-

Apple: Using Elliott Wave to Forecast the Path

Read More$AAPL made a 5 waves move from 2013 low, ending the move at 117.25 (4/27/2015 peak). The stock since then declined, taking the form of a double three WXY (7 swing structure). Watch the video below to understand WXY structure and how to use it to forecast the correction in Apple. From 117.25 peak, the decline […]

-

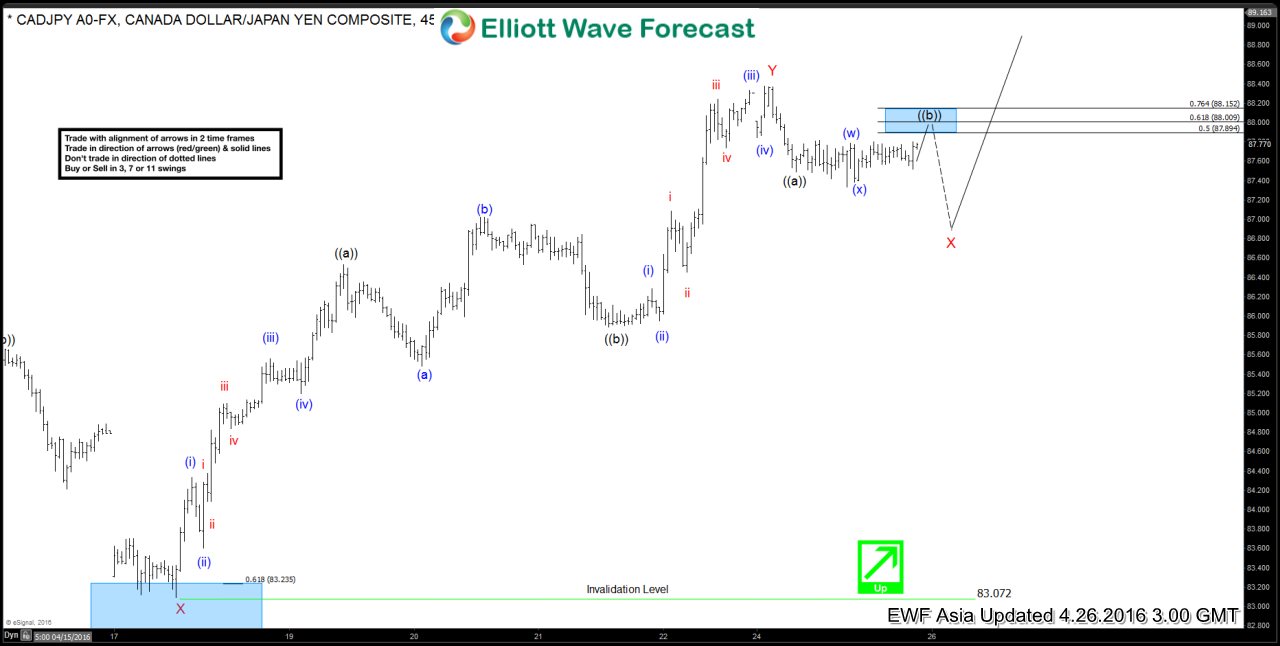

CADJPY Short-term Elliott Wave Analysis 4.27.2016

Read MoreShort term Elliottwave structure suggests that cycle from 4/7 low (81.7) remains alive as a triple three where wave W ended at 85.7 on 4/13, wave X ended at 83.07 on 4/18, wave Y ended at 88.37 on 4/25, and 2nd wave X pullback is proposed complete at 87.28 on 4/26. Near term, while dips stay above 87.28, pair is favored […]

-

CADJPY Short-term Elliott Wave Analysis 4.26.2016

Read MoreShort term Elliottwave structure suggests that cycle from 4/7 low remains in progress as a triple three where wave W ended at 85.7 (4/13 high), wave X ended at 83.07 (4/18 low), and wave Y is proposed complete at 88.37 (4/23 high). Second wave X pullback is in progress to correct the rally from wave X low […]

-

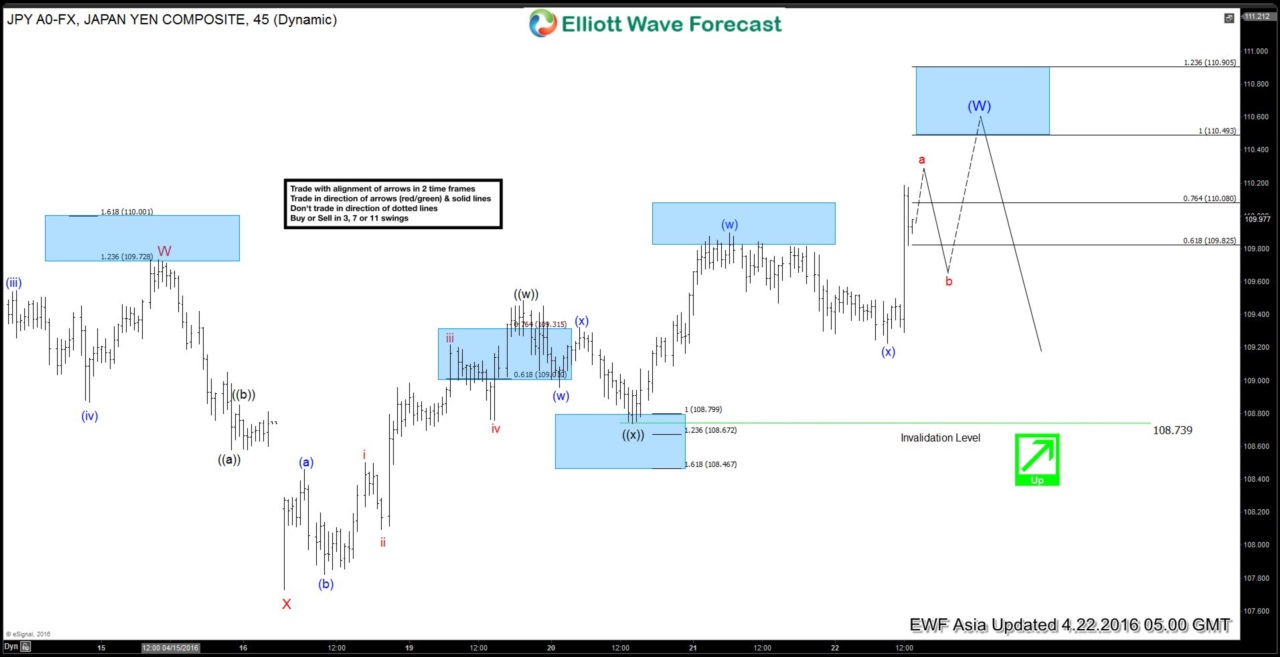

USDJPY Short-term Elliott Wave Analysis 4.22.2016

Read MoreShort term Elliottwave structure suggests dip to 107.73 ended wave X. Rally from there is unfolding as a double three structure where wave ((w)) flat ended at 109.48, wave ((x)) pullback ended at 108.74, and pair has resumed the rally higher in wave ((y)) of Y towards 110.5 – 110.9 area. Near term, while wave b pullback […]

-

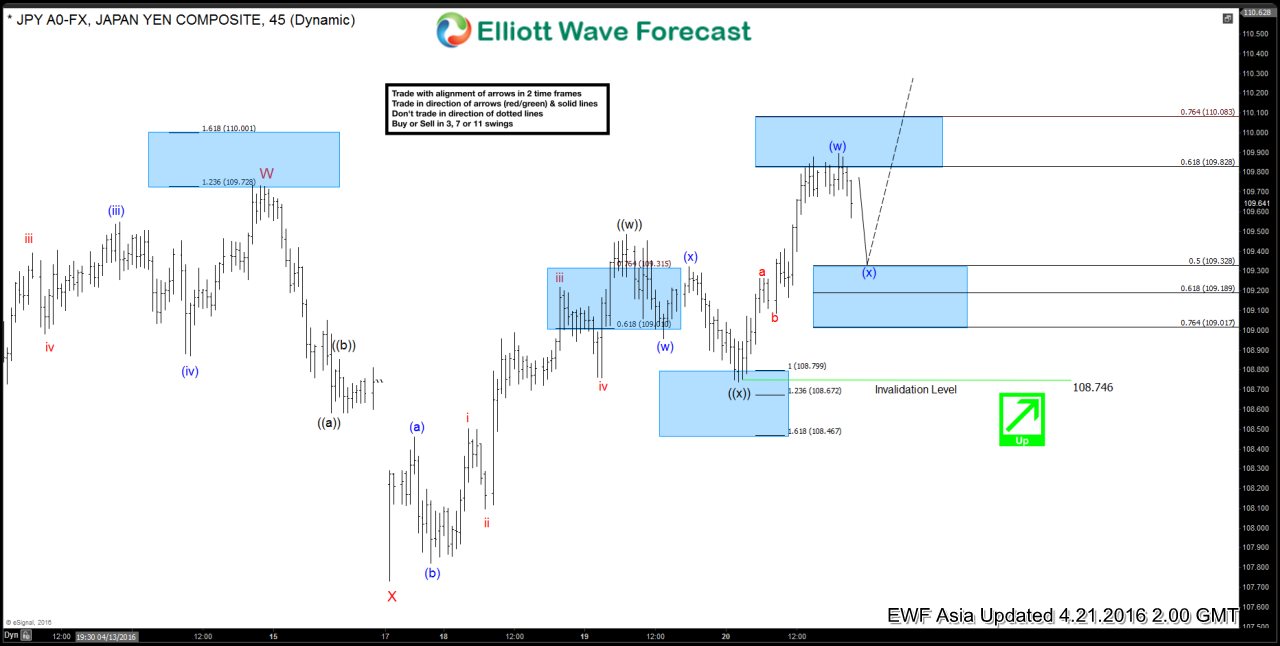

USDJPY Short-term Elliott Wave Analysis 4.21.2016

Read MoreShort term Elliottwave structure suggests that dip to 107.73 ended wave X. Rally from there is unfolding as a double three structure where wave ((w)) flat ended at 109.48, wave ((x)) pullback ended at 108.74, and pair has resumed the rally higher in wave ((y)) of Y towards 110.5 – 110.9 area. Near term, while wave […]

-

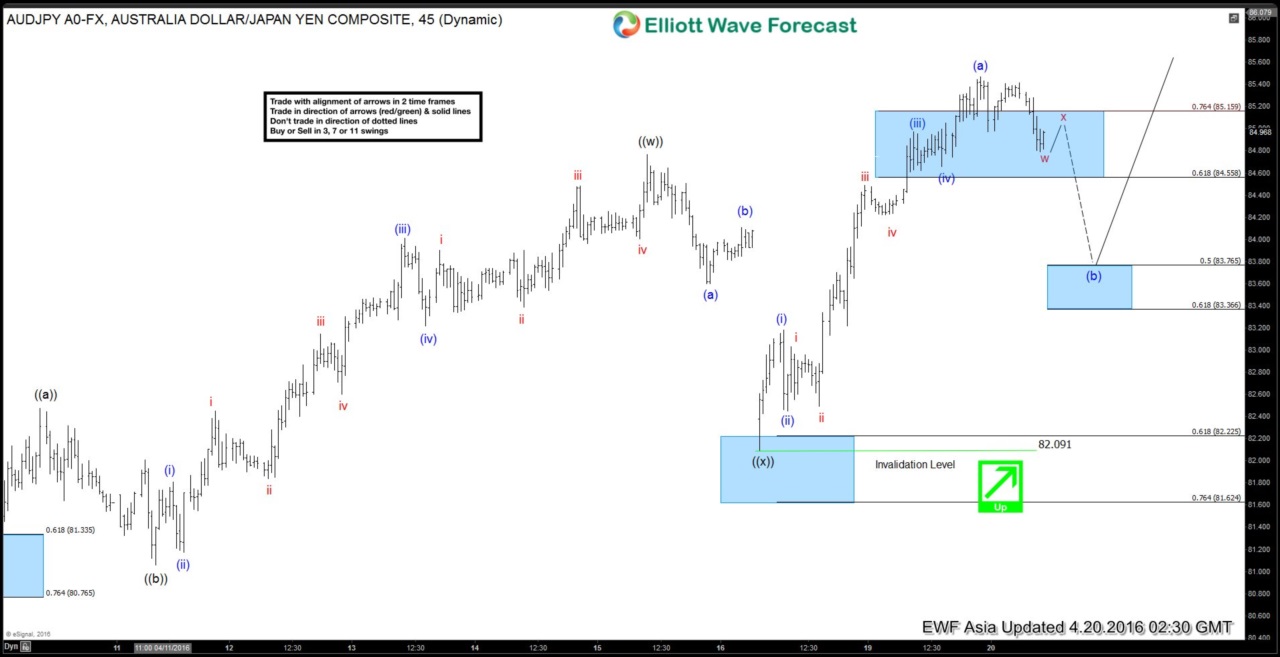

AUDJPY Short-term Elliott Wave Analysis 4.20.2016

Read MoreShort term Elliottwave structure suggests that dip to 80.66 ended wave (X). Rally from there ended wave ((w)) flat at 84.77, wave ((x)) pullback ended at 82.09, and pair has resumed the rally higher in wave ((y)) of (Y). From wave ((x)) low at 82.09, rally is unfolding as a zigzag where wave (a) ended at […]