Artificial intelligence is used to augment industries such as business, education, construction, healthcare, transportation, etc. It has now become a major tool that assists in saving lives, creating new technology, and improving the lives of people around the world. There are countless ways in which AI can be used in daily life.

Artificial intelligence is used to augment industries such as business, education, construction, healthcare, transportation, etc. It has now become a major tool that assists in saving lives, creating new technology, and improving the lives of people around the world. There are countless ways in which AI can be used in daily life.

The industry broke records during the global uncertainty of the COVID-19 pandemic, as AI funding doubled in 2021 compared to 2020, according to CB Insights.

As an investor, you can invest in companies that build AI hardware, develop AI solutions, or sell AI development tools. In addition to it, there are companies that use AI to make better products, improve their marketing or create efficiencies.

List of Top Artificial Intelligence-Backed Stocks 2024

Here is a list of top Artificial Intelligence Backed Stocks to invest in 2024:

| Sr. | Company Name | Symbol | Market Cap | Price as of 17th Feb 2023 |

| 1 | Microsoft | MSFT | $ 1.95 trillion | $ 262.15 |

| 2 | UiPath | PATH | $ 8.89 billion | $ 16.06 |

| 3 | Twilio | TWLO | $ 13 billion | $ 70.67 |

| 4 | Baidu | BIDU | $ 49.76 billion | $ 141.71 |

| 5 | NVIDIA Inc | NVDA | $ 533 billion | $ 213.88 |

| 6 | Palantir Technologies | PLTR | $ 19.14 billion | $ 9.2 |

| 7 | C3.ai | AI | $ 2.63 billion | $ 23.84 |

| 8 | Tesla, Inc. | TSLA | $ 659 billion | $ 208.31 |

| 9 | Intel Corporation | INTC | $ 114.2 billion | $ 27.61 |

| 10 | Micron Technology, Inc. | MU | $ 64.4 billion | $ 59.01 |

Microsoft

Microsoft is committed to making the promise of AI real and with the mission to help every person on the planet to achieve more. The company is focused on creating AI systems that help people solve real-world challenges. They are building AI into every Microsoft Cloud service, designed to benefit every person and organization, including businesses, academic institutions, research labs, and manufacturers. And they are committed to advancing AI based on ethical principles that put people first. Microsoft is dedicated to ensuring that AI functions as intended and is used in ways that earn trust.

Microsoft’s Azure OpenAI Service is now available for all. It is built on Azure using the most advanced AI models in the world—like GPT-3.5, Codex, and DALL-E 2—developed in partnership between Microsoft and OpenAI. Azure is also the core computing power behind OpenAI API’s family of models for research advancement and developer productivity. Azure is currently the only global public cloud that offers AI supercomputers with massive scale-up and scale-out capabilities.

Also, learn:

Microsoft recently shared its second-quarter report for FY 2023:

- Revenue was reported at $ 52.7 billion, a 2 % increase on a year-on-year basis

- Operating Income was reported at $ 20.4 billion, an 8 % decline on a year-on-year basis

- Net income was reported at $ 16.4 billion, a 12 % decline on a year-on-year basis

- Earnings per share were reported at $ 2.2

Microsoft has a $ 1.95 trillion market cap with its shares trading at $ 262.15.

The stock of the company reaches its peak at the end of 2021 when it touched $ 343.11, the highest in the past 5 years. After that, the share picked up a bearish trend and continued throughout the year 2022. In the year 2023, the stock changed its course and has been on the rise. To date, the stock has appreciated by 9.6 %.

UiPath

UiPath

UiPath is a leading enterprise automation software vendor that helps organizations efficiently automate business processes. Started in 2005 in Romania, UiPath has the vision to deliver a fully automated enterprise™ where companies use automation to unlock the creativity and full potential of every worker. UiPath offers an end-to-end platform for automation, combining the leading robotic process automation (RPA) solution with a full suite of capabilities that enable every organization to digitally transform its business.

UiPath, Inc. recently announced its report financial results for its fiscal third quarter:

- Revenue was reported at $ 262.7 million, a 19 % increase on a year-over-year basis.

- Operating Loss was reported at $ 67 million, as compared to an operating loss of $ 120 million in the previous year’s same quarter.

