-

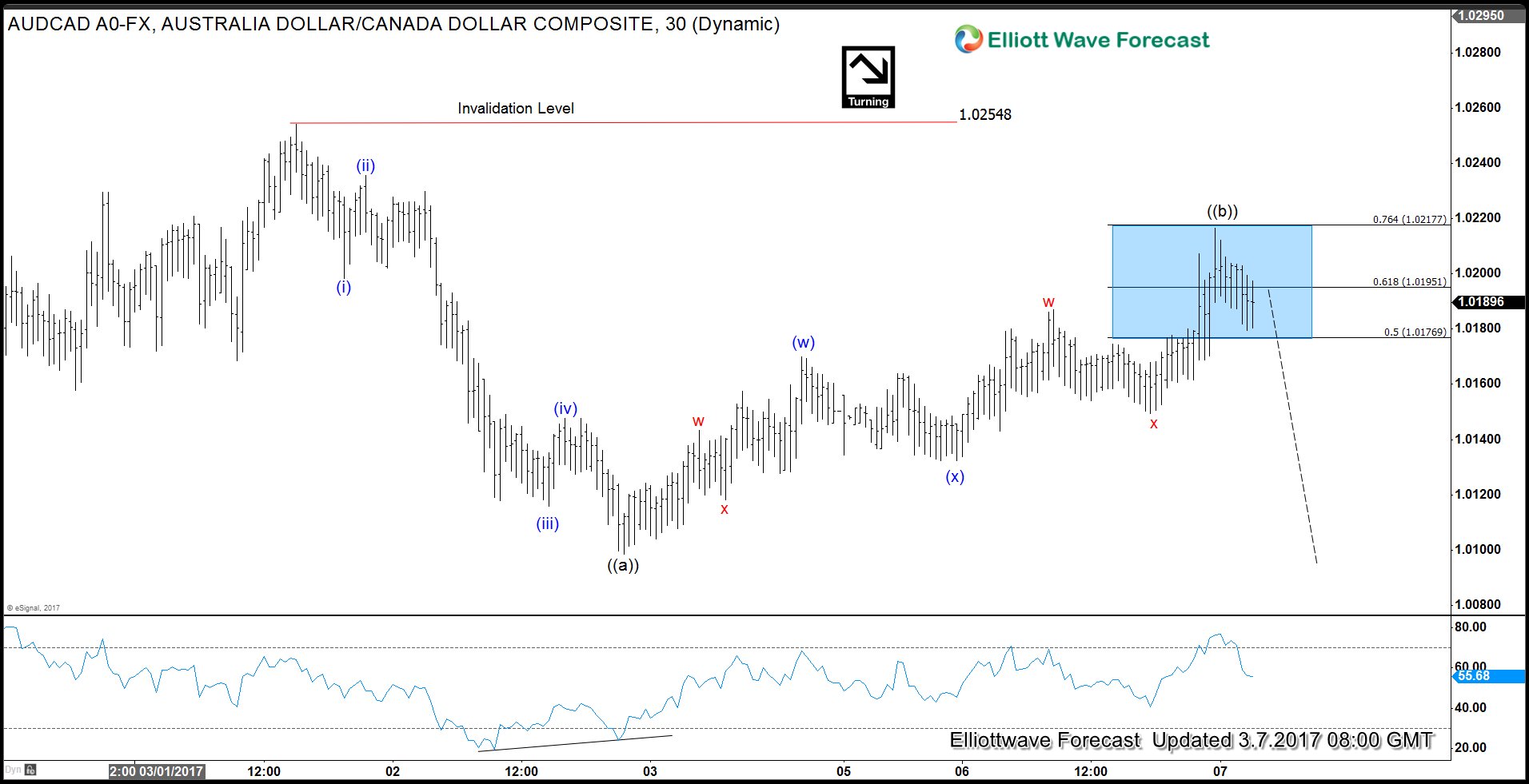

AUDCAD Elliottwave Intraday View

Read MoreShort term Elliottwave structure of AUDCAD from 3/1 peak (1.025) looks to be showing an impulse structure with a nice 5 waves subdivision where Minuette wave (i) ended at 1.0198, Minuette wave (ii) ended at 1.0235, Minuette wave (iii) ended at 1.0115, Minuette wave (iv) ended at 1.0147, and Minuette wave (v) ended at 1.0098. We […]

-

SPX Elliott Wave View: Ending wave 3 soon

Read MoreRevised short term Elliott wave view in SPX suggests that the rally from 1/23 low is unfolding as a 5 waves Elliott wave impulse structure where Minor wave 1 ended at 2301 and Minor wave 2 ended at 2267.2. The Index has erased momentum divergence at the peak suggesting it is likely still within Minor wave 3 […]

-

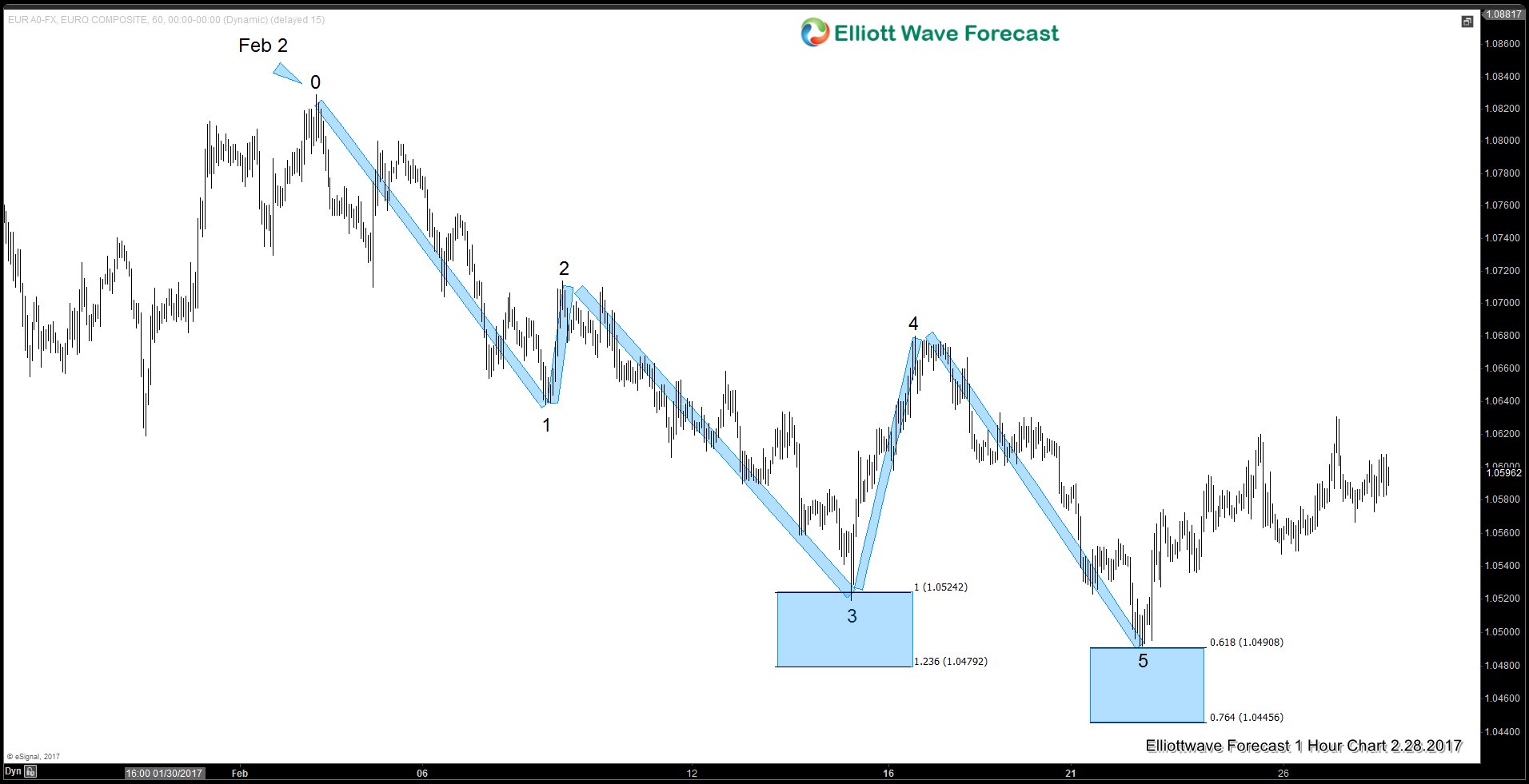

EURUSD: Euro area elections may limit strength

Read MoreThe Euro dollar (EURUSD) has been trading sideways since March 2015 before breaking into a new low in late December 2016. The single currency remains heavy technically and the underlying political and economic risks in the Euro-area in 2017 could provide a cap for any strength in the currency. The Euro zone has survived various crises […]

-

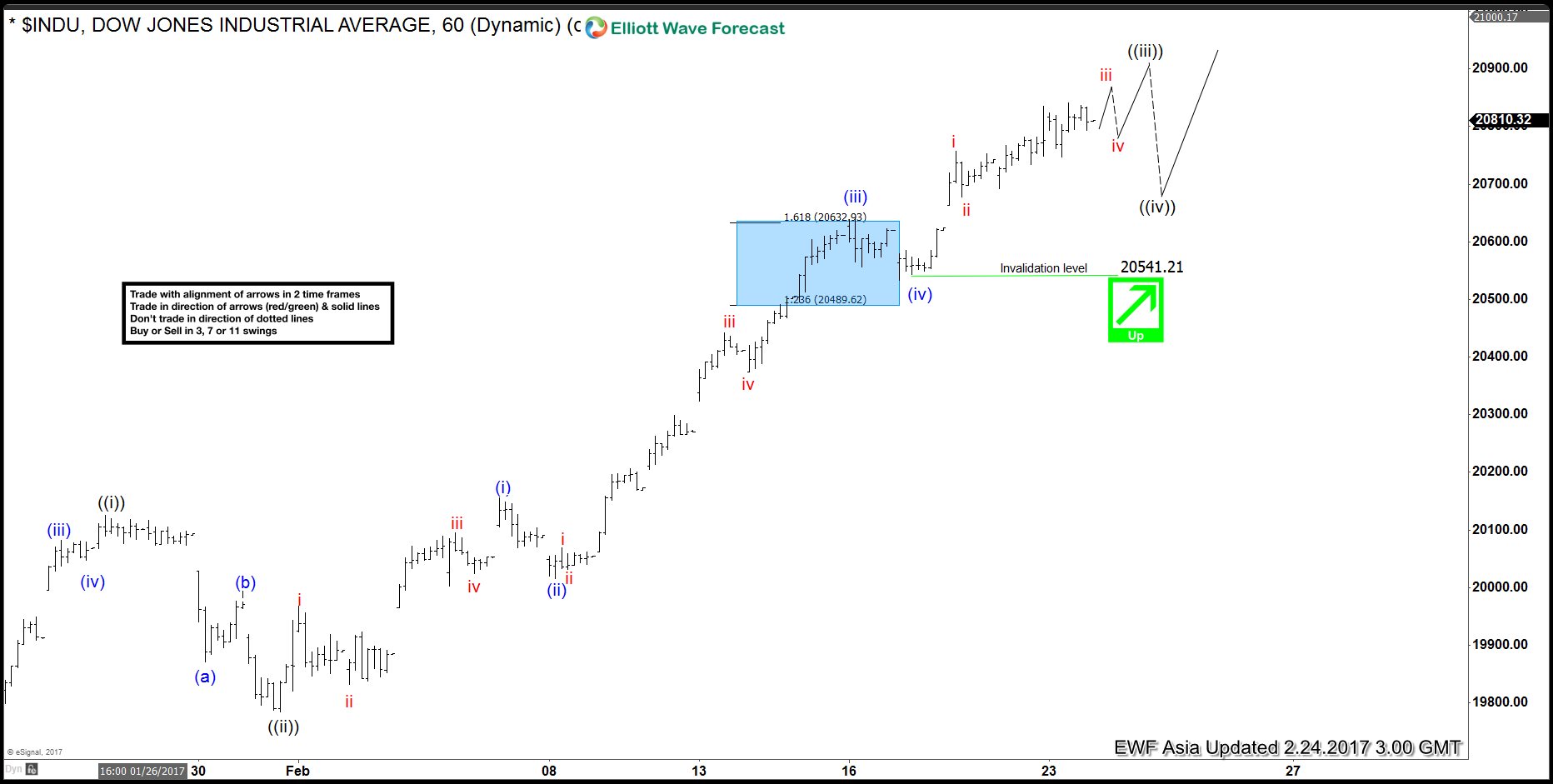

DJIA Elliott Wave View: Ending wave ((iii)) soon

Read MoreShort term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of Minute wave ((iii)) is showing an extension […]

-

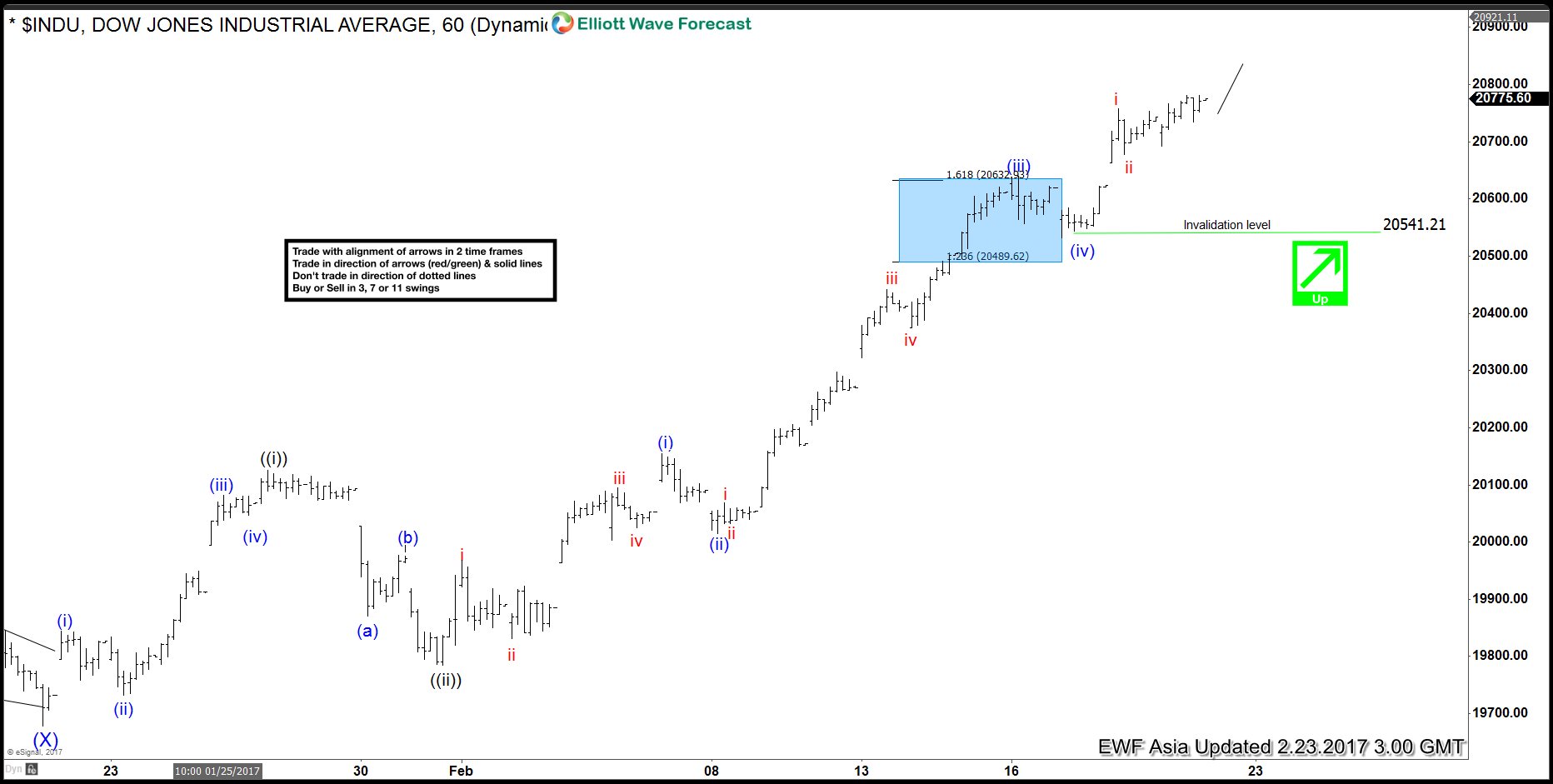

DJIA Elliott Wave View: Extension expected

Read MoreShort term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of wave ((iii)) is showing an extension and […]

-

Elliott Wave Chart Reading & Labeling free Seminar for beginner

Read MoreIn the video seminar below, we discuss about how to read and label Elliott Wave charts. The following excerpt comes from the opening of the video. You can skip to the video directly if you want to watch the seminar Key Steps to Read Elliott Wave Charts Steps to read Elliott wave chart: Look at Elliott […]