-

Educational Series – Zig-Zag Elliott Wave Structure

Read MoreIn this educational video, we will talk about the Elliottwave zigzag structure. Zigzag is a corrective 3 wave move labelled as an ABC. Zigzag is a 5-3-5 Elliott wave structure but zigzag can also be the internal structure of a double three WXY or an internal structure of a triple three WXYZ. What are some of the […]

-

Criteria of Impulsive Elliott Wave structure

Read MoreIn this video we will explain how we can identify 5 waves impulsive move, which is the most popular structure and everyone with some knowledge of Elliott Wave are familiar with. However, this 5 waves move do not happen that often in today’s market, compared to the market in the past. So what are some of […]

-

Expanded / Irregular Flat Elliott Wave Structure

Read MoreAn Elliott Wave Flat structure is a 3-3-5 structure and has three different types: Regular Flat, Expanded / Irregular Flat, and Running Flat. In this blog, we will take a look at an example of expanded / irregular Elliott Wave structure with $GBP/USD chart. Let’s take a look at the 4 hour chart below: […]

-

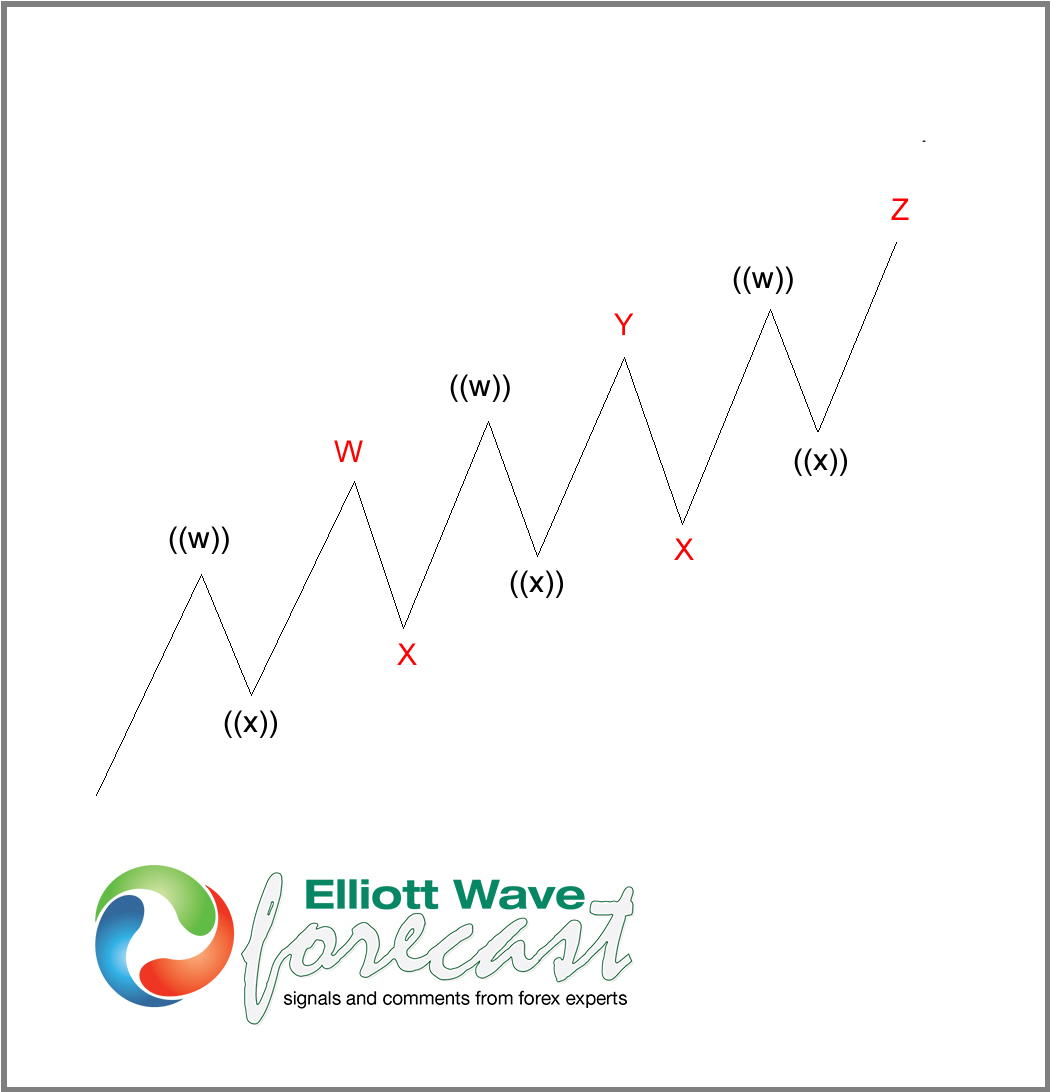

Triple Three Elliott Wave Structure

Read MoreIn this blog, we will take a look at Elliott Wave Triple Three structure wxyz. WXYZ is an 11 swing Elliott Wave structure which looks like below: From the chart above, we can see red W, red X, red Y, red X, and red Z. Each leg of WXYZ Elliott Wave structure has 3 swing subdivisions ((w)), ((x)), and ((y)). A […]

-

5 wave Elliott wave Impulse

Read MoreGold has been rallying since early June low of 1240 in 5 waves. In Elliott Wave Principle, market does not run in straight line and after 5 waves rally, a pullback in 3 waves is expected. Current wave structure and count in gold suggest that the yellow metal is close to completing this 5 waves rally in an […]

-

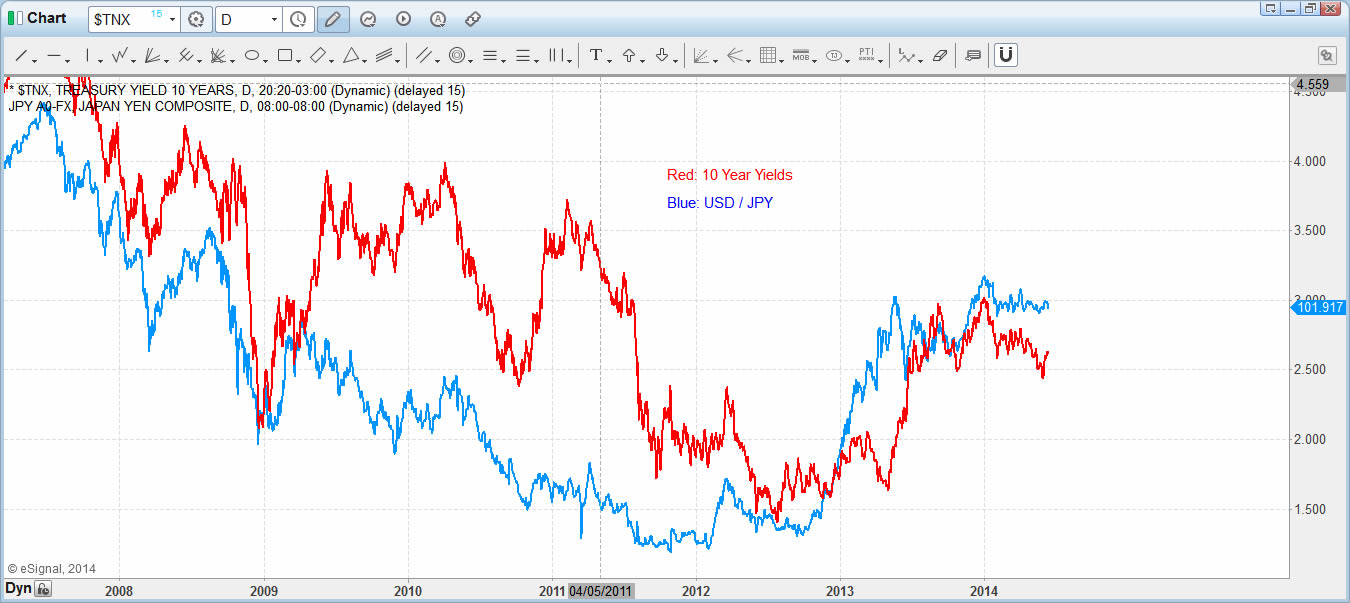

The New Elliott Wave Theory: Market Correlation

Read MoreOne of the common challenges to practicioners of Elliott Wave principle is that the technique is subjective. There’s a saying that if you put 10 different Ellioticians together in the same room, they will all come up with a different Elliott Wave count. During our 20 years of experience with Elliott Wave Theory, we find […]