have covered best ETFs to buy in all categories.

We also have covered best ETFs to buy in all categories.

Emerson Electric

Emerson Electric is a technology and engineering company that provides various solutions for customers in industrial, commercial, and residential markets in the Americas, Asia, the Middle East, Africa, and Europe. The company operates through Automation Solutions, and Commercial & Residential Solutions segments. Penny stocks are also one of the best investment opportunities.

Emerson works with major energy providers in the North and South Americas to remotely centralize operations of geographically dispersed renewable sources Their innovative platform helps the energy providers to securely connect potentially hundreds of renewable energy sources into one center.

Emerson Electric recently reported their second-quarter earnings report for 2022:

- Net Sales were $ 4.8 billion, an increase of 8 percent from last year

- GAAP earnings per share were $1.13, an increase of 22 percent from last year

- Declared a quarterly cash dividend of $0.515 per share

Emerson Electric has a market valuation of around $ 50 billion. The share of the company is currently trading at $ 83.64. The below chart shows the stock performance of Emerson Electric for the past two years.

After the pandemic-led crisis, the stock of the company suffered a lot and took time to recover. Gradually the stock continued to rise and peaked at $ 105.38 in August 2021. During the current year, the stocks started trading at $ 92.97 and have declined by 10% to date.

Get to know best vaccine stocks to invest in now.

Get to know best vaccine stocks to invest in now.

Enphase Energy

Enphase transformed the solar industry with its revolutionary microinverter technology. This inverter has been designed to convert sunlight into a safe and scalable source of energy in addition to it, they also manufacture microinverters that work with virtually every solar panel made. Enphase Energy also has smart battery technology which contributes to offering the industry’s best performing clean energy system. Investors are now looking for the finest solar energy stocks to invest in.

Enphase recently shared its quarterly report for the year 2022:

- Record quarterly revenue of $441.3 million

- GAAP net income of $51.8 million

- GAAP diluted earnings per share of $0.37

During the quarter the company shipped, approximately 2,838,693 microinverters, or 1,029 megawatts DC, and 120.4-megawatt-hours of Enphase IQ Batteries.

Enphase Energy has a market valuation of $ 22.7 billion. The share of the company is trading at $ 168.25. The below chart shows the performance of Enphase Energy stock for the past two years. The stock peaked at $ 267.74 in Nov’21. The stock started in the year 2022 at a price of $ 182.94. Despite being volatile, the stock has almost maintained its price level with a slight decline of 7 %.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

SolarEdge Technologies

SolarEdge is a global leader in smart energy technology. The company designs develop and sell direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations worldwide. It operates through five segments: Solar, Energy Storage, e-Mobility, Critical Power, and Automation Machines. Get to know the list of crypto mining companies that are leading the industry.

The Company’s products include SolarEdge Power Optimizer, SolarEdge Inverter, StorEdge Solutions, and SolarEdge Monitoring Software. SolarEdge offers inverters, power optimizers, communication devices, and smart energy management solutions used in residential, commercial, and small utility-scale solar installations; and a cloud-based monitoring platform that collects and processes information from the power optimizers and inverters, as well as monitors and manages the solar PV system

In the last earnings report for the year 2021, the company reported:

- Record revenues of $1.96 billion, an increase of 34.6% from 2020

- Record revenues from a solar segment of $1.79 billion

- Record GAAP net income of $169.2 million

- Record GAAP net diluted earnings per share of $3.06

Solar Edge has a market valuation of $ 14.2 billion. Its share is trading at a price of $ 256.81. the below chart shows the stock performance of Solar Edge for the past two years. The share has been very volatile in the past two years. In 2021 and 2021, the stock crossed $ 350. During the current year, the stock started off at $ 280 and has depreciated by roughly 9 %.

Learn about head and shoulders patterns trading guide.

Learn about head and shoulders patterns trading guide.

Plug Power

Plug Power is building the hydrogen economy as the leading provider of comprehensive hydrogen fuel cell turnkey solutions. Plug Power created the first commercially viable market for hydrogen fuel cell technology. As a result, the Company has deployed over 40,000 fuel cell systems for e-mobility, more than anyone else in the world, and has become the largest buyer of liquid hydrogen, having built and operated a hydrogen highway across North America. The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

The company recently announced its first-quarter result for 2022:

- Revenue was $140.8 million, as compared to $72 million for the first quarter of 2021

- Net loss was reported at $ 156 million, owing to a huge cost of sales

- Net loss per share has been reported at $ 0.27

Plug Power has a market valuation of $ 9.5 billion. Its share is currently trading at a price of $ 16.45. The below chart shows the stock performance of Plug Power. During the last quarter of 2020, the stock of Plug Power picked up a bullish trend. This trend continued till the stock peaked at $ 66.87 in Jan 2021. After hitting the peak, the stock price dropped. The stock entered the year 2022 at a price of $ 28.23. To date, the stock has depreciated by 41% in the current year.

Check our updates for NASDAQ Forecast.

Check our updates for NASDAQ Forecast.

First Solar

First Solar, Inc. provides photovoltaic (PV) solar energy solutions in the United States, Japan, France, Canada, India, Australia, and internationally. The company designs manufacture and sells cadmium telluride solar modules that convert sunlight into electricity. It serves developers and operators of systems, utilities, independent power producers, commercial and industrial companies, and other system owners.

The company recently shared its first-quarter report for the year 2022:

- Net Sales of $ 367 million

- Operating loss of $ 43 million

- Net loss per share of $ 0.41

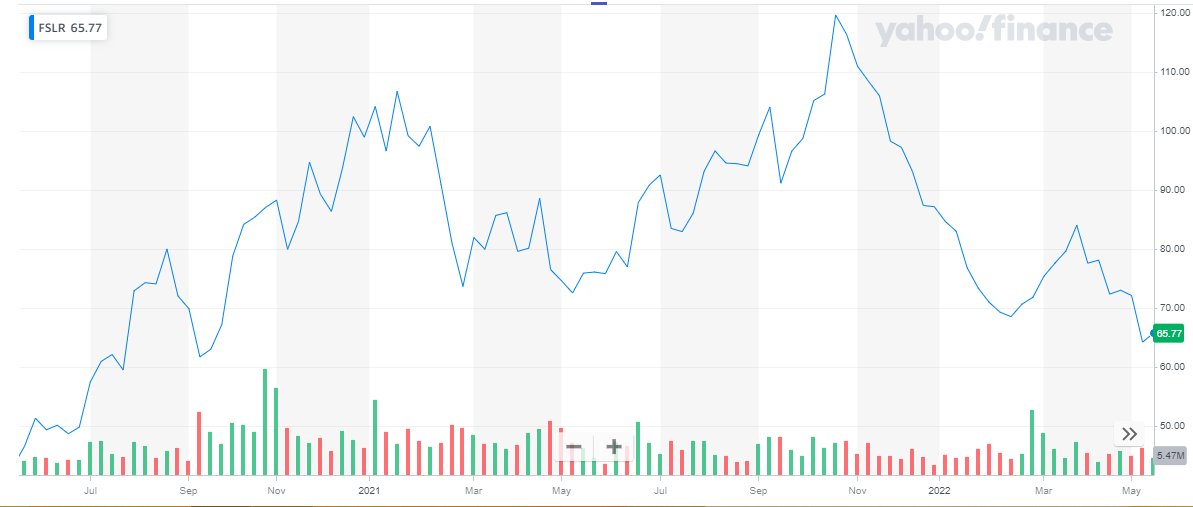

First Solar has a market valuation of $ 7 billion. The share of the company has a market price of $ 65.77. The below chart shows the past two-year performance of First Solar stock. The stock of the company has been volatile in the past two years. In 2021, the stock peaked at $ 119.59 and after depreciating by 12 % it closed at $ 87.16.

Also read:

Also read:

Clearway Energy

Clearway Energy is engaged in the renewable energy businesses in the United States. It had approximately 5,000 net megawatts (MW) of installed wind and solar generation projects. The Company has over 7,500 net MW of assets and also includes approximately 2,500 net MW of environmentally sound, highly efficient natural gas generation facilities.

The company recently published its first-quarter results for 2022:

- Net Loss of $ 97 million

- Cash from Operating Activities of $93 million

Clearway energy is a $ 6.44 billion company. Its share is currently trading at a price of $ 32.71. The below chart shows the stock performance of the company in the past two years. The company’s share has been volatile in the past two years with multiple peaks and trenches.

In 2021, the stock appreciated by 13%. During the current year, the stock has declined by almost 12% to date.

Also read: Best Stocks for Covered Calls in 2024.

Also read: Best Stocks for Covered Calls in 2024.

Renewable Energy Group

Renewable Energy Group is a biodiesel production company. It produces and trades biofuel and renewable chemicals. It operates through Bio-Based Diesel, Services, and Corporate and Other segments.

