The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: NVDA Bullish Momentum Looking for More Upside

Read MoreNvidia Corporation (NVDA) rally from 4.26.2023 low as an impulse looking for more upside. This article & video look at the Elliott Wave path for the stock.

-

XPEV Elliott Wave View: May Update

Read MoreXPeng, Inc. (XPEV) designs, develops, manufactures, and markets smart electric vehicles. It produces environmental friendly vehicles, namely SUVs (the G3), and a four-door sports sedan (the P7). The company was founded by Xiao Peng He, Heng Xia, and Tao He in 2015 and is headquartered in Guangzhou, China. We published an article on XPEV back […]

-

Roblox (RBLX) Needs To Complete A Correction Structure Before Rally Again

Read MoreRoblox (RBLX) is an online game platform and game creation system developed by Roblox Corporation that allows users to program games and play games created by other users. Created by David Baszucki and Erik Cassel in 2004 and released in 2006, the platform hosts user-created games of multiple genres coded in the programming language Lua. Roblox (RBLX) finished a bullish movement in December 2021. We called that peak wave […]

-

ASML Holdings Starts New Bullish Cycle

Read MoreASML Holding N.V. (ticker: ASML) is a leading Dutch semiconductor equipment manufacturer. It’s one of the world’s largest suppliers of lithography systems for the semiconductor industry. Established in 1984, ASML has played a crucial role in the advancement of chip-making technology. Its advanced lithography machines enable the production of smaller, faster, and more powerful microchips […]

-

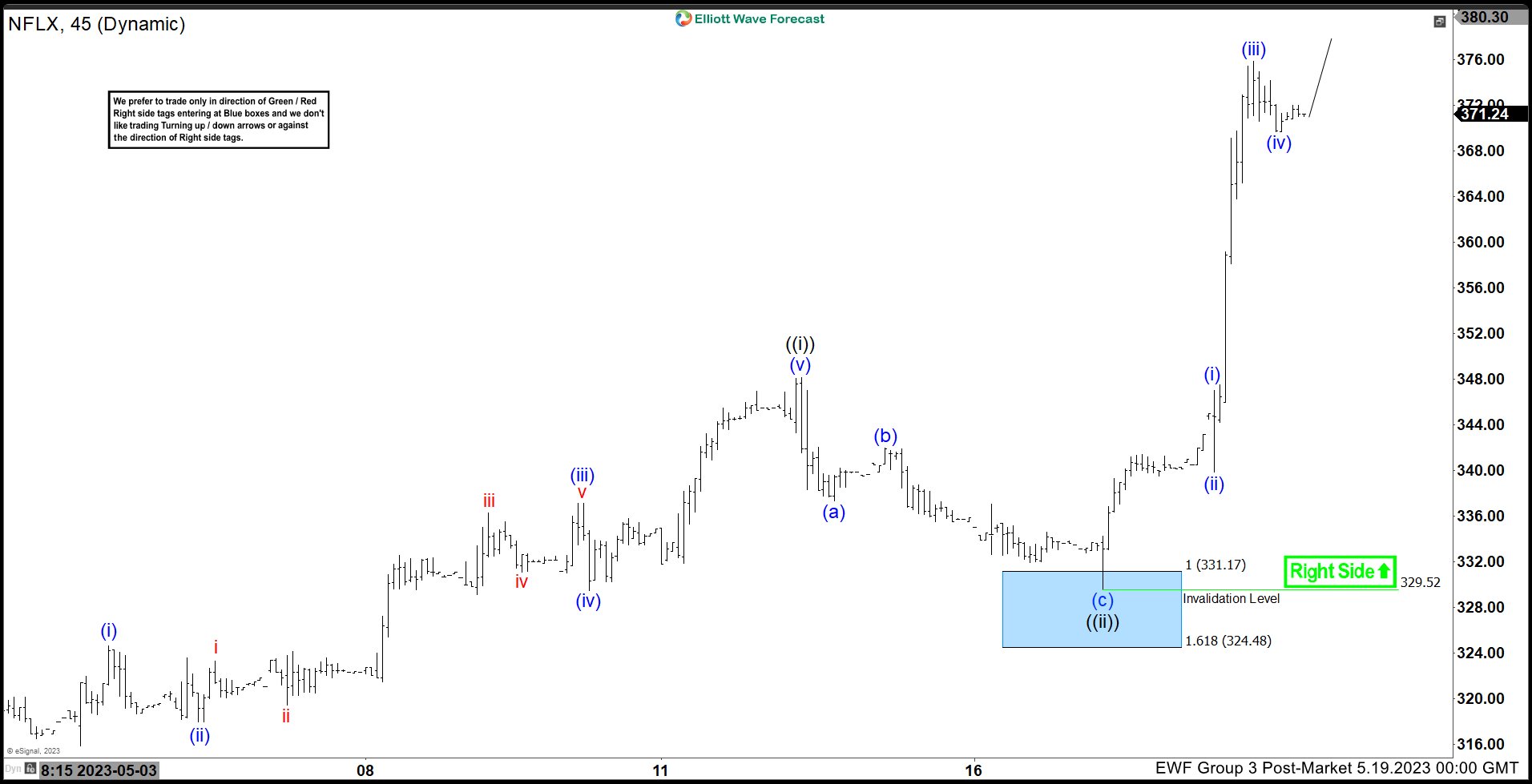

NFLX: Found Buyers From Blue Box Area

Read MoreHello Traders, in this article we will analyze our forecast for NFLX in the short term cycle. Since the short term peak of NFLX from 05.12.2023 to end wave 3 we have been expecting a pullback within wave 4 to take place. Here at Elliott Wave Forecast we have in place a system that allows […]

-

Elliott Wave View: S&P 500 (SPX) Has Started Wave 5 Higher

Read MoreSPX has started wave 5 in an impulsive structure favoring more upside. This article and video look at the Elliott Wave structure.