-

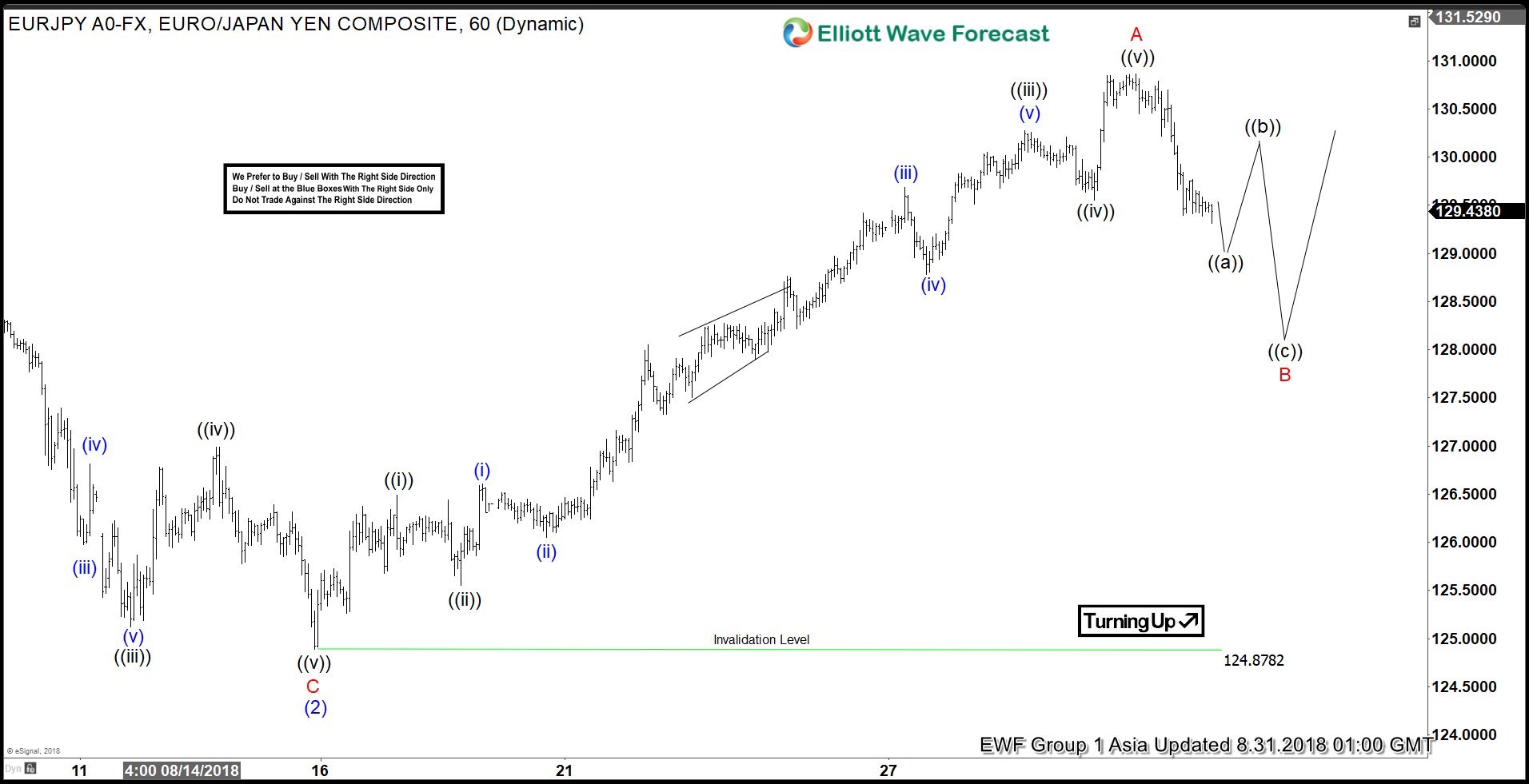

EURJPY Elliott Wave View: Ended 5 Waves Advance

Read MoreEURJPY short-term Elliott wave view suggests that the decline to 124.87 low ended intermediate wave (2) pullback of a leading diagonal structure from 5/29/2018 cycle. Above from there, the rally higher is taking place as Elliott wave zigzag structure within intermediate wave (3) of a diagonal. In a zigzag ABC structure, lesser degree cycles should […]

-

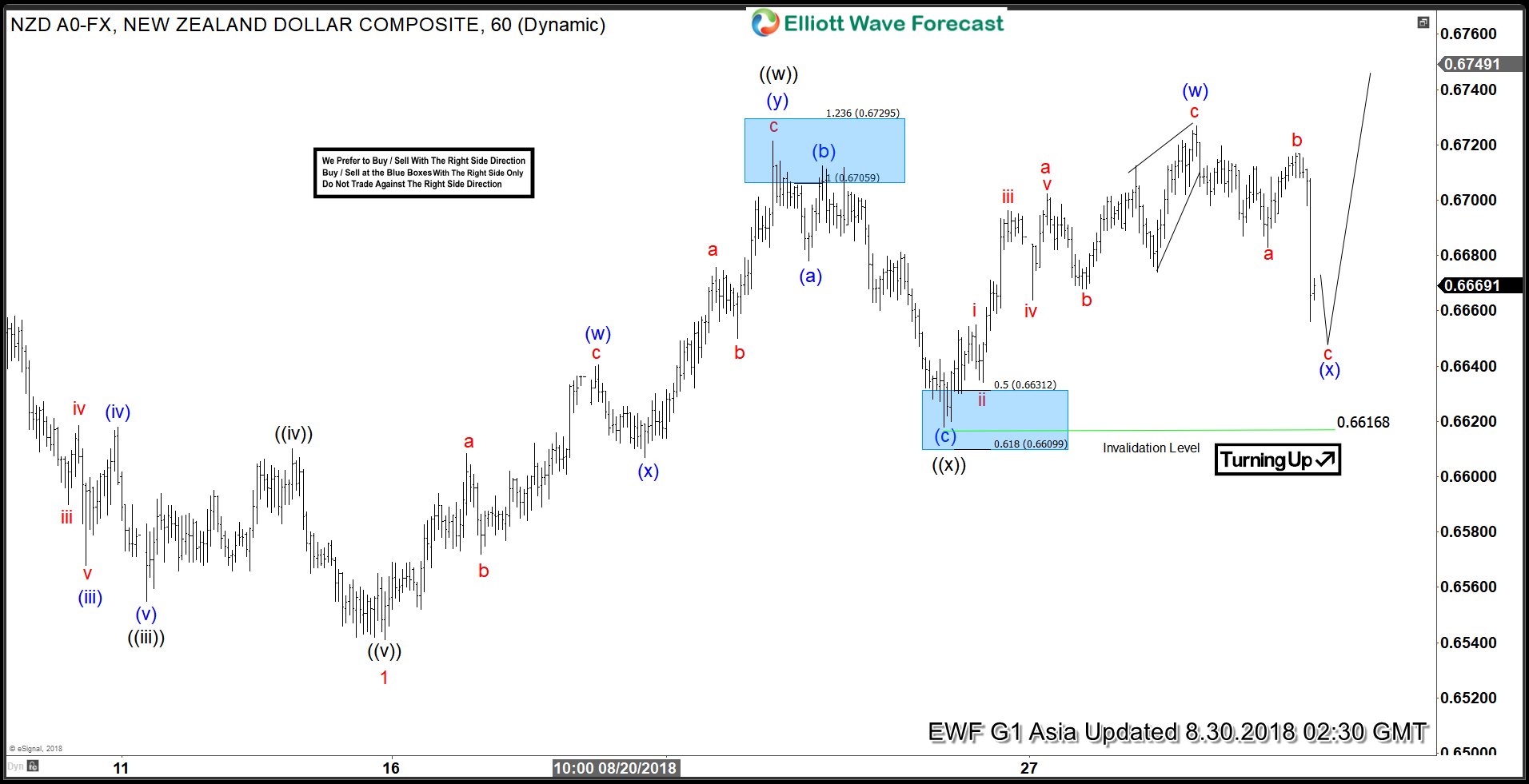

NZDUSD Elliott Wave Analysis: Double Correction Taking Place

Read MoreNZDUSD short-term elliott wave analysis suggests that the decline to 0.6543 low ended Minor wave 1. The internals of that decline unfolded as impulse structure with lesser degree Minute wave ((i)), ((iii)) & ((v)) unfolded in 5 waves structure. Above from there, Minor wave 2 bounce is taking place as double correction higher with lesser […]

-

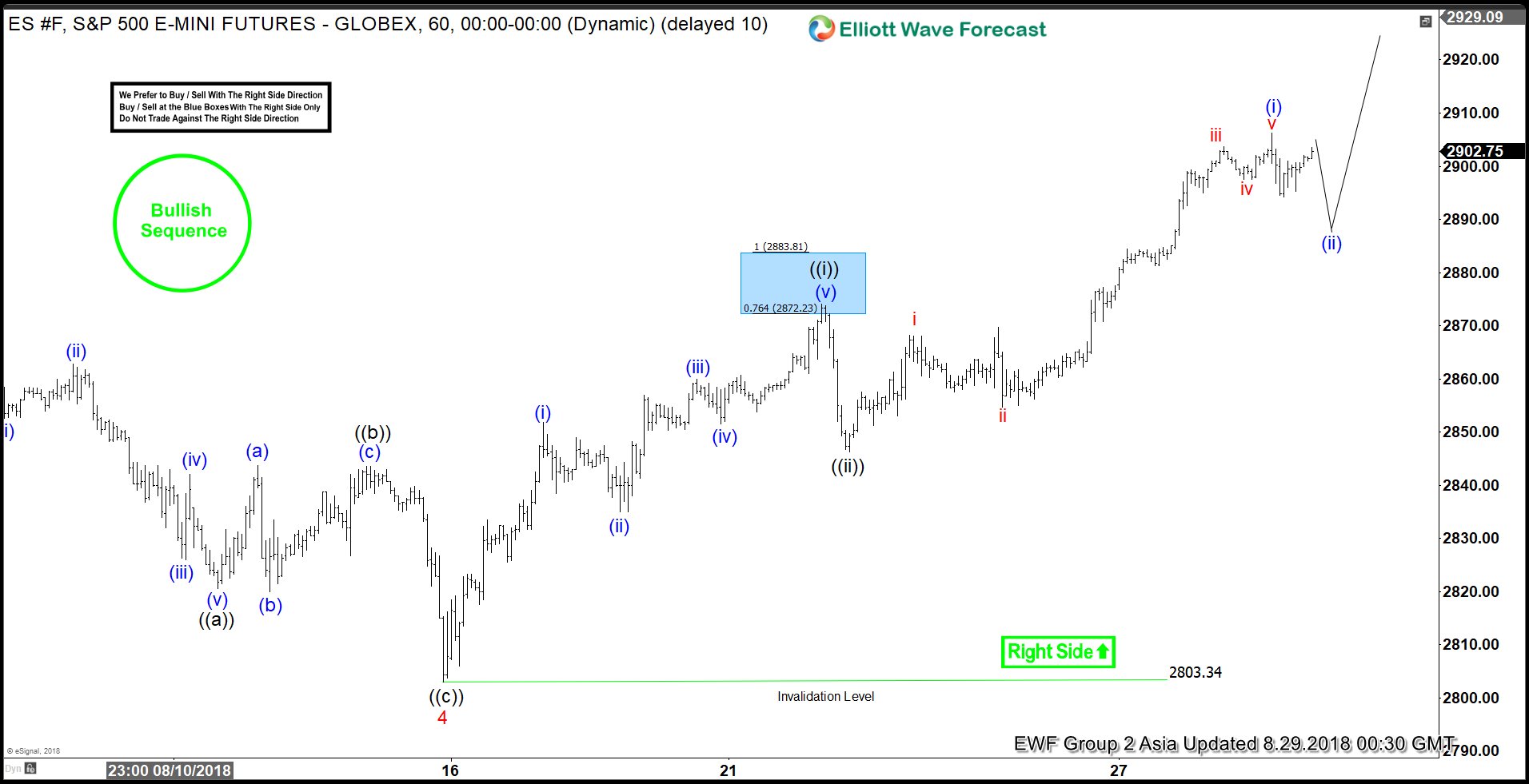

S&P500 Mini Futures: Extending Higher As Impulse

Read MoreS&P500 Mini Futures ticker symbol: $ES_F short-term Elliott wave view suggests that the decline to $2803.34 low ended Minor wave 4 pullback. The internals of that pullback unfolded as Elliott wave zigzag correction. The lesser degree Minute wave ((a)) ended in 5 waves at $2820.5 low. Then the bounce to $2843.50 high ended Minute wave […]

-

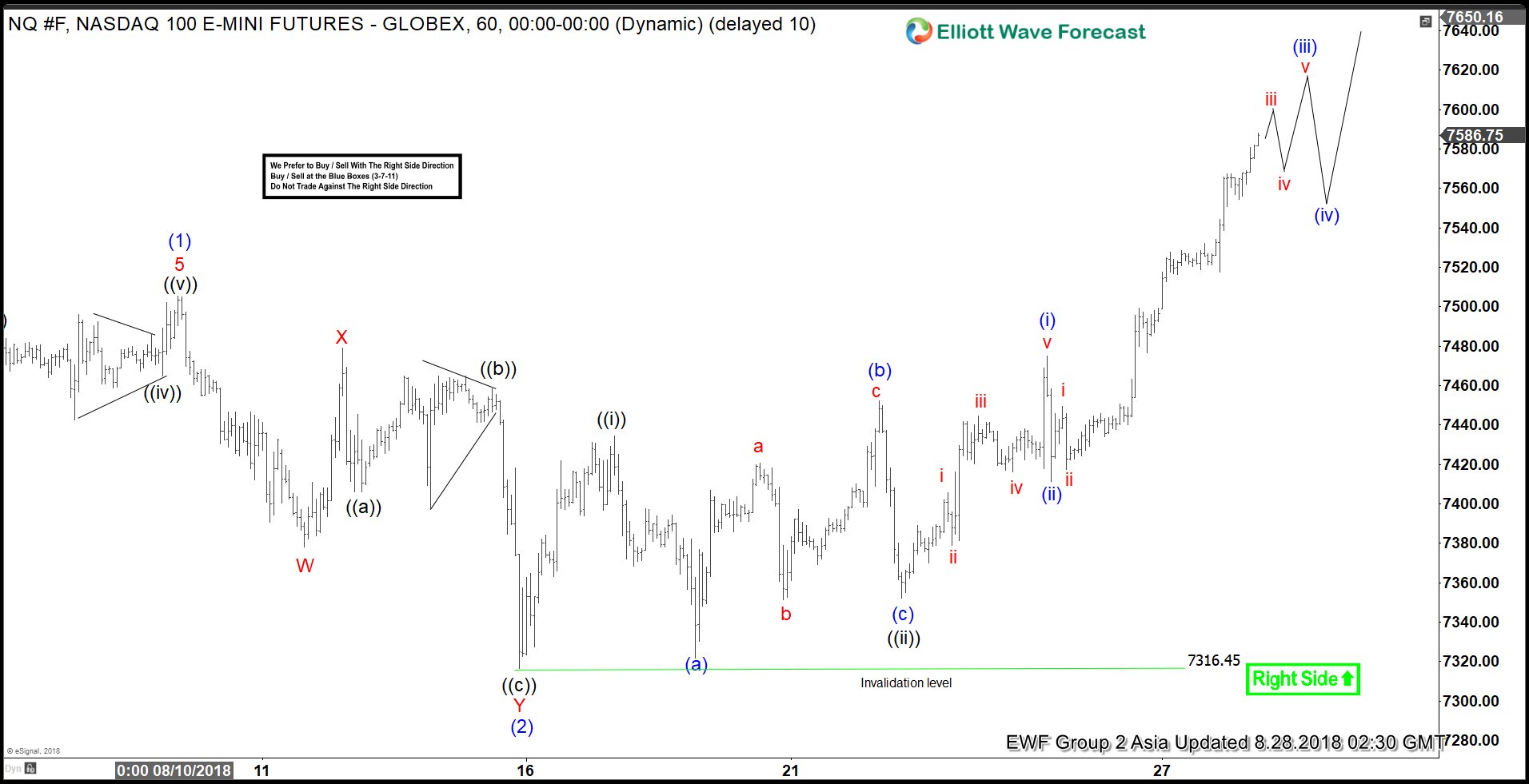

NASDAQ Elliott Wave Analysis: Nesting Higher As Impulse

Read MoreNASDAQ ticker symbol: $NQ_F short-term Elliott wave analysis suggests that the rally from 7/30 low ($7167.75) to $7505.25 high ended Intermediate wave (1). The internals of lesser degree cycles within Intermediate wave (1) unfolded as 5 waves impulse structure. Down from there, the correction against that cycle in Intermediate wave (2) pullback is proposed complete at […]

-

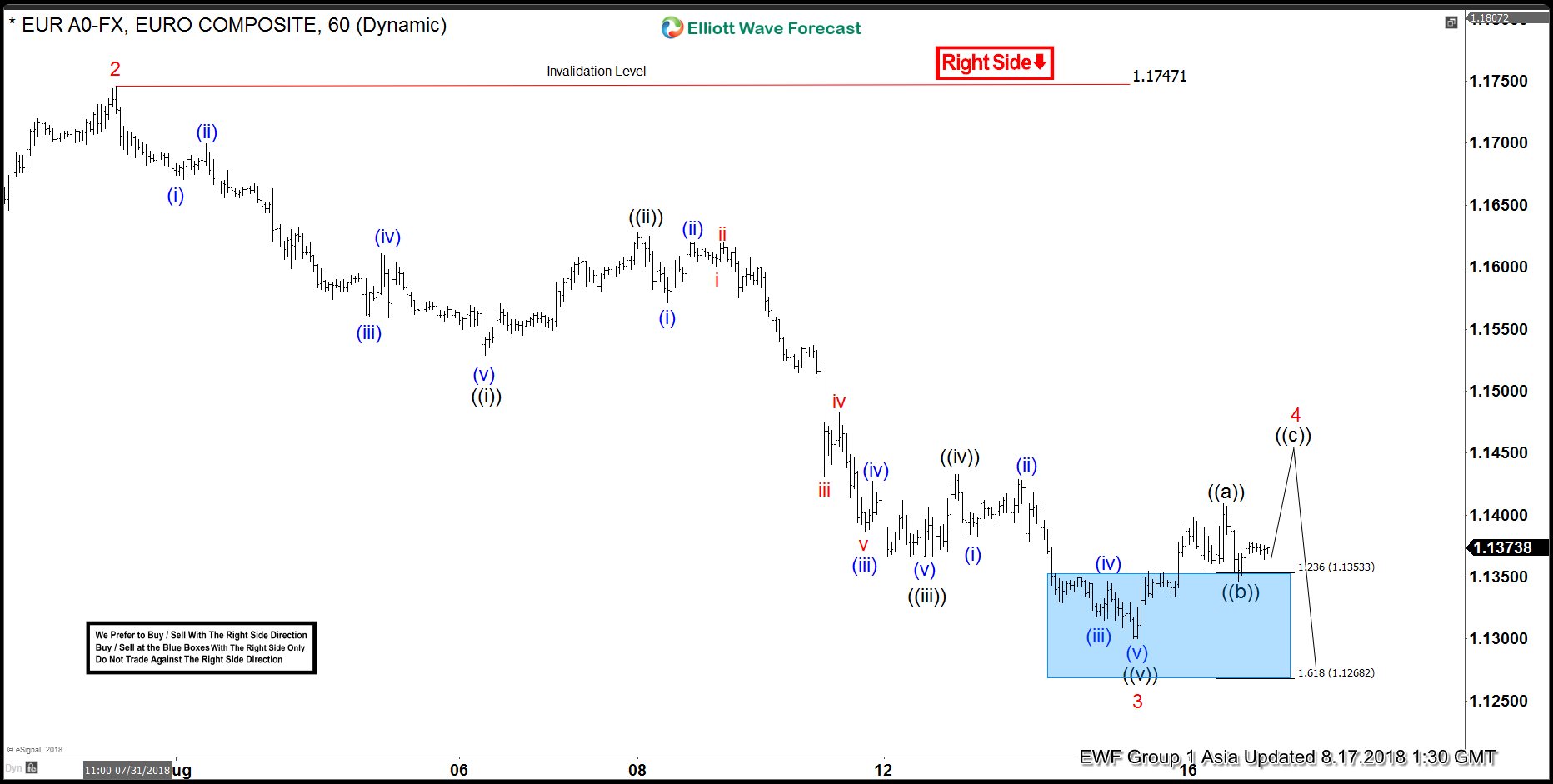

EURUSD Elliott Wave Analysis: More Weakness Expected

Read MoreEURUSD short-term Elliott Wave analysis suggests that the bounce to 1.1747 high ended Minor wave 2. Down from there, Minor wave 3 ended at 1.1299 low. The internals of that decline unfolded as impulse structure with lesser degree cycles are showing sub-division of 5 waves structure lower in it’s each leg lower i.e Minute wave ((i)), […]

-

USDNOK Elliott Wave View: Dips Should Remain Supported

Read MoreUSDNOK short-term Elliott wave view suggests that the pullback to $8.1165 low ended Minute wave ((ii)). Up from there, the rally higher is taking place as Elliott wave impulse structure where Minute wave ((i)), ((ii)) & ((iii)) unfolding in 5 waves structure & wave ((ii)) & ((iv)) are expected to unfold in 3 swings corrective sequence. […]