The company recently published its first-quarter report for the year 2022:

- Revenues of $936 million

- Net income of $12 million

Renewable Energy Group has a market capitalization of $ 3.1 billion. Its share is trading at a price of $ 61.4 billion. The below chart shows the stock performance of renewable energy for the past 2 years. The stock peaked at $ 108.93 in Feb 2021. Since then, the stock has been on a downward trend. During the current year, the current year the stock shifted directions and has appreciated by 44 % to date.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

SunPower Corporation

SunPower Corporation, a solar technology and energy services provider, offers solar, storage, and home energy solutions to customers primarily in the United States and Canada. It operates through Residential, Light Commercial; Commercial and Industrial Solutions; and others segments. Also learn about Best Day Trading Stocks

The company recently shared its first-quarter report for the year 2022:

- Non-GAAP revenue of $ 336 million, a 41% year-over-year growth

- Non-GAAP net income per share of $ 0.02

- Added 16,500 new customers, representing 40% year-over-year growth

The company’s market valuation is $ 2.89 billion. The company’s stock is currently trading at a price of $ 16.6. The below chart shows the stock performance of SunPower corporation for the past two years. The company’s stock peaked at $ 54.01 in January 2021. During the year 2021, the stock depreciated by 19 %. In 2022, the stock has depreciated by 20 % to date.

Investing in value stocks is a long-term investment.

Investing in value stocks is a long-term investment.

Canadian Solar

Canadian Solar Inc. designs, develops, manufactures, and sells solar ingots, wafers, cells, modules, and other solar power and battery storage products in Asia, the Americas, Europe, and internationally. The company operates through two segments:

- Canadian Solar Inc. – It offers standard solar modules and battery storage solutions, as well as solar system kits that are ready-to-install packages comprising inverters, racking systems, and other accessories; and engineering, procurement, and construction (EPC) services.

- Solar and Global Energy – It is engaged in the development, construction, maintenance, and sale of solar and battery storage projects; operation of solar power plants; and sale of electricity.

In the 2021 earnings report, the company reported:

- Net revenues of $ 5.3 billion

- Net Income of $ 109 million

- Earnings per share of $ 1.46

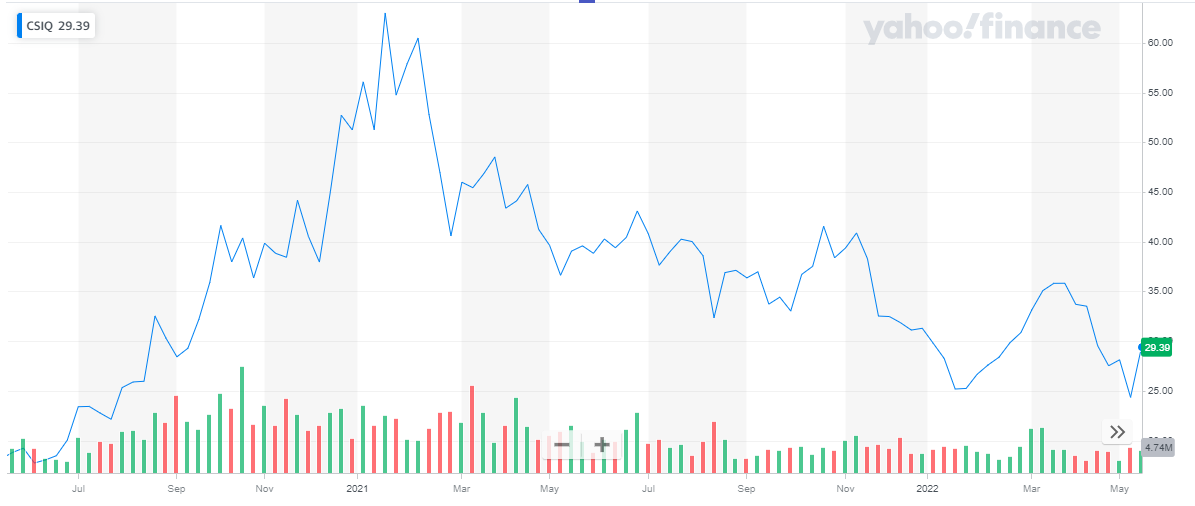

Canadian Solar has a market capitalization of $ 1.89 billion. The share of the company is currently trading at $ 29.39. The below chart shows the stock performance of the company for the past two years. The stock peaked at $ 63 in early 2021. In 2021, the stock depreciated by 39 %. During the current year, the stock started off at $ 31.29 and has depreciated by 6 % to date.

Also check out: List of Most Volatile Stocks

Also check out: List of Most Volatile Stocks

CONCLUSION

Because of the overall economy’s focus on clean energy and the increasing profitability of the respective companies, the clean energy sectors have become a lucrative investment option. There is no denying the fact that this sector continues to grow. And the growth is primarily attributed to government backing and support for this sector.

The best time to benefit from a growing sector like this is when the profits start increasing. Therefore, the clean energy sector is currently an excellent investment opportunity.

You may also like reading: