List of Top Best Drone Stocks to Buy in 2024

Here is a list of 9 Drone stocks that are an excellent buy for the current year:

| Sr. | Company Name | Symbol | Market Cap | Price (As of 9th th Dec 23) |

| 1 | AeroVironment | AVAV | $ 3.64 billion | $ 129.45 |

| 2 | E-Hang | EH | $ 1.093 billion | $ 18.21 |

| 3 | Northrop Grumman Corporation | NOC | $ 72.18 billion | $ 463.66 |

| 4 | The Boeing Company | BA | $ 159.524 billion | $ 256.24 |

| 5 | NVIDIA Corporation | NVDA | $ 1.212 Trillion | $ 483.5 |

| 6 | GoPro Inc | GPRO | $ 541.42 million | $ 3.6550 |

| 7 | Amazon | AMZN | $ 1.557 trillion | $ 147.42 |

| 8 | Lockheed Martin Corporation | LMT | $ 110.69 billion | $ 445.27 |

| 9 | Kratos Defense-and-Security Solutions | KTOS | $ 2.744 billion | $ 20.35 |

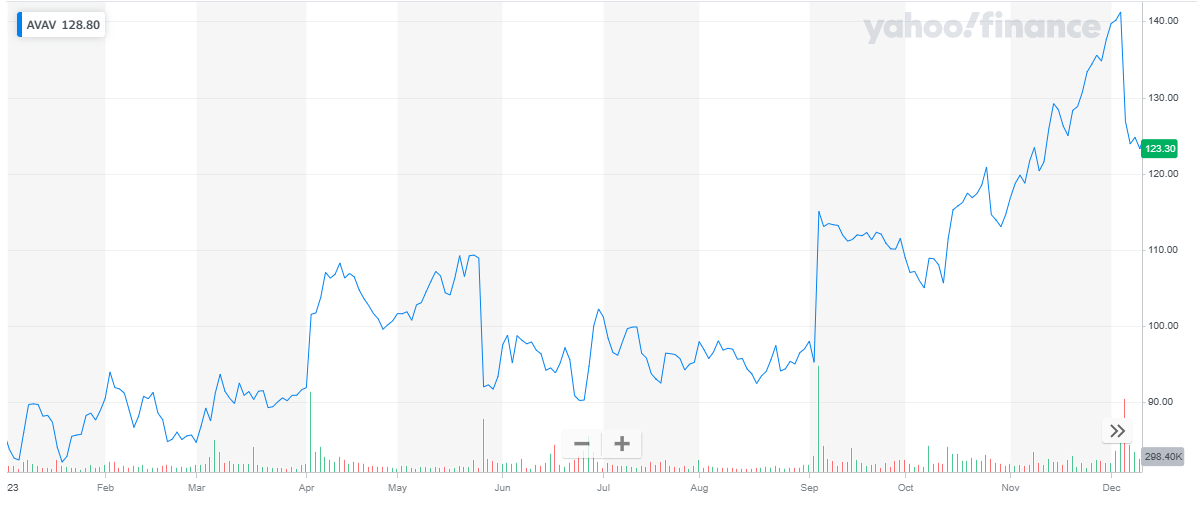

AeroVironment (AVAV)

AeroVironment Inc. reported its second quarter report for the year 2024:

- Revenue was reported at $ 180.9 million, as compared to $ 111.6 million in the previous year’s same quarter.

- Net Income was reported at $ 17.84 million, as compared to a net loss of $ (6.7) million in the previous year’s same quarter.

- Earnings per share was reported at $ 0.66, as compared to a loss per share of ($ 0.27) in the previous year’s same quarter

AeroVironment Inc. has a market cap of $ 3.64 billion. Its shares are trading at $ 129.45.

The stock picked up pace during the first quarter of 2022 when it was trading at its low of $ 53.78. From here the stock rose as high as $ 109.18. the stock closed in the year 2022 at $ 85.66. Overall, the stock appreciated by 38 % during the year.

In 2023, the stock again picked up pace and has been majorly bullish during the year. The stock started off at $ 83.84 and went as high as $ 141.23 during the year before closing at $ 129.45. To date, the stock has appreciated by 54 %.

Also, read:

E-Hang (EH)

E-Hang recently reported its first quarter report for the year:

- Total revenues were reported at RMB 28.6 million ($ 3.9 million), as compared to RMB 8.2 million during the same period last year, representing an increase of 247.9 %.

- Operating loss was RMB 70 million ($ 9.6 million) as compared to RMB 73.7 million during the same period last year, representing an increase of 5 %.

- Net loss was RMB 67.1 million ($ 9.2 million), as compared to RMB 76.5 million during the same period last year, representing an increase of 12.3 %.

E-Hang has a market cap of $ 1.089 billion. Its shares are trading at $ 18.03.

The stock started the year 2022 at $ 14.92 The stock has been on a bearish run since 2021. In the year 2022, the stock went from $ 14.92 to $ 8.58 representing a 42 % decline during the year.

In 2023, the stock exhibited volatile behavior with multiple dips and peaks. The stock started the year at $ 9 and last closed at $ 16.81. During the year, the stock went as high as $ 22.66 and as low as $ 8.88. To date, the stock has appreciated by 77 % till date.

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Northrop Grumman Corporation (NOC)

Northrop Grumman Corporation recently reported its third quarter report for the year 2023:

- Sales were reported at $ 9.38 billion, as compared to $ 8.98 billion in the previous year’s same period, a 9 % increase

- Net Earnings were reported at $ 937 million, as compared to $ 915 million in the previous year’s same period, a 2.4 % increase

- Earnings per share were reported at $ 6.2, as compared to $ 5.92 in the previous year’s same period, a 4.73 % decline

NOC has a market cap of $ 72.013 billion. Its shares are trading at $ 463.66.

The stock started the year 2022 at $ 387.07. Throughout the year the stock maintained its bullish run. The stock closed the year at the peak price of $ 545.61, representing a 41 % appreciation during the year.

In 2023, the stock suffered a huge dip at the start. It started off at $ 540.33 and last closed at $ 478.76, representing an 11 % decline to date.

Checkout:

The Boeing Company (BA)

The Boeing Company recently reported its third quarter report for the year 2023:

- Total Revenues were reported at $ 18.1 billion, as compared to $ 16.9 billion in the previous year, representing a 13 % change from the previous year same period

- Loss from operations was reported at ($ 808) million as compared to ($ 2.8) billion in the previous year’s same period

- Net Loss was reported at ($ 1.654) million as compared to a net loss of ($ 3.4) billion in the previous year’s same period

- Loss per share was reported at ($ 2.70) as compared to a loss per share of ($ 5.49) in the previous year’s same period

The Boeing Company has a market cap of $ 159.77 billion. Its shares are trading at $ 256.24.

The stock started the year 2022 at $ 201.32. It went on a bullish run and dropped as low as $ 121.08. From here on the stock started its recovery journey and eventually closed the year at $ 190.49. Overall, the stock declined by 5.4 % during the year.

In 2023, the stock has been volatile throughout the year. The stock maintained its price level in the first half of the year before rising to $ 238.69. after that, the stock suffered a huge blow and dropped to the low of $ 177.73. The stock picked up again and last closed at $ 256.24.

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

NVIDIA Corporation (NVDA)

NVIDIA Corporation recently reported its third quarter report for the fiscal year 2024:

- Total Revenues were reported at $ 18.12 billion, as compared to $ 5.9 billion in the previous year’s same quarter, representing a 206 % year-on-year increase.

- Operating Income was reported at $ 10.4 billion, as compared to $ 601 million in the previous year’s same quarter, representing a 1,633 % year-on-year increase

- Net Income was reported at $ 9.24 billion, as compared to $ 680 million in the previous year’s same quarter, representing a 1,259 % year-on-year increase

- Earnings per share were reported at $ 3.71, as compared to $ 0.27 in the previous year’s same quarter, representing a 1,274 % year-on-year increase

During the quarter, record Data Center revenue of $14.51 billion, up 41% from Q2, up 279% from a year ago. Their strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI.

NVIDIA Corporation has a market cap of $ 1.211 trillion. Its shares are trading at $ 483.5.

The stock started the year 2022 at $ 294.11 with a downward trend. The stock continued to fall till it dropped to $ 112.27. From here on the stock started to recover and eventually closed off the year at $ 146.14. Overall, the stock declined by 50 % during the year.

In 2023, the stock continued to climb high. Throughout the year, the stock remained bullish and it peaked at $ 504.09 and last closed at $ 483.5. To date, the stock has appreciated by 238 %.

GoPro (GPRO)

GoPro (GPRO)

GoPro recently reported its first-quarter results for the year 2023:

- Total Revenues were reported at $ 294.3 million, as compared to $ 305 million in the previous year’s same quarter, representing a 3.5 % decline on a year-on-year basis

- Operating loss was reported at ($ 3.8) million, as compared to an operating profit of $ 24.4 million in the previous year’s same quarter, representing a 115 % decline on a year-on-year basis

- Net loss was reported at ($ 3.7) million, as compared to net income of $ 17.6 million in the previous year’s same quarter, representing a 121 % decline on a year-on-year basis

- Loss per share was reported at ($ 0.01), as compared to earnings per share of $ 0.02 in the previous year’s same quarter, representing a 120 % decline on a year-on-year basis

GoPro subscriber count rose up to 2.5 million with a 20 % year-over-year.

GoPro has a market cap of $ 536.23 million. Its shares are trading at $ 3.7.

The stock started the year 2022 at $ 10.31. The stock started off with a declining trend. Throughout the year the stock continued to decline and closed off the year at $ 4.98, representing a 52 % decline.

In 2023, initially, the stock rose up to $ 6.4, From here the stock picked up a downward journey and last closed at $ 3.7. To date, the stock has declined by 27 %.

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

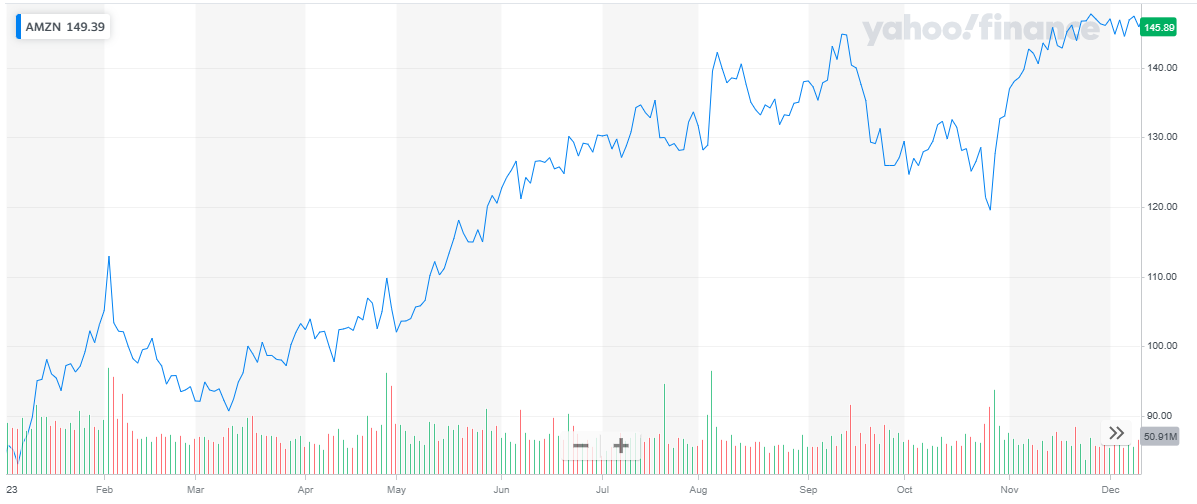

Amazon-com (AMZN)

Amazon is guided by four principles: customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking. Amazon strives to be Earth’s Most Customer-Centric Company, Earth’s Best Employer, and Earth’s Safest Place to Work.

Amazon recently reported its first quarter results for the year 2023:

- Net sales increased 13 % to $ 143.1 billion in the third quarter, compared with $ 127.1 billion in the third quarter 2022, representing an 11 % increase on a year-on-year basis

- Operating income increased to $11.2 billion in the third quarter, compared with $2.5 billion in the third quarter 2022

- Net Income was reported at $ 9.9 billion as compared to $ 2.9 billion in the previous year’s same period

- Earnings per share was reported at $ 0.94, as compared to earnings per share of $ 0.28 in the previous year’s same period

Amazon has a market cap of $ 1.558 trillion. Its sales are trading at $ 147.42.

The stock started the year 2022 at $ 166.72. It started off with a bearish run and closed off the year at $ 84. Overall, the stock declined by 50 %.

In 2023, the stock picked up a bullish run. From a price of $ 85.82, at the start of the year, the stock last closed at $ 147.42 representing a 72 % appreciation to date.

Lockheed Martin Corporation (LMT)

Lockheed Martin Corporation (LMT)

Lockheed Martin Corporation recently reported its third-quarter results for the year 2023:

- Net Sales were reported at $ 16.9 billion, as compared to $ 16.6 billion in the previous year’s same period, representing a 2 % year-on-year increase.

- Net Earnings were reported at $ 1.7 billion, as compared to $ 1.78 billion in the previous year’s same period

- Earnings per share were reported at $ 6.73 as compared to $ 6.71 in the previous year’s same period

The company operates in four business segments organized based on the nature of products and services offered: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space. Aeronautics is the highest revenue-generating segment.

Lockheed Martin Corporation has a market cap of $ 111.32 billion. Its shares are trading at $ 445.27.

The stock started the year 2022 at $ 355.41. The stock started off with a bullish run and continued this trend throughout the year till it closed at $ 486.49. Overall, the stock appreciated by 37 %.

In 2023, the stock has been volatile with multiple dips and peaks. During the year, the stock went as high as $ 501.41 and as low as $ 397.35. The stock last closed at $ 445.27 representing a 7 % decline to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

- Reliable forex signals

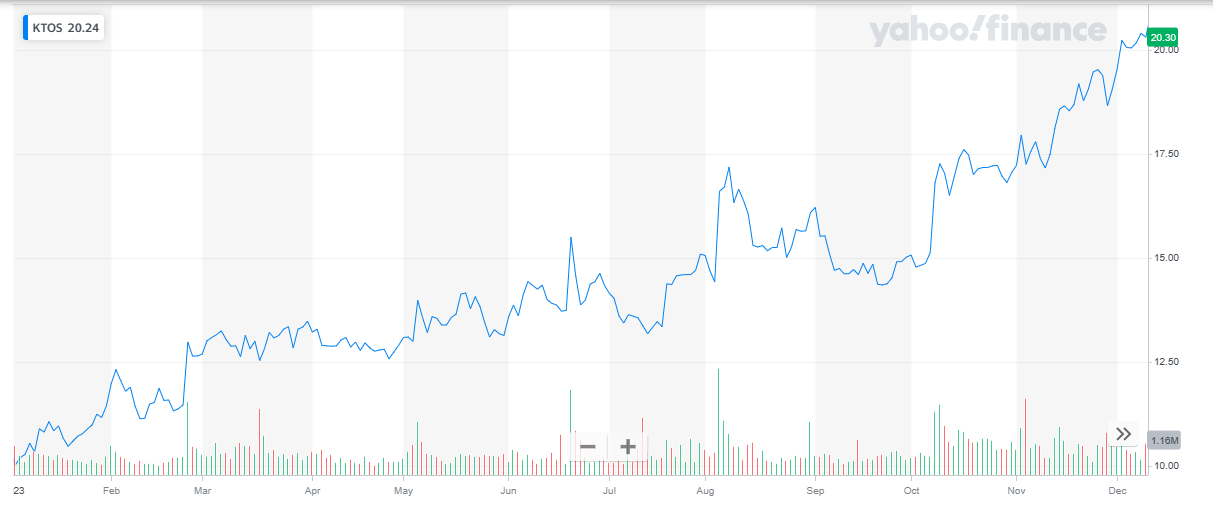

Kratos Defense-and-Security Solutions (KTOS)

Kratos recently reported its third quarter report for the year 2023:

- Total Revenue was reported at $ 274.6 million, as compared to $ 228.6 million in the previous year’s same period, representing a 20.1 % growth on a year-on-year basis

- Operating Income was reported at $ 73.4 million, as compared to $ 54.9 million in the previous year’s same period

- Net Loss was reported at ($ 1.6) million as compared to ($ 8) million in the previous year’s same period

- Loss per share was reported at ($ 0.01) as compared to ($ 0.06) in the previous year’s same period

Kratos Defense-and-Security Solutions has a market cap of $ 2.711 billion. Its shares are trading at $ 20.22.

The stock started in the year 2022 at $ 19.4. The stock continued to decline throughout the year and closed off the year at $ 10.32. Overall, the stock declined by 47 %.

In 2023, the stock has been on a bullish pattern. It started off the year at $ 10.03 and last closed at $ 20.22, representing a 101 % appreciation to date.

Also, learn:

Also, learn: