-

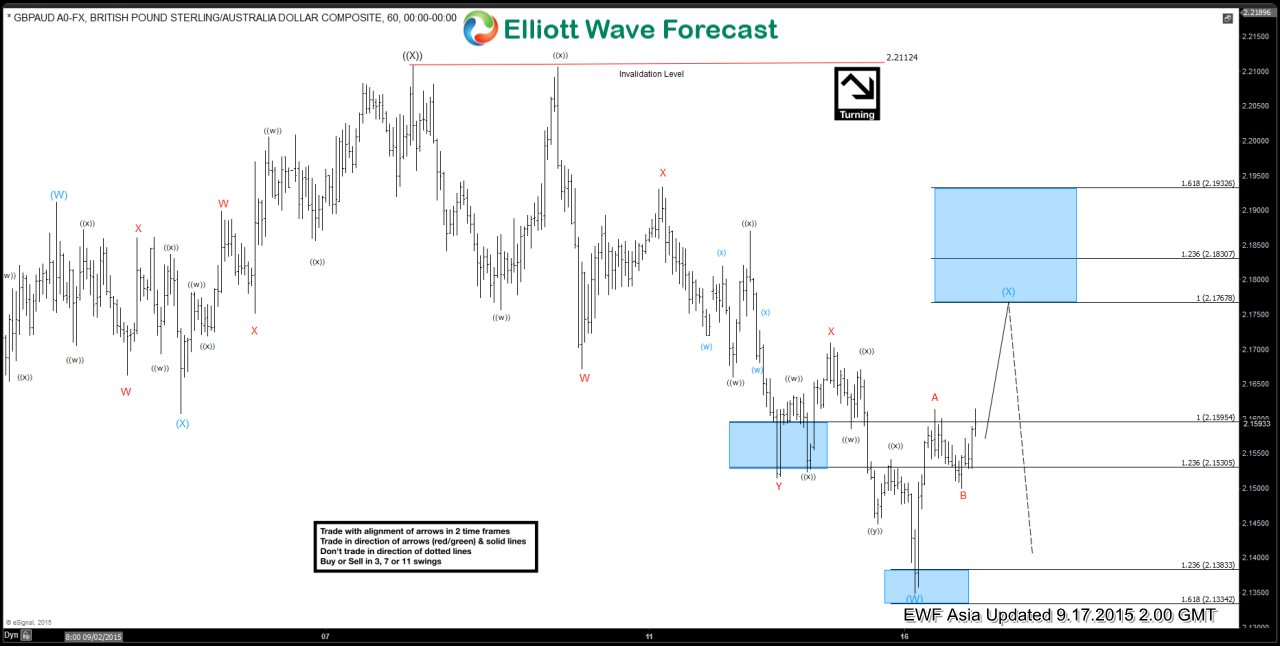

GBPAUD Short Term Elliott Wave Update 9.17.2015

Read MoreShort term Elliottwave view suggests the decline from wave ((X)) at 2.21 unfolded in a triple three structure WXYZ where wave W ended at 2.167, wave X ended at 2.193, wave Y ended at 2.151, second wave X ended at 2.17, and wave Z of (W) ended at 2.135. Wave (X) bounce is currently in progress as a zigzag […]

-

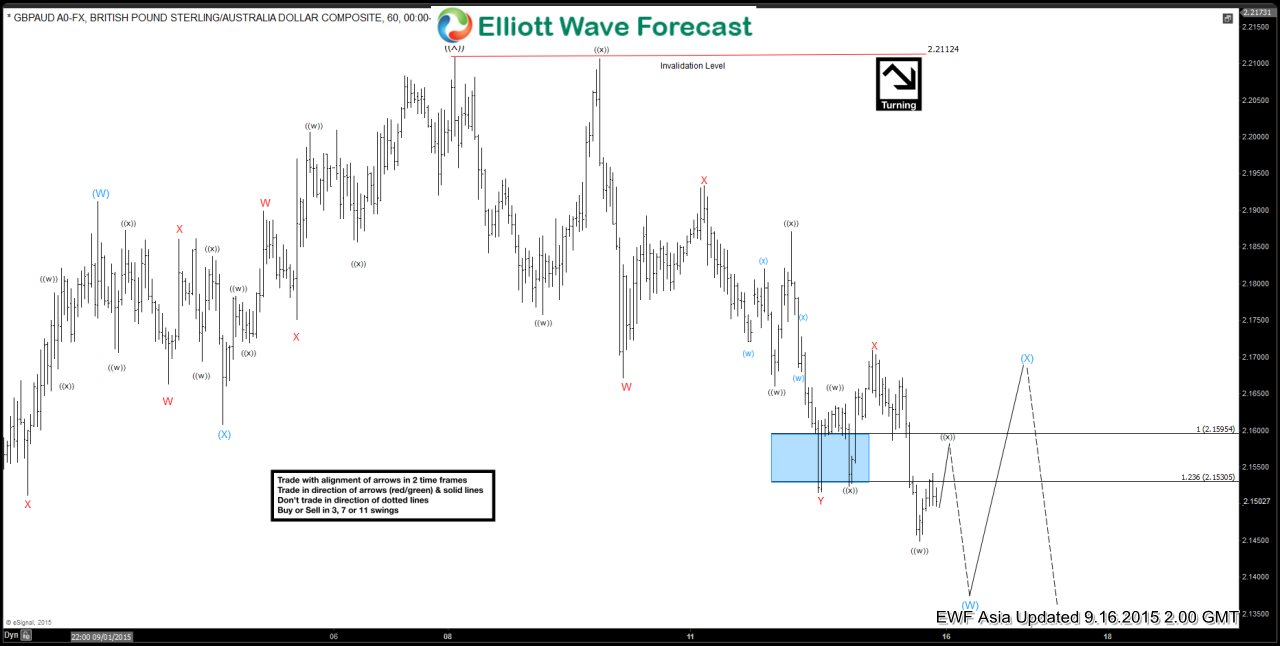

GBPAUD Short Term Elliott Wave Update 9.16.2015

Read MoreRevised short term Elliottwave suggests the decline from wave ((X)) at 2.21 is unfolding in a triple three structure WXYZ where wave W ended at 2.167, wave X ended at 2.193, wave Y ended at 2.151, second wave X ended at 2.17, and wave Z lower is in progress and can reach as low as 2.116 – […]

-

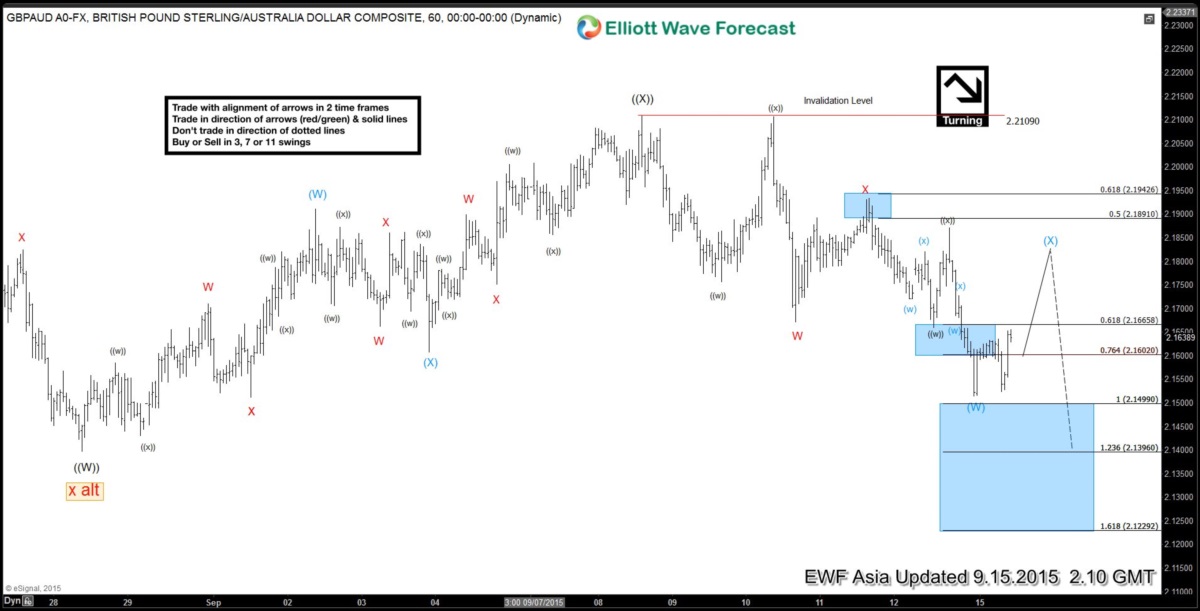

GBPAUD Short Term Elliott Wave Analysis 9.15.2015

Read MoreDecline from wave ((X)) at 2.21 unfolded in a double three structure WXY where wave W ended at 2.167, wave X ended at 2.193, and wave Y of (W) ended at 2.151. Wave (X) bounce is currently in progress and may reach as high as 2.181 – 2.194 (50 – 61.8 back from 2.21) before turning lower. We […]

-

Copper Short Term Elliott Wave Update 9.12.2015

Read MoreRally from wave (W) low at 2.209 is unfolding in double corrective structure WXY where wave W ended at 2.418, wave X ended at 2.3053, and wave Y of (X) is in progress towards 2.516 – 2.64 area before turning lower at least in 3 waves. Short term, metal is still in wave ((x)) and […]

-

Copper Short Term Elliott Wave Update 9.10.2015

Read MoreRally from wave (W) low at 2.209 is unfolding in double corrective structure WXY where wave W ended at 2.418, wave X ended at 2.3053, and wave Y of (X) is in progress towards 2.516 – 2.64 area before turning lower at least in 3 waves. Short term, wave ((w)) is proposed complete at 2.4755, […]

-

EURCAD Medium Term Elliottwave Analysis 9.9.2015

Read MoreThis is a medium term Elliott Wave Analysis video update on $EUR/CAD. The pair is currently in wave (X) pullback and once complete, it is likely to turn higher one more leg later. We currently cover 42 instrument ranging from forex, indices, and commodities in 4 different time frames. Welcome to check our service and see if […]