The shipping sector had to face many challenges over the past few years which led to skyrocketing prices, and a three-fold increase in transit times. As a result, 93% of importers and exporters reported supply-chain difficulties.

Over 80% of world trade volume is in seaborne. Due to supply and demand factors, world trade was initially impacted heavily by the pandemic.

Two incidents within the shipping industry made headlines in 2021, which are the grounding of the container liner in the Suez Canal and the port congestion on the U.S. West Coast. Both resulted in supply chain disruption around the world.

Despite these disruptions, global trade reached record highs in 2021. Global trade growth stabilized during the second half of 2021. The economic recovery from the pandemic in 2021 has been characterized by large and unpredictable swings in demand, which have resulted in increased stress on supply chains. Investing in fintech stocks is a smart investment move today.

In 2022, the shipping industry is expected to perform, as mentioned below, in the areas:

- Freight Rates – It is very difficult to predict freight levels, after a tumultuous year. Despite that, the freight market is expected to do well in 2022.

- Contracts – There has been an increasing trend of carriers signing long-term contracts. And this is expected to continue in 2022. Investing in value stocks is a long-term investment.

- Inventory Management – Importers are taking extreme measures to ensure that they have the supply ready to sell in their warehouse when there is demand. After the supply chain was disrupted the importers learned their lesson. Importers are shipping in advance and have eliminated the items that have become extremely expensive.

- Centralizing the freight and other supply chain solutions – There has been a rise in demand for companies that offer most of this service. This has been saving a lot of time for importers to focus on different areas. The importance of diversification of overseas sourcing, digitization, sustainability, and regulatory involvements will continue to increase in the year ahead. Get to know about top Infrastructure stocks to invest in.

Top Shipping Stocks in 2024

Keeping in mind these trends and the growth potential of the shipping industry, we have chosen a list of “Top Shipping Stock” for investment in 2024.

| Sr. | Company Name | Symbol | Market Cap | Price (As of 21 July 2022) |

| 1 | A.P. Moller Maersk | AMKBY | $ 46.17 Billion | $ 12.63 |

| 2 | ZIM Integrated Shipping Services | ZIM | $ 6 Billion | $ 50.05 |

| 3 | Matson | MATX | $ 3.484 Billion | $ 85.94 |

| 4 | Danaos Corp. | DAC | $ 1.423 Billion | $ 68.67 |

| 5 | Textainer Group | TGH | $ 1.48 Billion | $ 30.82 |

| 6 | International Seaways | $ 1.13 Billion | $ 22.7 | |

| 7 | Genco Shipping & Trading | GNK | $ 804.6 Million | $ 19.11 |

| 8 | Eagle Bulk Shipping | EGLE | $ 720 Million | $ 52.58 |

| 9 | Global Ship Lease | GSL | $ 710.1 Million | $ 17.77 |

| 10 | Seanergy Maritime Holdings Corp. | SHIP | $ 137.3 Million | $ 0.7699 |

| 11 | International Seaways | INSW | $ 1.86 billion | $ 37.97 |

| 12 | Expeditors International of Washington | EXPD | $ 17.33 billion | $ 108.92 |

| 13 | FedEx Corporation | FDX | $ 47.6 billion | $ 188.63 |

| 14 | Hub Group | HUBG | $ 2.718 billion | $ 81.78 |

| 15 | Genco Shipping & Trading | GNK | $ 682.7 million | $ 16.13 |

A.P. Moller Maersk

A.P. Moller – Maersk is an integrated transport and logistics company. It is a global leader in container shipping and ports. The company employs roughly 95,000 employees and operates in around 130 countries.

The year 2022 has been an excellent year with the best earnings level reported for Q1. Despite continued global supply chain pressures, the company demonstrated excellent ability to help customers overcome logistic challenges. Growth was reported across Ocean, Logistics, and Terminals. Moreover, the increased earnings were driven by freight rates and by contracts being signed at higher levels.

Get to know the best quantum computing stocks.

For the quarter, the company reported:

- Revenue was reported to be RSD 15.6 billion, an increase of 64 %

- Revenue in Oceans increased by 64 %

- Revenue in Logistics increased by 41 %

- Revenue in Terminals increased by 20 %

- EBITDA was recorded at $ 9.8 million

A.P. Moller Maersk has a market cap of $ 45.3 billion. Its share is trading at a price of $ 12.42. in the past two years, the share has been on a bullish run. After peaking at $ 18.4, the share started declining.

In 2021, the share price went from $ 11.11 to $ 17.92, representing a 62 % appreciation during the year. In 2022, the share has risen from $ 17.92 to 12.42, representing a 30 % decline to date.

Also, check out:

Also, check out:

ZIM Integrated Shipping Services

ZIM Integrated Shipping Services has set itself apart as an independent carrier. It provides container shipping and related services in Israel and internationally. It provides door-to-door and port-to-port transportation services for various types of customers, including end-users, consolidators, and freight forwarders. As of December 31, 2021, ZIM operates a fleet of 118 vessels, which included 110 container vessels and 8 vehicle transport vessels, of which four vessels were owned by it and 114 vessels are chartered-in; and a network of 70 weekly lines. Cybersecurity stocks are also one of the best investment opportunities.

ZIM Integrated Shipping recently announced its consolidated results for the three months ended March 31, 2022:

- Revenues were reported at $3.7 billion, representing a year-over-year increase of 113%

- Operating income (EBIT) was reported to be $2.2 billion, a year-over-year increase of 228%

- Net income was reported at $ 1.7 billion, as compared to $ 590 million in the first quarter of 2021 representing a year-over-year increase of 190%

- The company announced a dividend of $2.85 per share for the quarter

ZIM Integrated Shipping Services has a market capitalization of $ 5.44 billion. Its share is trading at a price of $ 45.3. The company went public in Feb’2021. Since then, its share has come a long way. From a price of $ 12, the share price has risen by an astounding 277 % in less than 18 months.

For the major part of the period, since going public, the share has been on a bullish run. After peaking at $ 84.5 in March’2022, the share reversed its course and started declining.

In 2021, the share price went from $ 12.05 to $ 58.86, representing an appreciation of roughly 400 %.

In 2022, the share price started off at $ 58.86, peaked at $ 84.5, and is currently trading at $ 45.39.

Investors are now looking for the finest solar energy stocks to invest in.

Investors are now looking for the finest solar energy stocks to invest in.

Genco Shipping & Trading

Genco Shipping & Trading Limited is a provider of international seaborne dry bulk transportation services. The Company transports iron ore, coal, grain, steel products, and other dry bulk cargoes along worldwide shipping routes through the ownership and operation of dry bulk carrier vessels. The company owns a fleet of dry cargo vessels which include 44 dry bulk carriers, including 17 Capesize dry bulk carriers, 15 Ultramax dry bulk carriers, and 12 Supramax dry bulk carriers with an aggregate carrying capacity of approximately 4,636,000 deadweight tons (dwt).

Get to know about RSI trading strategies.

Genco reported its financial results for the three months ended March 31, 2022:

- Revenues were reported at $ 136.2 million, as compared to $ 87.6 million for the previous quarter’s same period

- Net income was reported at $ 41.7 million

- Earnings per share were recorded at $ 0.99

- The company announced a $0.79 per share dividend for the first quarter

Genco has a market capitalization of $ 778.5 million. Its share is trading at a price of $ 18.49. In the past two years, the stock has been volatile but has been steadily rising.

In 2021, the stock started off at $ 7.36 and closed off at $ 16, representing a 117 % increase during the year.

In the current year, the stock started off at $ 16, peaked at $ 26.3, and is currently at $ 18.49. Overall, the stock inched up 15 %.

Tech stocks are also one of the best investment opportunity.

Tech stocks are also one of the best investment opportunity.

International Seaways

International Seaways, Inc. is engaged in the transportation of crude oil and petroleum products in the International Flag trade. It owns and operates a fleet of oceangoing vessels. It operates in two segments: Crude Tankers and Product Carriers. The company serves independent and state-owned oil companies, oil traders, refinery operators, and international government entities. Oil stocks are one of the riskier yet most profit-generating sectors.

As of December 31, 2021, the company owned and operated a fleet of 83 vessels, which include 12 chartered-in vessels, as well as had ownership interests in two floating storage and offloading service vessels.

International Seaways, Inc. is one of the largest tanker companies worldwide providing energy transportation services for crude oil and petroleum products. It reported financial results for the first quarter of 2022:

- Net loss was reported to be $13.0 million, as compared to a net loss of $13.4 million the previous year same period

- Adjusted EBITDA was reported at $ 26 million, as compared to $10.7 million for the previous year’s same period.

- Announced a quarterly cash dividend of $0.06 per share

- Cash was reported to be $75.6 million

International Seaways has a market capitalization of $ 1 billion. Its share is trading at a price of $ 21.68. The share has been extremely volatile in the past two years.

In 2021, the share went from a price of $ 16.33 to $ 14.68 after multiple dips and peaks during the year.

In 2022 the share started off a $ 14.68. After peaking at $ 24.5, the share dropped and is currently trading at $ 21.68. This represents an approx. 50 % share price appreciation to date.

Semiconductor stocks are also one of the best investment opportunities.

Semiconductor stocks are also one of the best investment opportunities.

Textainer Group

Textainer is one of the world’s largest intermodal container lessors with a total of 4.3 million twenty-foot equivalent units (TEU) in our owned and managed fleet. It supplies standard dry freight, specialized, and refrigerated containers to approximately 200 global customers, including all of the world’s leading shipping lines.

Textainer has achieved the status of one of the largest sellers of used containers. They sell an average of roughly 130,000 containers per year for the last five years to more than 1,000 customers.

Textainer reported first quarter results for the year 2022:

- Revenue was reported at $ 275 million, as compared to $ 214 million in the previous year’s same period

- Net Income was reported at $ 72. million, as compared to $ 62 million in the previous year

Textainer Group has a market capitalization of $ 1.48 billion. Its share is trading at a price of $ 30.85. for the major part of the past two years, the stock has been on a bullish trend. After hitting the peak of $ 40.38, the stock started a steady decline downwards.

In 2021, the stock started at $ 19.18 and closed off the year at $ 35.71 representing an 86 % increase during the year.

During the current year, the stock started at $ 35.71, peaked at $ 40.38, and is currently at $ 30.85. Overall, the stock declined by 13.6 % to date.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

Global Ship Lease

Global Ship Lease, Inc. is engaged in owning and chartering out containerships to liner companies. The Company owns a fleet of mid-sized and smaller containerships, which it charters out under fixed-rate charters to container shipping companies. It focuses on mid-size Post-Panamax and smaller containerships.

Get to know everything about high-frequency trading.

The Company’s fleet consists of approximately 65 mid-sized and smaller containerships, ranging from 1,118 to 11,040 twenty-foot equivalent units (TEU), with an aggregate capacity of 342,348 TEU. Its 32 ships are wide beam Post-Panamax.

Global Ship Lease announced its results for the three months ended March 31, 2022:

- Operating revenue was recorded at $ 153.6 million, as compared to $ 73. million for the previous year’s same period. This represents a 2.1-fold increase

- Net income was reported to be $ 70.2 million, as compared to $ 4.2 million for the previous year’s same period. This represents a whopping 16.7-fold increase.

- Earnings per share were reported at $ 1.93

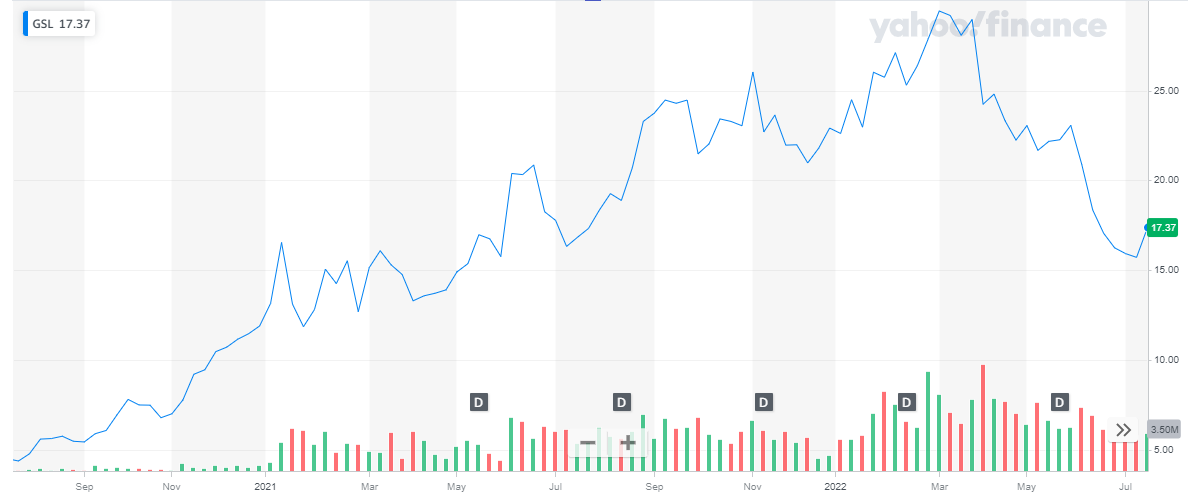

Global Ship Lease has a market cap of $ 694 million. Its share is trading at a price of $ 17.37. the stock has been on a bullish run, for the major part of the last two years. After hitting the peak of $ 29.43, the stock price changed course and started declining.

In 2021, the stock went from $ 11.89 to $ 22.91, representing a 93 % increase during the year.

In 2022, the stock went from $ 22.91 to $ 17.37, representing a 24 % decline to date.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Matson

Matson is a leading provider of ocean transportation and logistics services. The Company’s fleet of owned and chartered vessels includes containerships, combination containers, roll-on/roll-off ships, and custom-designed barges. Matson Logistics, established in 1987, extends the geographic reach of Matson’s transportation network throughout the continental U.S.

Its integrated, asset-light logistics services include rail intermodal, highway brokerage, warehousing, freight consolidation, Asia supply chain services, and forwarding to Alaska

Matson Inc reported first quarter results for 2022:

- Revenue was reported to be $ 1.2 billion as compared to $ 711.8 million for the first quarter of 2021.

- Ocean Transportation’s revenue increased by 68.4 %

- Logistics revenue increased by 46.5 %

- Net Income was reported to be $ 339.2 million, as compared to $ 87.2 million for the previous year’s same period

- Earnings per share were reported at $ 8.23

Matson has a market capitalization of $ 3.43 billion. Its share is trading at $ 84.68. For the major part of the past two years, the stock was bullish. After peaking at $ 121.47, the stock reversed its course and started declining.

In 2021, the stock went from $ 56.97 to $ 90.03, representing a 58 % appreciation during the year.

In 2022, the stock went from $ 90.03 to the peak of $ 121.47 and is currently trading at $ 84.68. Overall, the stock declined by 6 %.

Also read Forex trading vs Stocks trading.

Also read Forex trading vs Stocks trading.

Danaos Corp.

Danaos Corporation is a holding company and an international owner of containerships, chartering its vessels to a range of liner companies. The Company’s principal business is the acquisition and operation of vessels.

Danaos Corp. conducts its operations through vessel-owning companies, whose principal activity is the ownership and operation of containerships that are under the management of a related party of the company. The Company has a fleet of over 50 containerships aggregating approximately 329,590 twenty-foot equivalent units (TEUs). Its containership fleet includes approximately 53 containerships deployed on time charters and approximately two containerships deployed on a bareboat charter.

Danaos Corporation, one of the world’s largest independent owners of containerships, recently reported results for the quarter ended March 31, 2022:

- Operating revenues were reported at $ 229.9 million, as compared to $ 132 million for the previous year’s same period

- Net income of $ 331.5 million, as compared to $ 296.8 million for the previous year’s same period. This represents an 11.8 % increase

- Earnings per share were reported at $ 16 per share

- The company announced a dividend of $ 0.75 per share

Danaos Corp has a market capitalization of $ 1.37 billion. Its share is trading at a price of $ 66.12. For the major part of the last two years, the stock of Danaos Corp has been on a bullish run.

In 2021, the stock went from $ 21.43 to $ 74.65, representing a 2.5-fold increase during the year.

In 2022, the stock started off at $ 74.65 peaked at $ 105.23, and is currently trading at $ 66.12. Overall, the stock declined by 11 %.

There is no guarantee of success but a good crypto trading signal provider will contribute to your financial security.

There is no guarantee of success but a good crypto trading signal provider will contribute to your financial security.

Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is an international provider of marine dry bulk shipping services through the ownership and operation of dry bulk vessels. The Company currently owns five Capesize and two Supramax vessels. Also, the company anticipates the completion of the acquisition of the remaining vessel. Check out our list of the best day trading stocks in 2024.

In total, Seaenergy will have a modern fleet of a total of eight dry bulk carriers, six Capsizes, and two Supramaxes, with a combined cargo-carrying capacity of approximately 1,145,553 DWT.

Seanergy Maritime Holdings Corp. reported first quarter financial results for the year 2022:

- Net revenue was reported to be $ 29.7 million, as compared to $ 20.4 million in Q1 2021. This represents a 46 % increase

- Net Income was reported at $ 3.7 million, as compared to a net loss of $1.3 million in Q1 2021

- Earnings per share were reported at $ 0.02

- The company announced a quarterly dividend of $0.025 per share.

Seanergy Maritime Holdings Corp has a market cap of $ 126.2 million. Its share is currently trading at $ 0.7077. The stock has been extremely volatile in the past two years.

In 2021, the stock went from $ 0.54 to the peak of $ 2.01 and closed off the year at $ 0.71. Overall, the stock appreciated by 32 % during the year.

In 2022, the stock went from $ 0.92 to $ 0.71 representing a 23 % decline during the year.

There are multiple forex trading platforms in the market.

There are multiple forex trading platforms in the market.

Eagle Bulk Shipping

Eagle Bulk shipping is a US-based fully integrated shipowner-operator engaged in the global transportation of dry bulk commodities.

Eagle Bulk Shipping engages in the ocean transportation of dry bulk cargoes worldwide. The Company owns, charters, and operates dry bulk vessels that transport a range of bulk cargoes, including coal, grain, ore, pet coke, cement, and fertilizers.

Eagle Bulk Shipping Inc. is one of the world’s largest owner-operators within the midsize dry bulk segment. It recently announced its financial results for the first quarter ended March 31, 2022:

- Revenues were reported at $ 184.4 million, as compared to $ 96.6 million for the same period last year. This represents an increase of 90 %

- Net Income was reported at $ 53.1 million, as compared to 9.8 million for the same period last year. This represents a whopping 4.5-fold increase

- Earnings per share were reported at $ 4.09 per share

- The company declared a dividend of $ 2 per share

Eagle Bulk Shipping has a market capitalization of $ 700 million. The share of the company is currently trading at $ 51.12. In the past two years, the stock has been on a bullish run. After hitting the peak of $ 76.1, the stock started declining.

In 2021, the stock went from $ 19 to $ 45.5, representing a 140 % increase during the year.

In 2022, the stock started off at $ 45.5, peaked at $ 76.1, and is currently trading at $ 51.12. Overall, the stock appreciated by 12.3 %.

Commodity stocks have also evolved as an asset class.

Commodity stocks have also evolved as an asset class.

International Seaways (INSW)

International Seaways, Inc. owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade. It operates in two segments, Crude Tankers, and Product Carriers. As of December 31, 2021, the company owned and operated a fleet of 83 vessels, which include 12 chartered-in vessels, as well as had ownership interests in two floating storage and offloading service vessels. It serves independent and state-owned oil companies, oil traders, refinery operators, and international government entities

International Seaways recently shares its third-quarter report for the year 2022:

- Revenues were reported at $ 236.9 million, as compared to $ 84.8 million in the previous year’s same period

- Operating income was reported at $ 128.4 million, as compared to operating loss ($ 57.1) million in the previous year’s same period

- Net income was reported at $ 113.4 million, as compared to a net loss of ($ 67.4) million in the previous year’s same period

- Earnings per share were reported at $ 2.3, as compared to ($ 1.44) in the previous year’s same period

International Seaways has a market cap of $ 1.86 billion. Its shares are trading at $ 37.97.

For the major part of the past two years, the stock remained steady. In 2021, the stock started the year at $ 16.33 and closed at $ 14.68 representing a slight decline during the year.

In 2022, the stock started with a steady behavior but later during the year spiked high and peaked at $ 45.9. The stock eventually closed off at $ 37.022 representing a 152 % appreciation during the year.

Expeditors International of Washington (EXPD)

Expeditors International of Washington, Inc. engages in the provision of global logistics services. The firm offers airfreight, ocean freight, and ocean and customs brokerage and other services. It also provides customer solutions such as order management, time-definite transportation, warehousing and distribution, temperature-controlled transit, cargo insurance, and customized logistics solutions.

Expeditors International of Washington recently shared its third-quarter report for the year 2022:

- Revenues were reported at $ 4.4 billion, as compared to $ 4.3 billion in the previous year’s same quarter

- Operating income was reported at $ 527 million, as compared to $ 490 million in the previous year’s same quarter

- Net Earnings were reported at $ 414 million, as compared to $ 359 million in the previous year’s same quarter

- Earnings per share were reported at $ 2.54, as compared to $ 2.09 in the previous year’s same quarter

Expeditors International of Washington has a market cap of $ 17.33 billion. The stock of the company has been trading at $ 108.92.

The stock has been volatile in the past two years. It started the year 2021 at $ 95.11. The stock remained bullish throughout the year and closed the year at the peak price of $ 134.29. Overall, the stock appreciated by 41 % throughout the year.

In 2022, the stock went bearish. The stock dropped to the low of $ 87.66 and eventually closed the year at $ 103.92. During 2022, the stock declined by 22.6 %.

FedEx Corporation (FDX)

FedEx Corp. is a holding company, which engages in the provision of a portfolio of transportation, e-commerce, and business services. It operates through the following segments:

- FedEx Express – The FedEx Express segment consists of domestic and international shipping services for the delivery of packages and freight.

- FedEx Ground – The FedEx Ground segment focuses on small-package ground delivery services.

- FedEx Freight – The FedEx Freight segment offers less-than-truckload freight services across all lengths of haul.

- FedEx Services – The FedEx Services segment provides sales, marketing, information technology, communications, customer service, technical support, billing and collection services, and certain back-office functions.

- Corporate, Other, and Eliminations – The Corporate, Other, and Eliminations segment includes corporate headquarters costs for executive officers and certain legal and finance functions, as well as certain other costs and credits not attributed to the company’s core business.

