-

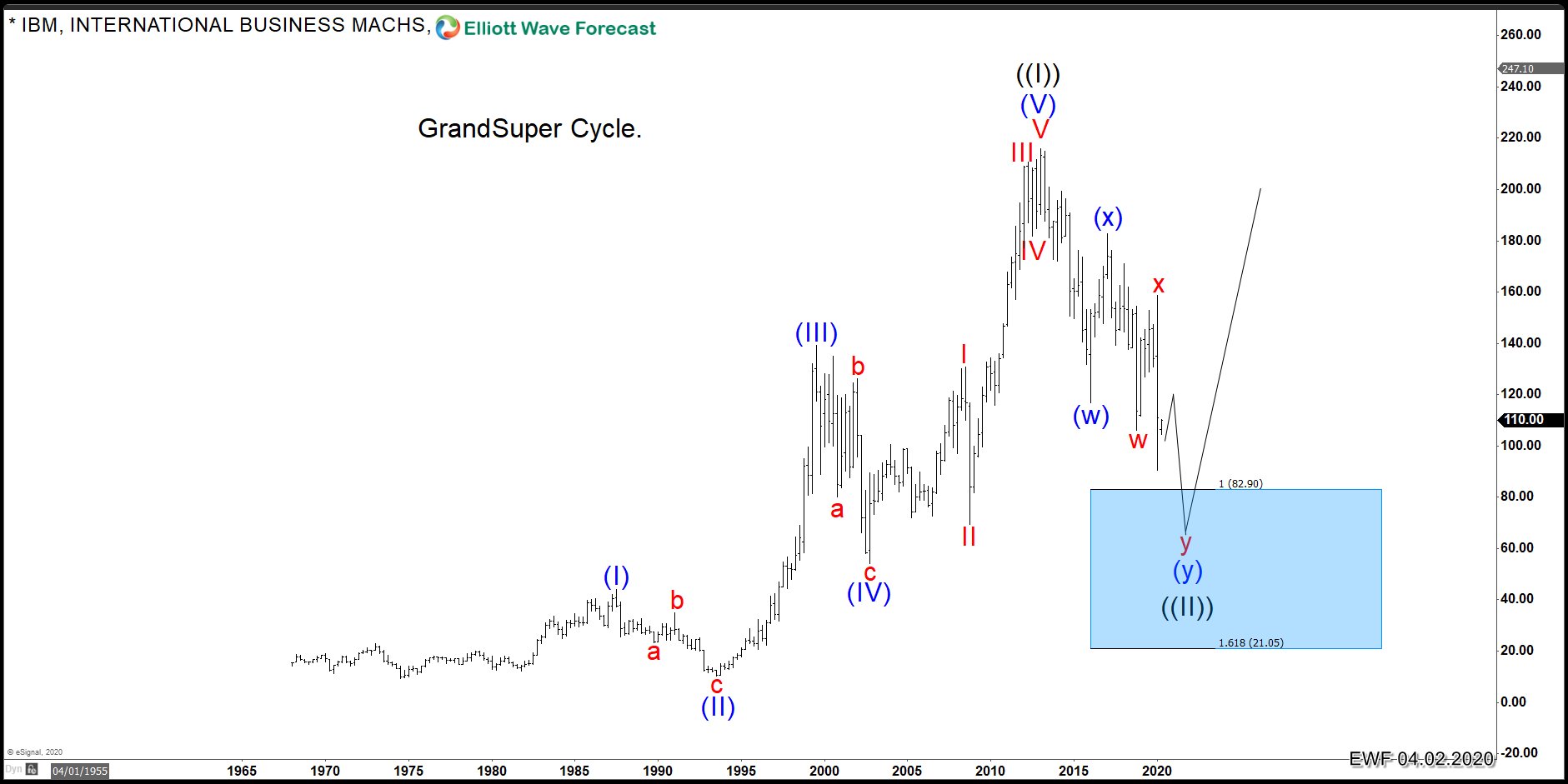

IBM: A Long-Term Investment Opportunity Could Be On The Horizon

Read MoreIn this article, we look at the long-term view of IBM which we believe ended an Elliott Wave Grand Super Cycle from all time the low and is currently correcting that cycle. We will look at the preferred structure of the pull back, where we are within the correction, what is the swing sequence suggesting […]

-

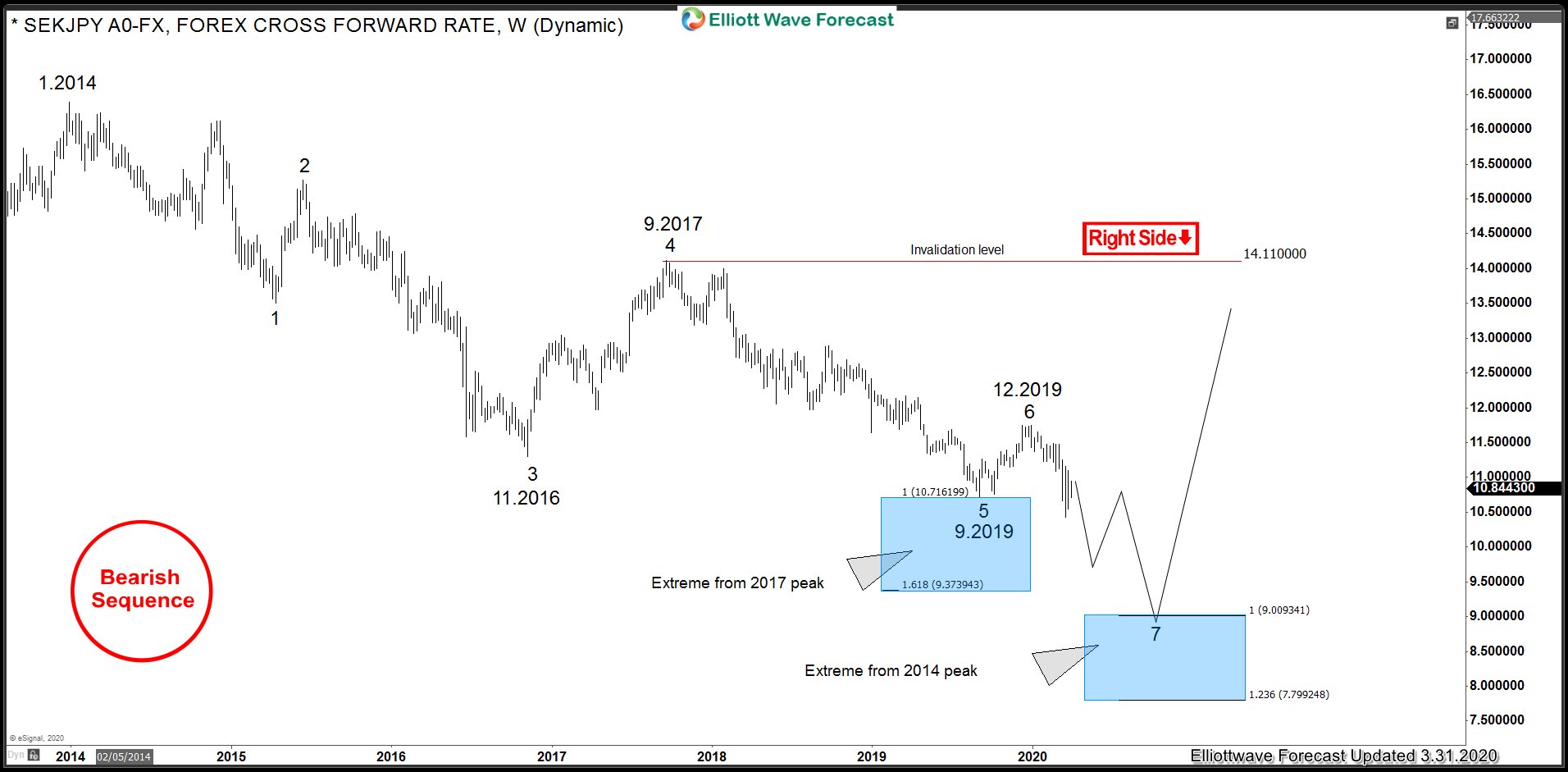

SEKJPY Breaks below September 2019 to Resume The Decline

Read MoreBack in October 2019, we mentioned that SEKJPY had reached extreme area down from September 2017 peak and should bounce soon in 3 or 7 swings which should fail for more downside. In this article, we will look at the price action which followed since then and what is expected next in the pair. First […]

-

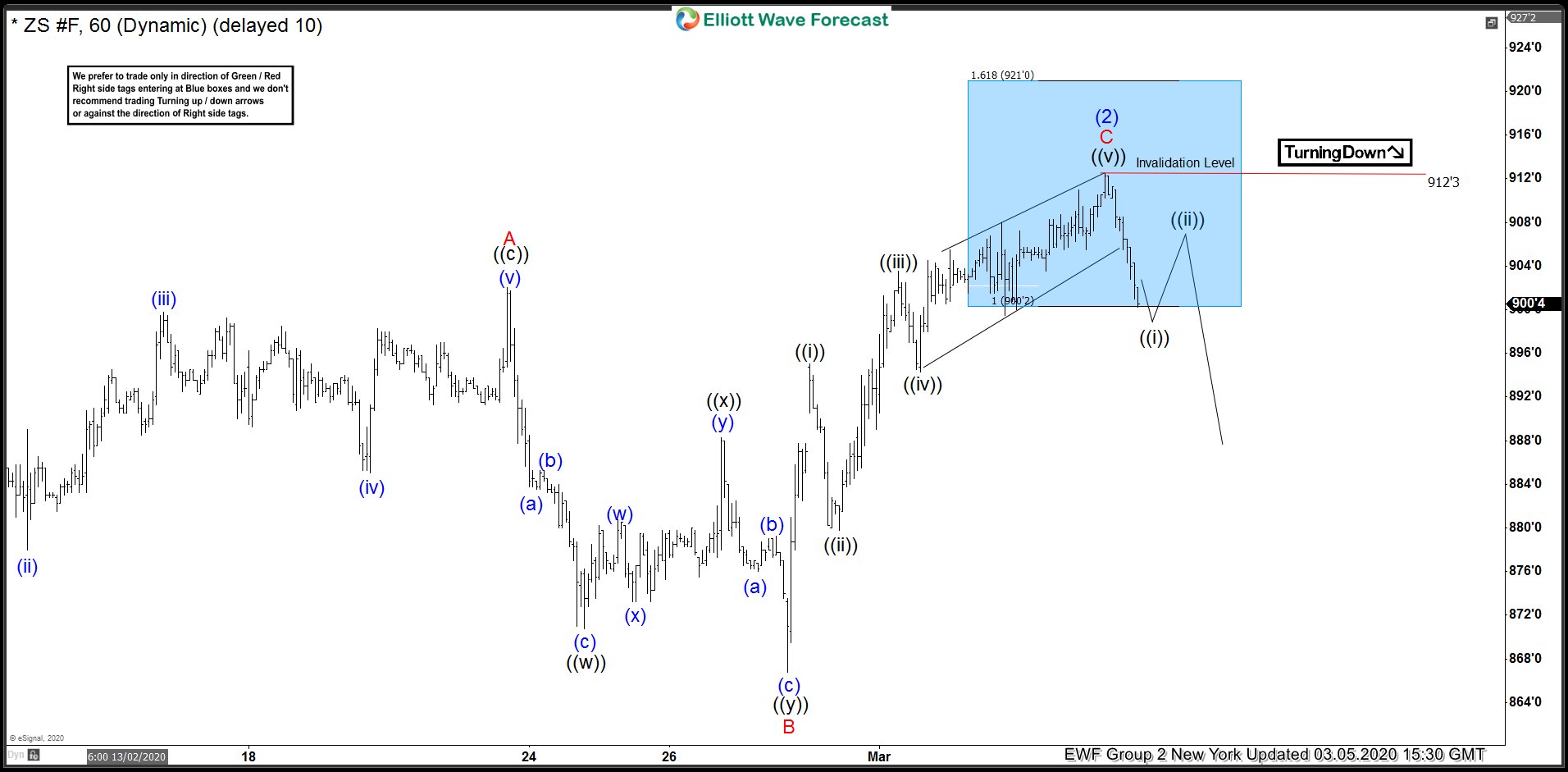

ZS_F (Soybean Futures) Selling Rallies In The Blue Boxes

Read MoreZS_F (Soybean Futures) decline from 961’4 peak to 868’6 low was in 5 waves as 4 Hour chart below shows and thus, we expected bounces to fail below 961’4 peak for another round of selling in 5 waves. Soybean Futures bounced in 3 waves to 902’0 high and broke below the low at 868’6 suggesting […]

-

Cruise Stocks Drop Due to Corona Virus Might Present An Opportunity

Read MoreThe World Health Organization (WHO) has a declared the outbreak of the new corona virus a pandemic as health authorities around the globe continue to scramble to contain the sickness, first detected in the central Chinese city of Wuhan in December last year. The virus, which causes a respiratory illness called COVID-19, has spread to […]

-

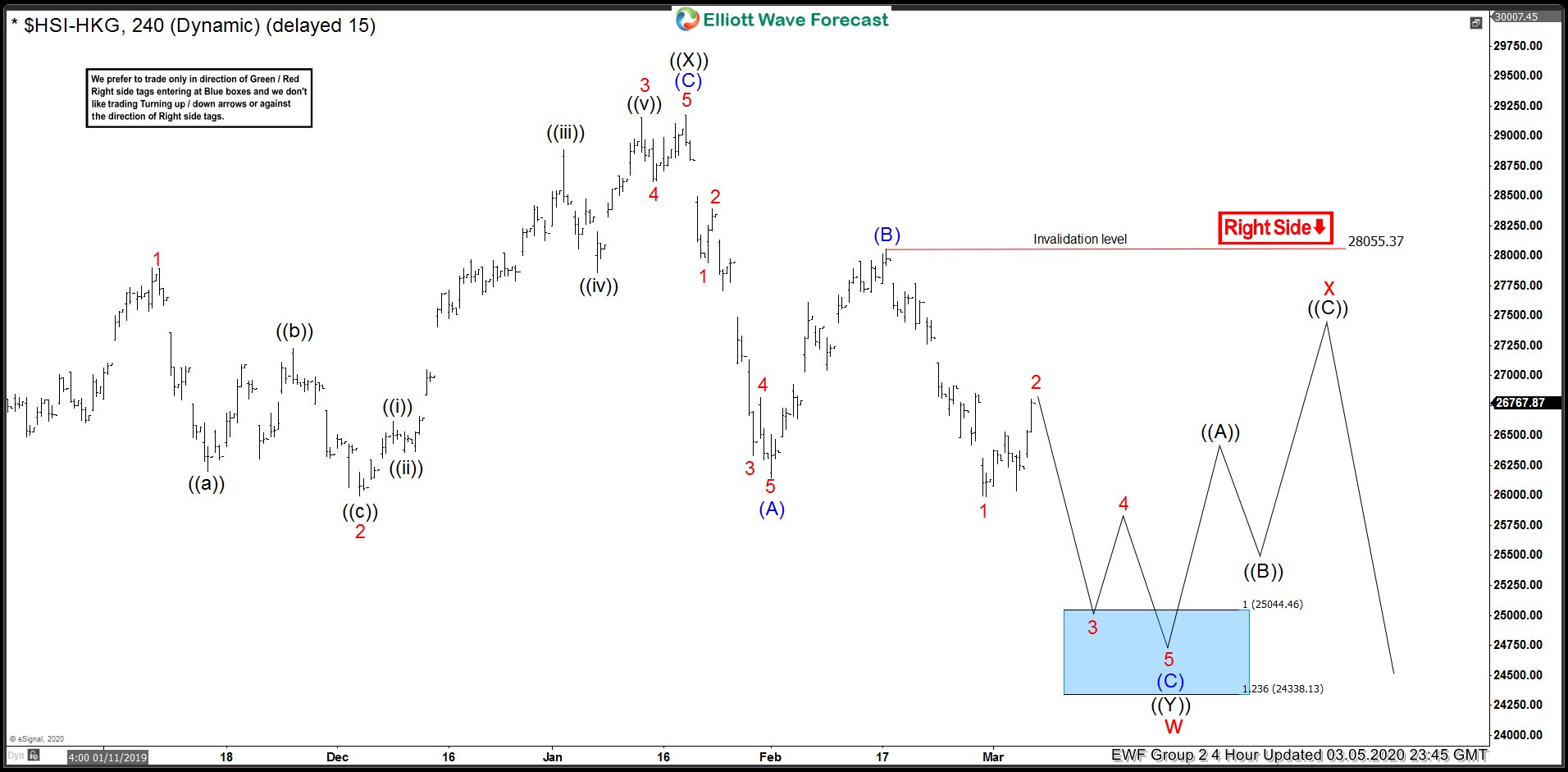

How Hangseng Called for More Downside In US Markets

Read MoreWe at Elliottwave-Foreast.com use a lot of market correlation to derive our forecasts alongside other tools that we use. In this article, we would look at a recent example of Market correlation used in our forecasts and how a Stock Market from Asia (Hangseng) kept us on the right side in US Indices by calling […]

-

Sugar: Sellers Entered In The Blue Box As Anticipated

Read MoreWe always refer a lot to the blue boxes which are often shown on our charts and define them as High-Frequency areas which are based in a relationship of sequences, cycles and calculated using extensions. Traders are always looking for answers and news to decide what to do next, whether to buy or sell, whereas […]