-

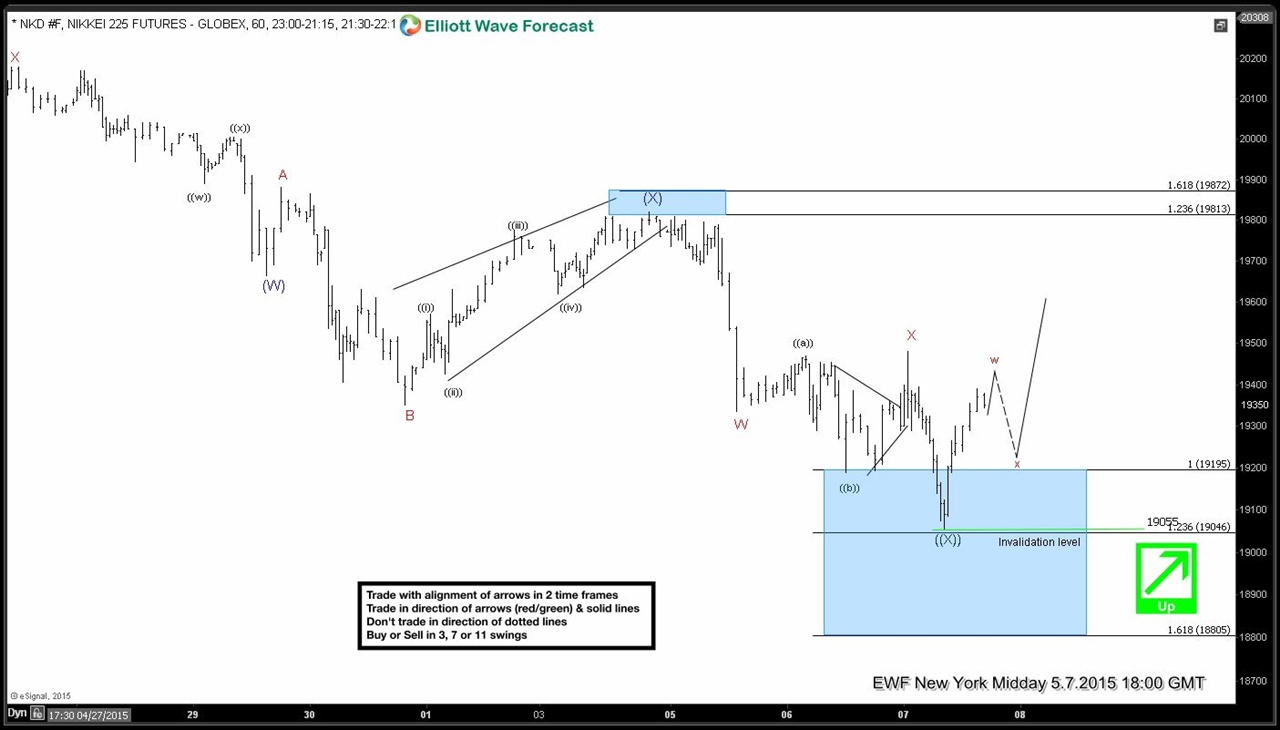

Nikkei (NI225) Short Term Elliott Wave Update 5.7.2015

Read MorePreferred Elliott Wave view suggests wave ((X)) pullback took the form of a double three (W)-(X)-(Y) structure. Wave (W) ended at 19665. Wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. In our last Chart of the Day update, we said wave Y of ((X)) can still make one more low and test 18805 – 19045 […]

-

Nikkei (NI225) Short Term Elliott Wave Update 5.6.2015

Read MoreWave ((X)) pullback is in progress and is taking the form of a double three i.e. (W)-(X)-(Y) Elliott wave structure. Wave (W) ended at 19665, wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. Wave (Y) is now in progress and is expected to end at 18805 – 19045 area to complete wave ((X)). […]

-

Nikkei (NI225) Short Term Elliott Wave Analysis 5.5.2015

Read MoreIndex has broken below 19348 low which means we are still in wave ((X)) pull back which is taking the form of a double three i.e. (W)-(X)-(Y) Elliott wave structure. Wave (W) ended at 19665, wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. Wave (Y) low is now in […]

-

IBEX Short Term Elliott Wave Analysis 4.30.2015

Read MoreShort term Elliott Wave view suggests rally to 11883.6 completed wave (Y). Decline from here is taking the form of a double three or WXY structure when wave W ended at 11301, wave X ended at 11684.3, and wave Y lower is in progress. Wave ((w)) of Y ended at 11259.1, wave ((x)) of Y bounce is currently in progress and could retrace 50 […]

-

Educational Video Series – Expanded / Irregular Flat

Read MoreIn this video, we will look at Elliottwave structure called a Flat, and we will focus at one type of Flat called the Irregular / Expanded Flat. Flat is a corrective 3 wave structure labelled as ABC. Internally it is a 3-3-5 structure. Wave A is subdivided into 3 waves, wave B is subdivided into […]

-

Live Trading Room Recap 4.24.2015

Read MoreHere is a quick recap from our Live Trading Room on 4.24.2015 where we presented many short term trade and swing opportunities to our members. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join us there for […]