FedEx Corp. recently reported the second quarter results for the period ending November 30, 2022:

- Revenue was reported at $ 22.8 billion, as compared to $ 23.5 billion in the previous year’s same period

- Operating income was reported at $ 1.18 billion, as compared to $ 1.6 billion in the previous year’s same period

- Net Income was reported at $ 788 million, as compared to $ 1.04 billion in the previous year’s same period

- Earnings per share were reported at $ 3.07, as compared to $ 3.88 in the previous year’s same period

FedEx has a market cap of $ 47.16 billion. Its shares are trading at $ 188.63.

The stock started the year 2021 at a price of $ 259.62. Initially, the stock spiked high and peaked at $ 314.68. After that, the stock reversed its course of action and closed the year at $ 258.64. Overall, the stock maintained its share price by the end of the year.

In 2022 stock further declined and dropped to the low of $ 148.47. Eventually, the stock closed at $ 173.2 representing a 33 % decline in 2022,

Hub Group (HUBG)

Hub Group is a supply chain management company offering solutions ranging from intermodal, truckload, dedicated, and logistics services. Founded in 1971 in Hinsdale, IL by Phillip and Joyce Yeager, Hub Group has grown to be a $ 4B, award-winning, publicly traded company with offices in the United States, Canada, and Mexico. With over 4,000 employees, Hub Group delivers customer-focused solutions and industry-leading services to help customers better control their supply chains and their costs.

Hub Group, Inc. recently announced third-quarter results for the year 2022:

- Revenue was reported at $ 1.36 billion, as compared to $ 1.075 billion for the previous year’s same period

- Operating income was reported at $ 118 million, as compared to $ 60 million for the previous year’s same period

- Net income was reported at $ 87 million, as compared to $ 43.3 million for the previous year’s same period

- Earnings per share were reported at $ 2.63, as compared to $ 1.3 for the previous year’s same period

Hub Group has a market cap of $ 2.718 billion. Its shares are trading at $ 81.78

The stock has been volatile in the past two years. It started off in the year 2021 at $ 57. Throughout the year the stock remained bullish. Eventually, the stock closed at $ 84.24 representing a 48 % appreciation during the year.

In 2022, the stock exhibited volatile behavior. The stock went as high as $ 85.84 and dropped to a low of $ 61.37. Eventually, the stock closed at $ 79.49 representing a 5.6 % decline in 2022.

Genco Shipping & Trading (GNK)

Genco Shipping & Trading Ltd. is an international ship-owning company, which engages in the transportation of iron ore, coal, grain, steel products, and other dry bulk cargoes. It operates through the ocean transportation of dry bulk cargoes worldwide through the ownership and operation of dry bulk carrier vessels segment.

Genco Shipping & Trading Limited, the largest U.S. headquartered dry bulk shipowner focused on the global transportation of commodities, today reported its financial results for the three months ending September 30, 2022:

- Revenue was reported at $ 136 million, as compared to $ 155 million in the previous year’s same period

- Operating income was reported at $ 45 million, as compared to $ 65 million in the previous year’s same period

- Net Income was reported at $ 41 million, as compared to $ 57 million in the previous year’s same period

- Earnings per share were reported at $ 0.96 as compared to $ 3.07 in the previous year’s same period

Genco Shipping & Trading Limited has a market cap of $ 682.7 million. Its shares are trading at $ 16.13.

The stock remained bullish for the major part of the past two years. It started the year 2021 at $ 7.36. After peaking at $ 20.53, the stock closed the year at $ 16. Overall, the stock appreciated by 179 % during the year.

In 2022, the stock started off with a bullish run. After peaking at $ 26.3, the stock reversed its course of action and closed off the year at $ 15.36. Overall, the stock maintained its price levels by the end of the year.

Conclusion

The shipping industry is an important part of our broader economy. As these companies recover from the pandemic, they look to see favorable growth in the coming months. Therefore, it is the best time to invest in these companies as they are poised for growth in the near future.