What is Uranium?

Uranium is a heavy metallic element that has been used as a reliable source of energy for many years. It is naturally found in the Earth’s core. Uranium is of very high value. Despite the high value, it is found abundantly in Earth’s core.

Its value can be identified from the fact that one kilogram of uranium can generate energy that is equivalent to the production capability of about 1,500 tons of coal. Semiconductor stocks are also one of the best investment opportunities.

Highest Uranium Producing Countries

The top 10 countries that produce uranium are:

- Kazakhstan

- Canada

- Australia

- Niger

- Namibia

- Russia

- Uzbekistan

- China

- USA

- Ukraine

Get to know about top Infrastructure stocks to invest in.

Factors Affecting Demand for Uranium

Uranium has become increasingly popular because of the rise in the nuclear energy industry. It plays a vital role in the production of nuclear energy which is expected to fuel the future energy demands. Because of its high value and increasing demand, there are a few factors that highly affect the price of Uranium. These factors are:

- Nuclear Power Demand – The increase in the demand for nuclear power as an alternative to fossil fuel is rising the demand for nuclear power. As more and more nations are shifting to greener methods for energy generation, the nuclear energy industry is gaining traction worldwide.

- Rising prices of fossil fuels – The price of fossil fuels like coal and natural gas has also been triggering the increased demand for Uranium. As the price of fossil fuels increases people seek alternative options like uranium as a source of energy. Investors always choose the best brokers that better suits his/her trading goals.

Since the start of 2022, there have been announcements from countries like the United States, the United Kingdom, France, South Korea, and Belgium. These countries are focusing on preserving and expanding the life of their existing reactor fleets as well as on building new reactors. There is also momentum building for non-traditional commercial uses of nuclear power around the world such as the development of small modular reactors and advanced reactors, with numerous companies and countries pursuing projects. Investing in Long-term stocks involves building wealth over a long period.

Best Uranium Stocks for Investment in 2024

In order to invest in Uranium stocks, below we have listed 10 Uranium stocks that are a good buy today.

| Sr. | Company Name | Symbol | Market Cap | Price (As of 9th June 2022) |

| 1 | Cameco | CCJ | $ 10.4 billion | $ 27.31 |

| 2 | NexGen Energy | NXE | $ 2.3 billion | $ 5.04 |

| 3 | Uranium Energy | UEC | $ 1.14 billion | $ 4.47 |

| 4 | Energy Fuels | UUUU | $ 1.108 billion | $ 7.18 |

| 5 | Denison Mines | DNN | $ 1.014 billion | $ 1.33 |

| 6 | Centrus Energy (LEU) | LEU | $ 678.7 million | $ 46.84 |

| 7 | Uranium Royalty Corp (UROY) | UROY | $ 216.7 million | $ 2.21 |

| 8 | Ur-Energy Inc. (URG) | URG | $ 286.9 million | $ 1.27 |

| 9 | Westwater Resources Inc (WWR) | WWR | $ 54.3 million | $ 1.15 |

| 10 | Rio Tinto | RIO | $ 89.1 billion | $ 54.97 |

Cameco ( NYSE : CCJ )

Cameco ( NYSE : CCJ ) is one of the largest global providers of the fuel needed to energize a clean-air world. For three decades, Cameco has been safely and reliably producing uranium and nuclear fuel products to generate electricity at the world’s nuclear reactors. Oil stocks are one of the riskier yet most profit-generating sectors.

Cameco has interests in tier-one mining and milling operations that have the licensed capacity to produce more than 30 million pounds (our share) of uranium concentrates annually, backed by more than 464 million pounds (our share) of proven and probable mineral reserves. The company is also the leading supplier of uranium refining, conversion, and fuel manufacturing services. Cameco proudly owns Canada’s largest employers of Indigenous people, and land holdings are spread around 2.1 million acres.

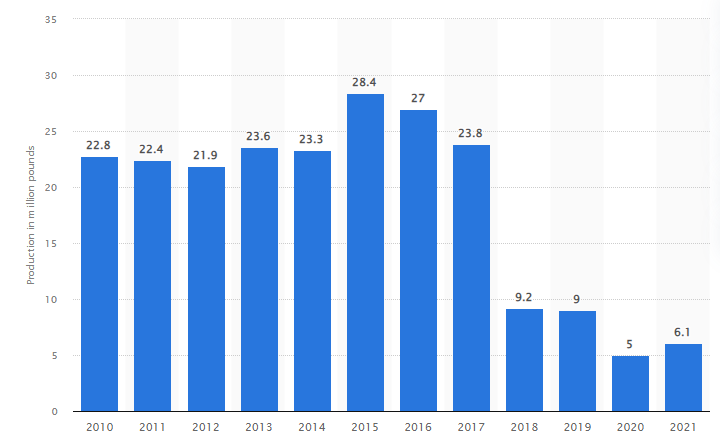

The below chart shows the production volume of Uranium by Cameco:

Cameco reported its consolidated financial and operating results for the first quarter ended March 31, 2022.

- Net earnings of $40 million

- Cash and cash equivalents and short-term investment of $ 1.5 billion

There has been a significant pipeline of contract discussions in a strengthened price environment. Since the beginning of 2022, the company has been successfully adding 40 million pounds to its portfolio of long-term uranium contracts.

Cameo has a market capitalization of over $ 10 billion. The stock of Cameo has been on a bullish trend for the past two years. The below chart shows the stock performance for the past two years.

During the year 2021, the stock rose from $ 13.4 to $ 21.81, representing a 63 % increase.

In 2022, the stock started at $ 21.87 and peaked at $ 31.41. To date, the stock has appreciated by approx. 20 %.

Also read Best Stocks for Covered Calls in 2024.

Also read Best Stocks for Covered Calls in 2024.

NexGen Energy ( NYSE: NXE )

NexGen Energy ( NYSE: NXE ) is a Canada-based company which is focused on being the largest low-cost producer of uranium, globally, all the while incorporating the highest levels of environmental and social governance. If you are seeking a steady stream of income, you should invest in REIT stocks.

Canada is the world’s second-largest producer of uranium, with approximately 13% of global production. NextGen Energy is amongst the active mining companies.

The Company has a strong portfolio of highly prospective projects:

- Rook I – was discovered in 2014. It is one of the most attractive Uranium assets in development

- South Arrow – was discovered in 2017.

- Harpoon – discovered in 2016

- Bow – discovered in 2015

- Cannon area – discovered in 2016

NextGen reported a financial report for the three months ending March 31, 2022:

- Net Loss of CAD 31.2 billion

- Loss per share CAD 0.05

NexGen Energy has a market capitalization of around $ 2.3 billion. Its shares are trading at a price of $ 5.04. The below chart shows the stock performance for the past two years.

Despite multiple dips and peaks, the stock has maintained an upward trend. In 2021, the stock rose from $ 2.76 to $ 4.37, representing an approx. 60 % increase throughout the year.

In 2022, the stock peaked at $ 6.23. To date, the stock has appreciated by approx. 10 %.

Thinking to invest in bonds? Get to know whether it’s a good decision to invest in bonds or stocks.

Thinking to invest in bonds? Get to know whether it’s a good decision to invest in bonds or stocks.

Uranium Energy ( NYSE: UEC )

Uranium Energy Corp ( NYSE: UEC ) is America’s leading, fastest-growing, uranium mining company. UEC is a pure-play uranium company and is advancing the next generation of low-cost, environmentally friendly In-Situ Recovery (ISR) mining uranium projects. The Company has two productions ready ISR hub and spoke platforms in South Texas and Wyoming, anchored by fully licensed and operational processing capacity at the Hobson and Irigarayan plants. Get to know the best vaccine stocks to invest in now.

Uranium Energy has other diversified holdings of uranium assets:

- one of the largest physical uranium portfolios of U.S. warehoused U3O8

- a major equity stake in the only royalty company in the sector, Uranium Royalty Corp

- a pipeline of resource-stage uranium projects in Arizona, New Mexico, Texas, Wyoming, and Paraguay

The company recently shared its quarterly earnings report for the period ending Jan, 31st 2022:

- Sales and Service Revenues of $ 13.1 million

- Net Loss was reported at $ 5.5 million

- Loss per share was $ 0.02

Uranium Energy has a market capitalization of $ 1.14 billion. Its share is currently trading at $ 4.03. The below chart shows the stock performance for the past two years.

Also learn about Best Day Trading Stocks.

During this period the stock has undergone multiple peaks and dips in price. Nevertheless, the stock has maintained an upwards trend in price. In 2021, the stock appreciated by more than 90 %.

In 2022, the stock peaked ta $ 6.4 before shrinking. During the current year, the UEC stock has appreciated by 20.3 %.

With a production-ready capacity of 4 million pounds and a substantial pipeline of additional projects, UEC is the next-generation producer, ready to provide low-cost, low-capital fuel for the country’s large electricity-generating nuclear fleet. Hence it is one of the best Uranium stocks to invest in with huge growth potential.

With a production-ready capacity of 4 million pounds and a substantial pipeline of additional projects, UEC is the next-generation producer, ready to provide low-cost, low-capital fuel for the country’s large electricity-generating nuclear fleet. Hence it is one of the best Uranium stocks to invest in with huge growth potential.

Also, check out:

Energy Fuels ( NYSE: UUUU )

Energy Fuels ( NYSE: UUUU ) is the leading U.S. producer of uranium – the fuel for carbon- and emission-free nuclear energy. It supplies U3O8 to major nuclear utilities. The Company also produces vanadium from certain of its projects, as market conditions warrant, and is ramping up to full commercial-scale production of RE Carbonate. Get to know the list of crypto mining companies that are leading the industry.

The White Mesa Mill, which Energy Fuels own, is the only conventional uranium mill operating in the U.S. today. This facility has a licensed capacity of over 8 million pounds of U3O8 per year and has the ability to produce vanadium when market conditions warrant.

Energy Fuels reported its financial results for the quarter ended March 31, 2022:

- Total Revenues of $ 3 million

- Operating loss was reported at $ 10 million

- Net Loss was $ 14.7 million

- Net loss per share was $ 0.09

During this quarter Energy fuels did not report any Uranium Sales. But it is actively engaged in pursuing selective long-term uranium sales contracts.

The company has a very strong and positive outlook for 2022. The Company plans to recover 100,000 to 120,000 pounds of uranium and approximately 650 to 1,000 tons of mixed RE Carbonate containing approximately 300 to 450 tons of TREO.

