-

AAPL Elliott Wave View: Ready For Wave 5 Higher?

Read MoreAPPLE ticker symbol: AAPL short-term Elliott wave view suggests that the rally to $229.67 high ended intermediate wave 3 higher. The internals of that rally higher unfolded as impulse structure with the sub-division of 5 waves structure in it’s each leg higher. Down from $229.67 high, the instrument did a 7 swing pullback & completed […]

-

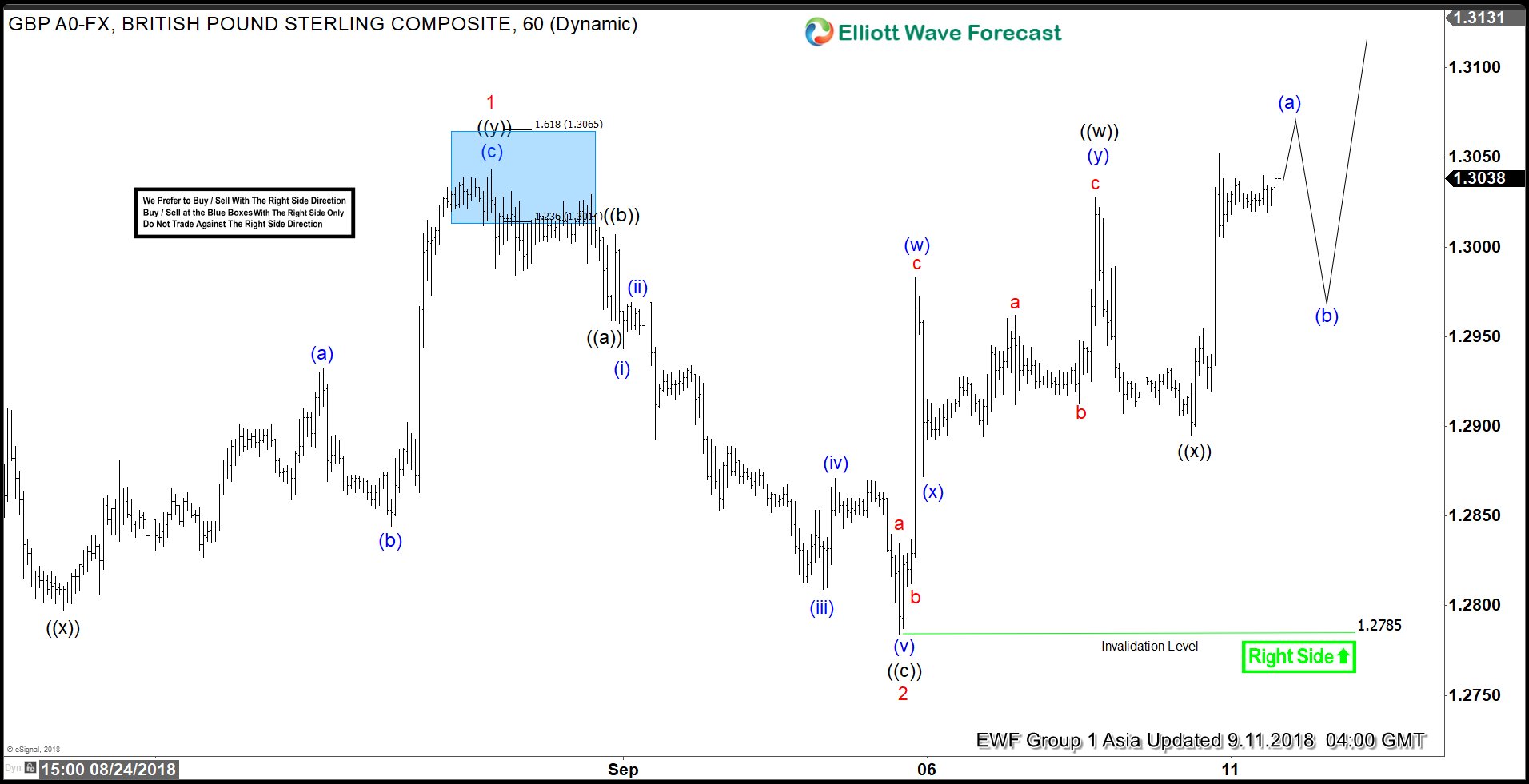

GBPUSD Elliott Wave Analysis: Calling Further Upside

Read MoreGBPUSD short-term Elliott Wave analysis suggests that the rally from 8/15/2018 low at 1.2660 to 1.3042 high ended Minor wave 1. The internals of that rally higher took place in 3 wave corrective sequence i.e double three thus suggesting that the pair can be doing a Leading diagonal structure. Up from 1.2660 low, the initial […]

-

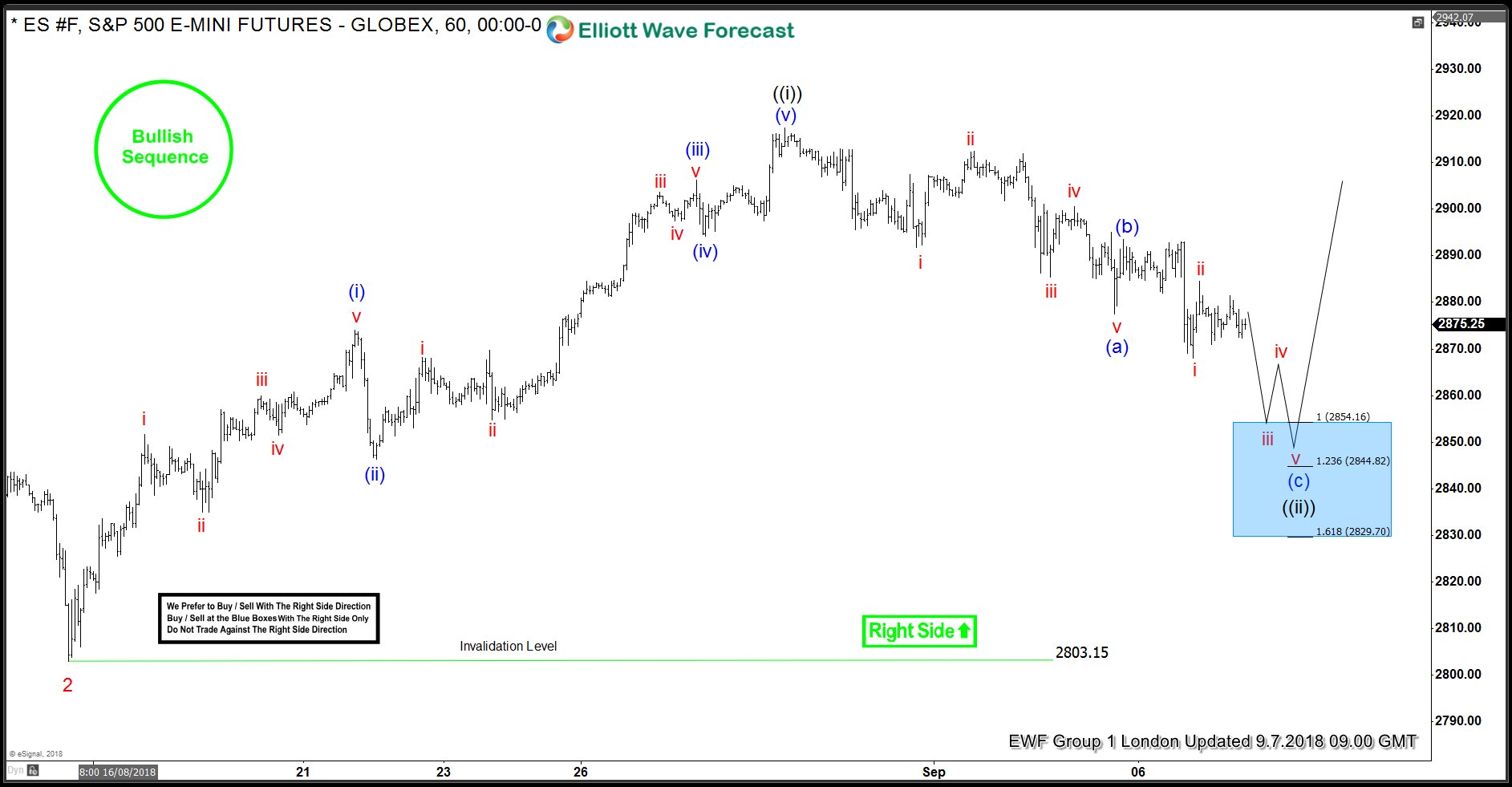

ES_F Elliott Wave Analysis: Correction Taking Place

Read MoreES_F Short-term Elliott wave analysis suggests that the pullback to $2803.15 ended Minor wave 2 pullback. Up from there, the index has rallied higher into new highs confirming that Minor wave 3 has started. The internals of that rally higher is unfolding as impulse structure with the sub-division of 5 waves structure in the lesser […]

-

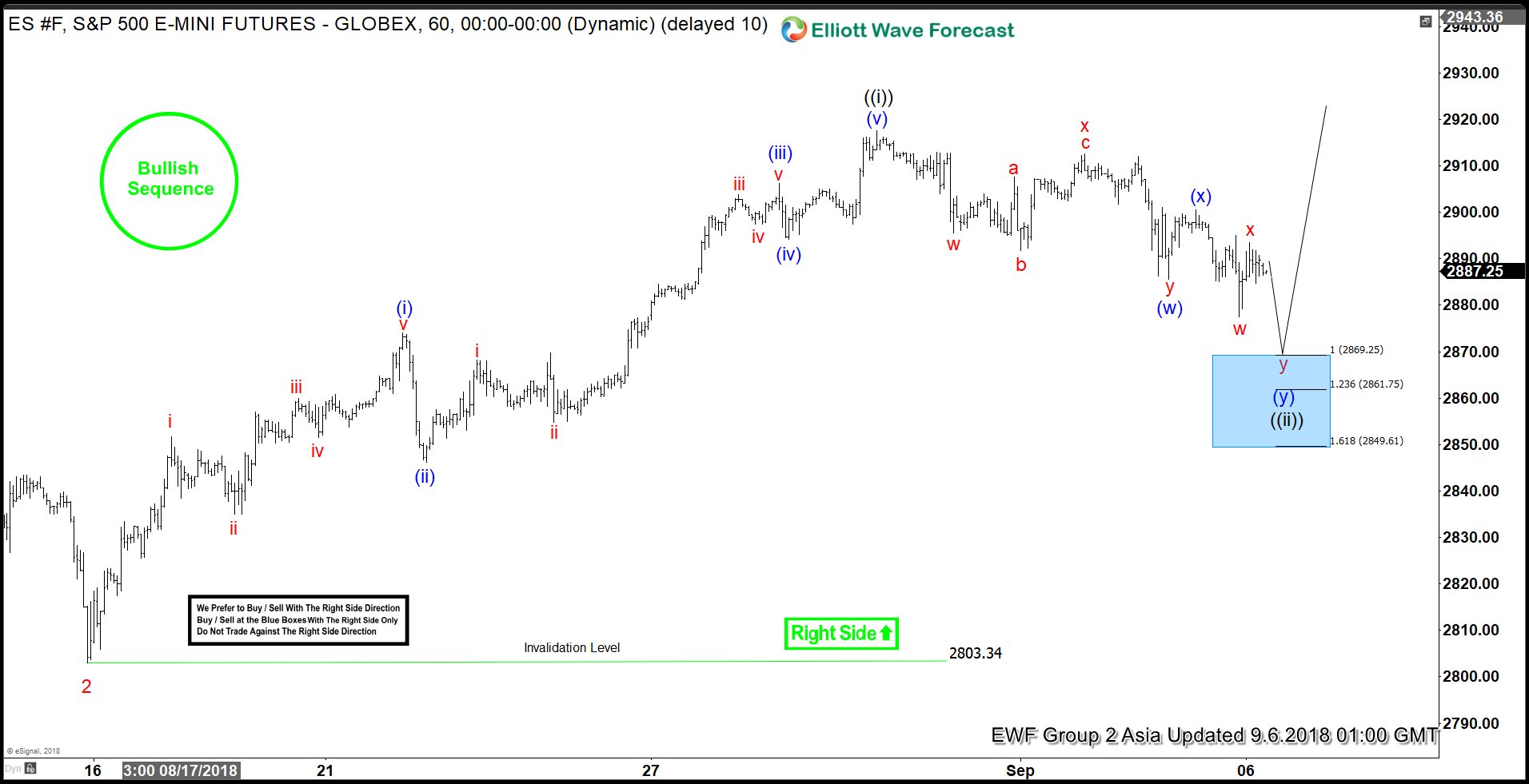

S&P500 E-Mini Futures Entering Buying Areas Soon?

Read MoreS&P500 E-Mini Futures ticker symbol: $ES_F Elliott wave view suggests that the pullback to $2803.34 low ended Minor wave 2. Up from there, the rally higher to $2917.50 high ended Minute wave ((i)). The internals of that rally higher unfolded as impulse structure with the sub-division of 5 waves structure in it’s each leg higher […]

-

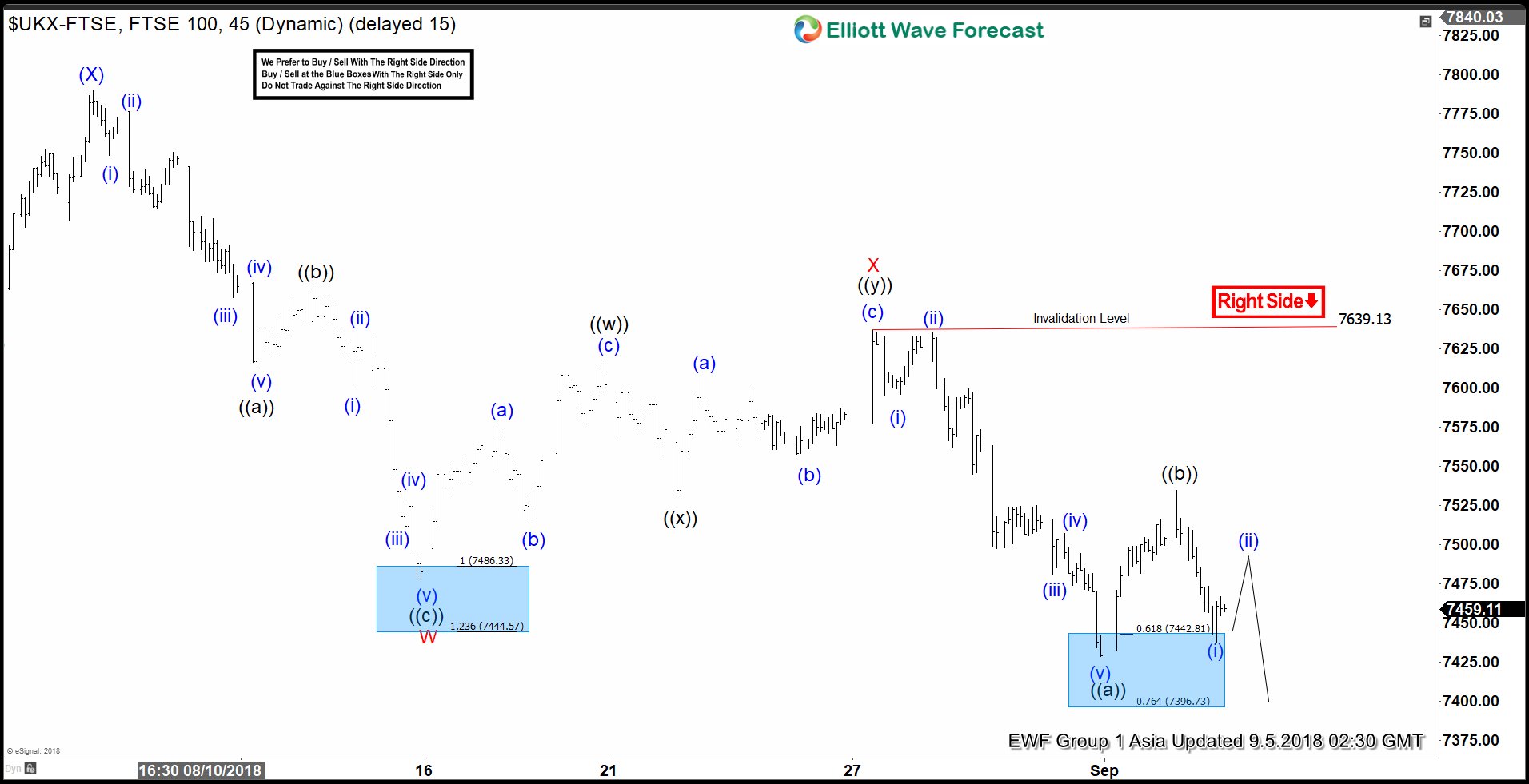

FTSE Elliott Wave Analysis: Started 7th Swing Lower

Read MoreFTSE short-term Elliott Wave view suggests that the rally to 7790.17 high ended intermediate wave (X) bounce. Down from there, intermediate wave (Y) remains in progress with instrument showing a lower low sequence. The internals of that leg lower is taking place as double correction lower due to overlapping price action happening from 7790.17 high […]

-

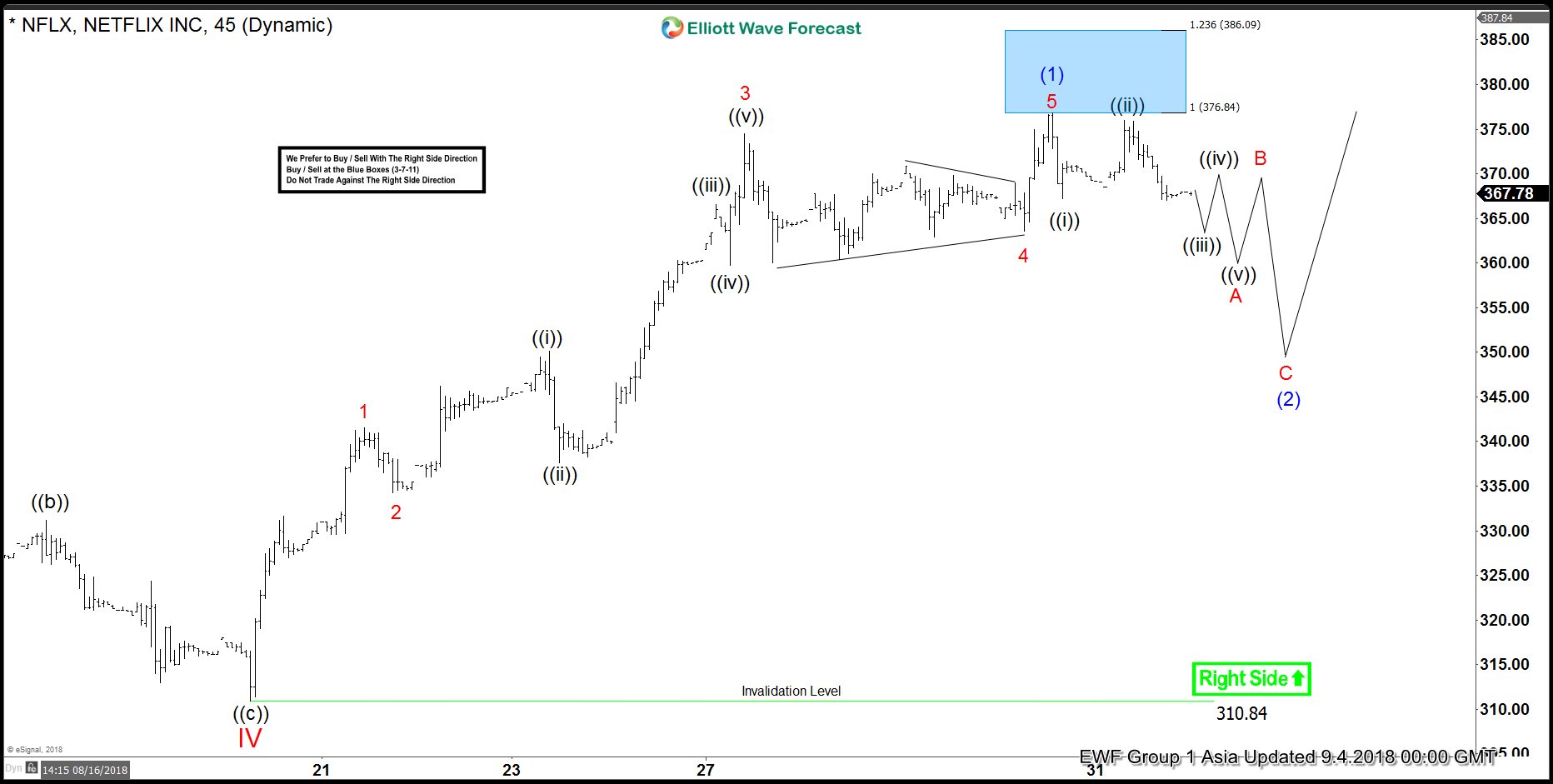

Netflix Elliott Wave View: Pullbacks Should Remain Supported

Read MoreNetflix ticker symbol: $NFLX short-term Elliott wave view suggests that the decline to $310.84 low ended cycle degree wave “IV” pullback. Up from there, cycle degree wave “V” can have started but a break above $423.21 6/21/2018 high remains to be seen for final confirmation. Above from $310.84 low, the rally higher $376.81 high ended […]