What is a REIT Stock?

REITs (real estate investment trusts) are publicly traded companies that own shares in income-producing real estate. Investors interested in investment can buy shares of REIT and gain exposure to all the real estate companies the REIT has invested in. REIT offers the benefit of diversified exposure in the real estate market. It also provides a higher return than the average market return. Unlike other real estate companies, a REIT is not in the business of building real estate properties to sell. Instead, a REIT buys and develops properties primarily to operate them as part of its investment portfolio

During Covid-19, REITs were hit pretty badly. Lockdowns and work-from-home left spaces empty and rent uncollected. The returns offered by the REITs were very low as compared to the market indexes like S&P 500

Types of REITs

- Equity REIT: It is one of the most common REITs. Income from this REIT is generated in the form of rent by leasing office space, warehouses, and hotels.

- Mortgage REIT – Income from this REIT is generated from mortgages by lending money to real estate owners or buying existing mortgage-backed securities.

- Hybrid REIT – It is a combination of investments in properties and mortgages. Income comes from both rent and interest income.

Benefits And Risks Of REITs

Benefits

- Transparency – REITs are traded on the stock exchanges under the same rules as other publicly listed securities.

- Liquidity – Shares of REIT can be easily bought and sold in the market.

- Dividends – REITs provide a regular stream of income

- Diversification – REIT offers the benefit of a diversified portfolio within the real-estate sector.

- Performance – REITs have historically proven to perform well. Also, REITs perform better even when other stocks or securities are down because it is not affected by the performance of other asset classes

Risks

- Higher tax payment – Dividends of REITs are taxed at the same rate as regular income

- Investment risk – The risk of investment is very high as there are a lot of factors that can affect the real estate market: property valuation, interest rates, debt, geography, and tax laws

- Management fees –REITs charge comparatively high transaction and administrative fees

- Minimal control – Investors of REITs have no control over the operational decisions which are the decision of strategies for market trading and/or which property to buy or sell

| Name | Symbol | Market Capitalization | Dividend ($) | Stock Price (as of 2nd July 2021 |

| American Tower Corporation | AMT | $124.1 Billion | 4.53 | $272.87 |

| Equity LifeStyle Properties | ELS | $13.7 Billion | 1.372 | $75.17 |

| Innovative Industrial Properties Inc. | IIPR | $4.77 Billion | 4.47 | $199.15 |

| Digital Realty Trust Inc. | DLR | $42.32 Billion | 4.48 | $150.27 |

| Realty Income | O | $25.6 Billion | 2.814 | $67.48 |

| Physicians Realty Trust | DOC | $3.94 Billion | 0.92 | 18.29 |

1. American Tower Corporation (NYSE: AMT)

American Tower Corporation is one of the largest global Real Estate Investment Trusts (REITs). It is a leading independent owner, operator, and developer of wireless and broadcast communications real estate. The company holds a vast portfolio of 187,000 communications sites, which are spread in the United States, India, and other major countries. It has been awarded the title of “World’s Most Admired Company of 2021’ by Fortune Magazine.

For the Fiscal year 2020, the REIT reported strong performance. The highlights of the company’s performance are:

- Total revenue increased 6.1% to $8,042 million

- Property revenue increased 6.5% to $7,954 million

- Net income decreased 11.7% to $1,692 million

- Dividend announced for the year $4.53

The dividend payout of American Tower is very high. This high dividend makes this company one of the best REIT dividend stocks.

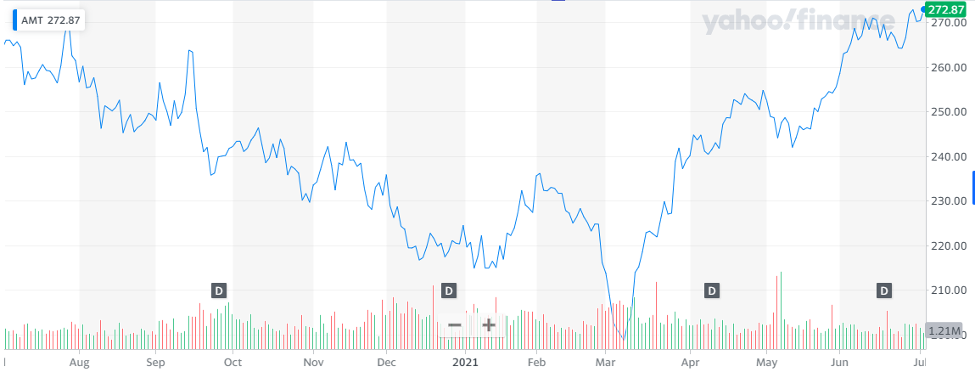

The performance of American Tower on the stock exchange is shown in the below chart:

Over the past few years, American Tower has been performing well and has even outperformed the S&P 500. At some points in time, the performance of American Tower REIT was more than double the performance of the index. When Covid-19 reached a pandemic status in the year 2020, the REIT’s performance dropped. Use the tools and indicators to get educated and to make well-informed decisions for investments.

Over the past few years, American Tower has been performing well and has even outperformed the S&P 500. At some points in time, the performance of American Tower REIT was more than double the performance of the index. When Covid-19 reached a pandemic status in the year 2020, the REIT’s performance dropped. Use the tools and indicators to get educated and to make well-informed decisions for investments.

The return on the REIT stock is shown in the below table:

| Year | Opening Price | Closing Price | Annual Return |

| 2015 | 87.0052 | 87.0061 | 0 % |

| 2016 | 87.0061 | 96.7719 | 11.22 % |

| 2017 | 96.7719 | 133.269 | 37.71 % |

| 2018 | 133.269 | 151.025 | 13.19 % |

| 2019 | 151.025 | 223.315 | 47.87 % |

| 2020 | 223.315 | 222.238 | -0.48 % |

Read more:

2. Equity LifeStyle Properties (NYSE: ELS)

Equity LifeStyle Properties is a leading owner and operator of manufactured home communities, RV resorts, and campgrounds in North America. The company offers housing options and vacation opportunities to meet a variety of customer needs. Equity LifeStyle Properties owns or has controlling interest in more than 400 communities and resorts in 33 states and British Columbia with more than 165,000 sites.

For the Fiscal year 2020, the REIT reported a good performance. The highlights of the company’s performance are:

- Total revenues increased by 5.2% to $1,091.4 million

- Net income available for Common Stockholders decreased by $0.28 per share to $1.25

- Dividend announced for the year $1.37/ share

Read: Best Gold Trading Signal Providers.

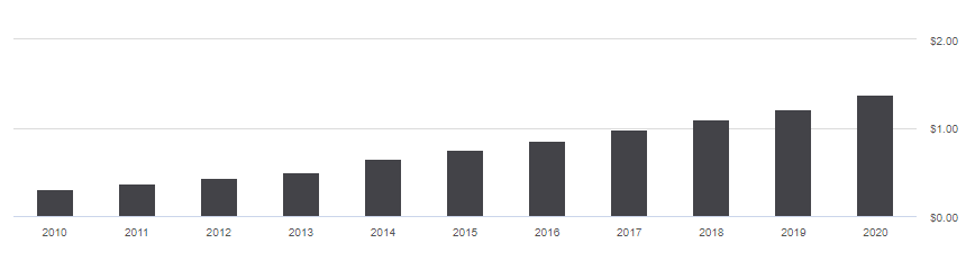

This REIT has been regularly giving out dividends to shareholders. And the dividend per share has been increasing steadily over the past years, as shown in the table below:

It is one of the best REIT dividend stocks.

It is one of the best REIT dividend stocks.

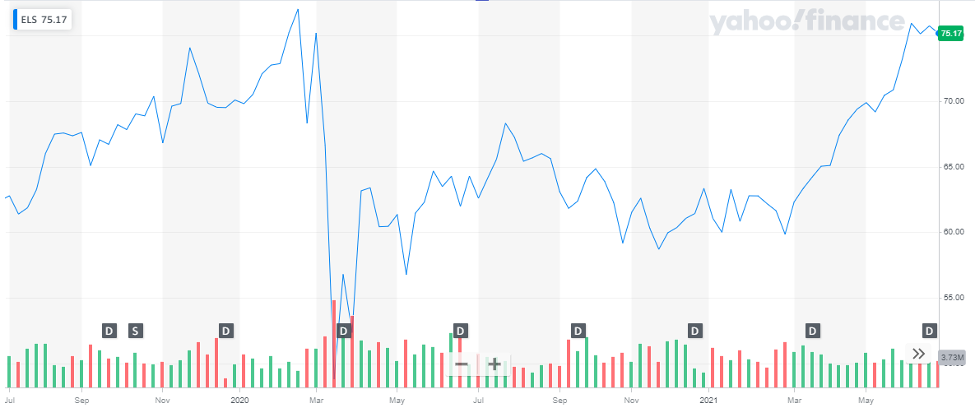

The performance of the stock of Equity LifeStyle Properties is shown below:

As shown in the chart above, the stock plummeted by a good percentage as the global lockdown started. Since then, the stock of ELS has able to recover itself completely.

As shown in the chart above, the stock plummeted by a good percentage as the global lockdown started. Since then, the stock of ELS has able to recover itself completely.

The company’s business model enables it to manage same-site income growth of an average of 4% annually. This growth is higher than apartment REIT and the overall sector growth levels. Moreover, the company has expanded its portfolio in other states of the US.

Read more:

3. Innovative Industrial Properties Inc. (NYSE: IIPR)

Innovative Industrial Properties is a publicly traded REIT that acquires cannabis processing and cultivation properties. It then leases these properties to growers under triple-net, long-term contracts.

The company operates the only NYSE-listed REIT that caters to medical-use cannabis. This market of the medical-use cannabis industry is set to boom in the coming years. The ArcView Group projects that sales of state-regulated cannabis in the United States will grow from $12.4 billion in 2019 to nearly $34 billion in 2025.

The highlights of the company’s performance for the year 2020 are:

- Revenue increased by 162% to $116.9 Million

- Net Income (attributable to common stockholders) increased by 192% to $64.4

- Declared announced for the year $4.47 per share

As of February 24, 2021, IIP owned 67 properties located in Arizona, California, Colorado, Florida, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New York, North Dakota, Ohio, Pennsylvania, Virginia, and Washington, totaling approximately 5.8 million rentable square feet (including approximately 2.0 million rentable square feet under development/redevelopment).

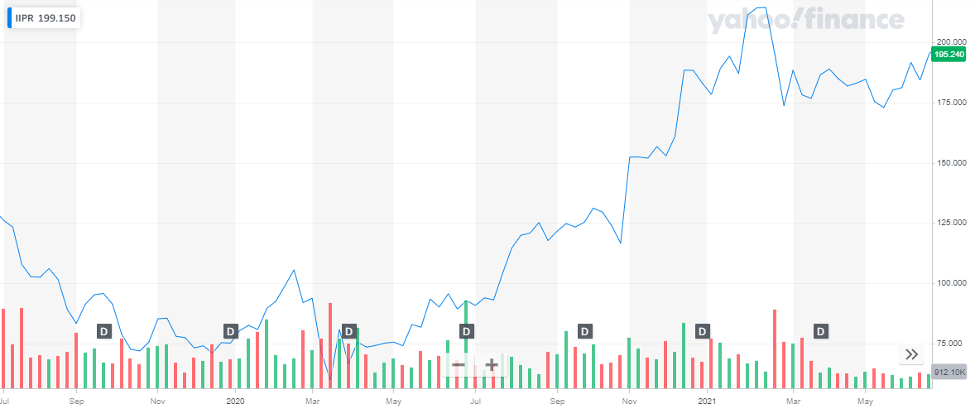

The billion-dollar company has shown impressive performance over the past years. The stock of IIPR is on a bullish track, as seen in the chart below:

The stock of IIPR has shown tremendous growth over the last 2 years.

The stock of IIPR has shown tremendous growth over the last 2 years.

The return of this REIT in comparison to the market can be viewed in the table below:

| II | US REITs | US Market | |

| 1 Year Return | 114.6% | 28.4% | 42.32% |

IIPR has outperformed the US market of REIT along with the overall market. With huge growth potential in the cannabis market coupled with the company’s bullish trend makes IIPR one of the best REIT stocks to buy.

Read more:

4. Digital Realty Trust Inc. (NYSE: DLR)

Digital Realty owns, acquires, develops, and operates data centers. The company is focused on providing data center, colocation, and interconnection solutions for domestic and international customers across a variety of industry verticals ranging from cloud and information technology services, communications, and social networking to financial services, manufacturing, energy, healthcare, and consumer products.

Globally, Digital Realty Trust has a network of 291 state-of-the-art, interconnected data centers concentrated in major cities of the world-spanning across 24 different countries. 19% of revenue contribution is from North Virginia followed by 11% from Chicago. The portfolio of the company contains a total of approximately 43.6 million square feet, including approx. 5.4 million square feet of space under development and approx. 2.3 million square feet reserved for future development.

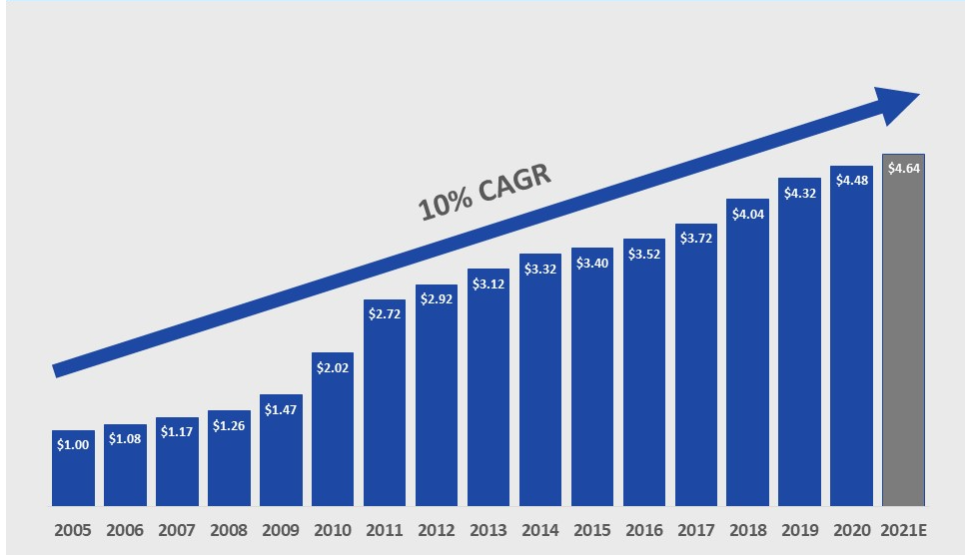

It is the 6th largest publicly traded REIT with a market capitalization of $55 Billion. The annual dividend paid out to shareholders has been consistently increasing for the past 16 years. In the fiscal year 2021, it is expected to rise even more. The below graph shows the dividend growth over the years and the expected dividend for the year 2021 as declared by the company.

The highlights of the company’s performance for the year 2020 are:

The highlights of the company’s performance for the year 2020 are:

- Revenue increased by 22% to $3.9 Billion

- Net income decreased by 47% to $260 Million

- Dividend declared for the year $4.48 per share

The stock of DLR has been performing well. In the past few months, the stock rose to $160.

The stock has been rising since 2021, with a few dips on the way. With a bullish trend continuing, SLR is one of the best REIT stocks to buy to benefit from the rising prices.

The stock has been rising since 2021, with a few dips on the way. With a bullish trend continuing, SLR is one of the best REIT stocks to buy to benefit from the rising prices.

5. Realty Income (NYSE:O)

Realty Income, one of the most popular dividend REITs providing stockholders with dependable monthly income. The company owns over 6,600 real estate properties owned under long-term lease agreements with commercial clients. To find more about dividend stocks please read here.

Realty Income has a portfolio occupancy of almost 98% in all its real estate properties. The company has leased its properties to more than 600 different clients belonging to more than 50 different industries.

The highlights of the company’s performance for the year 2020 are:

- Revenue increased by 10% to $1,651 Million

- FFO per share increased by 9% to $3.31

- Dividend declared for the year $2.814 per share

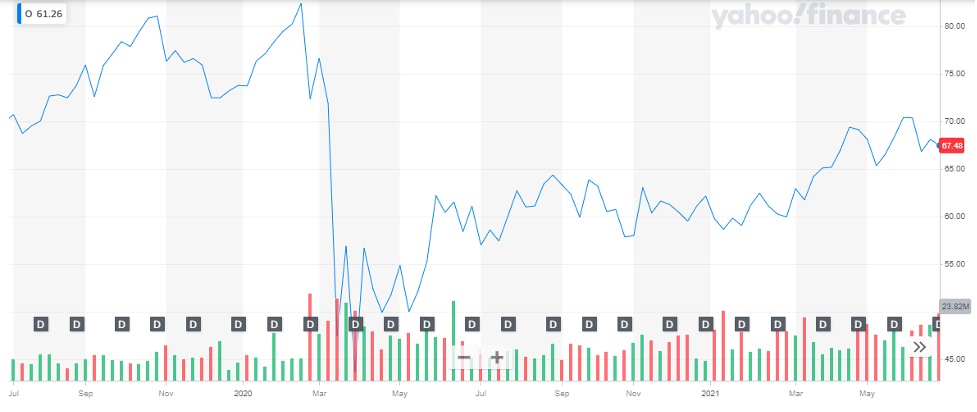

The stock performance of Realty Income is shown below:

The stock has performed well since the big dive down due to Covid-19. The dividend-paying stock has been steadily recovering and will reach the pre-Covid-19 price soon.

The stock has performed well since the big dive down due to Covid-19. The dividend-paying stock has been steadily recovering and will reach the pre-Covid-19 price soon.

A 25 billion-dollar company, Realty Income has established itself well in the REIT market. It provides a steady stream of income to all shareholders and has paid 611 consecutive monthly dividends. It has been consistently raising its dividend over the years. Realty Income is one of the best dividend REIT stocks. Investors seeking a steady stream of income should invest here. Checkout the best value stocks to invest in now.

6. Physicians Realty Trust (NYSE: DOC)

Physicians Realty Trust is in the business of acquiring, developing, owning, and managing healthcare properties that are leased to physicians, hospitals, and healthcare delivery systems. During 2020, the company has made some major investments which include the acquisition of seven facilities, adding 356,298 square feet to its current portfolio. In addition to this DOC has financed the developments of 2 new projects which completed in 2020. As of 30 December 2020, Physicians Realty Trust has 275 Health Care Properties spread across 36 different states of the US and a total of 14 million square feet available for lease.

The highlights of the company’s performance for the year 2020 are:

- Revenue increased by 5% to $437.5 million

- Net Income decreased by 11.3% to 68.5 million

- Dividend declared of $0.92 per share

The return of this REIT in comparison to the market can be viewed in the table below:

| DOC | US REITs | US Market | |

| 1 Year Return | 5.2% | 28.4% | 42.32% |

The stock of DOC has been performing well since the start of 2021. The stock plummeted in March last year due to Covid-19. Since then, it has risen back continuously and has almost reached the pre-Covid-19 price.

With a market capitalization of $3.8 Billion Physicians Realty is building a strong presence for itself in the REIT market. With the company maintaining a good reputation in the medical industry, the REIT stock is expected to rise further in the coming years. Also, the company is continuously investing in development projects which is a healthy way to prosper. From an investor’s point of view, DOC is one of the best REIT stocks to invest in today.

With a market capitalization of $3.8 Billion Physicians Realty is building a strong presence for itself in the REIT market. With the company maintaining a good reputation in the medical industry, the REIT stock is expected to rise further in the coming years. Also, the company is continuously investing in development projects which is a healthy way to prosper. From an investor’s point of view, DOC is one of the best REIT stocks to invest in today.

Conclusion

The above-listed REITs are the top performers in the market backed by good portfolios of real estate. They have strong historical performance and are investing in development projects to increase their performance. These are the best REIT stocks to invest in today and benefit in the future.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading

Back