What is Bond ETFs?

What is Bond ETFs?

Bond ETFs are exchange-traded funds that invest solely in bonds. They are traded on all major stock exchanges and hold a portfolio of bonds. Bond ETFs include various fixed securities, long-term and short-term debt securities, and convertible securities. Bond ETFs provide exposure to the bond market with the ease and transparency of stock trading. They are more liquid than individual bonds and mutual funds. Investing in Bonds and Stocks can make or break an economy.

Pros and Cons of investing in Bond ETFs

Pros

- Diversified portfolio – Bond ETFs provide investors with a diversified portfolio along with a diversified bond portfolio.

- Targeted Exposures to Bonds – With Bond ETFs investors can have different kinds of bond ETFs, such as a short-term bond fund, an intermediate-term fund, and a long-term fund. If as an investor you prefer only one segment of the bond, e.g., short term bonds you can easily target that bond

- High liquidity – Since Bond ETFs are traded on the stock market like regular stocks, they have higher liquidity than regular bonds

- No detailed analysis of bonds – With Bond ETFs, you don’t have to research every individual bond. Just select and research the category of bonds you are interested in and invest there.

- Low investment – With Bond ETFs, as an investor you are not liable to invest the full value of bonds. You can easily purchase a small share and invest from as low as the price of a regular share

Cons

- Higher Fees – Bond ETFs fund managers charge comparatively higher to manage the fund. And these charges can consume a good portion of the interest earned from the bonds

- Low Returns – Yields of Bond ETFs are likely to reflect the broader market.

- No guarantee on principal – If interest rates run in the opposite directions, it could mean the loss of your principal also as the bond fund declines overall.

Investing in best ETFs is one of the most easiest and safe investment option. ETFs are a great addition to the investment portfolio. Bond ETFs are very attractive in terms of a diversified portfolio with minimum investment.

List of Top Bond ETFs to Invest in 2023

To provide more benefit, we have compiled a list of Top Bond ETFs to invest in 2023 which can boost your portfolio.

| Sr. | Bond ETF | Symbol | Price(as of 20th August 2021) | NAV |

| 1 | Vanguard Total International Bond ETF | BNDX | $58 | $116.4 billion |

| 2 | iShares Core U.S. Aggregate Bond ETF | AGG | $116.16 | $88.8 billion |

| 3 | Vanguard Short-Term Corporate Bond ETF | VCSH | $82.56 | $47.9 billion |

| 4 | iShares 20+ Year Treasury Bond ETF | TLT | $150.55 | $15.15 billion |

| 5 | iShares TIPS Bond ETF | TIP | $128.75 | $28.3 billion |

| 6 | The SPDR Portfolio Long Term Corporate Bond ETF | SPLB | $32.26 | $999.4 million |

| 7 | The VanEck Vectors Investment Grade Floating Rate ETF | FLTR | $25.37 | $622.8 million |

| 8 | Flexshare Credit-Scored US Long Corporate Bond Index Fund | LKOR | $61.55 | NA |

| 9 | Direxion Daily 20+ Year Treasury Bull ETF | TMF | $29.98 | $286 million |

Vanguard Total International Bond ETF (BNDX)

This fund attempts to track the performance of the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). This Index provides a broad-based measure of the global, investment-grade, fixed-rate debt markets. The Index includes government, government agency, corporate, and securitized non-U.S. investment-grade fixed-income investments, all issued in currencies other than the U.S. dollar and with maturities of more than one year.

What BNDX offers:

- Employs hedging strategies to protect against uncertainty in exchange rates.

- Provides a convenient way to get broad exposure to non-US dollar-denominated investment-grade bonds.

- Passively managed, using index sampling.

BNDX has an expense ratio of 0.08% and is trading at around $58. Currently, it has roughly $119 billion worth of assets to be managed. The below chart shows the price history for the last 5 years.

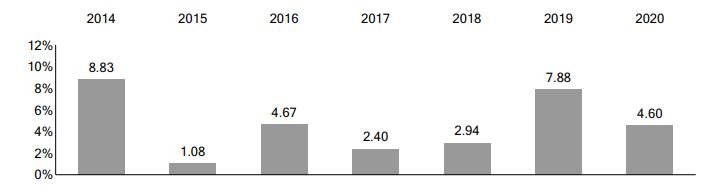

The annual total returns of BNDX is shown in the below chart:

Oil and gas ETFs are also one of the great addition to investment portfolio.

iShares Core U.S. Aggregate Bond ETF (AGG)

This ETF offers broad-based exposure to investment-grade U.S. bonds, making AGG a building block for any investor constructing a balanced long-term portfolio as well as a potentially attractive haven for investors pulling money out of equity markets.

AGG offers:

- Broad exposure to U.S. investment-grade bonds

- Low-cost easy way to diversify a portfolio using fixed income

- Use at the core of your portfolio to seek stability and pursue income

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Total Return | 2.56 | 3.53 | -0.05 | 8.68 | 7.43 |

| Market Price | 2.42 | 3.55 | 0.08 | 8.51 | 7.45 |

AGG has an expense ratio of 0.04% and is currently trading at around $116.

Maturity of the Bond ETF

- 28.7 % of the index valuation lies in securities with maturity of 3-5 years.

- 17 % of the index valuation lies in securities with maturity of 5-7 years.

- 13.5 % of the index valuation lies in securities with a maturity of 7-10 years.

- 13.5 % of the index valuation lies in securities with maturity of 20+ years.

- 27.3% of the index valuation lies in securities with maturity different from the above mentioned.

Checkout best solar energy stocks to buy now.

Vanguard Short-Term Corporate Bond ETF (VCSH)

VCSH offers exposure to investment-grade corporate bonds that fall towards the short end of the maturity spectrum, thereby delivering a moderate amount of credit risk but limiting exposure to rising interest rates. Like most Vanguard ETFs, VCSH is among the most cost-efficient in its ETFdb Category. VCSH might be useful for investors looking to enhance fixed income returns through additional credit risk but also interested in shortening up effective duration. Always choose trusted and reliable broker if you are new into investing as market is subjected to risk.

What VCSH offers:

- Seeks to provide current income with modest price fluctuation.

- Invests primarily in high-quality (investment-grade) corporate bonds.

- Maintains a dollar-weighted average maturity of 1 to 5 years.

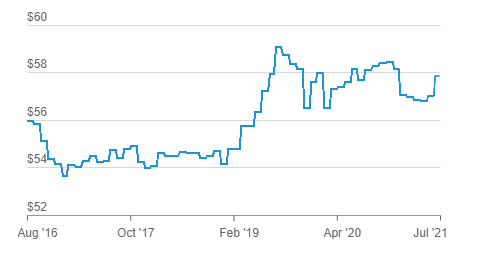

VCSH has an expense ratio of 0.05% and is trading at around $82.6. Currently, it has roughly $47 billion worth of assets to be managed. The below chart shows the price history for the last 5 years:

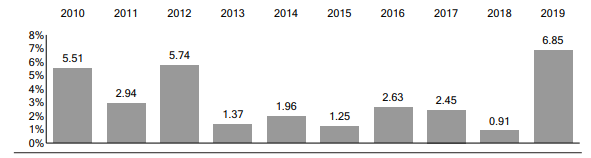

The annual total returns of VCSH is shown in the below chart:

The annual total returns of VCSH is shown in the below chart:

Read more:

iShares 20+ Year Treasury Bond ETF (TLT)

This ETF is one of the most popular options for investors seeking to establish exposure to long-dated Treasuries. TLT is light on credit risk but offers attractive yields due to longer maturities and therefore material interest rate risk. For investors seeking extension of the duration of their portfolio and potentially enhance the current return offered, this can be a useful product.

What TLT offers:

- Targeted access to a specific segment of the U.S. Treasury market

- Customization of exposure to Treasuries

TLT has an expense ratio of 0.15% and is trading at around $150. Currently, it has roughly $15 billion worth of assets to be managed. The below chart shows the price history for the last 5 years:

Maturity of the Bond ETF

Maturity of the Bond ETF

- 99.3 % of the index valuation lies in securities with maturity of 20+ years.

- 0.3 % of the index valuation lies in securities with maturity of 15-20 years.

- 0.4 % of the index valuation lies in Cash and Derivatives

iShares TIPS Bond ETF (TIP)

This ETF offers broad-based exposure to TIPS, bonds issued by the U.S. government featuring principal that adjusts based on certain measures of inflation. TIP has become tremendously popular as a way of protecting asset values against upticks in inflation, and as such can be used in different ways by several different types of investors.

What TIP offers:

- Access to the domestic TIPS market in a single fund

- Seek to protect against intermediate-term inflation

TIP has an expense ratio of 0.19% and is trading at around $129. Currently, it has roughly $28 billion worth of assets to be managed. The below chart shows the price history for the last 5 years:

99.78% of the fund’s holdings are in United States Treasury with the following maturity breakdown:

99.78% of the fund’s holdings are in United States Treasury with the following maturity breakdown:

- 26.7 % of the index valuation lies in securities with maturity of 3-5 years.

- 20.74 % of the index valuation lies in securities with a maturity of 7-10 years.

- 15.5 % of the index valuation lies in securities with maturity of 20+ years.

- 14.4 % of the index valuation lies in securities with maturity of 5-7 years.

- 10.6 % of the index valuation lies in securities with a maturity of 1-2 years.

- 10 % of the index valuation lies in securities with a maturity of 2-3 years.

- 2.06% of the index valuation lies in securities with maturities different from above

By using the signal providers, you can avoid hours of technical analysis to understand the market.

The SPDR Portfolio Long Term Corporate Bond ETF (SPLB)

The SPDR Portfolio Long Term Corporate Bond ETF (SPLB) tracks an index that offers exposure to investment-grade corporate bonds with a maturity greater than or equal to 10 years. The index includes U.S.-dollar denominated, fixed-rate debt.

What SPLB offers

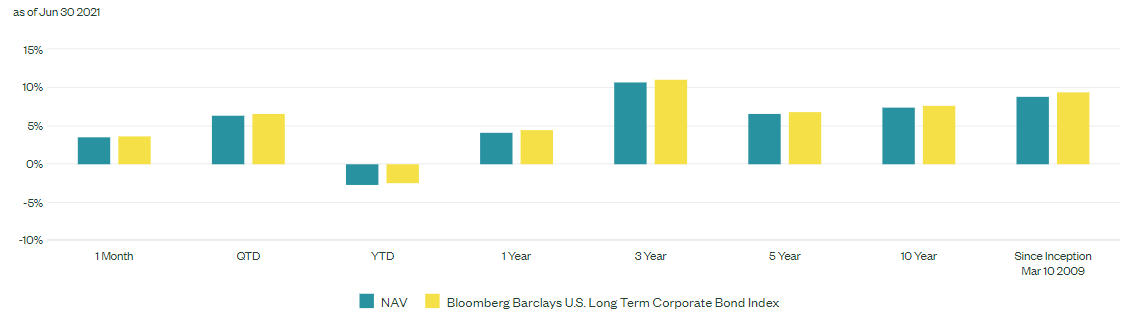

- This bond ETF provides investment results that, corresponding to the price and yield performance of the Bloomberg Barclays Long U.S. Corporate Index (the “Index”)

- Low-cost Bond ETF

SPLB has an expense ratio of 0.07% and is currently trading at around $32. Currently, it has roughly $982 million worth of assets to be managed.

Maturity of the Bond ETF

Maturity of the Bond ETF

- 58 % of the index valuation lies in securities with maturity of 20-30 years.

- 21 % of the index valuation lies in securities with maturity of 15-20 years.

- 11 % of the index valuation lies in securities with maturity of 10-15 years.

- 9 % of the index valuation lies in securities with maturity of 30+ years.

- 1% of the index valuation lies in securities with maturity different from the above mentioned

The VanEck Vectors Investment Grade Floating Rate ETF (FLTR)

This ETF is among a small number of products that offer exposure to floating rate debt, giving it a risk/return profile that is somewhat unique. This bond ETF has minimal interest risk as the effective duration is close to zero. FLTR compensates investors for the credit risk taken on but allows them to steer clear of any interest rate risk.

What FLTR offers:

- Potential to Benefit from Rising Rates

- Investment Grade Credit Quality

- Near-Zero Duration with Enhanced Yield Potential

FLTR has an expense ratio of 0.14% and is currently trading at around $25. Currently, it has roughly $683 million worth of assets to be managed.

Maturity of the Bond ETF

- 76 % of the index valuation lies in securities with a maturity of 1-3 years.

- 11 % of the index valuation lies in securities with maturity of 3-5 years.

- 8.5 % of the index valuation lies in securities with a maturity of less than 1 year.

- 17.5% of the index valuation lies in securities with maturity different from the above mentioned

Flexshare Credit-Scored US Long Corporate Bond Index Fund (LKOR)

The FlexShares Credit-Scored U.S. Long Corporate Bond Index Fund (LKOR) follows a proprietary index of investment-grade debt with maturities of 10 years or longer. The underlying index is Northern Trust US Long Corporate Bond Quality Value Index. ETFs and Index Fund both provide a diversified portfolio.

The focus of LKOR – Is for investors seeking exposure to investment-grade U.S. corporate bonds with intermediate-term maturities and a focus on issuer quality and value. It makes use of multi-factor selection criteria and diversification controls that enhance the portfolio’s risk-adjusted returns. Through Value and Quality score method, this fund optimizes the exposure to quantitative factors of eligible securities.

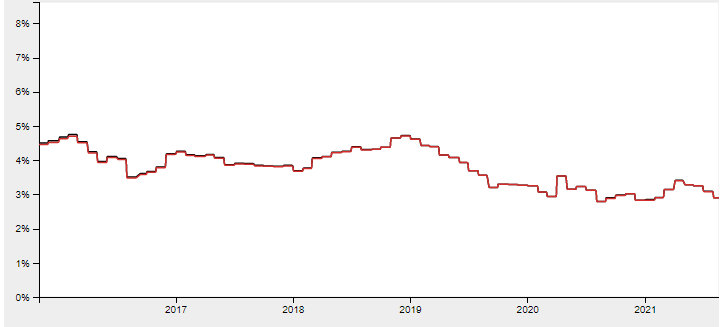

LKOR has an expense ratio of 0.22% and is currently trading at around $62. The below graph shows the yield of the bond ETFs since 2017.

Source: Index

Maturity of the Bond ETF

- 63 % of the index valuation lies in securities with maturity of 20-30 years.

- 23 % of the index valuation lies in securities with maturity of 15-20 years.

- 9 % of the index valuation lies in securities with maturity of above 30 years.

- 4 % of the index valuation lies in securities with a maturity of 10-15 years.

Direxion Daily 20+ Year Treasury Bull ETF (TMF)

This ETF offers 3x long leveraged exposure to the broad-based NYSE 20 Year Plus Treasury Bond Index, making it a powerful tool for investors with a bullish short-term outlook for U.S. long-term treasuries. These leveraged ETFs seek a return that is +300% or -300% of the return of their benchmark index for a single day.

Targe of TMF:

- Magnify short-term gains with daily 3X leverage

- Seek opportunity in the market

- Agility to trade through rapidly changing markets

This bond ETF is for investors who understand leverage risk and actively manage their investments. TMF has an expense ratio of 1.05% and is currently trading at around $29.97.

Maturity of the Bond ETF

- 45 % of the index valuation lies in securities with a maturity of 27-30 years.

- 27 % of the index valuation lies in securities with a maturity of 24-27 years.

- 28 % of the index valuation lies in securities with maturity of 20-24 years.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Top Stock Indicators for Stock Trading

- Top 5 Covid-19 Vaccine Stocks To Invest In 2023

- Best Airlines Stocks to Buy

- Best Penny Stocks

- Best Day Trading Stocks

- Best Forex Signals

- Monthly Dividend Stocks

- Best Cryptocurrencies

- Most Volatile Stocks

- Best Drone Stocks

- Renewable energy stocks