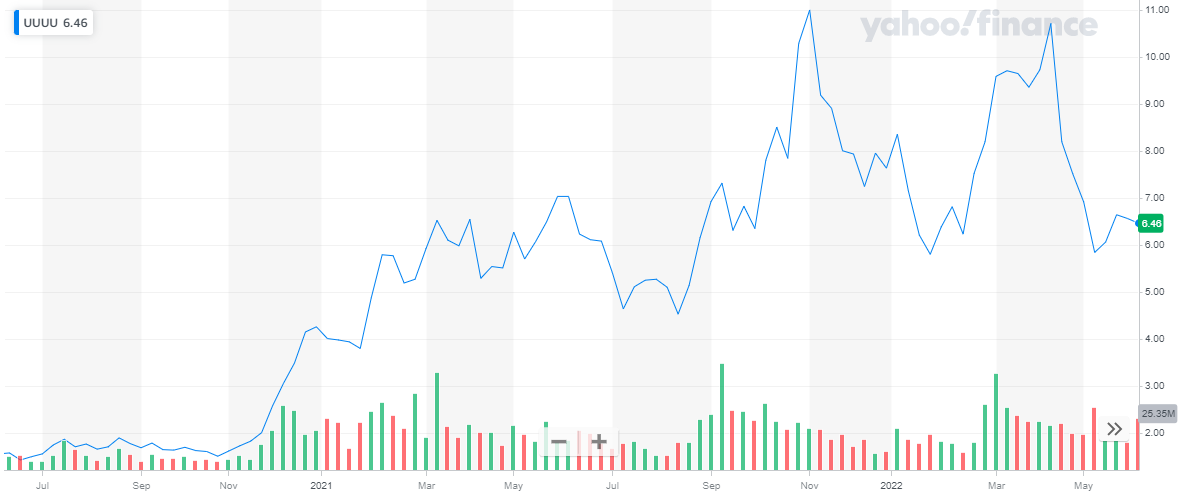

Energy fuels have a market capitalization of over $ 1 billion. The share of the company is trading at a price of $ 6.46. The below chart shows the stock performance for the past two years. Get to know the best tech stocks to invest in now.

The stock has been following an upward trend throughout the period. In 2021, the stock peaked at $ 10.99. The stock went from a price of $ 4.25, at the start of the year, to $ 7.63, at the end of the year. Overall, the stock appreciated by 80 % during the year.

In 2022, the stock went from $ 7.63 and peaked at $ 10.7 before declining. The stock has declined by XXXapprox. 15.3 % to date.

Energy Fuels continue to benefit from increases in the prices for all of the critical elements and materials they produce. U.S. uranium and nuclear fuel suppliers may be seeing increased interest from U.S. utilities as a result of the $6 billion civil nuclear credit program, which prioritizes reactors that purchase nuclear fuel and uranium from U.S. suppliers, which would include Energy Fuels.

Energy Fuels continue to benefit from increases in the prices for all of the critical elements and materials they produce. U.S. uranium and nuclear fuel suppliers may be seeing increased interest from U.S. utilities as a result of the $6 billion civil nuclear credit program, which prioritizes reactors that purchase nuclear fuel and uranium from U.S. suppliers, which would include Energy Fuels.

Therefore, it is the best time to invest in Energy Fuels to take advantage of the expected growth of the company in the near future.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

Denison Mines ( NYSE: DNN )

Denison ( NYSE: DNN ) is a uranium exploration and development company. Its exploration and development portfolio consists of numerous projects covering approximately 280,000 hectares in the Athabasca Basin region. The Athabasca Basin is home to the world’s largest and highest-grade uranium mining and milling operations – including the McArthur River and Cigar Lake uranium mines, as well as the Key Lake and McClean Lake uranium mills.

Learn about head and shoulders patterns trading guide.

The flagship project of Denison Mines, Wheeler River, is the largest undeveloped uranium project in the eastern portion of the Athabasca Basin region. Exploration activities are ongoing, with a current focus on the discovery of additional high-grade uranium deposits.

Denison Mines reported its quarterly financial report for the period ending 31st March 2022:

- Total Revenues were reported at $ 4.1 million

- Net Earnings were $ 42.6 million

- Earnings per share were at $ 0.05

During the year, other operational highlights include:

- Obtained regulatory approval for the expansion of the McClean Lake Tailings Management Facility

- Discovered high-grade uranium mineralization at 24.68% owned Waterfound River Joint Venture

Denison Mines has a market capitalization of over $ 1.01 billion. Its shares are trading at $ 1.24. The below chart shows the company’s stock performance over the past two years.

The share of Denison Mines has been steadily rising. The stock peaked at $ 1.697 during the last quarter of 2021. In 2021, the stock appreciated from $ 0.65 to $ 1.37., representing an increase of over 100 %. Check our updates for NASDAQ Forecast.

During the current year, the stock went from $ 1.37 to $ 1.75 before declining. The stock has declined by approx. 10 %.

Centrus Energy (LEU)

Centrus Energy is a trusted supplier of nuclear fuel and services for the nuclear power industry. Centrus has world-leading expertise in uranium handling, nuclear fuel design, and criticality, and is working collaboratively with the advanced reactor community to develop next-generation nuclear fuel. Centrus has designed, manufactured, and successfully operated the world’s most advanced gas centrifuge enrichment technology, the American Centrifuge, which has undergone rigorous testing by the Department of Energy and is available for national security deployment.

At its 440,000-square foot, state-of-the-art Technology & Manufacturing Center in Oak Ridge, Tennessee, the company’s team of scientists and engineers transform innovative ideas into proven designs and high-quality products and components. With deep technical expertise and capabilities, a billion-dollar order book, and long-term supply agreements through 2030, the company is well-positioned to support its customers and the growth of the nuclear industry.

Centrus Energy Corp. recently reported second-quarter 2022 results:

- Net income was reported at $ 37.4 million, as compared to net income of $ 11.6 million in the previous year’s same quarter

- Revenues were reported at $ 99.1 million, compared to $ 62.4 million in revenue in the previous year’s same quarter.

Centrus Energy Corp. has a market cap of $ 681.83 million. Its shares are trading at $ 47.06.

The share started in the year 2021 at a price of $ 23.13. During the year the stock peaked at $ 85.59 and closed off the year at $ 49.91. Overall, the stock appreciated by 116 % during the year.

In 2022, they started with a declining trend. It went as low as $ 21.29 before picking up pace. The stock last closed at $ 40.73, representing an 18 % decline year-to-date.

Uranium Royalty Corp (UROY)

Uranium Royalty Corp (UROY)

Uranium Royalty Corp. is the world’s only uranium-focused royalty and streaming company. URC provides investors with uranium commodity price exposure through strategic acquisitions in uranium interests, including royalties, streams, debt, and equity in uranium companies, as well as through holdings of physical uranium.

Uranium Royalty Corp reported its three months report on 31st July 2022:

- Operating loss was reported at $ 1.4 million

- Net Loss was reported at $ 2.5 million

Uranium Royalty Corp has a market cap of $ 225.3 million. Its shares are trading at $ 2.31.

The stock started off the year 2022 at $ 3.65 and last closed at $ 2.31 representing a 36.7 % decline to date.

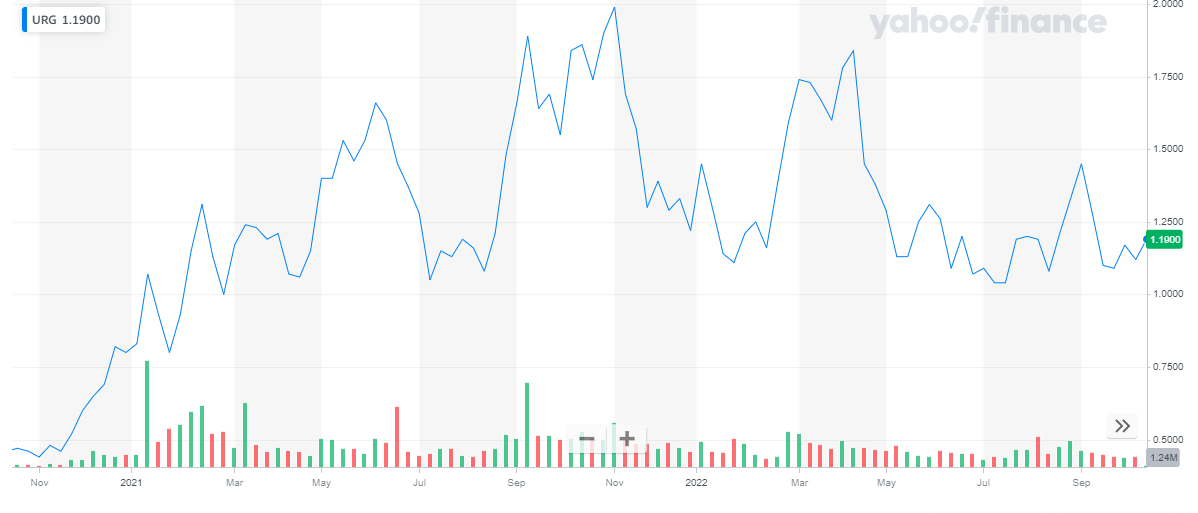

Ur-Energy Inc. (URG)

Ur-Energy Inc. (URG)

Ur-Energy engages in the identification, acquisition, exploration, development, and operation of uranium projects. Ur-Energy owns and operates the Lost Creek in-situ recovery uranium facility in south-central Wyoming. The company has produced, packaged, and shipped approximately 2.6 million pounds U3O8 from Lost Creek since the commencement of operations. The company holds interests in 12 projects located in the United States.

Ur-Energy has recently filed its second-quarter results for the year 2022:

- Total Sales were reported at $ 19 million

- Net loss was reported at $ 353 million, as compared to $ 6.9 billion the previous year same period

Ur-Energy has a market cap of $ 292.3 million. Its shares are trading at $ 1.31.

The stock of the company has been steadily rising throughout 2021. From $ 0.8 at the start of the year, the stock went as high as $ 1.99 and closed the year at $ 1.22. Overall, the stock appreciated by 52.5 % during the year.

During 2022, after an initial rise in price, the stock has remained steady to date. From $ 1.22, the stock went as high as $ 1.84 and last closed at $ 1.19. To date, the stock has declined by a mere 2.5 %.

Westwater Resources Inc (WWR)

Westwater Resources Inc (WWR)

Westwater Resources Inc is an explorer and developer of mineral resources that are materials essential to clean energy production. It holds mineral rights in the Western United States and the Republic of Turkey for both lithium and uranium deposits, as well as licensed production facilities for uranium in Texas.

The company recently shared its second quarter results for the year:

- Net Loss was reported at $ 3.15 million

Westwater Resources Inc. has a market cap of $ 52.9 million. Its shares are trading at a price of $ 1.12.

The stock of the company has been on a downward trend since 2021. The stock started the year 2021 at $ 4.93. After an initial spike when the stock spiked up to $ 9.01, the stock started declining. This bearish trend continued till the end of the year and closed at $ 2.15 representing a 56 % decline during the year.

In 2022, the stock continued its bearish run. To date, the stock has declined by 47.4 %.

Rio Tinto

Rio Tinto

Rio Tinto Group is an Anglo-Australian multinational company that is the world’s second-largest metals and mining corporation. It engages in the exploration, mining, and processing of mineral resources. It operates through the following business segments: Iron Ore, Aluminium, Copper and Diamonds, Energy and Minerals, and Other Operations.

In 2021, Rio Tinto produced approximately 65,000 pounds of uranium. The company’s uranium production has seen an overall decline from a peak of 11.4 million pounds in 2010.

Rio Tinto has a market cap of $ 87.9 billion. Its shares are trading at $ 52.83. The stock has been exhibiting volatile behavior in the past two years.

In 2021, the stock started at $ 75.22. after multiple dips and peaks, the stock closed the year at $ 66.94, representing an 11 % decline.

In 2022, the stock continued its volatile behavior while steadily declining. The stock last closed at $ 52.64 representing a 21.4 % decline to date.

Conclusion

Conclusion

The demand and need for green energy projects are on the rise due to the continuous increase in global energy consumption. Many leading countries like China and Russia are focusing on nuclear power energy. The future of uranium stocks seems promising, and now might be the right time to invest. The increased awareness regarding renewable energy resources is making governments more inclined to approve nuclear projects in different countries.

The uranium stocks listed above have been carefully selected after analyzing the historical performance, market cap, company outlook, and capital management & leadership. Moreover, with the global acceptance of nuclear energy, these top uranium stocks are expected to benefit hugely. Therefore, the best time to invest in these companies is now to enjoy explosive growth in the investment portfolio in the near future

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Swing Trading Stocks to Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy