-

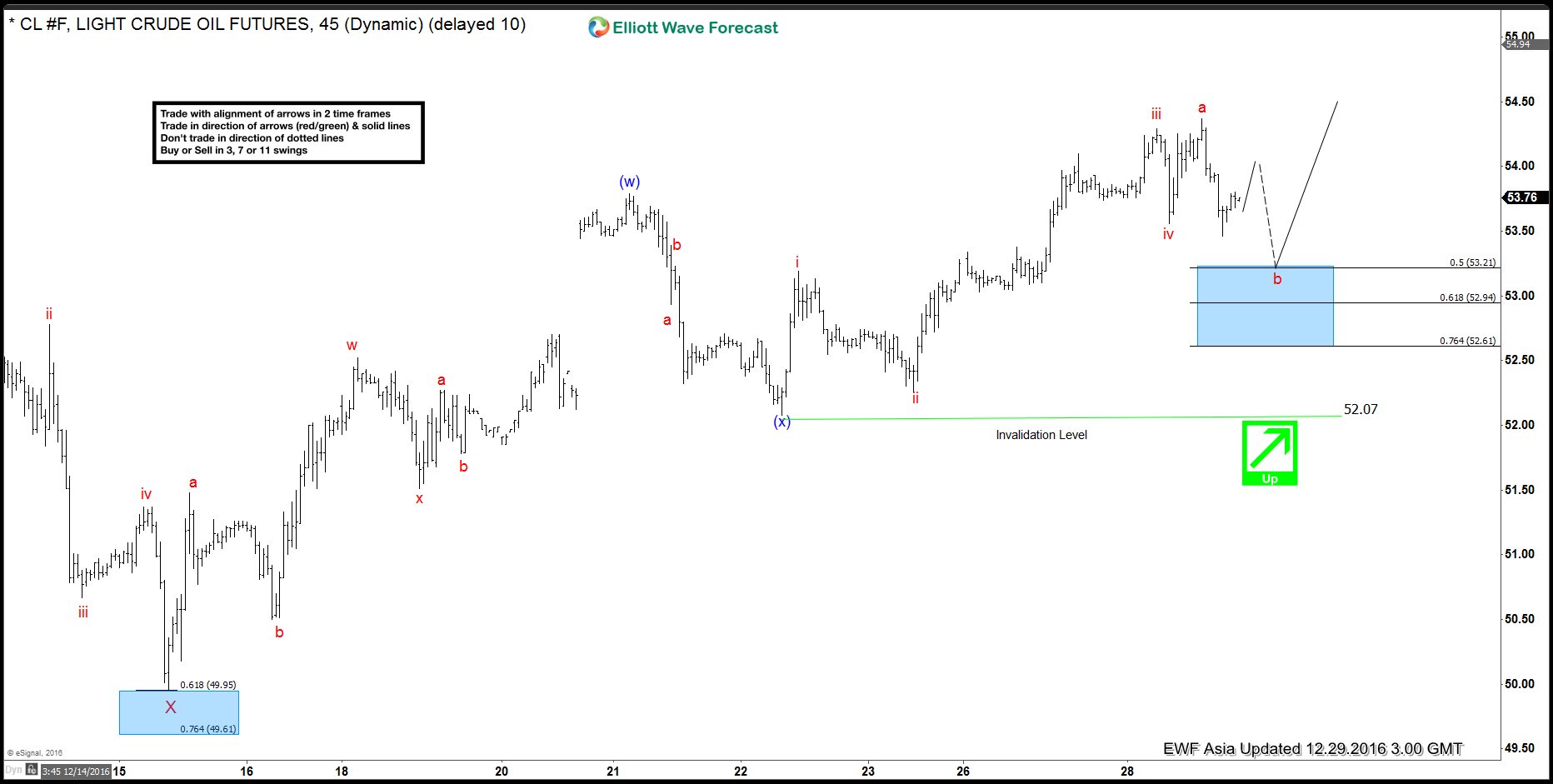

CL_F Elliott Wave Forecast 12.29.2016

Read MoreCL_F (Oil) is showing an incomplete 5 swing sequence from 2/8 low ($26.02), favoring for more upside. The latest rally up from 11/14 low ($42.2) is proposed to be unfolding as a triple three where wave W ended at $49.2, wave X ended at $44.82, wave Y ended at $54.51, and second wave X ended […]

-

Bitcoin Performance in 2016 – Elliott Wave Analysis

Read MoreAnother year is almost over. What an interesting year it has been. Two major and rather unexpected geopolitical developments: Brexit and the election of Donald Trump, are not able to halt the march of the world indices. The American Indices in particular manage to rally to all-time high. With only a few trading days left in […]

-

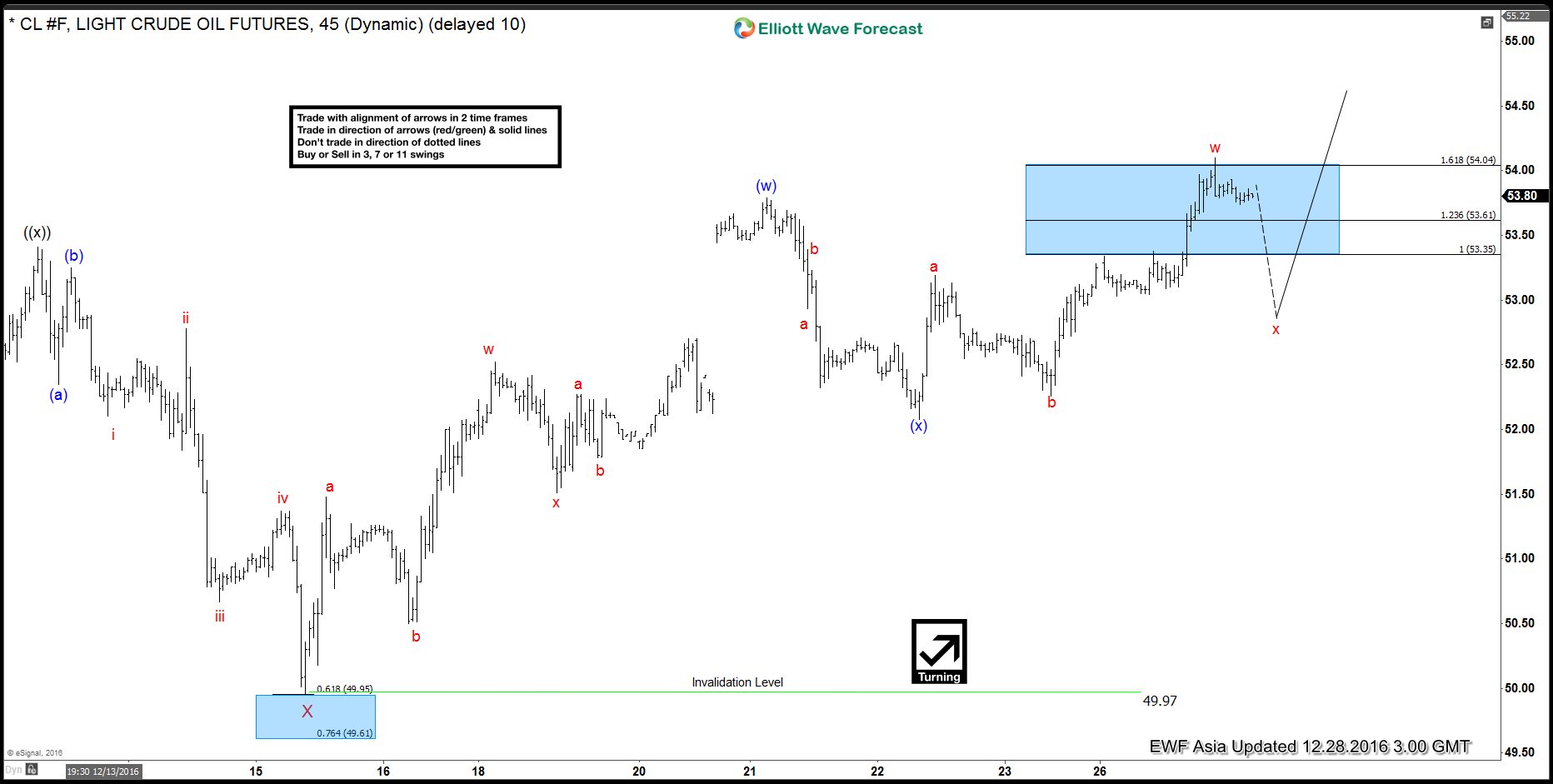

CL_F Elliott Wave Forecast 12.28.2016

Read MoreCL_F (Oil) is showing an incomplete 5 swing sequence from 2/8 low ($26.02), favoring for more upside. The latest rally up from 11/14 low ($42.2) is proposed to be unfolding as a triple three where wave W ended at $49.2, wave X ended at $44.82, wave Y ended at $54.51, and second wave X ended […]

-

CL_F Elliott Wave Forecast 12.27.2016

Read MoreCL_F (Oil) is showing an incomplete 5 swing sequence from 2/8 low ($26.02), favoring for more upside. The latest rally up from 11/14 low ($42.2) is proposed to be unfolding as a triple three where wave W ended at $49.2, wave X ended at $44.82, wave Y ended at $54.51, and second wave X ended […]

-

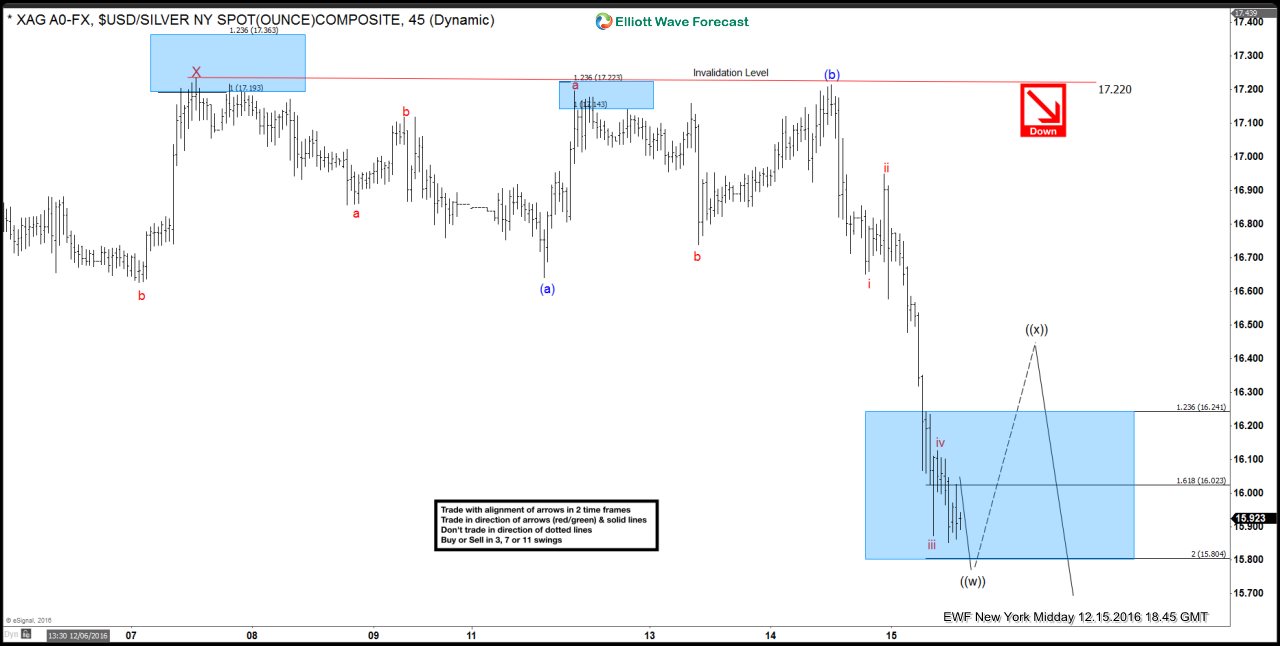

Silver XAGUSD Elliott Wave Forecast 12.16.2016

Read MoreShort Term XAGUSD Elliott wave forecast suggests that the rally to 17.25 ended wave X. Decline from there is unfolding as a FLAT where wave (a) ended at 16.64, wave (b) ended at 17.21 and wave (c) of ((w)) is expected to complete soon although marginal low is still expected towards as low as 15.8. Afterwards, […]

-

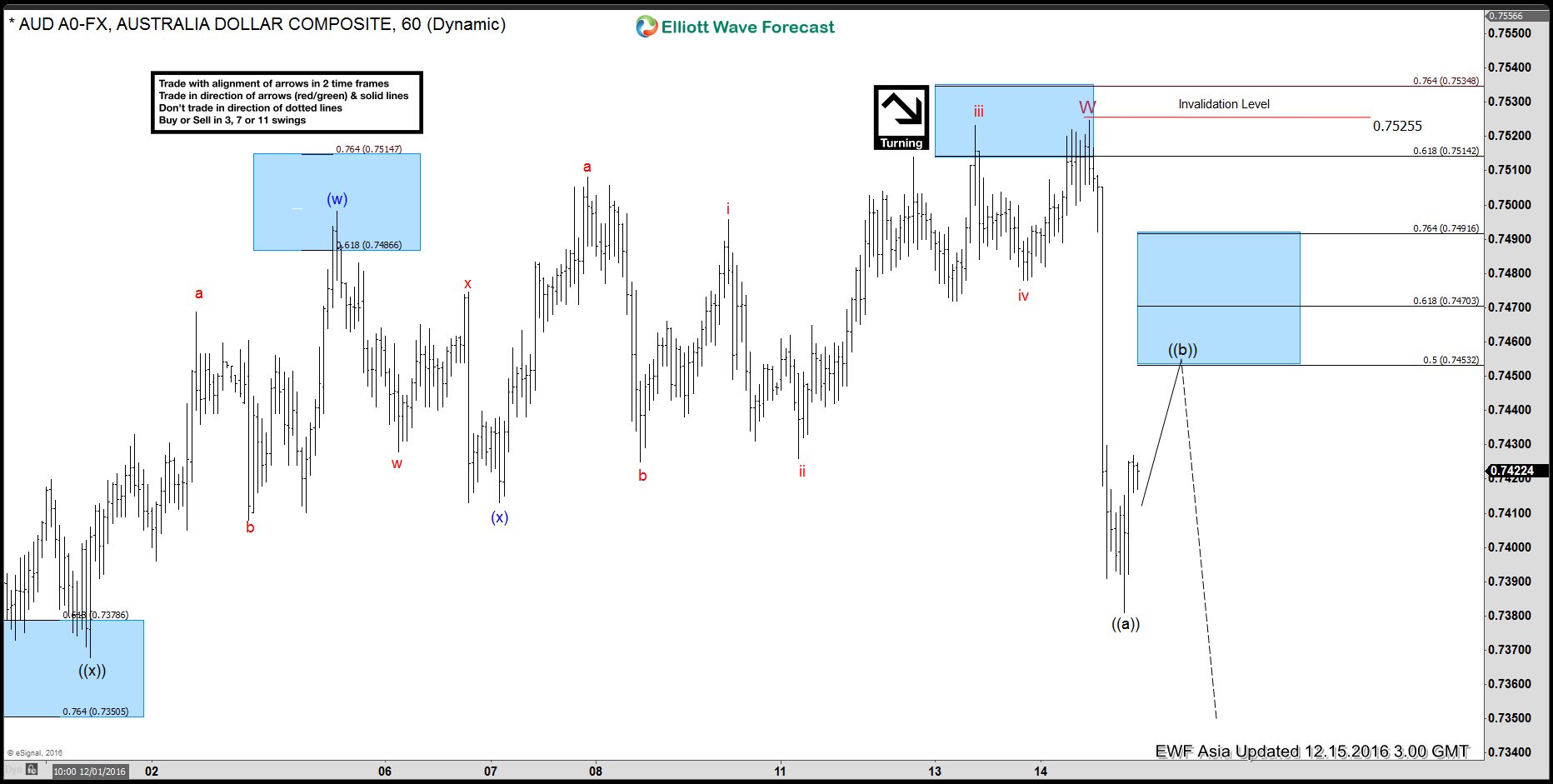

AUDUSD Elliott Wave Forecast 12.15.2016

Read MoreShort Term AUDUSD Elliott wave forecast suggests that the decline to 0.7306 on 11/21 low ended wave (X). Up from there, pair is rallying as a double three structure where wave ((w)) ended at 0.749, wave ((x)) ended at 0.736, and wave ((y)) of W is proposed complete at 0.7525. Pair is currently in wave X […]