The holiday season will be starting soon. And with it will come increased consumer spending on a wide array of goods. Despite a slow economy, consumer spending is expected to be higher this year as compared to 2021. Holiday retail sales are likely to increase between 4 % and 6 % in 2022, according to Deloitte’s annual holiday retail forecast. Deloitte’s retail and consumer products practice projects holiday sales will total $ 1.45 to $1 .47 trillion during the November to January timeframe. In addition to it, e-commerce sales will grow by 12.8 % to 14.3 %, year-over-year, during the 2022-2023 holiday season. This will likely result in e-commerce holiday sales reaching between $ 260 billion and $ 264 billion this season. Investors when investing always choose the best brokers that better suit his/her trading goals.

Best Stocks to Buy for the Holiday Season

Here are 8 companies that will benefit from strong sales between Thanksgiving and New Year’s.

Walmart (WMT)

Walmart is the go-to place for many people for holiday shopping. From food and décor items to gifts and toys, Walmart offers everything under its roof. It is one of the world’s biggest retailers. Each week, approximately 230 million customers and members visit more than 10,500 stores and numerous eCommerce websites under 46 banners in 24 countries. Walmart employs approximately 2.3 million associates worldwide. The retailer offers some of the best holiday deals. This year the holiday sales started earlier at Walmart. Also, investing in fintech stocks is a smart investment move today.

One of the unique offerings for the holiday season is that the retailer has teamed up with gaming platform Roblox to launch Walmart’s Universe of Play and Walmart Land. In addition to this, Walmart has expanded its Netflix Hub to more than 2,400 stores. This provides customers with a low-priced Netflix Streaming Card which gives users the ability to watch a few of Netflix’s shows without using a debit or credit card. Also, another offer that attracts more consumers is an extension of return and exchange dates to the end of January 2023.

The below chart shows the company’s financial highlights for the FY ending 31st Dec 2021 and the recent quarter ending 30th June 2022:

| Sr | Financial Highlights | For the Quarter ending 30th June 2022 | For the Quarter ending 30th June 2021 | For the year ending 31st Dec 2021 |

| 1 | Total Revenue | $ 152.9 billion | $ 141 billion | $ 572.8 billion |

| 2 | Operating Income | $ 6.9 billion | $ 7.4 billion | $ 25.9 billion |

| 3 | Net Income | $ 5.1 billion | $ 4.4 billion | $ 13.7 billion |

| 4 | Earnings per share | $ 1.88 | $ 1.53 | $ 4.9 |

Get to know about top Infrastructure stocks to invest in.

Walmart Inc. has a market cap of $ 382.6 billion. Its shares are trading at $ 140.97.

The share has been volatile since last year. In 2021, the stock started off at $ 144.15. after multiple dips and peaks, the stock closed the year at $ 144.69 representing a negligible decline throughout the year.

In 2022, after a huge spike in price hitting $ 157.41, the stock suffered a huge dip. The stock last closed at $ 131.37 representing a 9.2 % decline to date.

Get to know the best quantum computing stocks.

Get to know the best quantum computing stocks.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

United Parcel Service (UPS)

United Parcel Service (UPS)

United Parcel Service, Inc. provides letter and package delivery, transportation, logistics, and related services. It operates through two segments; U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery of letters, documents, small packages, and palletized freight through air and ground services in the United States. The International Package segment provides guaranteed day and time-definite international shipping services in Europe, the Asia Pacific, Canada, and Latin America, the Indian subcontinent, the Middle East, and Africa. Investing in value stocks is a long-term investment.

The company operates a fleet of approximately 121,000 package cars, vans, tractors, and motorcycles; and owns 59,000 containers that are used to transport cargo in its aircraft. Recently, the company announced plans to hire more than 100,000 workers to help with holiday shipments.

The below table shows the financial highlights of UPS for the quarter ending 30th Sept 2022 and the previous year ending 31st Dec 2021:

| Sr | Financial Highlights | For the Quarter ending 30th Sept 2022 | For the Quarter ending 30th Sept 2021 | For the year ending 31st Dec 2021 |

| 1 | Total Revenue | $ 24.1 billion | $ 23.2 billion | $ 97.3 billion |

| 2 | Operating Income | $ 3.15 billion | $ 2.97 billion | $ 12.8 billion |

| 3 | Net Income | $ 2.6 billion | $ 2.3 billion | $ 12.9 billion |

| 4 | Earnings per share | $ 2.97 | $ 2.66 | $ 14.75 |

Also, check out the best swing trading stocks.

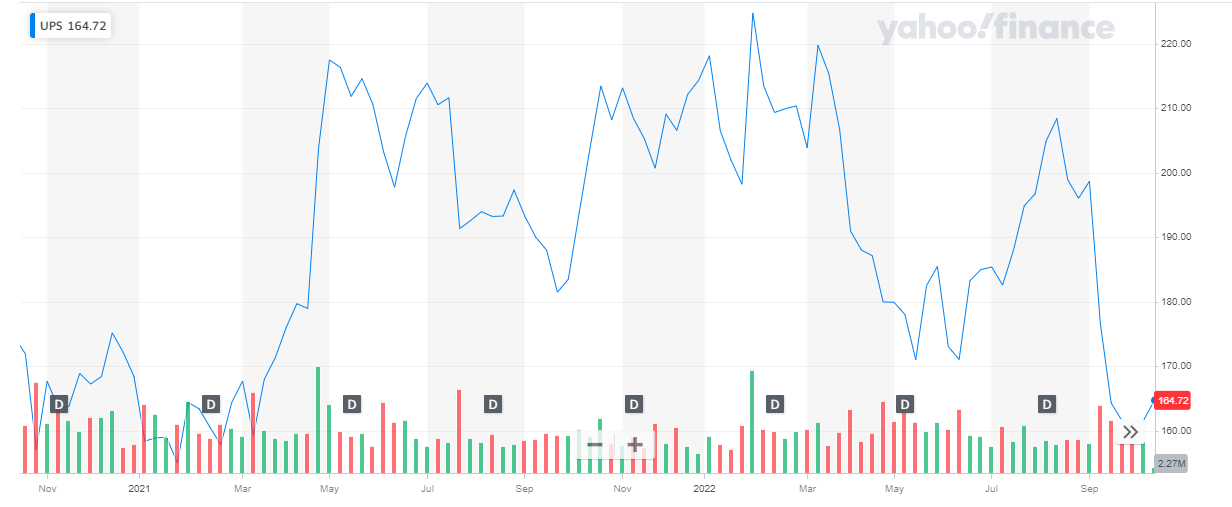

UPS has a market cap of $ 146.2 billion. Its shares are trading at $ 169.13.

The share of the company started off the year 2021 at $ 168.4. After staying low, the share price spiked in May. Despite multiple dips and peaks, the share continued trading at high levels and closed off the year at $ 214.34 representing a 27 % appreciation during the year.

In 2022, the stock continued its volatile journey but it suffered a huge dip in may when the stock went from a high of $ 219.78 to a low of $ 171.07. After recovering a bit, the share plunged further to $ 159.14. The share last closed at $ 164.72 representing a 23 % decline to date.

Cybersecurity stocks are also one of the best investment opportunities.

Cybersecurity stocks are also one of the best investment opportunities.

Also read:

Amazon (AMZN)

Amazon’s e-commerce website is now a global marketplace that sells a variety of products. In fact, it is also nicknamed the “The Everything Store” due to the vast array of products it offers. Amazon dominates the tech industry and is named alongside big tech companies like Apple and Google.

Amazon came under the limelight when it announced its Prime sales event early this year in October. The motive behind this early sale was to kickstart the holiday shopping early and boost their Q4 revenue. While the sales figures for the month of October have not been announced yet, there are unofficial announcements that the e-commerce giant sold more than 100 million items during the 2-day sales event.

Amazon continues to benefit from strong e-commerce sales throughout the holidays, especially around Black Friday and leading up to Christmas. Like the other companies on this list, the fourth quarter is typically the strongest for Amazon. Investors are now looking for the finest solar energy stocks to invest in.

The below table shows the financial highlights of Amazon for the quarter ending 30th Sept 2022 and the previous year ending 31st Dec 2021:

| Sr | Financial Highlights | For the Quarter ending 30th Sept 2022 | For the Quarter ending 30th Sept 2021 | For the year ending 31st Dec 2021 |

| 1 | Total Revenue | $ 110.8 billion | $ 127 billion | $ 469.8 billion |

| 2 | Operating Income | $ 4.8 billion | $ 2.5 billion | $ 24.9 billion |

| 3 | Net Income | $ 3.15 billion | $ 2.87 billion | $ 33.36 billion |

| 4 | Earnings per share | $ 0.31 | $ 0.28 | $ 65.96 |

Get to know about RSI trading strategies.

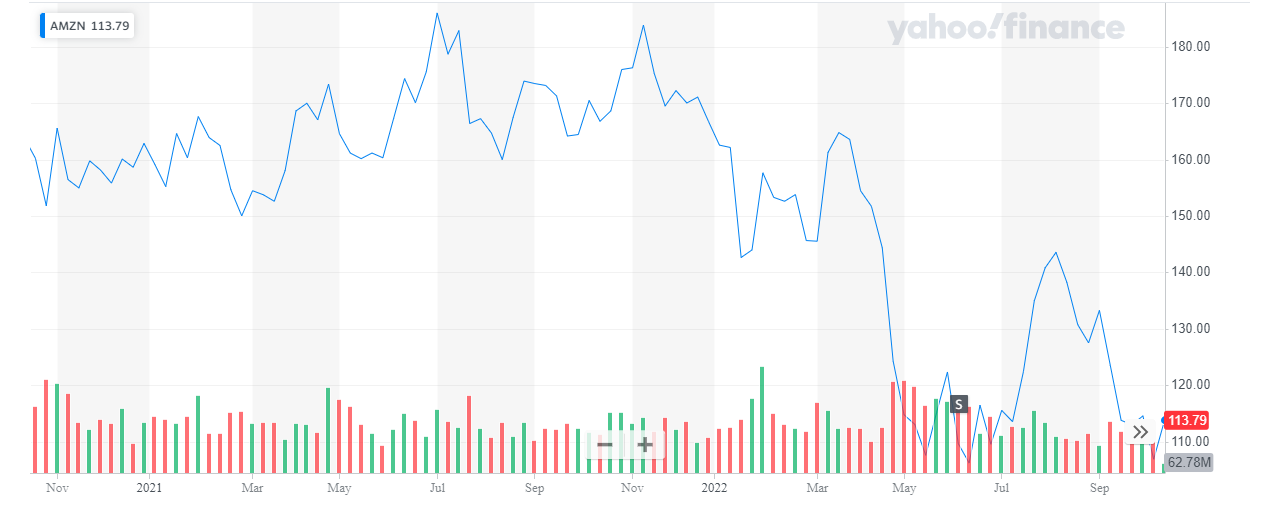

Amazon has a market cap of $ 923.5 billion. Its shares are trading at a price of $ 90.53.

The year 2021 was a good year for the company’s stock. The stock continued to rise slowly and steadily throughout the year. From a price of $ 162.85, at the start of the year, the stock closed off at $ 166.72 representing a 2.4 % appreciation throughout the year. In 2022, the stock reversed its course. After an initial decline and recovery, the stock plunged to the low of $ 106.22 in June’22. The stock last closed at $ 113.79 representing a 32 % decline to date.

CVS Health (CVS)

CVS Health (CVS)

CVS Health is the parent company behind the CVS Pharmacy chain and a variety of other health-related subsidiaries. CVS Health is a provider of pharmacy healthcare solutions. It offers pharmacy benefit management (PBM) solutions, such as plan design and administration, formulary management, clinical services, disease management programs, medical pharmacy management services, etc. The company also sells drugs, cosmetics, personal care products, convenience foods, seasonal merchandise, and other related products. In addition, CVS Health offers a range of traditional, voluntary, and consumer-directed health insurance products and related services. If you are seeking a steady stream of income, you should invest in REIT stocks.

The below table shows the financial highlights of CVS Health for the quarter ending 30th Sept 2022 and the previous year ending 31st Dec 2021:

| Sr | Financial Highlights | For the Quarter ending 30th Sept 2022 | For the Quarter ending 30th Sept 2021 | For the year ending 31st Dec 2021 |

| 1 | Total Revenue | $ 81.2 billion | $73.8 billion | $ 292 billion |

| 2 | Operating Income | – $ 3.9 billion | $ 3.1 billion | $ 13.2 billion |

| 3 | Net Income | -$ 3.4 billion | $ 1.6 billion | $ 7.9 billion |

| 4 | Earnings per share | $ 2.09 | $ 1.97 | $ 8.4 |

Get to know the best regional bank stocks.

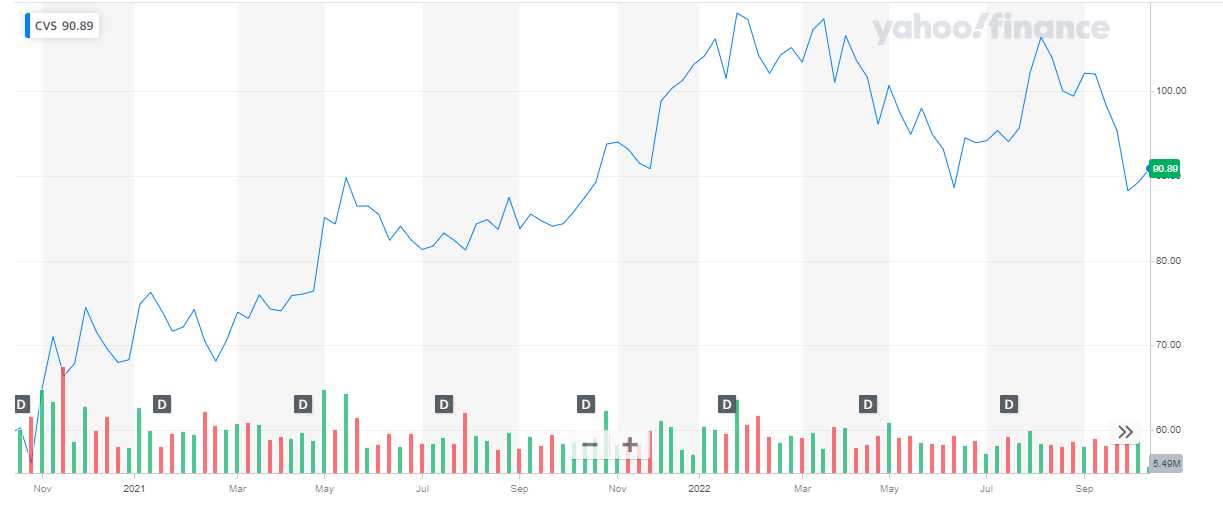

CVS Health has a market cap of $ 132.9 billion. Its share is trading at $ 101.18.

The share of the company is on a bullish run since 2021. The stock started the year 2021 at $ 68.3 and ended the year at $ 103.61 representing a 52 % appreciation during the year.

In 2022, the stock continued its bullish journey but after peaking at $ 109.27, the stock reversed its course. The stock last closed at $ 101.18 representing an 8 % decline to date.

Southwest Airlines (LUV)

Southwest Airlines (LUV)

After the pandemic led lockdown, people are dying to travel. And this year about 70% of Americans are planning to travel during the holiday season. Therefore, it is an excellent opportunity for airlines like Southwest Airlines to capitalize on this opportunity. Southwest Airlines is the world’s largest low-cost carrier and one of the busiest airlines in the U.S., Southwest carries more domestic passengers than any other airline in America. To give investors an idea where to start and which companies to look for investment in, we have compiled a list of the top best oil and gas ETFs to buy now.

The below table shows the financial highlights of Southwest Airlines for the quarter ending 30th Sept 2022 and the previous year ending 31st Dec 2021:

| Sr | Financial Highlights | For the Quarter ending 30th Sept 2022 | For the year ending 31st Dec 2021 |

| 1 | Total Revenue | $ 6.2 billion | $ 15.79 billion |

| 3 | Net Income | $ 277 million | $ 977 million |

| 4 | Earnings per share | $ 0.44 | $ 1.65 |

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

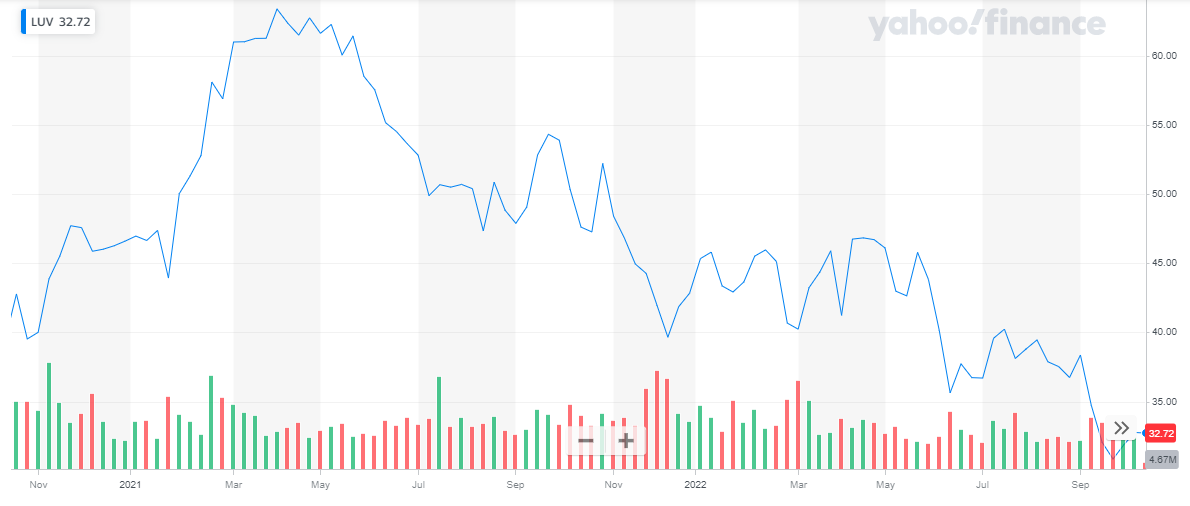

Southwest Airlines has a market cap of $ 22.2 billion. Its shares are trading at $ 37.4.

The year 2021 brought new heights for the airline stock. The stock started off at $ 46.61 and during the year peaked at $ 63.42. After hitting the peak, the stock started its downward journey and eventually closed off the year at $ 42.84. During the year the stock declined by 8 %.

In 2022, the stock continued its bearish journey. The stock started trading at $ 42.84 and last closed at $ 37.4 representing a 12.7 % decline during the year.

Best Buy (BBY)

Best Buy (BBY)

Best Buy Co., Inc. engages in the provision of consumer technology products and services. It operates through two business segments:

- Domestic – The Domestic segment comprises the operations in all states, districts, and territories of the U.S., operating under various brand names, including Best Buy, Best Buy Mobile, Geek Squad, Magnolia Audio Video, Napster, and Pacific Sales.

- International – The International segment includes all operations outside the U.S. and its territories, which include Canada, Europe, China, Mexico, and Turkey.

Also read Forex trading vs Stocks trading.

The consumer electronics retailer has also gotten a jump on holiday deals and exclusive member offers. Like other companies listed here, Best Buy also offered deals and discounts early this year starting in October. The company has offered early Black Friday deals, it has announced exclusive offers to its “My Best Buy” members. These exclusive sales are expected to continue till January.

The below table shows the financial highlights of Best Buy for the quarter ending 30th Sept 2022 and the previous year ending 31st Dec 2021:

| Sr | Financial Highlights | For the Quarter ending 30th Sept 2022 | For the Quarter ending 30th Sept 2021 | For the year ending 31st Dec 2021 |

| 1 | Total Revenue | $ 10.7 billion | $ 11.6 billion | $ 51.76 billion |

| 2 | Operating Income | $ 462 million | $ 769 million | $ 3.039 billion |

| 3 | Net Income | $ 341 million | $ 595 million | $ 2.454 billion |

| 4 | Earnings per share | $ 1.49 | $ 2.32 | $ 9.84 |

Read Top NASDAQ Stocks to buy in 2023.

Best Buy has a market cap of $ 15.45 billion. Its shares are trading at $ 68.66.

The share started in the year 2021 at $ 99.79. Throughout the year the share remained steady despite multiple dips and peaks. However, in September the share price spiked and peaked at $ 136.13 and eventually closed the year at $ 101.6. Overall, the stock appreciated by 1.8 % during the year.

In 2022, the share went on a bearish run. From $ 101.6, the stock last closed at $ 68.66 representing a 32.4 % decline to date.

Molson Coors (TAP)

Molson Coors (TAP)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in America, Europe, the Middle East, Africa, and Asia Pacific. It offers flavored malt beverages, craft, and ready-to-drink beverages. It operates under the brands Blue Moon, Coors Banquet, Coors Light, Miller Genuine Draft, Miller Lite, taropramen, Carling, Molson Canadian, Creemore Springs, Cobra, Doom Bar, Henry’s Hard, and Leinenkugel’s.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

Molson Coors is the second-largest brewer in the U.S. and the third-largest maker of alcoholic beverages in the world. During the Holiday season, Alcohol intake increases. The most popular alcoholic beverages during the holidays are eggnog, coffee with Bailey’s, beer, and cider. Molson Coors is surely to benefit from an uptick in sales during the holidays.

The below table shows the financial highlights of Molson Coors for the quarter ending 30th Sept 2022 and the previous year ending 31st Dec 2021:

| Sr | Financial Highlights | For the Quarter ending 30th Sept 2022 | For the Quarter ending 30th Sept 2021 | For the year ending 31st Dec 2021 |

| 1 | Total Revenue | $ 2.9 billion | $ 2.8 billion | $ 10.3 billion |

| 2 | Operating Income | $ 330 million | $ 531 million | $ 1.454 billion |

| 3 | Net Income | $ 216 million | $ 453 million | $ 1.0 billion |

| 4 | Earnings per share | $ 1.0 | $ 2.09 | $ 9.84 |

Get to know everything about high-frequency trading.

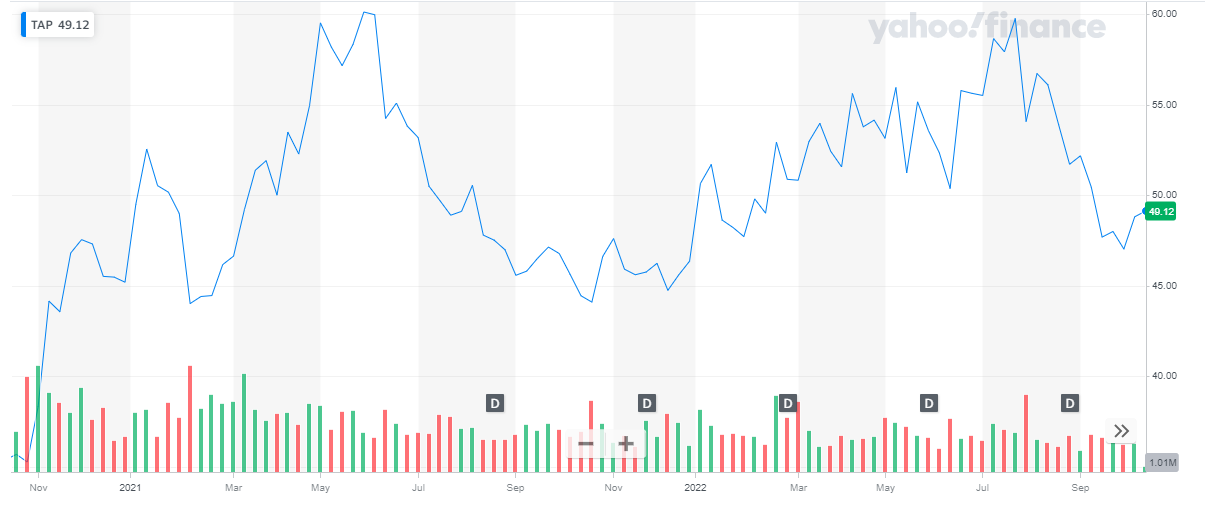

Molson Coors has a market cap of $ 11.1 billion. Its shares are trading at $ 50.98.