- Net Loss was reported at $ 57.7 million, as compared to a net loss of $ 122.8 million in the previous year’s same quarter.

UI Path has an $ 8.9 billion market cap with its shares trading at $ 16.06. The company went public in March 2021. After an initial stellar performance, the investor frenzy dies and with it, the price of the stock started to decline. From a price of $ 65.5 at the start of the trading, the stock closed the year 2021 at $ 43.13 representing a 34 % decline. This bullish trend continued in the year 2022 and the stock closed the year at $ 12.7 representing a 70.1 % decline.

The year 2021 has brought a slight recovery with President Joe Biden focusing more on AI technology. To date, the stock has appreciated by 26.5 %

Twilio

Twilio

Twilio Inc., together with its subsidiaries, provides a cloud communications platform that enables developers to build, scale, and operate customer engagement within software applications in the United States and internationally. Its customer engagement platform provides a set of application programming interfaces that handle the higher-level communication logic needed for nearly every type of customer engagement, as well as enable developers to embed voice, messaging, video, and email capabilities into their applications.

By making use of AI technology, Twilio is changing communications and customer engagement for decades to come.

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

Twilio is a popular customer engagement platform that drives real-time, personalized experiences for today’s leading brands. It recently reported its financial results for its fourth quarter and full year ended December 31, 2022:

| Q4 2022 | Q4 2021 | FY 2022 | FY 2021 | |

| Revenue | $ 1.02 billion | $ 843 million | $ 3.83 billion | $ 2.841 billion |

| Loss from Operations | ($ 219) million | ($ 283.6) million | ($ 1.2) billion | ($ 915.6) |

| Net Loss | ($ 229.4) million | ($ 291.4) million | ($ 1.256) billion | ($ 949.9) billion |

| Net Loss per share | ($ 1.24) | ($ 1.63) | $ 6.86 | ($ 5.45) |

Twilio has a market cap of $ 13 billion. The stock of Twilio surged during COVID-19. In 2020 alone the stock underwent a 2.3-fold increase. After that, the stock maintained this price level for the major part of 2021 before reversing its performance.

Twilio has a market cap of $ 13 billion. The stock of Twilio surged during COVID-19. In 2020 alone the stock underwent a 2.3-fold increase. After that, the stock maintained this price level for the major part of 2021 before reversing its performance.

In the last quarter of 2021, the stock started its bearish journey. This trend continued for the remainder of 2021 and the whole of 2022. The year 2021 brought a stop to this bearish journey and the stock started to climb again. To date, the stock has appreciated by 44 % in 2023.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Baidu

Baidu, Inc. offers internet search services in China. It operates through Baidu Core and iQIYI segments. The company offers:

- Baidu App to access search, feed, and other services using mobile devices

- Baidu Search to access its search and other services

- Baidu Feed provides users with a personalized timeline based on their demographics and interests

- Haokan, a short video app

It also provides Baidu Knows, an online community where users can ask questions to other users;

- Baidu Wiki

- Baidu Healthcare Wiki

- Baidu Wenku

- Baidu Scholar

- Baidu Experience

- Baidu Post

- Baidu Maps, a voice-enabled mobile app that provides travel-related services;

- Baidu Drive

- Baijiahao

- DuerOS, a smart assistant platform.

In addition, it offers online marketing services, which include pay for performance, an auction-based service that allows customers to bid for priority placement of paid sponsored links and reach users who search for information related to their products or services; other marketing services that include display-based marketing services and other online marketing services based on performance criteria other than cost per click; mobile ecosystem, a portfolio of apps, including Baidu App, Haokan, and Baidu Post; various cloud services and solutions, such as platform as a service, software as a service, and infrastructure as a service; self-driving services, including maps, automated valet parking, autonomous navigation pilot, electric vehicles, and robotaxi fleets, as well as Xiaodu smart devices.

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Baidu recently reported its third-quarter results for the year 2022:

- Revenue was reported at $ 4.5 billion, a 2 % improvement from the previous year’s same period

- Operating income was reported at $ 747 million, a 130 % improvement from the previous year’s same period

- Net loss was reported at $ 21 million

- Loss per share was reported at $ 0.11

The stock of Baidu peaked at $ 339.1 during the first quart of 2021. Since then, the stock has been on a bearish trend. The stock continued to decline till it reached the lowest point of $ 78.54 in Oct-2022. After that, the stock changed its course and has been climbing up. In the current year, the stock has appreciated by 24 %.

NVIDIA Inc

NVIDIA Inc

NVIDIA is the world leader in artificial intelligence computing. It pioneered accelerated computing to tackle challenges no one else can solve. The company’s advancements in AI and the metaverse are transforming the world’s largest industries and profoundly impacting society.

NVIDIA specializes in products and platforms for the large, growing markets of gaming, professional visualization, data center, and automotive. Its creations are loved by the most demanding computer users in the world – gamers, designers, and scientists. And its work is at the center of the most consequential mega-trends in technology.

NVIDIA has recently shared its financial report for the quarter ending October 2022:

- Revenue was recorded at $ 5.9 billion, a 17 % decline from the previous year’s same period

- Income from operation was reported at $ 601 million, a 77 % decline from the previous year’s same period

- Net Income was reported at $ 680 million, a 72 % decline from the previous year’s same period

- Earnings per share were recorded at $ 0.27

NVIDIA has a market cap of $ 533 billion. Its shares are trading at $ 213.88. The stock of NVIDIA continued its bullish trend for many years which ended in Nov 2011, after hitting a peak of $ 329.55. After a prolonged bullish run, the stock was bound to reverse its course of action. The stock remained bearish for the major part of 2022 till it hit the lowest point of $ 112.27. After that, the stock again reversed its course and started to climb again. In 2023, the stock has appreciated by 46 % to date.

Palantir Technologies

Palantir Technologies

Palantir Technologies is focused on creating the world’s best user experience for working with data, one that empowers people to ask and answer complex questions without requiring them to master querying languages, statistical modeling, or the command line. To achieve this, the company builds platforms for integrating, managing, and securing data on top of which we layer applications for fully interactive human-driven, machine-assisted analysis.

Palantir recently shared its fourth quarter report for 2022:

- Revenue was reported at $ 508 million, an 18 % year-over-year increase. This is the first quarter of positive net income reported.

- Loss from operations was reported at $ 17.8 million

- Net income was reported at $ 30.1 million

- Earnings per share were reported at $ 0.01

Palantir also shares its full-year result for the year 2022:

- Revenue was reported at $ 1.9 billion, a 24 % year-over-year increase.

- Loss from operations was reported at $ 161 million

- Net loss was reported at $ 373.8 million

- Loss per share was reported at $ 0.18

Palantir has a market cap of $ 19 billion. Its shares are trading at $ 9.2. After going public in 2021, the stock peaked at $ 35.18 and remained bullish for almost a year. During the last quarter of 2022, the stock started to decline and continued this bearish pattern for the whole of 2022. In 2023, the stock changed its course and has appreciated by 43 % to date.

C3.ai

C3.ai

C3 AI is an Enterprise AI application software company. C3 AI delivers a family of fully integrated products including the:

- C3 AI Application Platform, an end-to-end platform for developing, deploying, and operating enterprise AI applications

- C3 AI Applications is a portfolio of industry-specific SaaS enterprise AI applications that enable the digital transformation of organizations globally.

C3 AI provides over 40 turnkey Enterprise AI applications that meet the business-critical needs of global enterprises in manufacturing, financial services, government, utilities, oil and gas, chemicals, agribusiness, defense and intelligence, and more. It provides an integrated family of development tools to meet the needs of different development communities.

In the recent second-quarter report for the year 2022, the company reported:

- Total revenue for the quarter was reported at $ 62.4 million, an increase of 7 % compared to $ 58.3 million in the previous year.

- Loss from operation was reported at ($ 72) million, as compared to $ 56 million in the previous year’s same period

- Net loss was reported at ($ 68.9) million, as compared to ($ 56.7) million in the previous year’s same period

- Net loss per share was reported at ($ 0.63), compared to ($ 0.55) in the previous year.

C3.ai has a market cap of $ 2.63 billion. Its shares are trading at $ 23.84. The company went public in 2020. After an initial hike in price, the stock picked up a downward trajectory. This bearish trend started at the end of the first quarter of 2021 and continued throughout 2021 and 2022.

In the year 2023, after an initial decline, the stock picked up the pace and last closed at $ 23.84. To date, the stock has increased by 113 %.

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Tesla, Inc.

Tesla Inc (Tesla) is an automotive and energy company. It designs, develops, manufactures, sells, and leases electric vehicles and energy generation and storage systems. The company produces and sells the Model Y, Model 3, Model X, Model S, Cybertruck, Tesla Semi, and Tesla Roadster vehicles.

Tesla also installs and maintains energy systems and sells solar electricity; and offers end-to-end clean energy products, including generation, storage, and consumption. It markets and sells vehicles to consumers through a network of company-owned stores and galleries.

Tesla reported its year-end results for the year 2022:

- Revenue was reported at $ 81.4 billion, as compared to $ 53.8 billion in the previous year’s same period

- Income from operations was reported at $ 13.6 billion, as compared to $ 6.5 billion in the previous year’s same period

- Net income was reported at $ 12.6 billion as compared to $ 5.5 billion in the previous year’s same period

- Earnings per share were reported at $ 3.62, as compared to $ 1.63 in the previous year’s same period

Tesla has a market cap of $ 659 billion. Its shares are trading at 208.31.

During COVID-19, Tesla’s stock picked up the pace. The stock started its bullish journey in 2020 which continued throughout the year, the year 2021 during which it peaked at $ 407.36. After a prolonged bullish run, the stock was bound to change its course. The stock started its slow and steady decline. By the end of the year 2022, the stock closed at $ 113.06. In the year 2022, the stock picked up the pace and last closed at $ 208.31. In 2023, the stock appreciated by 84 %.

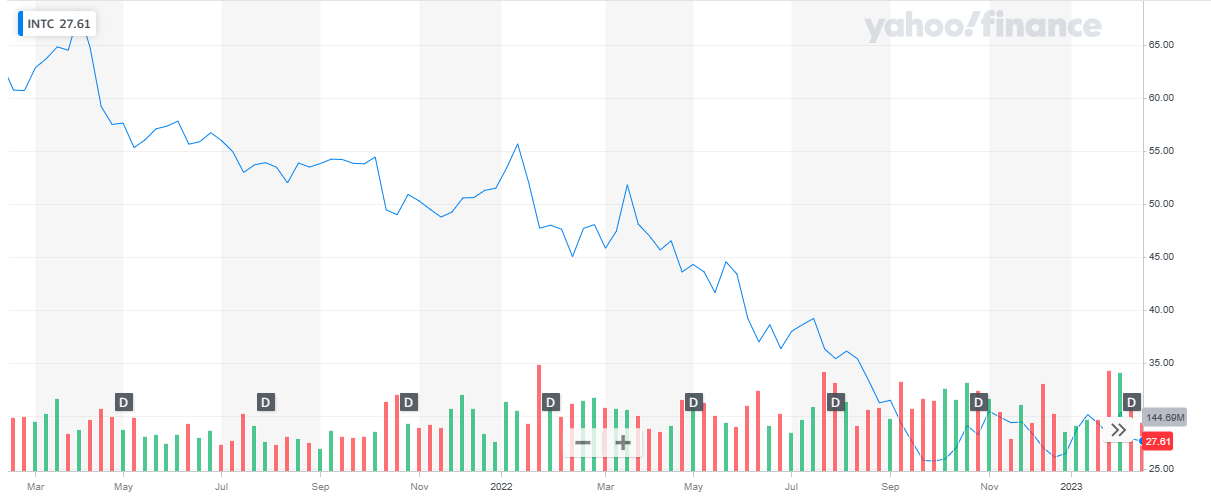

Intel Corporation

Intel Corporation

Intel’s technology has been at the heart of computing breakthroughs. They are an industry leader, creating world-changing technology that enables global progress and enriches lives. Intel Corp. stands at the brink of several technology inflections—artificial intelligence (AI), 5G network transformation, and the rise of the intelligent edge—that together will shape the future of technology. Silicon and software drive these inflections, and Intel is at the heart of it all.

Intel Corp recently reported its year-end results for 2022:

- Revenue was reported at $ 63 billion, as compared to $ 79 billion in the previous year’s same period

- Operating Income was reported at $ 2.3 billion, as compared to $ 19.5 billion in the previous year’s same period

- Net Income was reported at $ 8.3 billion, as compared to $ 19.9 billion in the previous year’s same period

Intel Corp has a market cap of $ 114.2 billion. Its shares are trading at $ 27.61.

