The stocks bought for the purpose to hold for a long time and which generate a regular stream of income are known as retirement stocks. Some investors also label such stocks as buy and hold stocks. The main aim of retirement stocks is to generate a steady stream of income for investors during their retirement period.

The stocks bought for the purpose to hold for a long time and which generate a regular stream of income are known as retirement stocks. Some investors also label such stocks as buy and hold stocks. The main aim of retirement stocks is to generate a steady stream of income for investors during their retirement period.

One of the most important factors to consider while selecting retirement stocks is the dividend yield. The dividend yield of retirement stocks should be healthy enough to generate stable and regular income for investors after retirement. However, the yield must not be too high to be sustainable. Penny stocks are also one of the best investment opportunities.

Go through the list of the best forex indicators.

List of the Best Stocks to Consider for Retirement

Here is the list of best stocks to consider for retirement:

| Sr | Company Name | Symbol | Price (As of 23rd Dec 2022) | Market Cap |

| 1 | PepsiCo | PEP | $ 182.26 | $ 251 billion |

| 2 | Shopify | SHOP | $ 33.71 | $ 42.8 billion |

| 3 | Netflix | NFLX | $ 294.96 | $ 131.3 billion |

| 4 | Texas Instruments | TXN | $ 164.32 | $ 149.2 billion |

| 5 | Taiwan Semiconductor | TSM | $ 74.89 | $ 388.4 billion |

| 6 | Qualcomm | QCOM | $ 110.84 | $ 124.25 billion |

| 7 | Broadcom Inc. | AVGO | $ 552.43 | $ 230.85 billion |

| 8 | Main Street Capital Corporation | MAIN | $ 36.79 | $ 2.84 billion |

| 9 | Verizon Communications Inc | VZ | $ 38.41 | $ 161.3 billion |

| 10 | Chevron Corporation | CVX | $ 177.4 | $ 343 billion |

PepsiCo (NASDAQ: PEP)

PepsiCo (NASDAQ: PEP)

PepsiCo, Inc. manufactures, markets, distributes, and sells various beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America; Quaker Foods North America; PepsiCo Beverages North America; Latin America; Europe; Africa, Middle East, and South Asia; and Asia Pacific, Australia and New Zealand and China Region

PepsiCo has a very diverse product portfolio. The company’s diversification strategy makes it a very stable business. Due to a diverse product portfolio, PepsiCo’s revenue is not dependent on any one revenue source. As a result, the company is resistant to economic downturns.

PEP is a dividend-paying stock. It has a dividend yield of 2.52 %. The below chart shows the recent dividend payment:

| Year | 2022 | 2022 | 2022 | 2022 | 2021 | 2021 | 2021 | 2021 |

| Quarter | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| Dividend Payment | $ 1.07 | $ 1.15 | $ 1.15 | – | $ 1.02 | $ 1.07 | $ 1.07 | – |

Get to know the top stock indicators for stock analysis.

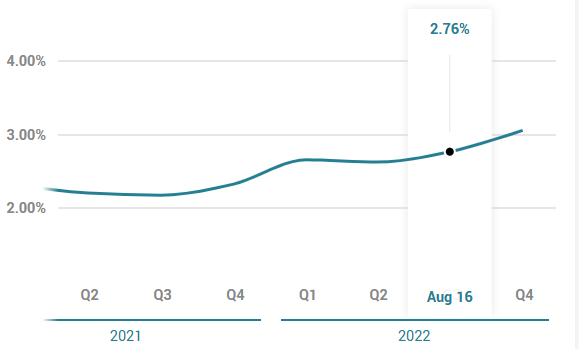

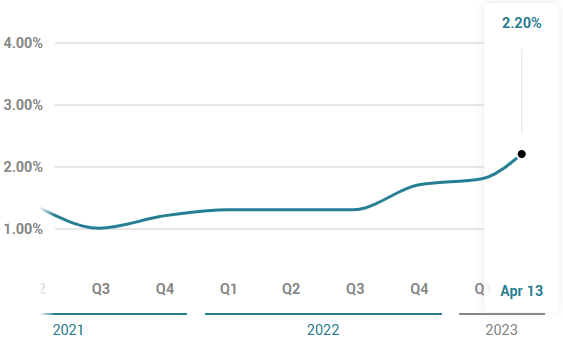

The below chart shows the dividend yield of the stock:

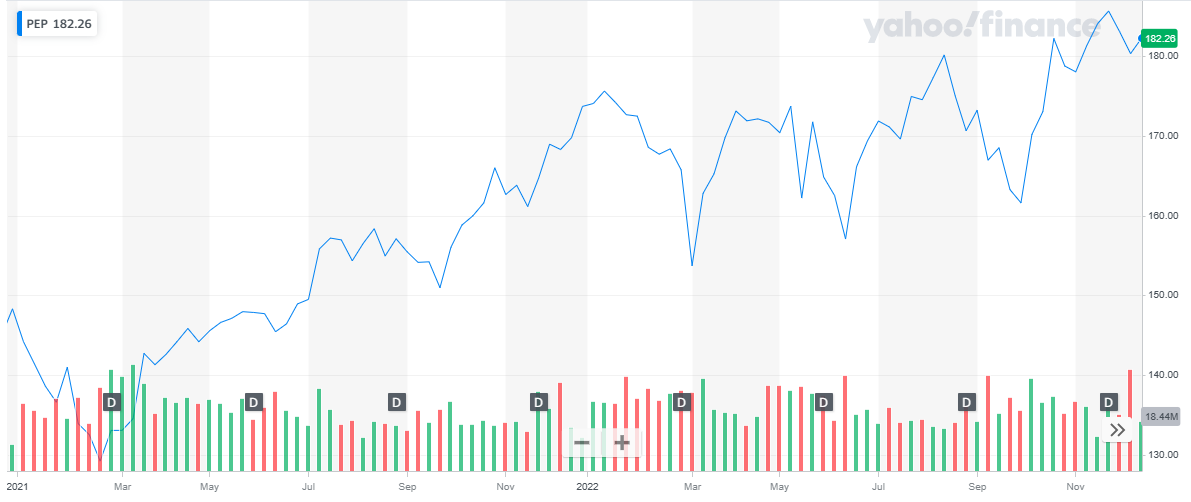

PepsiCo has a market cap of $ 251 billion. Its shares are trading at $ 182.26.

The stock has been on an upward trend since 2021. From $ 148, at the start of 2021, the stock closed at $ 173.71. Overall, the stock appreciated by 19.4 % during 2021.

In 2022, the stock continued its upward trend and last closed at $ 182.26. To date, the stock has appreciated by 5 %.

Also, read The Best Travel and Tourism stocks.

Also, read The Best Travel and Tourism stocks.

Shopify (NYSE: SHOP)

Shopify Inc. is a Canadian e-commerce platform and eCommerce infrastructure provider connecting small businesses with a large and growing global marketplace. The company is in business to provide an e-Commerce platform for small businesses globally. Its platform enables merchants to market, manage and sell their products through a variety of sales channels that include but are not limited to eCommerce. Channels include the company’s core Shopify website as well as brick-and-mortar locations, pop-ups social media, and buy-now buttons.

As of October 2022, the company boasted “millions” of merchants in 175 countries with more than $543 billion in economic activity generated since launch. In terms of scale, Shopify employs more than 10,000 individuals and is among the top 20 publicly traded companies in Canada.

Shopify rose rapidly after the pandemic.

Also, read Best Preferred stocks.

Shopify has a market cap of $ 42.8 billion. Its shares are trading at $ 33.71.

After maintaining a bullish run throughout 2021, the stock of the company suffered a huge plunge in share price. In 2021, the stock went from $ 113.19 to $ 137.74 representing a 22 % appreciation during the year.

In 2022, the stock went from $ 137.74 to $ 33.71 representing a 75 % depreciation in price.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Netflix (NASDAQ: NFLX)

Netflix is a subscription-based streaming service that allows our members to watch TV shows and movies without commercials on an internet-connected device. You can also download TV shows and movies to your iOS, Android, or Windows 10 device and watch without an internet connection.

Netflix does not pay dividends. Netflix is currently focused on growth. They are concentrated on growing internationally, increasing memberships, and accelerating their original programming. Which makes it an excellent stock to invest in to benefit from capital appreciation.

The below table shows the company financials:

| Q1 2022 | Q2 2022 | Q3 2022 | |

| Revenue | $ 7.9 billion | $ 8 billion | $ 8 billion |

| Operating income | $ 1.97 billion | $ 1.6 billion | $ 1.53 billion |

| Net Income | $ 1.6 billion | $ 1.4 billion | $ 1.4 billion |

| Earnings per share | $ 3.60 | $ 3.24 | $ 3.14 |

If you are seeking a steady stream of income, you should invest in REIT stocks.

Netflix has a market cap of $ 131.3 billion. Its shares are trading at $ 294.96.

The stock of the company enjoyed a bullish pattern during the pandemic. In 2021, the stock remained bullish and appreciated by 11 %.

In 2022, the stock suffered a huge plunge and went from $ 602.44 to $ 294.96 representing a 51 % decline 2022.

Investors who are looking to benefit from the rising technology by earning profits should consider drone stocks for investment.

Investors who are looking to benefit from the rising technology by earning profits should consider drone stocks for investment.

Texas Instruments (NASDAQ: TXN)

Texas Instruments is a global semiconductor company that designs, manufactures, tests, and sells analog and embedded processing chips.

It operates in two segments:

- Analog – This segment offers power products to manage power requirements at various levels using battery-management solutions, DC/DC switching regulators, AC/DC and isolated controllers and converters, power switches, linear regulators, voltage supervisors, voltage references, and lighting products.

- Embedded Processing – This segment offers microcontrollers that are used in electronic equipment; digital signal processors for mathematical computations; and applications processors for specific computing activity. This segment offers products for use in various markets, such as industrial, automotive, personal electronics, communications equipment, enterprise systems, calculators, and others.

Check out the best fintech stocks as it is a smart investment move today.

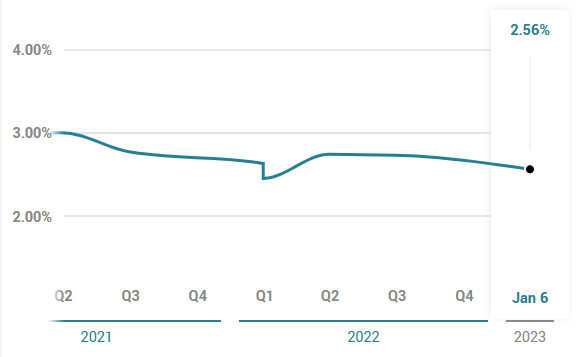

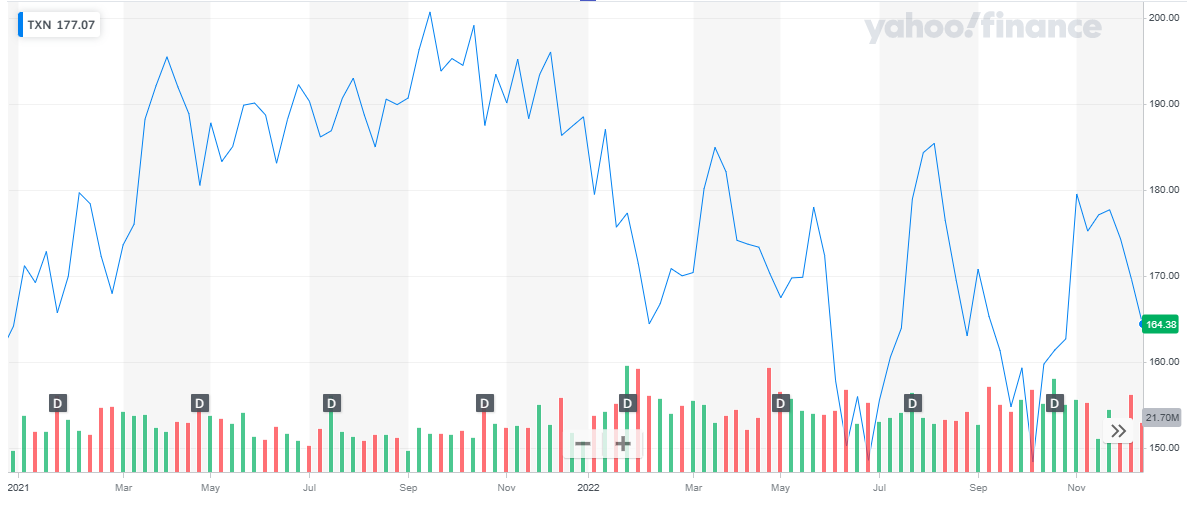

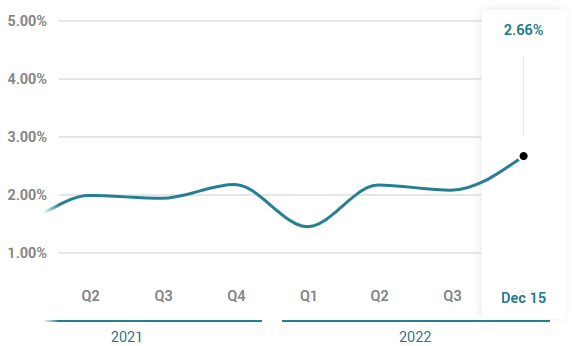

Texas Instruments has a market cap of $ 149.2 billion. Its shares are trading at $ 164.32.

In 2021, the stock of the company remained bullish throughout. From a price of $ 164.16, at the start of the year, the stock closed at $ 188.47 representing a 14.9 % appreciation during the year.

In 2022, the stock exhibited volatile behavior. The stock started at $ 188.47. And after multiple dips and peaks, the stock last closed at $ 164.38 representing a 13 % decline to date.