The share performance shows a head and shoulders pattern since the start of 2021. The stock started in the year 2021 at $ 45.19. During the year the stock went as high as $ 60.11 and closed the year at $ 46.35. Overall, the stock appreciated by a mere 2.6 % in 2021.

In 2022, the stock started trading at $ 46.35. The stock went on a steady journey upward before declining. The stock last closed at $ 50.98 representing a 10 % appreciation to date.

Uber Technologies

Uber Technologies

Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. It connects consumers with independent providers of ride services for ridesharing services; and connects riders and other consumers with restaurants, grocers, and other stores with delivery service providers for meal preparation, grocery, and other delivery services. Get to know the best S&P companies for investment.

The company operates through three segments:

- Mobility – The Mobility segment provides products that connect consumers with mobility drivers who provide rides in a range of vehicles, such as cars, auto rickshaws, motorbikes, minibusses, or taxis.

- Delivery – The Delivery segment allows consumers to search for and discover local restaurants, order a meal, and either pick it up at the restaurant or have the meal delivered; and offers grocery, alcohol, and convenience store delivery, as well as select other goods.

- Freight – The Freight segment connects carriers with shippers on the company’s platform and enables carriers upfront, transparent pricing, and the ability to book a shipment, as well as transportation management and other logistics services offerings.

Uber has recently gained attention for all the right reasons. It announced that it signed a multi-year partnership with Nuro, a leading autonomous vehicle company. As a result of the partnership, Uber Eats will use Nuro’s autonomous electric vehicles for food deliveries in the U.S.

Tech stocks are also one of the best investment opportunities.

Below table shows the financial highlights of Uber Technologies for the quarter ending 30th Sept 2022 and the previous year ending 31st Dec 2021:

| Sr | Financial Highlights | For the Quarter ending 30th Sept 2022 | For the Quarter ending 30th Sept 2021 | For the year ending 31st Dec 2021 |

| 1 | Total Revenue | $ 8.3 billion | $ 4.8 billion | $ 11.1 billion |

| 2 | Operating Income | -$ 495 million | $ 572 million | -$ 4.87 billion |

| 3 | Net Income | -$ 1.2 billion | -$ 2.4 billion | -$ 6.7 billion |

| 4 | Earnings per share | -$ 0.61 | -$ 1.28 |

Uber has a market cap of $ 56.6 billion. Its shares are trading at $ 27.69.

The share of the company has been on a bearish run since 2021. The stock started the year 2021 at a price of $ 51. After a steady performance, the stock started declining and closed off the year at $ 41.93 representing an 18 % decline during the year.

In 2022, the stock continued its bearish run and last closed at $ 25.94. To date, the stock has declined by 61 %.

Semiconductor stocks are also one of the best investment opportunities.

Semiconductor stocks are also one of the best investment opportunities.

Conclusion

The holidays can be a financial boon for many industries. Therefore, they can be a lucrative time to invest. As per historical records stocks usually perform well in the month of December and January.

Also, some of the best sectors to invest in during the Holiday season are:

- Retail and e-commerce – The whole year people wait for the sales of the Holiday season. As time evolve retail has shifted online. Hence retail and e-commerce are amongst the best-performing sectors.

- Shipping and Delivery – While online shopping continues to boom, so does the delivery company stock. With the rise in shopping around the holiday season, the shipping and delivery companies also start to show an increase in revenue. Within this also comes the food delivery companies. The holiday season brings its own food deals and the delivery companies are all ready to deliver.

- Supply chain – Not only the product increases in demand, but the raw material of that product also rises. If electronics see a rise in sales, the companies which produce its parts are also experiencing a rise in sales. Similarly, if jewelry sales increase around the holiday season, so do the precious metal mining companies.

The above list of companies is amongst the best-performing stocks during the holiday season. However, always make a calculated and careful decision before investing. After all, it is your own money at stake!

You may also like reading:

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2023

- 11 Best ESG ETFs to Buy in 2023

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy