-

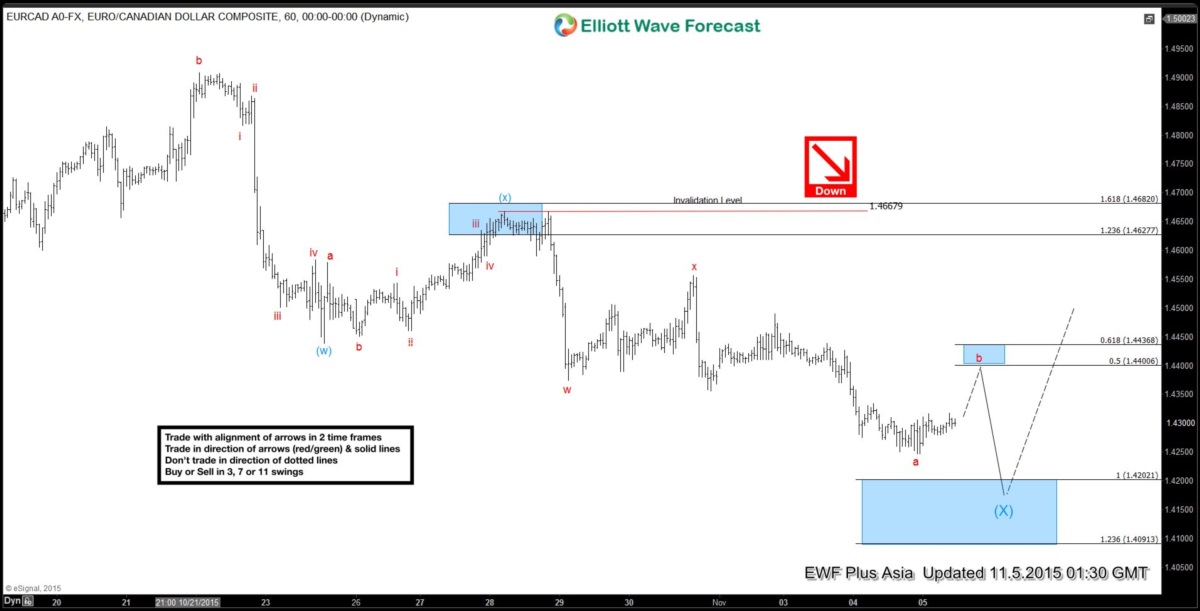

EURCAD Short Term Elliott Wave Analysis 11.05.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a triple three, where wave w ended at 1.4374, wave x ended at 1.455, wave y ended at 1.4247, and second […]

-

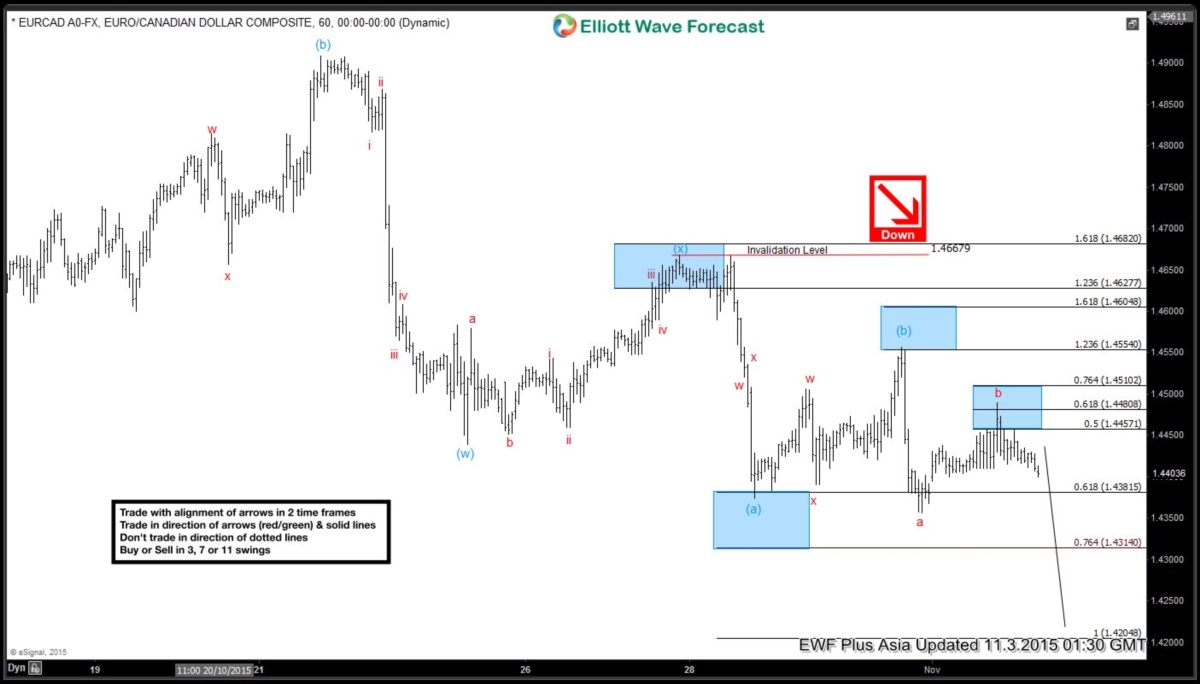

EURCAD Short Term Elliott Wave Analysis 11.04.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a double correction. The first leg of the decline wave (a) ended at 1.4374, wave (b) bounce ended at 1.455, […]

-

EURCAD Short Term Elliott Wave Analysis 11.03.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a double correction. The first leg of the decline wave (a) ended at 1.4374, wave (b) bounce ended at 1.455, […]

-

Shanghai Composite Index Medium Term EWF Analysis 11.02.2015

Read MoreThis is a medium term Elliottwave Analysis video on Shanghai Composite Index. Index is still expected to make another leg lower sometimes later towards 1944 – 2370 equality area before a larger bounce or a new bullish cycle can be seen. Short term, Index is in the process of completing wave (X) bounce. EWF currently covers 50 instrument […]

-

EURCAD Short Term Elliott Wave Analysis 10.29.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a zigzag. The first leg of the decline wave (a) is in progress as 5 waves. From 1.4668 high, the […]

-

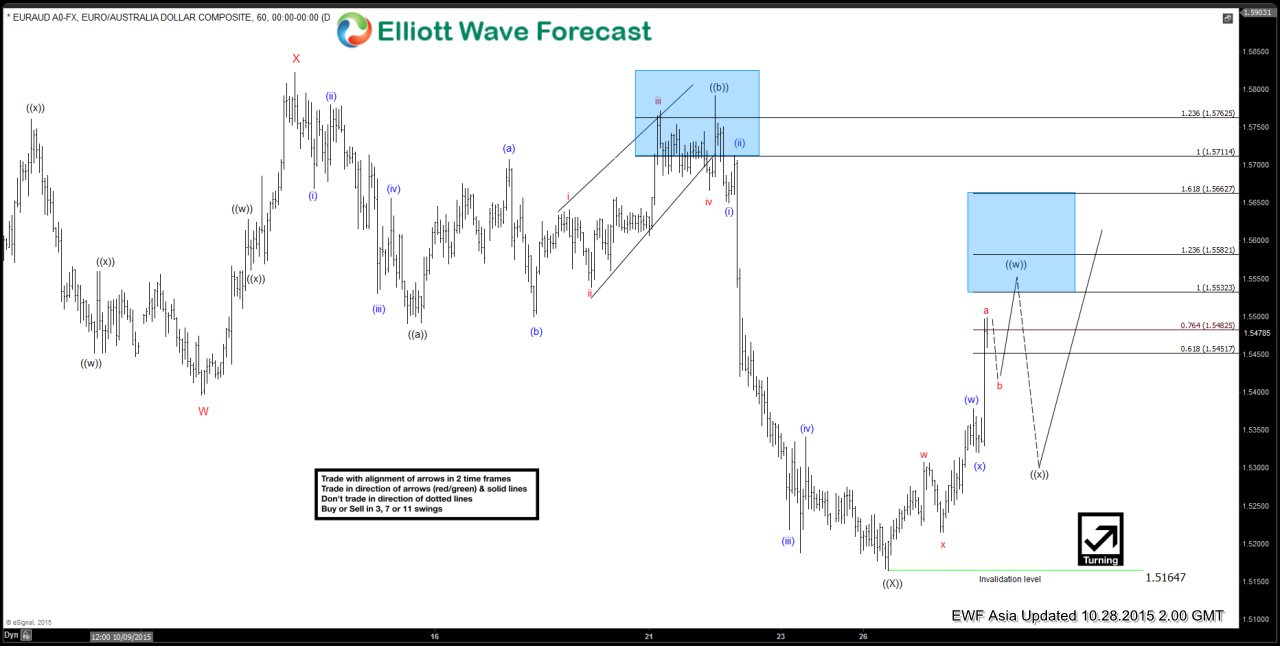

EURAUD Short Term Elliott Wave Update 10.28.2015

Read MoreRevised short term Elliott wave view suggests decline to 1.515 ended wave (X)) and pair has resumed the rally. Wave ((w)) is unfolding in a double three structure where wave (w) ended at 1.5378, wave (x) ended at 1.532, and wave (y) is in progress towards 1.5532 – 1.5582 before a 3 waves pullback. Near term, pair […]