TXN is a dividend-paying stock. It has a dividend yield of 3.02 %. The below chart shows the recent dividend payment:

TXN is a dividend-paying stock. It has a dividend yield of 3.02 %. The below chart shows the recent dividend payment:

| Year | 2022 | 2022 | 2022 | 2022 | 2021 | 2021 | 2021 | 2021 |

| Quarter | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| Dividend Payment | $ 1.15 | $ 1.15 | $ 1.15 | $ 1.24 | $ 1.02 | $ 1.02 | $ 1.02 | $ 1.15 |

Also read: Top Infrastructure Stocks to Invest in now.

The below chart shows the dividend yield over the past two years:

Taiwan Semiconductor (NYSE: TSM)

Taiwan Semiconductor Manufacturing Company is the world’s largest dedicated independent semiconductor foundry. It is one of the most influential computer chip manufacturers in the world. TSMC holds a large percentage of global chip fabrication.

Taiwan Semiconductor’s expanded product portfolio provides a complete solution from one source: including trench Schottky’s, MOSFETs, power transistors, LED driver ICs, analog ICs, and ESD protection devices, which are used in various applications in the electronics industry including automotive, computer, consumer, industrial, telecom and photovoltaic.

TSM is a dividend-paying stock. It has a dividend yield of 1.91 %. The below chart shows the recent dividend payment:

| Year | 2023 | 2023 | 2022 | 2022 | 2022 | 2022 | 2021 | 2021 |

| Quarter | Q1 | Q2 | Q1 | Q2 | Q3 | Q4 | Q3 | Q4 |

| Dividend Payment | $ 0.34 | $ 0.46 | $ 0.46 | $ 0.39 | $ 0.39 | $ 0.49 | $ 0.39 | $ 0.35 |

Also, agricultural stocks offer excellent opportunities for investors.

Taiwan Semiconductors has a market cap of $ 388.4 billion. Its shares are trading at $ 74.89.

The stock of the company started the year 2021 at $ 109.04 and closed off at $ 120.31. Overall, the stock appreciated by 10.33 %. In 2021.

In 2022 the stock followed a bearish pattern. From a price of $ 120.31 at the start of the year, the stock last closed at $ 74.89. during 2022, the stock declined by 38 %.

Qualcomm (NASDAQ: QCOM)

Qualcomm (NASDAQ: QCOM)

QUALCOMM Incorporated engages in the development and commercialization of foundational technologies for the wireless industry worldwide. It operates through three segments:

- Qualcomm CDMA Technologies (QCT) – This segment develops and supplies integrated circuits and system software based on 3G/4G/5G and other technologies for use in wireless voice and data communications, networking, application processing, multimedia, and global positioning system products.

- Qualcomm Technology Licensing (QTL) – This segment grants licenses or provides rights to use portions of its intellectual property portfolio, which include various patent rights useful in the manufacture and sale of wireless products comprising products implementing CDMA2000, WCDMA, LTE, and/or OFDMA-based 5G standards and their derivatives.

- Qualcomm Strategic Initiatives (QSI) – This segment invests in early-stage companies in various industries, including 5G, artificial intelligence, automotive, consumer, enterprise, cloud, IoT, and extended reality, and investments, including non-marketable equity securities and, to a lesser extent, marketable equity securities, and convertible debt instruments.

Investing in value stocks is a long-term investment.

QCOM is a dividend-paying stock. It has a dividend yield of 2.71 %. The below chart shows the recent dividend payment:

| Year | 2022 | 2022 | 2022 | 2022 | 2021 | 2021 | 2021 | 2021 |

| Quarter | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| Dividend Payment | $ 0.68 | $ 0.75 | $ 0.75 | $ 0.75 | $ 0.65 | $ 0.68 | $ 0.68 | $ 0.68 |

Also check out the best forex signal service provider that is transparent, reliable, and focuses on long-term business relations with their clients.

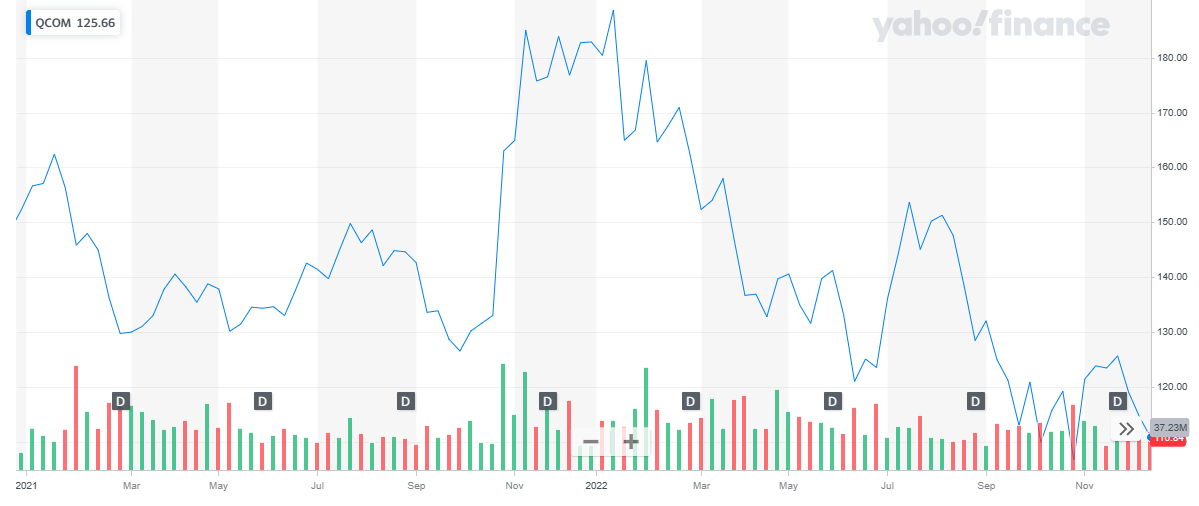

The below chart shows the dividend yield over the past two years:

Qualcomm has a market cap of $ 124.25 billion. Its shares are trading at $ 110.84.

The stock of the company has been volatile in the past two years. It started the year 2021 at $ 152.34, rose as high as $ 185, and dropped to a low of $ 126.55. Eventually, the stock closed at $ 182.27 representing a 20 % appreciation during the year.

In 2022 the stock went bearish while exhibiting volatile behavior. The stock started at $ 182.87, dropped to the low of $ 106.69, and eventually closed at $ 110.84 representing a 39 % depreciation in 2022 to date.

If you are confused between swing trading and day trading, read Swing trading vs Day trading.

If you are confused between swing trading and day trading, read Swing trading vs Day trading.

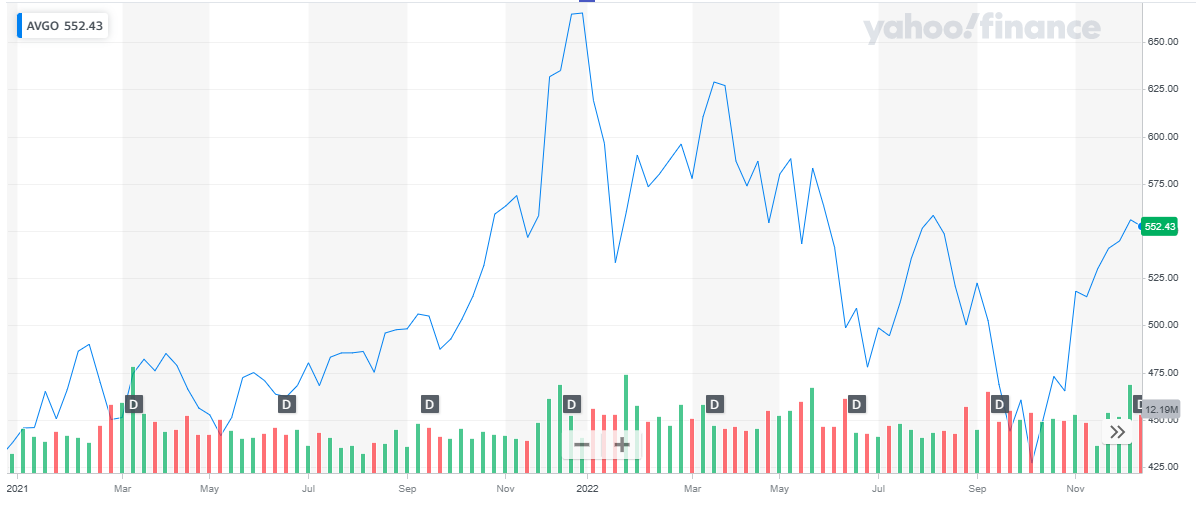

Broadcom (NASDAQ: AVGO)

Broadcom Inc. designs develop and supply various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor-based devices and analog III-V-based products worldwide. The company operates in two segments, Semiconductor Solutions, and Infrastructure Software. It provides set-top box system-on-chips (SoCs); cable, digital subscriber line, and passive optical networking central office/consumer premise equipment SoCs; wireless local area network access point SoCs; Ethernet switching and routing merchant silicon products; embedded processors and controllers; serializer/deserializer application specific integrated circuits; optical and copper, and physical layers; and fiber optic transmitter and receiver components. Check out some of the best recession stocks to buy now.

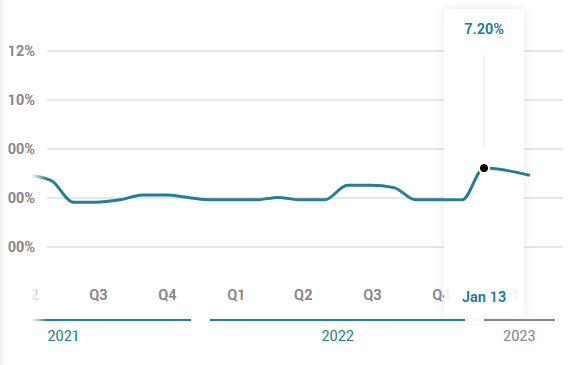

AVGO is a dividend-paying stock. It has a dividend yield of 3.33 %. The below chart shows the recent dividend payment:

| Year | 2022 | 2022 | 2022 | 2022 | 2021 | 2021 | 2021 | 2021 |

| Quarter | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| Dividend Payment | $ 4.1 | $ 4.1 | $ 4.1 | $ 4.6 | $ 3.6 | $ 3.6 | $ 3.6 | $ 4.1 |

It is the best time to invest in top shipping companies as they are poised for growth in the near future

The below chart shows the dividend yield over the past two years:

Broadcom has a market cap of $ 230.85 billion. Its shares are trading at $ 552.43.

The stock started the year 2021 at $ 437.85. During the year the stock went bullish and closed the year at the peak of $ 655.41. The stock appreciated by 50 % during the year.

In 2022, the stock exhibited volatility. It started the year at the peak price of $ 655.41 and during the year dropped to the low of $ 427.1 and last closed at $ 552.43. To date, the stock has declined by 16 %.

Get to know the best uranium stocks to invest in now.

Get to know the best uranium stocks to invest in now.

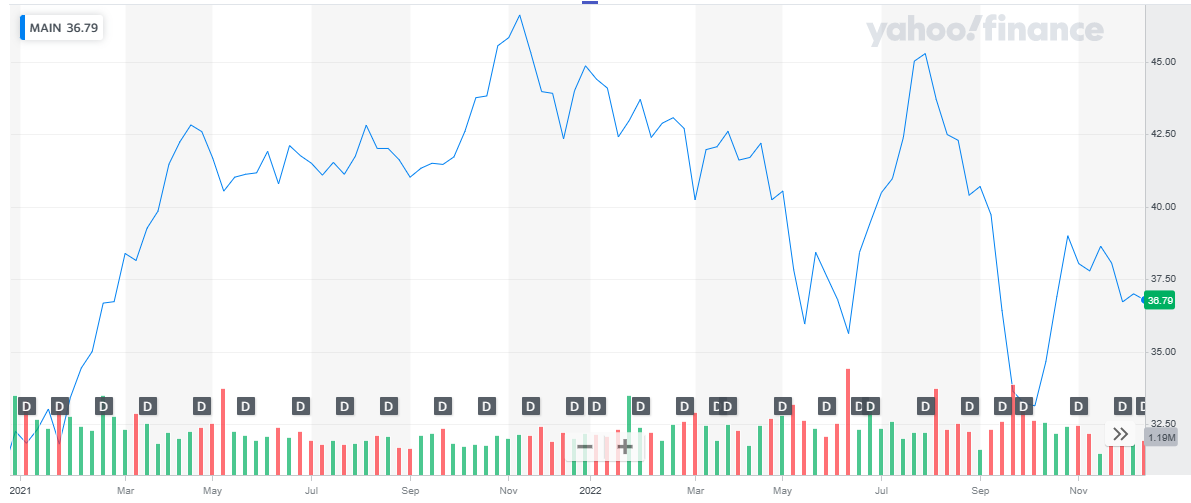

Main Street Capital Corporation (NYSE: MAIN)

Main Street Capital Corporation is a business development company that specializes in equity capital to lower middle market companies. The firm specializes in recapitalizations, management buyouts, refinancing, family estate planning, management buyouts, refinancing, industry consolidation, and mature, later-stage emerging growth. The firm also provides debt capital to middle-market companies for acquisitions, management buyouts, growth financings, recapitalizations, and refinancing.

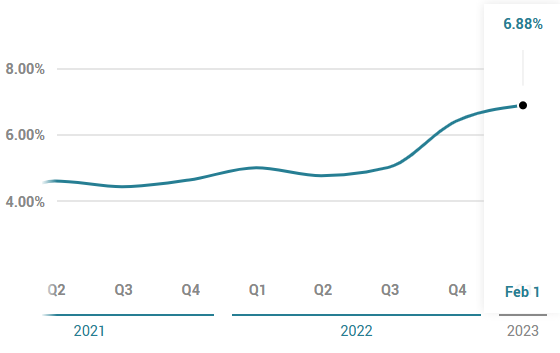

MAIN is a monthly dividend-paying stock. It has a dividend yield of 7.18 %. The below chart shows the recent dividend payment:

| Year | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 |

| Quarter | Jan | Feb | March | April | May | June | July | Aug | Sept | Oct | Nov | Dec |

| Dividend Payment | $ 0.21 | $ 0.21 | $ 0.21 | $ 0.21 | $ 0.21 | $ 0.21 | $ 0.21 | $ 0.21 | $ 0.21 | $ 0.22 | $ 0.22 | $ 0.1 |

It’s always wise to limit your exposure to risky investments like the best altcoins.

The below chart shows the dividend yield over the past two years:

Main Street Capital has a market cap of $ 2.84 billion. Its shares are trading at $ 36.79.

The stock started the year 2021 at $ 32.26. The stock went bullish during the year and peaked at $ 46.61 and closed off the year at $ 44.86. Overall, the stock appreciated by 39 % in 2021.

In 2022, the stock exhibited volatility. The stock underwent multiple dips and peaks and last closed at $ 36.79 representing an 18 % depreciation during the year.

Get to know the best commodity stocks to invest in now.

Get to know the best commodity stocks to invest in now.

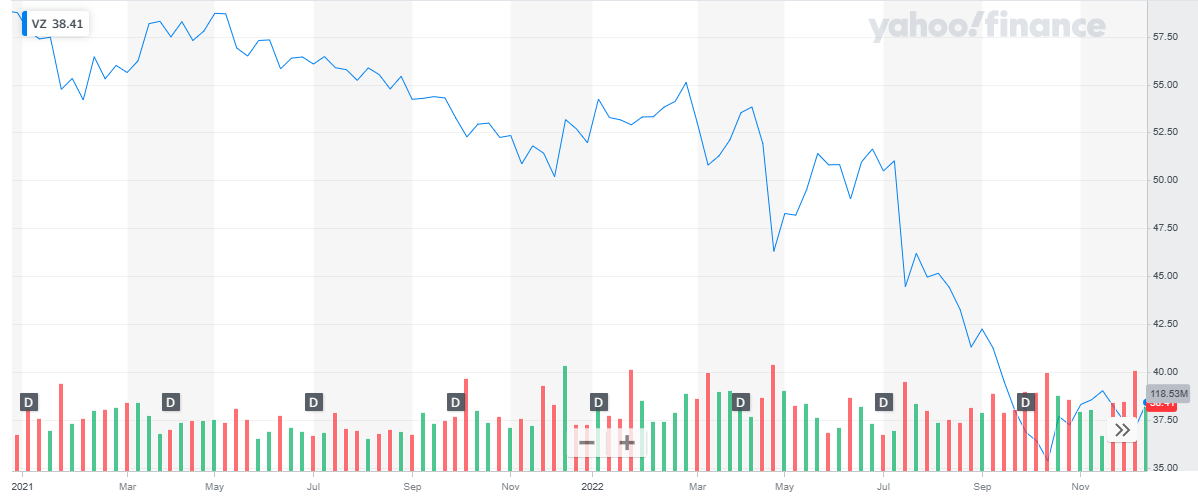

Verizon Communications Inc. (NYSE: VZ)

Verizon Communications Inc. is the US’s largest provider of mobile and telephone services.

Verizon offers communications, information technology, and entertainment products to consumers globally. The company operates in 2 key segments that include:

- Consumer – The Consumer segment provides wireless connectivity, internet access for mobile devices, and wireless and mobile devices including those for the IoT. As of the end of the year 2021, the company laid claim to more than 143 million retail subscribers and was the largest mobile provider by almost 30%.

- Business – The Business segment provides connectivity at the enterprise level that includes mobile, networking, Internet access, VOIP and video, security, and IoT.

Both the Consumer and Business segments are being upgraded to the 5G protocol. At the end of 2022 more than 175 million users were covered by the service.

Get to know the best 3d printing stocks.

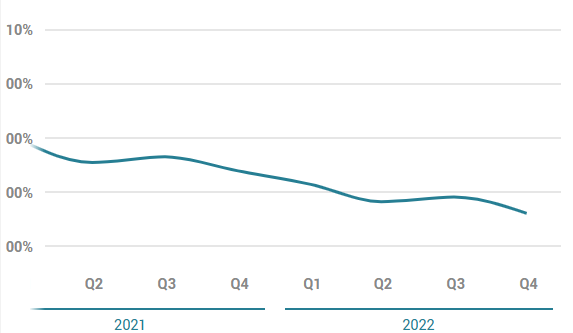

VZ is a dividend-paying stock. It has a dividend yield of 6.8 %. The below chart shows the recent dividend payment:

| Year | 2023 | 2022 | 2022 | 2022 | 2022 | 2021 | 2021 | 2021 | 2021 |

| Quarter | Q1 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| Dividend Payment | $ 0.65 | $ 0.64 | $ 0.64 | $ 0.64 | $ 0.65 | $ 0.63 | $ 0.63 | $ 0.63 | $ 0.64 |

The below chart shows the dividend yield over the past two years:

Verizon has a market cap of $ 161.3 billion. Its shares are trading at $ 38.41.

The stock of the company started the year 2021 at $ 58.75 and closed the year at $ 51.96. Overall, the stock declined by 11.5 %.

In 2022, the stock continued its bearish pattern and last closed at $ 38.41 representing a 26 % decline to date.

Also, check out:

Also, check out:

Chevron Corporation (NYSE: CVX)

Chevron Corporation, through a network of subsidiaries, engages in integrated energy and chemicals operations worldwide. The company is the 7th largest integrated oil company worldwide.

Chevron Corporation is now based in San Ramone, California, and has operations in 180 countries.

Give a read to some of the best hydrogen stocks worth investing in now.

The company operates in two segments:

- Upstream – The Upstream segment explores new reserves, develops known reserves, produces petroleum and gas products as needed, and transports, processes, pipes, stores, and markets petroleum worldwide.

- Downstream. The Downstream segment refines and markets the full line of petroleum-based products including but not limited to fuels such as gas, diesel, and aviation fuel, as well as lubricants, petrochemicals, and plastics.

The company transports products via pipeline, rail, marine vessels, and trucks.

Chevron recognizes the need to lower the world’s carbon output and is working toward that end. The company’s strategy is two-pronged and includes reducing its own carbon output while investing in green and lower-carbon technologies. The company’s goal is to invest $10 billion or more into lower-carbon energy sources and technologies by 2028. Also, read: Best commodity ETFs.

CVX is a dividend-paying stock. It has a dividend yield of 3.2 %. The below chart shows the recent dividend payment:

| Year | 2022 | 2022 | 2022 | 2022 | 2021 | 2021 | 2021 | 2021 |

| Quarter | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| Dividend Payment | $ 1.42 | $ 1.42 | $ 1.42 | $ 1.42 | $ 1.29 | $ 1.34 | $ 1.34 | $ 1.34 |

The cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention.

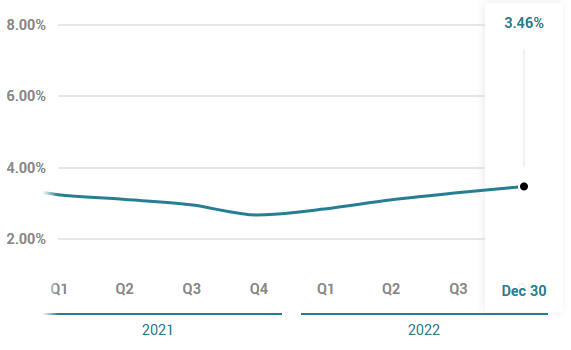

The below chart shows the dividend yield over the past two years:

Chevron has a market cap of $ 343 billion. Its shares are trading at $ 177.4.

The stock of the company started the year 2021 at $ 84.45. During the year the stock appreciated by 39 % and closed off the year at $ 117.35.

In 2022 the stock spiked high and peaked at $ 186.46. The stock last closed at $ 177.4 representing a 51% appreciation in 2022 to date.

Robotic stocks offer an exciting investment opportunity for traders.

Robotic stocks offer an exciting investment opportunity for traders.

Conclusion

Investing your retirement savings in stocks does have its risks. But with a careful selection of stocks, an investor also has the potential for significant growth, especially over the long term. Allocating a specific portion of your savings towards retirement stock is the ideal way to start preparing for retirement. Check out the list of best day trading stocks.

Stocks have produced long-term gains, as per history. These returns are the largest among all other investment options available. Since 1926, large stocks have returned an average of 10 % per year. Also, they did not lose ground during any period of 20 years or longer during that time. Those qualities make stocks much more appealing for long-term savings

The above list of stocks is some of the highest dividend-paying stocks with a good potential for capital appreciation. Investing in these stocks will also expand one’s capital value by a good percentage and provide a regular stream of income in form of quarterly dividends and in some cases monthly dividends.

Back