-

Webinar Recording – Indices Super Rally or Crash?

Read MoreWe conducted a Free webinar on Friday, 8th October 2021 titled Indices Supper Rally or Crash? in which we talked about Elliott wave structures in various Indices to arrive at the conclusion whether Indices will be going into a Crash or a Super Rally? We explained two paths in $SPY and then looked at Elliott […]

-

BTCUSD: Forecasting The Recent Rally after Zigzag Correction

Read MoreIn this article, we will look at the correction in BTCUSD during the month of September and how we called the rally after it completed a Zigzag Elliott wave correction. Chart below is from 28th September 2021 when we called the correction completed and called for the rally to resume. We saw an Elliott wave […]

-

Platinum Futures: Long-Term Elliott Wave Analysis

Read MorePlatinum is a metal which is used in jewelry, decoration and dental work. The metal and its alloys are also used for electrical contacts, fine resistance wires and medical / laboratory instruments. An alloy of platinum and cobalt is used to produce strong permanent magnets (chemicool.com). Other uses of the metal include cancer drugs, use […]

-

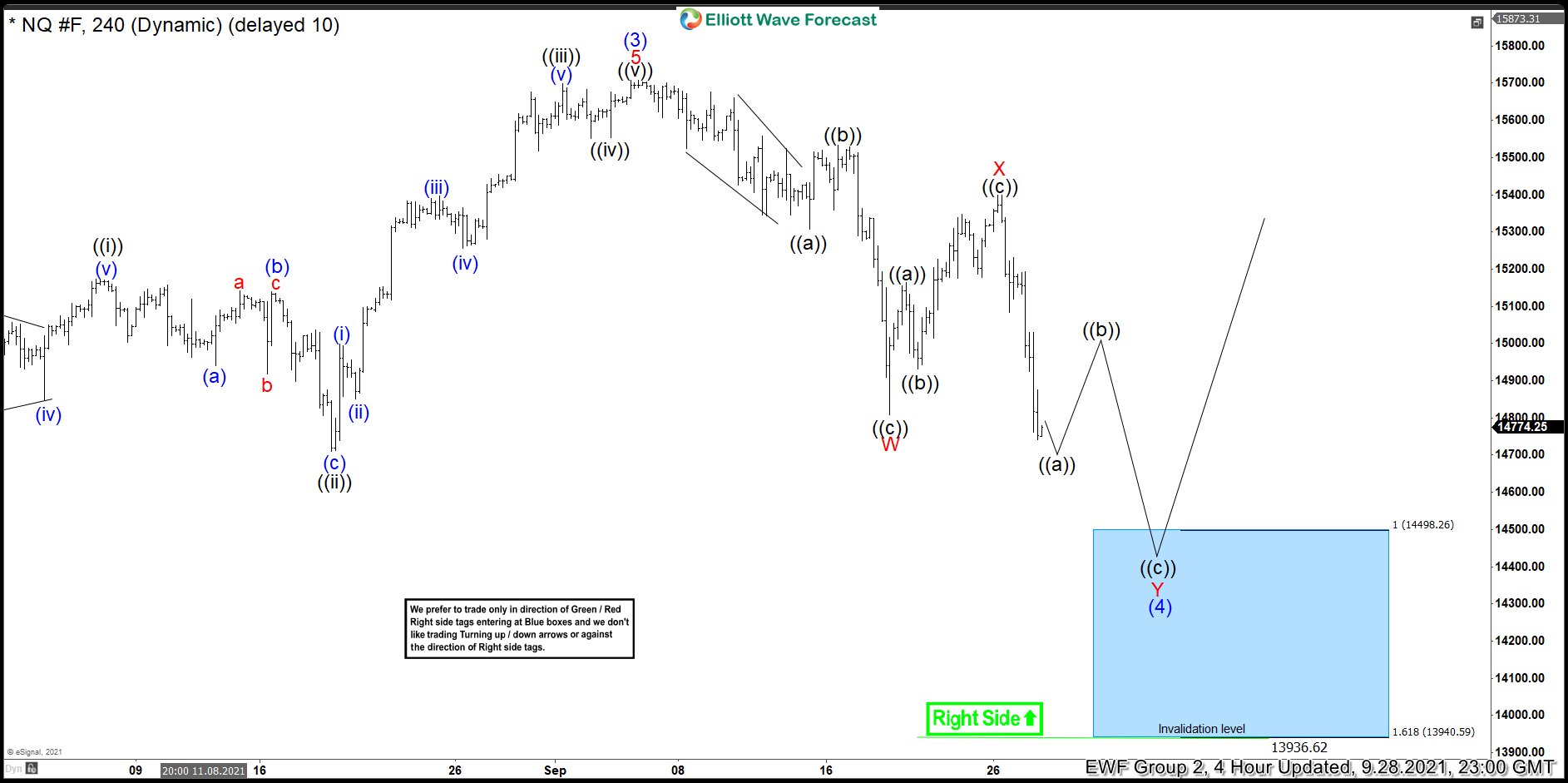

Nasdaq Futures: Forecasting the Decline and Next Blue Box Area

Read MoreNasdaq futures dropped from a peak of 15710.42 on September 6, 2021 to a low of 14711 on September 29, 2021 which is a drop of 997.75 points in just over 3 weeks and reflects a 6.36% drop. In this blog, we will look at how we forecasted the decline in Nasdaq Futures (NQ #F) based […]

-

Is it Time for a COKE or Wait for It to become Ice Cold!

Read MoreTemperatures Soaring – Is it time for a Coca Cola drink? In today’s article, we will look at the difference between COKE and KO tickers and determine whether it’s the right time to consume Coca Cola (COKE) or should we leave it in the refrigerator for now and wait for it to become Ice cold? […]

-

EURNZD Gets Rejected in Blue Box and Makes New Lows

Read MoreEURNZD this week dropped to a new low and traded at it’s lowest level since 21st February 2020. The recent decline started after sellers entered in our blue box area. In this article, we will look at some recent charts from members area calling for the bounce to get rejected in the blue box for […]