Environmental, social, and governance funds, commonly known as ESG funds are increasing in popularity amongst investors. These pools of funds include companies based on their ESG practices alongside their financial performance. ESG investing is also called responsible investing as it is all about investing in companies that perform better and create more value.

Environmental, social, and governance funds, commonly known as ESG funds are increasing in popularity amongst investors. These pools of funds include companies based on their ESG practices alongside their financial performance. ESG investing is also called responsible investing as it is all about investing in companies that perform better and create more value.

The ESG market is soaring and investors are continuously investing in these funds. According to the research and analysis done by Bloomberg, Global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management.

As an investor, you can use ETFs to incorporate ESG into your portfolio. Investing in ETFs ESG lowers the investment cost all the while enabling the investors to invest in responsible companies. Also, ESG ETFs allows investors to build a highly diversified portfolio.,

Pros of Investing in ESG ETFs

Investing in ESG ETFs comes with its own set of benefits, which are:

- ESG ETFs allow the investor to invest in responsible companies. Also, with ESG ETFs you can include multiple sustainable company stocks in your portfolio

- Higher ESG ratings indicate high performing companies

- ESG ETFs incorporates a wide range of asset classes, sectors, and geographies

- Investing in ESG ETFs is a cost-effective approach since they have a very low cost.

Best ESG ETFs to Invest in 2024

There are dozens of ESG funds to choose from. Here we have compiled a list of best ETFs which are worth investing in the current year.

| Sr. | Name of ESG ETF | Symbol | Expense Ratio |

| 1. | Vanguard FTSE Social Index Fund | VFTAX | 0.14% |

| 2. | First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index | GRID | 0.75% |

| 3. | 1919 Socially Responsive Balanced A | SSIAX | 1.16% |

| 4. | iShares Global Clean Energy ETF | ICLN | 0.42% |

| 5. | Parnassus Core Equity Investor | PRBLX | 0.84 |

| 6. | Thornburg Better World International Fund | TBWIX | 1.09% |

| 7. | Natixis Sustainable Future 2025 N | NSFEX | 0.56% |

| 8. | iShares MSCI USA ESG Select ETF | SUSA | 0.25% |

| 9. | iShares ESG MSCI EAFE ETF | ESGD | 0.20% |

| 10. | AllianceBernstein Sustainable Global Thematic Fund | ATEYX | 0.81% |

| 11. | Shelton Green Alpha Fund | NEXTX | 1.28% |

Vanguard FTSE Social Index Fund (VFTAX)

Vanguard FTSE Social Index Fund tracks the performance of the FTSE4Good US Select Index. The market-cap-weighted index is composed of large- and mid-capitalization stocks. This ETF is screened for the ESG criteria therefore it excludes stocks of certain companies in the following industries: adult, entertainment, alcohol, tobacco, weapons, fossil fuels, gambling, and nuclear power. This ESG ETF employs a passively managed, full-replication approach. Index Funds mirror the performance of a large group of assets.

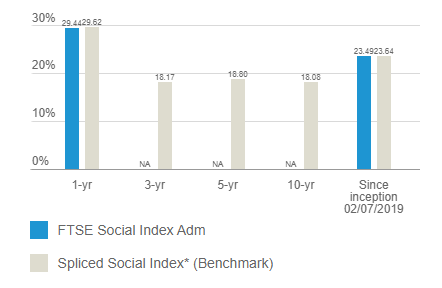

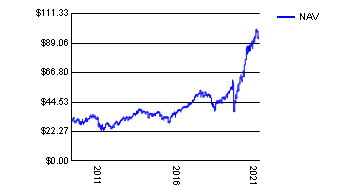

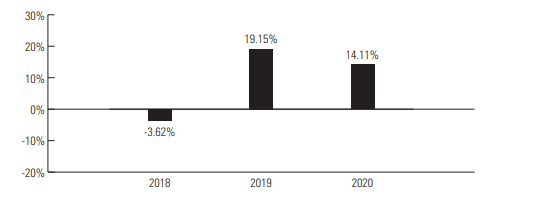

The average annual return of the index is shown in the graph below:

The price of this index as of 13th October 2021 is $42.57 and its recent 30-day yield is 0.98%. The details of the ESG ETF are listed below:

| ETF Details | |

| Number of stocks | 485 |

| Fund total net assets | $15.2 billion |

| Net assets of 10 largest holdings | 32.3% |

First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index (GRID)

First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index is designed to track the performance of common stocks in the grid and electric energy infrastructure sector. The index includes companies that are primarily engaged and involved in the electric grid, electric meters and devices, networks, energy storage and management, and enabling software used by the smart grid infrastructure sector. To meet the ESG criteria, this ETF includes company stocks that must meet certain criteria which are: being classified as a smart grid, electric infrastructure, and/or other grid-related activities company according to Clean Edge, have a minimum worldwide market capitalization of $100 million, have a minimum free float of 20%, and have a minimum three-month average daily dollar trading volume of $500 thousand. The index employs a modified market-capitalization weighting methodology. Investing in Bonds and Stocks can make or break an economy. Get to know best bond ETFs to buy now.

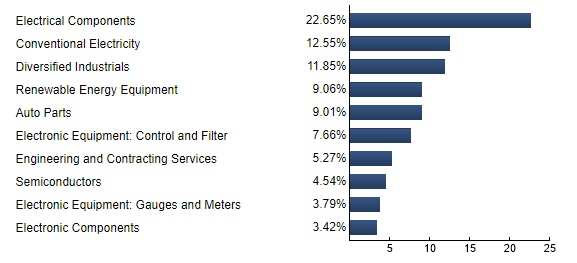

The historical performance of this ETF is shown in the below graph:

The index’s Total Net Assets are valued at $568,528,286. The recent closing price is quoted at $95.16. The details of the total funds invested according to companies are shown in the below chart:

1919 Socially Responsive Balanced A (SSIAX)

1919 Socially Responsive Balanced A fund invests in undervalued stocks which are managing business operations in a socially responsive manner. The Fund aims to invest 70% of total assets in U.S. stocks and 30% in investment-grade U.S. debt, and it may also invest in foreign stocks and debt.

Following the ESG criteria, this index includes companies that have no direct exposure to fossil fuel real assets, have fair and reasonable employment practices, minimize the negative impact of business activities on the environment, do not manufacture nuclear weapons or other weapons of mass destruction, and do not derive more than 5% of their revenue from production or sale of tobacco products. This top ETF is a great addition to the investment portfolio.

| ETF Details | |

| Total Fund Assets | $781.7 million |

| Number of Holdings | 211 |

| Turnover | 5.58% |

The total funds of the index are invested in different sectors. The equity sector allocation is as below:

| Sector | Percentage |

| Technology | 34.6% |

| Financial | 16.3% |

| Health Care | 14% |

| Industrials | 12.2% |

| Consumer Discretionary | 10.4% |

| Consumer Staples | 6.7% |

| Communication Services | 4% |

| Utilities | 1.8% |

iShares Global Clean Energy ETF

The iShares Global Clean Energy ETF tracks the investment results of an index composed of global equities in the clean energy sector. This ESG ETF provides exposure to companies that produce energy from solar, wind, and other renewable sources. Through this ESG ETF, investors get access to clean energy stocks from around the world.

| ETF Details | |

| Shares Outstanding | 266 million |

| Fund total net assets | $6 billion |

| 30 Day SEC Yield | 1% |

The breakdown of the exposure of the ESG ETF is as below:

| Sector | Percentage |

| Electric Utilities | 37.25% |

| Renewable Electricity | 14.57% |

| Semiconductor Equipment | 14.57% |

| Heavy Electrical Equipment | 13.58% |

| Electrical Components & Equipment | 10.10% |

| Semiconductors | 4.6% |

| Multi-Utilities | 1.8% |

| Oil & Gas Refining & Marketing & Transportation | 1.45% |

| Independent Power Producers & Energy | 0.92% |

| Commodity Chemicals | 0.63% |

| Cash and/or Derivatives | 0.23% |

| Industrial Machinery | 0.15% |

Also check out: List of Most Volatile Stocks.

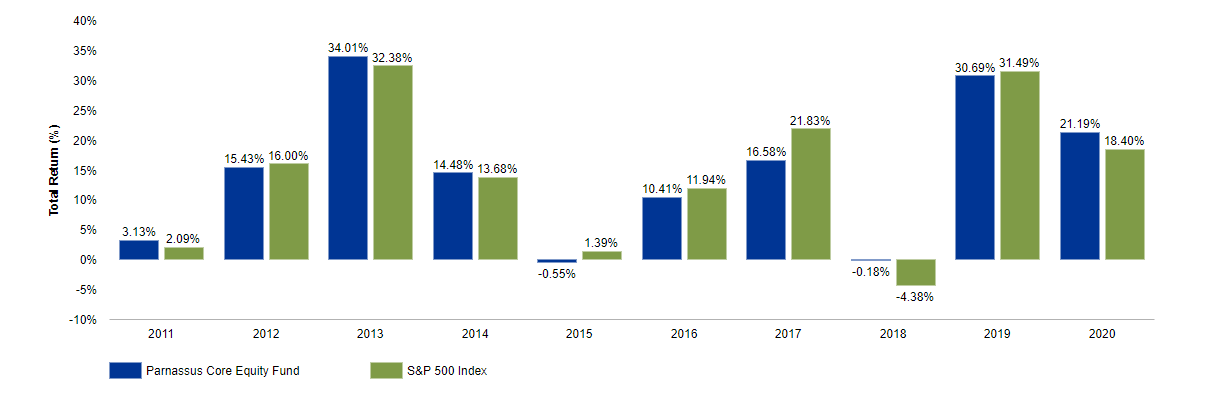

Parnassus Core Equity Investor

The Parnassus Core Equity Fund invests in large-cap companies with long-term competitive advantages and relevancy, quality management teams, and positive performance on ESG criteria. The ETF aims to outperform the S&P 500 index. Its portfolio managers diligently seek and invest in companies that can perform better than the market, especially during the downfall.

| ETF Details | |

| Fund total net assets | $29.4 billion |

| NAV as of 10/14/2021 | $63.27 |

The return of the index is shown in the below graph:

Thornburg Better World International Fund (TBWIX)

Thornburg Better World International Fund (TBWIX)

Thornburg Better World International Fund offers a distinct approach to environmental, social, and governance investing (ESG) overseas. The fund approaches the ESG space with a sustainable investing discipline. The ETF includes companies that follow standards that have a long-term economic benefit directly on the business and its stakeholders, like customers, employees, governments, and communities. This way this ETF is involved in creating lasting value for its stakeholders. Also, other characteristics of this ESG ETF include low operating costs over the long run, better capital allocation, innovation in investment, and improved reputation. By using the signals providers, you can avoid hours of technical analysis to understand the market.

| ETF Details | |

| Fund total net assets (as of 31st August 2021) | $347.2 Million |

The below chart shows the exposure of this ESG ETF, sector-wise:

| Sector | Percentage |

| Information Technology | 20% |

| Industrials | 19.3% |

| Consumer Discretionary | 13.3% |

| Financials | 12.6% |

| Communication Services | 10.3% |

| Materials | 9.7% |

| Utilities | 3.3% |

| Real Estate | 1.9% |

| Health Care | 1.3% |

| Cash and Cash Equivalents | 8.4% |

Read more:

Natixis Sustainable Future 2025 N

Natixis Sustainable Future 2025 N is a target-date fund that benefits from active and passive investments, unique managers and investment styles, and incorporation of ESG (Environmental, Social, Governance) considerations in manager and security selection. It aims to help investors meet their retirement goals. The fund’s allocations are carefully constructed and are well diversified across multiple dimensions including asset classes, investment styles within asset classes, active and passive strategies, differentiated investment managers, and approaches to incorporating ESG considerations. It is one of the best investment opportunities.

The fund’s asset allocation is adjusted to balance the appropriate levels of risk and reward throughout the investor’s lifetime, becoming more conservative over time, with each fund managed to and through a specific target retirement date.

The Fund’s Class N shares total return year-to-date as of March 31, 2021, was 3.22%. The previous years’ return is as below:

The below chart shows the exposure of this ESG ETF, sector-wise:

| Sector | Percentage |

| Information Technology | 21.28% |

| Financials | 16.53% |

| Health Care | 13.38% |

| Consumer Discretionary | 12.33% |

| Industrials | 11.12% |

| Communication Services | 8.4% |

| Consumer Staples | 5.64% |

| Materials | 3.43% |

| Utilities | 2.68% |

| Energy | 2.67% |

| Real Estate | 2.25% |

iShares MSCI USA ESG Select ETF

The iShares MSCI USA ESG Select ETF seeks to track the investment results of an index composed of U.S. companies that have positive environmental, social, and governance characteristics as identified by the index provider. Investors get exposed to these companies: alcohol, civilian firearms, controversial weapons, conventional weapons, gambling, nuclear power, nuclear weapons, and tobacco. These companies are chosen based on revenue or percentage of revenue thresholds for certain categories and categorical exclusions for others.

| ETF Details | |

| Fund total net assets (as on 14th October 2021) | $3.88 Billion |

| 30 Day SEC Yield | 1.11% |

The below chart shows the exposure of this ESG ETF, sector-wise:

| Sector | Percentage |

| Information Technology | 31.36% |

| Financials | 11.36% |

| Health Care | 10.97% |

| Industrials | 10.68% |

| Consumer Discretionary | 9.27% |

| Communication | 8.23% |

| Consumer Staples | 6.71% |

| Real Estate | 3.41% |

| Materials | 2.67% |

| Utilities | 2.56% |

| Energy | 2.51% |

| Cash and Cash Equivalents | 0.26% |

iShares ESG MSCI EAFE ETF

The iShares ESG Aware MSCI EAFE ETF tracks the performance of an index that includes large- and mid-capitalization developed market equities, outside the U.S. and Canada. These companies have positive environmental, social, and governance characteristics as identified by the index provider while exhibiting risk and return characteristics similar to those of the parent index.

Through this ESG ETF, investors get exposure to large- and mid-cap stocks to invest in Europe, Australia, Asia, and the Far East with favorable environmental, social, and governance (ESG) practices.

| ETF Details | |

| Fund total net assets (as on 14th October 2021) | $6.96 Billion |

| 30 Day SEC Yield | 1.91% |

The below chart shows the exposure of this ESG ETF, sector-wise:

| Sector | Percentage |

| Financials | 17.58% |

| Industrials | 16.07% |

| Health Care | 12.06% |

| Consumer Discretionary | 11.71% |

| Information Technology | 10.32% |

| Consumer Staples | 10.09% |

| Materials | 7.22% |

| Communication | 4.24% |

| Energy | 4.11% |

| Real Estate | 2.92% |

| Utilities | 2.87% |

| Cash and Cash Equivalents | 0.80% |

AllianceBernstein Sustainable Global Thematic Fund

AllianceBernstein Sustainable Global Thematic Fund adopts a top-down” and “bottom-up” approach towards investment and picks securities that follow sustainable investment themes. These sustainable investment themes are aligned with the United Nations Sustainable Development Goals such as health, climate, and empowerment. This ETF used bottoms-up company analysis, focusing on prospective earnings growth, valuation, and quality of company management and its exposure to environmental, social, and corporate governance (”ESG”) factors. There are many advisory services that recommends few of the best investment options to its members and subscribers.

| ETF Details | |

| Fund total net assets (as of 31st August 2021) | $2.5 Billion |

The below chart shows the exposure of this ESG ETF, sector-wise:

| Sector | Percentage |

| Information Technology | 29.46% |

| Industrials | 20.42% |

| Health Care | 20.02% |

| Financials | 12.28% |

| Consumer Discretionary | 6.64% |

| Utilities | 3.54% |

| Materials | 3.44% |

| Cash and Cash Equivalents | 3.17% |

| Consumer Staples | 1.03% |

Shelton Green Alpha Fund

The Fund’s investment objective is to achieve long-term capital appreciation by investing in stocks in the green economy. The fund managers seek green economy companies that have above-average growth potential. The companies of this ESG ETF participate in improving human well-being, work towards improving economic efficiencies, and reducing environmental risks.

| ETF Details | |

| Fund total net assets (as of 31st August 2021) | $340.2 million |

The below chart shows the exposure of this ESG ETF, sector-wise:

| Sector | Percentage |

| Consumer, Non-cyclical | 26.02% |

| Technology | 21.44% |

| Energy | 21.19% |

| Financials | 12.73% |

| Consumer Cyclical | 5.27% |

| Communications | 5.16% |

| Utilities | 3.62% |

| Industrial | 2.98% |

| Basic Material | 1.59% |

Conclusion

“Given the growing investor focus on positive and negative screening, improvement in performance on ESG metrics is a key target of corporates. However, most are also seeking to ensure their actions improve economic efficiency too,” quoted Barclays strategists.

The dual focus of ESG securities, that is environment-friendly practices along with strong financial performance, makes ESG ETFs more than just a ‘feel-good’ investment. This also assures that these companies do not sacrifice either of these performance metrics but adopt a strategy that amalgamates both of them in a good unison.

The above-mentioned ESG ETF list is our best pick for investment in the year 2024.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Best Day Trading Stocks in 2024

- Fibonacci Retracement, Extension & Trading Strategies

- Best Trading and Forex Signal Providers

- Best Crypto Currencies To Invest

- Monthly Dividend Stocks to Buy

- Best Renewable Energy Stocks to Invest

- Best Drone Stocks to Buy

- Best Penny Stocks to Buy

- Best Stock Signal Providers

- Best Crypto Signal Providers