The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

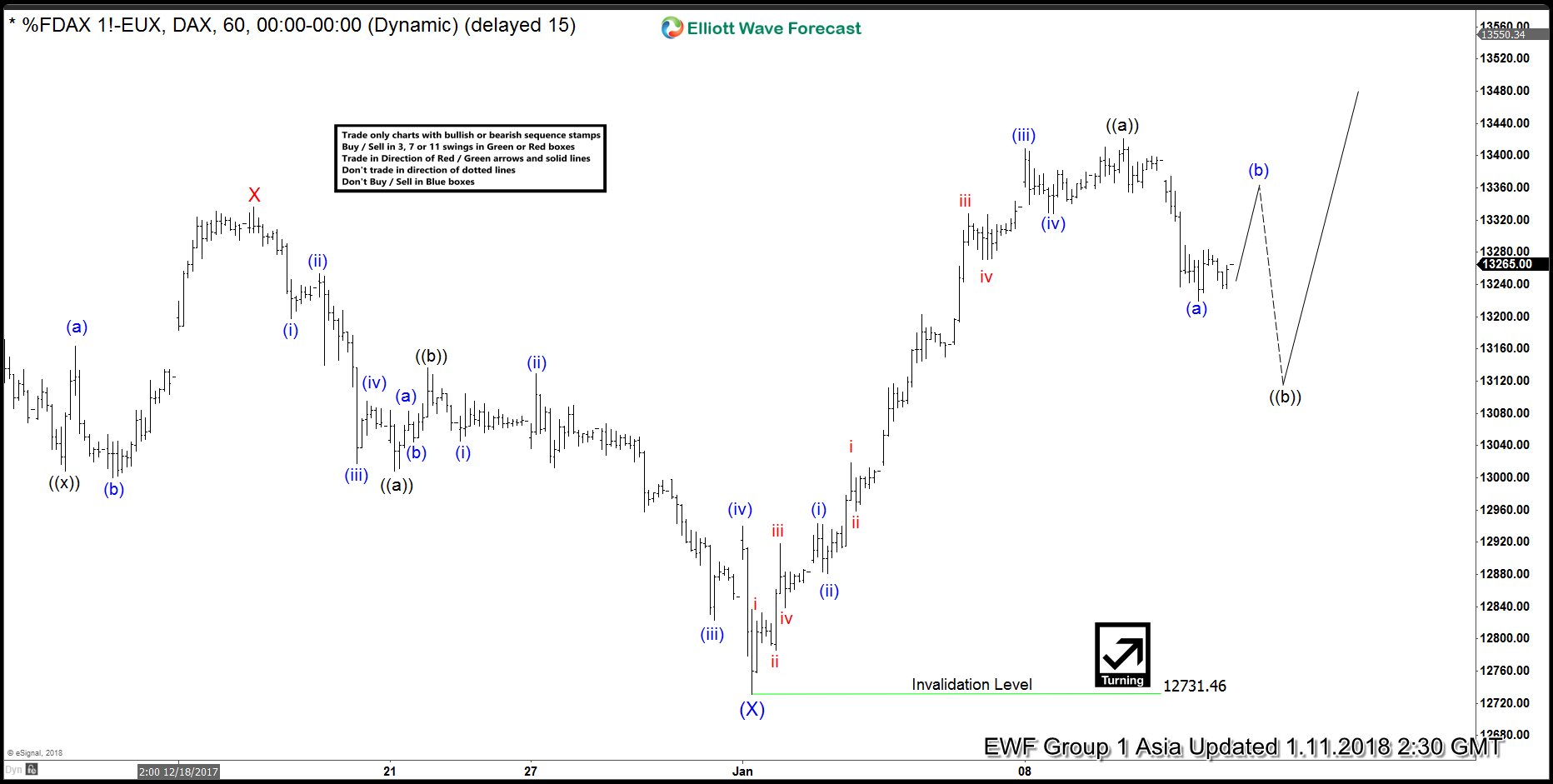

DAX Elliott Wave Analysis: Correction in Progress

Read MoreDAX Short Term Elliott Wave view suggests that Intermediate wave (X) ended at 12731.46. Rally from there is unfolding as a 5 waves impulsive Elliott Wave structure where Minutte wave (i) ended at 12943, Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5, Minutte wave (iv) ended at 13328.5, and Minutte wave (v) of […]

-

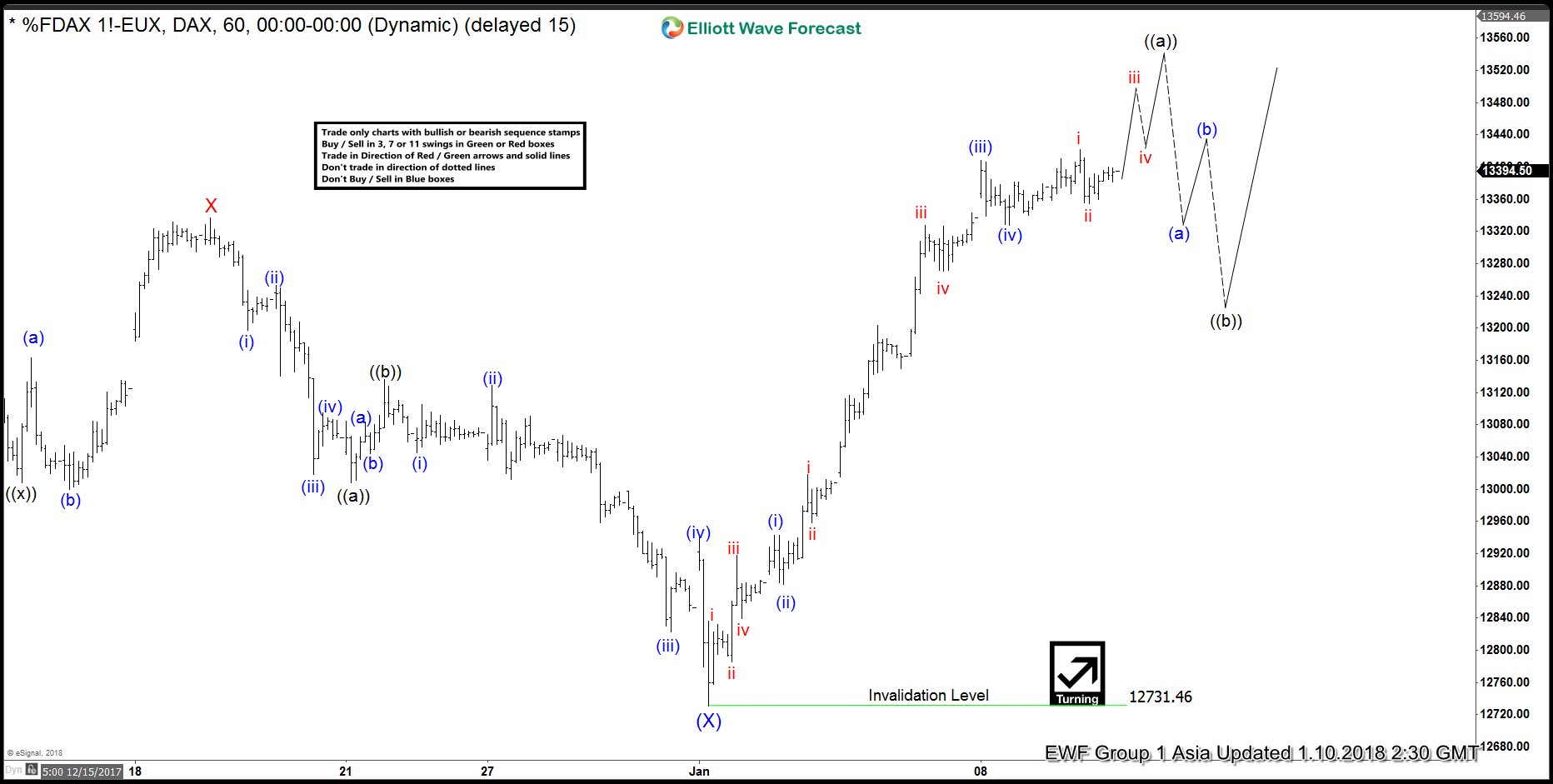

DAX Elliott Wave Analysis: Still In wave (v)

Read MoreDAX Short Term Elliott Wave view suggests that pullback to 12731.46 ended Intermediate wave (X). Up from there, rally is unfolding as a 5 waves impulsive Elliott Wave structure where Minutte wave (i) ended at 12943, Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5, and Minutte wave (iv) is proposed complete at 13328.5. […]

