In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

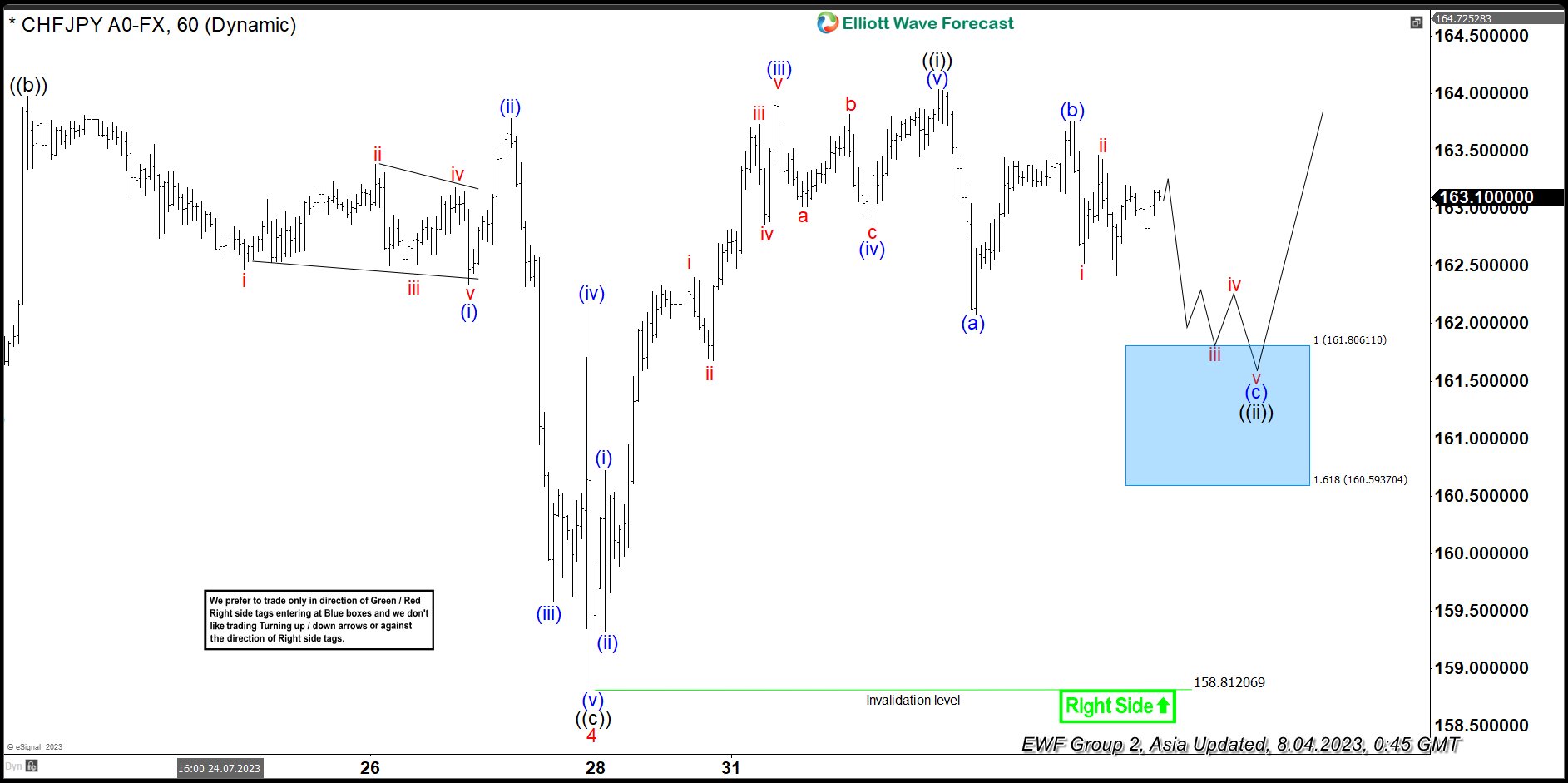

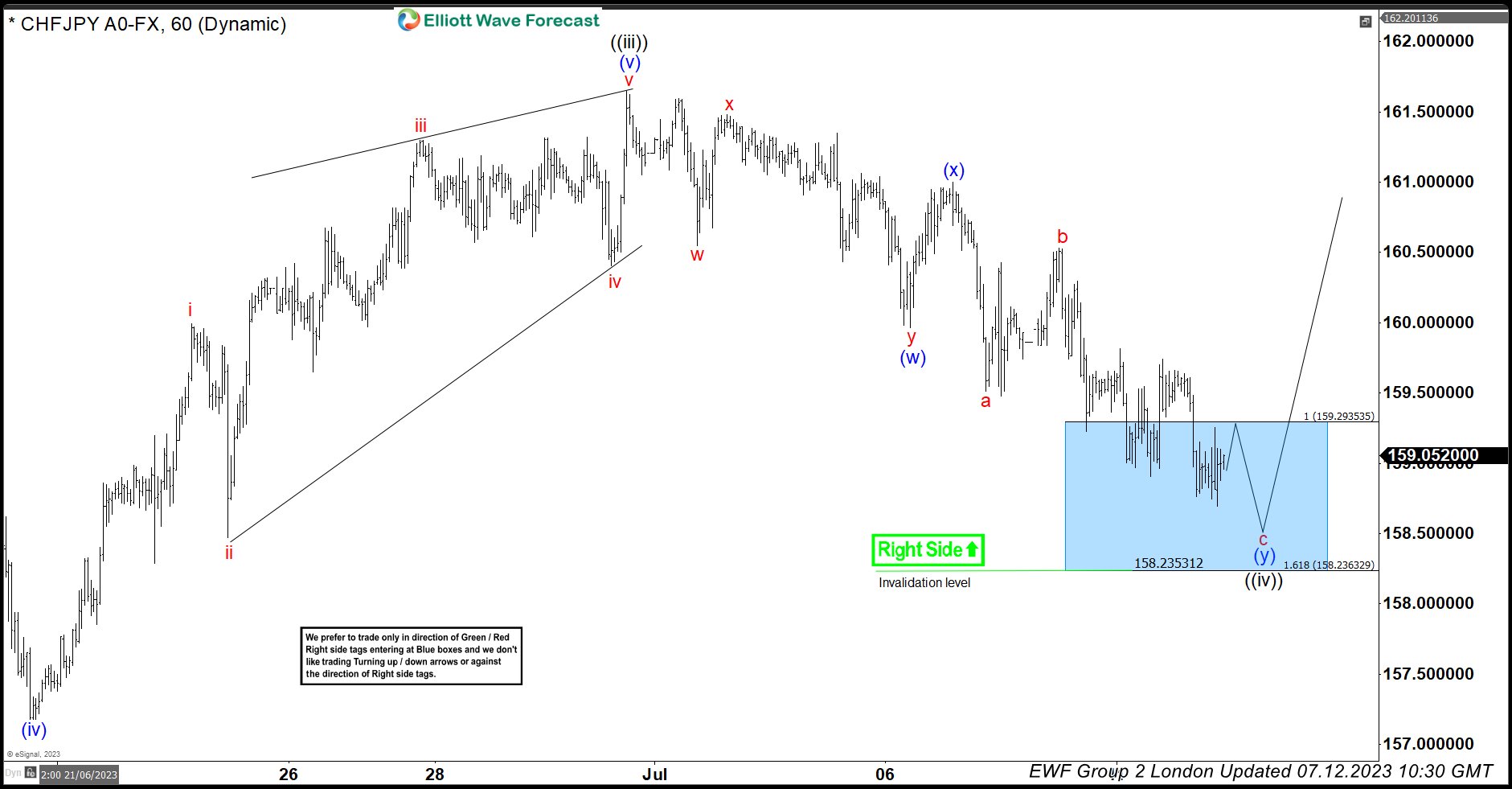

CHFJPY Pullbacks Are Expected To Remain Supported

Read MoreCHFJPY short term pullback from the peak are expected to remain supported in 3, 7 or 11 swings. This article and video look at the Elliott Wave path.

-

GBPJPY 3 Wave Pullback Coming After ending Impulse Rally

Read MoreGBPJPY the impulse rally from 7/28/2023 low is coming to an end & the pair is due a 3 wave pullback. This article and video look at the Elliott Wave path.

-

Elliott Wave View: GBPUSD Zigzag Correction in Progress

Read MoreGBPUSD is looking to correct lower as a zigzag and can see further downside. This article and video look at the Elliott Wave path

-

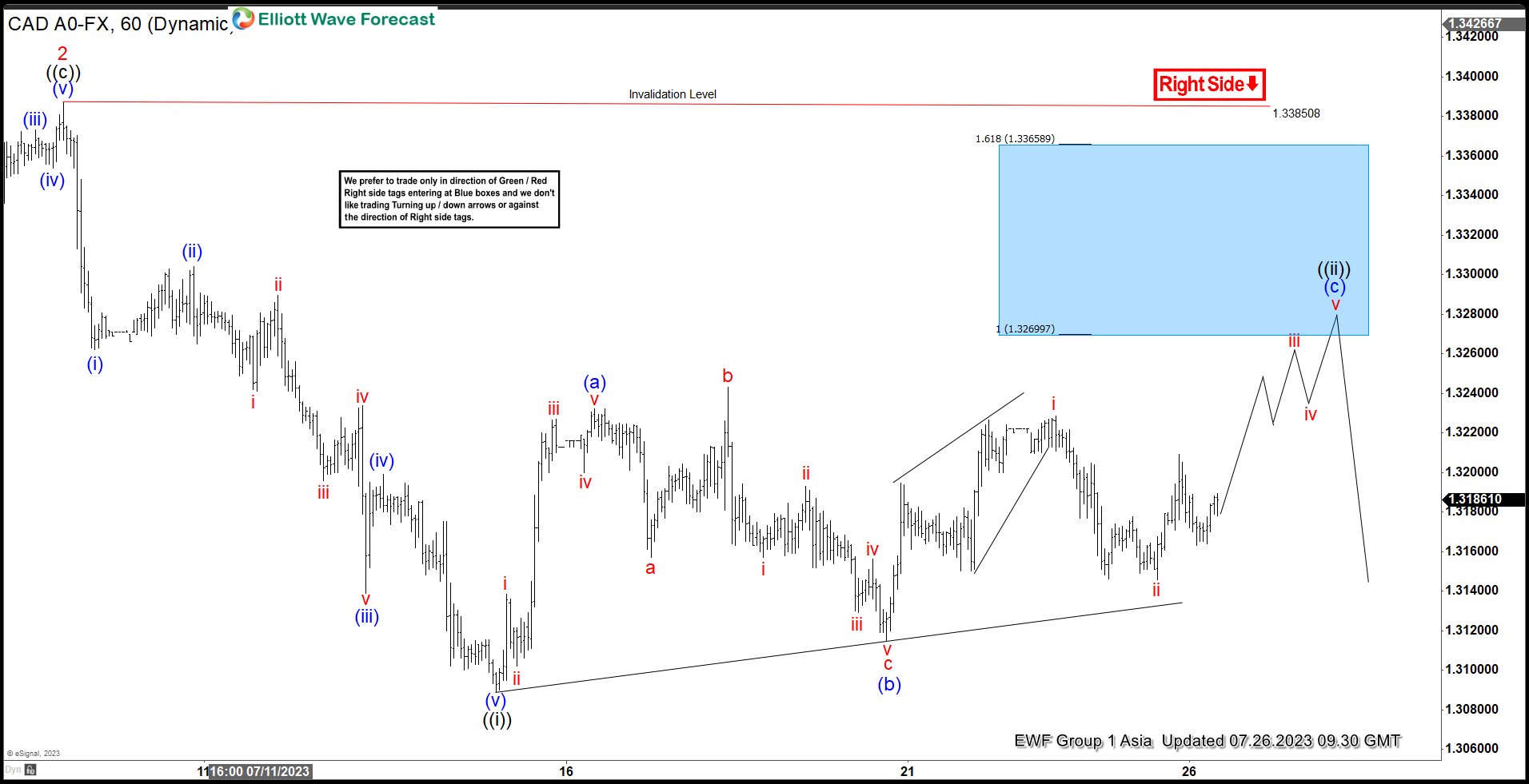

Elliott Wave View: USDCAD Rally Expected to Fail

Read MoreUSDCAD rallies to correct cycle from 7.7.2023 high as a zigzag. This article and video show where rally should fail and sellers should appear.

-

CHFJPY Strong Rally From The Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of CHFJPY charts. The pair provided a buying opportunity in the blue box area.

-

Short Term Any Breakout Of The Rupees (USDINR) Should Be False

Read MoreThe Indian rupee (USDINR) is the official currency of India. The rupee is subdivided into 100 paise (singular: paisa), though as of 2022, coins of denomination of 1 rupee are the lowest value in use whereas 2000 rupees is the highest. Quarterly USDINR Log Chart December 2022 In the quarterly log chart, we could see USDINR is building an impulse since 1970. Wave […]