Bank stocks usually reflect the economic performance, making them cyclical stocks. Bank stocks have undergone a huge downfall in 2020 as consumer spending receded, auto loans dropped and businesses stopped amid the coronavirus crisis. Moreover, Berkshire Hathway, owned by Warren Buffet, also unloaded its stakes in Bank stocks, which further triggered the downfall journey of bank stocks.

Categories Of Bank

- Commercial Banks – A commercial bank is a financial institution that grants loans, accepts deposits, and offers basic financial products to individuals and businesses. It’s earning money by providing loans to customers and charging interest. The basic functions of a commercial bank are:

- Taking Deposits

- Extending Credit – in the form of bank loan, cash credit, bank overdraft, discounted bills of exchange

- Credit Creation

- Agency Function – Collecting money on behalf of the customer in form of cheques, dividends, warrants, and bills of exchange

- Investment Banks– An investment bank is a large financial institution that helps companies access capital markets to raise money and take care of other business needs. Their clientele includes large corporations. The basic functions of an investment bank are:

- Raise equity capital

-

- Raise debt capital

- Universal Bank – A universal bank is a bank that offers the services of an investment bank.

Bank Stocks have been up to a good start in 2021 and are outperforming in the market. But recently, bank stocks fell sharply in response to the Federal Reserve meeting in June’21. The minutes of the meeting stated that the US central bank foresees rates rising in 2023. Below is the list of best banks to buy:

| Sr. | Name of Bank | Symbol | Market Cap | Price | Average Volume (3 month) |

| 1 | JPMorgan Chase & Company | JPM | $458 billion | $151.91 | 14.18 million |

| 2 | Goldman Sachs Group Inc. | GS | $125 billion | $364.8 | 2.78 million |

| 3 | Morgan Stanley | MS | $170 billion | $91.25 | 9.58 million |

| 4 | Wells Fargo & Company | WFC | $182 billion | $44.28 | 27 million |

| 5 | Bank of America | BAC | $321.8 | $37.92 | 43.94 million |

1. JPMorgan Chase & Company:

JPMorgan Chase & Co. is an American multinational investment bank and financial service provider with assets of $3.4 trillion. It is a global leader in financial services, offering solutions to the world’s most important corporations, governments, and institutions in more than 100 countries. JPMorgan has been named Fortune magazine’s Top 10 Most Admired Companies list.

JPMorgan has reported a net income of $29.1 billion and revenue of $122.9 billion in the last annual report. This reflects strong underlying performance across all businesses offset by additional reserves under new accounting rules. The bank extended credit and raised $2.3 trillion in capital for businesses, institutional clients, and U.S. customers in their last fiscal year.

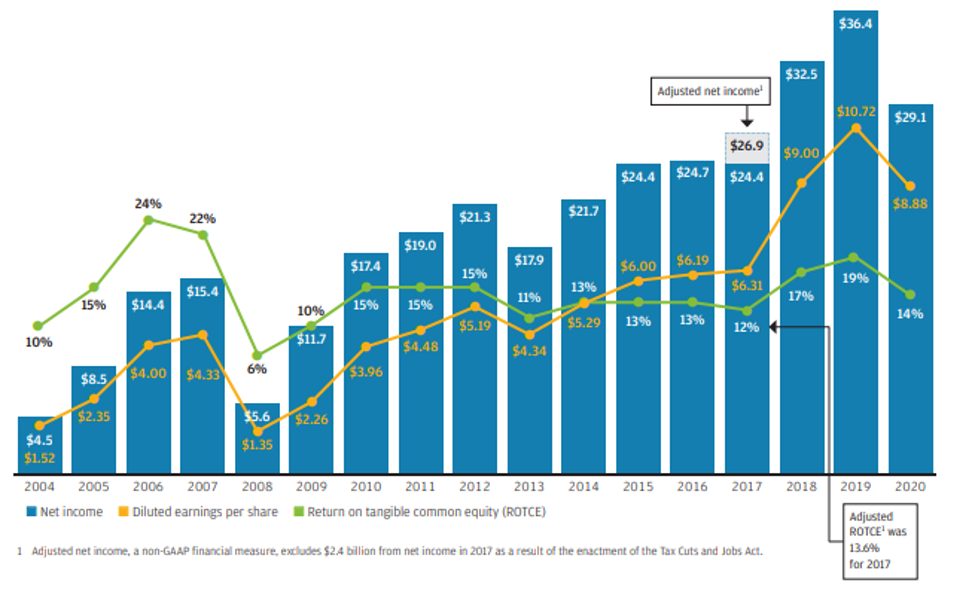

Below is the detailed chart showing the bank’s Earnings, Diluted Earnings per Share, and Return on Tangible Common Equity:

JPMorgan is known for its strong balance sheet and focuses on capital growth. Because of this the bank reported an increase in book value per share by 8% to $81.75 and posted a return on tangible common equity of 24%, up from 17% in the year 2020. Despite the pandemic and economic downfall, JPMorgan stood strong.

JPMorgan is known for its strong balance sheet and focuses on capital growth. Because of this the bank reported an increase in book value per share by 8% to $81.75 and posted a return on tangible common equity of 24%, up from 17% in the year 2020. Despite the pandemic and economic downfall, JPMorgan stood strong.

JPMorgan invests $11 billion per year in technology. Also, JPMorgan Chase is the first major bank to roll out an AI-powered virtual assistant that will make it easier for corporate clients. JPMorgan is always in the role to provide customers a great experience. They have a clear vision of the future. Indicators and tools are used by both professional and regular traders, both to understand the market.

JPMorgan stock is on a bullish trend since the decline due to the pandemic. It is currently trading at around $155. The stock performance for the past 5 years is shown below:

Read more:

2. Goldman Sachs Group Inc.

The Goldman Sachs Group, Inc. is a leading global financial institution that delivers a broad range of financial services across investment banking, securities, investment management, and consumer banking to a large and diversified client base that includes corporations, financial institutions, governments, and individuals.

The company reported net revenue of $15.4 billion and earnings of $5.3 billion, for the second quarter of 2021. Return on tangible common equity was 25.1% for the quarter and 28.9% year to date. While net revenue decreased 13% sequentially, overall revenue remains strong. The company also increased its quarterly dividend by 60% to $2.00 per share from $1.25.

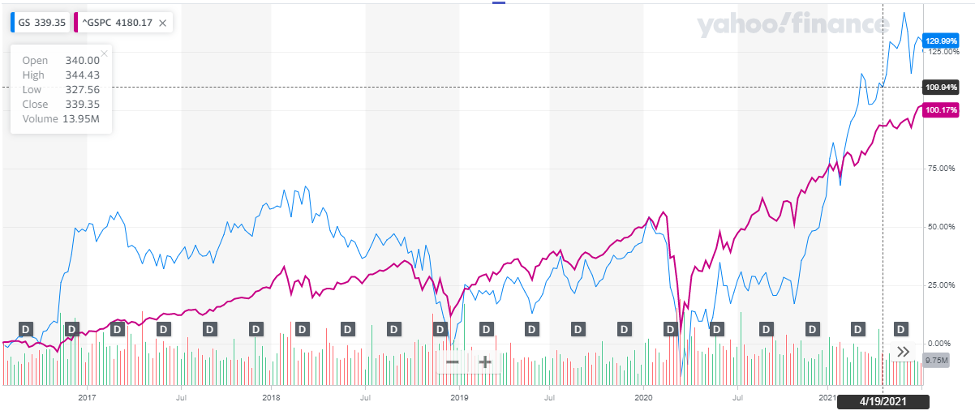

The stock of Goldman Sachs is on a bullish streak and has been performing better than the S&P 500 index. The bank’s stock gained approximately 40%, increasing from about $264 at the beginning of 2021 to around $369 today. In comparison, the S&P 500 grew by 11% year to date.

Read: Best Gold Trading Signal Providers.

The below chart shows the performance of the bank’s stock in comparison to the S&P 500 index:

One of the most reputable and running functions of Goldman Sachs is its investment banking division. Under this division, the bank provides financial advisory services and helps companies to raise capital to grow their businesses. The bank posted the second-highest revenue quarter ever, from its investment banking division, the highest being in the first quarter of 2021. Goldman’s net revenues from investment banking totaled $3.61 billion. Also, the leading investment bank was ranked number one in mergers and acquisitions globally, worldwide equity and equity-related offerings, common stock offerings, and initial public offerings.

One of the most reputable and running functions of Goldman Sachs is its investment banking division. Under this division, the bank provides financial advisory services and helps companies to raise capital to grow their businesses. The bank posted the second-highest revenue quarter ever, from its investment banking division, the highest being in the first quarter of 2021. Goldman’s net revenues from investment banking totaled $3.61 billion. Also, the leading investment bank was ranked number one in mergers and acquisitions globally, worldwide equity and equity-related offerings, common stock offerings, and initial public offerings.

Goldman Sachs is one of the best bank stocks to buy today. Its performance has been above the estimated figures and the stock is expected to rise further this year. Check out the best NFT stocks to buy.

3. Morgan Stanley

Morgan Stanley is a leading global investment bank that has three main business segments:

- Institutional securities

- Wealth management

- Investment management

The bank recently posted its Q2 report of 2021 which showed excellent performance. The highlights of the Q2 report are:

- Net revenues were $14.8 billion, reporting an 8% increase from last year

- Net income was$ 3.51 million

- Earning per share were declared $1.85

The breakdown of the revenue business segment-wise is listed below:

| Revenue for Q2 2021 | Revenue for Q2 2020 | |

| Institutional Securities | $7.1 billion | $8.2 billion |

| Wealth Management | $6 billion | $4.7 billion |

| Investment Management | $1.7 billion | $0.9 billion |

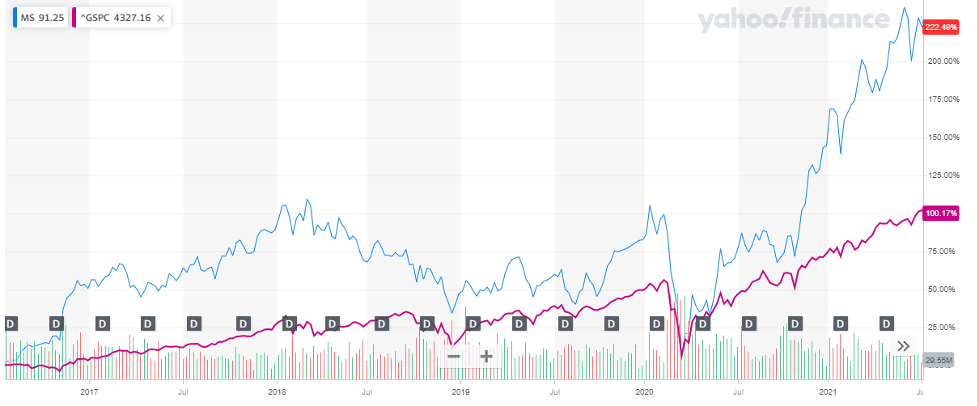

The stock of Morgan Stanley has been on an upward streak after a deep plunge due to the pandemic. The stock kicked off the year 2021 at $69 and is currently trading at $91.25, reporting a 32% year-to-date increase. The bank stock has outperformed the S&P 500 index, as shown in the chart below.

Despite the tough last year and low-interest rates, the bank is still standing strong and is expecting growth. This growth is accredited to the expansion initiatives of the bank. The goal behind the expansion was to increase revenue sources. The expansion includes acquisitions of Eaton Vance (closed on Mar 1), E*Trade Financial (October 2020), and Shareworks (2019).

Despite the tough last year and low-interest rates, the bank is still standing strong and is expecting growth. This growth is accredited to the expansion initiatives of the bank. The goal behind the expansion was to increase revenue sources. The expansion includes acquisitions of Eaton Vance (closed on Mar 1), E*Trade Financial (October 2020), and Shareworks (2019).

Morgan Stanley is one of the leading banks of the United States, located in New York. The bank’s stock has shown great performance and the strategic expansion will bring new levels of growth for the banking firm on the whole. Keeping in mind the plans and solid Q2 earnings, Moran Stanley is one of the best banks to invest in. Value Stocks and Growth stocks are also great investment opportunities.

Read more:

4. Wells Fargo & Company

Wells Fargo & Co. is a diversified, community-based financial services company. It is engaged in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance. It operates through the following segments:

- Consumer Banking

- Commercial Banking

- Corporate and Investment Banking

- Wealth & Investment Management

The band recently posted its Q2 report. The highlights of the report are:

- Total Revenue $20.3 billion, reporting an increase of 11% from the same period last year

- Net income of $6 billion, a tremendous improvement from the second quarter of 2020 when the bank reported losses

- Earnings per share $1.38

The financial highlights segment-wise are listed below:

- Consumer Banking – Average loans declined by 10% to $332 billion, while deposits increased by 17% rising to $836 billion

- Commercial Banking – Average loans declined by 22% to $178.6 billion, while deposits increased by 5% rising to $193 billion

- Corporate and Investment Banking – Average loans declined by 8% to $252 billion, and average deposits declined by 20% to $190.8 billion

- Wealth and Investment Management – Total client assets increased by 20% rising to $2.1 trillion; Average loans also increased by 5% to $81.8 billion and average deposits rose to $175.0 billion

The stock of Wells Fargo kicked off the year 2021 at $30 and is currently trading at $44.28, reporting an increase of more than 47% year-to-date. The stock growth has slowed down since the pandemic but the bank’s stock is on the path to recovery. Its trading volume has been very high indicating investor interest in this stock.

The performance chart of Wells Fargo stock for the past 5 years can be viewed below:

The bank’s strong fundamentals and future outlook make Wells Fargo well-positioned for growth. This growth is driven by the consistent rise in deposit balances and foreseeable growth in earnings. Also, the liquidity of the bank is fairly good, with a liquidity cover ratio of 123%. With solid financial performance, this is one of the best bank stocks to buy right now.

The bank’s strong fundamentals and future outlook make Wells Fargo well-positioned for growth. This growth is driven by the consistent rise in deposit balances and foreseeable growth in earnings. Also, the liquidity of the bank is fairly good, with a liquidity cover ratio of 123%. With solid financial performance, this is one of the best bank stocks to buy right now.

Get to know the best vaccine stocks to invest in 2023.

Read more:

5. Bank of America

Bank of America is an American multinational investment bank. It serves individual consumers, small and middle-market businesses, and large corporations with a full range of banking, investing, asset management, and other financial and risk management products and services. The bank serves approximately 66 million consumer and small business clients with approximately 4,300 retail financial centers, approximately 17,000 ATMs, and award-winning digital banking with approximately 41 million active users, including approximately 32 million mobile users.

The bank operates through four segments:

- Consumer Banking

- Global Wealth and Investment Management

- Global Banking

- Global Markets

The bank recently issued its Q2 earnings report. The highlights of the report are:

- Revenue of $21.5 billion, a 4% decline from previous year’s second-quarter result

- Net income of $9.2 billion, an approx. three-fold increase from the previous year’s second-quarter result. The major reason is a huge decline in provisions for credit losses

- Earnings per share of $1.03

The financial highlights segment-wise are listed below:

- Consumer Banking – This segment reported a net income of $3.0 billion and Deposits of $979 billion. Deposits increased by 21%

- Global Wealth and Investment Management – This segment reported net income of $991 million, client balances of $3.7 trillion, reporting an increase of 25%, and deposits of $333 billion reporting an increase of 16%.

- Global Banking – This segment reported a net income of $2.4 billion and deposits of $507 billion

- Global Markets – This segment reported Net income of $908 million

The bank stock started the year 2021 at $30.46 and is currently at $37.92, reporting an approximate 25% increase year-to-date. The stock has been on a bullish trend after the huge drop due to the pandemic in 2020. The below chart shows the 5 years stock performance of the bank.

The factors driving growth are its strong liquidity, low loss rates, and well-capitalized structure. The bank has reported $1.9 Trillion deposits in its recent quarter. Moreover, the trading volume of Bank of America stock has been very high over the past 3 months. With these highlights in mind, the bank stock is highly in demand in the investor’s circle and should be invested in today. Undoubtedly it is one of the best bank stocks to invest in right now.

The factors driving growth are its strong liquidity, low loss rates, and well-capitalized structure. The bank has reported $1.9 Trillion deposits in its recent quarter. Moreover, the trading volume of Bank of America stock has been very high over the past 3 months. With these highlights in mind, the bank stock is highly in demand in the investor’s circle and should be invested in today. Undoubtedly it is one of the best bank stocks to invest in right now.

Conclusion

The banking sector has great prospects in the future. With these banks in your portfolio, your portfolio will be generating great returns in the future.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading