-

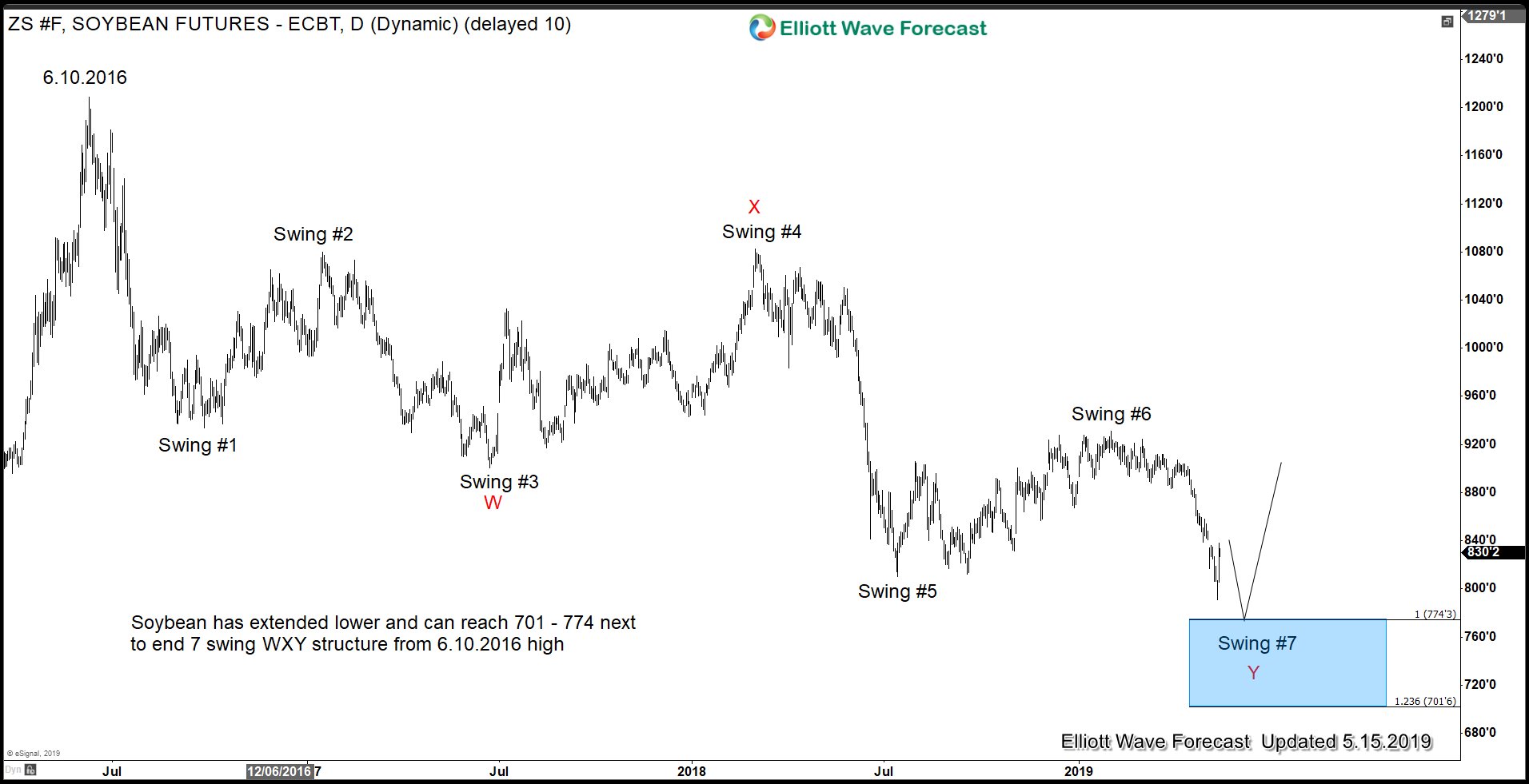

Soybean at Risk of Further Selloff as Trade War Escalates

Read MoreSummary The months-long trade negotiation between the U.S and China has failed to reach an agreement. Sticking points of the negotiation centers around intellectual property and technology transfer. The two sides can not come into agreement yet. The U.S. has increased the tariffs and China has retaliated, effectively escalating the trade war. One of the […]

