-

AUDJPY Short Term Elliott Wave Update 11.15.2015

Read MoreBest reading of the Elliott Wave cycle suggests decline to 85.42 ended wave (4). From this level, pair has resumed rally in wave (5) as a double three structure where wave W ended at 87.95, and wave X pullback is currently in progress. Internal of wave X is unfolding as a double three structure where wave ((w)) ended at […]

-

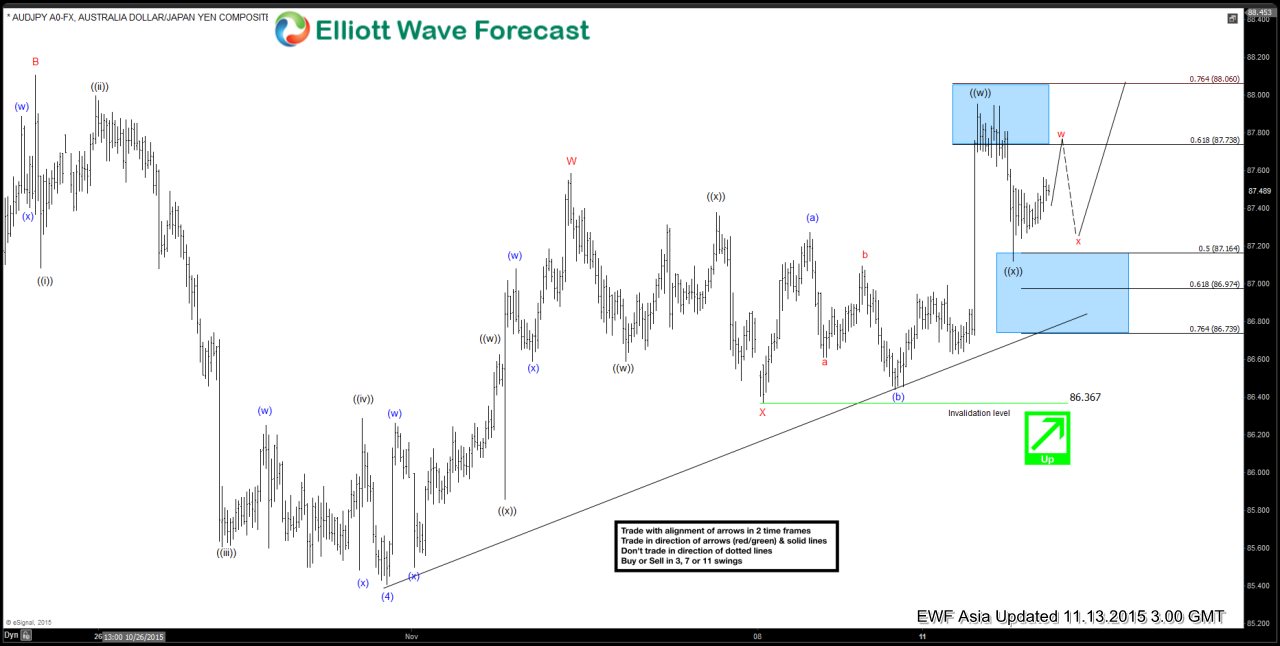

AUDJPY Short Term Elliott Wave Update 11.13.2015

Read MoreBest reading of the Elliott Wave cycle suggests decline to 85.41 ended wave (4). From this level, pair has resumed rally in wave (5) as a double three structure where wave W ended at 87.58, wave X pullback ended at 86.37, and wave Y is currently in progress. Internal of wave Y is unfolding as a double […]

-

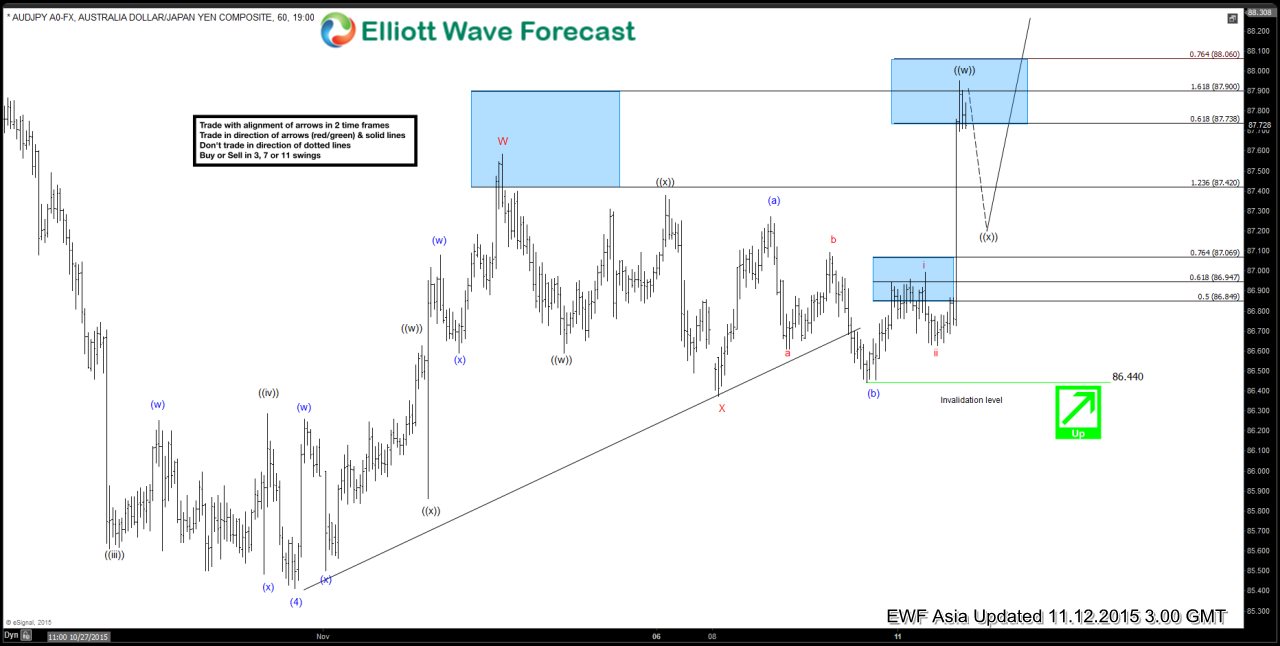

AUDJPY Short Term Elliott Wave Update 11.12.2015

Read MoreBest reading of the Elliott Wave cycle suggests decline to 85.41 ended wave (4). From this level, pair has resumed rally in wave (5) as a double three structure where wave W ended at 87.58, wave X pullback ended at 86.37, and wave Y is currently in progress. Internal of wave Y is unfolding as a double […]

-

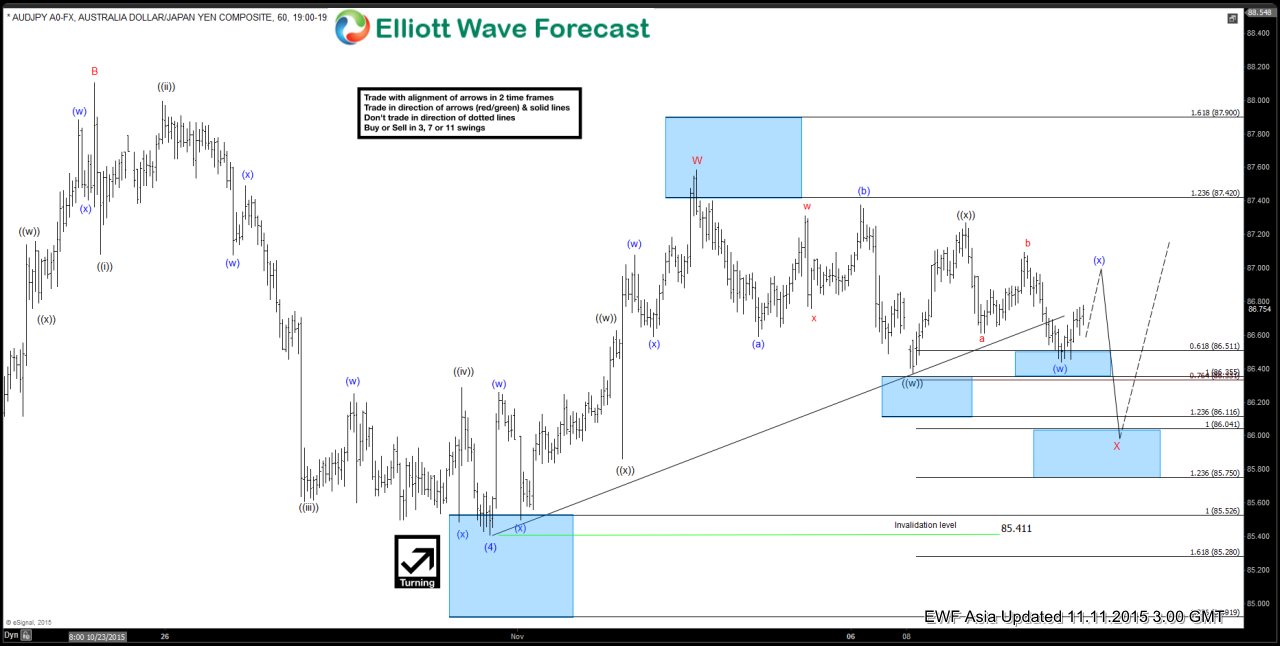

AUDJPY Short Term Elliott Wave Analysis 11.11.2015

Read MoreBest reading of the Elliott Wave cycle suggests decline to 85.41 ended wave (4). From this level, pair has resumed rally in wave (5) as a double three structure where wave W ended at 87.58, and wave X pullback is currently in progress towards 85.75 – 86.04 area. As far as 85.41 pivot stays intact during the pullback, […]

-

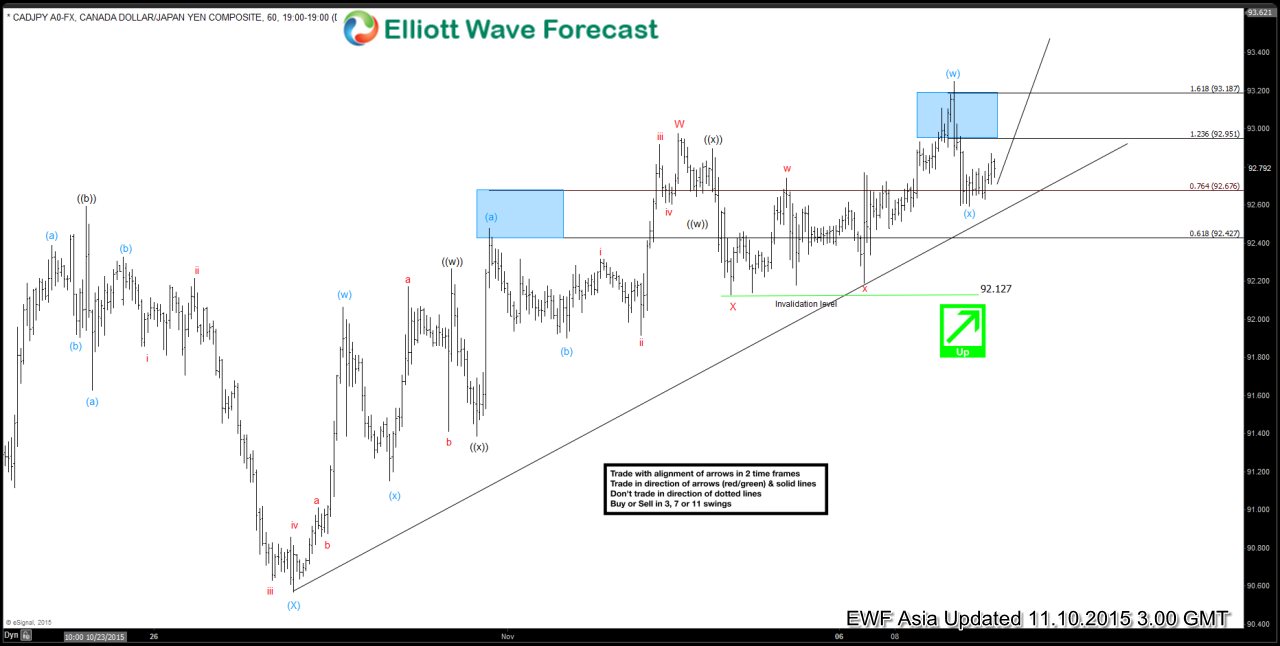

CADJPY Short Term Elliott Wave Analysis 11.10.2015

Read MoreBest reading of the Elliott Wave cycle suggests there are 5 swings from wave (X) low at 10/28 and another swing higher is ideal to complete a 7 swing structure as far as 92.12 pivot stays intact. Rally from wave (X) low at 90.56 is unfolding in a double three structure where wave W ended at 92.97, […]

-

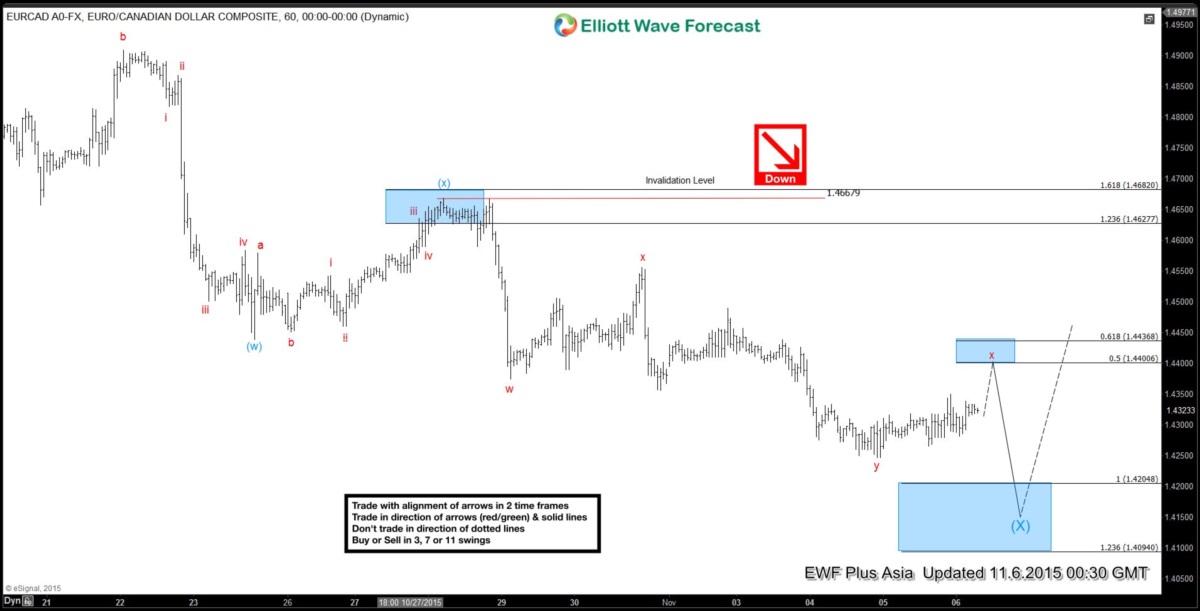

EURCAD Short Term Elliott Wave Analysis 11.06.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a triple three, where wave w ended at 1.4374, wave x ended at 1.455, wave y ended at 1.4247, and second […]