Drone Technology is one of the heavily invested technology by the military. Drone technology is expected to become a part of life for everyone in the coming years. This technology is expected to be used in a variety of routine activities which include, but are not limited to, photography, racing, farming, and package delivery. The Federal Aviation Administration (FAA) 2019 Aerospace Forecast report expects the commercial drone market to triple by 2023.

List of Best Drone Stocks to Invest

Investors who are looking to benefit from the rising technology by earning profits should consider the below list of drone stocks for investment:

| Sr. | Company Name | Symbol | Price $ (as of 22nd Feb 2021) | Percentage annual change (Last 52-week change) | Average Volume Traded (3-month) | Market Capitalization ($ Billion) |

|---|---|---|---|---|---|---|

| 1 | AgEagle Aerial Systems Inc. | UAVS | 9.3 | 1,623% | 9.13 Million | 607.4 Million |

| 2 | EHang Holdings Ltd | EH | 53.23 | 439.37% | 4.51 Million | 3.27 Billion |

| 3 | Drone Delivery Canada Corp | TAKOF | 1.58 | 165% | 1.09 Million | 329.9 Million |

| 4 | Plymouth Rock Technologies | PLRTF | 1.1 | 717.6% | 1.58 Million | 42.6 Million |

| 5 | Parrot | PAOTF | 8.4 | 146% | 7,480 | 246 Million |

| 6 | Ambarella | AMBA | 121.4 | 96.87% | 868,490 | 4.27 Billion |

| 7 | AeroVironment | AVAV | 126.29 | 92.85% | 224,240 | 3.07 Billion |

| 8 | Kratos Defense & Security | KTOS | 47.75% | 1.2 Million | 3.8 Billion | |

| 9 | Joby Aviation Inc. | JOBY | $ 3.35 | -55.21 % | 3.51 million | $ 2.083 billion |

| 10 | GoPro Inc. | GPRO | $ 4.98 | -53.28 % | 1.57 million | $ 776.5 million |

| 11 | Northrop Grumman | NOC | $ 545.61 | 41.52 % | 911,210 | $ 84 billion |

| 12 | Boeing Co. | BA | $ 213 | 1.76 % | 7.68 million | $ 127 billion |

| 13 | Lockheed Martin | LMT | $ 473.24 | 30.28 % | 1.42 million | $ 124 billion |

| 14 | Draganfly Inc. | DPRO | $ 0.84 | -43.62 % | 381,030 | $ 28.4 million |

| 15 | Amazon | AMZN | $ 89.14 | -46.7 % | 81.96 million | $ 912.3 billion |

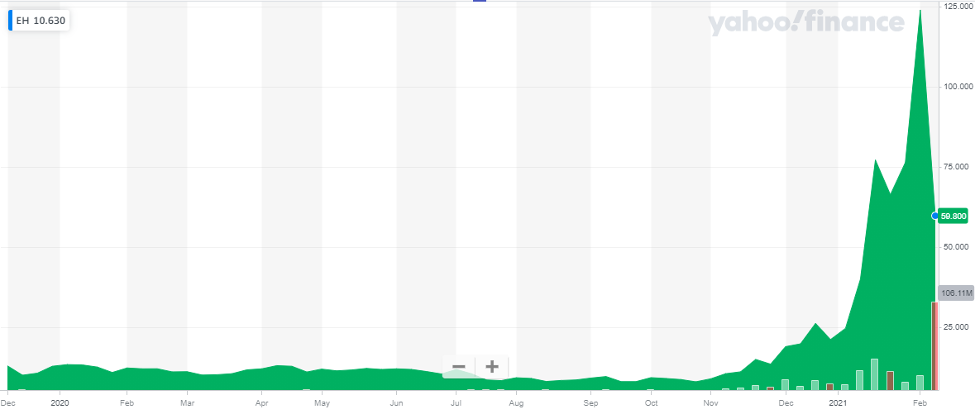

1. AgEagle Aerial Systems Inc (UAVS)

1. AgEagle Aerial Systems Inc (UAVS)

AgEagle Aerial Systems Inc. is one of the leading commercial drone technology, services, and solutions providers. They provide metrics, tools, and strategies that are needed to implement solutions through the use of the drone. AgEagle Aerial Systems Inc. delivers to people like you and me who can benefit from drone-enabled solutions in daily life. AgEagle Aerial Systems aims to be the leading commercial drone design, engineering, manufacturing, assembly, and testing companies in the United States. Moreover, it focuses on earning the trust of people by becoming the world’s trusted source for turnkey drone delivery services and solutions. Get to kn0w about best cryptocurrencies to Invest in

AgEagle Aerial Systems was considered a penny stock by investors and the total valuation of the company was less than $10 million. In the year 2020, when news spread about AgEagle Aerial Systems Inc. working with Amazon a retail delivery drone in near future, changed the fate of the stock. Till today of Ageagle Aerial Systems is on an upward trend with an astounding 1600% increase in price from last year.

Find below the stock performance chart over the last 2 years:

Read more:

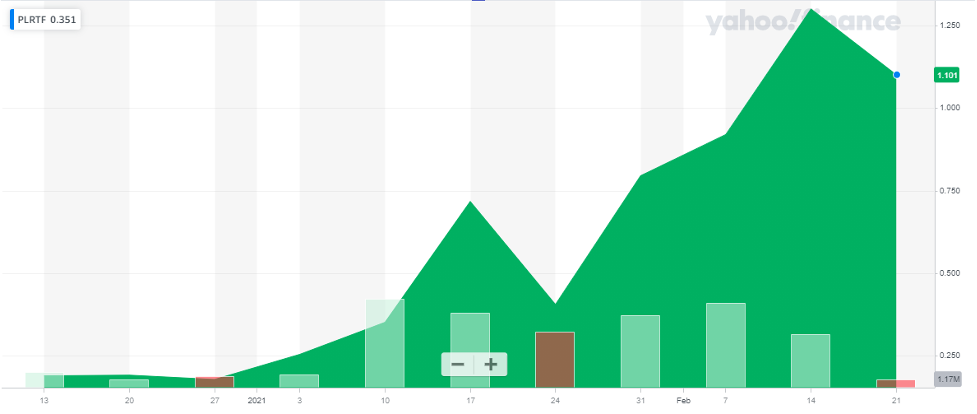

2. EHang Holdings Ltd. (EH)

EHang is the world’s leading autonomous aerial vehicle (AAV) technology platform company. EHang aims to provide safe, autonomous, and eco-friendly air mobility access to everyone. EHang’s customer base includes various industries and it provides commercial solutions to them like air mobility which includes passenger transportation and logistics, smart city management, and aerial media solutions. EHang’s mission is to continue to make daily life better with smart technological solutions.

Ehang is categorized as a very good investment for long-term investments with an expected increase of approximately 350% in the next 5 years. EHang’s share was traded at around $13 in December and it soared to $129 on 12th Feb 2021. On 16th Feb 2021, Wolfpack research issued a report accusing EHang of fabricating sales and claiming many of its partnerships as false. This resulted in the stock price dropping 63% in one day and the stock which opened at $124 closed at $46.3 on 16th Feb 2021. EHang reverted a few days later saying all these claims are false and they plan on taking legal counsel to pursue legal actions against Wolfpack Research for its malicious act and false allegations.

The report issued by Wolfpack Research is a risky report which lacks validity. We expect a solid response from EHang management and a strong comeback of the stock once the Chinese New Year holidays come to end.

Read: Best Gold Trading Signal Providers.

Find below the stock performance chart over the last 2 years:

Get to know the best covered call stocks to buy now.

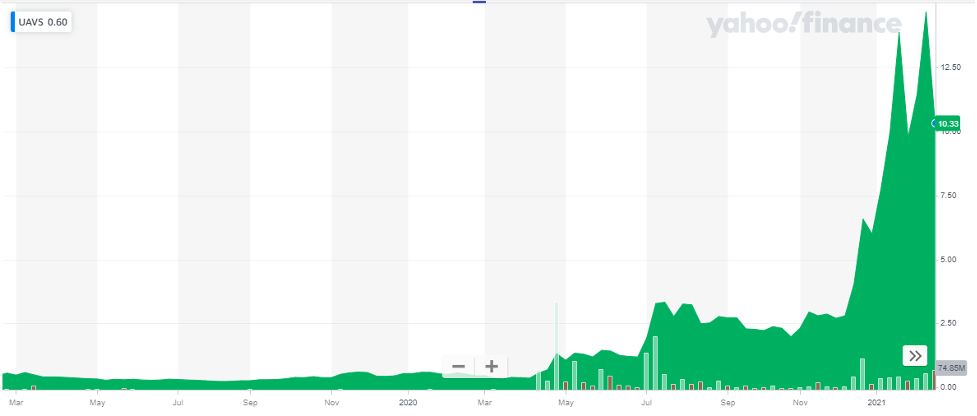

3. Drone Delivery Canada Corp (TAKOF)

Drone Delivery Canada is a pioneering technology company that is in the business of designing, developing, and implementing commercially viable drone-based logistics systems. Their technology is targeted for government use, commercial use, and industrial and retail customers around the globe. Drone Delivery Canada aims to be the premier drone delivery company at an international level. It is set on redefining the traditional logistic system with the introduction of drone technology. Through their drone-based logistics systems, Drone Delivery Canada is offering a cost-effective way to deliver cargo by reducing shipping time and reducing costs.

Analysts believe that the stock of Drone Delivery Canada is trading below its fair value. This is a good indication for investors that prices are likely to rise. Its cash holdings are pretty great with zero debt as reported in its balance sheet on September 2020. The stock price of Drone Delivery Canada is on an upward trend and has shown an improvement of more than 150% from last year till today.

Also read: Best Stock Forecasts & Prediction Services

Wall Street Analyst’s stance on Drone Delivery Canada Corp stock is “Moderate Buy”.

Find below the stock performance chart over the last 2 years:

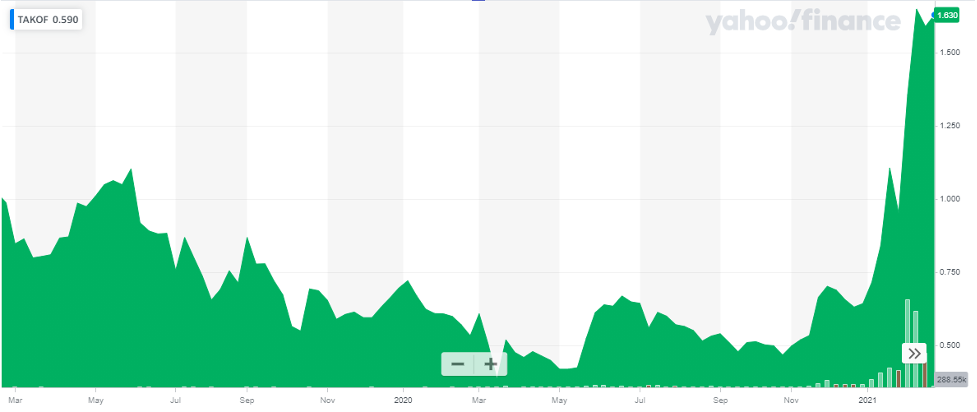

4. Plymouth Rock Technologies (PLRTF)

Plymouth Rock Technologies, Inc. focuses on developing security screening and threat detection technology solutions using radar imaging and signal processing technology. It is engaged in developing and deploying the latest electronic surveillance devices in the field of military, civil and private threat detection markets. The Company is developing next-generation threat detection solutions and Unmanned Aircraft Systems (UAS). Plymouth Rock Technologies aims to provide engineering-driven solutions for our safety problems. They work in collaboration with the government, law enforcement, and military and are on a fast track in innovative safety solutions for national security, defense and space systems

Plymouth completed testing for their CODA-1 system which has been designed to detect various concealed weaponry on a person. This system has been created to assist United States Government Security. Plymouth is set to continuously create technology-driven solutions to enable automation in processes and for this, it has always remained in news. Recently a Plymouth Rock Drone completed a UN mission in Somalia in record time. Also, they have recently announced the completion MediMod for Emergency Biological and Vaccine Transport. MediMod is an active insulated refrigerated storage module that will assist the government in deploying Covid vaccines to remote areas. In the future, it is expected to assist in the transportation of blood, human transplant organs, and various vaccines across cities and remote destinations

Plymouth has been in the news in this current year and is on an upward track in terms of stock price movement.

Find below the stock performance chart over the last 2 years:

Read more:

5. Parrot (PAOTF)

Parrot is today the leading European group in the fast-growing industry of drones. It creates, develops, and markets wireless products for the retail and professional markets. Parrot currently manufactures and supplies Civil drones which are retail leisure quadcopters and cutting hedge professional solutions. Parrot is the only company that manufactures the drone and provides the service and software to its clients. Its drones are known for their high performance and ease of use. Parrot is currently focused on providing its drone technology for the agriculture market, Defense and Security and 3D Mapping, Surveying and Inspection

In July 2020, Parrot partnered with WISeKey leading global cybersecurity and IoT company. This will integrate advanced digital security solutions into Parrot’s growing range of ANAFI drones. The stock price hit a new high on 22, January 2021 hitting $8.72. The stock price of Parrot is on an upward trend since last year and has shown an increase of approximately 150% since last year.

Find below the stock performance chart over the last 2 years:

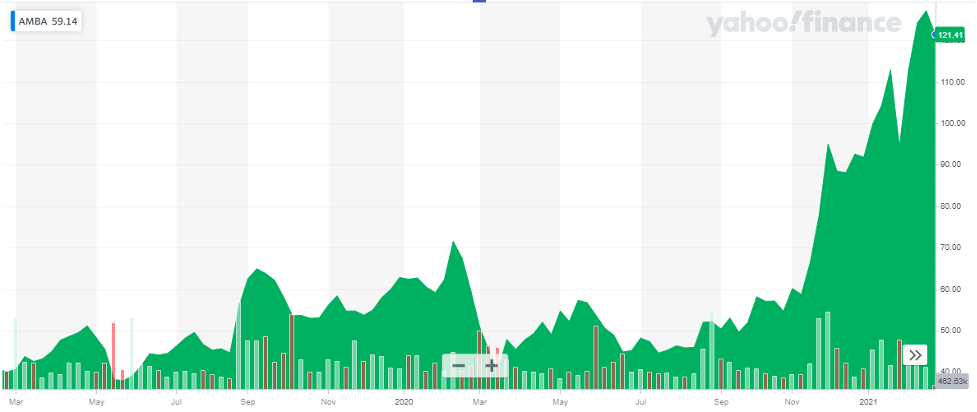

6. Ambarella (AMBA)

Ambarella is a fabless semiconductor design company that is focused on creating low-power, high-definition (HD) and Ultra HD video compression, image processing, and computer vision, processors. Ambarella’s products are being used for a growing number of applications and services within video security, driver assistance, and autonomous driving systems, among others. Ambarella’s low-power System-on-Chips (SoCs) offer high-resolution video compression, advanced image processing, and powerful deep neural network processing to enable intelligent cameras to extract valuable data from high-resolution video streams

Ambarella’s system on chips is apparently among the best options for extracting data from video, and their applications should grow along with the proliferation of recording video streams that are likely to occur over the coming years.

Amazon has included Ambarella amongst its partners in building an ecosystem of hardware-accelerated machine learning/AI devices This AWS Panorama appliance and device software development kit is designed to assist companies to add computer vision to on-premises cameras.

On 1st Feb 2021, Ambarella stock soared 11% because analyst Andy Buscaglia claimed that the company is progressing faster than expected. A good portion of Ambarella’s stock is owned by institutional investors which itself is very solid credibility in the investor’s world. Analysts believe that Ambarella is on a positive streak in terms of stock performance and company performance. If the company continues to outperform as expected, the forecast target price of Ambarella might need revision as they will rise more than expected. Get to know about list of best forex brokers for trading

Find below the stock performance chart over the last 2 years:

Read more:

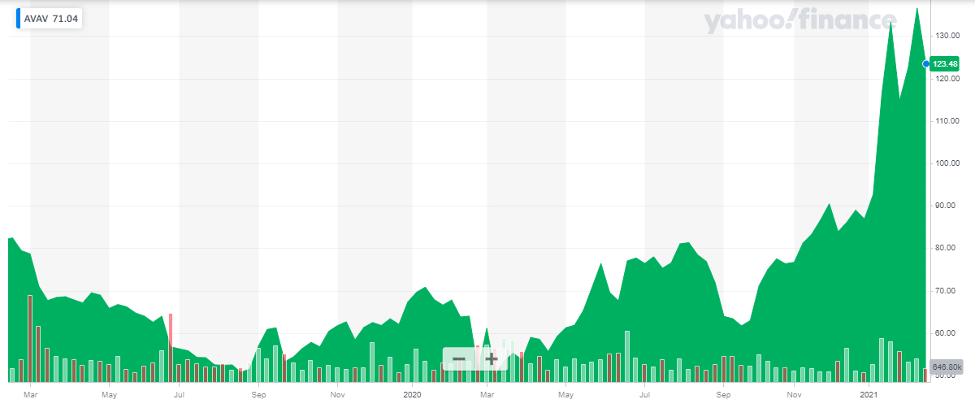

7. AeroVironment (AVAV)

AeroVironment Inc (AVAV) is a leading producer of military drones. It focuses on the supply of unmanned aerial vehicles (UAVs) to government agencies. AeroVironment Inc is one of the only companies with drones as their only business line. It currently is on the top of the market with an approximate $3 billion market capitalization.

With the US military increasing its investments in drone technology, AeroVironment Inc is expected to grow tremendously. Moreover, with an impressively strong balance sheet that shows zero long-term debt against its massive cash holdings, investors’ interest further spikes in this stock. Get to know about best trading and forex signal providers

Find below the stock performance chart over the last 2 years:

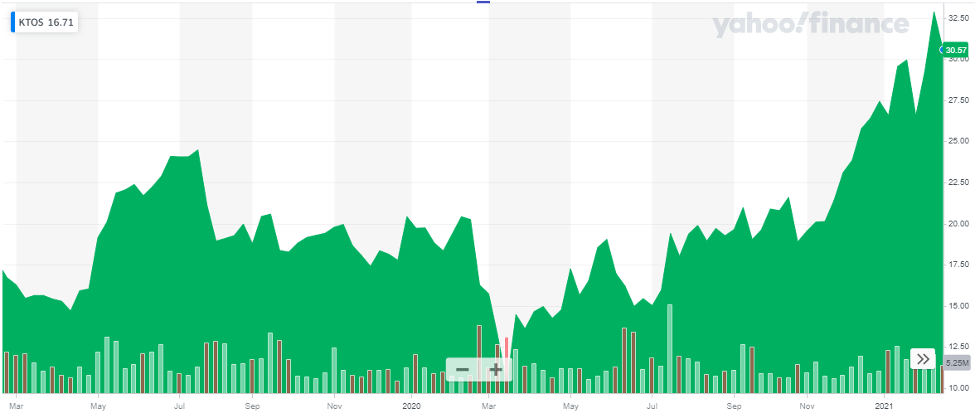

8. Kratos Defense & Security (KTOS)

Kratos Defense & Security Solutions, Inc develops and fields transformative, affordable technology, platforms, and systems for United States National Security-related customers, allies, and commercial enterprises. Kratos takes pride in its vision of the future of technology. It works on projects where it holds expertise which include unmanned systems, satellite communications, cybersecurity/warfare, microwave electronics, missile defense, hypersonic systems, training, combat systems, and next-generation turbojet and turbofan engine development.

The deal with Air Force in 2019, has highlighted Kratos in the drone’s stocks arena and increased investor’s interest. Goldman Sachs predicts that Kratos’ drone business could grow 10 times larger by 2025.

Find below the stock performance chart over the last 2 years:

9. Joby Aviation Inc. (JOBY)

Joby is a California-based company building quiet, all-electric aircraft to connect people like never before. With up to 150 miles of range and the ability to take off and land vertically, the Joby aircraft will change the way people move while reducing the acoustic and climate footprint of flight.

In the recent third quarterly report for the year 2022, the company reported:

- Loss from Operations was reported at $ 97 million, as compared to $ 68 million in the previous year’s same quarter

- Net loss of $ 79.2 million, as compared to $ 78.9 million in the previous year’s same period

Joby Aviation has a market cap of $ 2.083 billion The below chart shows the past two-year performance of the Joby Aviation stock.

The stock has been bearish in the past two years. In 2021, the stock started at $ 11.55 and closes at $ 7.3 representing a 40 % decline during the year.

In 2023, the stock continued its bearish trend. It went from $ 7.3, at the start of the year, to $ 4.1 at the end of the year, representing a 44 % decline during the year.

10. GoPro Inc. (GPRO)

GoPro, Inc. develops and sells cameras, drones, mountable and wearable accessories, and subscription services and software in the United States and internationally. The company offers:

- Cloud connected HERO10 Black, HERO9 Black, and HERO8 Black waterproof cameras

- MAX, a 360-degree waterproof camera

- Quik app, a mobile app that enables users to get their favorite photos and videos with footage from any phone or camera

- GoPro, a subscription service that includes full access to the Quik app, cloud storage supporting source video and photo quality, camera replacement, and damage protection

- Quik subscription provides access to editing tools, which allows users to edit photos, and videos, and create cinematic stories

In the recent third quarterly report for the year 2022, the company reported:

- Revenue of $ 323 million, as compared to revenue of $ 317 million in the previous year’s same quarter

- Net Income of $ 126 million, as compared to net income reported at $ 141 million in the previous year’s same quarter

GoPro has a market cap of $ 776.5 million. The below chart shows the past two-year performance of the GoPro stock.

The stock has been mostly following a bearish pattern.

The stock underwent an initial spike in the year 2021 and it peaked at $ 13.54. After that, the stock went bearish and closed the year at $10.31.

In 2021, the stock continued with its bearish pattern and closed the year at $ 4.98 representing a 51.7 % depreciation

11. Northrop Grumman (NYSE: NOC)

Northrop Grumman is one of the largest defense contractors currently in operation, making a range of high-tech drones for the U.S. Air Force. Its top drone is the Global Hawk, a surveillance model used for intelligence and data collection. In addition to drones, it manufactures aircraft, spacecraft, and high-grade missile systems.

Northrop Grumman primarily contracts with the government, so it has some added financial stability compared to other drone companies.

In the recent third quarterly report for the year 2022, the company reported:

- Revenue of $ 915 million, as compared to $ 1.063 billion in the previous year’s same period

- Earnings per share were reported at $ 5.89, as compared to $ 6.63 in the previous year’s same period

Northrop Grumman has a market cap of $ 84 billion. Its shares are trading at $ 545.61. The below chart shows the past two-year performance of the Northrop Grumman stock.

The stock has been on a bullish pattern for the past two years. It started off the year 2021 at a price of $ 304.72 and closed at $ 387.07 representing a 27 % appreciation in 2021.

In 2022, the stock continued its bullish pattern and closed off the year at $ 548.11 representing a 41.6 % appreciation during the year.

12. Boeing Co. (BA)

Boeing is one of the oldest companies in existence with over 100 years of operations. It is also one of the world’s most respected aviation companies. In addition to making commercial airplanes and military aircraft, Boeing also has a presence in the drone market.

Boeing has been slowly and steadily increasing its focus on its drone subsidiary company titled Insitu. It recently displayed its surveillance drones that exhibit the versatility of Boeing’s drone technology. Also, it piques interest in the fact that there is huge potential in military combat for drones.

Boeing recently reported its third quarter report for the year:

- Revenue was reported at $ 16 billion as compared to $ 15 billion in the previous year’s same quarter

- Net loss for the period for reported at ($ 3.3) billion as compared to ($ 132) million in the previous year’s same quarter

- Loss per share was reported at ($ 5.49) as compared to ($ 0.19) for the previous year’s same period

Boeing has a market cap of $ 127 billion. Its shares are trading at $ 213.

The stock of the company has been bearish for the past two years. In 2021 the stock started off at $ 214.06. After hitting $ 269.19, the stock started to decline and closed the year at $ 210.32 representing a 22 % decline during the year.

In 2022, the stock continued its bearish pattern. The stock dropped as low as $ 120.7 and eventually closed off at $ 129.79 representing a 38 % decline during 2022.

In the current year, the stock has had a bullish first week.

13. Lockheed Martin (NYSE: LMT)

13. Lockheed Martin (NYSE: LMT)

Lockheed Martin is one of the Big Four defense contractors. It employs more than 140,000 people and has a presence in 46 of the nation’s 50 states.

Lockheed Martin’s operating units are organized into broad business areas.

- Aeronautics – It includes tactical aircraft, airlift, and aeronautical research and development lines of business.

- Missiles and Fire Control – It includes the Terminal High Altitude Area Defense System and PAC-3 Missiles as some of its high-profile programs.

- Rotary and Mission Systems – It includes Sikorsky military and commercial helicopters, naval systems, platform integration, and simulation and training lines of business.

- Space – It includes space launches, commercial satellites, government satellites, and strategic missile lines of business.

The company recently shared its third quarter report for the year:

- Net Sales were reported at $ 16.5 billion, as compared to $ 16 billion in the previous year’s same quarter

- Net Earnings were reported at $ 1.8 billion, as compared to $ 614 million in the previous year’s same quarter

- Earnings per share were reported at $ 6.73, as compared to $ 2.22 in the previous year’s same period

Lockheed Martin has a market cap of $ 124 billion. Its shares are trading at $ 473.24.

In 2021, the stock started at $ 354.88 and closed off the year at $ 355.41. Overall, the stock maintained its stock price throughout the year.

In 2022, the stock started rising. The stock picked a bearish pattern and closed off the year at $ 486.49.

14. Draganfly Inc. (NASDAQ: DPRO)

14. Draganfly Inc. (NASDAQ: DPRO)

Draganfly is a leader in the professional drone industry. It manufactures drone and UAV technologies. The Company offers assembled multi-rotor-helicopters, industrial aerial video, civilian small unmanned, and wireless video systems, as well as provide custom engineering, training, simulation consulting, software, and UAV services. Draganfly serves customers worldwide.

Draganfly Inc. has a market cap of $ 28.4 million. Its shares are trading at $ 0.84.

The stock has been exhibiting volatile behavior with steep spikes and deep dips. In 2021, the stock started off at $ 1.402 and closed off at $ 1.63. During the year the stock peaked at $ 3.83. Overall, the stock appreciated by 16 %

In 2022, the stock peaked at $ 2.43 before closing the year at $ 0.75. Overall, the stock declined by 54 %.

15. Amazon (NASDAQ: AMZN)

15. Amazon (NASDAQ: AMZN)

Amazon is well-known as one of the world’s largest tech companies. What started as an online retailer has become a multi-faceted business with web services, and video streaming, amongst others.

Amazon is guided by four principles: customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking

In the recent third-quarter report, the company reported:

- Total net sales of $ 110.8 billion, as compared to $ 127 billion, in the previous year’s same period

- Operating income was reported at $ 4.852 billion as compared to $ 2.52 billion in the previous year’s same period

- Net Income was reported at $ 3.16 billion as compared to $ 2.88 billion in the previous year’s same period

- Earnings per share were reported at $ 0.31, as compared to $ 0.28 in the previous year’s same period

Amazon has a market cap of $ 905.3 billion. Its shares are trading at $ 89.14.

During 2021, the stock almost maintained its price levels. It started at $ 162.85 and closed off the year at $ 166.72 representing a 2.3 % appreciation during the year.

In 2022, the stock started to decline. The stock declined by almost 50 % during the year and closed off at $ 84.

Other Drone or Drone Related Stocks to keep an eye on in 2022

Other Drone or Drone Related Stocks to keep an eye on in 2022

16. Nvidia Corp. (NVDA)

17. Boeing (BA)

18. Lockheed Martin (LMT)

19. Global UAV Technologies Limited (YRLLF)

20. Draganfly Inc (DFLYF)

21. Bantec Inc. (BANT)

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

Back