The stock of Inter Corp maintained volatile behavior for many years. After hitting the peak of $ 68.26 in mid-2021, the stock picked up a bearish run. The stock continued this bearish trend for the remaining year and the whole of 2022.

In 2023, the stock changed its course and started to climb. The stock last closed at $ 27.52 representing an 8 % appreciation to date.

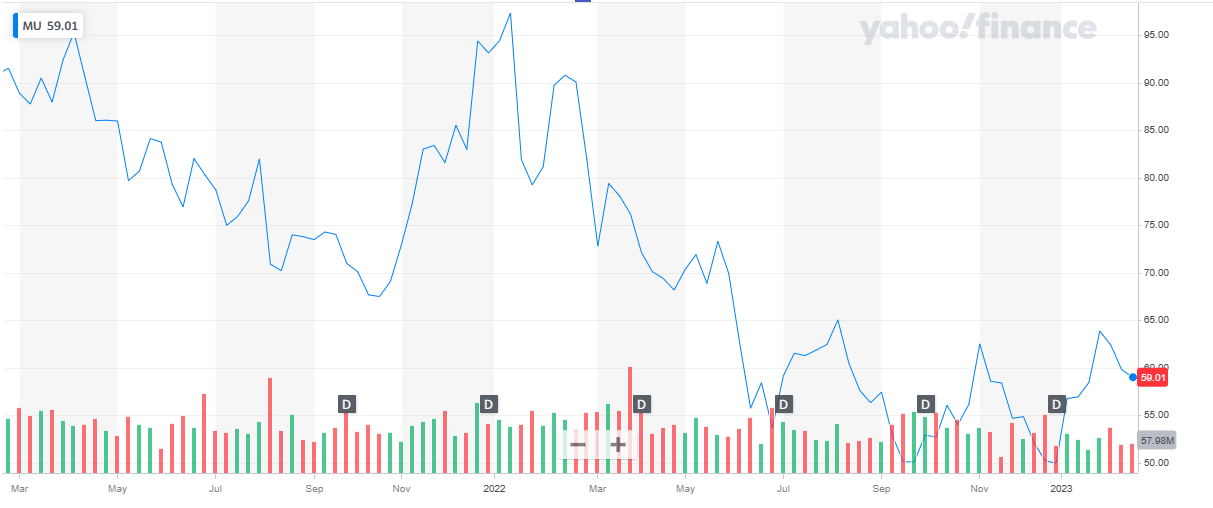

Micron Technology Inc.

Micron Technology Inc.

Micron Technology is a producer of computer memory and computer data storage solutions. It offers dynamic random access memory (DRAM) modules, ultra-bandwidth solutions, multichip packages, NAND and NOR flash, memory cards, SSDs, etc. The company serves a variety of markets, including networking, graphics, and cloud server, as well as enterprise, client, cloud, removable storage, automotive, industrial,

For more than 40 years, Micron Technology has been a world leader in innovative memory and storage solutions that accelerate the transformation of information into intelligence, inspiring the world to learn, communicate and advance faster than ever. They deliver the world’s broadest portfolio of technologies at the core of today’s most significant disruptive breakthroughs such as artificial intelligence and autonomous vehicles.

Micron Technology recently shares its quarterly report ending Dec 2022:

- Revenue was reported at $ 4.1 billion, as compared to $ 7.7 billion in the previous year’s same period

- Operating loss was reported at ($ 209) million, as compared to an operating profit of $ 2.7 billion in the previous year’s same period

- Net Loss was reported at ($ 195 million), as compared to net income of $ 2.3 billion in the previous year’s same period

- Loss per share was reported at ($ 0.18) as compared to earnings per share of $ 2.06 in the previous year’s same period.

Micron Technology has a market cap of $ 64.4 billion. Its shares are trading at $ 59.01.

The stock picked up pace during COVID-19. In 2020 the stock started its bullish journey and throughout the next two years maintained this bullish journey with multiple dips and peaks. In 2022, after hitting the peak of $ 97.36, the stock started to decline. The stock maintained this trend for the whole year and closed the year at $ 49.98.

In 2021, the stock changed its course and picked up a bullish trend. The stock last closed at $ 59.01 representing an 18 % appreciation to date.

Also read: