-

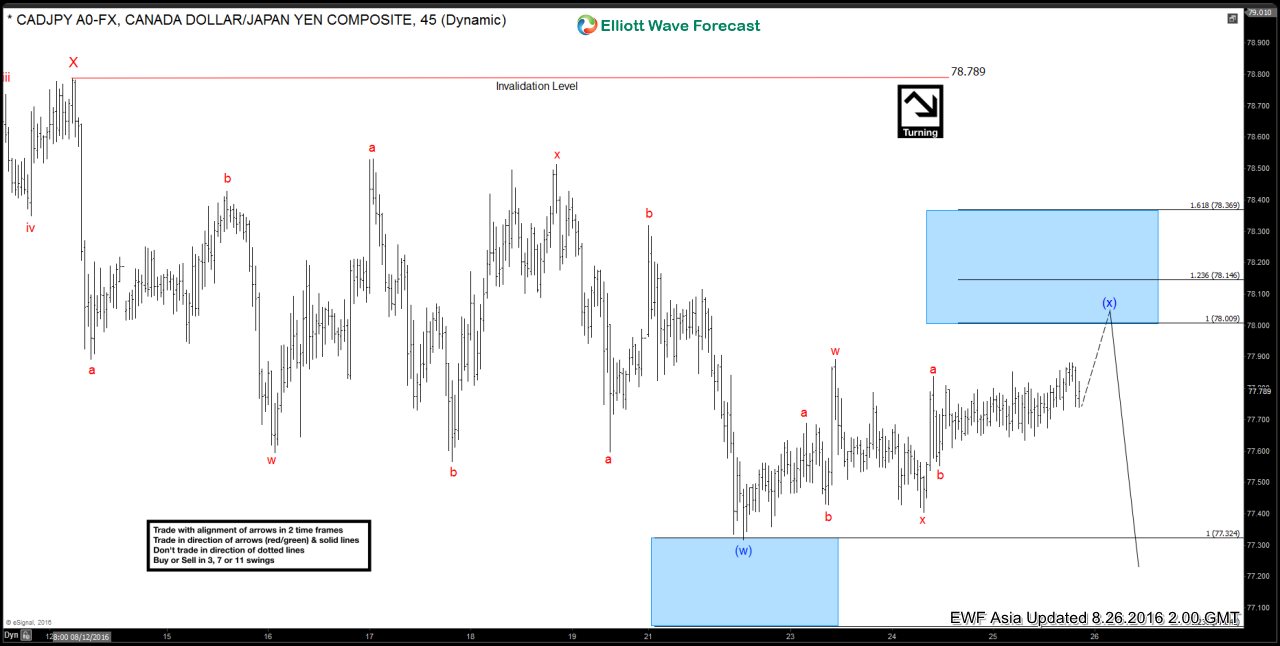

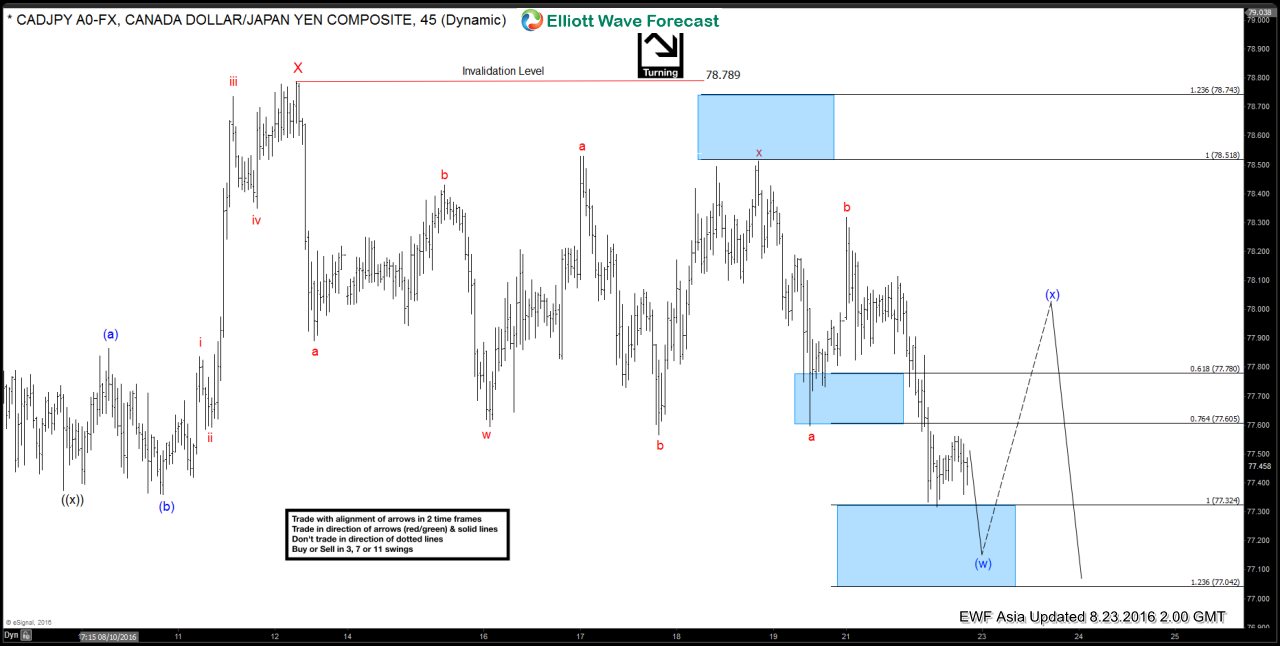

$CADJPY Short-term Elliott Wave Analysis 8.26.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. Wave (x) bounce is currently in progress towards 78 – 78.15 area, then pair is expected to extend lower or at least pullback in 3 waves to correct rally […]

-

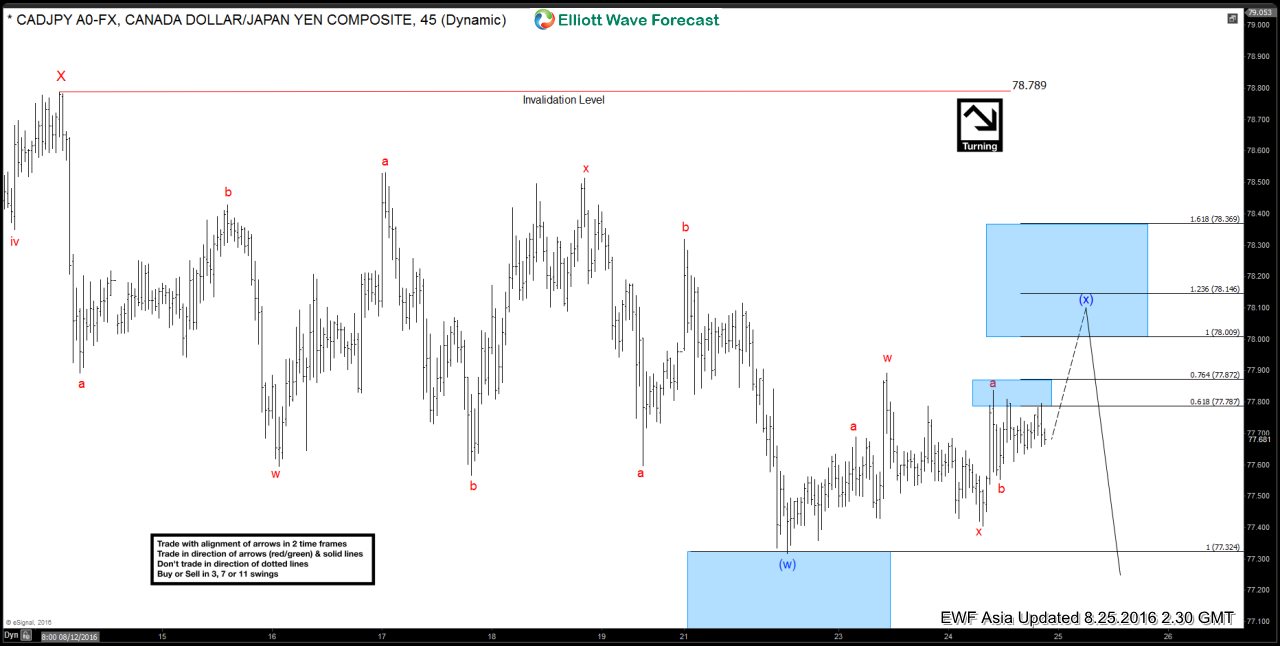

$CADJPY Short-term Elliott Wave Analysis 8.25.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. Wave (x) bounce is currently in progress towards 78 – 78.15 area, then pair is expected to extend lower or at least pullback in 3 waves to correct rally […]

-

$GBPJPY Live Trading Room Setup from 8/18

Read MoreWe issued a buy order for $GBPJPY on Aug 18 Live Trading Room and got filled on Aug 19 at 130.97. We took profit on Aug 24 at 132.6 for a +163 pips profit. Here’s the trade setup at 8/18 Live Trading Room Journal. Each day in Live Trading Room, members attending the session will receive a similar journal like the […]

-

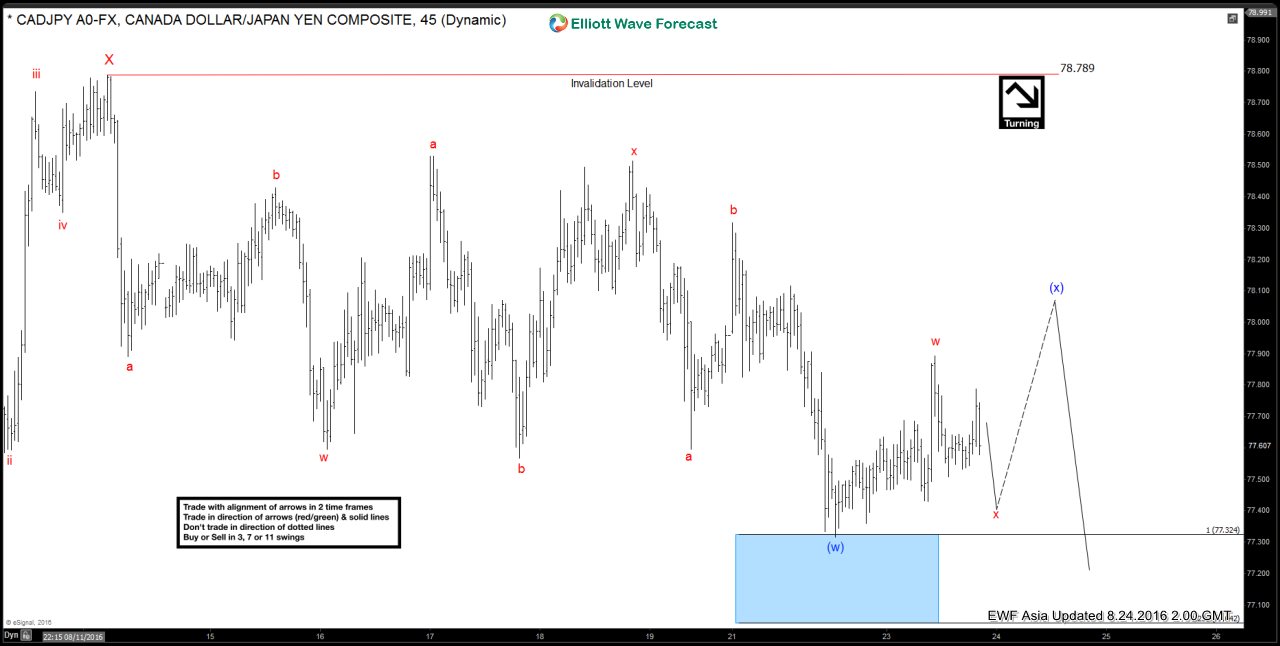

$CADJPY Short-term Elliott Wave Analysis 8.24.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. While near term wave (x) pullback stays above there, expect the pair to turn higher in wave y of (x) before the decline resumes again. We don’t like buying the […]

-

$CADJPY Short-term Elliott Wave Analysis 8.23.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Down from there, there’s enough number of swing and extension to call wave (w) completed. After wave (w) is confirmed over, likely from 77 – 77.3 area which it has already reached, then it should bounce in wave (x) before pair resumes lower again. We don’t […]

-

$AUDUSD Short-term Elliott Wave Analysis 8.19.2016

Read MorePreferred Elliott wave count suggests that rally to 0.776 ended wave ((w)) and wave ((x)) pullback is proposed complete at 0.7673. Rally from there is unfolding as a double three where wave w ended at 0.7723 and while wave x pullback stays above 0.7606, expect pair to resume higher. A break below 0.7606 suggests pair can extend lower to 0.7566 – […]