The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

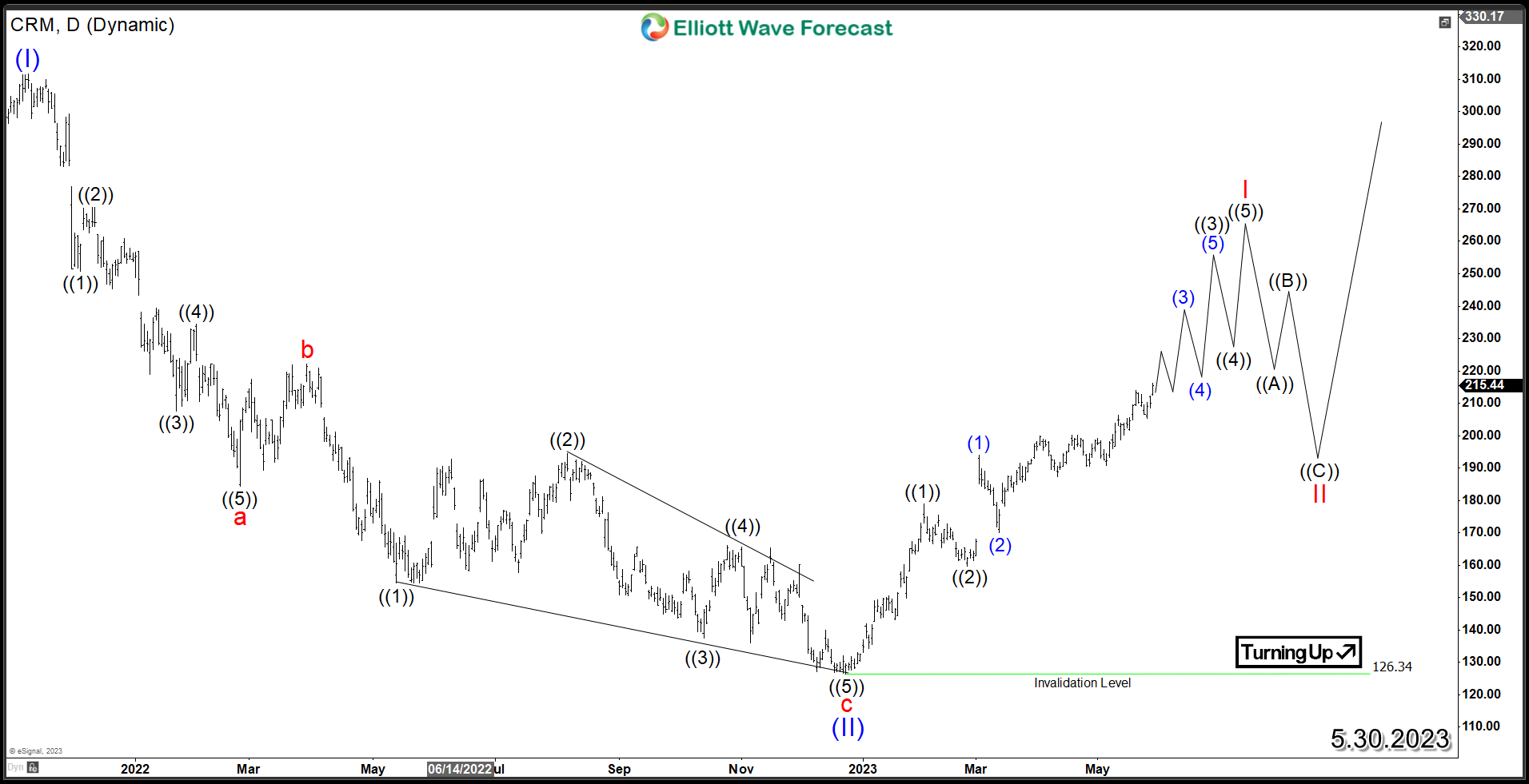

Salesforce CRM Primed for Growth as Cloud Computing Demand Soars

Read MoreSalesforce Inc (NYSE: CRM) is a leading player in the cloud computing industry, well-positioned for continued growth and success. This article explores the potential bullish technical structure of CRM using the Elliott Wave Theory. Between November 2021 and December 2022, CRM encountered a one-year decline. This downward movement resulted in a substantial drawdown of 59.5% from […]

-

Novo Nordisk (NVO) Should Remain Supported & Resume Rally

Read MoreNovo Nordisk A/S (NVO), a healthcare company engages in the research, development, manufacture and marketing of the pharmaceutical products worldwide. It operates in two segments, Diabetes & Obesity care & Biopharm. It is based in Denmark, comes under Healthcare – Biotechnology sector & trades as “NVO” ticker at NYSE. As showing in the previous article, […]

-

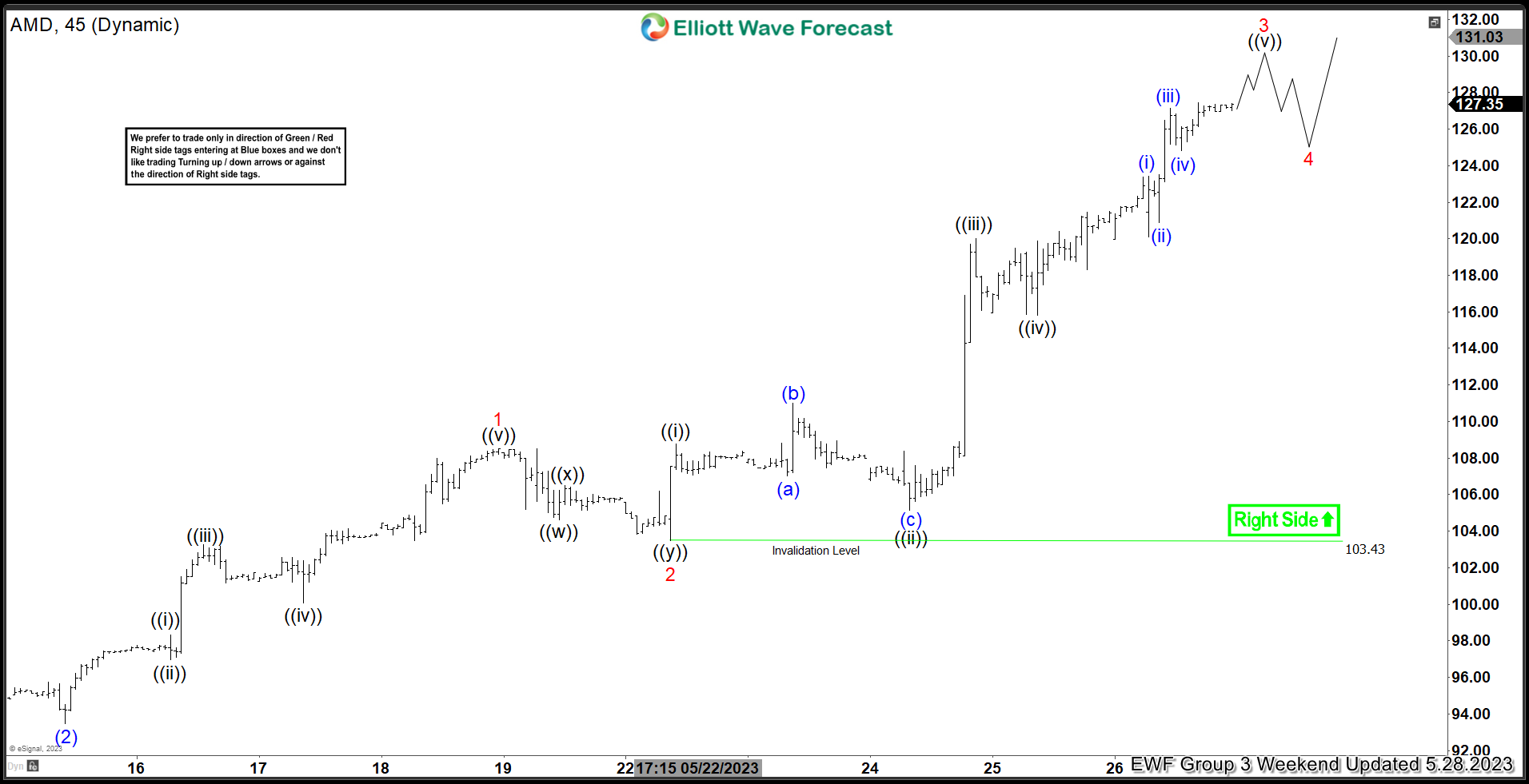

AMD Bullish View with Strong Elliott Wave Impulse Rally

Read MoreAMD rally from 5.4.2023 low is in progress as an impulse structure, looking for further upside. This article and video look at the Elliott Wave path.

-

Large-Cap vs. Small-Cap Stocks: Which Should You Choose?

Read MoreWhat are Large-Cap Stocks? Large-cap, or large capitalization, stocks belong to large, established companies with a high market capitalization. These stocks are often considered the safest of all equity investments. A stock that’s referred to as a large-cap is a stock that’s issued by a company with a market capitalization of $10 billion or more. […]

-

Alpha vs. Beta In Stock Investing: Definition & Comparison

Read MoreAlpha and beta are measures used by investors to evaluate the performance and risk of an investment security or portfolio. They are two different parts of an equation used to explain the performance of stocks and investment funds. Simply speaking Beta is a measure of market risk, and alpha indicates if the returns of an […]

-

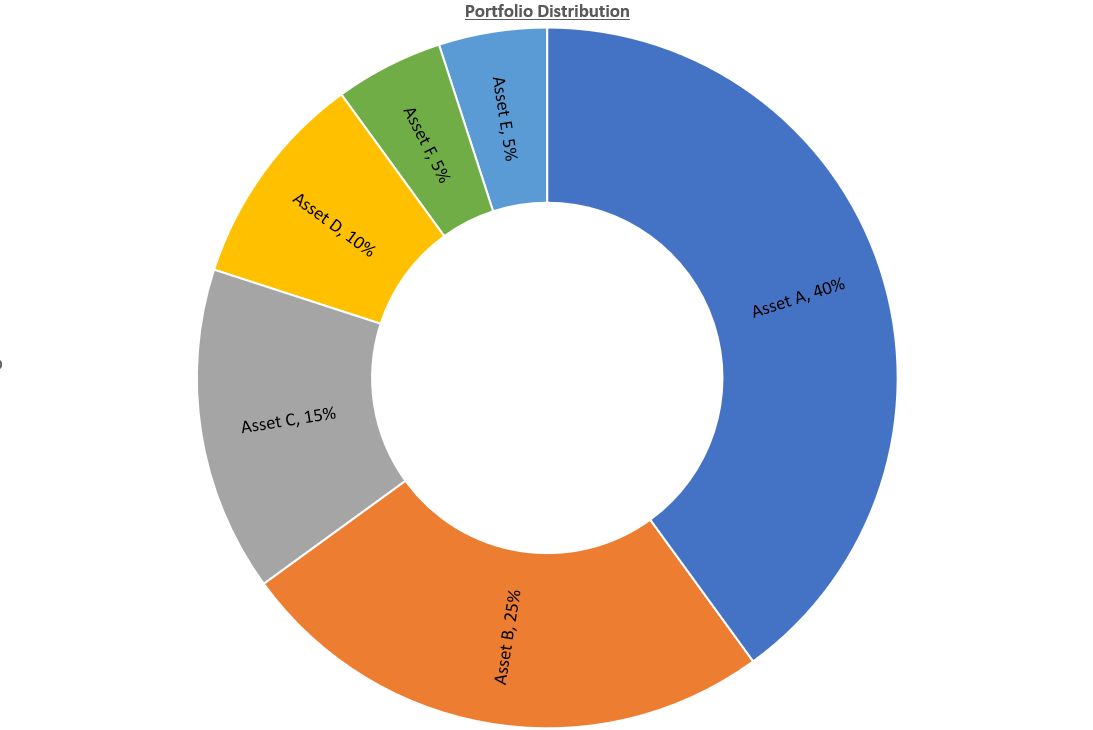

6 Steps To Create A Solid Investment Portfolio

Read MoreWhen it comes to create a financial portfolio, investors may have varying views and strategies based on their unique perspectives and goals. To choose financial instruments for a portfolio involves a combination of careful planning, diversification, and risk management. Therefore, here are some steps to help you create a solid financial portfolio: 6 Steps To Create […]