Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Updated Canopy Growth Corporation ($CGC) 4H Forecast

Read MoreGood day Traders and Investors. In today’s article, we are going to follow up on Canopy Growth Corporation ($CGC) forecast posted back in April 2022 and take a look at the latest 4H count. You can find the article here: https://elliottwave-forecast.com/stock-market/canopy-growth-corporation-cgc-lucrative-investment/ Company Profile: “Canopy is a global, best-in-class cannabis company and CPG organization with the intention […]

-

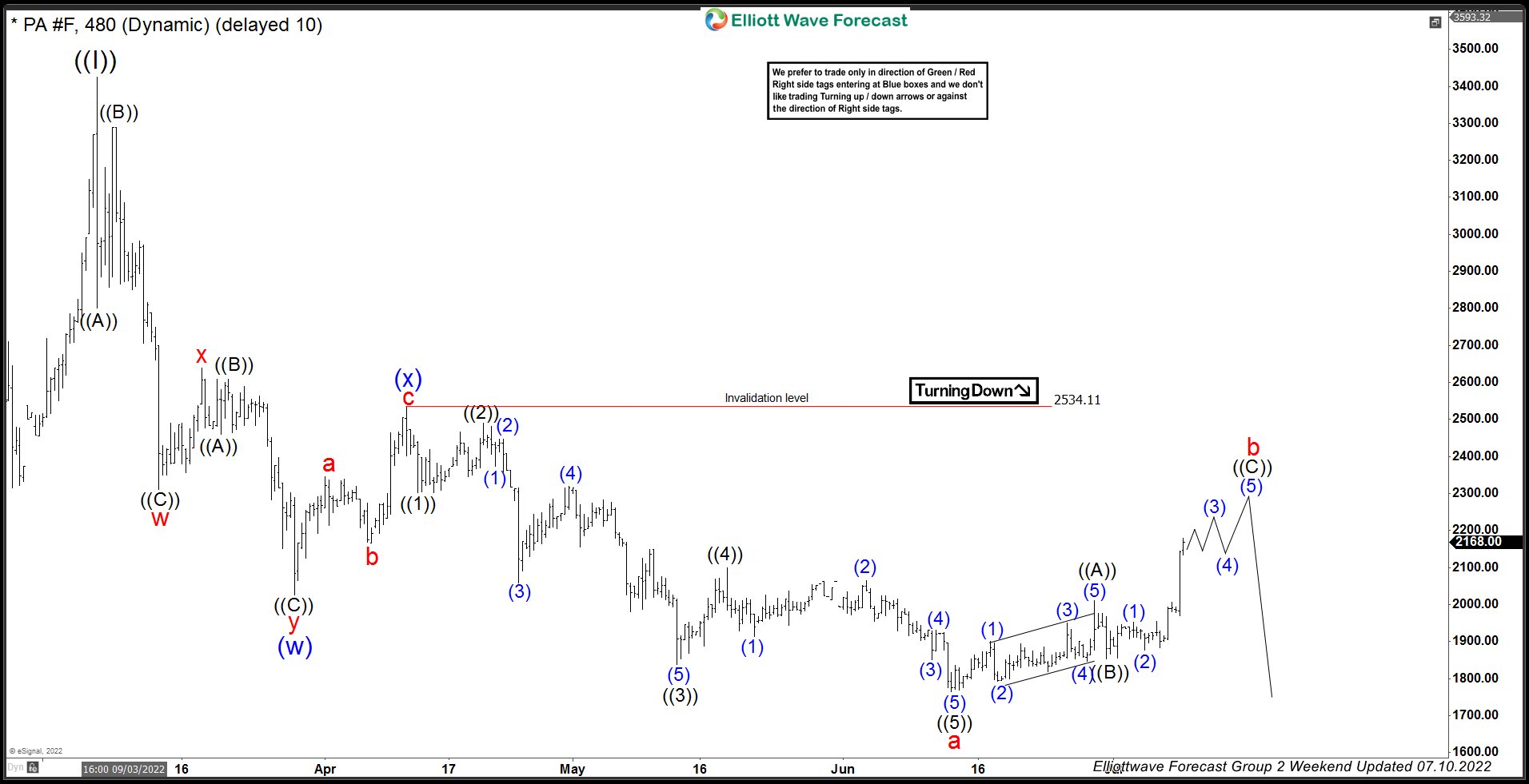

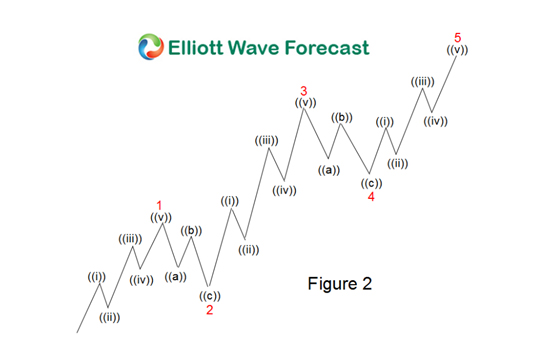

Palladium ( $PA_F ) Forecasting The Decline After Elliott Wave Zig Zag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Palladium ( $PA_F ) . As our members know, Palladium is showing incomplete bearish sequences in the cycle from the March peak (3425). Recently the commodity has given us 3 waves bounce against the 2354 […]

-

What Is Relative Strength Index (RSI) and Why Traders Use It?

Read MoreThe Relative Strength Index (RSI) is a very popular momentum based indicator that is specifically used within technical analysis by market technicians. It measures the speed and magnitude of an instruments most recent price changes to evaluate overbought or oversold conditions in the price. Developed by J.Welles Wilder Jr in the late 70s as a […]

-

Has ARK Invest ($ARKK) Bottomed or More Downside?

Read MoreSummary of the Fund: ARK Invest (ARKK) is an actively managed Exchange Traded Fund (ETF). It seeks long-term growth of capital by investing in domestic and foreign equity securities of companies that are relevant to the Fund’s investment theme of disruptive innovation. ARK defines ‘‘disruptive innovation’’ as the introduction of a technologically enabled new product […]

-

Fundamental Analysis vs Technical Analysis

Read MoreThere are two main types of analysis. Fundamental or technical analysis. Fundamental analysis studies factors that consist of macroeconomic and global events, individual country’s economy. Use data such as inflation numbers, interest rates, CPI reports, employment and unemployment rate and political conditions of the individual country. Technical analysis purely looks at the charts. Historical price […]

-

Will Rising Interest Rates Affect Real Estate?

Read MoreGood Day Traders and Investors. In this technical blog we are going to take a look at the Elliott Wave path in The Real Estate ETF (IYR). We will also help answer the question that many ask which is whether the Real Estate market is going to crash due to the Fed hiking rates. The […]