What is Metaverse?

Metaverse refers to a complex web of virtual worlds and platforms. Much of our lives revolve around online communications and platforms. Moreover, the rise of gaming, digital experiences, and digital collectibles has increased the trend of virtual worlds.

Metaverse has become the hottest topic of 2022. The credit goes to the news of Facebook, Inc. changing its name to Meta Platforms, Inc. in October 2021.

Get to know about top Infrastructure stocks to invest.

Pros and Cons of the Metaverse Industry

PROs

Innovative Communication for Work and Education

A platform based on the metaverse is very engaging for users as it allows them to interact in an immersive and graphically-rich virtual environment. Unlike the most common Zoom communication app, where participants are interacting via a computer screen. The Metaverse allows people to exist in a virtual office or a lecture hall, where they can interact with life-like avatars of the participants in a 360-degree fashion. Stock trading advisory websites help investors make the right financial decisions.

An Enjoyable and Interesting Technology

Without a doubt, the virtual economy offers attractive features, which make work and education more enjoyable. Since the virtual world can make everything possible that cannot exist in the real world, the level of interest of users automatically increases.

A Great Addition to The Blockchain Technology

Metaverse supplements the applications of blockchain technology.

Get to know the best industrial stocks for 2024.

Development of a Virtual Economy

The metaverse will provide a digital platform to everyone which will allow the exchange of digital and offline products and services. People can own digital assets as well which can have real economic value. Also, the new economy will create a new source of jobs and activities that exist in the virtual world.

Also read: Commodity stocks to invest in now.

CONs

Required Accessible Advanced Digital Technologies

Implementation will require the introduction of advanced technologies. Since it is a fairly new concept it will require additional investments in developing newer technologies. Semi conductor stocks are one of the best investment opportunities.

Human Relationships might become extinct

Artificial intelligence is one of the underlying technologies for designing and running the metaverse. This will lead to the creation of unhealthy and para-social relationships and can even lead to minimal to zero human interaction in the real world. Penny stocks are also one of the best investment opportunities.

Prevailing and Upcoming Privacy and Security Issues

All social media platforms along with online communication apps have been exposed to security and privacy risks, which eventually the public has the face. Since these platforms collect a huge amount of personal data, which is sold, and used for intrusive online advertisements, as well as for identity theft and other cyber-related crimes.The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

Addiction

The virtual world can become an obsession for users. Just like the cons of gaming the world has seen, this metaverse can cause a similar level of addiction for users. We also have covered best ETFs to buy in all categories.

Today there are many new players in the markets. Some are new entrants and some are old companies shifting their focus toward Metaverse.

Top 10 Metaverse Stocks to Buy in 2024

Here are the top 10 Metaverse stocks to buy in 2024:

| Sr. | Company Name | Symbol | Market Cap | Price (As of 13th May 2022) |

| 1 | Microsoft | MSFT | $ 1.95 Trillion | $ 261.12 |

| 2 | Meta Platforms (formerly known as Facebook) | FB | $ 538 Billion | $ 198.62 |

| 3 | NVIDIA | NVDA | $ 441 Billion | $ 177.06 |

| 4 | Autodesk | ADSK | $ 42.9 billion | $ 197.07 |

| 5 | Match Group | MTCH | $ 22 Billion | $ 77.51 |

| 6 | Cloudflare | NET | $ 21.7 billion | $ 66.38 |

| 7 | Roblox | RBLX | $ 20 Billion | $ 32.97 |

| 8 | Take-Two Interactive | TTWO | $ 12.7 Billion | $ 109.63 |

| 9 | Unity software | U | $ 11.6 Billion | $ 39.1 |

| 10 | Matterport | MTTR | $ 1.52 billion | $ 5.39 |

Microsoft

Microsoft remains a powerhouse within the tech industry. The trillion-dollar company plans to become the company that will power the metaverse and it seems inevitable.

The company’s most recent announcement concerning expansion within the Metaverse universe is the expansion of gaming platforms via Activision Blizzard. Moreover, the Mesh Platform of the company is already a step ahead within the virtual world. Microsoft Mesh enables presence and shared experiences from anywhere through mixed reality applications. If you are seeking a steady stream of income, you should invest in REIT stocks.

Microsoft Corp. has recently announced the financial results for the quarter ended March 31, 2022:

- Revenue was $ 49.4 billion and increased by 18 %

- Operating income was $ 20.4 billion and increased 19 %

- Net income was $ 16.7 billion and increased 8% GAAP (up 13 % non-GAAP)

- Diluted earnings per share were $ 2.22 and increased 9 % GAAP (up 14 % non-GAAP)

The share of Microsoft is currently trading at $ 261. The company’s stock is on a bullish run for the past two years, as the below graph shows. The stock appreciated by 51% during the year 2021, rising from $ 222 up to $ 336.

The stock entered the year 2022 amongst the high price levels beyond $ 325. To date, it has declined 17% during the current year.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Meta Platforms (formerly known as Facebook)

Meta Platforms are the reason the virtual platform is on the rise. The company’s userbase covers the majority of the earth’s population through its social media platforms: Facebook, Instagram, and WhatsApp. This fact is enough proof of the company’s success. The company is investing billions to create software and content for augmented reality and VR applications, allowing it to address multiple metaverse angles.

Meta Platforms have a history of making money before entering the metaverse. With the metaverse applications of the company in full bloom, imagine the peaks this metaverse stock would take.

Meta Platforms has recently announced the financial results for the quarter ended March 31, 2022:

- Total Revenue was reported to be $ 29 billion, a 7 % year-over-year increase

- Net Income was reported at $ 7 billion, a 21 % year-over-year decline

- Earnings per share were reported at $ 2.72, an 18% year-over-year decline

- Facebook daily active users were 1.96 billion on average for March 2022, an increase of 4% year-over-year.

The company’s stock is currently trading at $ 198.62. As per the below graph, the stock was on a bullish run for a major part of the year 2020 and the whole of 2021.

Starting at $ 273.16, the share closed off in the year 2021 at $ 336.35. This represents an appreciation of 23 % during the year.

In the current year, the stock has experienced a huge dip in price. Trading at the price levels of above $ 325 when the year started, the stock dropped to $ 187. Within three months the stock lost almost 50 % of its value. And it is still trading at the same price levels.

Get to know best vaccine stocks to invest in now.

Get to know best vaccine stocks to invest in now.

NVIDIA

NVIDIA produces graphics and video processing chips for artificial intelligence and high-end computing. And its products play an integral role in powering the metaverse.

Nvidia is well-positioned in the market to be one of the strongest metaverse stocks in the market. Because of its established chip business and Omniverse platform, the company will be benefitting from the rise in metaverse technology directly or indirectly.

NVIDIA is yet to announce its first-quarter report for the year 2022. In its full-year 2021 report, the company published:

- Record revenue of $ 16.68 billion, an increase of 53 % from $ 10.92 billion the previous year

- Net Income was reported to be $ 4.3 billion, an increase of 55 % from the previous year

- Earnings per share were recorded at $6.90, up by 53 % when compared to the previous year

The stock of NVIDIA is trading at $177. The company’s stock has been on a bullish run during the years 2020 and 2021. The stock appreciated by 121 % in the year 2021 and appreciated by 125 % during the year 2021. During the current year, the company’s stock has shifted directions and has been declining. To date, the stock has declined by approx. 40 %

Get to know the list of crypto mining companies that are leading the industry.

Autodesk

Autodesk is rapidly becoming one of the most popular options for developers who are engaged in Metaverse and its development. The company has been successfully shifting towards a profitable software-as-a-service (SaaS) business model. Autodesk’s software is being widely used by developers to design and construct virtual worlds for gaming and entertainment. The company currently offers a suite of technologies for rendering 3D animation, building and launching virtual buildings, and creating within virtual reality (VR) and augmented reality (AR) environments. Learn about head and shoulders patterns trading guide.

For the full year 2022, the company reported:

- Revenue of $ 4.4 billion, an increase of 16% from the previous year

- Income of $ 1.4 billion, an increase of 26% from the previous year

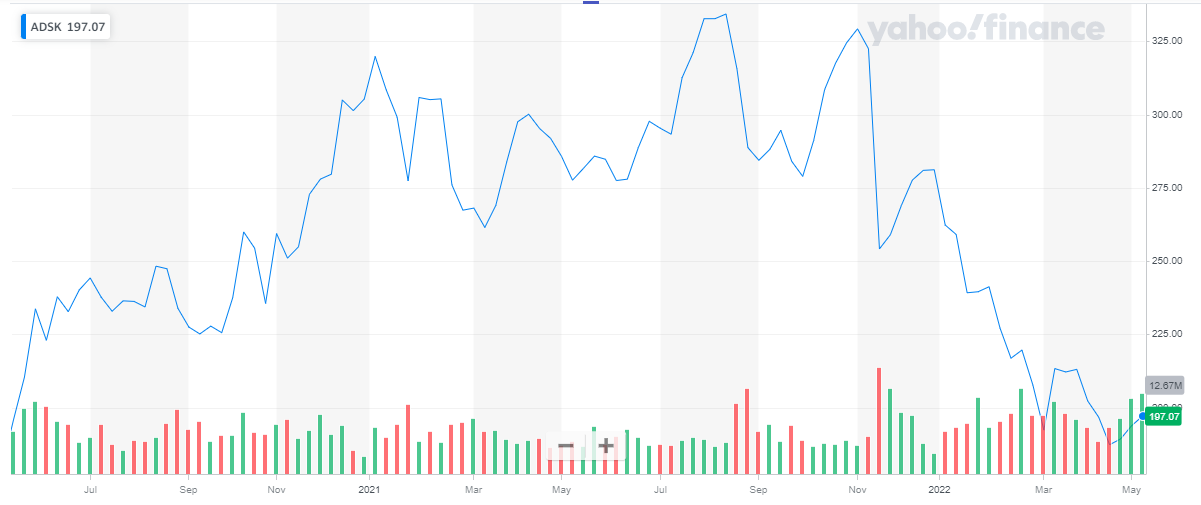

Autodesk’s share is trading at $ 197.07. Its share has been volatile in the past two years but maintained its upward streak. The stock changed course during the last month of 2021 when it started declining. During the year 2020, the stock appreciated by 65%. In the year 2021, the stock declined by 11%. In the current year, the stock has declined by 26 % to date.

Get to know the best tech stocks to invest in now.

Get to know the best tech stocks to invest in now.

Match Group

Match Group offers online dating apps. The company has announced its intention to expand its matchmaking efforts into the virtual realm. Match Group intends to integrate avatar-based virtual experiences into its portfolio of mobile applications.

The company has progressive plans for its popular Tinder app. Match Group has revealed plans to monetize the app through the app’s own virtual currency: Tinder Coins.

The company recently published its first-quarter earnings report for the year 2022:

- Total revenue was reported at $ 799 million, an increase of 20 % from the same period last year

- Operating income was reported to be $ 208 million, an increase of 10% from the same period last year

The company’s stock is currently trading at $ 77.51. The stock has been on a bullish trend for the major part of 2020 and 2021. In 2020, the stock appreciated by 80 %. In 2021, the stock went from $ 133 to the highs of $ 169 before closing off the year at $ 132.25. In the current year, the stock has declined by 42% to date.

Check our updated for NASDAQ Forecast.

Check our updated for NASDAQ Forecast.

Cloudflare

Cloudflare’s broad network already extends to 250 cities in more than 100 countries. Approximately 95 % of the world’s population can connect to that network within 50 milliseconds. It uses a software-defined networking (SDN) model – replacing networking hardware such as routers, switches, and load balancers with far cheaper and more scalable software.

Cloudflare plays a significant role in providing the underlying networking and data services required to make the metaverse a reality.

Cloudflare recently announced its first-quarter report for the year 2022:

- Total revenue was reported to be $ 212.2 million, representing an increase of 54% year-over-year

- Strong growth in paying customers. A record addition of roughly 14,000 paying customers in the quarter, bringing the total number of paying customers to 154,109.

- Net loss was reported at $41.4 million, compared to $40 million in the first quarter of 2021.

The stock of Cloudflare is currently trading at $ 66.38. The company’s stock has been on an upward streak since 2020. After peaking at $ 211 in Nov’21, the stock started declining. During the current year, the company’s stock has declined by 50 % to date.

Oil stocks is one of the riskier yet most profit-generating sectors.

Oil stocks is one of the riskier yet most profit-generating sectors.

Roblox

Roblox makes an open gaming platform, which lets players create their own “worlds” where they can interact and play with others over the internet. Roblox’s vision for the metaverse is to create a platform for immersive co-experiences, where people can come together within millions of 3D experiences to learn, work, play, create, and socialize.

The company recently published its quarterly report for the year 2022:

- Total Revenue was reported to be $ 537.1 million, an increase of 39% over Q1 2021

- Average Daily Active Users (DAUs) were 54.1 million, an increase of 28% year over year

The stock of Roblox is currently trading at $ 32.97. the company went public in 2021. It peaked at $ 134 in Nov’21. After hitting the peak, the stock picked up a bearish trend and has been declining. During the current year, the company’s stock has depreciated by approx. 68 %.

Also read:

Also read:

Take-Two Interactive

Take-Two is one of the strongest players in the gaming industry. It has all the tools to build a compelling metaverse. The company’s CEO believes that the company currently has the biggest and best metaverses that exist with Grand Theft Auto Online, Red Dead Online, and NBA 2K’s online version. And the number 1 company generating revenue out of this new technology. Also read: Best Stocks for Covered Calls in 2024.

The company recently published its third-quarter reported for the year 2022:

- Net Revenue was reported to be $ 903 million

- Net Income was reported at $ 145 million.

- Earning per share was reported at $ 1.24.

The company’s stock is currently trading at $ 109.39. the stock has been highly volatile in the past two years. The stock peaked at $ 210 at the start of 2021 before dropping in price. During the current year, the stock of the company has been declining. To date, it has dropped by 38 %.

Unity software

Unity software

Unity Software is the leading platform for creating and operating interactive, real-time 3D content which is a key component of the metaverse. Unity Software stands out as a Metaverse infrastructure play because the company’s platform is already used to create, operate and monetize interactive, real-time 3D content.

Last year, the company introduced its Mixed and Augmented Reality Studio (MARS), a tool that gives creators the power to build intelligent AR content seamlessly. Creators can build complex, data-oriented apps and test their experiences without leaving the MARS authoring environment. During the same year, the company also completed the acquisition of long-time partner Interactive Data Visualization (IDV). IDV is the creator of SpeedTree, a suite of vegetation modeling and environment creation products used in architecture, games, visual effects, and real-time simulations.

The company recently published its first-quarter report for the year 2022:

- Revenue was reported at $320.1 million, an increase of 36% from the first quarter of 2021

- Loss from operations was $171.2 million, compared to a loss from operations of $110.9 million in the first quarter of 2021

- Basic and diluted net loss per share was $0.60, compared to basic and diluted net loss per share of $0.39 in the first quarter of 2021.

The company’s stock is currently trading at $ 39.1. the stock has been experiencing volatility in the past 2 years. After peaking at $ 196 on Nov 21 the stock has been declining ever since. During the current year, the stock has declined by approx. 72 % to date.

Also check out Best Forex Brokers for Trading

Also check out Best Forex Brokers for Trading

Matterport

Matterport provides 3D cameras (which bring depth to an image), 360 cameras (which bring multiple angles), an app to capture these images on your smartphone, software that pulls this all together into one digital twin of the space, and applications to layer on AR features. A Matterport digital twin is the most accurate virtual 3D model of a real place – whether it be a room, an entire building, or an outdoor space

Matterport has collaborated with Facebook AI Research (FAIR), now called Meta AI. Matterport has its own AI, Cortex, that it uses to create precision 3D spatial data at scale.

In the recent second-quarter report for the year, the company reported:

- Total revenue was reported to be $ 28.5 million, an increase of 6 % from the same period last year

- Subscription revenue was $17.1 million, up 24% compared to the first quarter of 2021

- Annualized Recurring Revenue (ARR) of $68.6 million

- Total subscribers increased 70% to 562,000 when compared to the same period last year

The stock of Matterport is currently trading at $ 5.39. The company went public in 2021. The company’s stock peaked at $ 27.8 in Nov’21 before declining in price. During the current year, the stock has declined by approx. 74 % to date.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

Unity software

Unity software