-

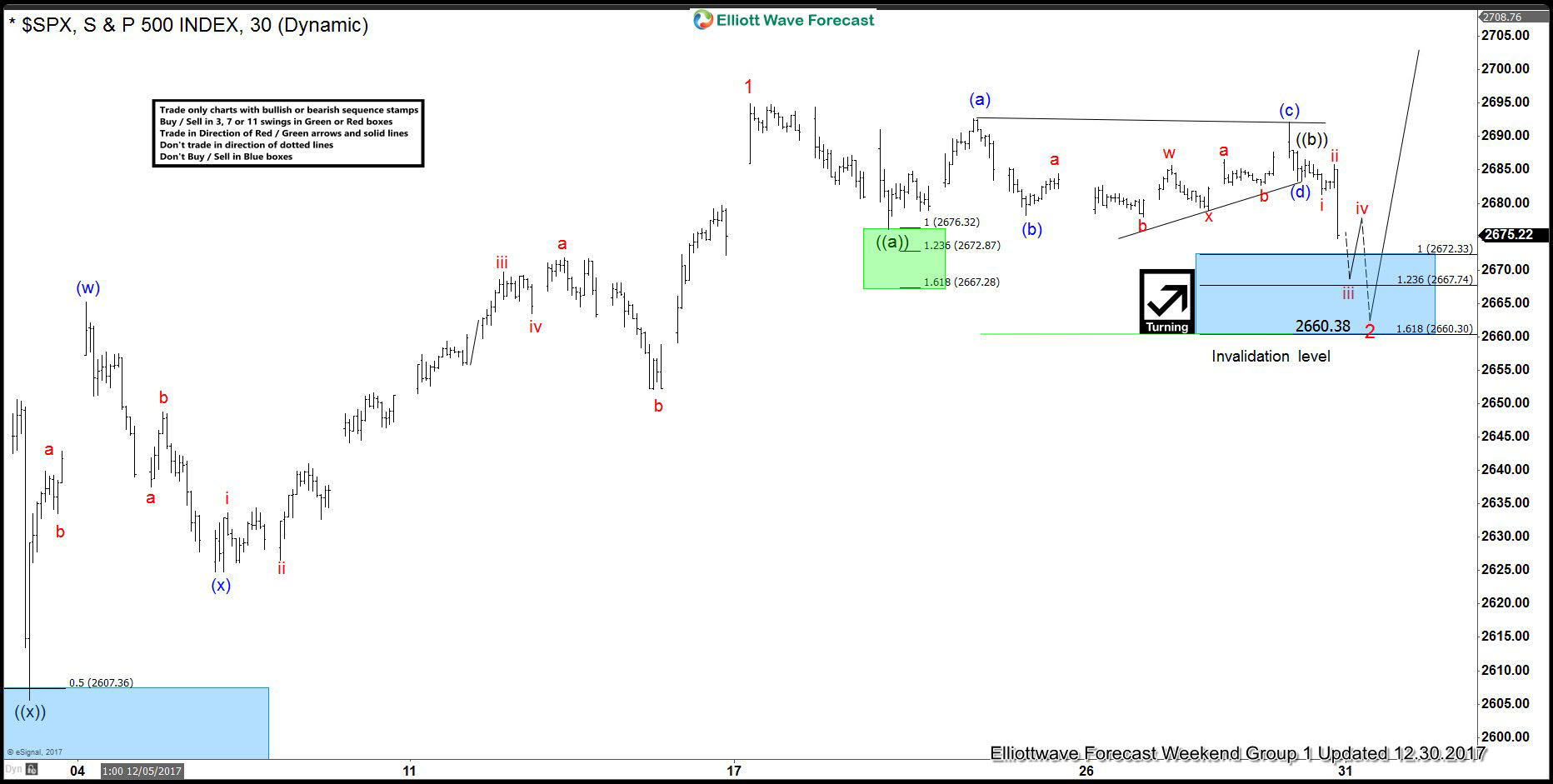

SPX Forecasting rally & Buying Dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of S&P 500 Index (SPX) published in members area of www.elliottwave-forecast.com. As our members know, we were kept saying that SPX is having incomplete bullish sequences in the 1 Hour cycle as shown in Sequence Report. […]

-

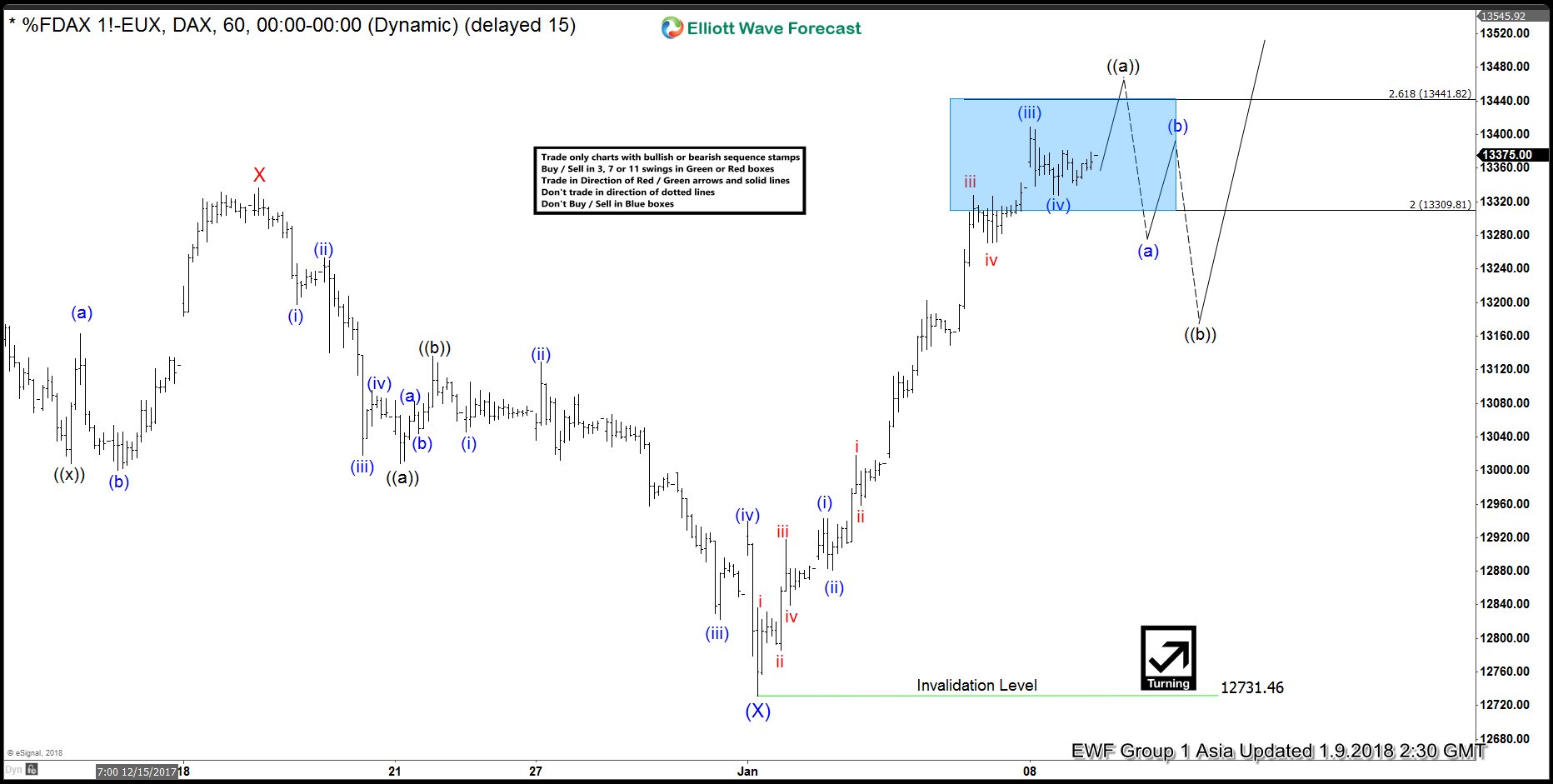

DAX Elliott Wave Analysis: Ending 5 Waves

Read MoreDAX Short Term Elliott Wave view suggests that the Index ended Intermediate wave (X) pullback at 12731.46. The rally from there is unfolding as a 5 waves impulse Elliott Wave structure where Minutte wave (i) ended at 12943, Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5, and Minutte wave (iv) is proposed complete at […]

-

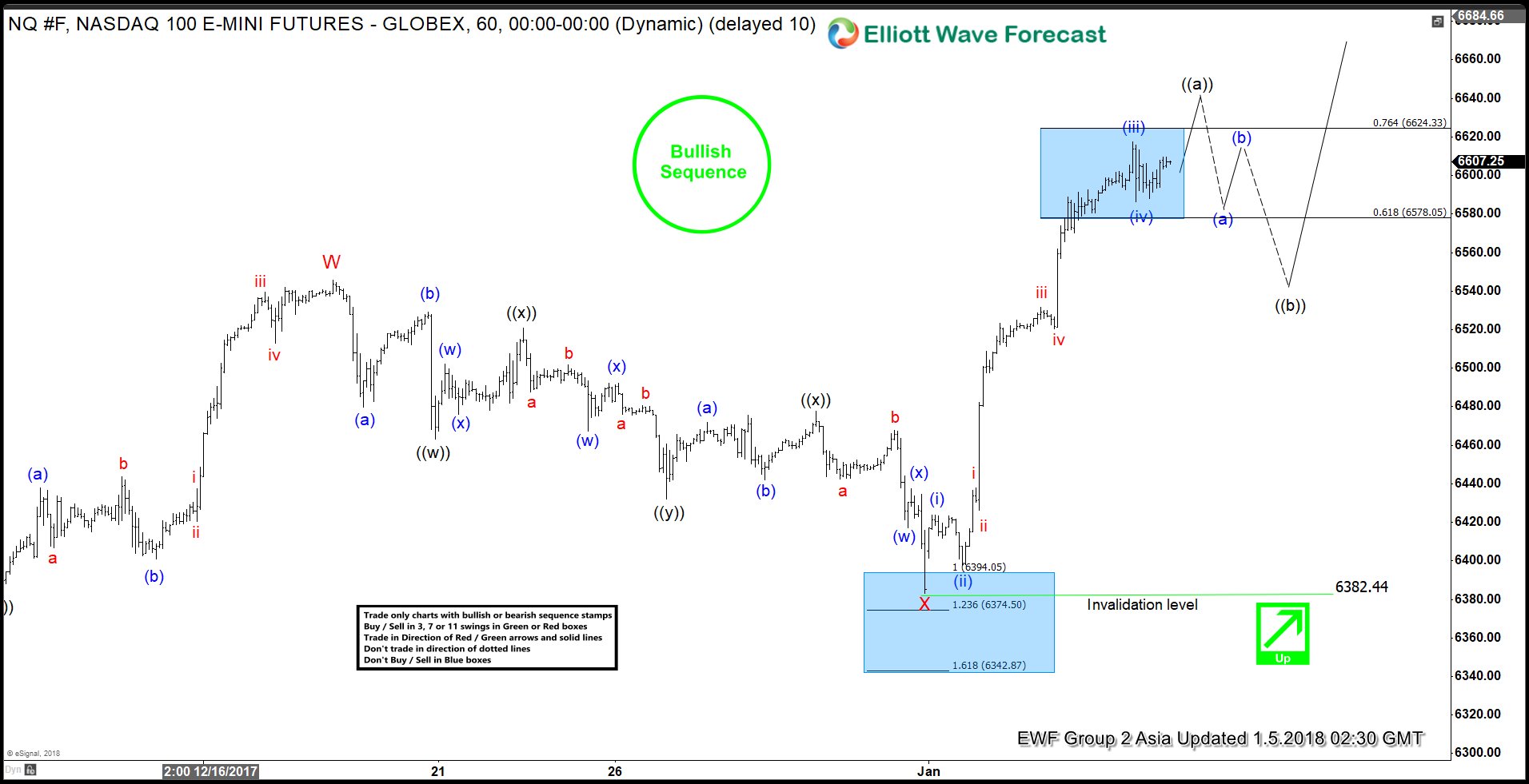

Nasdaq Elliott Wave Analysis: Ending Impulsive Move

Read MoreShort Term Nasdaq Elliott Wave view suggests that the rally from 12/5 low unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X ended at 6383.25. This week, the Index made a new high above Minor wave W at 6545.75, suggesting the next leg higher has started. Internal of Minor wave W […]

-

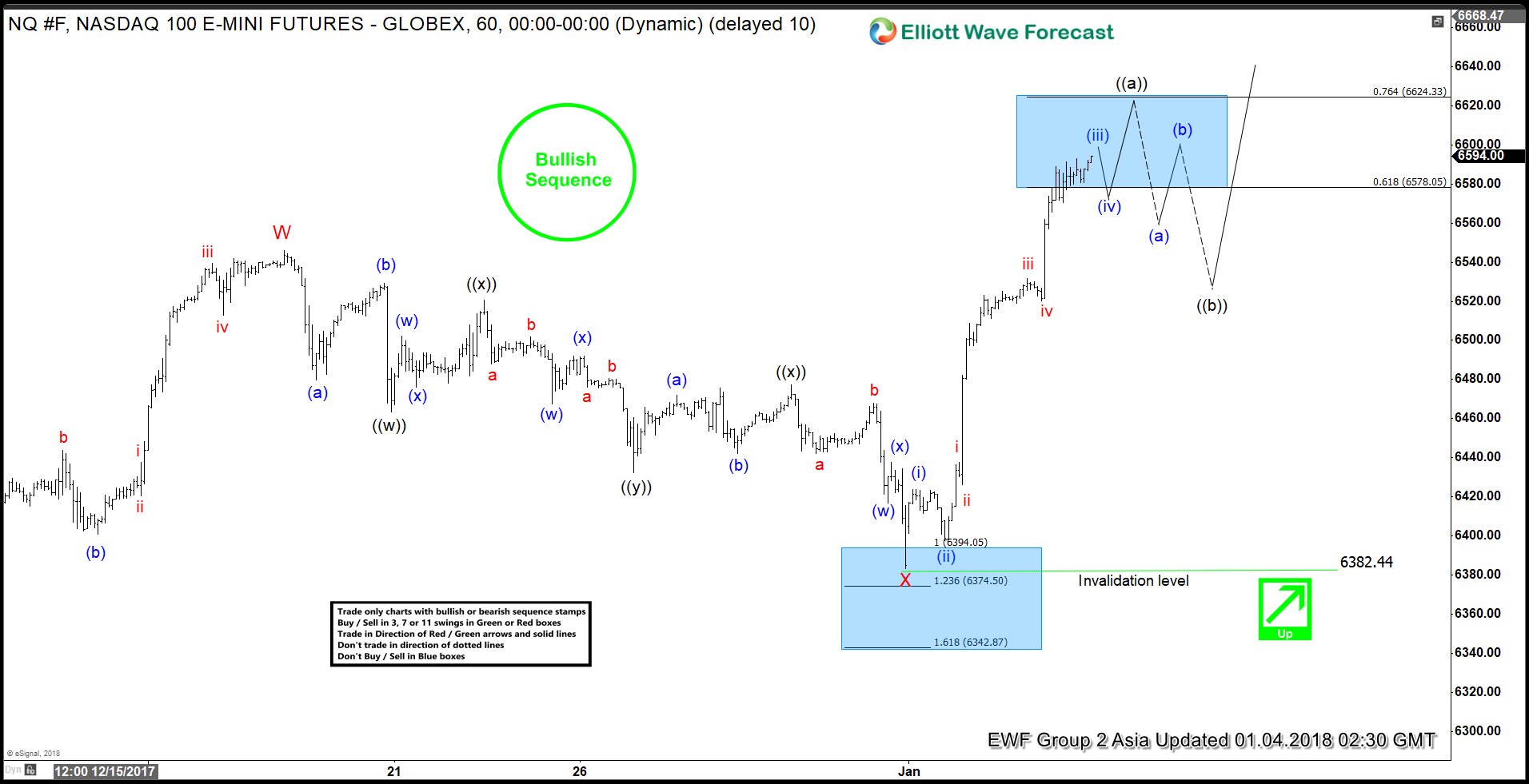

Elliott Wave Analysis: Nasdaq Has Resumed Higher

Read MoreElliott Wave view for Nasdaq suggests that the rally from Intermediate wave (4) on 12/5 unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X ended at 6383.25. The Index has made a new high above Minor wave W at 6545.75, which brings validity to this view. Subdivision of Minor wave W […]