-

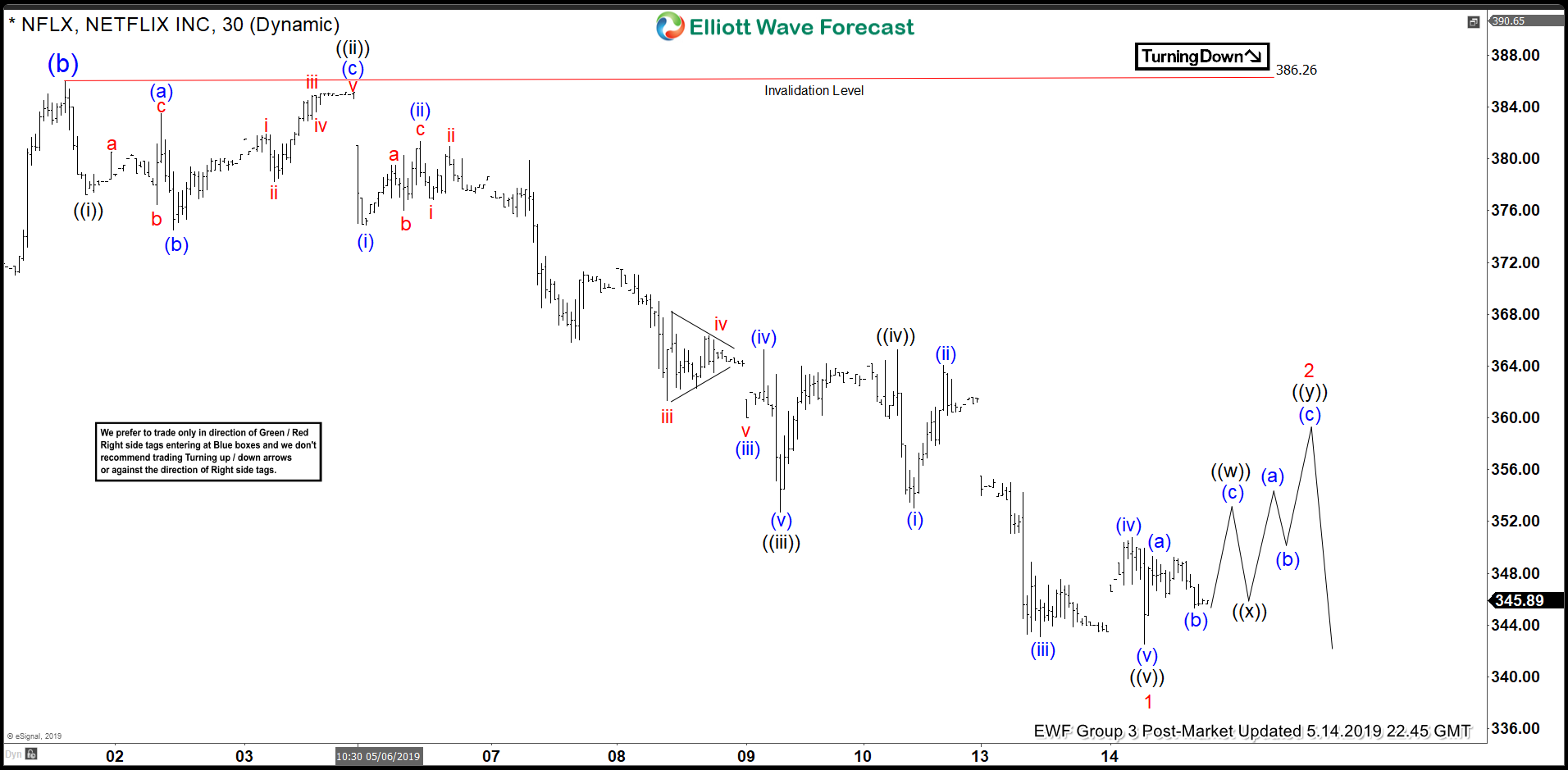

Elliott Wave View: Rally in Netflix Expected to Fail

Read MoreNetflix shows a 5 waves impulse move from May 2, suggesting further downside. This article & video talks about the short term Elliott Wave path.

-

Elliott Wave View Calling for More Downside in Oil

Read MoreOil (CL_F) shows a 5 waves down from April 23 high, looking for further downside. This article & video explains the short term Elliottwave path for Oil.

-

Elliott Wave View: Downside Pressure in USDJPY

Read MoreUSDJPY shows an impulsive decline from April 25 high. This article and video shows the short term Elliott Wave path for the pair.

-

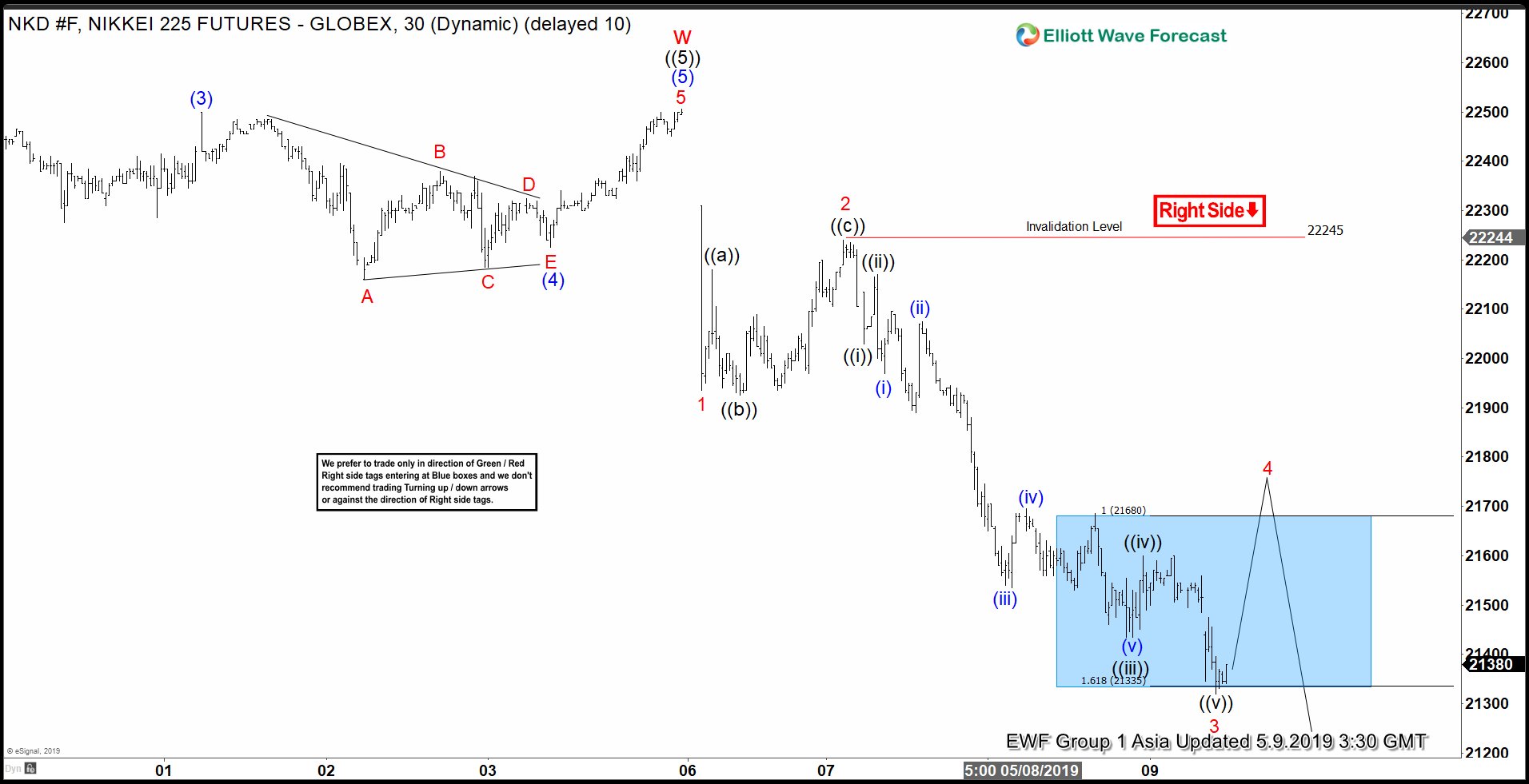

Elliott Wave View: Impulsive Decline in Nikkei

Read MoreOur Elliott Wave view on Nikkei suggests the rally to May 4, 2019 high (22505) ended wave w. This ended cycle from December 26, 2018 low and the Index is in the process of at least doing a larger 3 waves pullback. Short Term, decline in Nikkei from May 4, 2019 high is unfolding as […]

-

Trade Negotiation in Jeopardy After China Reneged its Commitment

Read MoreSummary The odds of trade war escalation rises after Trump sent a pair of tweets threatening to increase tariffs to Chinese goods. If there is no deal by this Friday, the tariffs to Chinese goods will rise to 25% from 10% on $300 billion. Additional $325 billion of Chinese goods will also get 25% tariff. […]