Exchange-traded funds are a basket of securities that you can buy or sell through a brokerage firm on a stock exchange. All type of assets is offered in ETFs, from traditional stocks to digital currencies. ETFs are one of the most pivotal investment products for investors because of their benefits and low risk. ETFs are a great option to diversify your portfolio and hedge against risks while still keeping some upside potential.

An ETF can be purchased and sold like typical day trading stocks. They have their symbols through which they are identified and traded.

Advantages of ETFs

- ETFs can be easily purchased from the stock market during the day.

- The majority of the ETFs are index-based and they are required to announce their holdings daily. This provides the advantage of transparency in trading ETFs.

- Since ETFs are traded like stocks, investors have multiple options in placing trading orders which include limit orders or stop-loss orders

Disadvantages of ETFs

- ETFs have very wide spreads. Investors might have to buy at the higher spread price and sell at a lower spread price

- Sometimes technical issues with ETFs create discrepancies in the returns.

- ETFs sales take 2 days to process and before that, an investor cannot reinvest its money

Read: Best Gold Trading Signal Providers.

For the current year, we have compiled a list of the Best ETFs to buy:

List of Best ETFs To Buy For 2024:

1. 21shares Ethereum ETP (AETH)

2. 21Shares Bitcoin ETP (ABTC)

3. Rize Medical Cannabis and Life Sciences UCITS ETF (FLWR)

4. 21Shares Bitcoin Cash ETP (ABCH)

5. Invesco Elwood Global Blockchain UCITS ETF A (BCHN)

6. SPDR S&P 500 ETF (SPY)

7. Invesco QQQ Trust (QQQ)

8. Schwab U.S. Small-Cap ETF (SCHA)

9. Global X Silver Miners ETF (SIL)

10. Financial Select Sector SPDR Fund (XLF)

11. Energy Select Sector SPDR Fund (XLE)

1. 21Shares Ethereum ETP (AETH)

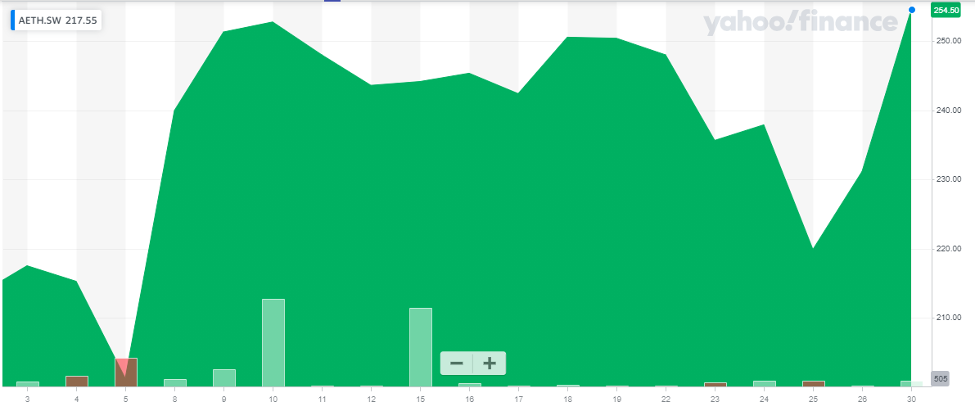

21 Shares Ethereum ETP (AETH) is the world’s first physically-backed Ethereum ETP. This ETP tracks the value of the cryptocurrency Ethereum. It was launched in March 2019 and was initially traded at CHF 20.96 per unit. Today one unit of 21Shares Ethereum ETP is being traded at more than CHF270. Its closing price as of 31st March 2021 is CHF 253.75. As per Just ETF, the return for the year 2020 for 21 Shares Ethereum ETP was 390%.

Also read: Best Stock Forecasts & Prediction Services

21Shares AG is the pioneer in the institutionalization of cryptocurrency assets into portfolio allocation. This company launched 21Shares Ethereum ETP along with 11 others crypto ETPs to the market which is performing well. The 21Shares Ethereum ETP is a small ETN with 92 Million euros assets under management. In spite of its small size, the explosive growth of the underlying cryptocurrencies makes AETH one of the best performing ETFs for 2024.The price trend of 21 Shares Ethereum ETP for the past 2 years is shown below:

Read more:

2. 21Shares Bitcoin ETP (ABTC)

21Shares Bitcoin ETP (ABTC) is the first physically-backed Bitcoin ETP. It tracks the value of cryptocurrency Bitcoin. It was launched in February 2019 and was being traded for CHF20. Currently, the price of one unit of 21Shares Bitcoin ETP is more than CHF 250. Its closing price as of 31st March 2021 is CHF 277.75. The annual return for the year 2020 for this ETP was reported to be approximately 250%.

The ETN replicates the performance of the underlying index with a collateralized debt obligation which is backed by physical holdings of Bitcoin. The 21Shares Bitcoin ETP has 263 Million Euro assets under management. ABTC and its high returns make it one of the best ETFs for investors to invest in

Amongst the 12 top cryptocurrencies ETPs launched by 21 Shares AG, 21Shares Bitcoin ETP is also amongst the list.

The price trend of 21 Shares Ethereum ETP for the past 2 years is shown below:

3. Rize Medical Cannabis and Life Sciences UCITS ETF (FLWR)

The Rize Medical Cannabis and Life Sciences UCITS ETF invest in stocks with a focus on the Health Care World. The dividends in the fund are reinvested. It was launched in Feb 2020 and was traded at CHF4.87. Its closing price as of 31st March 2021 is CHF 9.07. The return for Rize Medical Cannabis and Life Sciences for one year (from the date it was launched) is approx. 136%.

The fund performance follows the performance of the underlying index by buying all the index constituents. The index follows a modified liquidity-based weighting scheme where companies with higher liquidity achieve a bigger weight in the index. The Rize Medical Cannabis and Life Sciences UCITS ETF is a small ETF with 48 Million euros assets under management.

Get to know the best covered call stocks to buy now.

The price trend of Rize Medical Cannabis and Life Sciences UCITS ETF for the past 2 years is shown below:

4. 21Shares Bitcoin Cash ETP (ABCH)

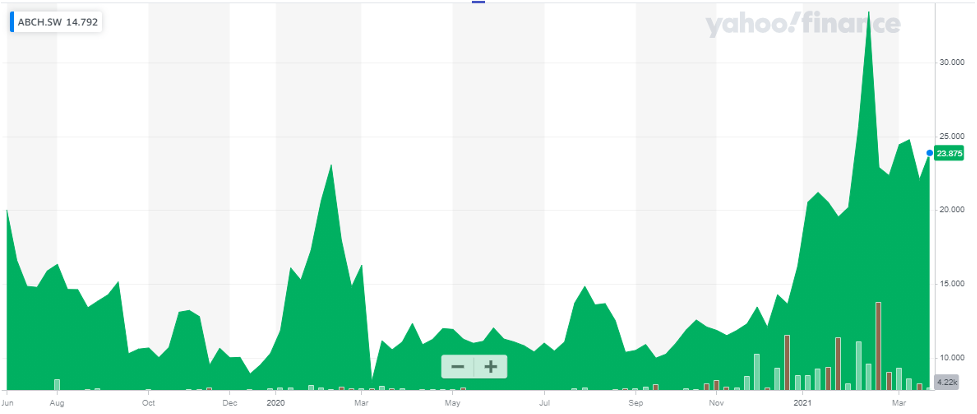

21Shares Bitcoin Cash ETP is the world’s first physically-backed Bitcoin Cash ETP. It tracks the value of the cryptocurrency Bitcoin Cash. It was launched in July 2019 and was being traded at $19.77. Currently, it is being traded at approximately $24. Its closing price as of 31st March 2021 is $23.88. The return for the year 2020 for 21Shares Bitcoin Cash ETP was reported to be 47%.

The ETN replicates the performance of the underlying index with a collateralized debt obligation which is backed by physical holdings of Bitcoin. The 21Shares Bitcoin Cash ETP is a very small ETN with 6 Million euros assets under management.

The price trend of 21Shares Bitcoin Cash ETP for the past 2 years is shown below:

Read more:

5. Invesco Elwood Global Blockchain UCITS ETF A (BCHN)

The Invesco Elwood Global Blockchain UCITS ETF A invests in stocks with focused Technology, World. The dividends in the fund are reinvested. Invesco Elwood Global Blockchain ETF was launched in March 2019 and was being traded at a price of Euro 34.78. Its closing price as of 31st March 2021 is Euro 108.94. The annual return for the year 2020 for Invesco Elwood Global Blockchain was reported to be approximately 76%.

The fund replicates the performance of the underlying index by buying a selection of the most relevant index constituent. The Invesco Elwood Global Blockchain UCITS ETF A is a large ETF with 916 Million Euro assets under management.

The price trend of Invesco Elwood Global Blockchain ETF for the past 2 years is shown below:

6. SPDR S&P 500 ETF (SPY)

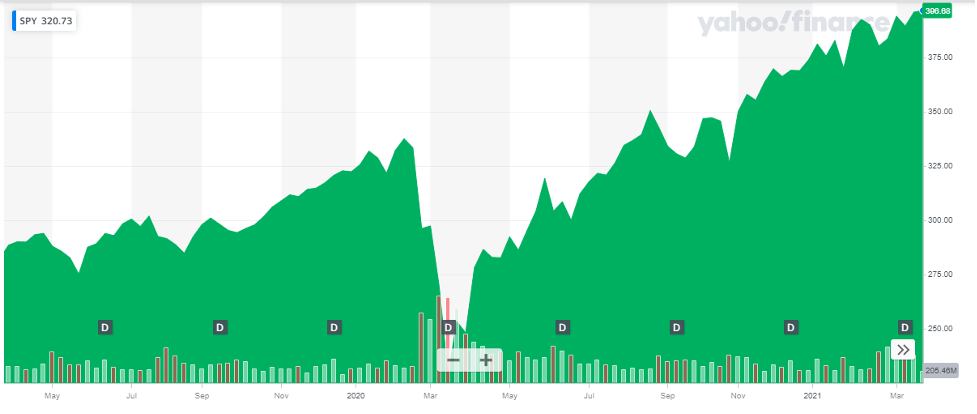

The S&P 500 is a stock market index that includes hundreds of the largest publicly traded U.S. companies. The SPDR S&P 500 ETF replicates the performance of the S&P 500. It was launched in 1993 and is one of the oldest ETFs in the US. In the year 2019, the index reported a return of 33.45%, and in the year 2020, the index reported a return of 7.38%.

SPDR S&P 500 ETF’s closing price as of 31st March 2021 is $396.33 With just a long history, this ETF can never go wrong with its return to investors and it is one of the best ETFs to invest in. SPDR S&P 500 ETF is a huge index that has $341.6 Billion in Assets Under Management.

The price trend of SPDR S&P 500 ETF for the past 2 years is shown below:

7. Invesco QQQ Trust (QQQ)

The Invesco QQQ ETF tracks the Nasdaq-100 Index, and it includes just over 100 of the largest non-financial stocks listed on the Nasdaq. This ETF was listed in December 2002. Invesco QQQ Trust’s closing price as of 31st March 2021 is $319.13. The performance of Invesco QQQ Trust is fairly good. This ETF reported an annual return of approximately 41% and 36% in 2019 and 2020, respectively.

Almost half of this fund comprises stocks belonging to the IT Sector. With the IT sector having a record of explosive growth, Invesco QQQ Trust is expected to grow similarly. This expected growth makes this ETF one of the best ETFs to buy for 2024. Invesco QQQ Trust has $152 Billion under Assets Under Management.

The price trend of Invesco QQQ Trust for the past 2 years is shown in the below graph:

8. Schwab U.S. Small-Cap ETF (SCHA)

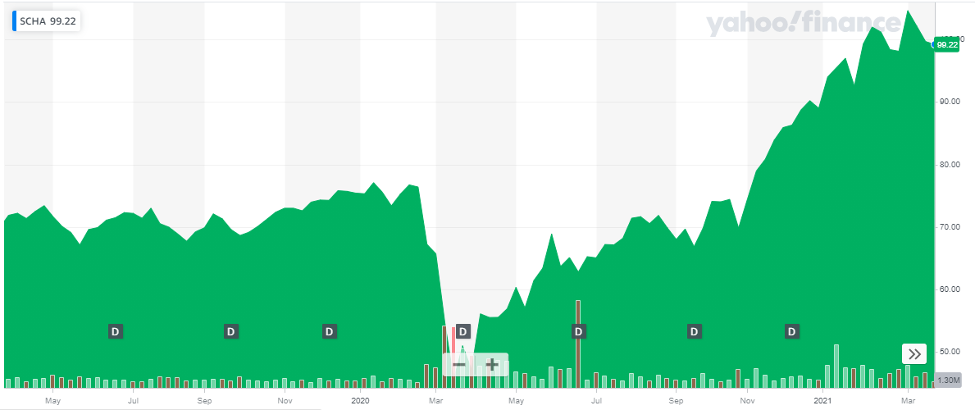

The Schwab U.S. Small-Cap ETF includes more than 1,800 stocks from a wide variety of industries, including healthcare, information technology, financials, and industrials. Schwab U.S. Small-Cap ETF was established in 2009. Its closing price as of 30th March 2021 is $99.67.

Small-cap stocks, no doubt, are comparatively risky because they show more volatility than the larger industries. But small-cap stocks have more growth opportunities and can give higher returns. This expected higher than expected returns qualifies SCHA amongst the best ETFs to invest in. Schwab U.S. Small-Cap ETF has a total of $15 Billion worth of Assets Under Management. As per Yahoo Finance, Schwab U.S. Small-Cap ETF reported an annual return of 26.54% and 19.35% in 2019 and 2020, respectively. Investing in best ETFs is one of the most easiest and safe investment option.

The price trend of Schwab U.S. Small-Cap ETF for the past 2 years is shown in the below graph:

Read more:

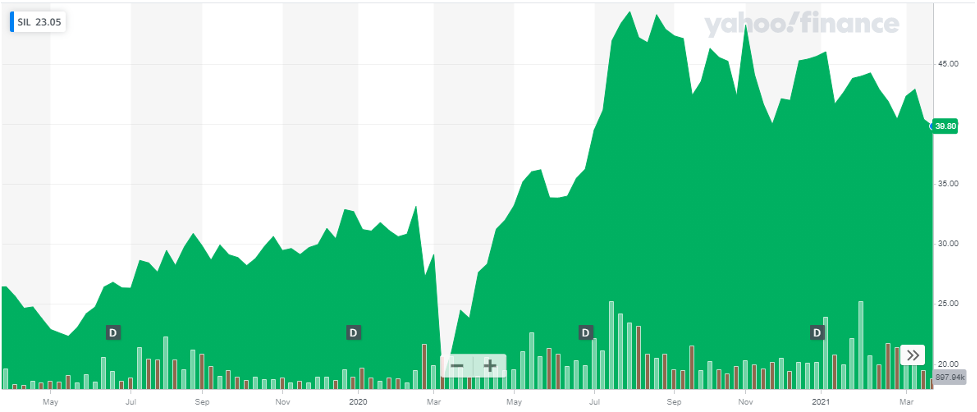

9. Global X Silver Miners ETF (SIL)

Global X Silver Miners ETF(SIL) tracks a market-cap-weighted index of companies actively engaged in the silver mining industry. It was launched in April 2010. Global X Silver Miners ETF closing price as of 31st March 2021 is $39.9.

Global X Silver Miners ETF excels in capturing the global silver miners’ market. It dominates the sector with a huge asset base and also offers the investors the ease of trade with million dollars of exchange taking place in this index. SIL is amongst the best performing ETFs and a good investment for the current year. Global X Silver Miners ETF is a huge fund with an Asset Under Management Value of $1.14 Billion. As per Yahoo Finance, the annualized return for the year 2020 was reported to be 41% and for the year 2019 was 34.3%.

The price trend of Global X Silver Miners ETF for the past 2 years is shown in the below graph:

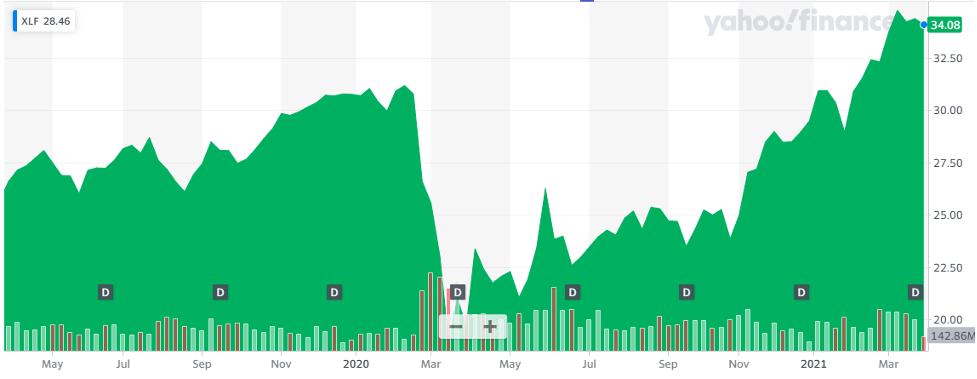

10. Financial Select Sector SPDR Fund (XLF)

Financial Select Sector SPDR Fund tracks an index of S&P 500 financial stocks, weighted by market capitalization. It was launched in 1998. Financial Select Sector SPDR Fund’s closing price as of 31st March 2021 is $34.05.s

Financial Select Sector SPDR Fund reflects the performance of the heavyweight segments of the US financial sector. Its portfolio is majorly concentrated in large banks. Financial Select Sector SPDR Fund is the go-to ETF for financial exposure amongst investors and one of the best ETFs to buy for 2024. Financial Select Sector SPDR Fund is a huge fund and has an Asset Under Management value of $38.44 Billion. As per Yahoo Finance, this fund reported an annual return of 32% in 2019 and a negative 1.68% return in 2020.

The price trend of the Financial Select Sector SPDR Fund for the past 2 years is shown in the below graph:

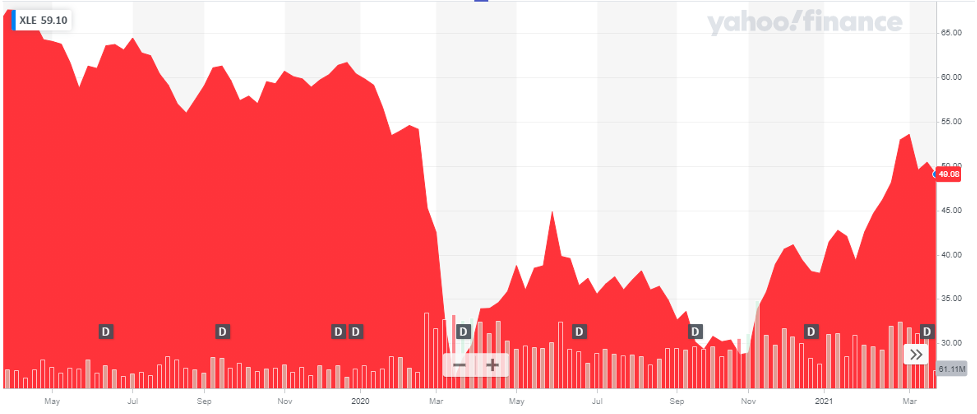

11. Energy Select Sector SPDR Fund (XLE)

The SPDR S&P US Energy Select Sector UCITS ETF invests in stocks with a focus on renewable energy stocks, United States. It was launched in 1998. Energy Select Sector SPDR Fund’s closing price as of 31st March 2021 is $49.06.

Energy Select Sector SPDR Fund offers liquid exposure to US energy firms. This fund picks its holding from the S&P 500 rather than the total market and that is the reason it majorly holds large-cap industries. Energy Select Sector SPDR Fund reported an annual return of 13.58% in 2019 and a negative 38.54% in 2020. In the current year, its year-to-date return is 38.44% which completely covers the negative return for the last year. Energy Select Sector SPDR Fund is a huge fund with a total of $22.88 Billion of Assets Under Management.

The price trend of the Financial Select Sector SPDR Fund for the past 2 years is shown in the below graph. The negative trend, of the graph, correlates with a negative return reported for the year 2020. The performance of the fund in the current year is amazingly great.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.