-

Nikkei: Forecasting The Rally From Elliott Wave Blue Box

Read MoreThis week we witnessed a sharp decline in Nikkei followed by an equally sharp rally. Our weekend update informed members that a decline was expected to unfold this week followed by a reaction higher, we even showed them the area where we expected the decline to end and reaction higher to take place. In this […]

-

DOCU: Docusign Growth Accelerated due to Covid Pandemic

Read MoreDOCU History: From contracts to offer letters to purchase orders, agreements are the foundation of doing business. Innovation and agreements are intrinsically connected. Both fuel each other and create that opportunity where ideas collide and intellectual capital starts to flow. Had it not been for the innovative thinking of certain businesses, industries and luminaries, opportunities […]

-

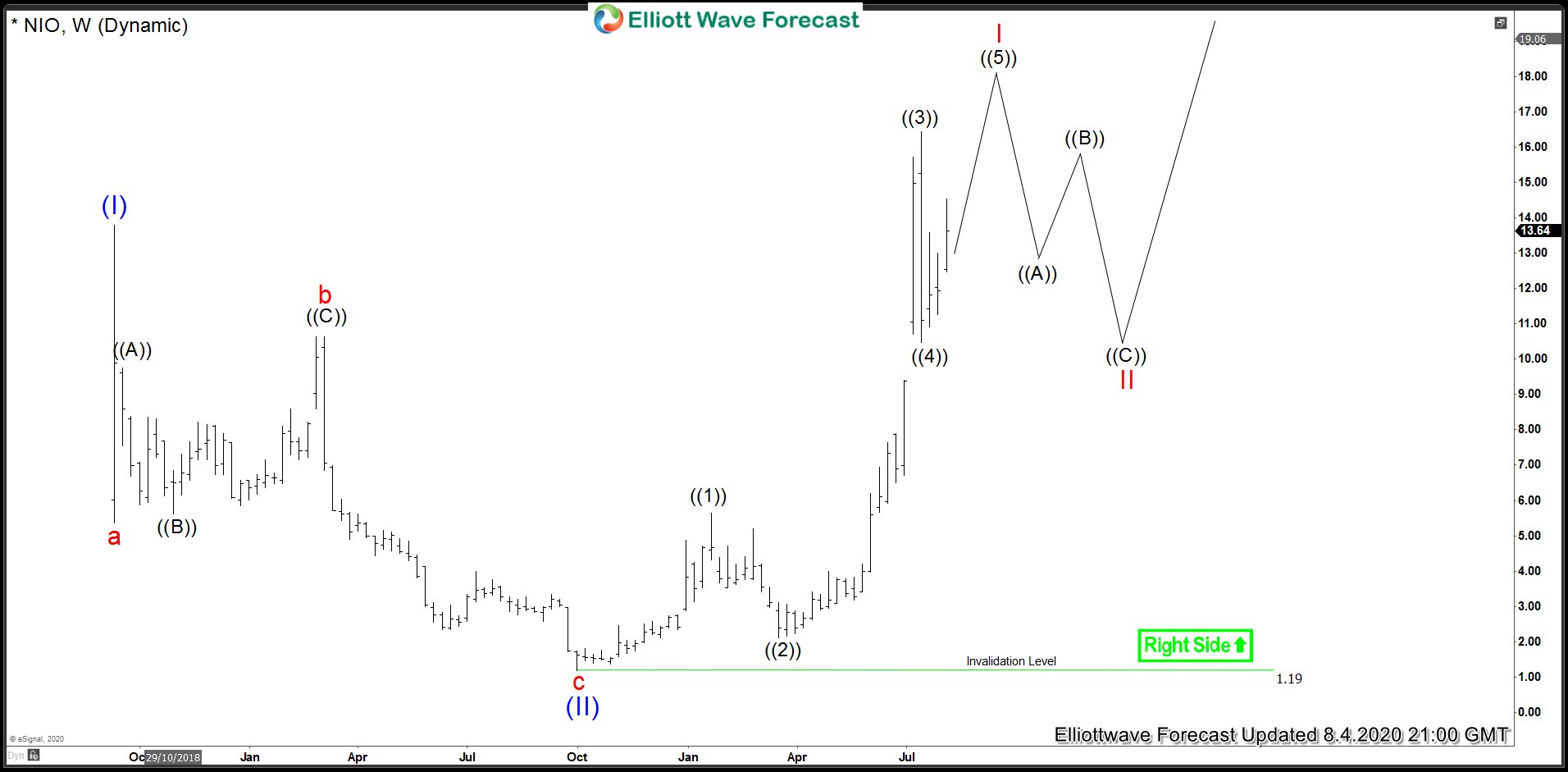

NIO (NYSE): Consolidating Gains Before a Break Higher

Read MoreCompany Profile. NIO Inc. is a pioneer in China’s premium electric vehicle market. We design, jointly manufacture, and sell smart and connected premium electric vehicles, driving innovations in next generation technologies in connectivity, autonomous driving and artificial intelligence. Nio held its U.S. IPO back in September of 2018, selling IPO shares at $6.26 and raising $1 billion. […]

-

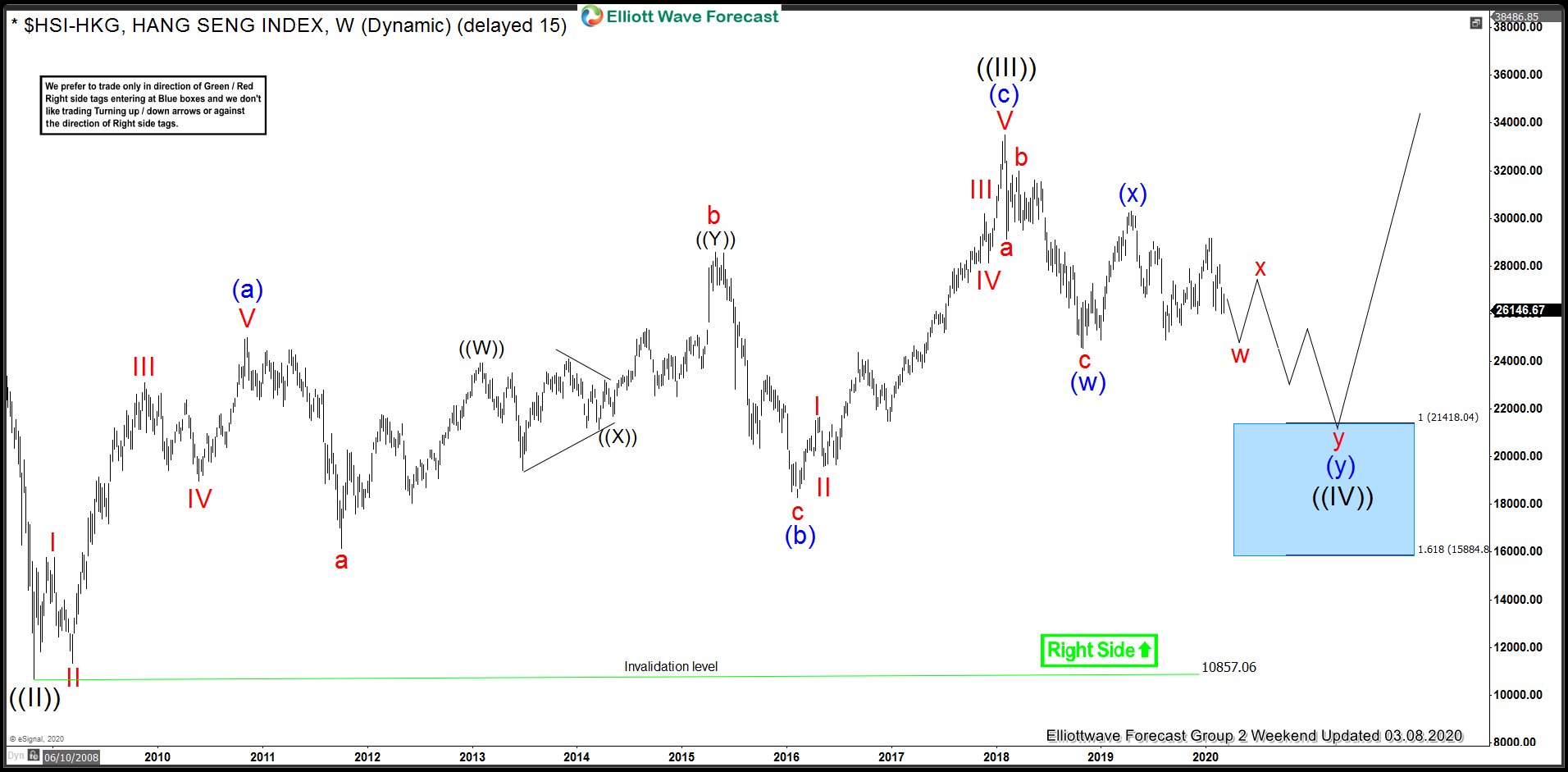

HSI-HKG (Hangseng) Buying The Weekly Correction

Read MoreIn this blog, we take a look at the price action in Hangseng Index since March 2020. Initial decline from January 2018 peak to October 2018 low was in 3 waves and was labelled as a zigzag to complete wave (w). This was followed by a sharp rebound to 30280 level in April 2020. Index […]

-

Future of Airlines and Transportation Sector After Global Pandemic

Read MoreWe conducted a Free Webinar about Future of Airlines and Transportation sector after Global Pandemic on Friday, 12th June 2020 and below is the recording of that webinar. Future of Airlines and Transportation Sector After Global Pandemic Webinar Recording

-

USDJPY: Forecasting the Rally Based on Elliott Wave Structure

Read MoreUSDJPY extended the rally this week and exceeded the peak seen on 20th May 2020. In this article, we would look at the forecast from start of the week and how we called it higher. We will show some charts presented to clients this week and explain the reason for calling the extension higher and […]